The best banks for small businesses in Texas offer great business checking with other excellent business products and services. Here are the best banks for small businesses in Texas, each spotlighting an economic region of the state, with links directly to the bank’s website:

- Featured bank in the Metroplex: Chase Member Federal Deposit Insurance Corp. (FDIC)

- Featured bank in Alamo: Bank of America Member FDIC

- Featured bank in South Texas: Frost Bank Member FDIC

- Featured bank in Central Texas: PNC Bank Member FDIC

- Featured bank in High Plains: Prosperity Bank Member FDIC

- Featured bank in Northwest: Wells Fargo Member FDIC

- Featured bank in Upper East: Capital One Member FDIC

- Featured bank in Upper Rio Grande: First National Bank Texas Member FDIC

- Featured bank in Gulf Coast: Comerica Bank Member FDIC

- Featured bank in West Texas: Truist Member FDIC

- Featured bank in Southeast: Regions Bank Member FDIC

- Featured bank in Capital: Centennial Bank Member FDIC

In addition to the banks above that have physical branches in the state of Texas, there are other banks and fintechs that provide outstanding business banking products available nationwide and accounts you can open from anywhere in the state.

Those providers are listed below, with links directly to the provider websites.

- U.S. Bank Member FDIC : Best overall for free checking and businesses with low transaction volumes

- Bluevine Provider is a fintech platform backed by and FDIC-insured through a supporting bank partnership with Coastal Community Bank. : Best overall fintech for interest-earning accounts with best line of credit and international payments

- Found Provider is a fintech platform backed by and FDIC-insured through a supporting bank partnership with Piermont Bank. : Best digital-only provider for self-employed professionals

- Novo Novo is a fintech company; not a bank. Deposit account services provided by Middlesex Federal Savings, F.A., Member FDIC. : Best for early access to Stripe payouts

- Mercury Provider is a fintech platform backed by and FDIC-insured through supporting bank partnerships with Choice Financial Group and Evolve Bank & Trust. : Best for tech companies and startups needing additional FDIC insurance

