Pricing strategies are the methods and formulas that businesses use to determine the cost of their products. A good pricing strategy finds the sweet spot between what customers are happy to pay and what makes your business money. It should also adapt to changes in the market or economy.

Here’s a list of 19 effective pricing strategies—from using the manufacturer’s suggested price to aligning with your competitors’ pricing to changing pricing in real time based on events—with examples of how to use them.

1. Keystone Pricing

What Is It: Doubling the product cost to get the selling price

Commonly Used By: Retailers and ecommerce sellers

Keystone pricing is a strategy in which the asking price is double the product’s wholesale cost, or close to a 50% profit margin. It’s the default pricing strategy across both retail and ecommerce due to its simple application and ability to yield profits.

Occasionally businesses will use keystone pricing as a base markup on most goods, then apply higher markups or discounted pricing to certain items based on demand, volume, and competition. It’s a particularly common strategy in fashion, consumer goods, and grocery sectors.

For example, say you run a jewelry store. You purchase a birthstone ring from a wholesaler for $90. To maintain a keystone pricing strategy, you set the retail price for the ring at $180, ensuring a consistent 100% markup. This approach allows you to cover your costs, account for operating expenses, and generate a reasonable profit while offering the product to customers at a perceived fair market value.

Keystone pricing may not be the best strategy for every type of product. If your goods have low turnover rates, involve high shipping and handling costs, or are unique or rare, you may be undervaluing them by using keystone pricing. However, if your products are widely available and easily replaceable, keystone pricing may put them at too high of a price to generate sales.

Check out our guide on how to price your products for step-by-step instructions.

2. Cost-plus Pricing

What Is It: Applying a standard markup percentage on top of your cost of goods sold (COGS)

Commonly Used By: Wholesalers, manufacturers, artisans, and private label sellers

Cost-plus pricing (also known as markup pricing) involves calculating the total fixed and variable costs associated with your product (labor, marketing, shipping, etc.), and then adding a markup to achieve your desired profit margin. Most retail brands aim for a 30%–50% margin, which means roughly a 40%–100% markup.

Cost-plus pricing works well for companies that sell labor-intensive products or large amounts of similar products. Here are some examples of how wholesalers, manufacturers, artisans, and craftsmen typically use cost-plus pricing:

- Wholesalers: Wholesalers usually add a flat percentage markup to all goods that pass through their hands. A common wholesale or middleman markup on most consumer goods is 20%, but that can vary depending on your industry.

- Manufacturers: Manufacturers use different cost-plus prices depending on the buyer. A manufacturer might sell bulk goods to wholesalers at a cost-plus of 100%, just like a keystone markup—but then also sell single units directly to consumers on its website at a 200% markup (generating a 67% margin). This way, it makes more money per unit on smaller sales.

- Artisans and Craftsmen: Labor is the cornerstone of artisanal and craft works, so the cost-plus price represents the value of the labor and the product. For example, if you have a wooden chest built by an artisan, the cost-plus markup might be 70%. The base price represents materials and hours, and the 70% markup represents the value of the labor and finished product.

Use this formula to calculate cost-plus pricing based on the markup you want:

Item Cost x (1 + [Markup/100]) = Selling Price

So, if you are a craftsman who spent $150 making that wooden chest we mentioned above and wants to sell it at a 70% markup, your calculation would be:

150 x (1 + [70/100]

150 x (1 + 0.70]

150 x 1.70

Selling price = $255

3. Manufacturer’s Suggested Retail Price (MSRP)

What Is It: Using the price that product manufacturers recommend for their goods

Commonly Used By: Retailers and ecommerce sellers

The MSRP pricing strategy is popular among retailers that purchase goods rather than making the products themselves. The MSRP often matches the Keystone price, but there can be exceptions.

Some retailers may have the flexibility to adjust the MSRP, but certain manufacturers or brands strictly prohibit alterations to their suggested prices. This is called MAP or Minimum Advertised Pricing, and it’s commonly used by brands like Apple to maintain their products’ value. Because of this, it’s crucial to know the pricing terms before you start working with a manufacturer to avoid legal trouble.

