The first step to completing your Form 1065 is to gather all the information you’ll need. Then, you’ll fill out the form’s sections for general information and income and deductions before filling out Schedules B, K, L, M-1, and M-2 (found on Pages 2 through 5). Lastly, you’ll complete a Schedule K-1 for each partner that shows their share of income, deductions, credits, and more.

Thank you for downloading!

Quick Tip

Tax software can make completing your Form 1065 much easier, and will also allow you to file it electronically. TaxAct is our top choice for filing business returns.

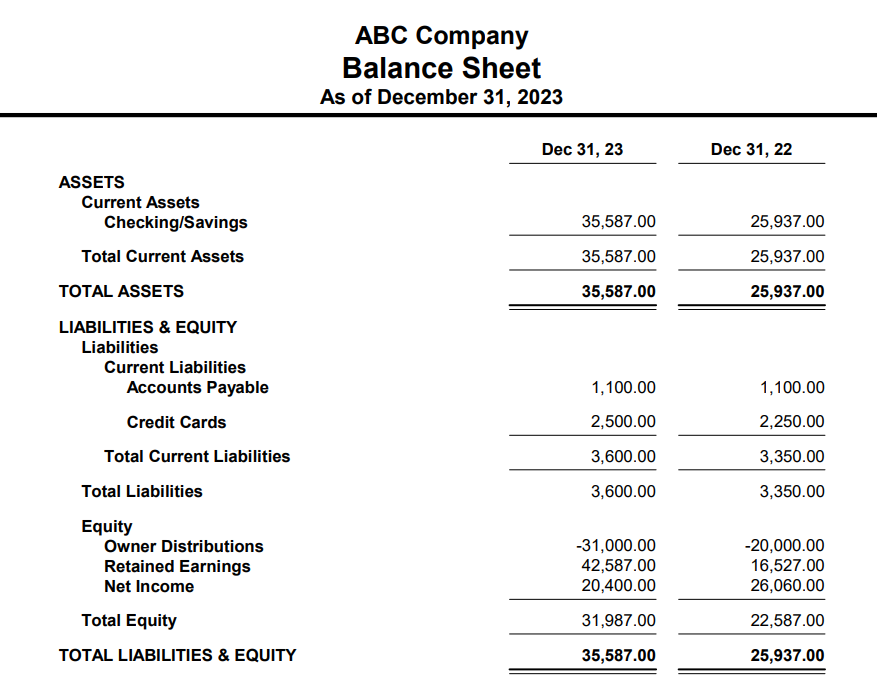

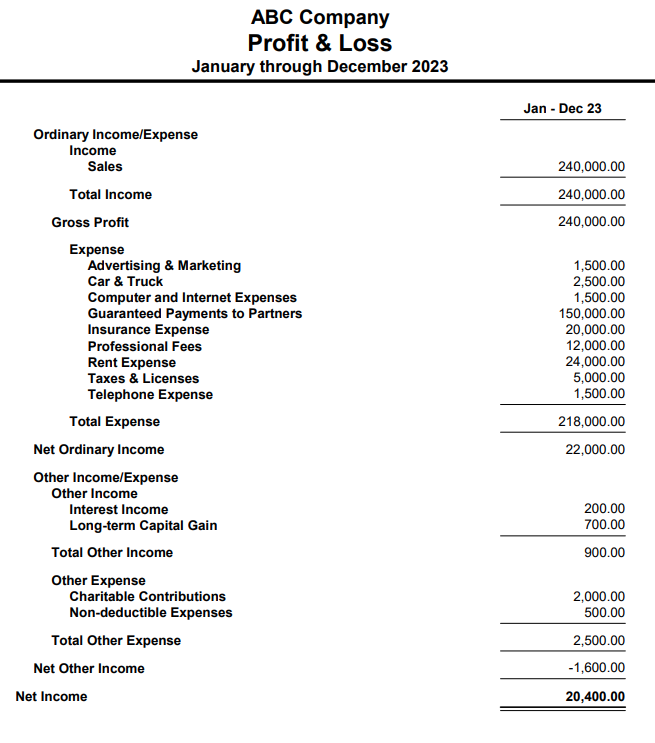

We’ll show you how to complete Form 1065 for your partnership using ABC Company’s balance sheet and income statement below.

