Tracking employee hours is not only a safe way for managers to gauge where employees’ time is being spent, but it also helps businesses understand labor costs, prepare for payroll, and increase employee productivity. The simplest and best ways to track employee hours include using pen and paper methods, timesheet software, spreadsheets, time clocks, and mobile apps.

Regardless of what you choose, determine what works best for your small business by weighing the technology requirements, cost, legal compliance, and ease of use for your employees.

1. Time Tracking Software

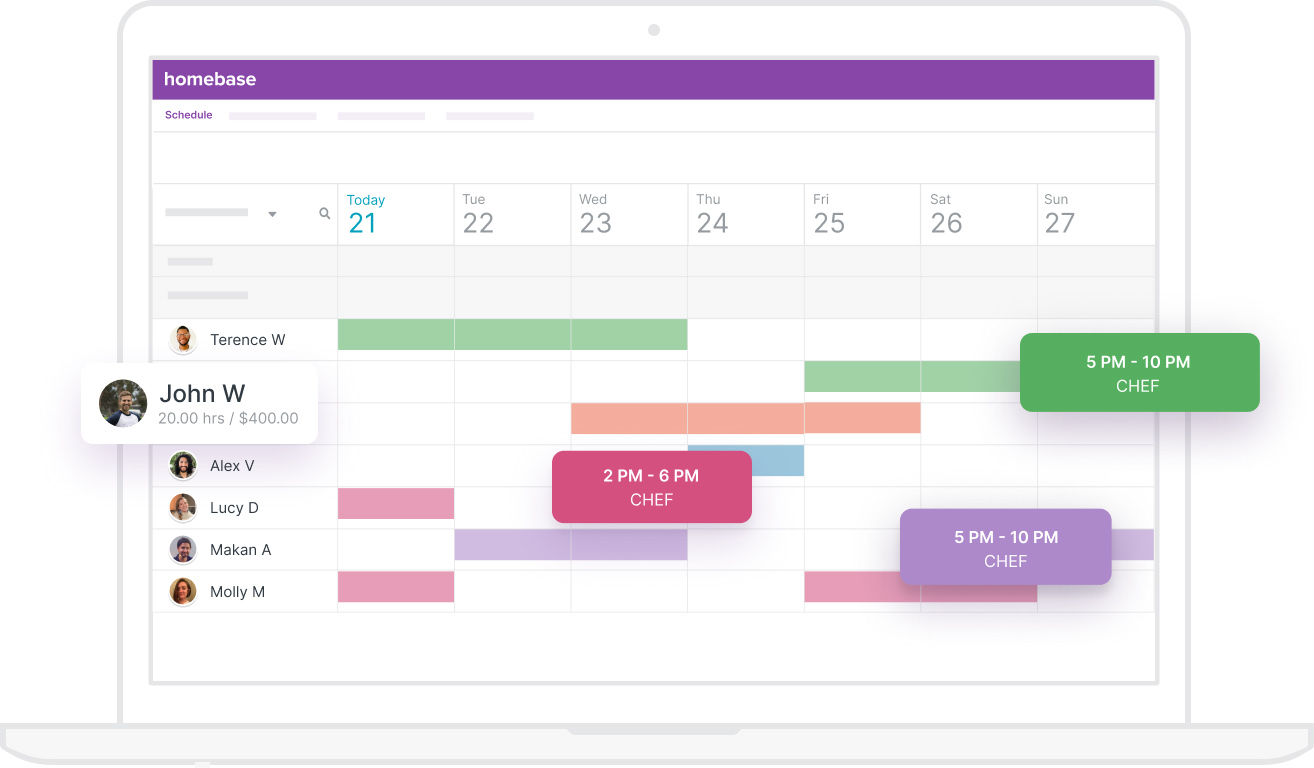

Time tracking software eases the burden of logging employee hours, ensures your staff is compensated accurately, and assists in maintaining employee schedules.

Homebase scheduling and time tracking software (Source: Homebase)

Using time tracking software can also make payroll processing more efficient because:

- Employees can track their time digitally, decreasing error

- Supervisors and managers can approve time entered online with a click of a button

- HR Specialists can run reports, allowing management to see where improvements can be made

You may be interested in our list of the best time and attendance software that have a broad set of adaptable features. Or, read our guides to the best time tracking software and best time tracking apps to find one that suits your business’s requirements.

Below is a list of recommended time and attendance software, including which businesses each one is best for and the associated costs.

