Form 2220, used by corporations, calculates the underpayment penalty (if any) at a predetermined interest rate from the time at which a quarterly payment was due until it was paid or the due date of the return, if earlier. Corporations are expected to pay the IRS any income tax due throughout the year if the entity is expected to owe more than $500 with the tax filing.

Key takeaways

- Form 2220 is optional—unless the annualized installment or adjusted seasonal installment methods are used or you’re a large corporation figuring your first quarter installment.

- If Form 2220 is not filed and a penalty applies, the IRS will do the calculations and send a bill for the amount owed.

- A taxpayer with seasonal or fluctuating income may be able to avoid or reduce an underpayment penalty by using the annualized installment method on Schedule A of Form 2220.

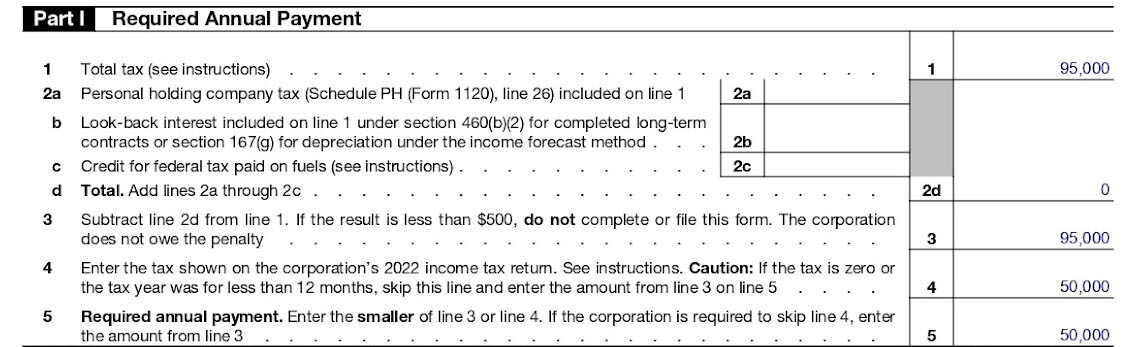

The most updated version of IRS Form 2220 can be found on the IRS website. There are four main parts to the form. Those parts are followed by Schedule A, which is used to calculate the annualized and adjusted seasonal installment methods.