ABC Company Balance Sheet

ABC Profit and Loss (P&L) Statement

Step 1: Gather Information Needed To Fill Out Form 1065

Download IRS Form 1065. You’ll need financial statements for the tax year, information for each of the partners, and in-depth details about fixed assets and tax payments. Our free Form 1065 checklist linked above will help you in filling out your Form 1065.

The information and reports needed to prepare Form 1065 for a partnership include:

- P&L statement: Summarizes the partnership’s income and expenses for the tax year and calculates the bottom line net P&L.

- Balance sheet statement: Summarizes the assets, liabilities, and owner’s equity as of the end of the tax year.

- Last year’s Form 1065: You’ll need to refer to last year’s partnership return when preparing this year’s return.

- Employer identification number (EIN): This is your federal EIN, also known as a taxpayer identification number. If this is the first return for a new partnership, you’ll need to apply for one from the IRS before filing the partnership return. Our guide on how to get an EIN will help you through the process.

- Business start date: You’ll need to provide the date you started the business.

- Principal business activity code: This numeric code represents the principal line of business the partnership is engaged in. Select the code that best describes your partnership from the list provided in the IRS’s Form 1065 Instructions.

- Principal business activity: This is a short description of the nature of the partnership’s business activity. Examples include manufacturing, retail, food service, and professional services.

- Principal product or service: This is a short description of the primary product or service the partnership offers. Examples include toys, restaurants, and accounting.

- Accounting method: Cash or accrual are the most common accounting methods. For more details, check out our comparison of the cash vs accrual method.

- Number of partners: Total number of partners in the business.

- Partners’ information: For each partner, you’ll need their name, address, taxpayer identification number, the amount of capital they invested during the year, and a signed Form W-9 or Form W-8BEN.

- Distributions made to partners: You’ll need reports showing the amount of payments to each partner, whether those payments are classified as guaranteed payments or as distributions of profit, and any federal or state tax withheld on these payments.

- Form 1099 reporting requirements: You’ll need to know if the partnership is required to issue any Forms 1099 and whether the partnership issued them. For more details, check out our guide to Form 1099 reporting.

- Fixed asset purchases: You’ll need a report showing the date and amount for each purchase of a fixed asset, such as machinery, equipment, computers, furniture, or buildings. You’ll also need to know the date each asset was placed in service for business use.

- Fixed asset sales: If any fixed assets were sold during the period, you’ll need the date of sale, the sales proceeds, and to identify from the list of fixed assets exactly which asset was sold.

If you use an accounting program like QuickBooks, you can run P&L and balance sheet reports in a few minutes. Read our review of QuickBooks Online to learn about how the solution can help your business. However, if you already use it and just need guidance, check out our tutorials:

- How To Run a Profit and Loss Report or Income Statement in QuickBooks Online

- How To Create a Balance Sheet in QuickBooks Online

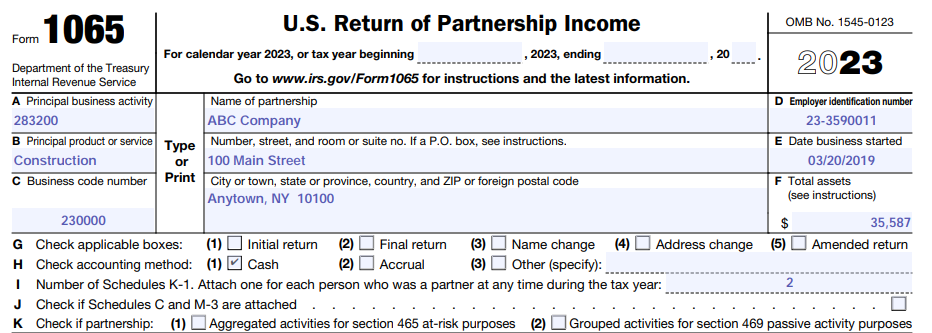

Step 2: Fill Out General Information Section

Form 1065 General Information

Now that you have financial statements and information about the partnership and the partners, let’s begin preparing the partnership tax return, starting at the top of Form 1065. The top portion of Form 1065 asks for general information about the partnership, such as the name, address, and type of business the partnership operates.

