US businesses that work with noncitizens or foreign entities may need to file Form 1042, an Annual Withholding Tax Return furnished by the Internal Revenue Service (IRS). It is used for reporting the taxes your company has withheld related to the income paid out to international payees—including nonresident aliens and foreign partnerships, estates, trusts, and companies.

Form 1042 is important because it ensures that foreign persons and entities pay the appropriate amount of US tax on income earned from US sources. Failing to properly file this form or to withhold tax when required can result in penalties and legal consequences.

Who Needs to Fill Out Form 1042

If you employ foreign workers or work with a foreign entity on business specifically related to the US, you should complete Form 1042. This is the case for both US and foreign companies.

You do not need to complete this form if you are hiring foreign workers to perform work that does not involve any US business transactions. For example, even if you are headquartered in the US, if you send an employee to work in Europe, then that income is not considered to be sourced in the US.

For information on other payroll forms that you may have to complete, see our Payroll Tax Forms article.

What Is US-sourced Income?

US-sourced income refers to income that’s earned or sourced within the US. Some common types of income that may be reported on Form 1042 include interest income, dividends, rents, royalties, compensation, and other types of income paid to foreign persons or entities.

The determination of whether income is US-sourced is based on a variety of factors, including the place where the income was earned, the place of residence of the person or entity receiving the income, and the type of income earned. Here are a few examples:

| US-sourced Income | Not US-sourced Income |

|---|---|

| Wages paid to an employee for work performed in the US | Wages paid to an employee for work performed entirely in a foreign country |

| Rent payments for property in the US | Royalty payments for the use of intellectual property outside the US |

| Gains from the sale of US real estate | Gains from the sale of real estate located outside the US |

How Form 1042 Works

The instructions for Form 1042 span 11 pages, but the form itself is only two pages long. You may also have to fill out a 1042-S and 1042-T along with the 1042—find out more about these forms under the section, “Other Forms to Take Note Of.”

To assist with completing the form correctly, we have identified key items below with explanations. While we provide you with detailed information about each part of the form, you may skip to the sections that are most important to you.

Basic Information

In this section, you’ll focus on basic information about the worker and your business. You’ll need to have relevant information handy and be ready to review and apply any exemptions.

If this is a correction to your original form, you will need to check the box to alert the IRS.

This is the individual, corporation, or entity that is completing the form. This agent also is required to have control and authority to hold back income for the remittance of taxes to the government.

This is a nine-digit number provided by the IRS to identify individuals or groups who are required to file returns. Review our article for more information on getting an EIN.

IRS Chapter 3 provides rules and regulations on how you should withhold taxes on US-sourced income paid to foreign individuals. In most cases, you will need to withhold 30% of the gross amount, but there are some exemptions to Chapter 3, which are listed below.

Code | Exemption Reason |

|---|---|

01 | Effectively connected income. A nonresident foreigner who conducts business and generates US income within the United States. |

02 | Exempt under IRC. This code is used when no other chapter 3 exemption code is applicable. |

03 | Income is not under US Sources. This would be related to a foreign person only doing work outside of the United States. |

04 | Exempt under Tax Treaty. This code is used when you are working with a country that has a tax treaty with the United States. |

05 | Portfolio interest exempt. Nonindividuals and foreign corporations that are exempt for interest paid on debt obligations. |

06 | Qualified intermediary that assumes primary withholding responsibility. If you have another person or organization helping you facilitate your taxes. |

07 | Withholding foreign partnership or withholding foreign trust. This code is any non-US partnership that has an existing withholding agreement with the IRS. |

08 | US Branch treated as US person. A company or organization that is regarded as a person for tax purposes. |

09 | Territory financial institution treated as US person. A financial institution (i.e., a bank) that is regarded as a person for tax purposes. |

10 | Qualified intermediary represents that income is exempt. Similar to code 6, with the addition that your assigned third-party claimed that your income is exempt from US Taxes. |

11 | Qualified securities lender that assumes primary withholding responsibility. A foreign financial institution (i.e., bank, security trader) that takes on the responsibility of withholding taxes on your behalf. |

12 | Payee subject to chapter 4 withholding. Payee is considered a foreign financial institution. |

22 | Qualified Derivatives Dealers that assumes primary withholding responsibilities. Similar to code 11 but more specialized, as a derivative is a specific security. |

23 | Exempt under section 897 (I). Foreign institutions that invest in US real estate may be exempt from US taxes if they follow certain rules. |

IRS Chapter 4 outlines how to withhold taxes on income paid to foreign financial institutions (FFI), distinct from Chapter 3, which mainly focuses on individuals. You must enter both Chapter 3 and 4 codes on the form, even if only one applies. Generally, 30% of the gross amount must be withheld, with some exceptions (such as Codes 15 and 16) that small businesses are most likely to use.

Note: The most common reason the average company might pay money to an FFI is due to subcontracting work, so that business can be done in certain foreign countries. It’s also possible if working with a private equity company on a merger and acquisition or expansion.