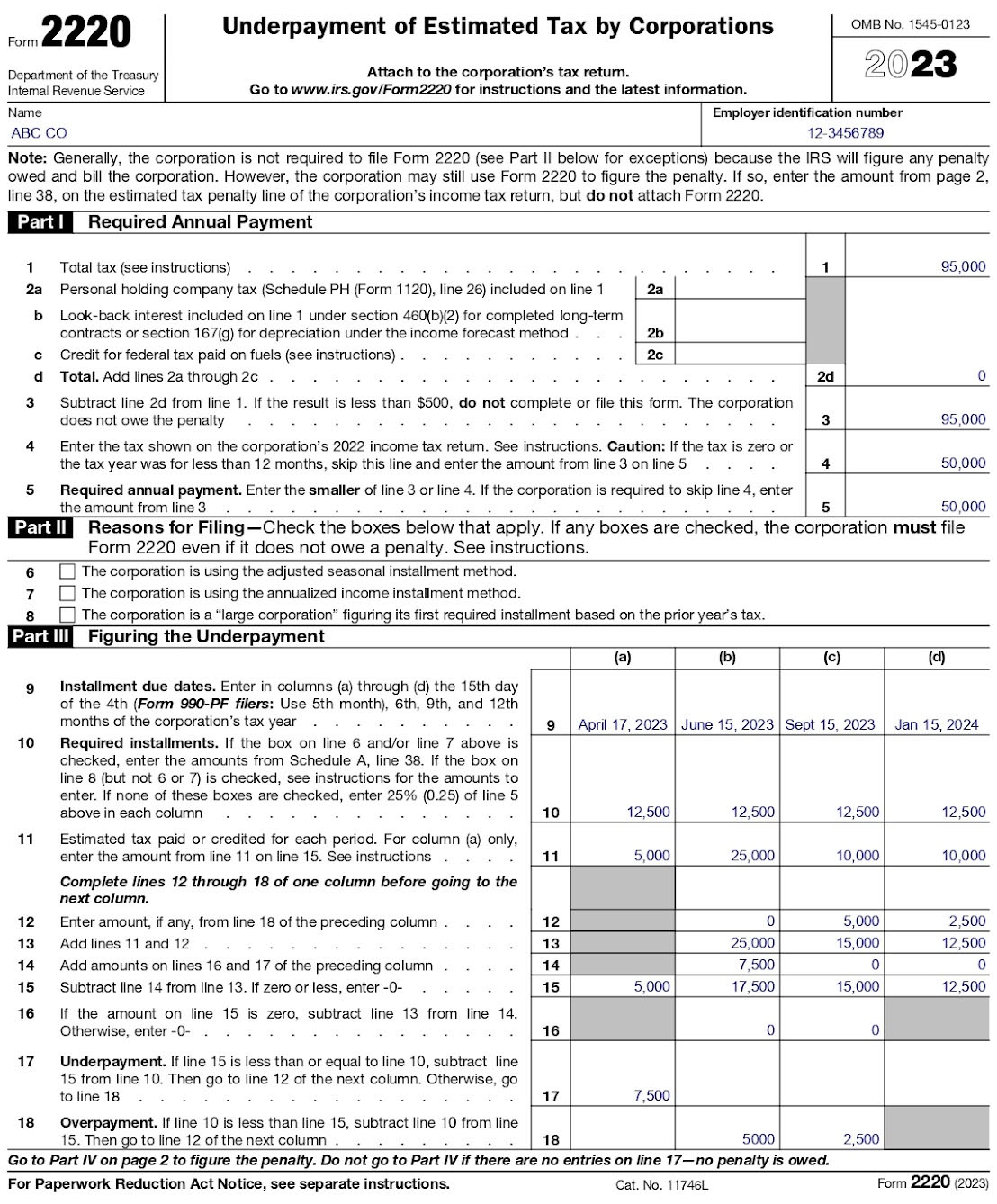

Example of Form 2220 Input

ABC Co. is a C corporation (C-corp). The tax preparer would like to calculate the underpayment penalty on Form 2220 and uses the fact summary below to do so:

- 2022 income tax due from 2022 Form 1120, line 31: $50,000

- 2023 income tax due from Form 1120, line 31: $95,000

- Federal estimates paid April 17, 2023 The payment would ordinarily be due on April 15 but, since that date fell on a weekend, the payment was allowed to be paid on the next business day. : $5,000

- Federal estimates paid June 6, 2023: $25,000

- Federal estimates paid Sept. 9, 2023: $10,000

- Federal estimates paid Jan. 9, 2024: $10,000

Pages 1 and 2 of Form 2220 have been completed for the company as shown below, followed by an explanation of the line-by-line input.

Example of Completed Form 2220, Page 1

Example of Completed Form 2220, Page 2

Form 2220 Overview Example

The main Form 2220 is divided into four sections:

- In Part I (Required Annual Payment), ABC Co.’s required annual payment is calculated. This is the amount of tax that the corporation should have paid in estimated taxes throughout 2023.

- In Part II (Reasons for Filing), the corporation needs to identify its reason for filing the form. If a box is checked in Part II, Form 2220 is required; otherwise, the form is optional.

- In Part III (Figuring the Underpayment), the underpayment is calculated as the difference between what ABC Co. paid in estimated taxes and what it should have paid.

- Part IV (Figuring the Penalty) is where the penalty on that underpayment is calculated.

Form 2220, Part I Example

ABC Co. will enter the following items in Part I to determine how much it should have paid in 2023 estimates:

Sample of Completed Form 2220, Part I

- Line 1: $95,000 is the total tax on ABC Co.’s 2023 Form 1120, line 31.

- Lines 2a–2c: Adjustments made on these lines reduce line 1 for taxes paid elsewhere.

- Line 2d: This line is a sum of the items backed out in lines 2a–2c.

- Line 3: Line 3 is the difference between the corporate income tax from line 1 and the sum of the adjustments in 2d

Since ABC Co’s adjusted tax is 90,000 (greater than $500), we move forward with completing the form. When line 3 is less than $500, the company does not have an underpayment penalty and this form does not need to be completed.