Information that’s reported at the top of Form 1065 includes:

- Name of the partnership

- Address of the partnership

- Principal business activity and business code

- Federal EIN

- Date that the business started

- Accounting method

Step 3: Fill Out Income & Deductions Section

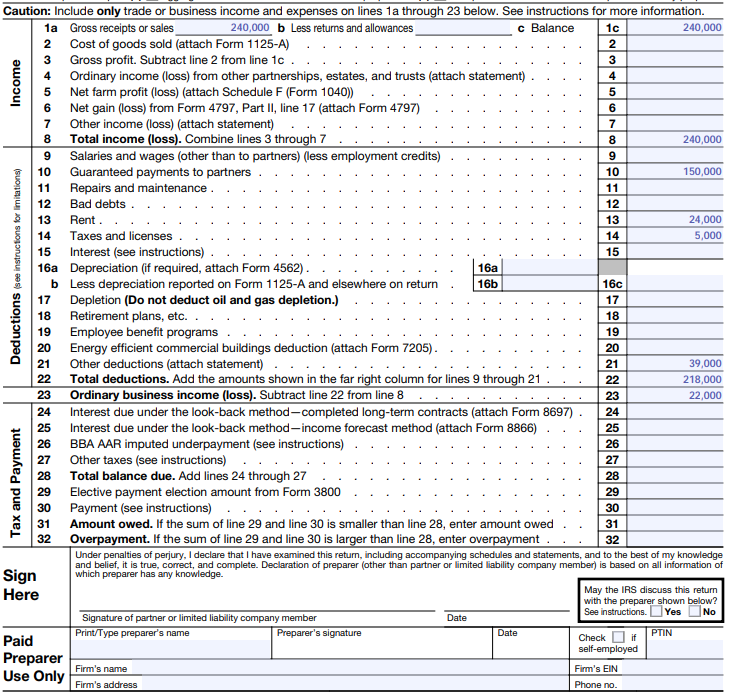

Page 1 of Form 1065 reports the business income and deductions of the partnership. The purpose of this section is to calculate the net ordinary business income (or loss) for the tax year. Details about income and expenses will come from the partnership’s P&L statement.

Page 1 of Form 1065 includes only ordinary business income and deductions, the net of which flows to Schedule K, line 1 of Form 1065 (Step 5). Dividends, interest, and rental income from investments shouldn’t be reported on Page 1. Instead, they should be reported directly on Schedule K. Including them on both Page 1 and Schedule K would double-count them.

Special tax deductions, such as Section 179, are also shown directly on Schedule K instead of Page 1. Briefly skip ahead to step 5, and review the income and deductions included separately on Schedule K lines 2 through 13 to ensure you don’t also include them on Page 1.

IRS Form 1065 Page 1

Expert tip: Guaranteed payments to partners (line 10) made in exchange for services are similar to a salary paid to the partner. However, partners are not allowed to be an employee of the partnership, so guaranteed partners are treated by partnership as distributions instead of a salary.

Guaranteed payments appear in multiple places on the return. While guaranteed payments are deducted for book purposes—as shown on the sample P&L statement above—they are not deductible for tax purposes.

While they are deducted on Page 1, line 10, they are then added back to income as a separately stated item on Schedule K, line 4. In addition to being income, guaranteed payments must be shown as partnership distributions on Schedule K, line 19.

Step 4: Fill Out Schedule B

Schedule B, found on Pages 2 through 4 of Form 1065, asks 31 questions that require yes or no responses. You’ll need to look at the instructions for Form 1065 because these questions are quite technical.

One of the most important questions on Schedule B is question #4. Your answer to this question will determine if you need to fill out Schedules L, M-1, and M-2, Item F on Page 1 of Form 1065, or Item L on Schedule K-1.

Let’s look at this question and see if it applies to our tax return:

- Does the partnership satisfy all four of the following conditions? Yes/No

- The partnership’s total receipts for the tax year were less than $250,000.

- The partnership’s total assets at the end of the tax year were less than $1 million.

- K-1s are filed with the return and given to the partners on or before the deadline for the partnership return, including any extensions.

- The partnership isn’t filing and isn’t required to file Schedule M-3.

If “yes,” then the partnership isn’t required to complete Schedules L, M-1, and M-2; item F on Page 1 of Form 1065; or item L on Schedule K-1. Our sample corporation answers “yes” to this question, so we don’t need to file those schedules. However, for illustrative purposes, we’re going to complete those schedules anyway.

