Bookkeeper360, founded in 2012, is a financial technology firm that offers accounting and cloud-based bookkeeping and business advisory services. As a Xero Platinum partner, Bookkeeper360 provides seamless integration with Xero’s cloud-based accounting software.

For cash-basis accounting, pricing starts at $399 per month for companies with up to $20,000 in monthly expenses. For accrual-basis accounting, prices start at $549 per month for companies with up to $20,000 in monthly expenses. You can also use the Bookkeeper360 App without bookkeeping services for $19.99 per month. The Bookkeeper360 pricing scheme isn’t as affordable as many of its competitors and isn’t transparent—even though starting prices for each service are listed online, it is largely quote-based.

Pros

- Free consultations

- Compatible with Xero and QuickBooks Online

- Accrual basis accounting available

- Wide range of services and tailored solutions

- Dedicated bookkeeper

- No contract required; cancel anytime

- Simple setup that generally takes one to two weeks

Cons

- No free trial

- Not as affordable as other online bookkeepers

- Can’t integrate with FreshBooks

- Pricing is largely quote-based although starting prices for each service are listed online

- Pay-as-you-go plan requires a $500 initial retainer

- No sales tax management

Supported Bookkeeping Software | QuickBooks Online and Xero |

Pricing |

|

Free Trial | ✕ |

Money-back Guarantee | ✕ |

Assigned a Personal Bookkeeper? | ✓ |

Bookkeeper Communications | Telephone, video meeting, and live chat |

Monthly Account Reconciliations & Financial Statements | ✓ |

Back-office Services Like Customer Invoicing & Bill Pay | Separate plan starting at $150 per month |

Full-service Payroll Available | Separate plan starting at $46 per month |

Tax & Consulting Services Available | Separate plan starting at $800 per filing for businesses |

Average User Reviews | Bookkeeper360 scored high among users, with praise for its responsive and efficient customer service and available features. It took a hit for its lack of sales tax support and no free trial. |

- Businesses seeking invoicing and bill pay support: Bookkeeper360 offers assistance with both paying bills and invoicing customers, a feature that not all online bookkeeping services offer.

- Businesses seeking a full-service virtual accounting firm: Bookkeeper360 is a “one-stop shop” when it comes to accounting, and it not only offers invoicing and bill pay services but also catch-up bookkeeping and tax filing.

- Businesses using Xero: Bookkeeper360 offers seamless integration with Xero accounts.

- Startups and growing businesses: It has scalable and customizable solutions and even offers add-on services, such as payroll and HR solutions, tax filing, and CFO Chief Financial Officer advisory.

- Businesses using accrual-based accounting: Accrual accounting is available with Bookkeeper360, which includes deferred revenue, inventory, and accrued expenses.

- Small businesses seeking weekly bookkeeping services: Most online bookkeeping services offer only monthly bookkeeping services, whereas Bookkeeper360 offers a weekly and even a pay-as-you-go option.

- SaaS companies: Bookkeeper360 offers specialized accounting services tailored to the unique needs of SaaS Software as a Service companies. These services include revenue recognition, cash burn analysis, SaaS metrics tracking, and sales tax compliance assistance.

Bookkeeper360’s Featured Industry Uses on Fit Small Business

- Best Online Bookkeeping Services: Best for companies using Xero accounting software

- Best Online Bookkeeping Services for Freelancers: Best for help with invoicing and bill pay

Bookkeeper360 Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Xero app integration provides key performance indicators and metrics | Expensive compared with competitors |

| Responsive and knowledgeable team | No sales tax support |

| Accrual-basis accounting available | No free trial |

Only a few users have left a Bookkeeper360 review. However, most scores are high, and Bookkeeper360’s team of accounting professionals was praised for its knowledge and quick responses. Users, however, wished it offered sales tax support and a free trial because pricing can be expensive compared with competitors.

Since the software works best when integrated with QuickBooks and Xero, I took user scores from the app stores of each accounting software.

- QuickBooks App Store[1]: 4.5 out of 5 based on around 25 reviews

- Xero App Store[2]: 4.9 out of 5 based on about 30 reviews

Bookkeeper360 pricing took a hit in my evaluation because it’s quite pricey compared with competitors, and I believe that very small businesses with limited budgets might find its services expensive. It also fails to provide complete pricing information for many of its services.

The three subscription plans for core bookkeeping services are listed below. Any services beyond bookkeeping—such as payroll, HR, taxes, or keeping your books up-to-date—are available at an additional cost. For $19.99 a month, you can also opt to use the Bookkeeper360 App (available for QuickBooks and Xero users) without subscribing to the bookkeeping service. You can sign up by visiting the app store for QuickBooks or Xero.