.

Line 4: ABC Co’s prior year (2022) income tax is entered here. If the prior year’s tax was zero or if the prior year return was for less than 12 months, line 4 would be left blank. The line 3 amount would have then been transferred directly to line 5. - Line 5: The lesser of line 3 or 4 was entered here. ABC Co. should have paid total 2023 estimates of the lesser of the current year tax (modified by 2a–2c adjustments) or the prior year tax. If the prior year tax was zero, the company would have needed to pay estimates based off of the current year tax.

Form 2220, Part II Example

This is where ABC Co. tells the IRS why it is filing the form. This is explained by checking the correct box that identifies the reason.

Sample of Completed Form 2220, Part II

- Line 6: The box on this line would be checked if the company were filing this form to use the adjusted seasonal installment method If ABC Co. were a chain of Halloween costume shops, it would likely get most of its income during one part of the year. This uneven receipt of income could subject the company to an underpayment penalty. In a case like that, ABC Co. would be a good candidate for the adjusted seasonal or annualized income installment method. .

- Line 7: The box would be checked if the company were filing this form to use the annualized income installment method.

- Line 8: The box here would be checked if the company were filing this form because it is a large corporation A large corporation is a C-corp with taxable income of $1 million or more for any of the three tax years immediately preceding the 2023 tax year. .

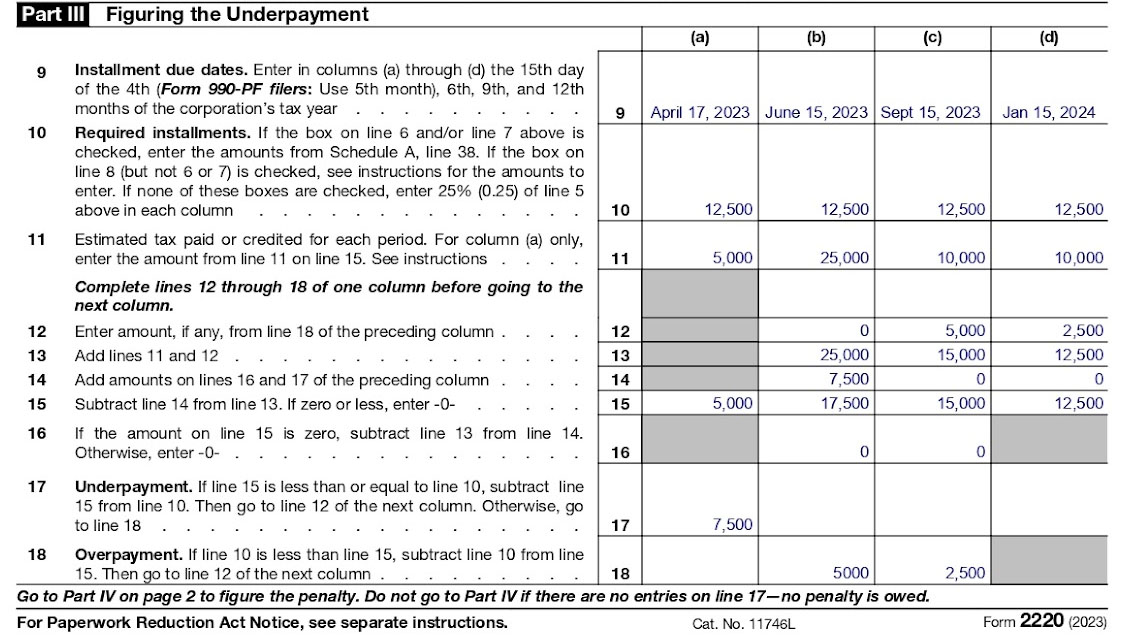

Form 2220, Part III Example

In Part III, the underpayment amount is calculated, as shown below. The underpayment will later be used to calculate the underpayment penalty.

Sample of Completed Form 2220, Part III

- Line 9: The dates entered here are April 15, June 15, September 15, and January 15 of the following year since ABC Co. is a calendar-year entity and not a tax-exempt organization.