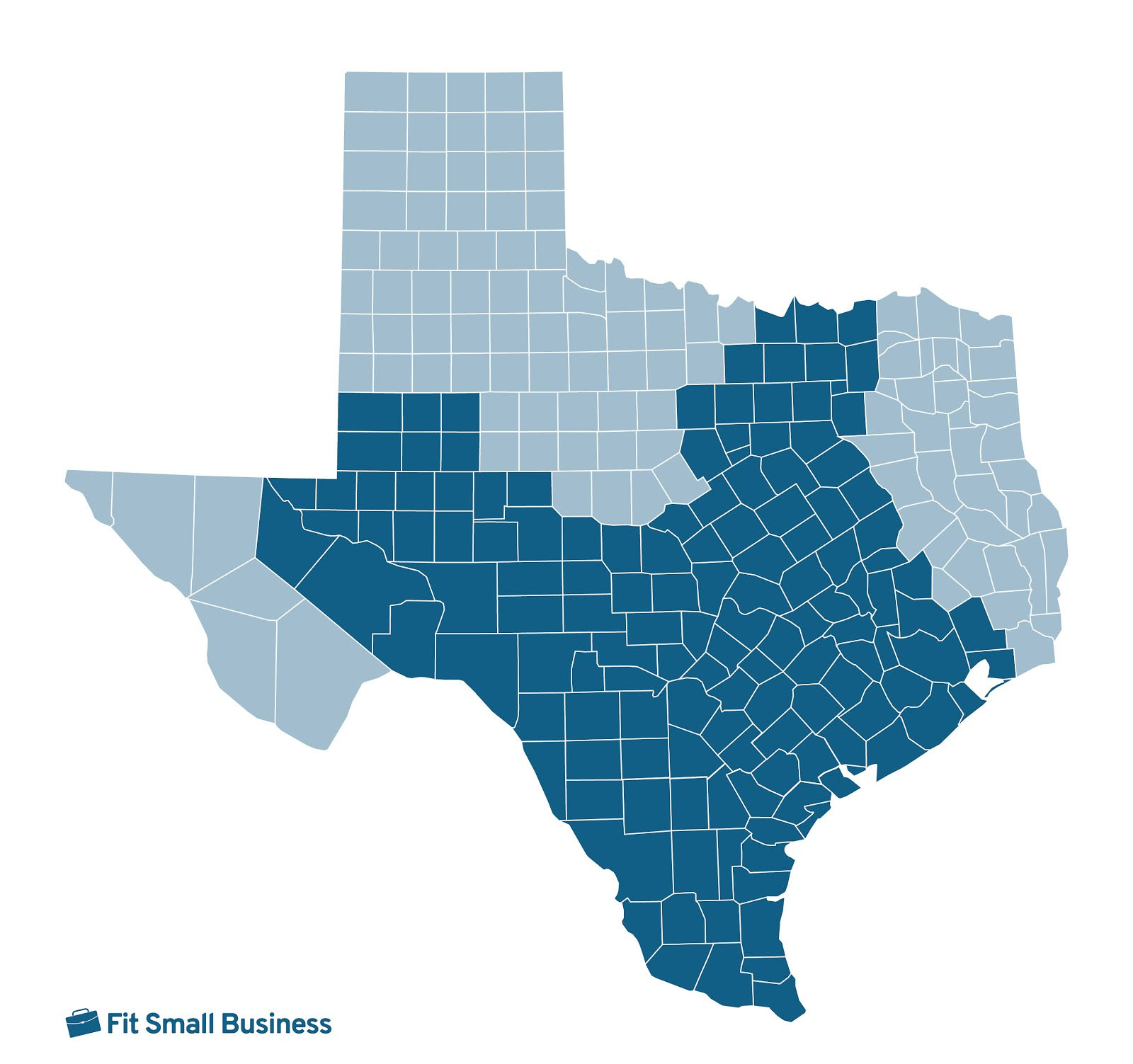

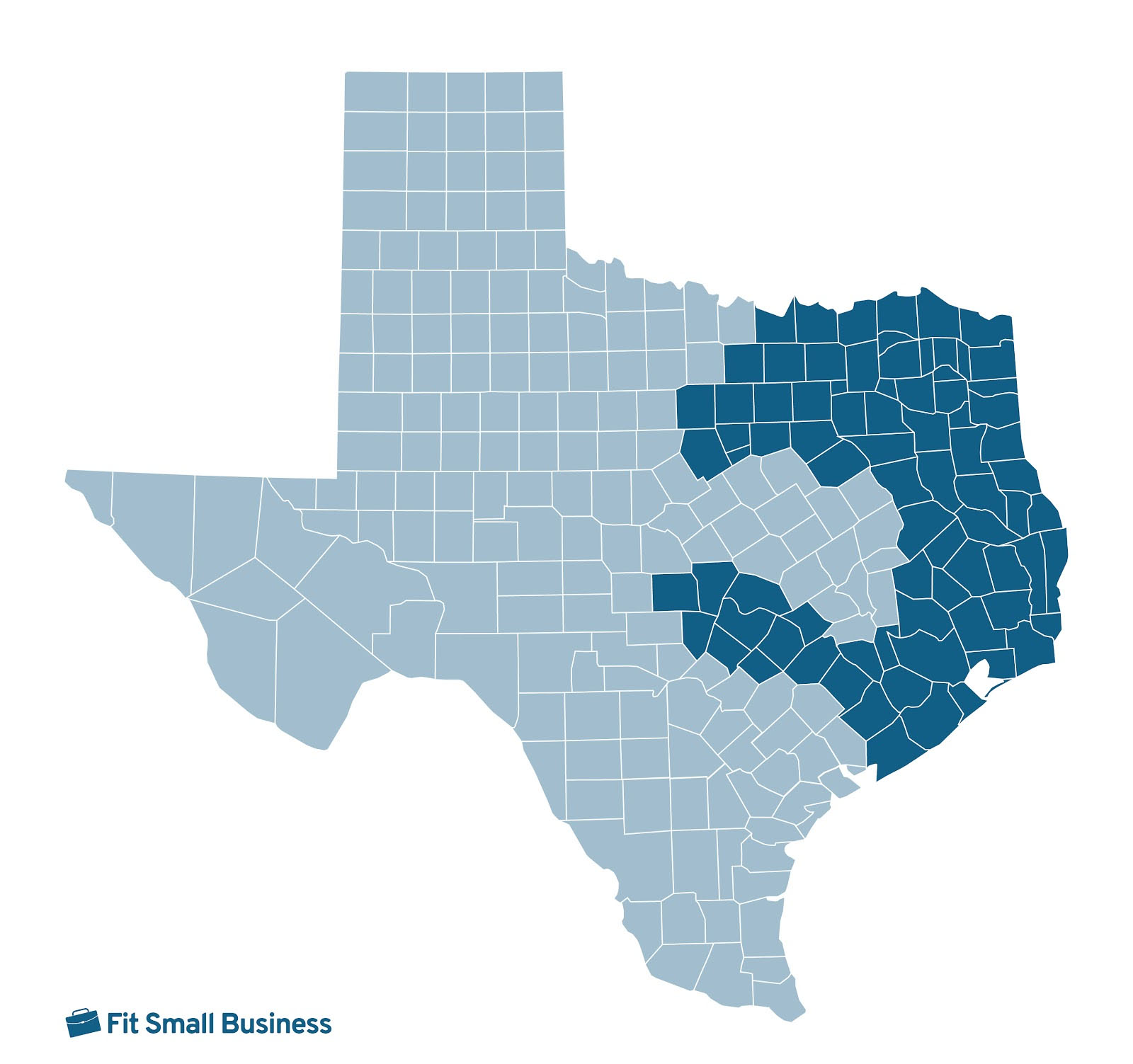

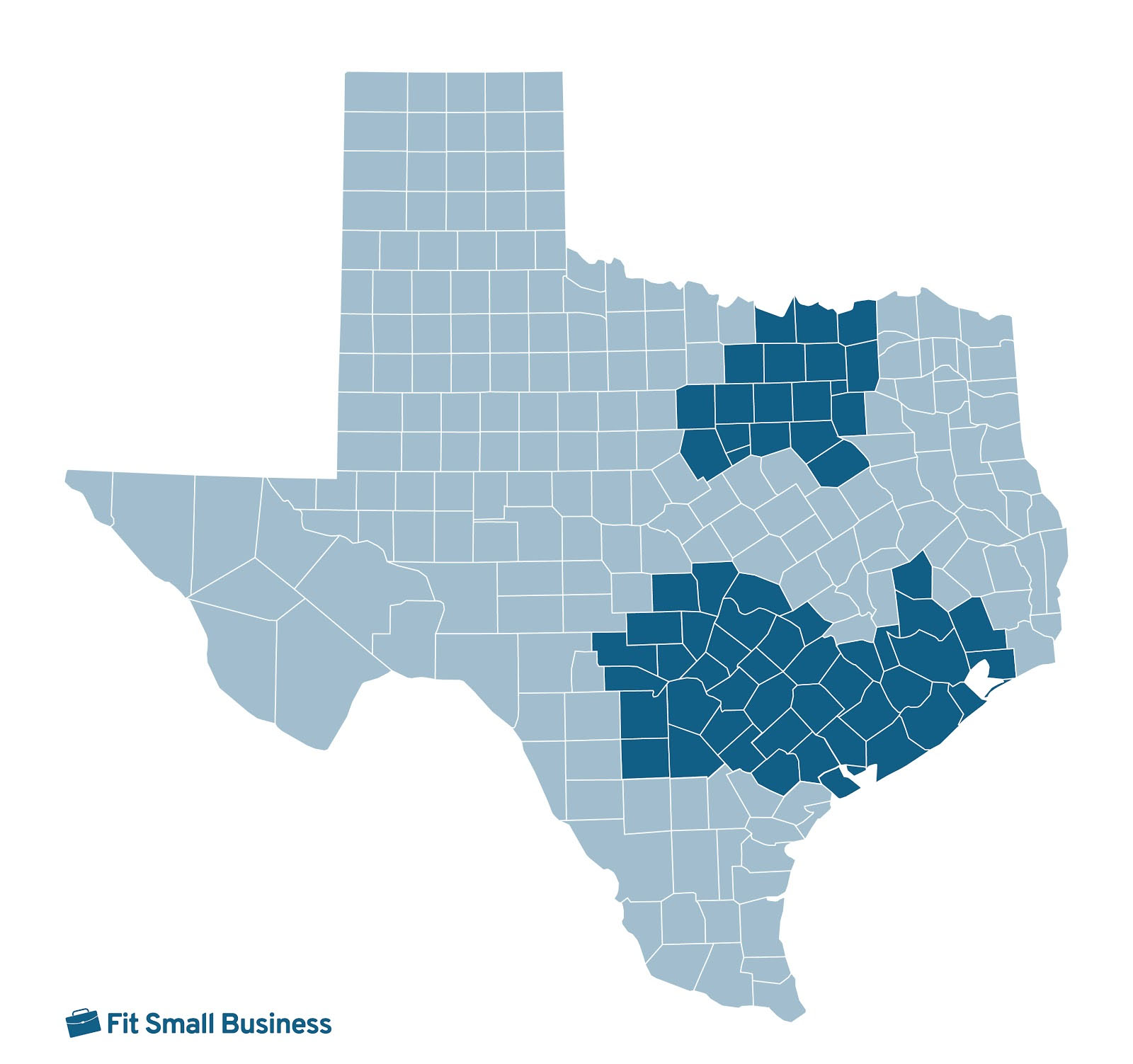

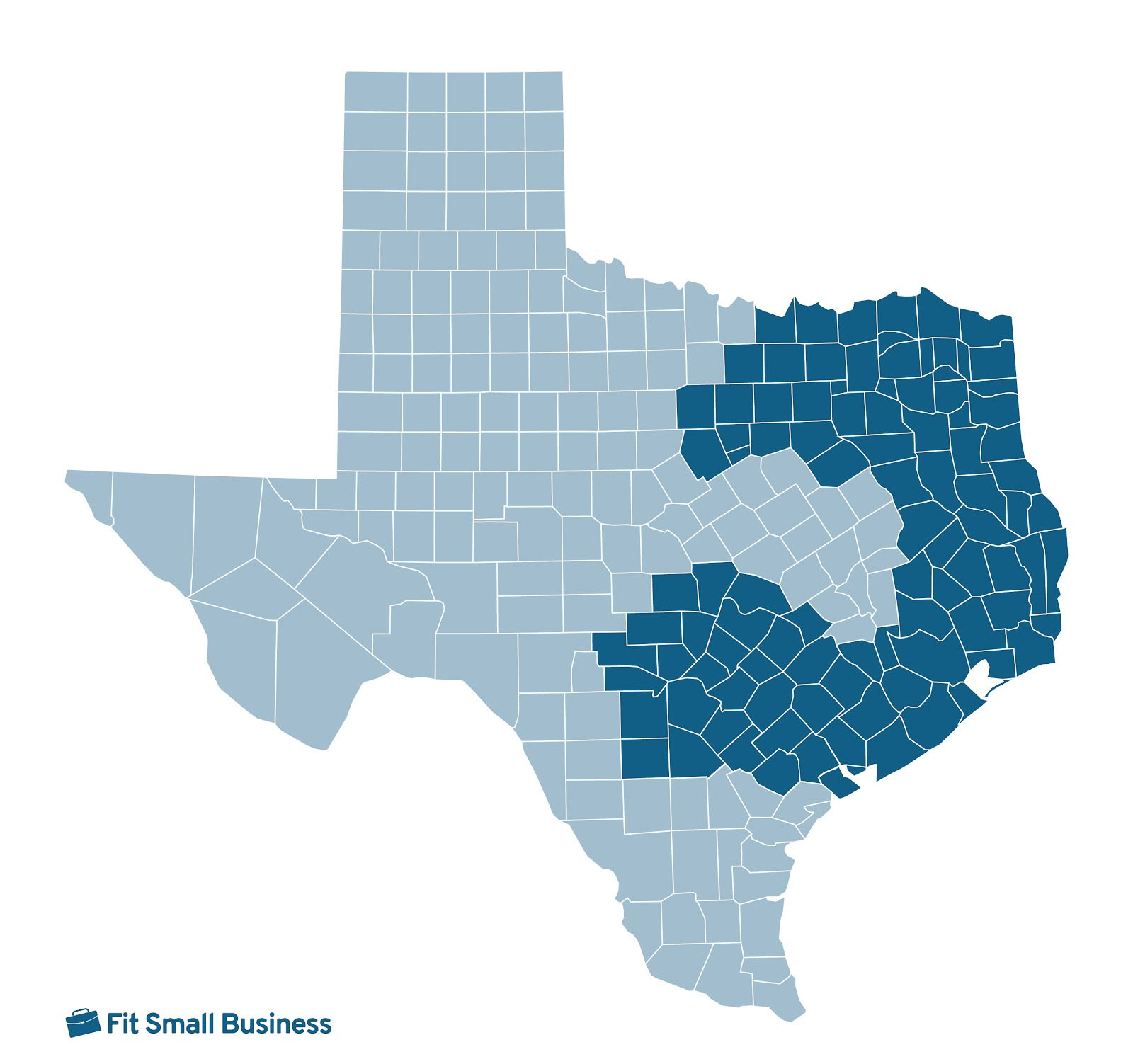

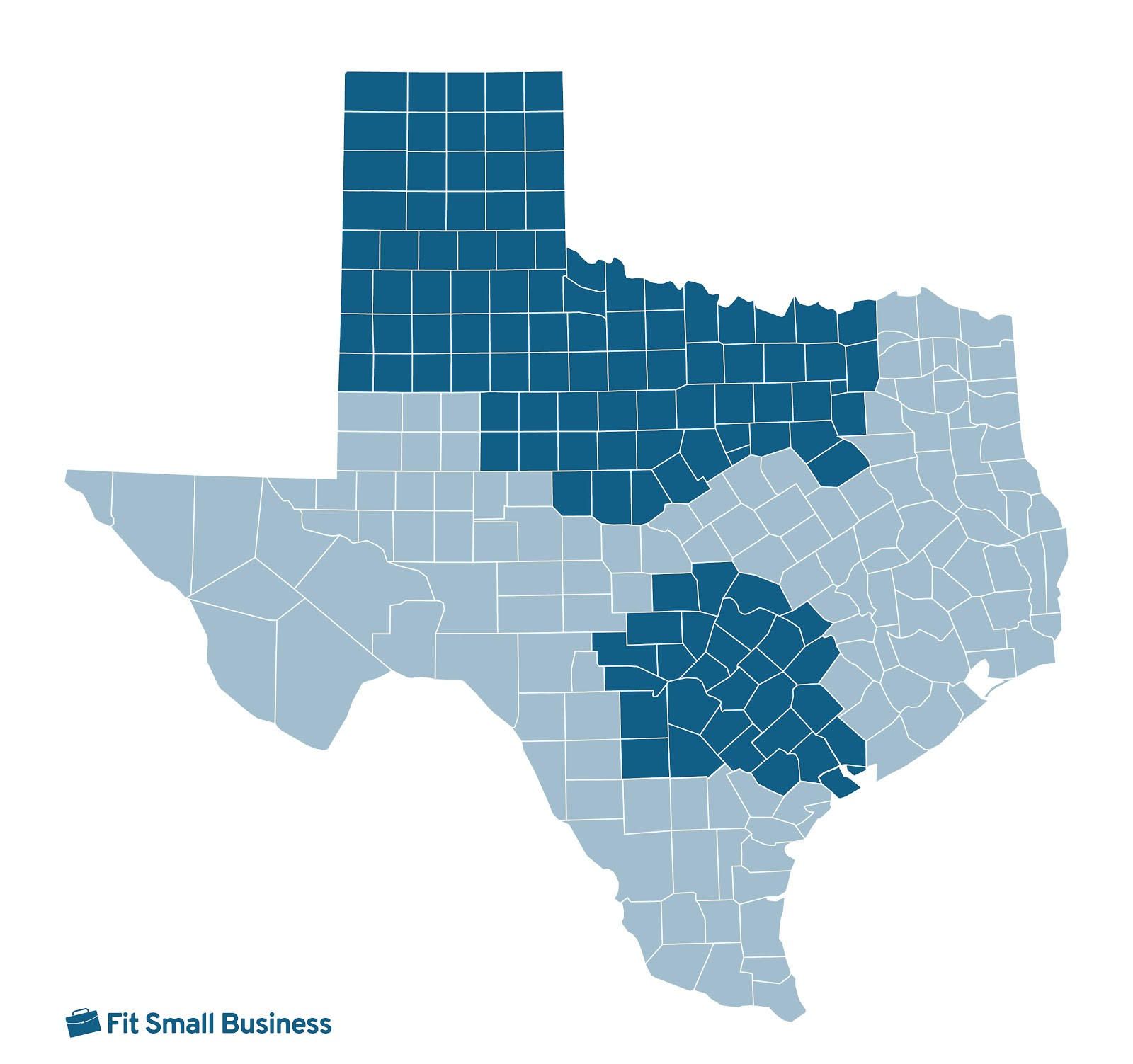

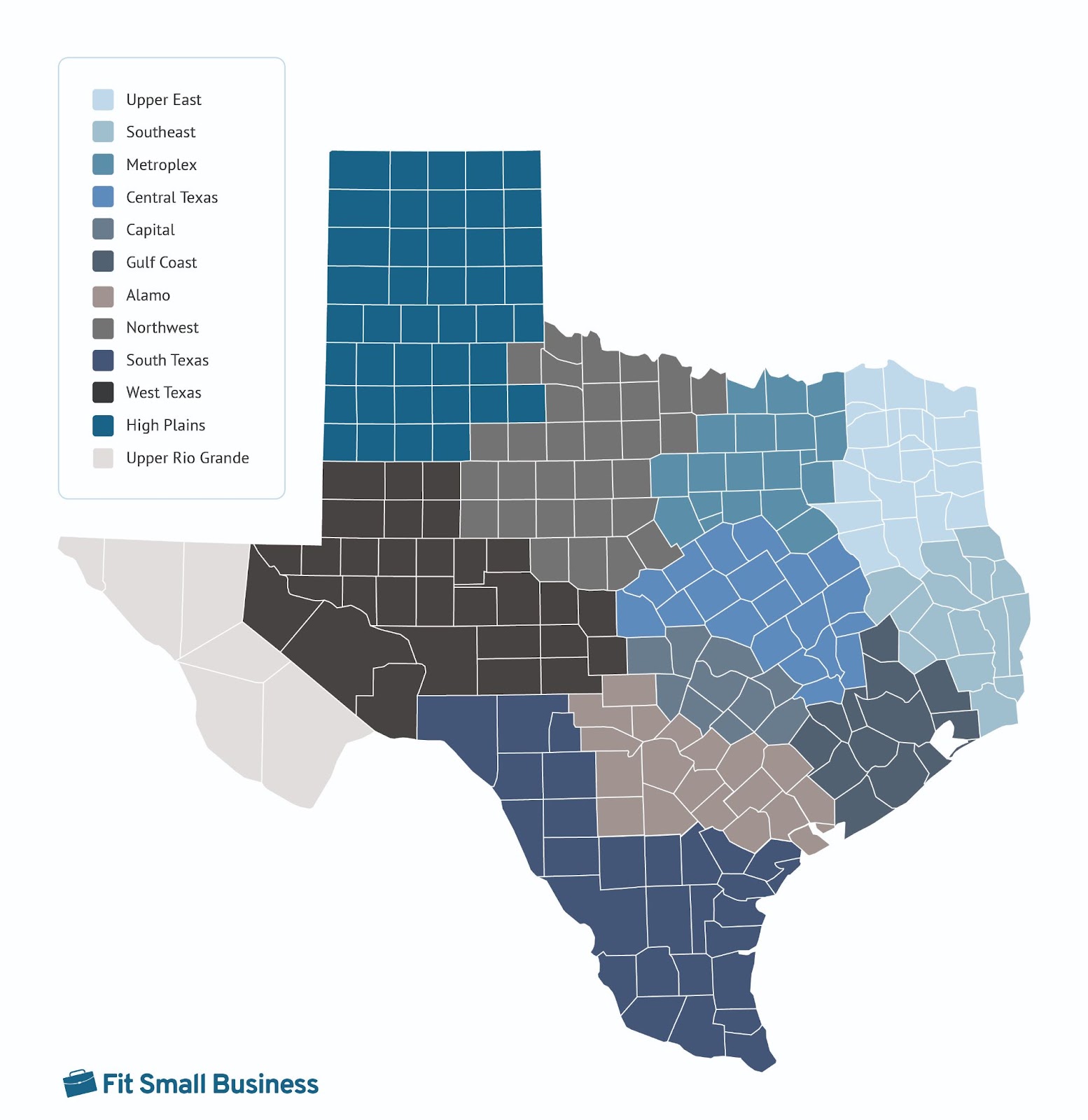

Economic Regions of Texas

Below is a map of Texas’ economic regions. Use the drop-down to choose your region to go directly to that section of this guide. If you are unsure of the region where your business is located, you can use our map by clicking the header below.

Map of Texas Economic Regions

Best Banks for Small Business in Texas at a Glance

Metroplex Business Bank: Chase

What We Like

- Up to $500 bonus when you open a new account

- Monthly fee is waivable on three checking options

- Built-in POS options

Drawbacks

- Only 20 free transactions at basic checking level

- ATM fees not reimbursed

- Low savings interest rates

- Built-in card acceptance with QuickAcceptSM via the Chase Mobile® app

- Manage debit, deposit, and ATM card settings for individual employees

- Deposit checks, view account balances, pay bills, and make transfers through the mobile app

- Integrates with QuickBooks and other leading accounting software

