Buy online, pick up in-store (BOPIS), also known as click and collect, is a hybrid ecommerce model that allows customers to order an item online and pick it up in person at the store or curbside. It merges the convenience of online shopping and the efficiency of bringing the product home the same day.

Let’s look at some BOPIS statistics—why shoppers use the service, its benefits and challenges for retailers, and how businesses can adapt to emerging BOPIS retail trends.

BOPIS Statistics Key Takeaways:

- Click and collect is expected to grow by 10% in the US from 2023 to 2024.

- Curbside pickup is used by over one-third of consumers.

- Nearly two-thirds of US retailers now offer BOPIS.

BOPIS Statistics Overview

1. The global BOPIS market is expected to reach more than $666 billion by 2028

According to Renub Research, the global BOPIS industry was at $345.38 billion in 2022 and is forecast to grow at a double-digit compound annual growth rate of 11.57% until 2028—up to $666.2 billion by 2028.

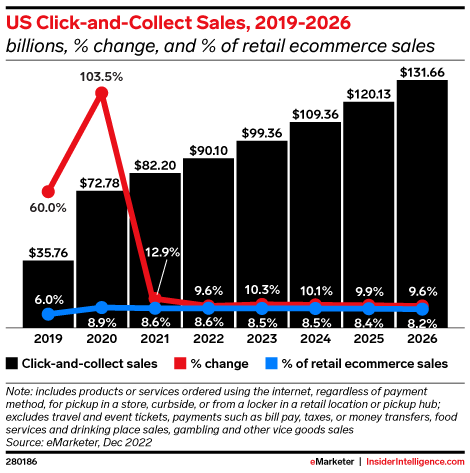

2. Click-and-collect sales in the US are expected to grow to $109.36 billion in 2024

By the end of 2024, eMarketer forecasts that total US click-and-collect sales will grow by a rate of 10.1% to hit $109.36 billion.

3. The US is forecast to have more than 150 million BOPIS shoppers by the end of 2024

By the end of 2024, the US is anticipated to have 150.9 million click-and-collect shoppers, per eMarketer. This is about 53.1% of the population.

4. More than one-third of consumers have used BOPIS

Per one survey, more than a third of consumers had used BOPIS shopping options over the past six months. Another 30.4% have opted for curbside pickup specifically.

5. Over 40% of retailers offer BOPIS

According to a survey, about 42% of businesses offer BOPIS options to their customers. However, customers don’t seem to be catching on to the offering. The same survey found that about 9% of orders are fulfilled via BOPIS.

6. Nearly two-thirds of retailers plan to offer BOPIS

Though not every retailer currently has BOPIS fulfillment options, just under two-thirds plan to offer it in the near future, according to the National Retail Federation (NRF).

BOPIS or Curbside Pickup Statistics in the US

7. The US has the largest pickup economy in the world

According to the 2023 PYMNTS Global Digital Shopping Index (March edition), nearly one-third of US consumers (roughly 16.4 million consumers) who recently made an online purchase picked it up in-store or curbside—a 37% year-over-year increase.

8. BOPIS accounted for 8.5% of ecommerce sales in 2023

While the slice of the pie is relatively small, BOPIS still accounted for about 8.5% of total ecommerce sales in the US in 2023, according to eMarketer.

Source: eMarketer

9. Curbside pickup grew six times as much as in-store pickup

The PYMNTS report said that curbside pickup is now the most common way that online shoppers get their pickup orders. Eighteen percent of online shoppers picked up their purchases curbside in 2022, reflecting a year-over-year growth of 66%.

10. In-store pickup experienced 12% growth year over year

Based on the same report, in-store pickup also grew, if less drastically—14% of online shoppers acquired their pickup orders in-store in 2022, representing a 12% increase year over year.

11. Two-thirds of click-and-collect buyers will use in-store pickup by 2026

Click and collect offers lots of fulfillment options. About two-thirds (66.4%) of BOPIS shoppers are expected to prefer in-store pickup by the end of 2026, compared to an anticipated 46.1% who will prefer curbside pickup options, per eMarketer.

12. More consumers are trading delivery for curbside pickup

According to the PYMNTS report, less than a third (32%) of online shoppers picked up their most recent purchase curbside or in-store in 2022—a 37% increase from 2021. They are trading delivery for curbside pickup, giving merchants an opportunity to reduce costs and improve customer loyalty.

This means that there were more online shoppers choosing to pick their purchases up either in-store or via curbside year over year.

13. More than 20% of US shoppers deem BOPIS and curbside pickup very important

The PYMNTS report found that US consumers (23.6%) say buy online, pick up in-store from an employee at a service desk or an employee delivering products to the car is a very or extremely important shopping feature. Meanwhile, 19.7% deem buy online, pick up in-store from a kiosk very or extremely important.

BOPIS Statistics on Consumer Use & Preferences

14. Curbside pickup is the preferred fulfillment method of millennials in the US

According to a Statista survey, around two-thirds of US millennial consumers chose curbside pickup as the delivery type for their online purchases. Online shopping and curbside pickup were not popular in older age cohorts.

15. Nearly a quarter of shoppers use BOPIS for non-grocery items

When asked what consumers order online and how they like to receive those items, about 25% of respondents to a Digital Commerce 360 and Bizrate Insights survey said “non-grocery items online to pick up at a physical store” and 22.61% said “groceries online to pick up at a store.”

Learn how to set up click and collect for your store.

