IRS Form 7205 is used to claim a deduction for energy-efficient commercial buildings placed in service during the current tax year. This deduction, also known as the section 179D deduction, is available to property owners and designers who add energy-efficient property to commercial buildings.

To take the deduction, property owners must verify that property modifications reduce energy consumption when compared to benchmarks set by the United States Department of Energy (DOE). The DOE calls these benchmarks reference standards Reference buildings are building models with standard features that are used for analysis when planning for new structure or design. and provides links to these benchmarks on its website.

Key takeaways

- The deduction applies to new construction and renovation.

- The deduction is $5.36 per square foot for buildings placed in service in 2023 and $5.65 per square foot for those placed in service in 2024.

- The deduction is for owners of commercial buildings.

- Designers of buildings owned by government or tax-exempt entities may be awarded an allocation of the deduction for their contribution to energy efficiency.

- Determination of the property’s energy efficiency should be done by a licensed engineer or contractor.

- Form 7205 must be included with the taxpayer’s income tax filing.

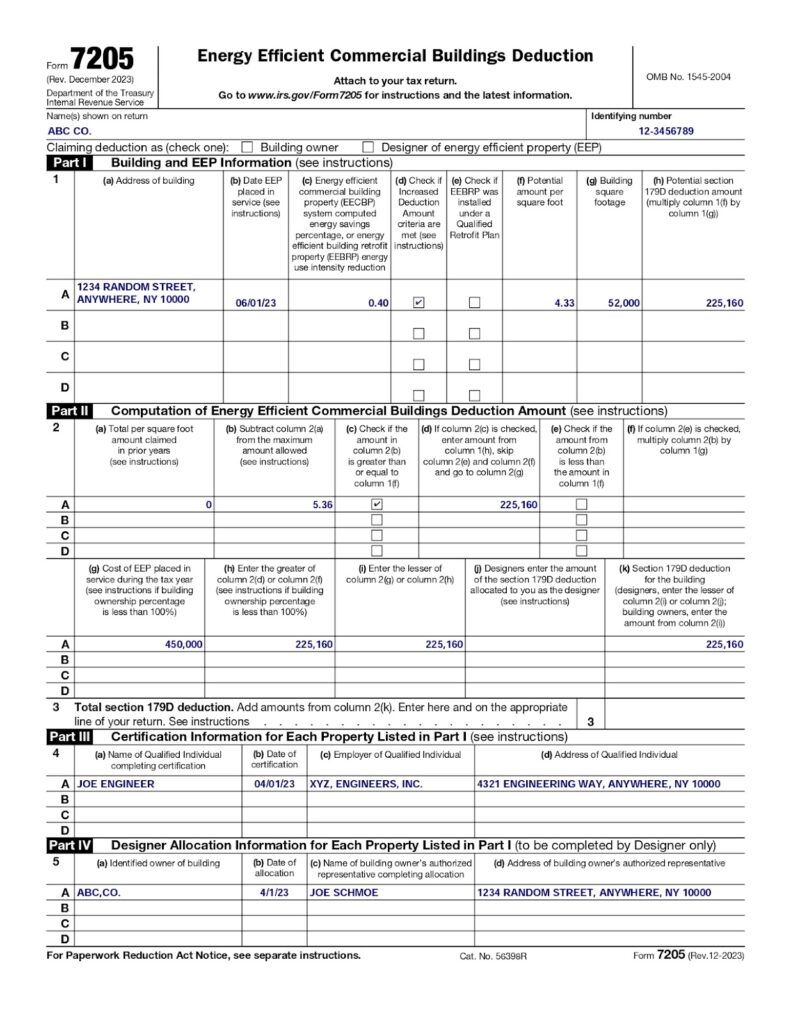

Example of Completed Form 7205

A sample Form 7205 has been completed below, using the following information:

A 52,000-square-foot commercial building was updated to include a new heating, ventilation, and air conditioning (HVAC) and hot water system. According to the engineering analysis, this new system reduces energy consumption by 40%. For purposes of this illustration, let’s assume the prevailing wage and apprenticeship requirements Reference buildings are building models with standard features that are used for analysis when planning for new structure or design. were met at this construction site.

