Depreciation is a fundamental concept that allows businesses to allocate the cost of long-term assets over their useful lives. While accumulated depreciation reflects the total depreciation recognized over the life of an asset, depreciation expense provides a snapshot of the current period’s allocation of the asset’s cost as an operating expense. In other words, depreciation expense is the depreciation claimed in a single period, whereas accumulated depreciation is the depreciation expense recognized life-to-date for an asset:

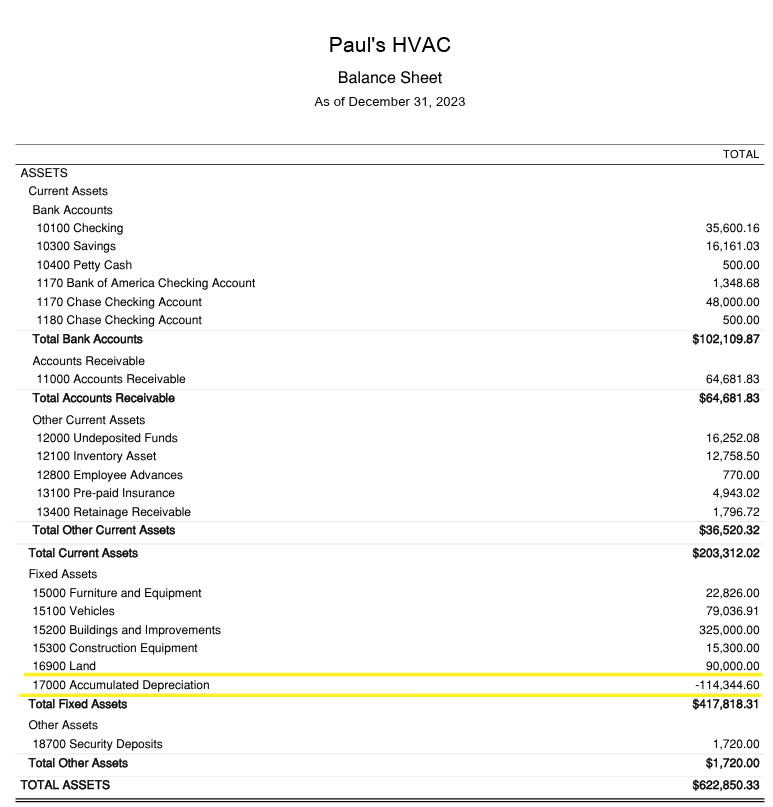

- Accumulated depreciation is a contra-asset account on the balance sheet that offsets the cost of fixed assets:

- It assists in impairment assessments, influences tax calculations, and offers insights into asset management practices.

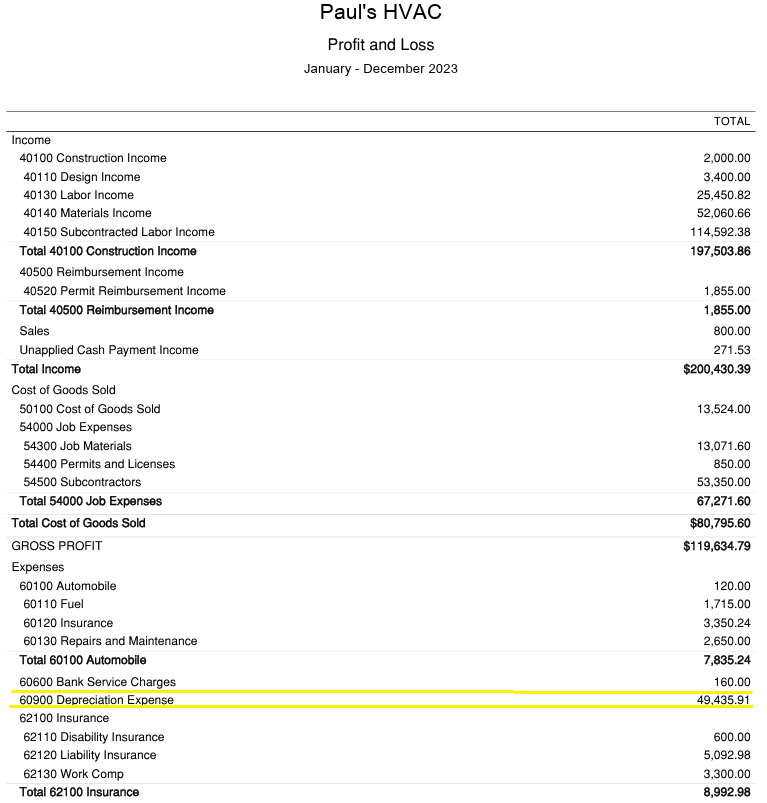

- Depreciation expense is an expense on the income statement that reflects the current-year depreciation of an asset:

- It facilitates tax deductions, provides insights into cash flow, aids in asset replacement planning, and supports financial analysis by investors and creditors.