- Free debit card, mailed within 10 business days of application approval

- Physical checks’ costs, depending on type ordered

- Chase Payment Solutions

- Live customer support online or in branch during business hours

- Other products include business savings, certificates of deposit (CDs), lending products, credit cards, merchant services, and collection services

| |

|---|---|

Required opening deposit | None |

Monthly fees | $15; waivable if conditions are met |

APY | N/A |

Transaction limit before fees | 20, then 40 cents per transaction |

Standard ACH fees | 2.50 per item for the first 10 items, then $0.15 per item after |

Same-day ACH fees | 1% of the transaction amount or $25, whichever is less |

Domestic wire transfer fees |

|

International wire transfer fees |

|

ATM Fees | $3 per transaction at any non-Chase ATM, plus ATM operator fees |

Cash Deposits | $2.50 per $1,000 after you deposit $5,000 in a billing cycle |

JPMorgan Chase Bank, N.A. Member FDIC |

When to Choose Chase

- You want a bank with a significant branch presence in Texas: With nearly 500 branches in all 12 of Texas’ economic regions, Chase is one of the best business banks in Texas.

- You have a large business and require over 20 fee-free paper transactions: Apart from the basic tier, Business Complete Checking, Chase offers two other business checking products with higher transaction allowances. You can compare these three accounts in our review of Chase Business Checking.

- You want the best premium business checking account on the market: Chase’s highest-tier account, Platinum Business Checking, offers 500 free monthly transactions, a $25,000 cash deposit allowance, and dedicated concierge support. See our Chase Platinum Business Checking review for detailed information.

Chase has full-service business banking products and services companies need, regardless of business size. You can get business savings, lending products, credit cards, and lines of credit with Chase, as well as commercial banking products through J.P. Morgan, including commercial real estate (CRE) loans, payment services, cash flow management, and merchant services.

Its app is solid, with decent ratings on the App Store[1] (4.8) and Google Play[2] (4.4) out of more than 7 million combined reviews. Some users were pleased with the app’s intuitive user interface and security features, while some had issues with the speed and random logouts.