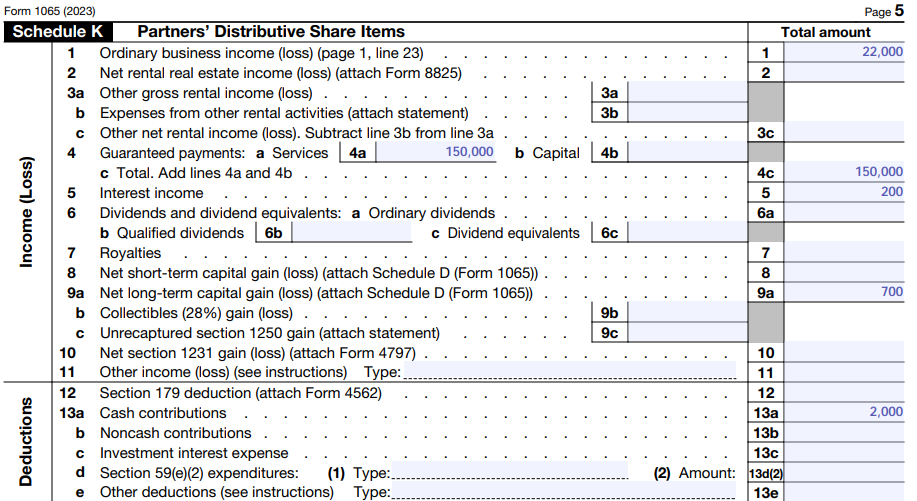

Step 5: Fill Out Schedule K

The partnership’s income, deductions, and credits for the year are all listed on Schedule K. The amounts shown on Schedule K will be allocated to each partner using Schedule K-1. Each partner will get a Schedule K-1 so that they can report their share of the partnership’s income on their own tax returns.

Line 1 of Schedule K reports the ordinary business income or loss from Page 1. Lines 2 through 13 report other items of income and deductions as shown as the sample P&L statement. Be careful not to report any income or deduction on both Page 1 and lines 2 through 11—except for guaranteed payments, which are a deduction on Page 1 and income on Schedule K, line 4.

Form 1065, Schedule K Income and Deductions

Lines 14 through 21 of Schedule K are for informational purposes and don’t affect the total taxable income reported by the partnership. Partners use this information to make certain tax calculations on their individual tax returns.

It’s fine for amounts on lines 14 through 21 to also be included on Page 1 or in the income and deduction section at the top of Schedule K. For example, foreign interest payments listed on line 16(i) should also be deducted as an interest expense on Page 1.

Here is how we calculated the numbers for our sample company:

- Line 14a, Net Earnings from self-employment, includes both the ordinary business income from line 1 and the guaranteed payments from line 4a.

- Line 14c, gross nonfarm income, is the total gross receipts from Page 1.

- Line 18c is the total nondeductible expenses from the sample P&L statement.

- Line 19a is the ownership distributions shown on the sample balance sheet plus the guaranteed payments to partners

- Line 20a, investment income, is the interest income from line 5. Notice it doesn’t include any capital gains shown on lines 8 or 9.

