1-800Accountant is a nationwide virtual accounting firm that will handle all of your accounting needs, from bookkeeping to tax preparation and filing, providing year-round support and advice with a team of experienced professionals. You’ll have access to bookkeepers, tax and financial advisors, payroll specialists, and a dedicated accountant who is an expert in your state and industry.

It’s ideal for small businesses wanting a full-service accounting firm at an affordable price. With its powerful mobile app, it’s also useful for businesses working remotely. Annual subscriptions start at $179 monthly, and if you need help setting up your business, there are entity formation services available for an additional fee. Bookkeeping services start at $399 monthly and include priority support and access to financial reports.

Pros

- Has dedicated accountants

- Can manage multiple business entities

- Features a capable mobile app

- Offers business formation services for LLCs and corporations

- Has year-round tax advice

Cons

- Lacks a monthly subscription option (must commit annually)

- Offers financial reports and bookkeeping services only with an Enterprise plan

- Has multiple unresolved complaints with the BBB

Supported Bookkeeping Software | ClientBooks, a proprietary bookkeeping software |

Monthly Pricing (Billed Annually) |

|

Free Trial | ✕ |

Assigned a Personal Bookkeeper? | ✓ |

Bookkeeper Communications | Phone, live chat, email, or secure messaging within the client portal |

Monthly Account Reconciliations & Financial Statements | Enterprise plan |

Back-office Services Like Customer Invoicing & Bill Pay | ✕ |

Full-service Payroll Available | Additional fee; undisclosed on website |

Tax & Consulting Services Available | Core Accounting and Enterprise plans |

Average User Reviews |

|

- Small businesses seeking a full-service accounting firm: If your business needs not only bookkeeping services but also tax filing and payroll processing, 1-800Accountant is a good option. It’s one of our best online bookkeeping services.

- Small businesses wanting access to year-round tax services: Available with the Business, Core Accounting, and Enterprise plans, 1-800Accountant can connect you with a dedicated accountant who will assist with proactive tax planning and quarterly reviews.

- Small businesses working remotely: Its robust mobile app has all of the same features as the cloud-based version, and it also includes mileage tracking and the ability to upload documents with your phone.

- New nonprofit organizations: It specializes in helping nonprofits with setup, compliance, bookkeeping, and more. Its certified public accountants (CPAs) will guide you through setup requirements and help you file your 501(c)(3) application. You’ll be educated on compliance, allowing you to accept donations while your nonprofit status is pending.

1-800Accountant Alternatives & Comparison

1-800Accountant Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Ability to work one-on-one with your own dedicated bookkeeper | Forms not tailored with nonprofit options |

| Free account setup and onboarding | Reports of bookkeeping not being completed on time |

| Year-round tax advice and planning in service fees | Issues with app crashing |

Users who shared a 1-800Accountant review stated that the dedicated bookkeepers are both patient and resourceful, ultimately saving time and money—and I agree. Reviewers also praised the additional services provided, including payroll, business formation, and year-round tax assistance. The biggest complaints about 1-800Accountant are issues with the app crashing and lack of customization with forms. Customers also cited bookkeeping tasks not being completed on time.

The firm has earned the following average scores on popular review sites:

- BBB[1]: 4.06 out of 5 from around 1,325 reviews

- Trustpilot[2]: 4.3 out of 5 from about 7,345 reviews

- Google Play[3]: 2.8 out of 5 from around 125 reviews

1-800Accountant Pricing

A free live bookkeeping consultation is required before signing up, and paid services are billed annually. There is also the option of customizing a package that’s tailored to your business needs.

1-800Accountant also offers some free and paid services to startups. Services include a verified name availability search, customized articles of organization, secure online access to incorporation documents, and unlimited phone and email support.