Understanding the difference between accumulated depreciation vs depreciation expense is not only necessary for accounting professionals, but also for business owners, investors, and stakeholders who value accurate financial reporting and decision-making processes.

Quick Comparison of Accumulated Depreciation vs Depreciation Expense

For in-depth information, see our guides on:

Example Financial Statements

Accumulated depreciation appears on the balance sheet, reducing the book value of fixed assets. It is listed under Fixed Assets and is shown as a negative amount under the respective asset category to indicate its deduction from the total value of the assets. In this case, the accumulated depreciation is $114,344.60.

Sample balance sheet showing accumulated depreciation

Meanwhile, depreciation expense appears on the income statement as an operating expense.

It reduces the net income for the period because it’s a noncash expense. In this case, the depreciation expense is $49,435.91.

Sample income statement showing depreciation expense

Common Depreciation Methods

Depreciation is the process of allocating the cost of a long-term asset over its useful life. There are several methods to calculate depreciation, and the appropriate method depends on factors such as the asset type, its expected useful life, and the accounting standards you follow. Following are some common depreciation methods.

How To Calculate Depreciation

The basic method for calculating depreciation is the straight-line method. The key idea behind it is to spread the cost evenly across each accounting period, resulting in a constant depreciation expense.

The formula for straight-line depreciation is:

Depreciation Expense | = | Cost of Asset – Salvage Value |

Useful Life |

Here are the main components of the formula:

- Cost of asset: This is the initial cost or purchase price of the asset. It includes all costs necessary to acquire and prepare the asset for its intended use.

- Salvage value: Salvage value is the estimated value of the asset at the end of its useful life. It represents the portion of the asset’s cost that is expected to remain after depreciation.

- Useful life: This is the estimated number of years or units the asset is expected to contribute to the business. It is based on factors such as wear and tear and industry standards.

The resulting depreciation expense is recorded on the income statement each accounting period. The book value of the asset is also updated each period, reflecting the reduction in book value due to depreciation.

Standard Journal Entry to Record Depreciation

The standard journal entry to record straight-line depreciation involves debiting the depreciation expense and crediting the accumulated depreciation account. This entry reflects the recognition of the periodic depreciation expense and the cumulative total depreciation for an asset.

For example, if you have $20,000 in depreciation expense in the current month. The journal entry would be:

Debit | Credit | |

|---|---|---|

Depreciation Expense | 20,000 | |

Accumulated Depreciation | 20,000 |

- The debit to depreciation expense increases depreciation expense and thus reduces net income.

- The credit to accumulated depreciation increases accumulated depreciation and thus reduces the book value of fixed assets.

Calculating a Fixed Asset’s Book Value

The book value of an asset is calculated by subtracting its accumulated depreciation from its original cost.

Here’s a step-by-step explanation:

- Step 1: Identify the asset cost. The asset cost, also known as historical cost or original cost, is the amount the company paid to acquire or construct the asset. This can include purchase price, taxes, transportation, and installation.

- Step 2: Determine accumulated depreciation. Accumulated depreciation reflects the amount of depreciation expense claimed over the life of the asset and can be obtained from that asset’s portion of the accumulated depreciation shown on the balance sheet.

- Step 3: Apply the formula. Subtract the accumulated depreciation from the asset cost to find the book value.

Here is an example:

- Asset cost: $50,000

- Accumulated depreciation: $10,000

$50,000 – $10,000 = $40,000

In this example, the book value of the asset is $40,000. This represents the remaining cost of the asset on the company’s balance sheet after accounting for the accumulated depreciation. The book value is important for determining the gain or loss if the asset is sold. See our article on accounting for the disposal of fixed assets for more information.

Frequently Asked Questions (FAQs)

One of the main distinctions between depreciation expense vs accumulated depreciation is that depreciation expense is recognized on the income statement for a specific period. Meanwhile, accumulated depreciation is the cumulative total of depreciation recognized over the entire life of the asset, shown on the balance sheet.

When an asset is sold, its cost and accumulated depreciation are removed from the balance sheet, and any gain or loss on the sale is recorded. To learn more about this process, check out our article on how to record the journal entry for disposal of fixed assets.

The difference between an asset’s cost and its accumulated depreciation is the asset’s book value, also known as its carrying value. The asset’s cost is the amount the company paid to acquire or construct the asset. It includes all costs necessary to get the asset ready for its intended use. Accumulated depreciation is the total amount of depreciation expense that has been recognized and accumulated on the asset since its recognition. The book value represents the remaining cost of the asset on the balance sheet.

Bottom Line

Depreciation expense and accumulated depreciation are integral components of the accounting process that reflect the allocation of an asset’s cost over time. Depreciation expense shows the current period allocation of the cost, while accumulated depreciation accumulates over time, representing the total depreciation recognized since the acquisition of the asset.