Recommended Time and Attendance Software | |||

|---|---|---|---|

Provider | What It Is | Best For | Cost |

All-in-one employee scheduling, time tracking, and HR solution | Growing businesses with one physical location that employ hourly workers | Basic Plan: Free for one-location businesses with up to 20 employees All-in-One Plan: $99.95 per month per location | |

Cloud-based time clock solution that offers online time entry, time-off tracking, GPS tracking, and an optional webcam and device lock feature | Small businesses that need help tracking their billable project time | Standard Plan: $3.49 per user monthly ($2.99 if billed annually) + $19 base fee per month Pro Plan: $4.49 per user monthly ($3.99 if billed annually) + $19 base fee per month Enterprise Plan: Custom-priced | |

Employee scheduling software with time clock and attendance features | Businesses with seasonal highs and lows like vacation rentals or lawn care services | Starter Plan: $2.50 per user monthly Premium Plan: $5 per user monthly Enterprise: Custom-priced | |

No Review Yet | |||

GPS Tracking Software

Monitoring your employees’ hours worked using GPS tracking software allows you to record their time and attendance from worksite to worksite.

ClockShark GPS tracking software (Source: ClockShark)

When your employees work off-site, a GPS tracking method may be the right option for your business. This works best for courier services, logistics, construction, and public transportation companies.

GPS time tracking is simple for the employee, who can log their time from any device—such as a cellphone—while they are working in the field. Additionally, it is easy for business owners and managers who maintain the time sheets from the office as they can be reported directly to HR through the app.

Pricing can start as low as $3 per month, per user (plus a $20 monthly base fee), with a basic service like ClockShark. Most software of this type also charges a base fee per month and offers custom packages for any business size.

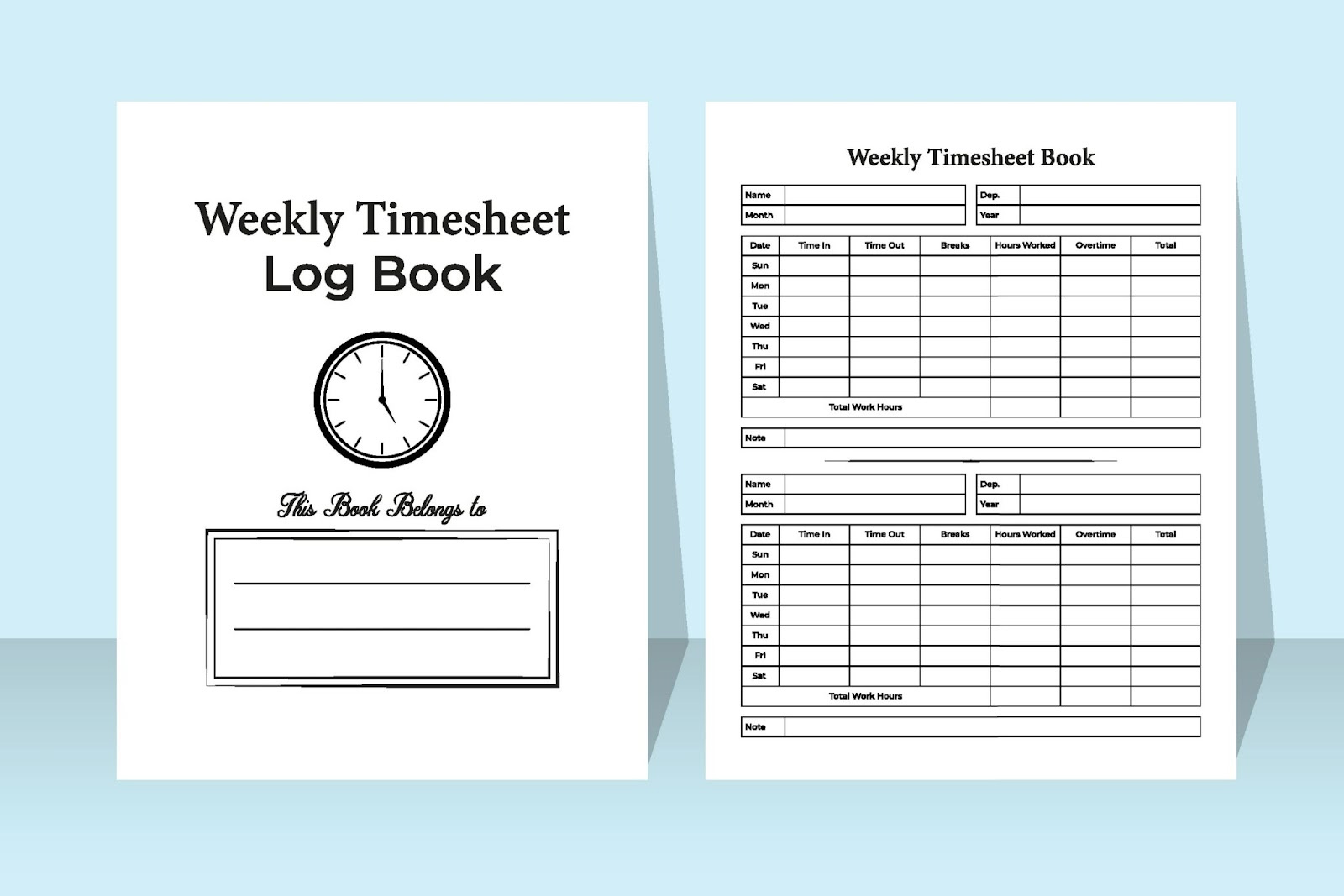

2. Manual Employee Time Tracking

Manual time tracking is as old as businesses themselves. Also known as pen-and-paper tracking, employees record their own time on a handwritten piece of paper. This method can lead to issues (such as time theft, accounting errors, payroll issues, and labor law violations) and is not recommended for small businesses.