Business | Core Accounting | Enterprise | |

|---|---|---|---|

Monthly Fee (Billed Annually) | $179 | $239 | $399 |

Access to Portal | ✓ | ✓ | ✓ |

Dedicated Accountant | ✓ | ✓ | ✓ |

Year-round Tax Advice | ✓ | ✓ | ✓ |

Proactive Tax Planning | ✓ | ✓ | ✓ |

Quarterly Reviews | ✓ | ✓ | ✓ |

Personal & Business Tax Preparation | ✕ | ✓ | ✓ |

Bookkeeping Software | ✕ | ✓ | ✓ |

Bookkeeping Services | ✕ | ✕ | ✓ |

Priority Support | ✕ | ✕ | ✓ |

Financial Reports | ✕ | ✕ | ✓ |

1-800Accountant Features

1-800Accountant offers a robust mobile app and secure online portal that allows me to communicate with my bookkeeper and access my documents. It can also assist with entity formation and filing my personal and business tax returns, offer tax advice, and provide catch-up bookkeeping services if I need assistance with getting my books up to date.

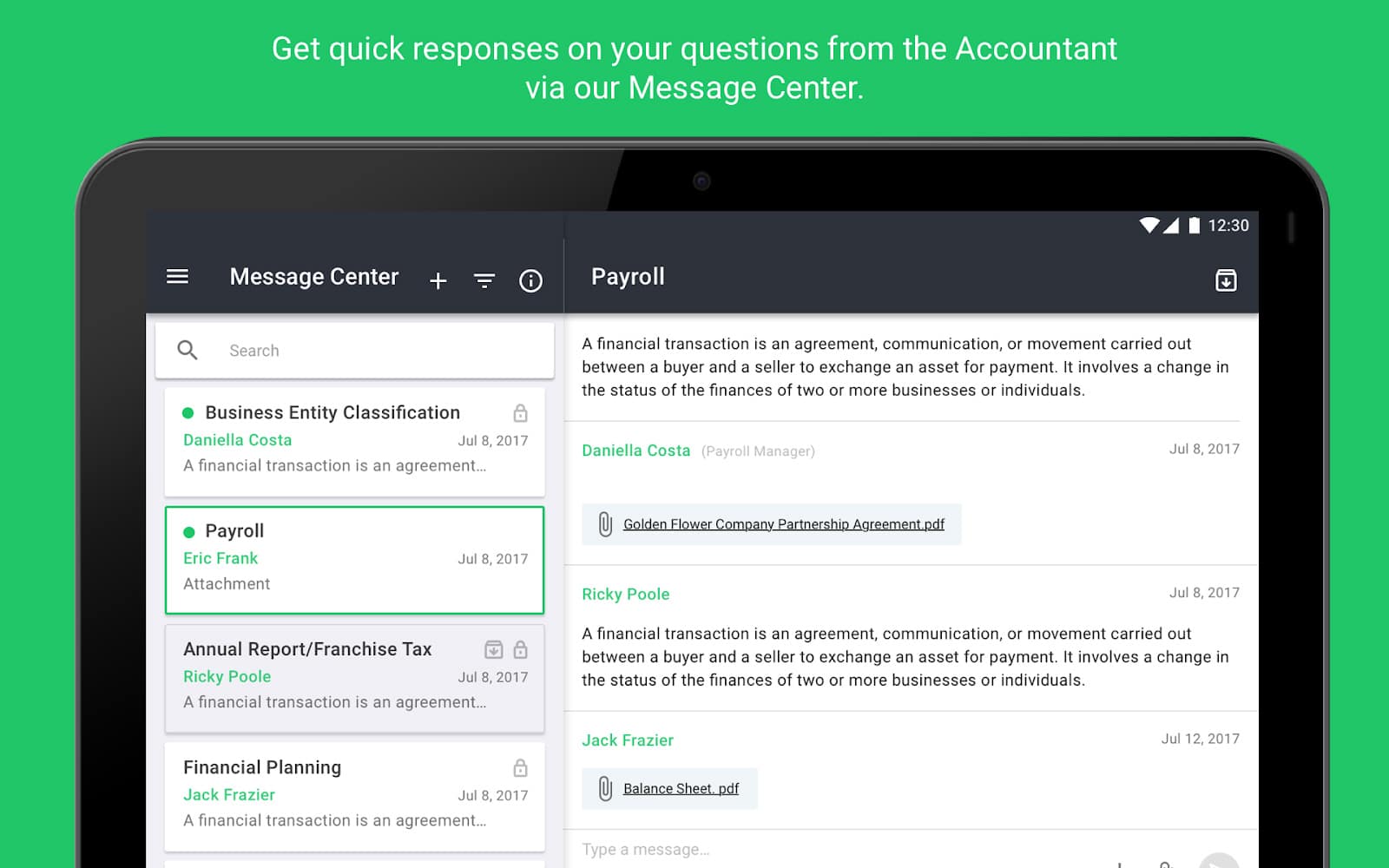

Available for both iOS and Android users, 1-800Accountant’s mobile app allows me to perform the same tasks as with my computer. These include creating and sending invoices, generating financial reports, creating journal entries, and syncing my bank accounts.

I can also track mileage and upload receipts, invoices, and other important documents into 1-800Accountant’s secure document center from a saved file on my phone or by taking a photo in the app. Should I need assistance, I can schedule an appointment or request a call from my dedicated accountant.

