Employers in California must provide paid sick leave to all employees working in California for 30+ days per year. In addition to state law, some localities also have leave requirements. As a small business, you’ll need to ensure compliance with California paid sick leave law and budget accordingly.

Compliance Note: Even if your business isn’t physically located in California, you’re subject to this law if you have employees working in California.

How California Sick Leave Works

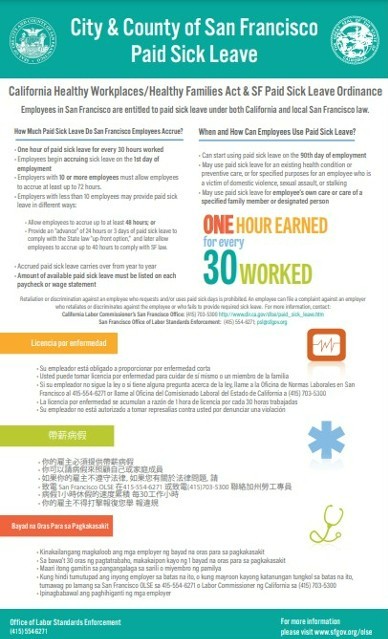

There are no federal paid sick leave laws, but some states like California require paid sick time off. California’s paid sick leave law, known as the Healthy Workplace, Healthy Family Act of 2014, requires all employers in the state to provide at least one hour of sick leave for every 30 hours an employee works, making it crucial that you track employee hours correctly. Accrual begins on the employee’s first day of work and applies to all employees working in California for 30 or more days per year.

Covered Employers & Employees

This law covers every employer with a worker in California. Full-time, part-time, seasonal, and temporary employees working at least 30 days per year in California are eligible for paid sick leave benefits. Employers can cap the hours accrued per employee to 48 hours or six days per year and limit the number of hours an employee can use in one year to 24 hours or three days.

As with most legal matters, there are exceptions to this law. The following employees are not entitled to paid sick leave in California:

- Employees covered under a union agreement

- Construction workers

- Airline employees

- Retired government employees

- In-home support workers

Any workers not in the above exceptions are entitled to receive paid sick leave. Your company can require an employee to work for 90 days before they can use any paid sick time off.

Rehired Employees: If you have rehired an employee less than one year since the employment relationship ended, regardless of the reason, you must reinstate any accrued and unused sick time on the employee’s first day.

Allowable Uses

Employers must allow employees to take paid sick time off for at least the following reasons:

- A preventative care appointment for themselves or an immediate family member

- Care of treatment of an existing health condition for themselves or an immediate family member

- For victims of domestic violence, sexual assault, or stalking

For this sick leave law, California defines an immediate family member as an employee’s parent, child, spouse, domestic partner, grandparent, grandchild, or sibling. Be aware of special local requirements. For example, employees in Emeryville may use paid sick leave to care for a service animal.

Compliance Note: Employers must allow employees to take paid sick leaves if they have accrued and unused time available, even when an employee does not provide details or a doctor’s note.

PTO vs Sick Leave

Although there is no federal or state requirement to provide paid time off (PTO), doing so is a significant benefit for your employees. In fact, if you do, you may already meet the requirements under California’s paid sick leave law.

If your company has a PTO policy that allows employees to use time off for any reason or for reasons that include sick time, you’re not required to implement a separate paid sick leave policy. However, your policy must provide at least 24 hours per year and allow for rollover of up to 48 hours per year to satisfy the California paid sick time law.

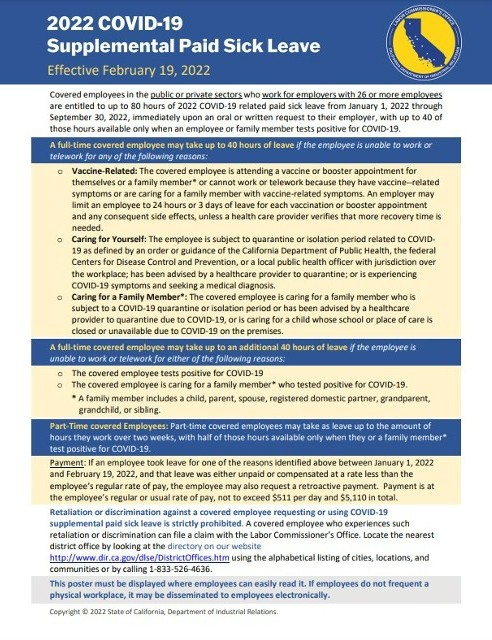

COVID-19 Paid Sick Leave

California originally provided COVID-19 sick leave that expired at the end of 2021. However, beginning Feb. 19, 2022, a new law went into effect, providing additional paid sick leave (retroactive to Jan. 1, 2022) for reasons related to COVID-19. It provides up to 80 hours of paid sick leave for full-time employees and is set to automatically expire Sept. 30, 2022, unless extended by the Governor.

Any employer operating in California with at least 26 employees is subject to this law. Allowable uses include:

- Employee getting a COVID-19 vaccine or booster

- Employee taking an immediate family member to a COVID-19 vaccine or booster appointment

- Employee experiencing COVID-19 symptoms or caring for a family member experiencing symptoms (even symptoms from a vaccine or booster)

- Employee is isolating

- Employee is caring for a child home from school for COVID-19-related reasons

- Employee tests positive for COVID-19

- Employee is caring for a family member who has tested positive for COVID-19

Local Leave Laws

Besides the state law, there are some special local leave law requirements that may apply to your business as well.