Alamo Business Bank: Bank of America

What We Like

- Bonus of up to $500, plus ongoing rewards if qualifications are met

- Free digital tools to track business performance

- Built in fraud prevention tools

Drawbacks

- Cash deposit fees charged per $100 over monthly allowance

- No ATM fee reimbursements

- $100-opening deposit required

- Deposit checks, view accounts, make transfers, and pay bills via the mobile app

- Cash Flow Monitor®, a cash management tool, lets you connect accounting, analytics, and payroll apps to help you make business decisions

- Allows you to check your business credit score through a partnership with Dun & Bradstreet

- Free debit card

- Integrations with QuickBooks, TurboTax, and Zelle

- Customer service during business hours in branch and via phone or social media messages

- Merchant services available through Expensify

- Other products include business savings, CDs, lending products, and financial analysis through Merrill Financial Advisor

Required Opening Deposit | $100 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 20, then 45 cents per item |

Monthly Fees | $16; waivable if conditions are met |

Conditions to Waive Monthly Fee | One of three ways to waive fee:

|

Domestic Wire Transfer Fees |

|

International Wire Transfer Fees |

|

ATM Fees | None at over 15,000 ATMs nationwide; $2.50 per transaction on out-of-network ATMs |

Cash Deposited | Up to $5000 per month free, then 30 cents per $100, per statement cycle |

APY | N/A |

When to Choose Bank of America

- You want the option to do in-person banking and online banking: With over 300 locations across Texas, Bank of America is another excellent choice for a business bank in the Lone Star State. Even if you aren’t near a branch, you can open a business checking account through the Bank of America website.

- Your business requires you to deposit cash regularly: Bank of America’s entry-level account, Business Advantage Fundamentals Banking, allows you up to $7,500 in cash deposits for free each month. The account’s $16 monthly fee can also be waived.

- You seek ongoing rewards: The bank gives $500 combined cashback rewards and statement credits with its business checking and credit card products. Under its Preferred Rewards for Business program, you get 25% to 75% bonus rewards on credit cards and 5% to 20% higher interest rates on Business Advantage savings accounts.

On top of business savings, CD products, credit cards, and small business loans, Bank of America also offers retirement plans and solutions through small business and individual 401(k) accounts and simplified employee pension individual retirement account (SEP IRA) and savings incentive match plan for employees (SIMPLE) IRA accounts.

Bank of America’s app is highly rated, with 4.8 stars on the App Store[3] and 4.9 stars on Google Play[4]. Users liked the ease of navigating the app, while others reported experiencing crashes.

South Texas Business Bank: Frost Bank

What We Like

- Multiple ways to waive monthly fees

- High free transaction limits

- Highly rated mobile banking app

Drawbacks

- Limited branch locations in Texas regions

- High required balances to waive monthly fees

- No APY

- Free debit card

- Online and mobile banking

- Multiple business checking accounts

- Debit card alerts

- Business savings accounts, credit cards, CDs, Small Business Administration (SBA) loans, lines of credit, term loans, and insurance

- Merchant services and treasury management services

- No ATM fees at Frost ATMs and several retail chains and terminals

| |

|---|---|

Required Opening Deposit | $50 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 200 nonelectronic items plus unlimited electronic deposits and withdrawals |

Monthly Fees | $10; waivable |

Domestic Wire Transfer Fees | Incoming: $15 Outgoing: Cost varies |

ATM Fees | None at Frost ATMs, Pulse POS terminals, H-E-B and Circle K locations statewide, plus CVS and Walgreens stores in Dallas and Tarrant County, $2 at non-Frost ATMs plus operator charges |

Cash Deposited | Up to $5,000 per month free, then 25 cents per item |

APY | N/A |

When to Choose Frost Bank

- Your business is located in the central and southern areas of Texas: There are Frost Bank locations in seven of the 12 Texas economic regions, concentrated largely in the central and southern parts of the state.

- You have a lot of monthly transactions: Frost Bank has an entry-level account offering up to 200 non-electronic items, unlimited electronic deposits, and free withdrawals per month. You also get up to $5,000 in free cash deposits monthly.

- You want a free business savings account: Frost Bank waives the monthly service fee of a regular savings product if you have an existing Frost Business Checking or Frost Business Checking Plus account under the same name.

Frost Bank offers full-service business product offerings, including savings, CDs, credit cards, business investments, and insurance. It even has business lines of credit, term loans, and SBA loans.

Another area where Frost Bank shines is its mobile app. It has earned 4.9 stars on the App Store[5] and 4.9 on Google Play[6] out of more than 60,000 reviews. While a few users mentioned issues when viewing multiple accounts through the app, overall, the reviews contained overwhelmingly positive feedback.

Central Texas Business Bank: PNC Bank

What We Like

- Waivable $12 monthly fee; no monthly fee for the first three months from account opening

- Up to 150 free transactions for Business Checking; 500 for Business Checking Plus

- $400 welcome bonus for Business Checking and Business Checking Plus

- Up to $1,000 welcome bonus for Treasury Enterprise Plan and Analysis Business Checking

Drawbacks

- No free checking account

- Hefty wire fees

- Banking limited to 27 states and Washington, D.C.

- Free Visa debit card with cash back rewards

- Deposit checks, pay bills, and view balances through the mobile app

- Online and mobile banking

- No setup fee for overdraft protection

- Integrates with QuickBooks, Xero, Intacct, and NetSuite

- Features PNC Merchant Services®, including ecommerce and in-person solutions

- Cash Flow Insight® tools help manage cash flow

| |

|---|---|

Required Opening Deposit | $100 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 150 per month, then 50 cents per transaction |

Monthly Fees | $12, waivable |

Domestic Wire Transfer Fees | Incoming: $15 Outgoing: $95 |

International Wire Transfer Fees | Incoming: $20 Outgoing: $135 |

ATM Fees | $3 per transaction at any non-PNC Bank ATM |

Cash Deposited | Up to $5,000 per month free, then 30 cents per $100, per statement cycle |

APY | N/A |

When to Choose PNC Bank

- You prefer a traditional bank with many locations across the state of Texas: It has the fourth most branches in the state. This widespread access is vital since you must visit a branch to open a business account.

- You’re a large business with high transaction or cash deposit volumes: PNC’s mid-tier Business Checking Plus offers 500 free transactions and $10,000 in free cash deposits monthly, while the high-tier Treasury Enterprise Plan gives 2,500 free transactions and $50,000 in free deposits.

- You seek rewards when opening a business checking account: PNC Bank provides a welcome bonus of $200 to $1,000 depending on the type of checking account you open. This is why PNC Bank is part of our list of best bank account promos & offers.

PNC Bank provides specialized business checking products, such as analyzed accounts, nonprofit checking, interest-earning accounts, and trust accounts. In addition, it offers the best PNC business credit cards, a premium money market account, various SBA loans, secured and unsecured lines of credit, and flexible commercial real estate loans with extended terms.

The bank’s app has a solid rating, earning 4.8 on the App Store[7] and 4.3 on Google Play[8] out of a combined 1.7 million ratings. Some people complained about the inconsistent loading and app glitches. Others said that they experienced updates that were too frequent.

