Real estate investing involves buying properties with the goal of generating profit, in the short or long term. There are many lucrative strategies to invest in, like fixing and flipping houses, holding and renting properties to tenants, or reselling homes. While investing in real estate can be a rewarding and profitable career or side hustle, there is a lot to learn about the science and strategy of real estate investment, and it isn’t the best fit for everyone.

Read our guide to real estate investing for beginners to learn how real estate investing works, if it’s the right fit for you, and the processes needed to build a successful investing business.

1. Decide if Investing in Real Estate Is Right for You

Some people jump into real estate investing because they’ve heard it can generate passive, easy, and steady income and build wealth. The idea of easy passive income is appealing, but learning how to invest in real estate as a beginner is anything but passive. It takes focus, hard work, and careful planning to build an investment business that generates money.

The current average salary for a real estate investor is $139,851, but this number varies greatly depending on whether you are doing it as a full-time career or a side hustle. The amount of money you make also depends on your location and the type of investments you make. Research your location to see if you’re in an area where real estate investing can lead to a positive cash flow business.

Here are the top 10 cities for real estate investors:

City & State | Annual Salary |

|---|---|

San Francisco, CA | $175,073 |

San Jose, CA | $169,163 |

Fremont, CA | $169,137 |

Oakland, CA | $166,923 |

Antioch, CA | $163,288 |

Lebanon, NH | $161,970 |

Hayward, CA | $161,642 |

Seattle, WA | $161,354 |

Vallejo, CA | $160,792 |

Santa Cruz, CA | $160,399 |

(Source: ZipRecruiter) | |

To determine whether investing in real estate is right for you, there are a few personal questions you should ask yourself. This will help you evaluate whether it is a good fit for your lifestyle, personality, and finances. Dive into these questions to help you decide if you’re ready to start real estate investing for beginners:

Is Investing in Real Estate Right for You?

There are many benefits and downfalls to investing in real estate for beginners, and you need to review them carefully before opening your wallet. Read our article Top 12 Benefits of Investing in Real Estate (+ Possible Cons) to get a better understanding if it’s the right choice for you.

2. Understand the Different Real Estate Investment Strategies

When you’re learning how to start off in real estate investing, there are so many different types of investment strategies and models to choose from. Each approach entails different responsibilities, roles, and return on investment (ROI). One of the most important real estate investment tips for beginners is to thoroughly research and understand each of these models before making any decisions.

Here are the most common investment strategies and who each is best for:

Investment Strategy | How It Works | Best For | Average US Salary |

|---|---|---|---|

Buy properties to own long term and earn rental income from tenants | Individuals interested in generating monthly income, building equity, and managing properties | ||

Purchasing distressed properties to repair, renovate, and sell for a profit | Handy, creative people who like hands-on projects | ||

Properties that are already rehabbed, rented, and managed | People who like to invest in real estate, but be more hands-off with property management | ||

Real Estate Investment Trust (REIT) | Purchase shares of properties through a trust to earn passive income | Analytical individuals who want to earn money from real estate, but do not want to fully own properties | |

Pool money with other investors to purchase a property or shares of a property | People who want the option for a smaller investment to earn passive income | ||

Wholesaling | Middle-person between buyers and sellers to earn profit from sales of homes | Individuals who like to network and make connections with investors, buyers, and sellers | |

Tax Liens & Deeds | Pay delinquent taxes and acquire deeds at auctions | Those who like to take risks and are able to wait for the profit | |

Land Banking | Buy and hold land for future appreciation, then sell when appropriate | People who are able to cover carrying costs while waiting for the land to gain value | |

Development & Redevelopment | Develop raw land or redevelop a site with a building | Investors who have a large amount of capital to invest |

As you decide which investing model you’d like to venture into, revisit some of the questions you asked yourself when choosing to become a real estate investor. Clarifying your goals, time availability, and finances will help guide your decisions and purchases.

For example, here are a few questions to ask as a beginner in real estate investing:

- How much time do you want to devote to investing? If you’d only like to devote part of your time, then a turnkey investment property might be better suited for you, whereas flipping houses or managing tenants requires full-time availability.