Code | Exemption Reason |

|---|---|

13 | Grandfathered Payment. This is used when the company has an exemption due to its operations being approved before new laws and/or regulations were passed. |

14 | Effectively Connected Income. A nonresident foreign financial institution that conducts business and generates US income within the United States. |

15 | Payee not subject to chapter 4 withholding. Payee is not considered to be an FFI. |

16 | Excluded nonfinancial payment. Income paid out was not due to financial activities. |

17 | Foreign entity that assumes primary withholding responsibility. A foreign financial institution (i.e., bank, security trader) that takes on the responsibility of withholding taxes on your behalf. |

18 | US Payees of participating foreign financial institutions or registered deemed-compliant foreign financial institutions. This is when you are paid income to an FFI through a US entity that it is partnered with. |

19 | Exempt from withholding under Intergovernmental Agreement. This is used if the payment is deemed to be exempt based on an agreement between the US and the company's country of origin. |

20 | Dormant account. This is used if this account has not been used for financial activity for a long time. |

21 | Other-payment not subject to chapter 4 withholding. This is used if no other code applies. |

The two lines right under the status code relate to the address of your company.

If you have plans on conducting business with foreign entities, individual or otherwise, in the future, you should not check this box.

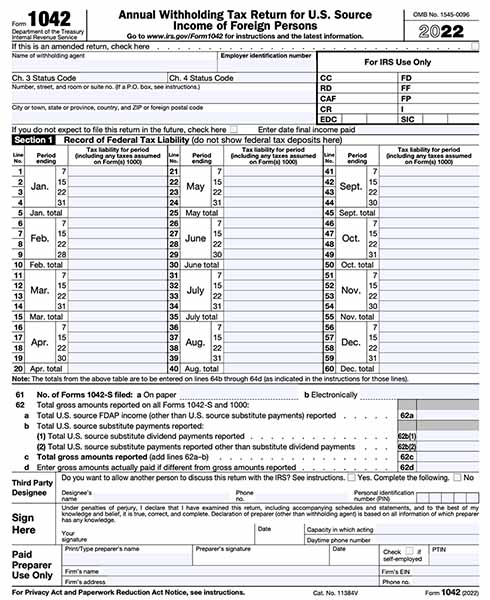

Section 1: Record of Federal Tax Liability

This section deals with tax liability for the foreign worker income. You’ll need to have information about how much tax was withheld, if any.

Under Section 1, lines 1 to 60, you should list the tax liability during the period when the income was paid.

A couple of notes regarding filling out this section correctly:

- You should enter the actual tax liability owed based on the income paid during that period, regardless of whether the tax was properly withheld.

- You need to enter the tax liability regardless of the status code or whether the taxes have been deposited.

- You should enter the liability amounts as positive numbers. If you had a repayment to report that results in a negative tax liability, you should report in the next earliest period. This would happen if your company over withheld taxes due to a calculation error due to the employee, the payroll processor, or the payroll system itself. In this case, you would repay the employee for the overage and then reimburse yourself by lowering your tax liability in the next available period to avoid having a negative amount.

These lines relate to the completion of your 1042-S and 1000 forms. This means that all of these forms must be completed before working on this section. If you are filing paper forms, you will also have to fill out Form 1042-T.

Form 1000 is a document used to record the amount of interest paid on bonds that had a tax-free agreement and issued before 1934. It is very unlikely that you will have this form if your business is newly created.

Line 61 asks about the number of 1042-S that you file via mail or electronically, while line 62 asks about the cumulative income of all income reported on Form 1042-S and 1000. This includes the total amount of FDAP income. FDAP includes income not directly correlated with the work of the business (i.e., employee compensation, consultant income). These items include but are not limited to interest, dividends, and investment property. It also includes the total amount of US source substitute dividend payments. These are payments given to you by a broker instead of stock dividends given.

It is very unlikely that your business will have these payments; therefore, the total amount of income for line 62 should be from FDAP income.

The last part of page 1 has three places to certify the information on the form and provide the IRS with the right contact information. Not all the places may be applicable to your company. A brief description of each is shown below.

- Third-Party Designee. The third-party designee is if you decide to have a consultant or someone outside of your company to discuss matters with the IRS. If that is the case, you should include their name.

- Signature. You will need to designate a person at your company (normally an executive) who can sign off on the validity of the information listed on the form.

- Paid Preparer Use Only. If you have paid another person to complete your form, you should have them complete this section with their information.

Line 63 is asking about the total tax reported on all of your 1042-S and 1000 forms, including any adjustments to tax withholding. This includes taxes withheld by you or others acting on your company’s behalf.

Lines 64–71 relate to the total recording of tax liability and tax paid.

Line 64 is specifically about net tax liability. Line 64a relates to any adjustments made to total net liability not included in the record of tax liability. One example is your company paying any under-withheld taxes.

Lines 64b–c are directly related to the total amounts that you placed in Section 1: Record of Federal Tax Liability.

Line 64d is a question that relates to a 2% excise tax if you are doing work for the US federal government. These amounts should also be included in your record of Federal Tax Liability. This primarily relates to companies acting as federal contractors and specifically focuses on certain goods or services provided in a foreign country by a foreign employee for the US government benefit where there is not an existing internal procurement agreement. For more information on what is included or excluded, please view the IRS guidance.