Fact summary:

- Ownership: Single owner—ABC, Co.

- Cost of new HVAC and hot water system: $450,000

- Energy consumption reduction percentage: 40%

- Square footage: 52,000

Sample input data for Form 7205

For properties placed in service in 2023 and beyond For section 179D deductions for years prior to 2023, reference the form 7205 instructions related to that year. , the deduction may be allowed if you build or install energy-efficient commercial building property that reduces energy consumption by at least 25%. The baseline allowable deduction is $2.68 per square foot if wage and apprenticeship requirements are met; and if not, the baseline deduction is 54 cents per square foot.

The allowable deduction increases by 11 cents per square foot for each percentage point over 25%. For taxpayers who meet the prevailing wage requirements, this deduction can get up to $5.65 per square foot if the new property reduces energy consumption by 50% or more when compared to DOE benchmarks.

The deduction is divided into two categories.

1. Taxpayers Who Meet the Prevailing Wage & Apprenticeship Requirements

To meet the prevailing wage and apprenticeship requirements, you must pay market compensation for similarly employed workers in that geographic area. In addition, a minimum number of apprentices and apprenticeship hours are required on the construction project.

2. Taxpayers Who Do Not Meet the Prevailing Wage & Apprenticeship Requirements

If you do not have the appropriate number of apprentices and apprenticeship hours and you fail to pay market compensation for similarly employed workers for the job site’s geographic area, you would not meet the prevailing wage and apprenticeship requirements.

Failure to meet the prevailing wage and apprenticeship requirements reduces the amount of the section 179D deduction for which you are eligible.

Impact of Wage and Apprenticeship (W&A) Requirements on Section 179D Deduction | |||

|---|---|---|---|

25% Reduction of Energy Consumption | Additional 11-cent Deduction for Each Percentage Point Greater Than 25% | 50% or Higher Reduction of Energy Consumption | |

Building Owner Meets W&A Criteria | $2.68 per square foot | 11 cents per square foot | $5.36 per square foot |

Building Owner Does Not Meet W&A Criteria | 54 cents per square foot | 2 cents per square foot | $1.07 per square foot |

You’ll need the following information to complete Form 7205:

- Legal name and employer identification number (EIN) for the taxpayer

- Address for the energy-efficient building property

- Date the energy-efficient property was placed in service

- Contractor report showing the percentage of reduction in energy consumption

- Cost of the energy-efficient property

In Part I, you’ll need to input the taxpayer’s name and EIN, the address and square footage of the property, and some basic information from the contractor report showing the reduction in energy consumption. You may also need to complete the Form 7205 worksheet to determine the potential amount per square foot.

In our example, ABC, Co. used the most recent Form 7205, obtained from the IRS website.

After including the name and EIN for ABC, Co. at the top of the form, the columns in Part I were filled in with the following information:

- 1(a): Address of the building with the energy-efficient property

- 1(b): Date the property was placed in service

- 1(c): Percentage of energy reduction from engineer’s report

- 1(d): This box was checked because the prevailing wage and apprenticeship requirements were met in the construction project. This box identified that the property was eligible for the additional deduction amount.

- 1(e): This box was not checked because ABC, Co.’s construction project was not a qualified retrofit plan (energy reduction came as a result of property modifications and reflected accordingly in the engineer’s report).