Manual time tracking does not offer the accuracy and security of a software time and attendance solution. Even though this is a free method, the following are reasons to reconsider manual time tracking:

- Inefficiency: Employees can spend hours manually tracking their time.

- Inaccuracy: Mathematical mistakes can be made when adding hours up.

- Inconvenience: In this digital world of computers and cellphones, it can be problematic for an employee to track hours on paper.

- Unreliability: Tracking hours on paper is a security issue. It can result in missed hours if you lose the report.

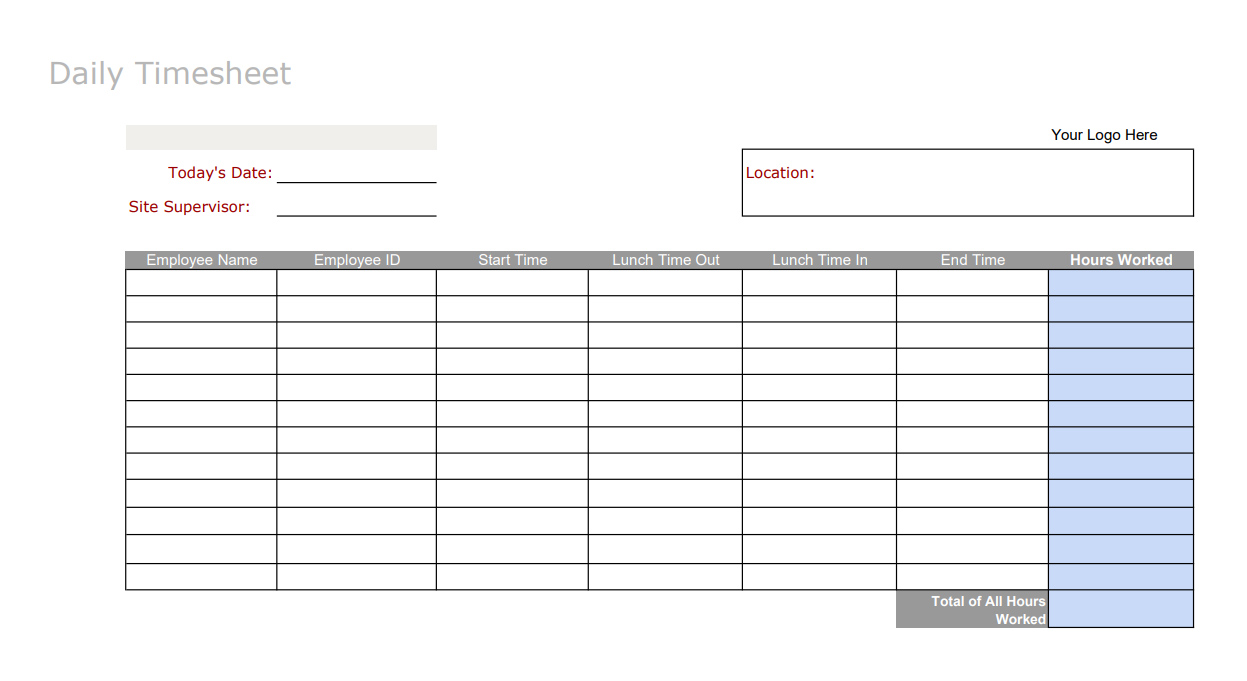

3. Spreadsheet Time Tracking

Spreadsheet time tracking utilizes a template on tools such as Google Sheets or Microsoft Excel. This is similar to manual time tracking, where the employee enters their time into a spreadsheet, but offers mathematical features to provide better accuracy. A spreadsheet can be shared online with managers and supervisors for time checking and approval.

Daily time sheet spreadsheet template from Fit Small Business

Both Google Sheets and Microsoft Excel offer time sheet templates that automatically calculate total hours, regular hours, and overtime hours. They can also help track the efficiency and productivity of teams within your organization.

Once you purchase Google Workspace (as low as $6 per user monthly) or Microsoft 365 ($70–$100 per year), the spreadsheets and time tracking templates are free to use.

4. Physical Time Clocks

Businesses that need their on-site employees to “punch in”’ for their shifts or workday can benefit from using a physical time clock. You may use a wall-mounted or biometric time clock depending on your specific business needs.

