Last weekend, we saw another record-breaking Black Friday Cyber Monday (BFCM) weekend with results that surpassed many expert projections. However, while total spending was up year-over-year, 2023’s BFCM did not see as much spending growth as we have seen in previous years and certainly did not outpace inflation.

Keep reading our top 2023 Black Friday and Cyber Monday statistics and results to see just how the weekend panned out.

BFCM Results at a Glance

Read below for a quick overview of Black Friday and Cyber Monday’s sales and revenue results.

1. Total retail sales were up 2.5% year-over-year

According to Mastercard SpendingPulse™, US retail sales on Black Friday were up +2.5% year-over-year across in-store and online sales channels.

2. Total BFCM Online Sales Results (US)

Day | Sales Total | YoY Growth |

|---|---|---|

Black Friday | $16.4B | 9% |

Cyber Monday | $12.6B | 3% |

Cyber Week | $70.8B | 5% |

Results based on findings from Salesforce’s Shopping Insights HQ. | ||

3. Online order volume increased by 8%

As with total spending on online orders, the number of online orders placed on Black Friday also increased, surpassing last year’s order volume by 8%.

4. In-store sales only saw a 1.1% increase YoY

While online sales totals saw an increase of 9%, in-store retail did not fare as well. In fact, in-store sales totals only saw a 1.1% increase compared to 2023, not even coming close to beating the rising inflation rate.

5. The US was among the top-selling countries on Black Friday

According to data from Shopify merchants, the US was among the list of countries with the highest sales. Also included are the UK, Australia, Canada, and Germany.

The US topped the list for top-selling cities as well with LA and New York raking in the highest sales on Black Friday.

Shopping Traffic: Where & How Did People Shop?

Now that you have a picture of the overall sales performance for the weekend, the next question to ask is where were people shopping?

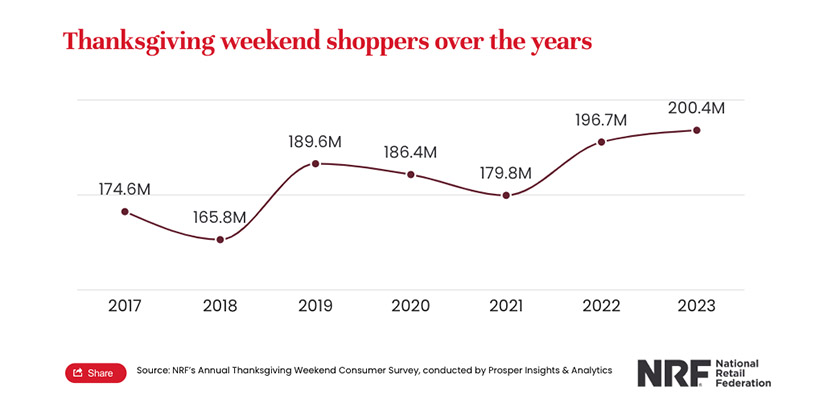

6. A record 200.4 million US consumers shopped over BFCM weekend

Between Thanksgiving Day and Cyber Monday, a record-breaking 200.4 million consumers shopped in-stores and online. This figure surpasses 2023 shopper traffic by 3.7 million people—the most on record.

2023 saw the most BFCM shoppers on record. (Source: NRF)

Earlier in the season, the National Retail Federation anticipated only 182 million Americans to shop over the BFCM weekend—falling short by over 18 million.

7. Ecommerce saw an additional 4 million shoppers

Online shoppers totaled 134.2 million in 2023, up from 130.2 million last year. This growth is slightly slower compared with ecommerce’s growth rate over the past several years, but experts largely attribute the massive growth between 2019 and 2022 to COVID and quarantine protocols.

8. In-store traffic was slightly down YoY

One hundred and twenty-one million people visited physical retail locations over the Black Friday weekend, both to browse and make purchases. This figure is slightly down from the 122.7 million in-store shoppers that BFCM saw in 2022 but is relatively consistent with the past few years.