Location | Paid Sick Leave Requirements |

|---|---|

Berkeley | 48 hours per year for employers with less than 25 employees; 72 hours per year for employers with over 25 employees |

Emeryville | 48 hours per year for employers with less than 56 employees; 72 hours per year for employers with over 56 employees |

Los Angeles | 48 hours per year for all employers |

Oakland | 40 hours per year for employers with less than 10 employees; 72 hours per year for employers with over 10 employees |

San Diego | 40 hours per year for all employers |

San Francisco | 48 hours per year for employers with less than 10 employees; 72 hours per year for employers with over 10 employees |

Santa Monica | 40 hours per year for employers with less than 25 employees; 72 hours per year for employers with over 25 employees |

Employer Requirements

Employers are required to take certain steps to adhere to the California sick leave law. If you do not comply, you could face fines and employee lawsuits.

Notice & Posting

Employers must provide notice to employees of the company’s paid sick leave policy. Even if your company only provides paid sick leave based on the minimum requirements, you must still provide a policy to all employees. The best way to do this is to create a written policy in your company handbook that all employees receive on their first day.

Like federal compliance posting requirements, California requires employers to display a compliance poster in a conspicuous location where employees can easily read about their rights. If you have remote employees, you may email the poster to the employees.

Paid Sick Leave Balance Records

Your company is required to keep detailed records about your employees’ sick leave. You must provide your employees with a record of how many hours of paid sick time they have taken and have left on each pay stub. If you don’t want to provide it on your pay stubs or your software program doesn’t allow it, you must provide a separate document on payday showing this information.

Besides giving your employees information about their paid sick time, you need to keep records for a minimum of three years. These records must show each employee’s accrued and used sick time.

Download our free pay stub template. It has space for your paid time off and sick leave balances.

Accruing & Calculating Sick Time Off Pay

The California paid sick leave law provides minimum guidelines on accruing sick time. But you are able to create your own method, as long as it meets the law’s requirements.

Note that when an employee leaves your company, regardless of the reason, you are not required to pay out any accrued and unused sick time. This is different from PTO, which, if you have chosen to provide to your employees, California requires you to pay out in certain circumstances.

Accruing Sick Time Off

As indicated above, every employee must receive at least one hour of sick time for every 30 hours worked. For example, an employee working 40 hours per week would accrue 1.33 hours of sick time. This is the most common method for providing employees with paid sick time.

Lump Sum Sick Time Off

Employers can also provide sick time in a lump sum. If you choose this method, you’ll need to provide at least 24 hours of paid sick leave at the beginning of the year. Any new hires must be given this lump sum within 90 days of their start date.

Compliance Note: You don’t have to use Jan. 1 as the anniversary date. You can use the employee’s hire date, your company’s fiscal year, or any 12-month period. We recommend using Jan. 1 to align all employees on the same schedule but, ultimately, you can choose a different date.

Calculating Pay

Sick leave is paid at the employee’s base rate of pay. When calculating sick leave pay for exempt employees, you pay them the same way as if they were taking any other paid leave, like PTO. When a nonexempt employee takes sick leave, you pay them their base hourly rate, including no overtime or bonus calculations.

Employee Rollover

California provides clear guidance on whether an employee can roll over accrued and unused paid sick time to the next year. And it all boils down to how your business gives sick time.

If you use the lump sum method, you will give each employee 24 hours or three days of paid sick leave at the start of their employment or the beginning of each year. No rollover is required.

However, if you use the accrual method, most employees will end up accruing more than 24 hours of sick time in a calendar year. While you can cap their total accrual at 48 hours, if they don’t use it all, you have to let them roll over the unused portion to next year.

Legal Considerations

While you already have countless laws and regulations you need to follow, failing to adhere to California’s paid sick leave law, whether intentional or unintentional, could lead to costly outcomes. Here are some items to keep in mind.

Fines & Penalties

If your company does not provide paid sick days compliant with the law, you will face fines from the state. Your company could be fined the number of paid sick days withheld from the employee times three, not to exceed $4,000. If the violation results in harm to the employee, an additional penalty of $50 per day may be imposed, up to a maximum of $4,000.

You’ll also be on the hook for attorneys’ fees, court costs, and interest. Only employers that make an isolated mistake that is quickly corrected may be excused from fines and penalties.

Employee Lawsuits

You cannot retaliate against employees who use paid sick leave. Do not discipline employees about absences related to taking paid sick leave, even if they don’t provide you with a reason or documentation.

If you discipline or retaliate against an employee for taking sick leave, your employee may be able to file a lawsuit against your company for damages. Those damages could include substantial monetary damages and even reinstatement of their job if they were terminated.

Consistency & Record Keeping

As with all HR-related matters, keep detailed records. Make sure you comply with the law by providing a record of each employee’s accrued and used sick time at least quarterly. But also keep any records relating to an employee’s sick time off. Because these records are medical, however, you’ll need to separate them from the employee’s regular personnel file and put them in a confidential file with limited access.

Effective employee management also requires consistency. Whether you provide the minimum state requirements or go above and beyond, don’t give 40 hours to one employee and 80 to another. Be fair and consistent with your sick leave policy both in the amount of time you provide and in how you react to employees taking leave. Remember that what you do for one employee, you need to do for all.

Bottom Line

Complying with California’s paid sick time off law may seem daunting. However, following a structured process that ensures your company offers what’s required can help you remain compliant and avoid costly penalties.