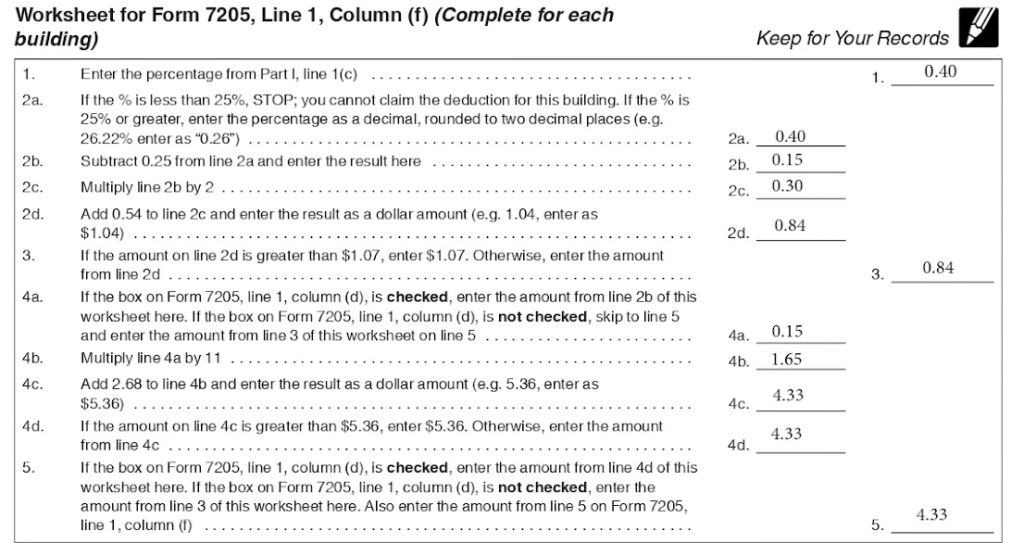

- 1(f): This amount was calculated using the Form 7205 worksheet (sample input shown in the second image below).

- 1(g): Building square footage

- 1(h): Column (f) was multiplied by column (g) to arrive at the potential §179D deduction amount. The potential amount is finalized in Part II.

ABC, Co. followed the step-by-step instructions on the Form 7205 worksheet and transferred the final line 5 number to Part I, line 1(f).

Example of completed Form 7205 worksheet.

The worksheet process determines the tentative section 179D deduction allowable before Part II of the form, where any applicable limitations are applied and the deduction amount is finalized. The worksheet calculation is summarized in table format below.