9. Black Friday was the biggest day for in-store shopping

While there was in-store traffic throughout the BFCM weekend, Black Friday continued to be the biggest day for brick-and-mortar retailers with the highest rates of foot traffic. In fact, according to the National Retail Federation, there were 76.2 million in-store shoppers on Black Friday this year, up from 72.9 million in 2022.

10. In-store traffic rose by 4.6%

Compared to 2022, in-store traffic was up by nearly 5% on Black Friday and 3.5% over the entire weekend. As we saw earlier, this did not necessarily translate to a proportionate increase in sales revenue, but boosting foot traffic is a step in the right direction for brick-and-mortar.

According to Sensormatic data, for this year to date, in-store traffic is up 7% year-over-year, the largest increase in recent memory.

11. Peak in-store traffic hit in the mid-afternoon

Long gone are the days when Black Friday shoppers would camp outside and hit the stores at the crack of dawn. Now, consumers are taking their time, with peak shopping hours happening between 2 p.m. and 3 p.m. across the whole weekend.

12. Saturday was for small businesses

On the Saturday following Black Friday, 59 million consumers were shopping in-store and online (down from last year’s 63.4 million). Seventy-eight percent of these shoppers were shopping specifically for Small Business Saturday.

13. Mobile commerce was down YoY

While desktop and laptop use remained about the same for Cyber Monday with about 44 million consumers using a computer to shop, mcommerce was not so lucky. In fact, on Cyber Monday, only 40.5 million shopped online using their mobile devices, down from a record 45.7 million in 2022.

14. Mcommerce accounted for an average of 77% of online traffic between Black Friday and Cyber Monday

For online traffic, mobile commerce was dominant on Black Friday and Cyber Monday. For Black Friday, m-commerce accounted for 79% of online traffic and 75% on Cyber Monday.

15. Mobile conversion rates were lower than desktop conversion rates

While the typical ecommerce conversion rate hovers at about 2.5% to 3%, you can expect higher rates on BFCM. In fact, for desktop ecommerce shoppers, the conversion rate was 6.5% on Black Friday. For mcommerce, however, the conversion rate was less than half of that, hovering at 3.2%. On Cyber Monday, the conversion rate for those shopping via desktop was 6.9% while mcommerce saw 3.5%.

16. Online was the top destination for Thanksgiving weekend traffic

According to the National Retail Federation, throughout the Thanksgiving weekend, the top destinations for shoppers were:

- Online: 44%

- Grocery stores and supermarkets: 42%

- Department stores: 40%

- Clothing and accessories stores: 36%

- Electronics stores: 29%

17. BOPIS fulfillment accounted for 23% of online orders between Black Friday and Cyber Monday

Buy online, pick-up in-store (BOPIS) options were even more popular this year than they were last, with 24% of Black Friday’s orders and 22% of Cyber Monday’s made through BOPIS. This is up from 19% for Black Friday and 21% for Cyber Monday in 2022.

18. Digital wallet use surged by 59%

Digital wallets have been a growing force in the payments landscape for years, and this Black Friday its usage surged. According to findings from Salesforce, digital wallet use surged by 59% throughout Cyber Week.

19. Afterpay use increased by 19% YoY

According to data gathered by Square, there was a 19% increase in purchases made through AfterPay’s customer financing services.

Top Products: What Did People Buy?

So, we know where people were shopping, but what were they buying this year? Read more to see what products performed the best this BFCM weekend.