- How hands-on do you want to be? Someone who is doing a buy-and-hold model where they will be a landlord will typically be dedicating a lot more time to the profession than someone who is investing in a real estate investment trust (REIT) and earning passive income.

- How much money do you have to allocate to real estate investing? This will dictate the type of properties and investments you can purchase.

3. Consider Your Financing Options

When you’re buying a property as your primary home, there are a limited number of financing options to choose from, and that information is typically handled by a mortgage broker. However, as a real estate investor, there is a wide range of financing types and options that you should be familiar with in order to make wise choices for your business.

For instance, a few of the most common types of investment property financing include:

- Conventional mortgage loan: This is one of the most common types of loans, and is provided by many different banks, credit unions, and online lenders like Baselane.

- Government loans: These include Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) loans.

- Home equity loan or line of credit (HELOC): If you own a property with equity, you can get a loan to get a lump sum of funds. Keep in mind that if you want to get a home equity loan on a property that isn’t your primary residence, you’ll need to get an investment property line of credit (LOC).

- Hard money loan: These loans typically have a short-term period of 18 months or less, and involve a lender or investor giving you money directly. Hard money loans are most commonly used for fix-and-flip loans.

- Owner financing: Instead of making payments to a lender, owner financing means paying the owner directly until the debts are fulfilled.

- Balloon mortgage loan: Unlike conventional or FHA loans, these mortgage loans typically have shorter periods for payoff, around five to seven years.

- Interest-only mortgage loan: Payments on an interest-only loan will only cover interest charges. Although payments are lower, the principal balance of the loan doesn’t decrease.

- Blanket mortgage loan: This is a single loan that can be used to purchase multiple properties at the same time.

Financing will be one of the most important elements of real estate investing for beginners, so make sure that you have a solid understanding of each type of financing. This will help you determine what type of financing is best for each property you purchase and each investment strategy you pursue.

For details on specific loans and providers, read our complete guide to the 7 Best Investment Property Loans for 2023.

4. Learn About the Types of Real Estate Investment Properties

In addition to learning about real estate investing strategies, you also need to learn about the types of properties you can invest in. This will help you learn specific tips for real estate investing and focus your efforts on what’s most profitable for your business model. There are many types of properties that range in size, cost, profit potential, and structure—from a single-family home or large apartment complex to land.

Here are the various types of properties with links to articles with more specific investment property tips for beginners:

- Multifamily properties (or kinds of multifamily homes like duplexes, triplexes, and fourplexes)

- Apartment buildings and complexes

- Land

- Distressed properties like preforeclosure and foreclosure

- Vacation rental homes

- Turnkey properties

- Commercial real estate

The type of property you invest in should coincide with your investment strategy. For example, if you are looking to flip properties for profit, you will get more value from buying distressed properties that need repairs and renovations. If you want to become a landlord by holding and renting properties, a multifamily, vacation, or complex might be better suited for you.

5. Create an Investment Business Plan

To organize a successful investing business, you need a business plan. It should be a step-by-step outline that dictates how you will meet your business and financial goals. A business plan is even more important for investors who will be working with a team or receiving financial assistance from a third party because it will be presented to cultivate partnerships.

Your business plan should include:

- Mission and vision statement

- Strengths, weaknesses, opportunities, and threats (SWOT) analysis

- Your investing model

- Specific and measurable goals

- Company summary

- Financial plan

- Market analyses and marketing plan

- Team and system

- Exit strategy

For more detailed information and a free template to create your business plan, visit our article How to Write a Real Estate Investment Business Plan (+ Free Template). If you choose a fix-and-flip investment model, check a plan specifically for flippers in How to Start Your Own House Flipping Business in 7 Steps (+ Free Download).

6. Find Real Estate Investment Properties & Run Reports

Knowing where to search for investment properties is one of the most important components of being a real estate investor. The right listing site will be the gateway to learning about the properties available and deciding which ones you’ll purchase. Depending on your business model, different types of listing websites will help you find specific types of properties.