1-800Accountant mobile app

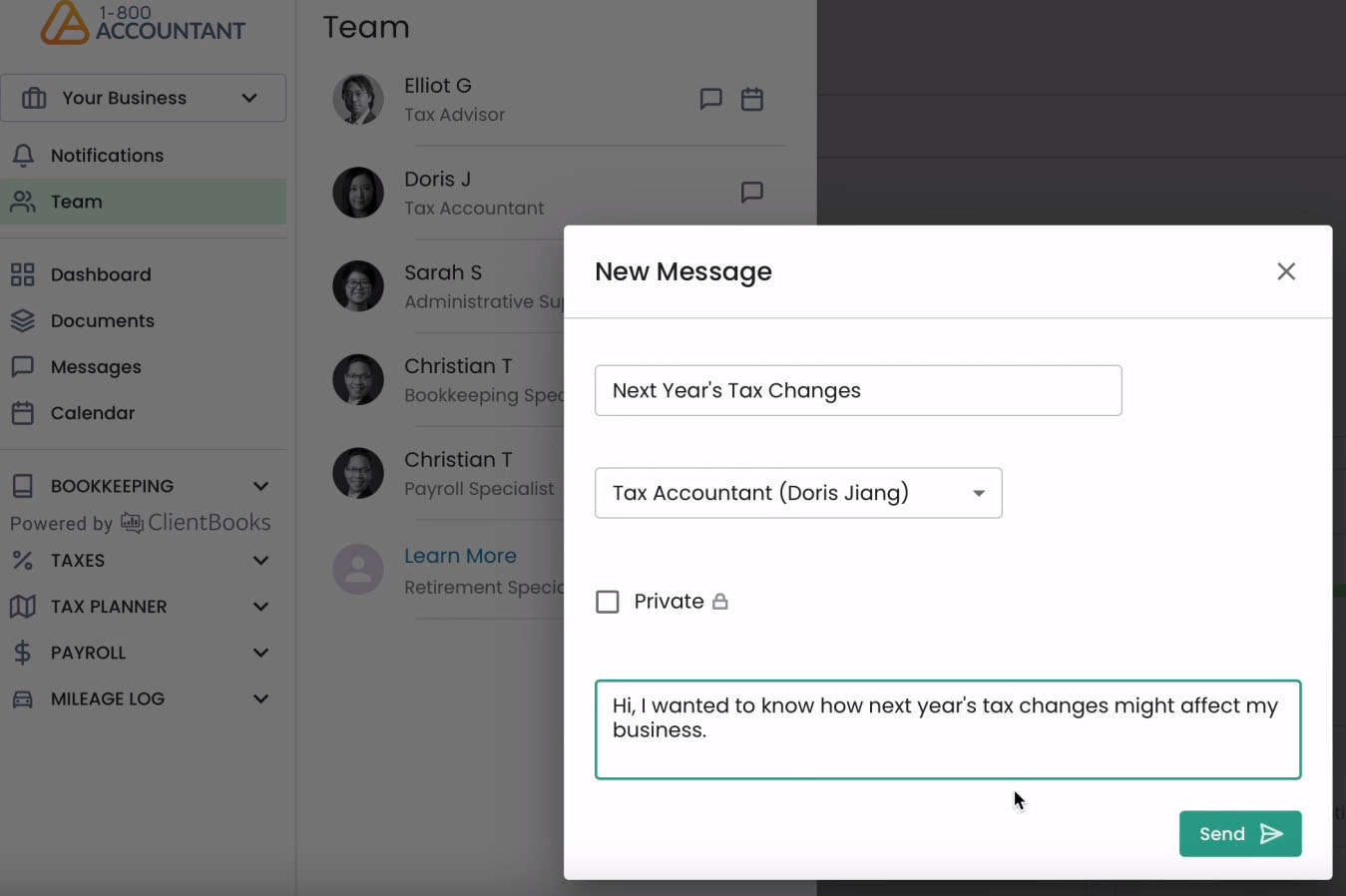

1-800Accountant’s client portal provides secure online access to my documents and records. It also allows me to message my accountant directly and schedule an appointment.