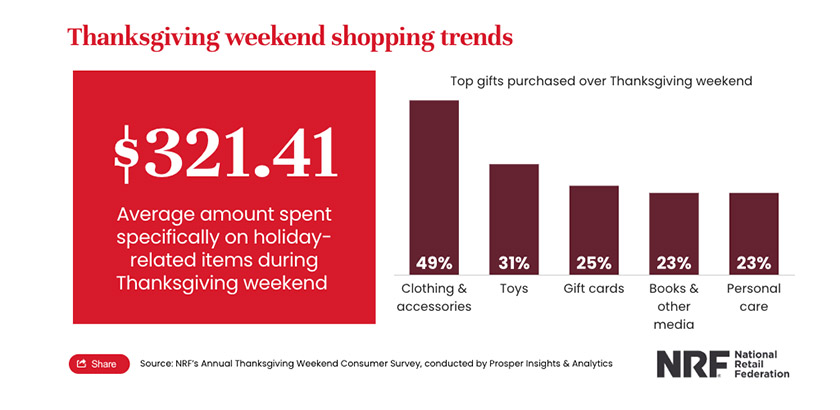

20. 95% of shoppers made holiday-related purchases

From decor to gifts to other bits and bobs, holiday-related purchases dominated this BFCM weekend with nearly every customer (95%) buying something for the holidays. And they weren’t spending pennies—the average consumer spent $321.41 on holiday merchandise.

21. 70% of those holiday-related purchases were spent on gifts

‘Tis the season of giving, and consumers spent 70% of their BFCM holiday-related budget on gift items. This translates to $226.55 per person on gifts, leaving only about $95 remaining in their holiday spend for the weekend.

Consumers typically spend around $900 on holiday items throughout the holiday season. You would think that more of this budget would be accounted for over the BFCM weekend, but the majority (85%) of consumers had started holiday shopping before the weekend even started and nearly half (48%) were already halfway done.

22. The top-purchased gift category was clothing and accessories

On par with previous years, the top gifts that people purchased over the BFCM weekend were clothing and accessories, followed by toys, gift cards, and books. An interesting development from this year, however, was the introduction of personal care items into the top five gift purchases, with nearly one in four people purchasing from the category.

23. The number of items per order stayed consistent

From last year to this, there was very little change in the average number of items people bought per order—3.7 units per ticket. For Black Friday, in fact, there was a 0% change, and for Cyber Monday, we only saw a 1% increase.

On average, BFCM consumers bought 3.9 times more items per online order than they did per in-store purchase.

BFCM Discounts: What Did Offers Look Like?

Consumers often gripe that Black Friday deals aren’t what they used to be. But what kind of Black Friday and Cyber Monday discounts and promotions were offered this year?

24. The average promotion was 28%

For both Black Friday and Cyber Monday, the average promotion was 28%. While this discount counts for something, experts say Black Friday sales aren’t worth it for consumers until they hit 40%.

25. Sales drove 55% of BFCM sales

The majority (55%) of Black Friday and Cyber Monday purchases were driven by sales and promotional offerings. This is up from 52% in 2022. Not only that, but limited-times sales also inspired 31% of people to make purchases they had been hesitant about, up from 29% last year. In other words—people are looking to save money, and discounts are what will continue convert sales this holiday season.

26. Discounts ranged from 25% to 27% for toys, electronics, and apparel during the BFCM weekend

When averaging the discount rates for electronics, toys, and apparel, some of the largest shopping categories for BFCM, discounts ranged from 25.33% on Sunday to 27.3% on Monday.

Day | Discount |

|---|---|

Thursday, November 23 | Electronics: 26.7% Toys: 28.2% Apparel: 22.7% Average: 25.87% |

Friday, November 24 | Electronics: 26.9% Toys: 28% Apparel: 24.2% Average: 26.37% |

Saturday, November 25 | Electronics: 27.1% Toys: 27.4% Apparel: 23.7% Average: 26.07% |

Sunday, November 26 | Electronics: 27.5% Toys: 26.1% Apparel 22.4% Average: 25.33% |

Monday, November 27 | Electronics: 31.4% Toys: 27.1% Apparel: 23.4% Average: 27.3% |

27. 35% more businesses offered discounts this year

According to data from Square, there was a 35% growth in the number of businesses offering discounts compared to 2022.

Bottom Line

All in all, the BFCM weekend was a success and proves the resilience of the consumer even in the face of difficult circumstances—inflation, economic uncertainty, and a world of endless conflict can’t seem to stop people from spending during the holidays. While it is true that Black Friday and Cyber Monday have become less novel in terms of their offerings over the years, the shopping weekend is still a pivotal one for retailers big and small and is always ripe with potential.