We evaluated the best employee time clocks to help businesses find an option that fits their requirements.

5. Mobile Apps

Many time tracking apps are available for smartphones and tablets. Employees can use these apps to log their hours, which can be automatically synced with your payroll system. The best time tracking apps allow employees to track productive hours, breaks, PTO requests, and even create invoices all from their mobile phones.

Employees can monitor hours worked for various projects assigned to them. (Source: Clockify)

Mobile time tracking can benefit a wide range of jobs and industries, but it is particularly valuable for roles and situations that involve flexibility, remote work, project-based work, and the need to track hours accurately. Here are some types of jobs that would benefit most from mobile time tracking:

- Remote workers

- Field service technicians

- Freelancers and contractors

- Construction workers

- Sales representatives

- Consultants

- Retail and hospitality

- Project managers

- Truck drivers

- Healthcare workers

- Event staff

- Agricultural workers

- Maintenance and repair technicians

Here are some of our top choices when it comes to employee time tracking:

Best for | Monthly Fees | Standout Features | Free Plan | |

|---|---|---|---|---|

Freelance workers | $4.99–$14.99 per user |

| ✓ | |

Those already using QuickBooks software | $20–$40 (base fee) plus $8–$10 per user |

| ✕ | |

Construction and field workers | $20–$40 (base fee) plus $8–$10 per user |

| ✕ | |

No review available | ||||

Reasons to Track Employee Hours

Small businesses need to track employee hours to:

- Process payroll accurately: To accurately calculate payroll, you must know each employee’s salary or time worked per pay period. Time sheets also help by tracking paid time off and accruals. Automated time tracking can streamline your payroll process by reducing timesheet errors. It can also eliminate the need for a large payroll department.

- Monitor employee attendance: Recorded time serves as an attendance-keeping method for your employees. Based on the hours logged, you will be able to determine if an employee worked their full scheduled workweek, took paid time off, or was short on hours. Time tracking can also give a clear view of how long it takes employees to get tasks completed. Managers can then better manage employees by calculating future tasks and team scope.

- Stay compliant with labor laws: The Fair Labor Standards Act (FLSA) requires all employers to track the time of their hourly employees. While the FLSA does not require a particular form for record-keeping, data must be kept on all nonexempt employees (whether salaried or hourly) showing their total hours worked daily and weekly, wages paid, and overtime earnings. A common form of noncompliance is due to inaccurate recordkeeping. Using software to track time and attendance can reduce errors and prevent costly legal issues that may arise.

- Perform specific accounting and HR duties: Employee time tracking can be used to determine whether the hours tracked are billable or non-billable, increasing the company’s productivity. As a result, accounting specialists can monitor project budgets and reprioritize tasks where needed. Additionally, tracking employee time can shed light on areas where additional resources may be necessary within the company.

Along with payroll, compliance, and other direct benefits, time tracking also provides more intangible benefits for both employees and the business.

Benefits to Small Businesses | Benefits to Employees |

|---|---|

Accountability: Employees are held to the hours they work. | Security: Assurance that they are being paid based on their actual hours worked. |

Clarity: Time tracking provides transparency about the tasks each worker performs. | Management: By tracking their time, employees can see where they are making progress and where improvements in their time management can be made. |

Morale: Tracking employee time can reduce micromanagement and increase employee satisfaction. | Insight: Time tracking helps employees record the projects they are working on, insight into work behaviors and patterns, and their overall performance. |

Accuracy: Time tracking delivers accurate information for a streamlined payroll process. | Independence: Time tracking allows employees to self-manage and understand their overall capacity and workload. |

Tracking Employee Hours Frequently Asked Questions (FAQs)

Yes, it is legal to track employee hours, but you must comply with labor laws and ensure employee consent when using certain tracking methods, especially in sensitive environments.

The FLSA is a federal law that sets guidelines for minimum wage, overtime, and other labor standards. Properly tracking hours is essential to comply with FLSA regulations.

GPS tracking can be used for employees working off-site or on the road, but you should establish clear policies and obtain employee consent to address privacy concerns.

Set clear expectations, use technology that employees find user-friendly, and provide training and support to ensure accurate time tracking without constant supervision.

Implement strict data privacy policies, inform employees of the tracking methods used, and obtain their consent where necessary. Limit tracking to work hours and locations.

Provide additional training and support, set clear expectations, and apply your company’s policies for addressing non-compliance, which may include disciplinary actions.

Bottom Line

Tracking employee hours is beneficial for both employers and employees. Accurate time tracking can save your business thousands of dollars by ensuring that you are only paying for the actual time your employees are working. Additionally, choosing the proper time and attendance method can mean the difference in legal compliance, efficient budgeting, reduced payroll errors, and increased employee performance.