Up to $20,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | From $49 per month plus $125 per hour of support | |

Monthly | From $399 per month, including support | From $549 per month, including support |

Weekly | From $549 per month, including support | From $749 per month, including support |

Up to $35,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | Starts at $49 per month plus $125 per hour of support | |

Monthly | Starts at $499 per month, including support | Starts at $649 per month, including support |

Weekly | Starts at $649 per month, including support | Starts at $849 per month, including support |

Up to $50,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | From $49 per month plus $125 per hour of support | |

Monthly | From $599 per month, including support | From $749 per month, including support |

Weekly | From $749 per month, including support | From $949 per month, including support |

Up to $65,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | Starts at $49 per month plus $125 per hour of support | |

Monthly | Starts at $699 per month, including support | Starts at $849 per month, including support |

Weekly | Starts at $849 per month, including support | Starts at$1,049 per month, including support |

Up to $100,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | From $49 per month plus $125 per hour of support | |

Monthly | From $899 per month, including support | From $1,049 per month, including support |

Weekly | From $1,049 per month, including support | From $1,249 per month, including support |

More Than $100,000 in Monthly Expenses

Frequency | Cash | Accrual |

|---|---|---|

Pay-as-You-Go | Starts at $49 per month plus $125 per hour of support | |

Monthly | Custom priced | Custom priced |

Weekly | Custom priced | Custom priced |

Other Services

- CFO Advisory: From $1,000 monthly

- Tax: $800 per business filing and $300 per individual filing

- Payroll & HR: From $46 a month

- Back Office (includes invoicing and bill pay): From $150 monthly

- Bookkeeper360 App for QuickBooks or Xero: $19.99 per month

Bookkeeper360 aced our evaluation for this category. Upon enrollment, you’ll be assigned a dedicated bookkeeper who will work with you to figure out the best strategy for your business. That includes determining the frequency of the service and deciding whether you require services in addition to bookkeeping, such as payroll and HR or tax filing. Then, you’ll connect Bookkeeper360 to your accounting system—either QuickBooks or Xero—and work online collaboratively with your bookkeeper to manage your finances.

Bookkeeper360 assigns US-based bookkeepers—who are employees, not contractors or freelancers—to keep your books up to date. If you need help, you can contact them via phone or live chat and set up unlimited meetings. They will also grant you access to their screen so that you can view your books.

You can also reach out to your dedicated adviser through the “Tasks” section, which eliminates the need to email your bookkeeper if you have questions. You can create a task for your bookkeeper, set a due date, and wait for them to get back to you. This feature is available because the communication happens within the Bookkeeper360 interface.

Bookkeeper360 allows the accrual basis of accounting with its bookkeeping service. If you’re using the cash basis, Bookkeeping360 will handle the accruals and deferrals for you. The dedicated bookkeeper will meet you monthly to fix your books and generate monthly reports.

Excluded in the bookkeeping service would be customer invoicing, inventory management, and vendor billing because these fall under a separate product called Back-office services. Visit Bookkeeper360’s Back-Office Technology page for more information about these services.