16. About 64% of click and collect will be in-store pickup

According to eMarketer forecasts, of all click-and-collect buyers in 2024, about 64% will opt for in-store pickup, and 48% will opt for curbside options.

17. A quarter of all click-and-collect purchases are locker pickup

Many click-and-collect buyers enjoy the convenience of locker or kiosk pickup. In fact, eMarketer estimates that there will be about 38.3 million locker or kiosk pickup orders by the end of 2024, accounting for 25.4% of all click and collect buyers.

18. Nearly 10% of shoppers want locker pickup

Specifically, 9.97% of shoppers said they would like to be able to use locker pickup to fulfill their online orders, per Digital Commerce 360. Another 6.02% said they would like to see more omnichannel pickup options—BOPIS and curbside pickup both fall under that category.

19. More than three-quarters of shoppers would use a locker to pick up purchases

According to one survey, 77% of online shoppers would consider using a locker to pick up their orders. About 53% would be motivated by convenient locations and half by convenient hours.

20. About 40% of shoppers would like to use a locker to avoid lines

Of those who would consider using locker pickup, 40% are motivated by the possibility of avoiding lines at retail stores or shipping providers. Another 35% like the idea of ensuring secure receipt of the packages, rather than losing it in the mail somehow. And 26% are motivated by not having to personally interact with anyone to get their order.

21. Only 4% of shoppers have made a return curbside

Not as popular as curbside pickup, only 4.34% of consumers have used curbside options to make returns, according to Digital Commerce 360.

22. Three-quarters of shoppers would use a locker for returns

Lockers offer another convenient return option. One survey found that 76% of shoppers would consider using locker drop-offs to process returns for online purchases. More than half (52%) would be motivated by convenient locations, and 46% by convenient hours.

23. Over 40% of shoppers would return via lockers to avoid lines

When asked about what would motivate shoppers to make returns at locker dropoff locations, 41% said they’d like to avoid lines at stores and shipping providers, and the same amount said they’d be motivated by knowing the return was received rather than risk losing it in the mail. Another 27% said the idea of not having to personally interact with anyone would motivate them to make returns via lockers.

24. A quarter of consumers would wait two to four hours for their orders

Consumers expect fast fulfillment for BOPIS orders. A quarter of BOPIS shoppers want to be able to pick up their purchase in two to four hours. About 20% would wait more than eight hours, and 14% would only wait less than two hours.

BOPIS Adoption Across Retail Industries

25. Luxury brands are lagging in BOPIS implementation

The Omnichannel Leadership Report assessed 300 leading luxury, premium, and lifestyle retail brands in their study and revealed that premium and luxury brands need to adapt to the omnichannel experience, specifically toward the digital. Luxury lags behind basic (69%) and mid-market (56%) at only 49% BOPIS adaptation. Premium brands are even farther behind at 39%.

26. Grocery pickups increased by 2.5% in January 2023

Grocery pickup was the only order fulfillment channel that increased in January 2023, with sales up 2.5% to $4.1 billion, according to Brick Meets Click—even with online grocery seeing a dip in sales.

27. More than 40% of back-to-school shoppers will use BOPIS

One survey from Sensormatic found that 43% of back-to-school shoppers planned to use BOPIS in 2024 for their shopping needs. This is a jump from the 34% who did the same in 2023.

28. Approximately 42% of back-to-school shoppers use BOPIS to avoid shipping fees

Back-to-school shoppers are mostly motivated to use BOPIS for cost savings. From the Sensormatic survey, about 42% say BOPIS helps them avoid shipping fees, while 21% say it helps them control spending by allowing them to prioritize certain purchases.

29. Nearly two-thirds of BOPIS back-to-school shoppers make additional purchases

About 62% of back-to-school shoppers who use BOPIS say they also make additional purchases when they use this fulfillment method, per the same survey. Often, these purchases are unrelated to their original orders.

30. BOPIS was used in 18.5% of holiday orders

According to Adobe, nearly one out of every five online orders placed globally in last year’s holiday season was via BOPIS—peaking at 37% of all orders on December 23 as shoppers retrieved last-minute gifts.

This year’s forecast projects BOPIS to peak at around the same time, accounting for 30% to 35% of orders, mostly last-minute gift purchases.

Frequently Asked Questions (FAQs)

Click through the sections below to learn about the answers to the most often-asked questions about BOPIS statistics.

Yes, BOPIS can increase sales by offering more fulfillment options to your customers. Even though it makes up less than 10% of total ecommerce sales, you can still cater to a niche and growing audience segment.

By the end of 2024, the US is anticipated to have 150.9 million click-and-collect shoppers. This is about 53% of the population.

The BOPIS market was valued at $345.38 billion in 2022 and is forecast to grow at a double-digit compound annual growth rate of 11.57% until 2028—up to $666.2 billion by 2028.

BOPIS is popular because of its convenience. Customers can avoid shipping delays, save on fees, get their purchase at their own preferred location and time, and even place returns. Why do customers choose BOPIS?

The rise of BOPIS really started with COVID-19 pandemic lockdowns in 2020. However, it’s continued to maintain steady growth in a post-pandemic economy. Now, the rise of BOPIS is largely attributed to convenience and cost savings.

Bottom Line

Click-and-collect is an order fulfillment option that allows you to blur the lines between your online storefront and brick-and-mortar store. It is a trend that is here to stay, and implementing it the right way will help increase foot traffic in-store and sales.

With more retailers including it as an offering, you should ensure your retail business doesn’t get left behind. Solutions like Shopify and Square provide features that allow for online and in-store order management, plus options for click and collect.