- Line 10: ABC Co. entered 25% of line 5 in 10a, 10b, 10c, and 10d, for a total 100% allocation of line 5.

- If the adjusted seasonal installment method or the annualized income installment method was being used, the number from Schedule A, line 38 would have been entered here.

- Line 11a: ABC Co’s quarter 1 estimated tax payment was entered here. If ABC Co had a 2022 tax overpayment applied to the 2023 tax return, that amount would have been entered here and carried down to line 15a.

- Lines 11 b–d: These lines represent the actual estimates that were paid each quarter For the remaining rows (11–18) in Part III, columns a–d were calculated vertically, such as 11a, 12a, 13a, 14a etc., then 11b, 12b, 13b, and so on. This was done because the calculation in each column involved cells above it. Figures from each preceding column transfer to the next column. .

- Lines 12–18: These are simple additions and subtractions of the information given in the first three rows. Follow the instructions given on each line of the form. After your calculations, pay attention to lines 17 and 18.

- Line 17: The underpayment (if any) of tax for each quarter; Part IV will use these amounts to calculate your underpayment penalty

- Line 18: The overpayment (if any) of tax for each quarter; no underpayment penalty is due for any quarter with an overpayment

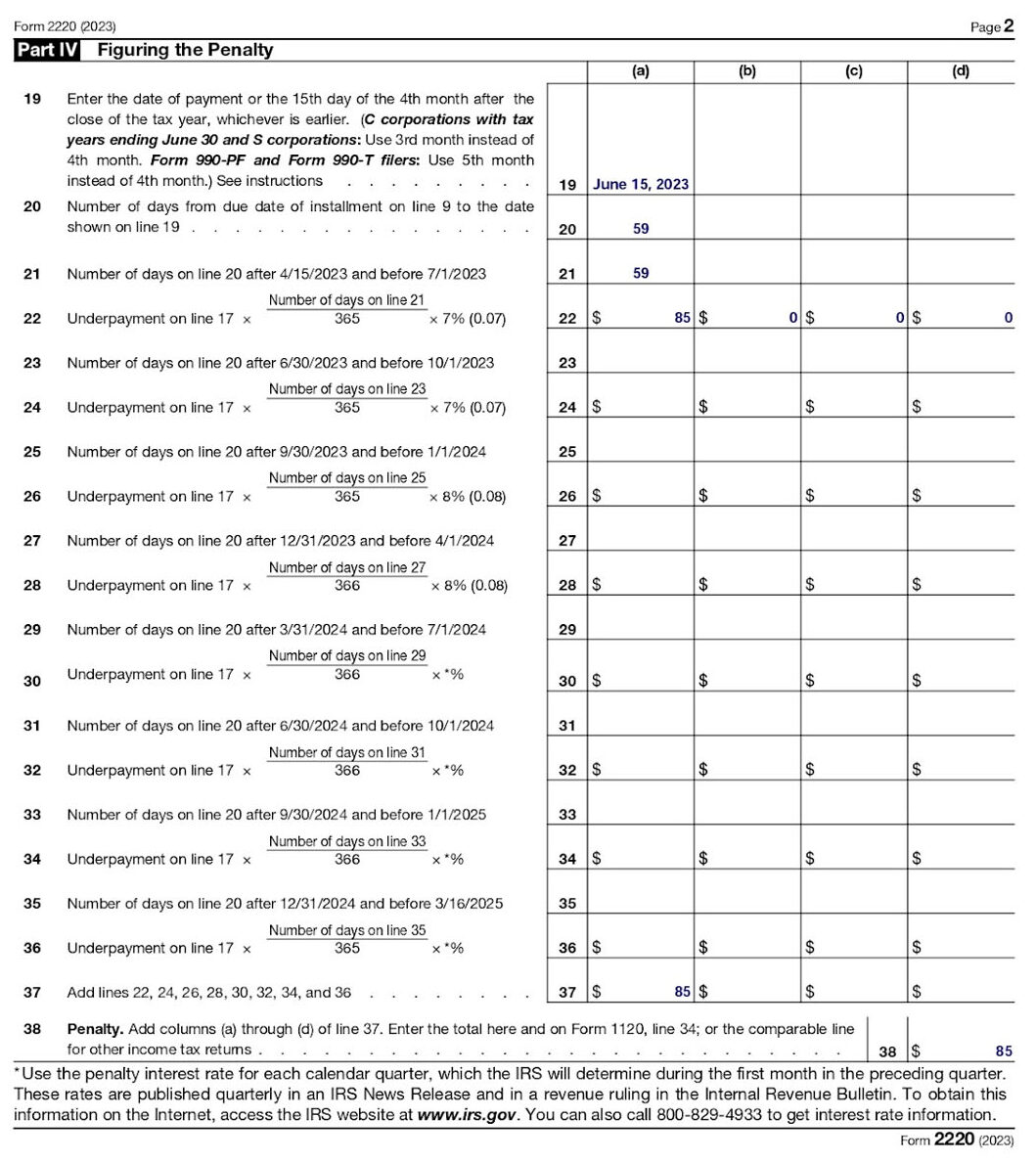

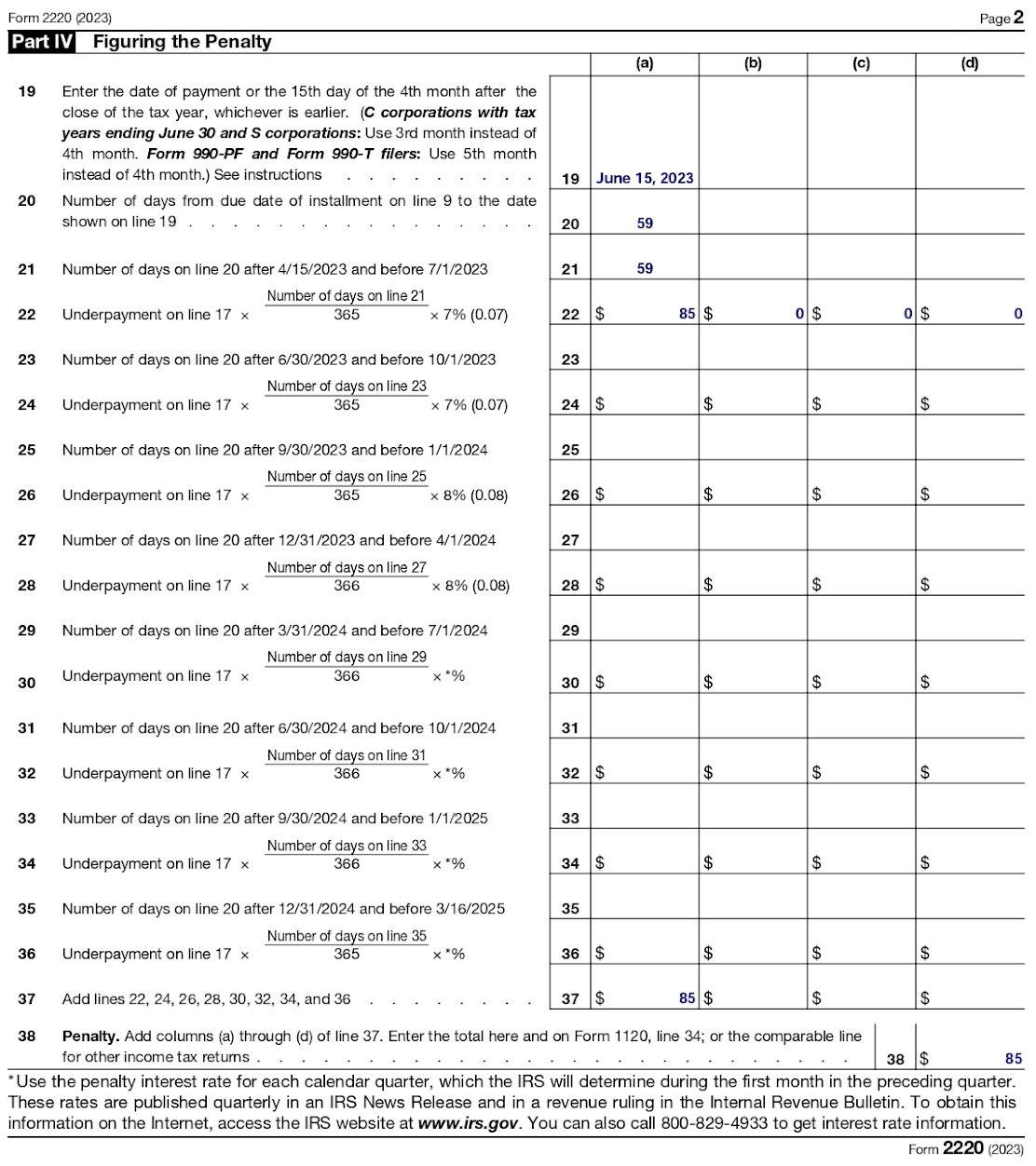

Form 2220, Part IV Example

In Part IV, the underpayment amount from row 17 of Part III is used to calculate ABC Co.’s penalty. For calendar year C-corps, the underpayment period is the time frame between when the estimated tax payment was due to the earlier of when the shortfall was paid or April 15 The underpayment period for C-corps with tax years ending June 30 and S-corps would be the time frame between when the estimated tax payment was due to the earlier of when the shortfall was paid or March 15. Instead of March 15, Form 990-PF and 990-T filers would use the same time frame, but with a period ending June 15. .