High Plains Business Bank: Prosperity Bank

What We Like

- 200 fee-free transaction limit for Small Business Checking and Small Business Checking with Interest accounts

- Low monthly fees

- Four business checking accounts

Drawbacks

- High balances required for monthly fee waivers

- $200 or $500 opening deposit requirement for non-Analysis checking accounts

- Locations limited to Texas and Oklahoma

- Free debit card

- Online and mobile banking

- Fastline telephone banking

- Business savings, money market accounts, and CDs available

- Offers SBA loans and commercial lending products

- Financing and investment options for medical professionals

| |

|---|---|

Required Opening Deposit | $200 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 200 per month, then 40 cents per transaction |

Monthly Fees | $10, waivable |

Domestic Wire Transfer Fees | Incoming: $7.50 Outgoing: $20 |

International Wire Transfer Fees | Incoming: $7.50 Outgoing: $20 to $40 |

ATM Fees | None at Prosperity Bank ATMs, $3 at non-Prosperity Bank ATMs |

Cash Deposited | Undisclosed |

APY | N/A |

When to Choose Prosperity Bank

- You need a bank that allows in-person transactions: Prosperity Bank is one of the best Texas banks for small businesses. It has branches in all but one region of the state (Upper Rio Grande) and has the sixth most number of locations of any bank in Texas.

- You want a basic account with more fee-free transactions: Prosperity Bank’s entry-level Small Business Checking offers up to 200 free transactions with a monthly fee of $10. While the fee is low, it is harder to waive than with other banks. You must maintain a $3,500 balance or a $25,000 deposit relationship balance to waive the fee.

- You run a medical business: Prosperity Bank offers medical practice loans and lines of credit, medical investment loans, and medical office building loans.

Aside from business checking accounts, Prosperity Bank offers savings products (MMAs and CDs), individual retirement accounts (IRAs), SBA loans, and real estate loans.

Prosperity Bank has an excellent mobile app. It is rated 4.8 on the App Store[9] and 4.4 on Google Play[10] out of more than 70,000 reviews. Most of the recent reviews have been very positive, with only some complaints about the lack of real-time updates in the app.

Northwest Business Bank: Wells Fargo

What We Like

- Low and easy-to-waive monthly fee for basic accounts

- Strong branch presence with more than 4,500 bank locations

- Access to more than 11,000 ATMs

Drawbacks

- Minimum opening deposit of $25 required

- Only 100 free transactions for basic Initiate account

- No sign-up bonus for new accounts

- Free debit card

- Customized cards and checks

- Deposit checks, pay bills, and view balances through the mobile app

- Online and mobile banking

- Earn interest with a Navigate Business Checking

- Fraud protection controls

- Features merchant services, including POS solutions

| |

|---|---|

Required opening deposit | $25 |

Monthly fees | $10; waivable |

APY | N/A |

Transaction limit before fees | 100 monthly, then 50 cents per transaction |

Standard ACH fees | $1.50 per item, same-day ACH |

Same-day ACH fees | $1.50 per item, same-day ACH |

Domestic wire transfer fees |

|

International wire transfer fees |

|

ATM fees | None at 11,000-plus ATMs nationwide; $3.00 per out-of-network transaction |

Cash deposits | Up to $5,000 free per month, then 30 cents per $100, per statement cycle |

Wells Fargo Bank, N.A. Member FDIC | |

When to Choose Wells Fargo

- You want an accessible bank for in-person transactions: Wells Fargo has the most locations in Texas, with over 500 branches across all 12 of Texas’ economic regions.

- You want a basic business checking account with an easy-to-waive monthly fee: The bank’s entry-level account, Initiate Business Checking, offers 100 free monthly transactions at a $10 monthly fee. This fee can be waived if you have at least a $500 minimum daily balance or average ledger balance of at least $1,000.

- You’re looking for checking accounts with higher fee-free transaction limits: Businesses needing more free transactions can get higher thresholds in the Navigate Business Checking or Optimize Business Checking products. Both of these higher-tier accounts allow you up to 250 free transactions

Wells Fargo offers a wide range of business products and services, including savings, CDs, lending, credit cards, and merchant services. It also provides 24/7 fraud monitoring and zero-liability debit card protection.

Wells Fargo’s app is well-rated on the App Store[11] (4.9) and on Google Play[12] (4.8) based on more than 11.4 million reviews. A few users reported small issues but most praised the app’s reliable functionality.

Upper East Business Bank: Capital One

What We Like

- Unlimited digital transactions

- Easy ATM access

- No opening deposit

Drawbacks

- Account doesn’t earn interest

- Limited physical locations

- No APY

- Pay bills, track accounts, transfer funds, and deposit checks with the mobile app

- Integrates with Xero and other top accounting software

- Free overdraft protection when linked to another small business deposit account

- Free debit card

- Connect with business payment solutions

- Online bill pay with credit health monitoring

- Waived monthly fees for additional business checking accounts

- 24/7 support by phone; in-branch support during business hours

- Other products include business savings, CDs, lending products, credit cards, and escrow accounts

| |

|---|---|

Required Opening Deposit | $0 |

Required Balance Minimum | None |

Transaction Limit Before Fees | Unlimited digital transactions |

Monthly fees | $15; waivable if conditions are met |

Required Balance Minimum to Waive Monthly Fee | $2,000 30- or 90-day average balance |

Domestic Wire Transfer Fees |

|

International Wire Fees |

|

ATM Fees | None at more than 70,000 Capital One, MoneyPass, and Allpoint ATMs nationwide; $2 for nonnetwork ATMs |

Cash Deposited | $5,000 free per month, then $1 per $1,000 |

APY | N/A |

When to Choose Capital One

- Your business is located in the eastern part of Texas: Capital One is a great choice for a business checking provider for companies in that area. You must visit a branch to open a Capital One business checking account.

- You’re looking for a bank that does not charge a fee for daily transactions: Capital One offers a plethora of free everyday transactions, which includes unlimited free deposits, withdrawals, and transfers—except international wires, cashier’s checks, and other services.

- You need a starter checking account with an easy-to-waive monthly fee: While the company charges a $15 monthly fee on its Business Basic Checking, you can easily waive the fee with just a $2,000 30- or 90-day balance average. Customers with higher balances can choose Capital One’s Unlimited Business Checking.

For business credit products, Capital One has a wide range of options. The bank offers several lending products, including real estate term loans, lines of credit, and SBA loans. Also, Capital One business credit cards are outstanding.

Business support products offered by Capital One include merchant services, escrow fund management, commercial banking, and B2B credit programs.

Capital One’s mobile app is highly rated, earning 4.9 on both the App Store[13] and 4.5 Google Play[14]. Many find the app notification alerts useful while some people using Android devices encountered issues with the recent app updates.