For example, Zillow, Realtor.com, and Trulia have a variety of property types for sale through traditional means. On the other hand, if you’re looking for distressed properties or those sold by the owner, you’ll have better luck on websites like Auction.com, FSBO.com, or Foreclosure.com.

Here are some of the best listing websites to find investment properties for sale:

Websites | ||||

|---|---|---|---|---|

Best For | Individuals who want access to a variety of property types | Investors seeking turnkey properties | Fix-and-flippers looking for distressed homes | People looking to invest in commercial properties |

Key Features |

|

|

|

|

Starting Price | Free to browse | |||

Learn More | ||||

7. Run Reports on Potential Properties

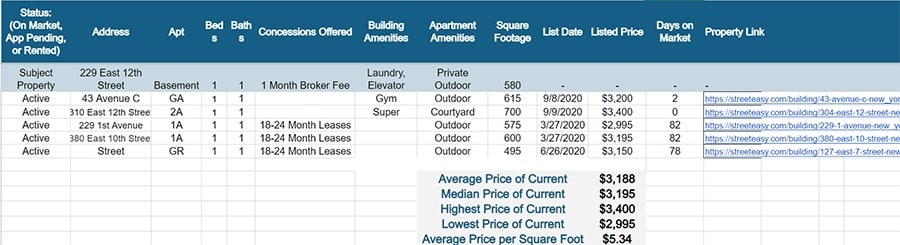

Once you find potential investment properties for sale, you’ll need to visit them and do a financial evaluation. Your evaluations should help you analyze the price and profitability of the property. In particular, you should be familiar with comparative market analysis (CMA) and rental market analysis (RMA), which can be done through an agent or with your own tools.

A CMA report analyzes a property’s value compared to similar properties, known as “comps.” It is an excellent tool for investors, informing you on any given property’s value. Similarly, an RMA report compares rental property values so landlords can properly price their rentals for tenants. Investors should know how to create and use the CMA and RMA reports before purchasing any property and make an informed decision about whether the property will ultimately yield a profit.

Sample rental market analysis report

8. Understand Laws & Regulations

When purchasing investment properties, you must know the legalities behind every real estate transaction. Real estate laws vary by state but generally follow guidelines set forth by the Fair Housing Act, which prohibits discrimination of protected classes like color, race, religion, national origin, disability, sex, and familial status. It is important for investors to understand these laws because they apply to all parties in a real estate transaction, including agents, investors, property managers, and landlords.

Furthermore, for those choosing a buy-and-hold investment model where they will become a landlord, it is especially crucial to know landlord-tenant laws. They will stipulate items like lease terms, security deposits, notices to tenants, property management, and eviction laws.

Visit our article Landlord Tenant Laws by State: Renter’s Rights & Compliance and click on your state to read specific laws and regulations.

9. Start a Real Estate Holding Company

Regardless of your investment business model, consider starting a real estate holding company or limited liability corporation (LLC) to protect your investments. This is a legal entity that will protect your assets in the event of a lawsuit or other catastrophic event that can lead to a financial loss. It will also provide tax benefits and separate your business from your personal finances.

The cost of starting an LLC ranges from only $40 to $500 depending on your state, and it can prevent you from losing thousands or more dollars in unexpected situations. Speak to an attorney about starting a holding company or about landlord-tenant laws to guarantee your business is legally set up for success.

Cost to start an LLC in each state

10. Build a Real Estate Investing Team

While many beginners in real estate investing believe they will work alone, it is impossible to possess all the skills necessary to complete investments on your own. One of the most valuable real estate investing tips is to surround yourself with a team of qualified and experienced professionals. This not only helps you save time and money, but also keeps your properties in legal, marketable, and proper condition.

A strong real estate team should include these members:

- Attorney

- Real estate agent

- Property manager

- Handyperson

- Plumber

- Accountant

- Title company

- Electrician

- Contractor

- Landscaper

- Mortgage professional

- Financial adviser

These professionals will be responsible for a variety of tasks—from securing your property purchase to doing emergency repairs. For example, an attorney and real estate agent can work together to negotiate a property purchase, while a plumber can be on call for a leaking pipe. While many items can be done on your own, having a list of names and contacts that you can call immediately is extremely beneficial for any property owner.