The downside of using MSRP as your pricing strategy is that you’ll have the same prices as your competitors. So, you’ll have to differentiate your store in other ways—for example, offering free shipping for ecommerce sellers and exceptional in-store promotions for retailers.

Some brands print the MSRP on their product packaging to ensure retailer compliance. If you choose to use a different pricing strategy in these cases, you’re likely to upset your customers as well as the manufacturer. (Source: Reddit)

4. Psychological Pricing

What Is It: Using prices that end in an odd number (typically 9, 5, or 7) to give the impression of a lower price and a good deal

Commonly Used By: Retailers, ecommerce sellers, big box stores, and discount chains

Have you ever walked into a store or viewed an infomercial and noticed that all of the prices end in 99 cents? That’s psychological pricing at work.

A store may price a product at $199 instead of $200 or $4.95 instead of $5. With psychological pricing, the theory is that customers put a greater emphasis on the first digit of a product price, so $199 seems like a much better value than $200, even though the actual price difference is minimal.

By providing customers with the sense that they’re getting a bargain or paying less, psychological pricing reduces the psychological pain of loss that customers experience when parting with their money. This incentivizes shoppers to buy, especially in impulsive scenarios. It also gives them the sense that they’re walking away with a good deal.

An ad from Food Lion shows all the deals that it is currently offering and gives us a great example of a retailer creating the illusion of a deal with psychological pricing. (Source: Pinterest)

Psychological pricing is also a great “bang for your buck” pricing strategy, where only a few cents can inspire customers to make much larger purchases. For example, at my boutique, we decided to re-price our jeans from $70 to $69.99. Immediately, we saw a massive uptick in denim purchases, simply due to the 1-cent price change.

Many retailers choose to mark all their goods with 99-cent endings. Some, however, will reserve the power of psychological pricing exclusively for their sale pieces to incentivize faster turnover of old merchandise. Other common prices that retailers use to make a more appealing sticker price are 95 cents, 89 cents, and 69 cents.

Steer clear of psychological pricing techniques if you sell high-value items, as it may decrease the perceived worth.

5. Value-based Pricing

What Is It: A strategy in which pricing is based on perceived value or how much the customer believes the product is worth

Commonly Used By: Specialty stores, luxury stores, sellers of rare and unique goods

The value-based pricing strategy works best for merchandise with high brand recognition, luxury goods, and unique products that have exclusive features that set them above the competition. It does not work well for businesses that sell commoditized goods or products that lack exclusive features (such as grocery or convenience retailers).

As a value-based pricing strategy example, say you own a shop that sells vintage luxury handbags. The value of your products is not represented by doubling the production cost price or by any MSRP. In this case, you would use a value-based pricing system that accounts for the exclusivity of designer labels and the rarity of the bags to reflect perceived value.

To implement a value-based pricing strategy, you have to analyze three things:

- Your Customers: Conduct surveys, research locally, and understand your target market so that you can learn their value system (and set prices accordingly).

- Your Market: Research industry trends and national consumer patterns to understand the value-based price that the greater population is willing to pay for your products.

- Your Competitors: Look to competing sellers to see how they are pricing their products. Successful businesses in your industry can help you understand the pricing that is helping them prosper, as well as what prices will allow you to compete.

6. Discount Pricing

What Is It: A strategy of regularly selling goods at prices under competitors’ Keystone or MSRP prices

Commonly Used By: Retailers, ecommerce seller, big box stores, and discount chains

Discount pricing drives entire business models—think Dollar Store, Big Lots, and Home Goods. It’s best for volume-driven businesses that can get lower prices from suppliers by purchasing large quantities.

Be sure customers know they’re getting a deal by clearly displaying your discount or even including the undiscounted MSPR/Keystone price on the tag. This shows customers exactly how much they are saving.

Mark your racks and tags with the discount you are offering so customers know just how much they are saving. (Source: Crazy Coupon Lady)

For the small retailer, an overall discount pricing strategy can leave you with razor-thin profits that easily dip into losses. But running occasional sales, markdowns, seasonal specials, and coupons is an excellent way for small businesses to move through old products and attract new shoppers.