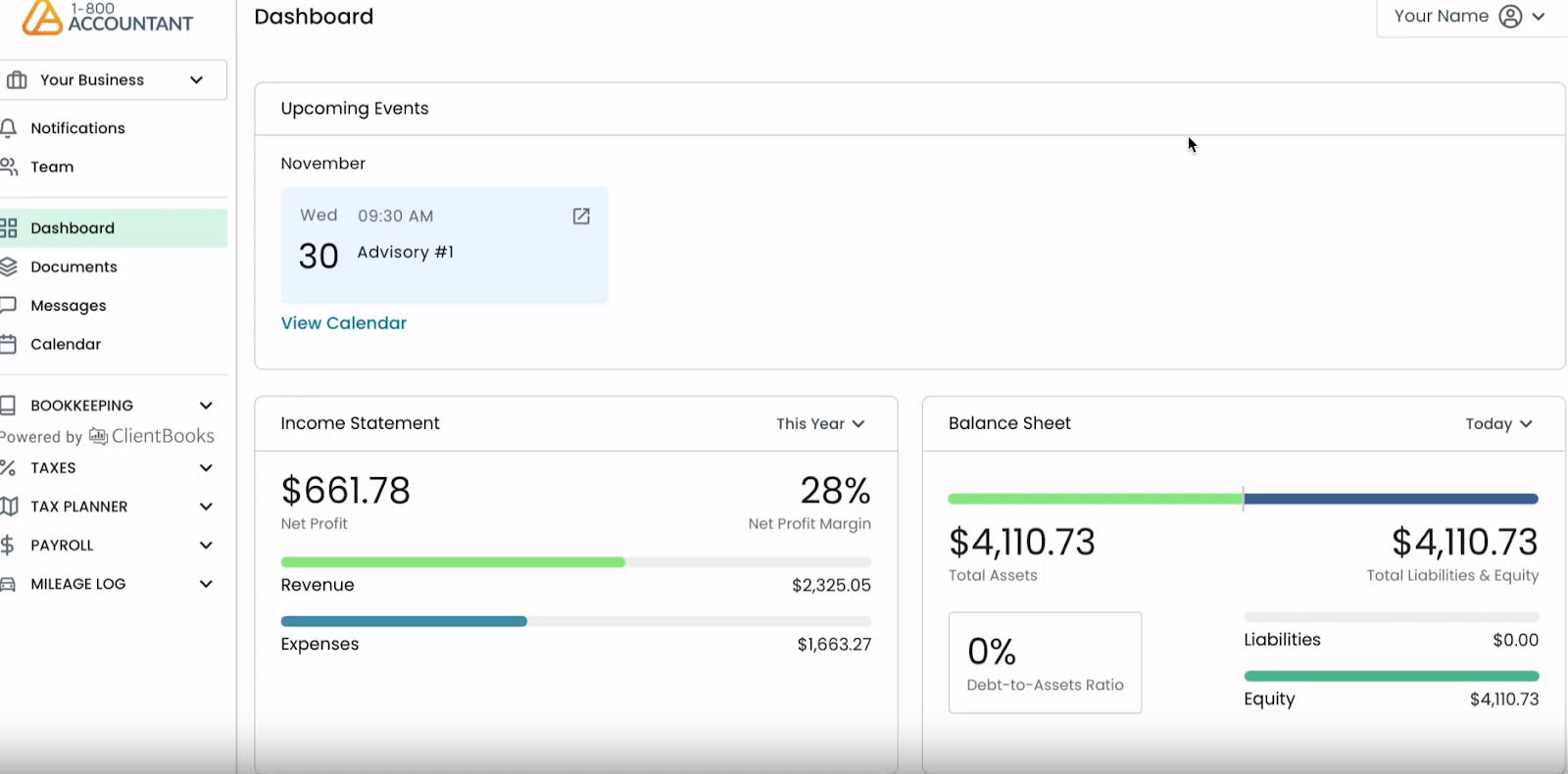

1-800Accountant Dashboard (Source: 1-800Accountant)

With any plan, I’ll be matched with a dedicated accountant who is knowledgeable in my industry and location. The Business and Core Accounting tiers provide tax assistance only, but with the Enterprise plan, my accountant will categorize my transactions, reconcile accounts, run reports, make recommendations, and help me stay compliant.