If you choose to be a landlord or own rental properties, make sure you have a property maintenance checklist. This will help you assess for normal wear and tear versus damage, and help prevent issues with tenants. Download our free checklist in the guide The Essential Rental Property Maintenance Checklist for Landlords.

11. Choose Real Estate Software

In conjunction with your real estate investing team, you should also invest in software to manage your properties and communicate with vendors and tenants. Real estate software tools assist in collecting rent, managing maintenance requests, screening tenants, creating and signing leases, and marketing your listings.

There are many software options to choose from that can complement your business. Take a look through the following articles:

- 8 Best Property Management Software for Small Businesses 2023

- 6 Best Tenant Screening Services for Landlords

- 7 Best Online Rent Payment Services for Landlords 2023

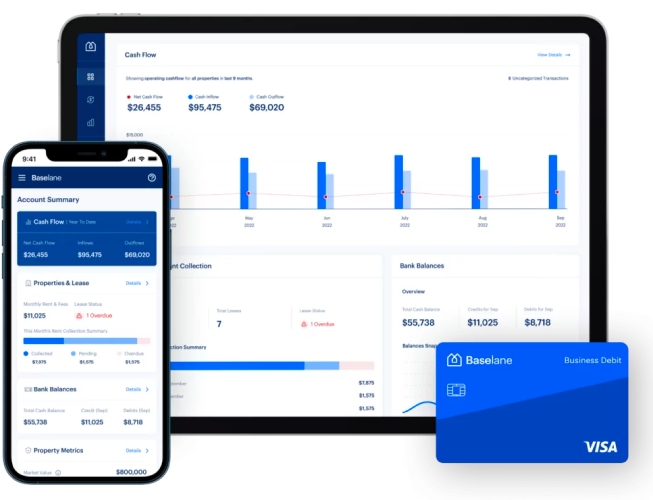

Baselane landlord banking dashboard (Source: Baselane)

Although there are many tools available to help you manage your relationships and communications with tenants, Baselane is the only tool that includes banking designed specifically for landlords. This bank tracks all of your income and expenses, provides reports, and automates rent collection so you don’t have to worry about tenants forgetting to pay. Learn more about how Baselane helps landlords successfully manage their rentals.

12. Conduct Real Estate Investment Calculations

Investing in real estate means that financial calculations will be a regular and common part of your daily life. You’ll need to constantly keep track of how much money you’re spending and how much you’re earning in order to stay profitable. If you spend above your means, your bottom line will suffer, and it will affect the next moves you can make in your real estate investing business.

These are the following equations that all investors should be familiar with:

Calculation | What It Is | Formula | Learn More |

|---|---|---|---|

Capitalization (“Cap”) Rate | Rate at which you will make a return on your investment. | Cap rate = Net operating income / Purchase price x 100 | |

Gross Operating Income (GOI) | Amount of money collected from a rental property before additional expenses. | GOI = Total rent + Other income – Vacancy losses | |

Net Operating Income (NOI) | Amount of money left after all property expenses are paid. | NOI = Rental income + Other income – Vacancy losses – Total operating expenses | |

Return on Investment (ROI) | Return on your total investment in the property, including debt and loans. | ROI = Annual return / Total investment x 100 | |

Vacancy Rate | Percentage of unoccupied units in a multi-unit rental property | Vacancy rate = # of vacant units x 100 / Total # of units | |

Gross Rent Multiplier (GRM) | Ratio that determines how long the rental income will take to pay for the property. | GRM = Property price / Gross rental income |

Another important calculation for beginner real estate investors is determining how much to charge for rent. There are many factors that contribute to that decision, like location, market trends, seasonality, and amenities. To most effectively calculate the price of rent, use the free calculator in our guide How Much Should You Charge for Rent? (+ Free Calculator & Tips).

Plus, learn how to calculate the profitability of a rental property with our Free Rental Property Calculator: Analyze Your Investment Property. It takes many factors into consideration, like property purchase details, monthly operating expenses, and property income, to compute the ROI, cap rate, and cash flow of a current or potential rental property.

