Getting the best commercial real estate loan rates requires evaluating various loan types and shopping around for a lender. Rates will vary depending on your financing needs and qualifications, so it’s important to consider all your options. Commercial real estate loans can be obtained from different sources, such as the Small Business Administration (SBA), conventional banks, and hard money lenders.

Explore your SBA lending solutions now with Grasshopper Bank |

|

Type of Loan | Average Commercial Mortgage Rates |

|---|---|

SBA 7(a) Loan | 11.5%-16.5% |

SBA 504/CDC Loan | 6.5%-7% |

Conventional Bank Loan | 8.5%-12% |

Hard Money and Bridge Loan | 7%-20% |

SBA 7(a) Loans

Who an SBA 7(a) Loan Is Right For

An SBA 7(a) loan is the most common type of loan issued by the SBA. Loan proceeds can be used for purchasing real estate, land, and buildings. You can also use this loan to cover costs associated with constructing and renovating a building, including self-storage financing.

Qualification criteria are defined by the SBA and generally have stricter requirements in comparison to other commercial real estate (CRE) loans due to the government-backed nature of the loan. However, this does pose less risk to the lender, and in turn, allows for favorable rates and terms for borrowers with strong credit history.

Before you apply for this loan, you should know that these loans tend to take longer to facilitate than most. They also carry a prepayment penalty for the first three years—5% during the first year, 3% during the second year, and 1% during the third year. A prepayment penalty also applies if you voluntarily repay 25% or more of the outstanding balance of the loan.

If you think an SBA 7(a) loan can benefit your business, check out our partner Grasshopper Bank. As an SBA preferred lender, it offers a streamlined application process that can help you get preapproved and receive funds faster.

Pros & Cons of SBA 7(a) Loans

| PROS | CONS |

|---|---|

| Favorable low interest rates | Application and approval process can be lengthy |

| Funds have limited restrictions for business purposes | Significant amount of documentation is required |

| Large loan amounts and long repayment terms | Qualification criteria can be strict |

SBA 504 Loans

Who an SBA 504 Loan Is Right For

An SBA 504 loan offers long-term fixed-rate financing options and is available through Certified Development Companies (CDCs) to be used to fund assets that promote job and business growth. It applies to borrowers who plan on making investments such as purchasing buildings, constructing new facilities, or improving land.

While the SBA does set some general eligibility criteria, individual lenders can have additional requirements. For this reason, specific requirements for things like credit score, time in business, and debt service coverage ratio (DSCR) can vary. Some other qualification standards include management expertise, a solid business plan, and a demonstrated ability to repay the loan.

If you think an SBA 504 loan is suitable for your financing needs, you can apply with our partner Grasshopper Bank. It facilitates SBA loans and is a preferred lender that can assist you with the application process.

Pros & Cons of SBA 504 Loans

| PROS | CONS |

|---|---|

| Favorable low interest rates and repayment terms | Approval and disbursement of funds can take months |

| Lower down payment requirements than other types of loans | Documentation and application process can require lots of paperwork |

| No additional collateral requirements beyond the assets being acquired | Qualification requirements may make it difficult for early-stage businesses to be eligible |

Conventional Commercial Real Estate Loans

Who a Conventional Commercial Loan Is Right For

Banks issue a large volume of commercial real estate loans, which can be used to finance a property that will be used for business purposes, such as an office space, warehouse, or manufacturing facility. Additionally, banks offer short-term commercial bridge loans that can allow you to acquire a property while you search for a more permanent source of financing.

A big advantage of getting a commercial real estate loan through a bank is that the available loan amounts usually exceed those available from loans that are backed by the federal government, like SBA loans. Rates are also competitive, but in exchange, the qualification requirements tend to be very strict. You’ll typically need to have strong credit, have an established history of conducting business, and be able to show that your business is performing well financially.

If you meet those requirements, U.S. Bank is an excellent provider to consider for long-term owner-occupied commercial real estate loans.

Pros & Cons of Conventional Commercial Real Estate Loans

| PROS | CONS |

|---|---|

| Higher loan amounts in comparison to other CRE loans | Higher down payments may be required |

| Competitive interest rates and flexible repayment terms | Qualification criteria can vary depending on the lender |

| Quicker approval and disbursement process | Closing and lender fees may be higher |

Hard Money Loans

Who a Hard Money Loan Is Right For

Hard money loans, including bridge loans and mixed-use loans, are a popular alternative to investment property financing and can be a good option if you are unable to obtain funding elsewhere. This can be due to low credit or because the property condition does not meet the requirements of a traditional lender. Hard money loans tend to have higher rates and fees, due to their short-term nature.

These loans are often used by fix-and-flip and fix-and-hold investors, as they can use this type of loan to purchase a property in need of repairs at a low price. Once the repairs are completed, they will sell the property for a profit, at which point the loan will be paid off. Fix-and-hold investors often replace a hard money loan with a permanent source of financing after repairs are completed.

Qualification requirements for a hard money loan usually revolve around prior flipping experience and credit scores. Although there are lenders that can finance those with no prior flipping experience, you’ll have a much better chance of getting approved with a track record of successful flips and a strong credit score.