Plus, small businesses can use discount pricing strategies to kick-start drooping sales, unload stale stock, and take advantage of seasonal shopping trends.

To ensure that you don’t sacrifice your bottom line, run your numbers and determine whether a discount will leave you with healthy margins before applying this strategy.

7. Loss-leader Pricing

What Is It: A strategy that sets prices below production costs to attract new customers or increase sales

Commonly Used By: Retail, ecommerce sellers, convenience stores, big box stores, and discount chains

Loss-leader pricing is when you sell select products at extremely low prices to draw customers in and then get them shopping for more profitable goods as well.

A good loss-leader pricing strategy example is Costco, a popular wholesale grocery membership club that sells rotisserie chickens for $4.99 each. Costco states that it actually loses money on each chicken sold, but they function as a loss leader that inspires people to sign up for memberships and shop the rest of their store.

Take a note out of Costco’s book and place your loss leaders in the back of your store. This will force shoppers to go through your entire space and be exposed to lots of other products before they reach the deal.

Loss-leader pricing is a great strategy for grocers and other stores where people make multi-item purchases, but it can be a risky pricing strategy for small businesses. The strategy relies on the fact that the profits you lose from your loss leader will be made up by profits of other items. This is difficult to ensure if you don’t sell many items per ticket or if your margins on other goods are small. Be sure that you run the numbers and know your typical units per ticker (UPT) before introducing a loss leader to your pricing strategies.

Units per ticket (UPT): A popular retail metric that tells you the average number of items in each transaction over a certain period of time. Also called IPC or Items Per Customer.

UPT formula:

UPT = total units sold / total number of transactions

8. Price Anchoring

What Is It: A strategy that involves displaying a higher anchor price alongside your product price to make it look like a better deal to customers

Commonly Used By: Retail stores, ecommerce stores, discount chains, secondhand stores

There are two primary ways that you can implement an anchor pricing strategy. This first is when you display a regular or MSRP price and your lower price on the same tag. Stores like Marshalls, TJ Maxx, and other discount, consignment, and antique stores use this pricing strategy storewide.

TJ Maxx, a popular discount store, shows the “compare at” price on all their tickets so shoppers know just how much they are saving. (Source: Consumer Products Safety Commission)

Another anchoring strategy that you can use is to display multiple models of the same product together so that the cheaper model seems like a good deal. For example, if you have ever had to choose a new phone or computer, you’ve seen that the cheaper models are typically displayed together with the most expensive model acting as the anchor price. In effect, when a customer chooses one of the less expensive models they feel as though they are getting a good deal compared to the anchor price.

Anchor pricing can work well for small sellers. It’s especially useful if you sell in a niche that has a lot of competition, but not so much that you have to substantially lower your price to compete. Often, a standard storewide 5% to 10% anchor pricing discount is enough to create a memorable sense of value that brings shoppers back for more.

9. Competitive Pricing

What Is It: A pricing strategy in which you use competitors’ prices to set the price of your same or similar products

Commonly Used By: Convenience stores, big box chain stores, discount stores, gas stations, retail stores

Competitive pricing ensures that your goods are priced low enough to compete with other sellers. It’s a smart option for products that are common and easily attainable elsewhere. It’s also a useful strategy to use when testing new products that are similar to competitor’s.

Alternatively, you can use this strategy to set yourself a step ahead by making your prices lower than the competition.

In the age of Amazon and other large-scale retailers, competitive pricing is particularly important. If a shopper could just as easily buy your product on Amazon, it’s crucial to have a better price. If that’s not attainable, consider creating value in other ways—like offering free shipping or a free gift with purchase.

10. Penetration Pricing

What Is It: A pricing and marketing strategy that involves temporarily selling at a lower price to attract customers and increase brand recognition

Commonly Used By: Retailers with membership options, discount stores, and big box retailers

Penetration pricing is a smart way to introduce a product to new customers, build brand recognition, and foster customer loyalty.

It works particularly well for promoting new products or things that you have to buy on a subscription or membership basis. The idea is that the low price will penetrate the market and get customers to make an initial purchase. Then, once hooked, they will continue purchasing the item as its price increases (or buying for other products from your store).

