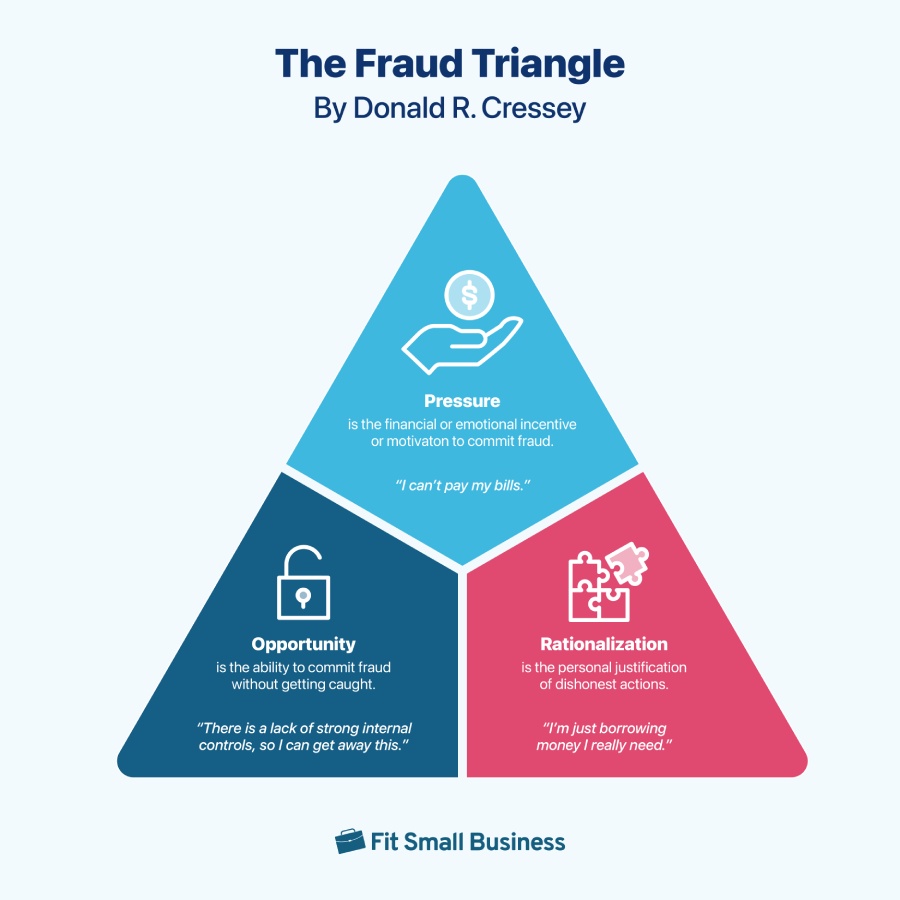

The fraud triangle is a framework that outlines three coexisting conditions that typically lead to higher instances of occupational fraud: pressure, opportunity, and rationalization.

What Is the Fraud Triangle in Accounting?

This article is part of a larger series on Bookkeeping.

Designed by well-known criminologist Donald R. Cressey, the fraud triangle explains the reasons behind fraud and is a guide for small business owners and managers to assess the areas where fraud might exist. In the accounting process, we look at fraud as a causative factor for material misstatements in accounting records and financial statements. We also look into how we can prevent fraud.

The Fraud Triangle by Donald R. Cressey.

1. Pressure (or incentive): the what

Pressure is the financial or emotional motive to commit fraud. And with the right incentive or situation that creates a personal demand for more money, some employees may be tempted to commit fraud.

Motivations that create pressure to commit fraud include:

- Survival needs, e.g., sustaining a life-saving medicine or keeping up with inflation

- Unexpected circumstances, e.g., paying for a sudden medical bill or a life partner losing their job

- Personal incentives, e.g., supporting a gambling addiction or wanting to keep up with peers’ lifestyles

- Disgruntlement or resentment, e.g., feeling constantly pressured to exceed goals to gain bonuses or being overlooked for a promotion

Meeting certain expectations is requisite before getting incentives Incentives include promotions, performance bonuses, salary increases, and fringe benefits. — and employees who want to receive them may resort to fraud if goals are impossible or difficult to meet. To prevent motivation-based fraud, consider:

- Setting realistic performance targets or SMART goals

- Showing empathy and having an open-door policy to promote honest communication

- Offering fair and practical employee incentive programs

2. Opportunity: the how

Opportunity is the ability to commit fraud without getting caught or the circumstance that allows fraud to occur. In the fraud triangle in accounting, it is the only condition you, as a business owner or manager, have complete control over.