An advantage of a hard money loan is that it can be funded quickly. Some of the best hard money lenders can fund in as little as 10 days. If you’re considering this type of loan, we recommend looking at our partner Kiavi for its low rates and fast funding speeds.

Our related resources:

- Commercial Bridge Loans: What They Are & How They Work

- Mixed-use Loans: What They Are and How They Work

- Investment Property Financing: What It Is & Who It’s Right For

Pros & Cons of Hard Money Loans

| PROS | CONS |

|---|---|

| Fast approval and funding speeds | Higher rates and fees than most CRE loans |

| Generally easier to qualify for | Large down payments are often required |

| Interest-only payment options | Shorter repayment terms |

Factors to Consider to Get the Best Commercial Real Estate Loan Rates

To ensure you get the best commercial property loan rates, you’ll need to do some research and prioritize your goals and budget. Rates will be determined based on factors such as your credit score, industry experience, and existing debt obligations. However, there are also external factors that can also play a role:

- Type of commercial real estate loan: Different types of loans will have varying ranges of rates offered, usually depending on the risk tolerance of the lender. Loans that have strict requirements, such as good credit and collateral, will typically be able to offer lower rates because of the reduced risk to the lender.

- Condition of property being acquired: Properties in good condition can be more easily resold. This reduces the lender’s risk especially if the property is used as collateral for a loan. If you fail to make payments on time, the lender can foreclose and resell it to cover its losses.

- Your business qualifications: Common requirements revolve around your company’s annual revenue, time in business, investment experience, and credit score. Highly qualified businesses represent a lower risk to lenders, which typically leads to more competitive rates being offered.

- Loan terms requested: Loan terms that can impact the rate you get include the loan amount, length of the loan, and whether you want a fixed or variable rate.

- Market rates: Economic conditions can impact the general range of rates available for loans. As the cost of borrowing money becomes more expensive for banks, the increased costs are typically passed on to borrowers.

How Much Do Rates Change Over Time?

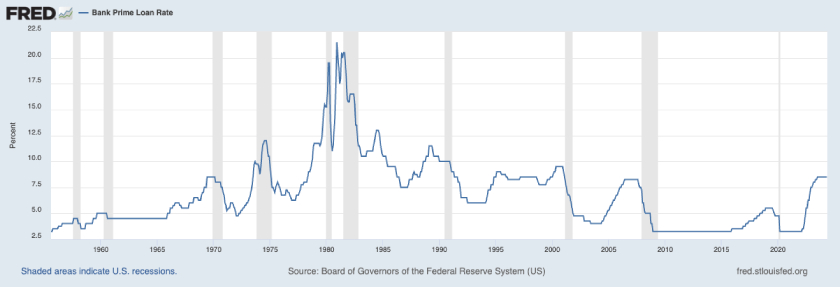

Although rates have risen over the past year, they are still low from a historical standpoint. Rates on many types of loans fluctuate with the US prime rate, and the following chart shows its changes since 1955.

Board of Governors of the Federal Reserve System (US), Bank Prime Loan Rate [DPRIME], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPRIME#, May 23, 2024

Alternatives to Commercial Real Estate Loans

If you think you may be ineligible for a CRE loan or simply want to explore all of your potential financing options, consider the following alternatives:

- Rollover for business startups: With a rollover for business startups (ROBS), you can use funds from your retirement account with an investment of $50,000 or more.

- Business line of credit: A business line of credit is a revolving credit facility that can provide you with quick access to funds to be used on an as-needed basis. Funds can be used for virtually any business expense, with the balance repaid over time.

- Personal loan for business: Personal loans are issued based on your personal credit and finances and typically have favorable rates and terms. Loan amounts are generally smaller than what you could receive with other CRE loans, but it’s a good option for borrowers who need quick access to funds. For a jumping-off point, see our roundup of the best personal loans for business funding.

- Friends and family loan: Raising money from friends and family to fund your business can be an option to secure favorable rates and repayment terms. You’ll have to apply an applicable interest rate, but overall, it’s less formal than traditional financing.

Frequently Asked Questions (FAQs)

Depending on the loan type you choose, interest rates will vary. Typically the most favorable rates are provided by government-backed loans, such as SBA(7a) and SBA 504 programs, which have rates that range anywhere from 6.5% to 16.5%.

They include SBA loans, term loans, conventional commercial mortgage loans, commercial bridge loans, and hard money loans.

Qualification requirements will vary depending on loan type and lender. Some lenders may have stricter criteria to be considered eligible, although most are flexible and review applications on a case-by-case basis, so you may still qualify even if you don’t check all the boxes.

Bottom Line

To ensure you get the best commercial property loan rates, you’ll need to consider your qualifications and financing needs. Depending on your real estate investment goals, there are various loan types that you can explore to ensure you find one that fits your budget. Businesses with a good credit score, strong cash flow, and track record of success will usually qualify for lower rates. Loans that require collateral or a large down payment also tend to offer more competitive rates and fees.

Regardless of these factors, it’s always a good idea to shop rates with multiple lenders so that you can get the best loan possible. You can use a commercial loan calculator to see if you can afford the monthly loan payments. If financing a property is not right for you, you can also consider leasing commercial property, and our article on how to lease commercial real estate will guide you.