Penetration pricing strategy examples include:

- Offering a free month of membership upon sign-up

- Selling a new product at a steep price to drum up hype

- Offering a limited-time deal

For example, Fabletics, a fitness clothing membership retailer, offers new customers two bottoms for $24 and 70% off everything when they sign up. This is a deal that really gets people excited and willing to sign up for the $50 monthly subscription. The catch? The deals that reeled you in are only available for your first purchase, and after that, prices are back to their normal rates.

Fabletics has mastered the art of penetration pricing with its enticing sign-up offers. (Source: Fabletics)

11. Bundle Pricing

What Is It: A pricing strategy that offers a discount when two or more products are purchased together, rather than buying them separately

Commonly Used By: Discount retailers, beauty supply, office supply, and grocers

Bundle pricing is a pricing strategy in which retailers sell multiple items together at a lower price than if purchased individually. This type of pricing typically has two objectives: giving customers a sense that they are getting a bargain and selling more products.

The benefit behind bundle pricing is that retailers are able to sell more items and increase their transaction sizes while customers walk away feeling like they got a deal.

Fast food restaurants famously take advantage of bundle pricing by offering discounted combo meals. (Source: Burger King)

In retail, bundle pricing is primarily used by discount stores or businesses that sell a lot of complementary products, like beauty or craft stores. It is also sometimes used around the holidays to promote gift baskets.

12. Project-based Pricing

What Is It: When you charge a flat fee for a specific service

Commonly Used By: Service providers, freelancers

Project-based pricing is a service pricing strategy in which you set your pricing based on the service/project provided, not based on an hourly rate. This is a great way for service-based businesses to create security in the minds of their customers because it allows them to know the price upfront.

Some businesses will set a time limit on the project-based price and then upcharge or set an hourly rate for the additional time the project requires.

This strategy works best for businesses that provide services with set parameters and few potential variables, and should not be used for more creative projects. For example, nail salons charge a set price for manicures and pedicures or a tire shop offers the same price for wheel removal. Home improvement projects, on the other hand, have more variability, so hourly pricing may be better suited here.

13. Hourly Pricing

What Is It: When your price is based on an hourly rate that correlates to the length of a project

Commonly Used By: Service industries that offer creative or highly variable services

This pricing strategy is the flip side of project-based pricing. It’s typically used for projects with more creative elements or less controllable or consistent parameters. This strategy is usually less favorable than project-based pricing in the eyes of the customers, but it’s more practical for most service-based industries.

For example, consider if a company charged a flat “landscaping” fee for their landscaping projects. This pricing structure would not make sense, as there are countless types of landscaping services and as well as sizes of yards and gardens. In this case, the company would have been better off using an hourly pricing strategy, so it could charge accordingly for the variability of the work and make a fair profit based on labor, resources, and time.

14. Premium Pricing

What Is It: The practice of setting a high price to give the impression that a product is superior or high quality

Commonly Used By: Luxury retailers, specialty shops, antique goods, and tourist shops

Premium pricing is when retailers artificially inflate prices to create a sense of value among customers. This is a practice commonly used by luxury retailers and specialty stores to help them demonstrate the value of their goods. In other words, the price of the good creates its perceived value, which increases its demand, and, in turn, justifies its price.

Retailers that sell established brands (or are established brands themselves) can use premium pricing on all their products. However, it is also a popular strategy to select only one or a few goods to set at a premium. The products with premium pricing will raise your entire brand’s perceived value and make customers willing to pay more all-around.

For example, say that you own a specialty pool store, and Walmart sells the same pool floaties that you carry. Rather than pricing your floaties equal to or lower than Walmart’s, you can price them slightly higher to reflect your expertise, personalized service, and unique value proposition.

15. Price Skimming

What Is It: Selling a product with a higher-than-usual markup and then lowering the price over time

Commonly Used By: New product launches, subscription-based businesses, retailers with membership options

Price skimming (also known as skim pricing) is a strategy that involves charging the highest initial price that customers will pay for your product then lowering it over time. The main goal is to generate the highest possible revenue by targeting customers who are willing to pay premium prices. Then, as consumer demand fades and new competitors enter the market, you reduce the price and attract more cost-conscious customers.