Form 1065, Schedule K, Lines 14 through 21

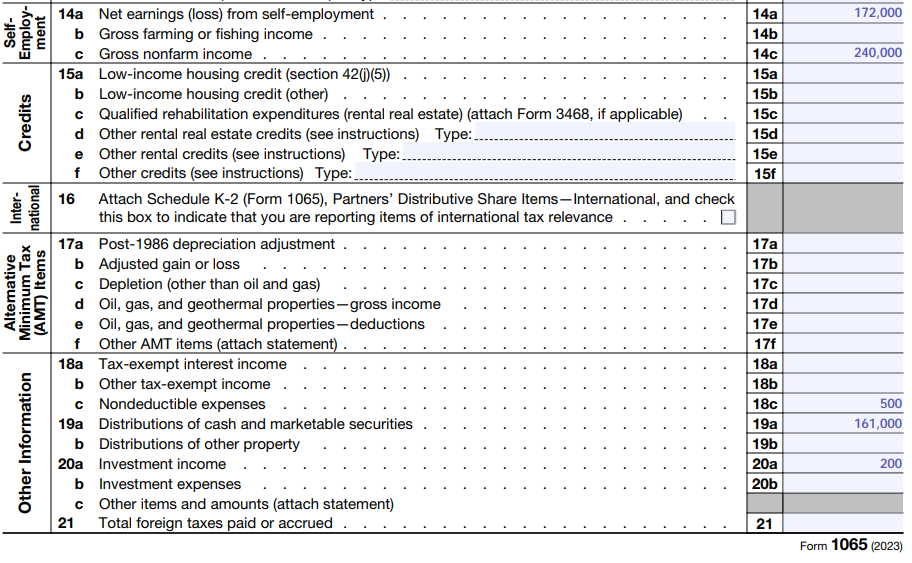

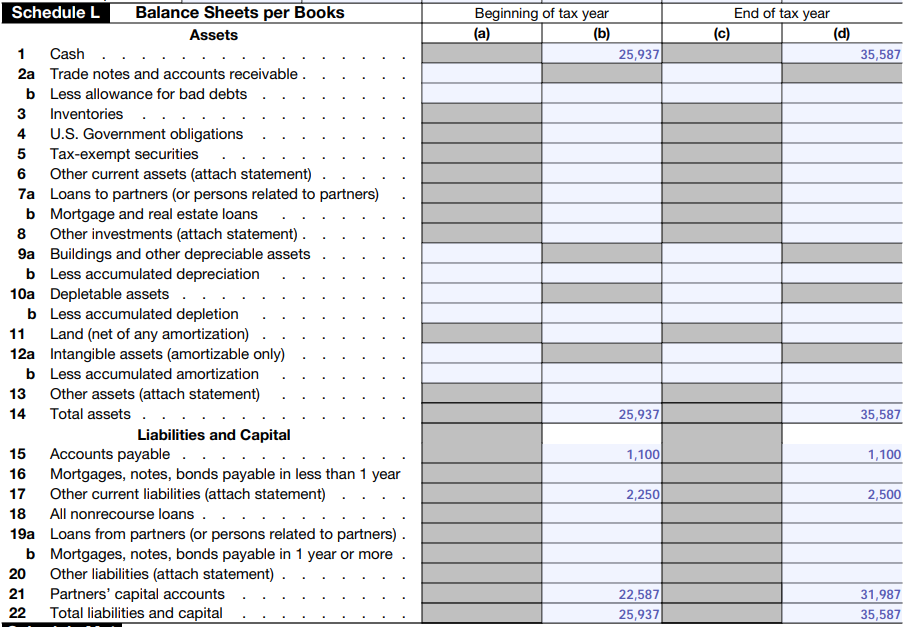

Step 6: Fill Out Schedule L Balance Sheet

Schedule L is used to give the IRS information about all of the partnership’s assets, debts, and equity at the beginning and end of the tax year. If you use an accounting program, this information will come directly from your balance sheet report. If you answered “Yes” to question 4 on Schedule B, you don’t need to complete Schedule L.

Since our sample partnership meets all of the requirements of Schedule B, question 4, it’s unnecessary for the partnership to fill out Schedule L. However, we’ll complete Schedule L as it confirms all the income and deduction information has been entered and the return balances. The information for Schedule L comes directly from the sample balance sheet.

Form 1065, Schedule L Balance Sheet

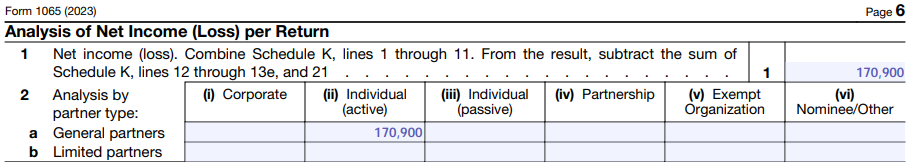

Step 7: Complete Analysis of Net Income (Loss) per Return

Lines 1 and 2 at the top of Page 5 summarize the income and loss shown on Schedule K. It then separates the income or loss by partner type. Our example partnership has all general, individual partners, so the entire income is shown on both line 1 and line 2a, column ii.