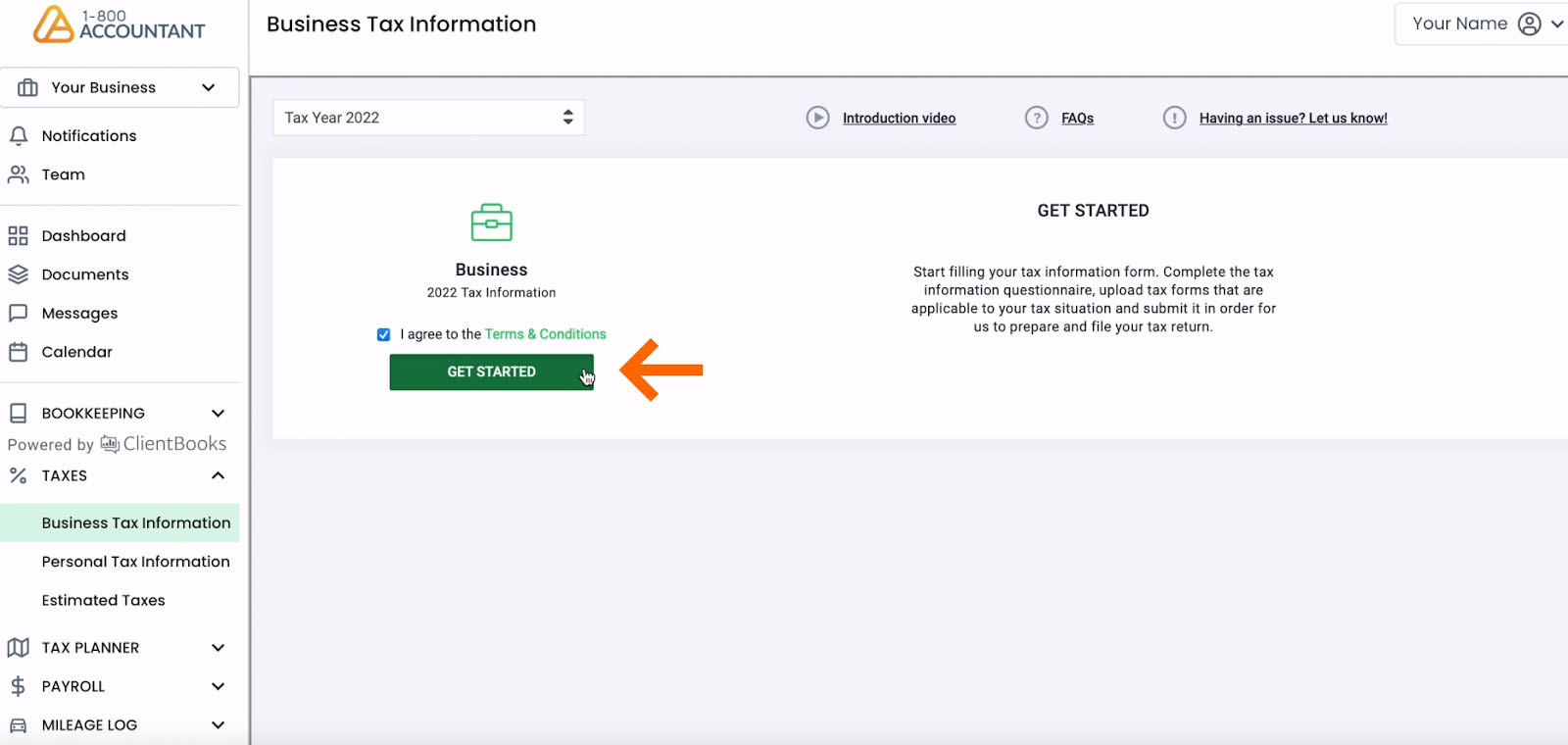

1-800Accountant will file my business and personal taxes, provide tax consulting and planning, and even extend audit defense. It will also process payroll for my employees, and a payroll specialist will help ensure compliance with the IRS.

1-800Accountant Business Tax Information

1-800Accountant will prepare and file my articles of organization, file for my employer identification number (EIN), serve as my registered agent, and help me set up my business for maximized tax savings.

No matter how far behind I am, 1-800Accountant will help me quickly and efficiently update my financials and become IRS-compliant.