Sample of Completed Form 2220, Part IV

The underpayment penalty calculation ends on the due date because amounts owed after the due date are subject to the late payment penalty plus interest instead. The late payment penalty plus interest is more severe than the underpayment penalty, so be sure to pay your tax by the due date of the return.

Only complete columns for the quarters in which there was an underpayment. For ABC Co., the only underpayment was $7,500 in the first quarter:

- Line 19: This is the date on which the underpayment was actually paid, or the due date of the return if the underpayment was paid after the due date. For ABC Co., the underpayment in the first quarter was paid with the second installment made on June 15, 2024.

- Line 20: This is the number of days between when the underpayment was due (line 9) and when it was actually paid (line 19). For ABC Co., this is the time between April 17, 2023, and June 15, 2023, which is 59 days.

The remaining lines in Part IV are somewhat tedious mathematical calculations. Follow the instructions on the form for each line carefully.

Form 2220, Schedule A

Schedule A is where calculations for the adjusted seasonal installment method and annualized installment method take place. Because the IRS normally expects payments to be remitted evenly over the year, specialized installment methods are advantageous for taxpayers who have seasonal fluctuations in income and would likely owe a penalty if they calculated the penalty using the traditional method shown above.

You should complete Schedule A using one of the alternative methods if you received a disproportionate amount of your income in the latter half of the year and your estimated payments are based on your current year liability and not 100% of your prior year liability.