Common opportunities that enable fraud include:

- Nonexistent or weak small business internal controls, e.g., employees can override internal controls or take advantage of its weaknesses

- Lack of owner participation, e.g., the owner does not actively participate in daily operations, such as approving large expenses and signing checks

- Lack of physical controls or supervision, e.g., employees have access to the inventory storages, allowing them to steal goods, especially if there are no security personnel or security cameras in place

You can prevent opportunity-based fraud by:

- Doing a segregation of duties in accounting

- Conducting periodic audits of internal systems to identify inconsistencies or unusual patterns

- Requiring superiors’ authorization so that no single employee can approve payments

3. Rationalization (or attitude): the why

Rationalization is the personal justification of dishonest actions. Even when employees feel pressured and have the opportunity to commit fraud, most will not unless they can justify their actions.

Common justifications used to rationalize fraud include:

- “Everyone does it,” or the “tone at the top,” e.g., the owner bragging about hiding income from the IRS may affect employees’ behavior

- “No one would know or see,” e.g., someone handling incompatible duties (like recording payments in the accounting records and accepting cash from customers)

- “The company deserves it,” e.g., someone who has a below-market salary or is passed on for a promotion rationalizing that the crime is a way of getting back at the employer

To prevent rationalization-based fraud, consider:

- Setting clear spending rules and discussing consequences for breaking them

- Practicing full transparency about the company’s finances

- Making employees feel appreciated by offering bonuses or a company holiday

Sample scenarios using the fraud triangle

Fraud can happen at any level of the business. I prepared two examples.

1. At the employee level

- Pressure (the what): Consider an employee struggling to keep food on the table due to debt — there’s an incentive to steal.

- Opportunity (the how): Say that the same individual lacks supervision and knows there are weak accounting controls. They have access to checks, so they steal them.

- Rationalization (the why): Imagine the employee thinking, “No one’s ever checked, so nobody will find out,” or “I deserve this money for all my hard work anyway.”

2. At the executive level

- Pressure (the what): Picture a greedy executive wanting more money to sustain their lavish lifestyle. However, the executive’s debt is piling up, and their income can no longer sustain it.

- Opportunity (the how): Say that person has the power to undo internal controls, hide spending in financial statements, and falsify documents.

- Rationalization (the why): Imagine them thinking, “No one will dare challenge me given my superiority,” or “Nobody will ask questions because I always deliver beyond what’s expected.”

Top management fraud is when executives abuse their role for their own gain (internal fraud) or the advancement of the company’s agenda (corporate fraud). The white-collar crime includes corruption, embezzlement, money laundering, and insider trading.

According to the same ACFE report above, owners or executives committed 18% of the fraud cases in the US and Canada. Additionally, fraud by owners or executives had median losses that were over seven times higher than those carried out by employees.

Fraud at the executive level is harder to detect and uncover. First, executives have the authority to manipulate financial processes and override internal controls without immediate scrutiny. Second, lower-level employees often hesitate to report suspicious activity due to fear of retaliation, job loss, or direct threats from those in power. This combination of influence and fear creates an environment where fraud can persist undetected for extended periods.

Kinds of business fraud

There are two types of business fraud applicable to every business: fraudulent financial reporting and misappropriation of assets. These can exist regardless of the business size and anywhere in the bookkeeping process.

Also known as financial statement fraud, this involves the intentional manipulation of financial statement information through misstatements and omissions of information.

Click through the tabs for some of the precursors of fraudulent financial reporting.

Asset misappropriation involves theft and unauthorized use of company assets. Lower-level employees can do it in small or immaterial amounts, while top management can misappropriate assets in large amounts by concealing them.

Click through the tabs for examples of asset misappropriation.