Line 65 is related to the amount of taxes paid via direct deposit during this and the previous calendar year. This includes payments included with a filing extension request. Lines 66 and 67 relate to credits to your taxes due.

Line 66 is about an overpayment that you made from the previous year, while line 67 is related to credits for taxes made by others that are attributable to your company. The sum of the amounts for these questions are your total payments, which should be placed on line 68.

If your total net liability (line 64e) is more than your total payments (line 68), then you must complete line 69. Line 69 would equate to your balance due.

Line 70 relates to overpayments. Line 70a is for overpayments relating to payments that are under Chapter 3 and Chapter 4 source income, while line 70b relates to overpayment dealing with the excise tax on federal procurement payments. These overpayments can either be refunded to you or placed as a credit on next year’s tax form, which is shown as a choice on Line 71.

Only if your business is effectively providing equity to foreign individuals as a form of compensation would you need to fill out the information in Sections 2, 3, and 4 described below.

Section 2: Reconciliation of Payments of US Source FDAP Income

Section 2 allows you to double-check that the FDAP income on your 1042-S accurately matches the amount required to be withheld, including any exceptions that may apply. Even if you don’t have income related to dividends or interest payments, you still need to complete this section.

If you find a variance between your 1042-S and your Chapter 4 reportable FDAP income, you can clarify the discrepancy on line 6.

Section 3: Potential Section 871(m) Transactions

In Section 3, there’s a checkbox to indicate if your company made any payments under a Section 871(m) transaction. This type of transaction generally involves the lending of stocks, bonds, or derivatives, or repurchase agreements for securities. While it’s uncommon for most small businesses, it can happen when an organization needs funds and uses the company as collateral.

Section 4: Dividend Equivalent Payments by a Qualified Derivatives Dealer

Section 4 is a checkbox if a payment was made by a Qualified Derivatives Dealer handling business on your company’s behalf. Similar to Section 3, most small businesses will not need to select this checkbox. If you fall into this category where you did work with a Qualified Derivatives Dealer, you will need to complete Schedule Q.

If you need help processing payroll and withholding taxes on your own, please see our articles on how to do payroll and payroll tax rates.

Form 1042 Deadlines & Penalties

Form 1042 (and its related 1042-S and 1042-T forms) must be submitted March 15 in the following year after the income was reported (or the next business day, if the 15th falls on a weekend).

If you need an extension on submitting the form, you must submit Form 7004, Application for Extension of Time to File Certain Excise, Income, Information, and Other Returns. This does not provide you an extension of paying the taxes—only on submitting the form.

If you do file Form 1042 late or fail to pay the tax when due, you may have to pay penalties and interest unless the IRS finds your reason for late submission to be valid and not a result of the company forgetting or overlooking the deadline.

Small businesses that don’t properly withhold taxes on payments to foreign individuals or entities could also result in the business being liable for any taxes that should have been withheld, adding to the potential financial burden.

Other Forms to Note

Reporting income and tax withholding for foreign employees is similar to the process for non-foreign employees, but you must file different forms that generally contain a little more detail.

Here is how payroll tax reporting for non-foreign and foreign employees compare:

Purpose | Form Filed for Non-Foreign Employees | Form Filed for Foreign Employees |

|---|---|---|

Annual report of wages and withholding to employees | W-2 | 1042-S |

Summary of wages and withholding for all employees | W-3 | 1042-T |

Withholding Tax Return | Form 941 filed quarterly | Form 1042 filed annually |

As indicated in the table above, Form 1042-S is a year-end form that US businesses need to complete and provide to each foreign worker after the end of the year. This form is similar to the Form W-2 provided to non-foreign employees. Form 1042-T summarizes all Form 1042-Ss if you choose to file by mail and is similar to Form W-3, which summarizes W-2s filed for non-foreign workers.

Comparing Form 1042 vs Form 1042-S vs Form 1042-T

Form 1042 is the annual withholding form to calculate the US-sourced income of foreign persons and entities.

Form 1042-S is a statement used to report various types of income that are paid to foreign individuals or entities. A company would need to use Form 1042-S if the payment recipient is a nonresident alien, a foreign partnership, or a foreign corporation. These forms are closely related, and if you’re required to file Form 1042-S, you’ll also need to file Form 1042.

If you’re submitting your forms via paper, you’ll also need to complete Form 1042-T. This form summarizes the number of forms provided, along with the total amounts reported and withheld.

Bottom Line

If you are a US employer that hires foreign employees or contractors, you will need to complete Form 1042. Determining the applicable status code, keeping track of your federal tax liability, making on-time tax payments, and having a list of applicable employees will go a long way in ensuring this process is not cumbersome.

If you need help processing your international payroll, especially for foreign employees and contractors, consider using a Payroll Software like Remote. It can handle your paperwork, tax requirements, and other compliance needs you may face when hiring international employees. Plus, you can pay global contractors for free.