W&A Requirements Met? | Yes |

Energy-efficient Property Addition | HVAC and hot water system |

Percent Reduction - Energy Consumption | 40% |

Energy Consumption Reduction Greater Than 25% Threshold | 15% |

Deduction per Square Foot | $4.33 |

Total Deduction | $225,160 |

40% – 25% = 15% bonus consumption reduction above threshold

11 cents × 15 = $1.65 additional per square foot deduction

$2.68 + $1.65 = $4.33 deduction per square foot

$4.33 × 52,000 square feet = $225,160 deduction

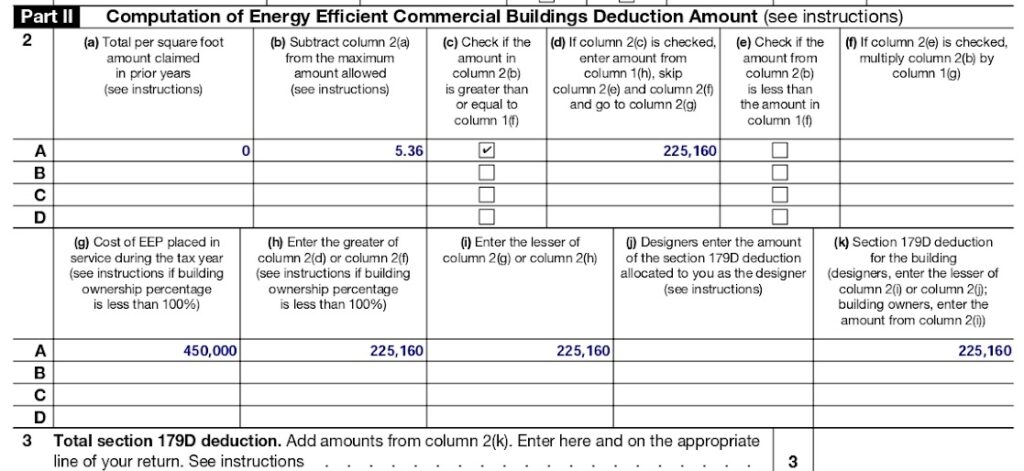

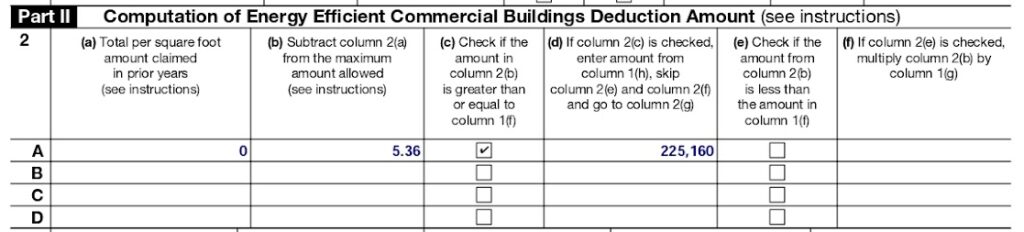

The main purpose of Part II is to ensure that multiyear section 179D deductions don’t exceed the total allowed and that no deduction is taken in excess of the cost of the property.

In our sample form input above, Part II is where ABC, Co.’s potential deduction from Part I was finalized.

Sample Form 7205, Part II data

- 2(a): ABC, Co. did not claim this deduction in prior years, so no amount was listed here.

- 2(b): The amount in 2(a) was subtracted from the maximum amount allowed. Per the form instructions, the maximum amount allowed depends on the year as well as whether the full or partial deduction is being taken.

- 2(c): ABC, Co. checked this box because the amount in 2(b) was greater than or equal to the amount in 1(f).

- 2(d): Since column (c) was checked, the amount in 1(h) was inputted here and the next input was added in 2(g). If column (c) had not been checked, “0” would need to be placed in 2(d), and 2(e) would need to be completed as applicable.

- 2(e): Not applicable for ABC, Co. If “0” had been in 2(d), 2(e) would need to be completed as shown in the column description.

- 2(f): Not applicable for ABC, Co. If “0” was in 2(d), 2(e) would need to be completed as shown in the column description.

- 2(g): The cost of ABC, Co.’s energy-efficient building property

- 2(h): This field was completed as shown in the column description. Note that the taxpayer owns 100% of the building for purposes of this example.

- 2(i): This field was completed as shown in the column description.

- 2(j): Since ABC, Co. owns the building, this field does not apply. This field should only be completed by designers.

- 2(k): The amount entered here was the deduction amount to be carried to ABC, Co.’s Form 1120-S, line 19.

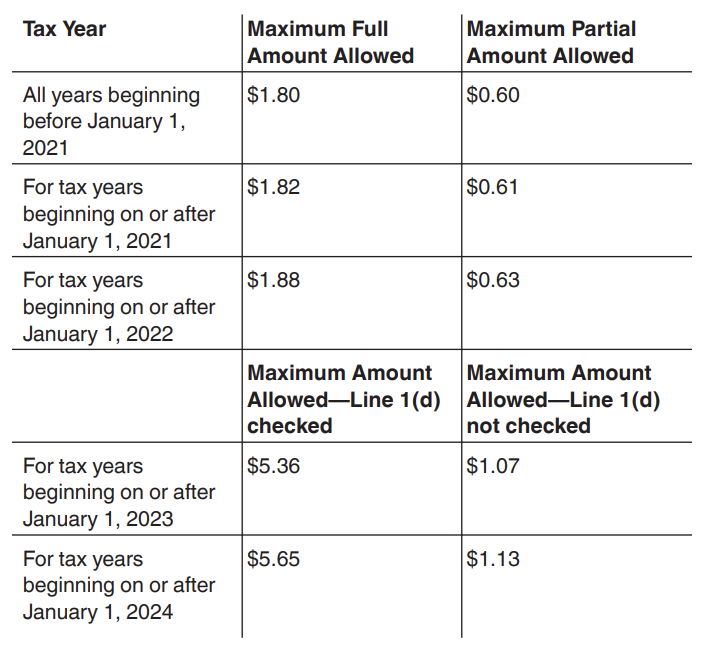

Note regarding line 2(b): The maximum deduction amount depends on whether the full amount is allowed or only the partial amount, and which tax year(s) are involved. This image shows the maximum deduction amount allowed by year.

Maximum deduction allowed.

