An accounts payable (A/P) aging report provides a concise overview of all outstanding vendor invoices categorized by the due date, enabling businesses to track their payment obligations efficiently. This report is essential for maintaining financial stability and fostering positive vendor relationships.

A primary benefit of utilizing an A/P aging report is proactive cash flow management. By clearly outlining upcoming payments, businesses can accurately forecast and allocate funds, which prevents missed payments and potential late fees. For small businesses, the A/P aging report is a particularly valuable tool, offering a streamlined approach to managing payables and ensuring financial health.

Why Is an A/P Aging Report Important?

An A/P aging report acts as a financial snapshot of your company’s outstanding obligations to vendors. It helps you with:

- Managing cash flow: The report provides a clear picture of upcoming payment obligations, allowing you to anticipate cash needs and plan accordingly. This helps avoid cash flow shortages and ensures you have funds to cover expenses. Also, by categorizing invoices by due date (e.g., 30, 60, 90 days overdue), you can prioritize payments and address the most pressing ones first.

- Maintaining healthy vendor relationships: Staying on top of due dates helps maintain good relationships with suppliers. Consistent on-time payments can lead to more favorable terms, early payment discounts, and continued access to goods and services. The report can also highlight potential problems with specific vendors. For example, consistently late payments to a certain vendor might indicate a dispute or an issue with their invoicing process.

- Monitoring financial health: The report is a key component of financial statements and provides insights into your company’s overall financial health. It helps you understand your short-term liabilities and make informed decisions about budgeting and investments. Additionally, analyzing the report over time can reveal trends in payment behavior, which help identify areas for improvement in your A/P process, such as negotiating better terms or streamlining invoice processing.

- Tracking operational efficiency: Reviewing the report can help identify errors in invoices, such as duplicate entries or incorrect amounts, before payments are made. By analyzing the report, you can identify bottlenecks or inefficiencies in your A/P process and take steps to improve it. This can lead to cost savings and reduced workload for your accounting team.

When & How to Generate an A/P Aging Report

You should generate an A/P aging report at least once a month or whenever you’re paying your vendors. If you do things manually, you must gather data from your A/P subsidiary journals and reconstruct the data in a spreadsheet file.

By using accounting software, you can generate a detailed or summarized A/P aging report with one click. For instance, in QuickBooks Online, select Reports in the left-hand menu bar. For more information, see our guide on how to run an A/P aging report in QuickBooks.

How to Read an A/P Aging Report

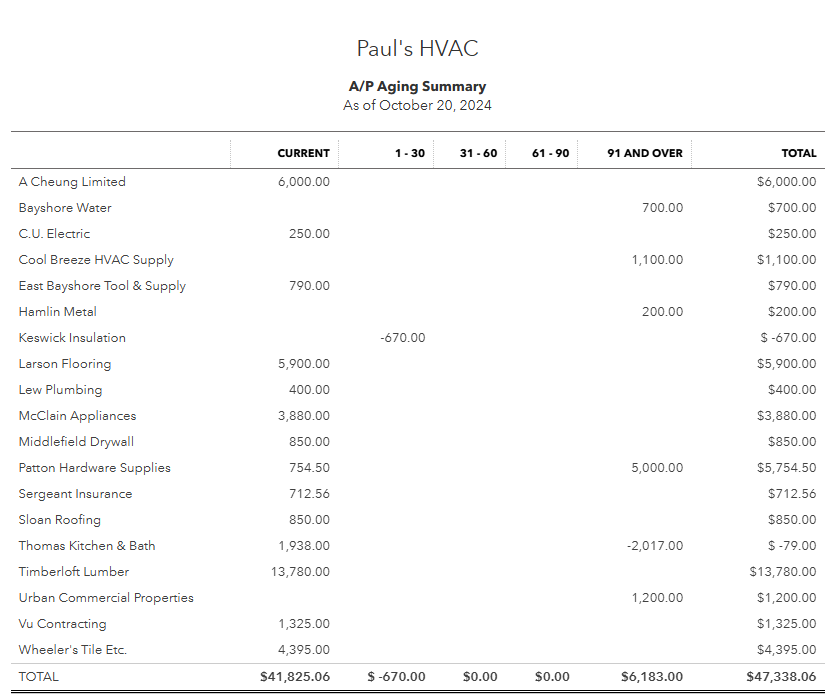

The image below shows an A/P aging summary report that presents the total balance per vendor, segregated by age group. It tells you how much you owe each vendor but doesn’t show the exact invoices that need to be paid.

If you want to see the overall status of your liabilities, a summarized A/P aging report, like the one above, gives you a snapshot of your payables. The best use of the summarized report is for cash flow planning purposes, especially when cash flow is poor, and you need to decide which vendors to pay with a limited amount of cash.