Upper Rio Grande Business Bank: First National Bank Texas

What We Like

- No account opening deposit and required minimum balance

- Waivable monthly fee for Business First Checking

- No monthly fees and transaction limit for nonprofits

Drawbacks

- Low free transaction limit

- Low APY for interest-earning commercial accounts

- No online account opening option for business checking accounts

- Free business debit card

- Digital banking for small and commercial businesses

- Multiple business checking account options, including interest-earning products

- Business credit cards, commercial money market accounts, SBA loans, commercial loans, and business insurance

| |

|---|---|

Required Opening Deposit | None |

Required Balance Minimum | None |

Transaction Limit Before Fees | 50 per month |

Monthly Fees | $15; waivable |

Domestic Wire Transfer Fees | Incoming: $15 Outgoing: $25 |

International Wire Transfer Fees | Offered at select locations; contact the bank for details |

ATM Fees | None at Gold Key ATMs®, $2.50 for non-Gold Key® ATMs, and $3 for international |

Cash Deposited | Up to $5,000 per month free |

APY | N/A |

When to Choose First National Bank Texas

- You’re looking for a traditional regional bank: First National Bank Texas (FNBT) is one of the best business banks in Texas and has been operating for over 120 years. It has the fifth most branches in the state (almost 300), covering all 12 economic regions.

- You’re a new business owner seeking an affordable checking account: The entry-level checking option, Business First Checking, provides up to 50 free monthly transactions. The account’s $15 monthly fee is waivable with at least a $250 minimum daily balance or 10 card purchases in a statement cycle.

- You’re a nonprofit that wants to save on fees: FNBT offers charitable, religious, educational, and other qualified organizations a nonprofit account that does not charge a monthly maintenance fee, including checks and debits paid and items deposited.

Apart from FNBT’s three higher-tier business checking accounts and a nonprofit account, it also offers a money market account, business insurance, and various types of commercial lending products that include real estate loans, professional loans, equipment or commercial vehicle loans, and construction loans.

The bank’s mobile app is very good. It has 4.7 stars on the App Store[15] from about 88,000 reviews and 4.7 stars on Google Play[16] from about 37,000 reviews. A lot of reviewers raved about the app’s user-friendly features and found it convenient. Others complained about the occasional glitch but still found the app excellent.

Gulf Coast Business Bank: Comerica Bank

What We Like

- No monthly fee for Basic Business Checking

- $5,000 fee-free cash deposit limit for mid-tier accounts

- QuickBooks and Quicken integration

Drawbacks

- Only operates in Arizona, California, Florida, Michigan, and Texas

- Extra $6.95 fee for online bill pay

- Poor user reviews for banking services and mobile app

- Scalable Checking Accounts

- Comerica Business Debit Card

- Comerica Web Banking

- Comerica Web Bill Pay

- Mobile Banking

- Savings accounts, money market accounts, lending products

| |

|---|---|

Required Opening Deposit | $50 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 75 per month |

Monthly fees | None |

Domestic Wire Transfer Fees | Incoming: $14 Outgoing: $24-$29 |

International Wire Transfer Fees | Incoming: $17 Outgoing: $50-$65 |

ATM Fees | None at Comerica ATMs; $2.50 for nonnetwork usage. Third-party fees may apply. |

Cash Deposited | Up to $2,500 per month |

APY | N/A |

When to Choose Comerica Bank

- Your business is based in the Metroplex, Capital, Gulf Coast, and Alamo region: Comerica has locations in these regions. The bank requires you to visit a branch or call a toll-free number to begin the process of opening an account, so if you are not in one of these regions, you should consider an alternative.

- You’re a small Texas-based business looking for a free basic business checking account: Comerica Bank’s entry-level account, Basic Business Checking, has no monthly fees. You get up to 75 free monthly transactions and up to $2,500 in free cash deposits monthly.

- You need a bank that offers higher fee-free transaction limits as your business grows: Comerica offers three other business checking options that scale up as your business grows. Monthly fees for those accounts increase as you go, but they can be waived or offset with earnings credits.

If you need business loans, Comerica Bank offers a wide variety of lending options, including lines of credit, term loans, SBA loans, and CRE loans. Customized insurance solutions are also available, such as commercial property insurance, business automobile insurance, and general liability insurance.

One major drawback is the bank’s mobile app, especially the iOS version. Comerica Bank’s mobile app is poorly rated on the App Store[17], earning just 2.0 stars from about 400 reviews. It is better reviewed on Google Play[18], earning 3.5 stars from more than 4,000 reviews.

It should be noted that it is highly unusual for the iOS rating to be both lower and less reviewed than the Android version. It may be indicative of Apple users preferring a web-based interface with the bank rather than an app. If you are an Apple user, be sure to ask about the mobile banking experience before opening an account.

West Texas Business Bank: Truist

What We Like

- No monthly fees for Simple Business Checking

- Waivable fees for Dynamic Business Checking (free for the first 65 days)

- Online account opening

Drawbacks

- No APY

- Low free transaction limit for Simple Business Checking

- Branches in only 17 states and Washington, D.C.

- Free personalized debit card

- Different reward levels (Core, Plus, and Preferred) offering discounted bank services under Dynamic Business Checking account

- Online and mobile banking

- Financial Wellness program for employees

- First four incoming domestic wires under Dynamic Business Checking are free

- $25 or $50 discount on first check order

- Specialty business checking accounts

Required Opening Deposit | $100 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 50 total combined transactions, then 50 cents per transaction |

Monthly Fees | None |

Domestic Wire Transfer Fees | Incoming: $15 to $65 Outgoing: $20 to $65 |

International Wire Transfer Fees | Incoming: $20 to $75 Outgoing: $35 to $75 |

ATM Fees | None at Truist ATMs, $3 at domestic non-Truist ATMs & $5 for international |

Cash Deposited | Up to $2,000 per month free, then $0.003 per $1 per statement cycle (30 cents per $100) |

APY | N/A |

When to Choose Truist

- You want a traditional bank with free business checking: Its entry-level account, Simple Business Checking, has no monthly fees. However, the free transaction and cash deposit thresholds are low at 50 total combined transactions and $2,000 in cash deposits for free each month.

- You require more fee-free transactions: Truist offers a higher-tier account, Dynamic Business Checking, that allows you 500 transactions and $25,000 in cash deposits for free each month. This account is free for the first 65 days then has a $20 fee, which is waivable if certain conditions are met.

- You’re a nonprofit looking for more account benefits: For nonprofit businesses, Truist offers the best nonprofit business checking accounts on the market. It has no limit on cash deposits and no monthly fees.

Overall, Truist is a great full-service traditional bank with savings, money market, business CDs, credit cards, lending, and insurance product offerings.

Truist has a very solid mobile app, which is rated 4.8 on the App Store[19] and 4.8 on Google Play[20] out of nearly a million reviews. While feedback is generally positive, some users had issues with mobile check deposits and some changes that occurred when the bank completed its merger.