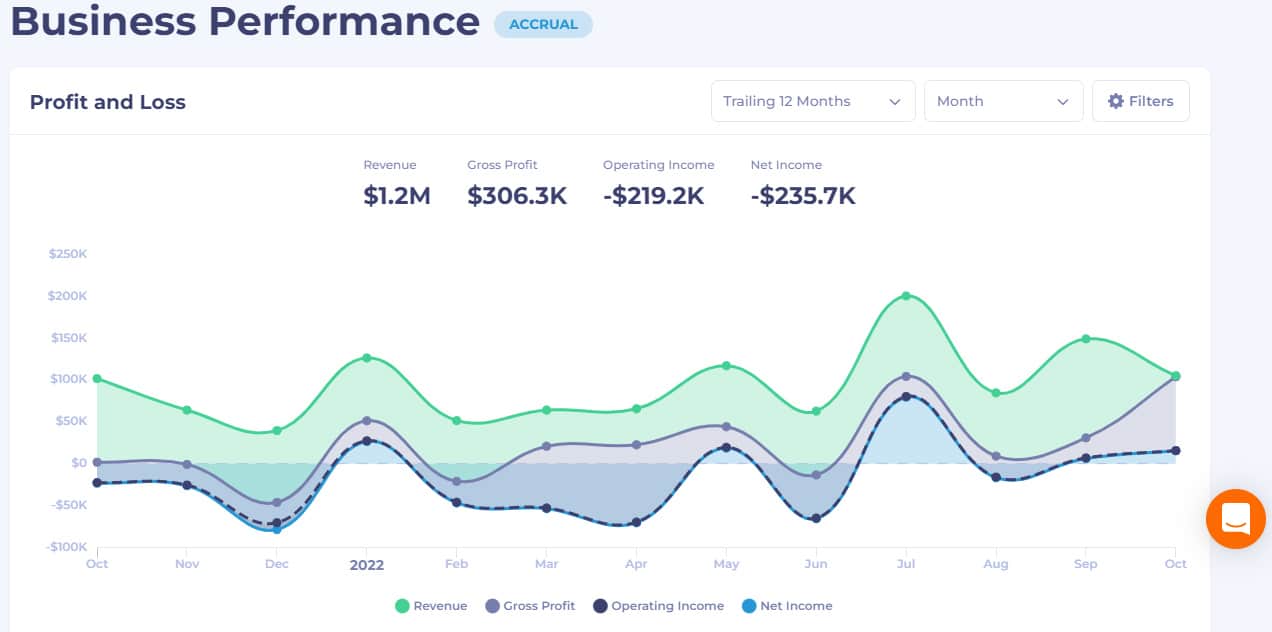

Aside from bookkeeping services, Bookkeeper360 offers a web-based app that summarizes your data from QuickBooks or Xero and transforms it into visually appealing charts and graphs. You can keep track of your business performance directly from the app after integrating it with your QuickBooks Online or Xero account.

If you get a plan from Bookkeeper360, the app is included in the package. You can also subscribe to it separately from the bookkeeping service by purchasing it from either the Xero or QuickBooks Online App Stores for $19.99 a month.

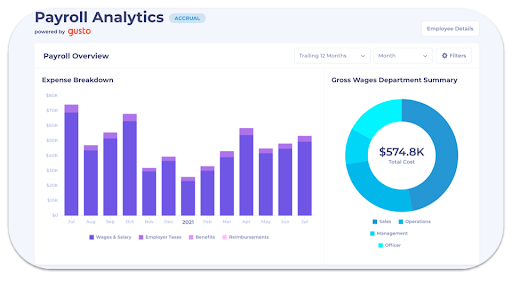

The payroll team will process payroll for both employees and contractors and provide full-service support with health benefits, direct deposit setup, W-2s, and 1099s. Bookkeeper360 also integrates with other payroll providers like Gusto and ADP. If you decide to get this service, it should take less than two weeks to set up. You can visit Bookkeeper360’s Payroll & HR page to learn more.

Bookkeeper360’s payroll integration with Gusto

If you’re using Xero or QuickBooks, both the desktop and mobile apps will connect to your account and provide information like scorecards and metrics. Using the app, you can keep track of business performance by looking at dashboards and auto-generated reports. You can view profit and loss details, revenues, direct costs, and net income. Yearly comparisons are also available.