This strategy doesn’t work in every scenario. Price skimming is usually used when:

- There is enough demand from prospective customers who are willing to pay a high price

- There is no direct competition that would deter buyers

- A high price can effectively contribute to the item’s perceived value

- You need to recoup development and/or production costs

A classic price skimming example is the iPhone. When Apple launches a new model, they sell it at a high price to plenty of loyal, price-insensitive customers who value having the latest technology. Then, as new versions and competing devices are introduced, the company drops the price to capture more sales.

Price skimming can also be used by businesses that require recurring payments (like subscriptions and memberships). It helps foster loyalty by rewarding long-term customers with better prices. The strategy can even help with the initial signup by creating an incentive to “earn” the better rate.

16. Freemium Pricing

What Is It: A model that provides a free basic service with the option to upgrade to a paid premium version for additional features

Commonly Used By: Subscription-based businesses, retailers with membership options, service providers, software-as-a-service companies

Freemium pricing is when a business will offer a base-level service, plan, or membership tier for free, as well as the option to upgrade to a premium or paid version with enhanced features, advanced functionality, or additional benefits.

By offering a free option at the forefront, the freemium pricing structure helps businesses reel in customers and get them interested in their products or services. You may be familiar with this pricing model from streaming services like YouTube or Spotify.

In both of these companies’ freemium pricing structures, there is a free service where you can play music or videos without charge. But, to listen to the entertainment without advertisements or breaks, you have to join their monthly subscription.

Another form of freemium pricing is offering a free trial. The free initial product also serves to get customers interested in your business and makes them more likely to sign up for your paid service.

Generally, you use freemium pricing on services and products that are low-cost and need to be sold in high volumes. A popularly cited stat says that there is between a 1% and 10% conversion rate from free trials to paid services through freemium pricing. If you’re thinking about using this pricing structure, be sure that your product’s overhead and marketing costs are low so you don’t end up digging yourself into an unprofitable situation.

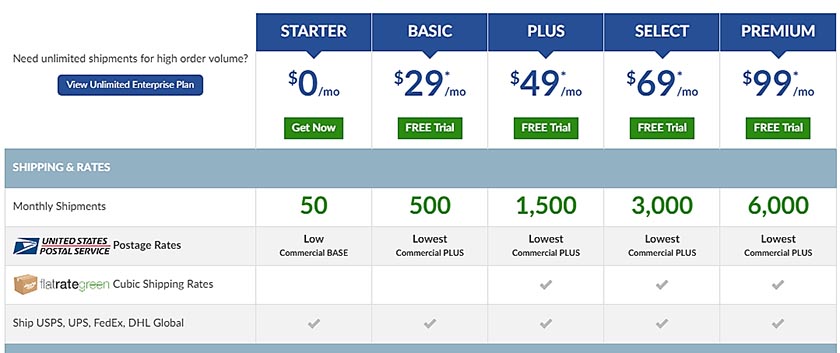

Shipping software companies (like ShippingEasy, pictured here) use a freemium pricing model to offer a low-volume base plan. When the customer’s business grows and sales increase, they must upgrade to a paid plan to meet their order volume.

17. High-low Pricing

What Is It: When a company alternates between offering high prices and promotional discounts to attract customers

Commonly Used By: Discount stores, electronics stores, clothing brands, supermarkets

High-low pricing is a strategy in which retailers alternate between discounted promotional prices and prices that are or above the product’s MSPR. This is accomplished by having frequent sales during which prices are lowered for a short time.

This strategy establishes the value of a product then uses limited-time promotions to deliver a bargain— which drives bursts of high-volume sales. Similar to loss-leader pricing, the high-low strategy works to drive store traffic and encourage customers to buy additional items once they’re in store. It also uses the same structure as price skimming to capture sales from multiple target markets by using different price points.

But, unlike price skimming, hi-low pricing can retain the product’s perceived value after the promotion as long as you’re careful. Too many sales and discounts will result in shoppers perceiving your sale prices as the actual value, which dilutes your brand.