Form 1065, Page 6, Analysis of Net Income

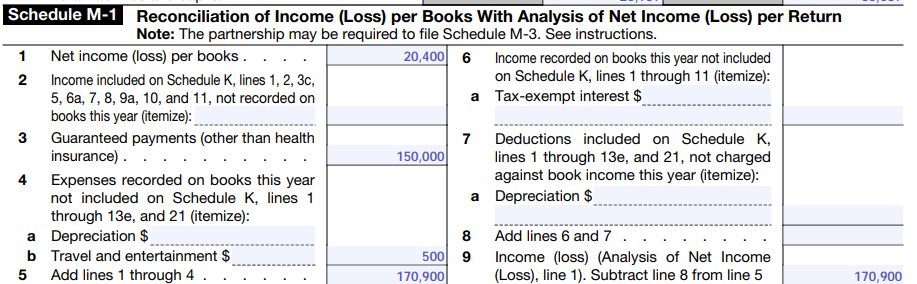

Step 8: Fill Out Schedule M-1

The purpose of Schedule M-1 is to show any differences in how income and expenses are reported for bookkeeping and tax purposes. Any differences between the two methods are summarized on Schedule M-1. If you answered “Yes” to Schedule B, question 4, you don’t need to complete Schedule M-1.

Some common book-tax differences include:

- The adjustment for any nondeductible meals

- Guaranteed payments to partners

- Tax-exempt interest income

- Nondeductible expenses, such as fines, penalties, or entertainment

The best way to tackle Schedule M-1 is to first review your P&L statement and enter the net income on Line 1 of Schedule M-1. Next, review the income and deductions you’ve reported on Page 1 and Schedule K lines 2 through 13, and then enter the net of those amounts on Schedule M-1, Line 9.

Compare the P&L statement and tax return income line-by-line to determine all differences. These differences must be shown on Schedule M-1, lines 2 through 9. For instance, if depreciation expense on the P&L statement is greater than depreciation expense on Page 1 of Form 1065, then the difference must be reported on Schedule M-1, line 4.

Even though our sample partnership meets all the requirements for Schedule B, question 4, and this schedule isn’t needed, we’ll still fill it out to show how important it is to keep track of all your income and expenses to gain a better understanding of your tax liability.

Form 1065, Schedule M-1

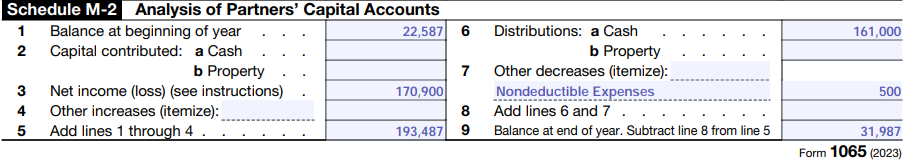

Step 9: Fill Out Schedule M-2

The purpose of Schedule M-2 is to show changes to the partners’ capital account for the year and to calculate the ending balance. Remember, if you answered “Yes” to question 4 on Schedule B, you don’t have to complete Schedule M-2.

The beginning and ending capital accounts (lines 1 and 9) should agree with the beginning and ending capital accounts on line 21 of Schedule L. Net income on line 3 should agree with the net income on line 1 of Schedule M-1. Any guaranteed payments to partners must be included in cash distributions.