Trailing 12 Months Profit and Loss Dashboard

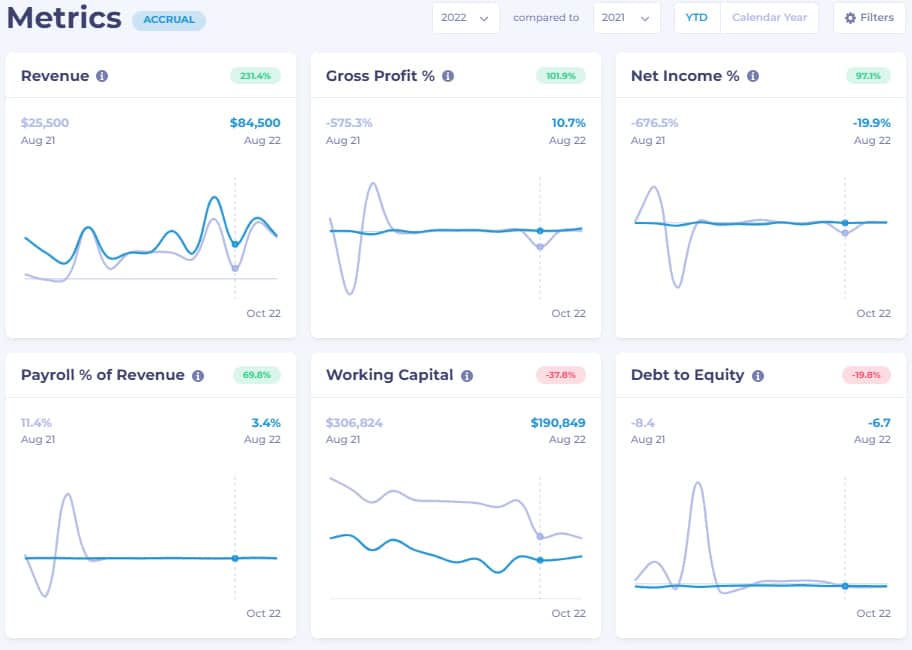

If you want a more detailed view of business performance, you can switch to the Metrics view to year-over-year data for revenue and common size amounts for gross profit, net income, and payroll. You can also check your working capital and debt-to-equity ratio to measure your business’s short-term and overall liquidity.

Bookkeeper360 Metrics

The interactive charts in Bookkeeper360 show a blue and gray line. The blue line represents current year data, while the gray line represents previous year’s data. You can use this year-over-year comparison to spot seasonality in revenues and expenses. You can also immediately abnormal fluctuations in numbers and investigate the reason for these fluctuations further.

Trends show you business revenues, direct costs, and operating expenses along its composition. This section of Bookkeeper360 can provide you with insights regarding composition of revenues and cost behavior.

Column Chart Showing the Composition of Revenues

The chart above shows you information about revenue. It shows that revenue sometimes increases, decreases, peaks, or plummets. But more importantly, it shows you its composition. For instance, pay attention to syndication revenue (yellow columns). This revenue source is not present in all months while merchandise licensing is consistent in almost all months. As a business owner, you can use this chart to analyze revenue not just as a whole but in different components.

Column Chart Showing Composition of Direct Costs

The direct cost column chart above is another chart that you’ll find very useful in costing. What we like about this chart is that you can see the cost behavior of different cost drivers in the business. For instance, we see consistent labor costs throughout the year except in July. Hence, we can say that labor costs are fixed costs. Moreover, costs arising from Scooby Snacks can be a mixed cost because it has fixed and variable components. You can interpret this chart in many different ways, and it can aid you in decision-making.

Column Chart Showing Operating Expenses

In cost and management accounting, operating expenses are mostly fixed costs and this cost behavior is evident in the sample chart above. You can use this chart to analyze the behavior of your business’ operating expenses. It isn’t in all cases that operating expenses are fixed and the chart from Bookkeeper360 can reveal fluctuations in expenses. For example, there is a significant increase in Other Expenses in March 2022 and Advertising Expenses in April 2022.