One example of high-low pricing is the fashion retailer Zara, which frequently introduces new collections at regular prices and then offers promotional discounts during seasonal sales. This strategy helps Zara attract customers with the initial higher-priced items and later bring in price-conscious shoppers with discounted prices. It also creates a sense of urgency and drives sales.

18. Dynamic Pricing

What Is It: A strategy where prices are adjusted in real time based on factors such as demand, supply, competitor pricing, and market conditions

Commonly Used By: Hospitality, tourism, transportation, entertainment, and utilities

Dynamic pricing is when a business changes its pricing based on the seasons or other demand-shift indicators (weather, day of the week, political climate, etc.). It takes into account things like competitor pricing, supply and demand, and other external market factors in setting its prices. This pricing strategy works best for services in the hospitality and transportation industry and essential goods like gas and electricity.

This strategy can help companies maximize their profits in industries with a lot of volatility in terms of traffic and demand. For example, a resort might charge $300 for a room during the peak season and $220 for the same room during the offseason. This type of pricing helps the business owners capitalize on busy times when demand is high, and use lower prices to incentivize offseason purchases.

To use dynamic pricing, be sure to understand your industry and its peaks and valleys in demand. Then assign higher prices during peaks and lower pricing during valleys. It’s important that your dropped prices can still generate enough revenue to cover your costs, or, alternatively, profits acquired during peak prices can cover profits lost from low prices.

19. Geographical Pricing

What Is It: The practice of adjusting an item’s price based on the location of the buyer

Commonly Used By: Multilocation retail stores, franchise businesses, ecommerce sellers, luxury brands

Geographical pricing is a strategy that adjusts the price of a product based on the buyer’s location. This pricing strategy takes into account several factors— including shipping costs, local market conditions, economic status, and buying habits of different geographical areas. Sometimes, it also considers the cost of living and the average income of people in a specific region.

For example, a multilocation clothing store might charge different prices for the same item in New York City versus a rural town in Kansas. In the city, the price could be higher due to increased demand, higher average income, and a higher cost of living. This higher price also helps to offset the inflated cost of the retailer’s rent and other utilities. On the other hand, in a rural town where income levels and cost of living are lower, the seller may opt for a lower price to match the local market’s purchasing power.

Pricing Strategies Frequently Asked Questions (FAQ)

The most popular and common pricing strategies are:

- Cost-plus pricing: calculating your costs and adding a markup

- Keystone pricing: doubling the wholesale price

- Competitive pricing: setting your price based on what competitors charge

- Value-based pricing: pricing your goods based on what the customer thinks they’re worth

These pricing strategies are used by businesses throughout a number of industries, from small companies and startups to enterprise-level companies. They’re popular because they’re simple to use across large inventories and generate profit while attracting customers.

You can combine multiple pricing strategies to find the best (and most profitable) ways to price and market your products.

For example, a handcrafted furniture business might use cost-plus pricing for a table that costs $200 to make. They add a 50% profit margin and sell it for $300. That business can then combine bundle pricing by offering a living room set that features the table along with a bookshelf and a chair. Bought separately, these items would cost $950, but as a bundle they sell for $850.

Another example of combined pricing strategies could be a retailer using high-low pricing to attract customers with promotional deals, while also implementing geographical pricing to adjust prices based on the location of their stores. This allows them to attract a wide range of customers while accounting for local market conditions and cost variations.

Setting the perfect price for your products means you need to understand your costs, know how much your customers are willing to pay, and keep an eye on your competitors. With this information, you can choose from a variety of pricing strategies to set a price that will be attractive to customers and still make you a profit.

It may take some experimentation to find the best prices for your goods. Even once pricing is dialed in, most businesses continuously test and adjust their pricing strategies based on market conditions and customer feedback.

Bottom Line

With nearly 20 pricing strategies to choose from, there are a lot of options when it comes to pricing your products. The best thing you can do to sell through your products and maximize your profits is to use a mix of pricing strategies based on what works for each individual item you sell. Whatever you choose, be sure to continuously monitor their success and ability to generate sales and profits, so you can make adjustments and continue to maximize your retail business.