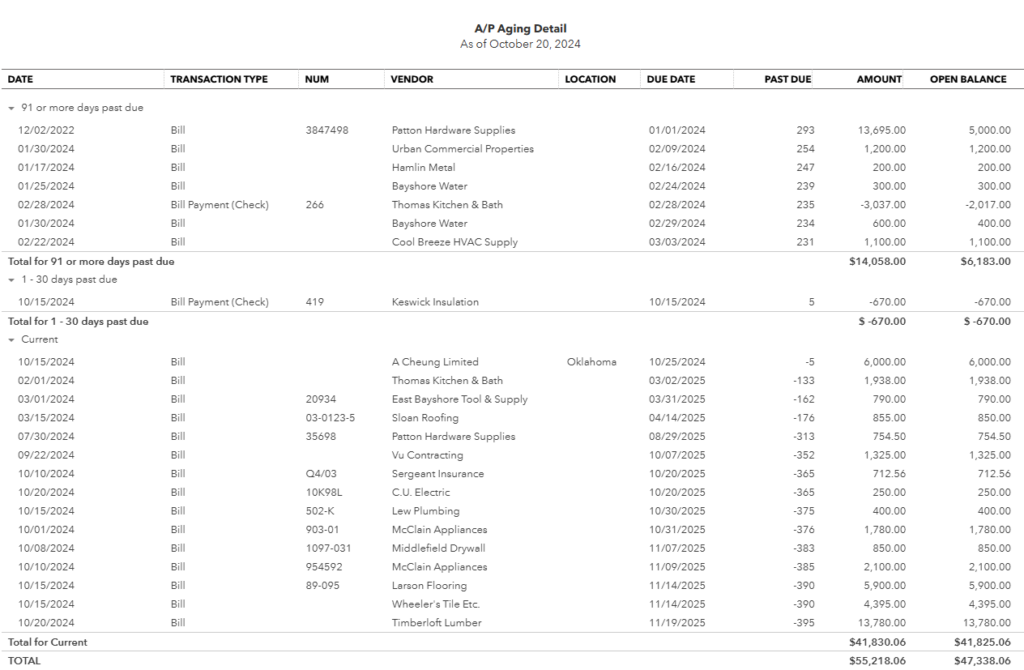

Detailed A/P Aging Report from QuickBooks Online

The detailed A/P aging report shows a list of invoices per customer and per age group. In the sample report above, the oldest bill that remains unpaid as of the report date is a bill from Patton Hardware Supplies for $13,695, with an open balance of $5,000. By reviewing our A/P aging detail, we know that we should make the $5,000 payment a high priority since this debt might be referred to collections.

Our related resources:

How to Use the A/P Aging Report to Manage Vendor Payments

In a perfect world where we always have the cash we need, we wouldn’t need an A/P aging report—we would simply pay all of our bills on time. Unfortunately, in the real world, we sometimes must choose which vendors get paid and which can wait.

The A/P aging report can be extremely useful in allocating limited cash to vendors by following a few recommendations:

- Determine the maximum amount of cash you have available to pay vendors. Be sure to set aside enough cash for upcoming payroll and payroll taxes, which I recommend paying before vendors. Then, decide how to divide your available cash among your outstanding bills.

- Give the “90 days and over” column the most attention as these debts are getting really old, so those vendors may stop selling to you, or you may be accumulating late payment fees. The potential of strained vendor relationships could also become an issue.

- Acknowledge the hard truth that not all vendors are equally important to you. While you eventually hope to pay all your debts, are there any vendors you can’t live without? For instance, if you get the majority of your materials from a single vendor, they should be given priority.

- Look for any unusual items, such as invoices much larger than usual or payments that appear to have been made but are still listed as outstanding. This can help uncover errors or discrepancies that need to be addressed. If you find discrepancies, contact the vendor immediately to resolve the issue. This might involve requesting a corrected invoice or providing proof of payment.

- Consider negotiating payment terms. If your aging report shows a consistent history of on-time payments, use this as leverage to negotiate with vendors. This could include extending payment deadlines or securing early payment discounts.

Frequently Asked Questions (FAQs)

An A/P aging report is a snapshot of all outstanding vendor invoices your company owes, organized by due date. It categorizes invoices into time buckets (e.g., 0-30 days, 31-60 days, 61-90 days, and 90+ days overdue) to show how long invoices have been outstanding.What three transactions are reflected in the accounts payable aging report?

The three main types of transactions reflected in an A/P aging report are vendor invoices, vendor credit memos, and invoice payments. The report takes all three transactions into account to provide an accurate overview of your company’s outstanding payables at any given time.

An A/P aging report includes the vendor name and contact details, invoice details (number, amount, date, and due date), aging categories, and total outstanding balance.

It depends on your business needs, but I generally recommend generating it at least monthly. Some businesses may need to run it weekly or even daily, especially if they have a high volume of invoices or tight cash flow.

Yes, most accounting software lets you customize the report to fit your needs. You can choose which columns to display, filter by specific vendors or date ranges, and adjust the aging periods.

Bottom Line

The accounts payable aging report is a helpful tool that offers valuable insights into your company’s financial health and vendor relationships. By regularly generating and analyzing this report, you can proactively manage your cash flow, optimize payment processes, and foster stronger relationships with your suppliers. Taking the time to understand and utilize the information within the report can significantly improve efficiency, cost savings, and overall financial stability.