Southeast Business Bank: Regions Bank

What We Like

- Waivable monthly fees

- Cash back on eligible debit card purchase

- Free budgeting tools

Drawbacks

- Locations only in 15 states

- No online account opening

- High overdraft fees

- Free and customizable Regions Business Visa Debit Card that earns cash back rewards

- Transfer funds, pay bills, and deposit checks via mobile app

- Online and mobile banking

- Access to Regions iTreasury® Small Business cash flow management platform

- Access to My GreenInsights budgeting tool

- Fraud prevention tools

- Discounted safe deposit boxes

- Integration with Quicken and QuickBooks

Required Opening Deposit | $100 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 150, then 50 cents per item |

Monthly Fees | $12; waivable |

Domestic Wire Transfer Fees | Incoming: $15 Outgoing: $25 |

International Wire Transfer Fees | Incoming: $18 Outgoing: $45 |

ATM Fees | None at Regions Bank ATMs, $3 at non-Regions Bank ATMs (plus operator fees), $5 for international ATMs |

Cash Deposited | $5,000 then $0.25 per $100 |

APY | N/A |

When to Choose Regions Bank

- Your business is located in eastern and southeastern Texas: Regions Bank is an excellent option if your company is based in the Upper East, Southeast, Metroplex, Capital, Gulf Coast, and Alamo regions since you will need to visit a branch to open an account.

- You need an affordable basic checking account: While the entry-level account, LifeGreen Business Simple Checking, offers only 75 free monthly transactions, the waivable monthly fee is just $7. You only need a monthly spend of at least $500 using your business debit or credit card to qualify for the waiver.

- You want additional perks with your business account: You get 30% off of one safe deposit box per Regions business account. Plus, you can also earn an additional 10% off with auto debit from a Regions checking or savings account.

Regions Bank offers business savings, MMAs, and CDs. For those wanting business credit products, the bank has credit cards and business loans, including lines of credit, SBA loans, equipment financing, and franchise banking.

Both versions of the Regions Bank mobile app are highly rated. The app has 4.8 stars on the App Store[21] and 4.8 stars on Google Play[22] out of more than 500,000 ratings. Some users encountered a check deposit problem but the mobile app support team was prompt in fixing the issue.

Capital Business Bank: Centennial Bank

What We Like

- High transaction limit before fees

- Low monthly fees

- $7,500 free monthly cash deposit limit

Drawbacks

- Limited locations; available in Arkansas, Florida, Alabama (southern area), and New York

- $100 minimum to open an account

- No free wire transactions

- Free instant issue business debit card

- Multiple business checking account options

- Reimburses ATM fees upon presenting an ATM receipt within 60 days of the transaction

- Online and mobile banking

- Basic bill pay

- Overdraft privilege for eligible business checking accounts

- SBA loans and United States Department of Agriculture (USDA) programs

- Has business savings, business money market accounts, business cards, and other lending products

| |

|---|---|

Required Opening Deposit | $100 |

Required Balance Minimum | None |

Transaction Limit Before Fees | 375, then 40 cents per item |

Monthly Fees | None; $10 fee is charged if the balance drops below $0 on any day during the statement cycle |

Domestic Wire Transfer Fees | Incoming: $15 Outgoing: $25 |

International Wire Transfer Fees | Incoming: $15 Outgoing: $50 |

ATM Fees | None at Centennial Bank, $2 at non-Centennial or non-Publix ATMs and $5 for international. Third-party fees may apply. |

Cash Deposited | Up to $7,500 free, then 20 cents per $100 |

APY | N/A |

When to Choose Centennial Bank

- Your business is based in northern Texas and the Capital and Alamo regions: Centennial Bank branches are located in these parts of Texas, and while you can open its basic account online, you need to visit a branch to open its other specialized checking accounts.

- You have a large volume of monthly transactions and need to deposit cash regularly: Centennial Bank’s entry-level account (Business Checking) offers up to 375 free transactions each month while the bank’s other four business checking options provide unlimited free transactions. All five of Centennial Bank’s accounts provide up to $7,500 in free cash deposits monthly.

- You are looking to recover from some financial difficulties: Centennial Bank offers Business Opportunity 100 for businesses that want to rebuild a strong financial reputation. This account provides unlimited transactions but charges a $12.95 monthly fee that is not waivable.

Centennial Bank offers business savings and money market accounts to go with its checking offerings. The bank also has business credit cards and lending products, including SBA and USDA loans.

The iOS version of the bank’s app is well-rated, while the Android version is not as highly rated. The app has 4.8 stars on the App Store[23] and 4.1 stars on Google Play[24] from around 30,000 combined reviews. Reviewers stated that it’s difficult to reset a password by yourself while others found the app glitchy, causing them to uninstall and reinstall often.

How We Evaluated the Best Small Business Banks in Texas

We considered over 50 Texas-based banks when compiling this guide. When we evaluated the best banks for small business in Texas and the alternatives, we considered:

- Banks with physical locations in Texas

- Monthly fees, if any, and how easily they are waived

- Required opening deposit and balance minimums

- Transaction limits before fees

- ACH and wire transfer fees

- ATM fees and availability

- Cash deposit fees and availability

- Interest yield, if applicable

- Other checking account perks

- Software integrations

- Other business services provided

- Lending products provided

- Customer service

- Customer reviews

Frequently Asked Questions (FAQs)

In terms of branch accessibility, the top popular banks in Texas are Chase and Wells Fargo, with the latter claiming the top spot with more than 500 branches in Texas.

Just like in most states, you need to present a valid form of identification, EIN or SSN, business license, and relevant business documents depending on your type of business organization.

Choosing the best bank for a small business will be determined by the business model and needs. If your business primarily operates online, you may consider an online-only bank like Bluevine, Novo, Found, or Mercury. If your business accepts cash and you need access to a physical location, you may want to consider Chase Bank, U.S. Bank, or Bank of America.

Some of our top picks are Chase Bank, U.S. Bank, and Bluevine, but the best bank account for an LLC is determined by many factors. Many banks offer accounts for startups with a $0 monthly maintenance fee, but these can also be used by established businesses based on their financial goals. If your business has employees, you may need an upgraded account that allows for treasury management services to fulfill the financial needs of the company.

Bottom Line

All the best small business banks in Texas featured in this buyer’s guide can help your business grow and prosper. In addition, we have listed fintech alternatives if you want to compare offerings. These providers may not have physical locations but offer convenient digital banking, especially if you don’t need to bank in person. Determine what you need from your business bank, and then choose the provider that best meets those needs.

User review references:

[1]App Store (Chase)

[2]Google Play (Chase)

[3]App Store (Bank of America)

[4]Google Play (Bank of America)

[5]App Store (Frost Bank)

[6]Google Play (Frost Bank)

[7]App Store (PNC Bank)

[8]Google Play (PNC Bank)

[9]App Store (Prosperity Bank)

[10]Google Play (Prosperity Bank)

[11]App Store (Wells Fargo)

[12]Google Play (Wells Fargo)

[13]App Store (Capital One)

[14]Google Play (Capital One)

[15]App Store (First National Bank Texas)

[16]Google Play (First National Bank Texas)

[17]App Store (Comerica Bank)

[18]Google Play (Comerica Bank)

[19]App Store (Truist)

[20]Google Play (Truist)

[21]App Store (Regions Bank)

[22]Google Play (Regions Bank)

[23]App Store (Centennial Bank)

[24]Google Play (Centennial Bank)