The alternative methods allow you to show substantial parts of the tax weren’t due until later in the year, thus reducing your penalty. These calculations are very tedious, so we highly recommend using good business tax software or consulting a tax pro.

Where To Report the Underpayment Penalty

- Form 1120: Check the box on line 34 and enter the Form 2220 penalty amount on that line.

- Form 1120-S: Check the box on line 25 and enter the Form 2220 penalty amount on that line.

- Form 990-T: Enter the Form 2220 penalty in Part III, line 8.

Who Should File Form 2220

Corporate entities owing tax of $500 or more that also meet the following requirements must file Form 2220 with the business tax return:

- Taxpayers using the adjusted seasonal installment method

- Taxpayers using the annualized income installment method

- a large corporation

A large corporation is a C-corp with taxable income of $1 million or more for any of the three tax years immediately preceding the current tax year.

Corporate taxpayers who would like to remit the penalty with their return to avoid a future notice from the IRS can also complete and attach Form 2220 to their return.

Frequently Asked Questions (FAQs)

No deduction is allowed for tax penalties paid to a government entity.

The corporation should pay 100% of the current year tax in even installments throughout the year. Small corporations can pay 100% of the prior year tax.

Taxes are required to be paid evenly throughout the year or an underpayment penalty will be assessed.

Bottom Line

Corporations owing more than $500 should use Form 2220 to calculate the applicable underpayment penalty. If Form 2220 is not filed, the IRS will calculate the penalty and send a bill for the balance due.