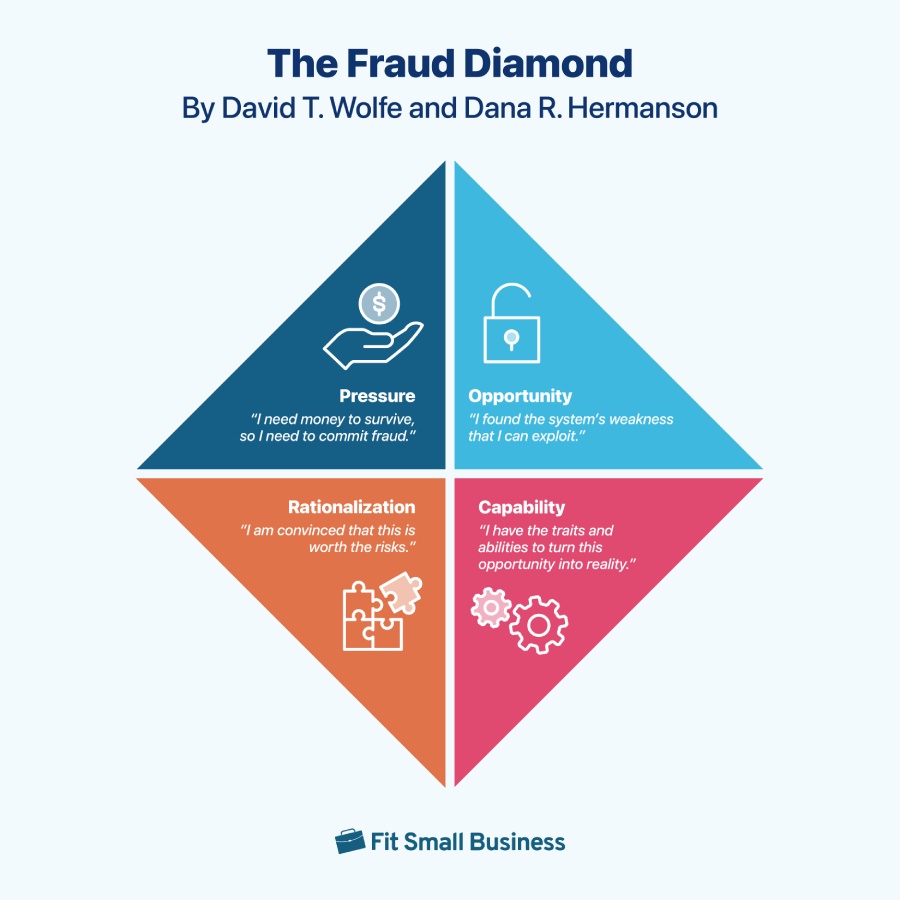

The new fraud triangle theory: The fraud diamond

The fraud diamond is a newer theory by David T. Wolfe and Dana R. Hermanson that incorporates capability as one of the key conditions to commit fraud, emphasizing the fraudster’s personal characteristics. While pressure, opportunity, and rationalization exist, the fraudster should also possess certain traits and abilities.

- Traits include greed, dishonesty, persuasion, and excessive pride.

- Abilities include knowledge of controls and the company’s vulnerabilities.

So capability, in this case, means that the fraudster would be intelligent and creative enough not only to recognize an opportunity to execute a fraudulent scheme but also to manipulate the system, deal with the stress of the crime, and stay undetected.

The Fraud Diamond by David T. Wolfe and Dana R. Hermanson.

Six factors constitute capability, per Wolfe and Hermanson.

- Position: The person holds a role or responsibilities within the company that enables them to create an opportunity for fraud, such as the ability to control a deal’s timing.

- Intelligence: The person is smart enough to understand the company’s weaknesses and creative enough to use their position or access to their advantage.

- Ego: The person has a big ego and is very confident; common personality types include self-centered and narcissistic.

- Coercion: The person can convince others to conceal or even participate in the fraud. They may threaten those who don’t comply or insist that colleagues look the other way.

- Deceit: The person can lie convincingly, consistently, and effectively. This is critical so that their fabrications remain undetected.

- Stress: The person manages their stress very well, as committing and concealing fraud is stressful.

When managing fraud risk, assess a person’s capabilities. That includes:

- Interacting with the person in various circumstances frequently, e.g., business and social settings

- Looking for red flags, no matter how small, in the person’s behavior

- Asking about others’ experiences with or observations about the person

Frequently asked questions (FAQs)

In simple terms, the fraud triangle states that employees commit fraud when three conditions co-exist: pressure, opportunity, and rationalization.

The fraud triangle theory is a model for identifying fraud risks. It states that three factors — pressure, opportunity, and rationalization — lead to fraud.

The four points of fraud in the fraud diamond are pressure, opportunity, rationalization, and capability.

Bottom line

Establishing strong internal controls can mitigate fraud risks — but only to a certain level. Business owners and leaders should create a healthy working relationship with, as well as an environment for, employees to prevent them from resorting to fraudulent acts. Keeping workers happy and providing growth opportunities will help them align personal goals with business goals.