Form 1065, Schedule M-2

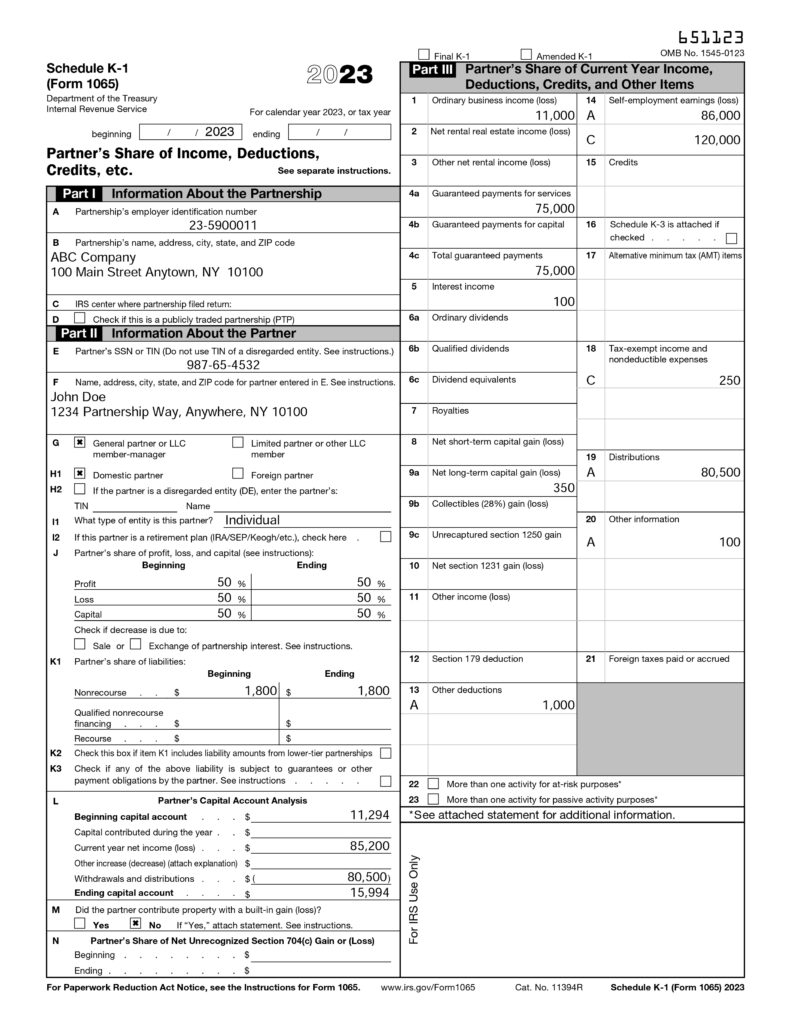

Step 10: Fill Out Schedule K-1 for Each Partner

After filing Form 1065, each partner is provided a copy of their Schedule K-1 by the partnership. The K-1 reflects the partner’s share of income, deductions, credits, and other items that a partner will need to report on their individual tax return. The information you’ll need to fill out for each Schedule K-1 will come from Schedule K of Form 1065.

For ABC Company, we’ve assumed that each partner is allocated 50% of all income and deductions and that each was paid a guaranteed payment of $75,000. Below is the Schedule K-1 prepared for one of the 50% partners. If you answered “Yes” to question 4 on Schedule B, then you’re not required to complete box L.

Form 1065 Schedule K-1

Tips to help you prepare your Schedule K-1 include:

- Amounts should total to Schedule K: The amounts in Part III of Schedule K-1 are an allocation of amounts from Schedule K. Therefore, each line item totaled across all Schedule K-1s must equal the amount from Schedule K.

- Furnish Schedule K-1 by due date: The partnership needs to distribute a Schedule K-1 to each partner by the filing deadline (March 15, or September 15 with an extension.)

- Amounts flow from Schedule K-1 to Form 1040: Partners take the amounts shown on their Schedule K-1 and report them on their personal tax return.

- Pass-through nature: This allocation process is how partnership income, deductions, and credits pass through to the partners’ personal tax returns.

Form 1065 Partnership Return Due Dates

The deadline to file Form 1065 is March 15 for calendar year partnerships. However, you can see the IRS’s six-month extension guide, which indicates that an extension to September 15 is available. Keep in mind that the partners can’t file their individual returns until the Form 1065 is filed.

Frequently Asked Questions (FAQs)

If you formed a limited liability company or other business entity with the state, then you will need to file Form 1065. However, if you have a general partnership and both spouses own and operate the business, you may elect to file two Schedule Cs under the rules for qualified joint ventures. Read IRS’s Election for Married Couples Unincorporated Businesses for more information.

No, the partnership or LLC files one Form 1065 for the year. That Form 1065 tallies up income, deductions, and credits for the year. Then, it allocates the income, deductions, and credits to each partner using Schedule K-1. Each partner uses Schedule K-1 to prepare their own personal tax return.

Yes, LLCs and partnerships can have foreign partners. There are some additional tax responsibilities, though. The LLC or partnership will need to withhold federal and state taxes on the income allocated to foreign partners. Foreign partners need a United States taxpayer identification number (TIN) and need to file their own tax returns in the US.

Bottom Line

You should now have a good idea of who needs to file Form 1065 and what kind of information is needed to fill it out. You can download Form 1065 from the IRS and complete it by hand or save time by purchasing tax software that will prepare Form 1065 for you.