Part III is where the independent engineer or contractor who certified the energy efficiency of the property is identified.

For our example, Joe Engineer from XYZ Engineers certified ABC, Co.’s energy-efficient construction project. His name, employer, address, and certification date were input in Part III.

Form 7205, Part III with sample data.

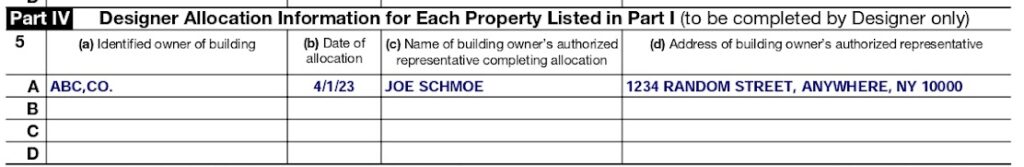

In our example, ABC Co. is completing Form 7205 as the owner of the building. If ABC, Co. had allocated the deduction to a designer, that designer would need to complete Part IV of the form. In this section, the designer would need to enter the company name and business representative authorizing the allocation.

Form 7205, Part IV with sample data.

Who Should File Form 7205?

Form 7205 should be filed by taxpayers who own commercial buildings and make qualifying expenditures that improve energy efficiency by at least 25%. The deduction can also be taken by designers of qualifying energy-efficient property if the building is owned by the government or a tax-exempt entity.

For purposes of the section 179D deduction, a designer is someone who drafts the installation blueprint for energy-efficient commercial building property. The designer designation includes architects, engineers, contractors, and environmental consultants and energy services providers.

What Is Qualifying Energy-efficient Commercial Building Property?

Property that qualifies for the deduction must meet the criteria provided below:

- Must be depreciable

- Must be located in the US

- Improvements must be made to part of one of the following systems:

a. The interior lighting system

b. Heating, cooling, ventilation, and hot water system

c. The building envelope The building envelope is composed of the parts of the building that separate the interior and exterior. These items include doors, windows, skylights, roofs, walls and other structures that are generally designed to insulate the building. - Must be able to demonstrate at least a 25% reduction in energy consumption using the standards set by the American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE) ASHRAE publishes a list of reference buildings that represent approximately 70% of the commercial buildings in the US.

- Must have an official certification from a licensed engineer or contractor confirming that the property meets the efficient energy requirements

How To Claim the Deduction

To claim the deduction, you will need to engage an engineering professional to analyze your energy usage. This contractor must certify that the property meets the applicable energy-efficient requirements. To confirm that analysis, contractors are required to use qualified software from a list published by the US Department of Energy.

You will use the contractor’s final report to populate Form 7205 and calculate the deduction. The report should be retained for audit support. Once the deduction has been calculated, complete form 7205 and attach it to your timely filed income tax return.

Where To Report the Form 7205 Deduction

The completed Form 7205 is included with the taxpayer’s income tax return. Since Form 7205 is attached to the income tax filing, the due date for the form is the same as for the taxpayer’s main income tax form (e.g., 1040, 1120-S, etc.).

The deduction calculated on Form 7205 flows to different lines depending on the type of return you file. In the absence of a specific line allocated to the energy-efficient commercial building deduction, the line for “Other Deductions” should be used. Per form instructions, the deduction should be reported on the lines below:

- Form 1040, Schedule C, line 27b

- Form 1120 S, line 19

- Form 1120, line 25

- Form 1065, line 20

Frequently Asked Questions (FAQs)

Eligible parties for the 179D tax deduction include commercial building owners and project designers for government and tax-exempt entities.

The section 179D deduction is for commercial building projects such as warehouses, hotels, malls, office buildings, and factories. Residential building projects may qualify if they are four stories or higher.

Yes. To claim this deduction for prior years, IRS Form 3115 must be filed and included with the taxpayer’s income tax return, along with Form 7205.

Bottom Line

The section 179D deduction was established to encourage eco-friendly construction. Building owners and designers can take advantage of the benefit by engaging a licensed engineer to calculate the value of the energy conservation resulting from the construction of the new property. Exact values for the tax benefit are indexed for inflation.