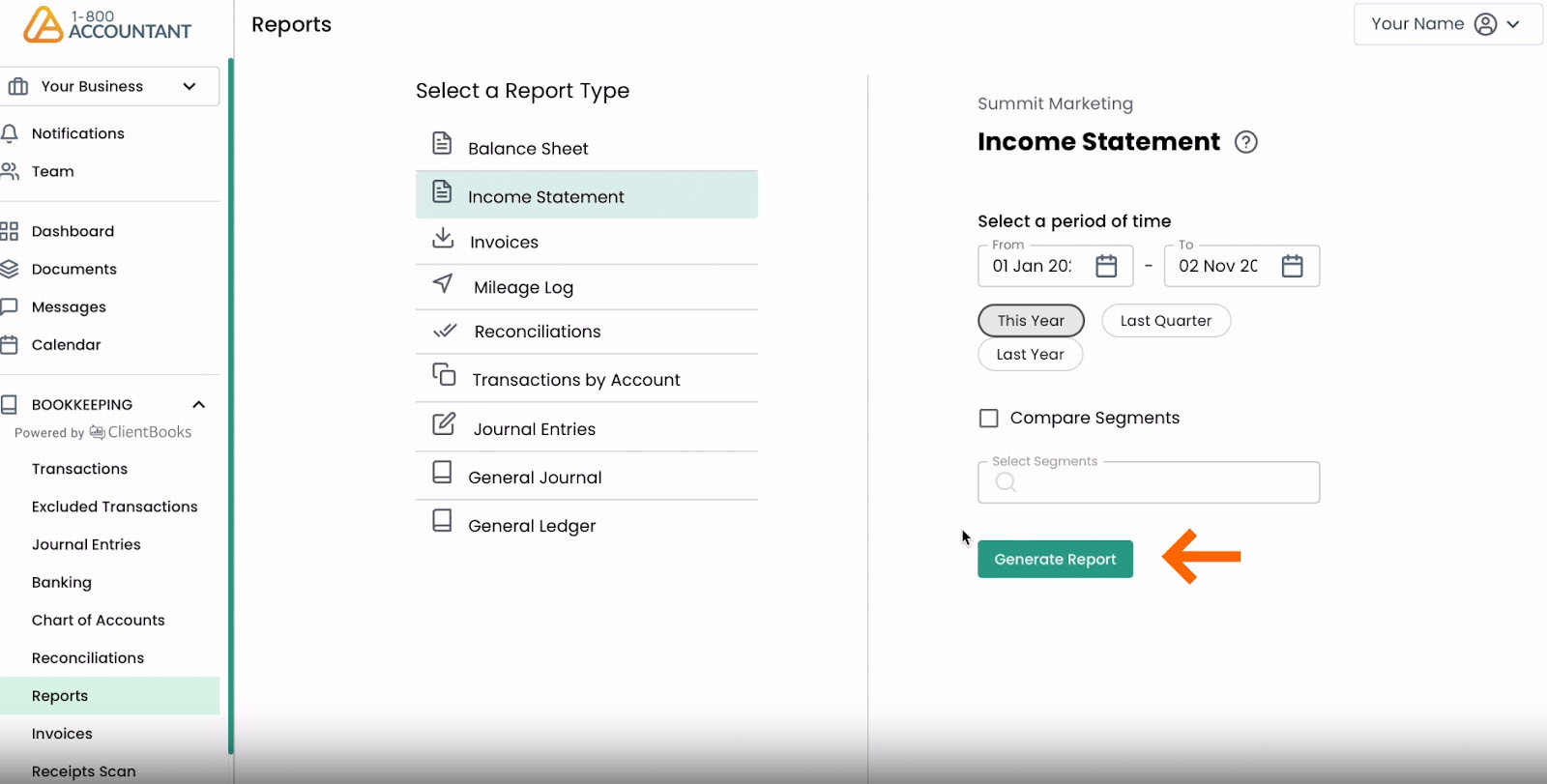

1-800Accountant offers a variety of financial reports. These include a balance sheet, income statement, invoices, mileage log, reconciliations, transactions by account, journal entries, general journal, and general ledger.

I can customize reports by selecting a period and can compare different segments. I can also generate my own reports using ClientBooks and customize them to obtain the data I’m seeking.

Accessing reports from 1-800Accountant’s dashboard

1-800Accountant: Working With Your Bookkeeper

Upon enrollment with 1-800Accountant, I received a welcome email with instructions on how to log in to my client portal. Before logging in, I was given the option to schedule a phone call with an expert bookkeeper based on my availability, and the appointment would’ve run anywhere from 15 to 30 minutes. I would’ve been matched with a bookkeeper who has experience in my industry and is knowledgeable about my location. They can answer my questions and provide assistance with logging into the portal if I haven’t yet done so.

If I fall behind in my bookkeeping, 1-800Accountant can help me get caught up as far back as needed. It uses the proprietary software ClientBooks, an all-in-one back office tool with advanced features to help you stay focused on growing your business.

ClientBooks allows me to create invoices, categorize my transactions, and access my financials, and its mobile app lets me track my mileage and upload receipts and business documents. I won’t need any other software, but ClientBooks can integrate with whatever accounting software I already use if desired.

1-800Accountant: Customer Service