13. Work With Tenants

Many real estate investing options will not require you to work with tenants, like wholesaling, crowdfunding, or land banking. However, if you are planning to become a landlord and rent out your properties, you must learn how to effectively work with tenants. This requires many steps, from screening potential tenants and reviewing paperwork to leases and collecting rent.

Although there are tools to help you with property management tasks, you should still know each process from beginning to end. This will help you avoid having any tenant horror stories, minimize vacancies, and ultimately maximize profits. Here are some examples of the ways you’ll need to work with tenants:

- Find tenants for your rental: Landlords must advertise and market their listings online so potential tenants know they are available. This requires them to create property descriptions, organize, manage, and post their listings to popular sites like Apartments.com, Zillow, and Craigslist to gain exposure and find quality tenants.

- Review application and paperwork: Before allowing someone to move into your property, it’s necessary to determine whether they are qualified to pay rent on time and take care of the property. All landlords should have a standard rental application, a list of required paperwork, and interview questions to properly screen applicants. This will give the landlord an opportunity to verify their income, perform a background and credit check, and review past rental history before making a decision on whether they will be a good fit for the building.

- Sign leases and rental agreements: After approving an applicant’s application, the tenants and landlord will sign a lease if it’s a long-term residence, or a rental agreement if it’s a short-term residence. This legally binding document for both parties stipulates the terms and conditions of living in the unit. Both sides should be aware of their responsibilities as a tenant and a landlord and be able to uphold them throughout the rental term.

- Collect rent: There should be a set system in place for landlords to collect rent from their tenants, whether that’s electronically (via Venmo, PayPal, or software system), bank transfer, or physical (e.g., check or money order). All payments should be documented for bookkeeping purposes, and tenants need to receive a rent receipt to document for their records. Landlords should also be cognizant of the real estate market to determine if a rent increase or decrease is needed.

- Remedy maintenance issues: If there is property damage, emergency repairs, or standard maintenance that needs to be taken care of, landlords need to be prepared to remedy them immediately. This could be anything from snow removal to a burst pipe to pest control. Communication with tenants during these situations will prove your dedication and attentiveness to your property and your tenants’ well-being.

- Show tenant appreciation (or evict, if necessary): The hope for landlords is that all tenants will be excellent and will stay in the apartment for the long term. If so, you can show your appreciation with small gifts or rent credit. Unfortunately, that isn’t always the case and, instead, may require landlords to evict their tenants. If it comes to this, landlords need to be aware of the process and laws in their state that accompany an eviction.

14. Plan an Exit Strategy

When you’re researching how to get into real estate for beginners, the idea of exiting the industry is probably not top of mind. However, planning for your long-term future is one of the most important tips on real estate investing, and should even be included in your business plan.

Your exit strategy should fit the goals you have for your real estate investments. Whether you want to build long-term wealth for retirement, free up your time and finances, or save for a college fund, it’s important to establish your goals, your starting point, and your ending point.

Frequently Asked Questions (FAQs)

Aspiring real estate investors can start by researching the market, understanding local trends, creating a business plan, and understanding different types of investments. Make sure to evaluate whether real estate investing is the right choice for your goals, lifestyle, and finances. Consider investment options like residential rentals or REITs when you start, and learn how to leverage financing to increase your profits.

Real estate investors make an average of $70,000 to $124,000 per year, although there are plenty of investors with billions of dollars in net worth. Investing in real estate can be incredibly profitable, but your success depends on factors like location, property type, market conditions, and management. In order to maximize your profits, make sure you do extensive due diligence on each purchase, using the calculators and templates included in this rental property investment guide.

Real estate is a great investment for new investors because of its relatively easy financing options and stable market. It’s ideal to start with smaller, more manageable properties or real estate investment trusts (REITs). However, make sure to be prepared for ongoing and unexpected expenses.

Bottom Line

When learning about real estate investing for beginners, there are a lot of variables and complex concepts that can be challenging. However, investing in real estate is a rewarding, worthwhile, and lucrative career that can help you generate wealth and run a successful business. Use this beginner’s guide to real estate investing as your jumping-off point to prepare yourself and learn how to make smart investments.