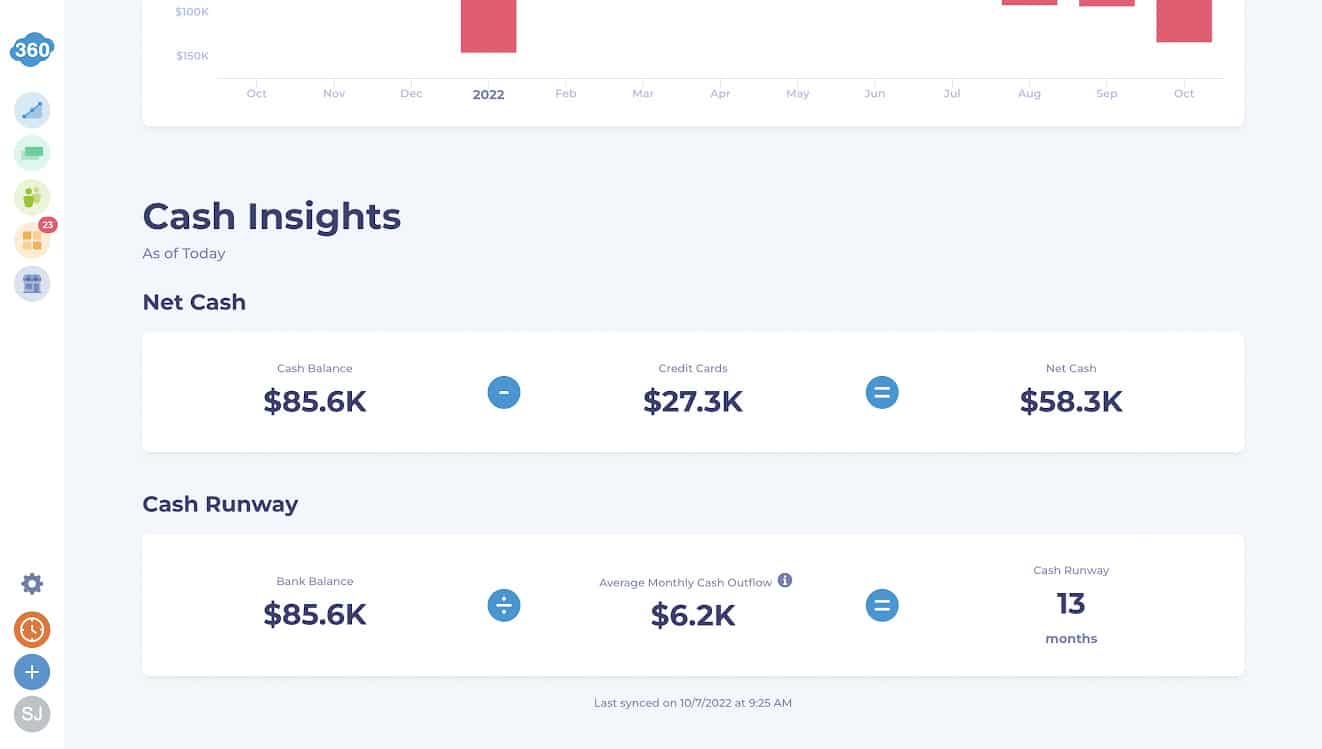

The Bookkeeper360 app can also provide cash management insights using illustrative charts. The charts will show your cash inflows and outflows for the past 12 months, past 24 months, last calendar year, last two calendar years, and last three calendar years. It also shows cash insights by computing your net cash after deducting credit card liabilities.

Cash Analyzer

The cash analyzer above shows your cash position per month. You can also change it per quarter and present it as trailing 12 months, trailing 24 months, or previous calendar years. The columns represent the volume of cash inflows and outflows while the line shows your net cash position. By using this chart, you can assess monthly cash needs based on expected cash inflows and outflows.

Cash Insights

The cash runway, also called cash burn rate, shows the estimated number of months until cash runs out. In the example above, the cash burn rate is 13 months, assuming the average monthly cash outflow remains the same.

Bookkeeper360 took a small hit in our rubric due to the inability of filing sales tax returns, and I recommend looking into Xendoo if that is necessary for your business (read our review of Xendoo). However, Bookkeeper360 offers tax services that include individual or business income tax filings, local tax filings, 1099 reporting, and overall tax planning and compliance. Included in the tax services is tax advisory, where you can consult your dedicated tax advisor for tax-related matters.

Aside from tax, Bookkeeper360’s team will work with you to analyze your financials and determine a strategy to manage and grow your business through the CFO advisory program. This separate service includes capital management and business coaching. With a CFO, you can optimize your business, minimize costs, and maximize profits through effective planning, organizing, and monitoring.

The CFO will help in determining and evaluating key performance indicators, performing profitability analysis, developing a growth strategy, and optimizing cash flow. If you’re planning to expand your business but need additional capital, the CFO will help you forecast the business’s financials, craft business plans, and determine the optimal capital structure.

How We Evaluated Bookkeeper360

We evaluated Bookkeeper360 based on bookkeeping services, personal bookkeeper, user reviews, tax and consulting services, and pricing.

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Yes. It can update your books even if they’re way behind, but you have to tell your dedicated bookkeeper during the first meeting so that they know where to start.

Bookkeeper360 offers a wide range of financial services, including bookkeeping, payroll processing, tax preparation, financial reporting, and accounts payable and receivable management. It also provides strategic financial planning and consulting services.

Yes, you need to be a QuickBooks or Xero subscriber. Subscriptions to these accounting software are excluded from Bookkeeper360’s monthly fees.

Under cash-basis accounting, revenues and expenses are recorded when cash is paid or received. Meanwhile, accrual accounting records revenue and expenses when earned or incurred. Learn more in our cash- vs accrual-basis accounting method comparison, which also covers when to use each.

Bookkeeper360 integrates with QuickBooks Online and Xero.

Bottom Line

Bookkeeper360 is an accounting solution designed to help businesses view financial data, streamline bookkeeping operations, and track goals on a unified platform. It allows business owners to create business and financial plans, conduct cost and margin analysis, generate income statements, and calculate sales taxes.

Moreover, it integrates with two of our best small business accounting software, QuickBooks Online and Xero. On the whole, Bookkeeper360 is a good solution for startup and growing companies.

User review references:

[1] QuickBooks App Store

[2 ]Xero App Store