I can contact 1-800Accountant via phone, chat, email, or secure messaging within the client portal.

Communicating with your 1-800Accountant bookkeeper

How I Evaluated 1-800Accountant

I evaluated 1-800Accountant based on the following:

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

1-800Accountant offers a diverse menu of services that include small business taxes and advisory, bookkeeping and payroll, and assistance with entity formation.

Yes, catch-up bookkeeping is available no matter how far behind you have fallen with your books.

The team is composed of licensed tax professionals, including certified public accountants (CPAs) and enrolled agents (EAs). They are qualified to prepare and file your taxes and have an average of 17 years of professional experience.

1-800Accountant’s free plan is designed for startups and new businesses looking to form a limited liability company (LLC). The plan is free, but you’ll need to pay any applicable state fees. It will assist with customized articles of organization, verified name availability search, secure online access to your organization documents, and unlimited phone and email support.

Bottom Line

The services of 1-800Accountant include advisory, tax, bookkeeping, payroll, and entity formation. The company combines personal support from a nationwide team of experts at an affordable flat rate that starts at $179 per month. You’ll even have access to a full-featured mobile app when you’re on the go.

For $399 monthly, you’ll receive industry-specific guidance from a local bookkeeper who will also manage your books. Depending on the service you enroll in, you’ll also have access to entity formation bookkeeping, payroll, and tax preparation services.

[1]BBB

[2]Trustpilot

[3]Google Play