Contactless payments are transactions made without a credit card making direct contact with a card reader; instead, payment information is transmitted via near-field communication (NFC) technologies. Contactless payment methods include tap-to-pay contactless chip cards, mobile payment options like Apple or Google Pay, and scannable quick response (QR) codes. All these methods are only available when used in tandem with a contactless card reader.

As people became wary of contact during the COVID-19 pandemic of 2020, contactless payments soared. And they have not gone anywhere—it is clear that contactless payments are here to stay and may even completely overtake traditional forms of payment. Take a look at the contactless payment trends and statistics below to better understand the modern payments landscape and incorporate these payment methods into your business.

Key takeaways:

- Contactless payments are booming: More and more people are adopting and using contactless payments every year, becoming a major force in the payments world.

- Mobile wallets dominate as QR codes fade: Mobile wallets are becoming the dominant force in the contactless landscape while QR code payments become less popular.

- People are coming to prefer and expect contactless (except for dining): The growing expectation among consumers is that retailers will offer contactless payment options and many will avoid shopping at businesses that don’t accept them. That’s for all businesses other than restaurants, where cash and card are still king.

Contactless Payment Statistics: Post-pandemic Growth

It is undeniable that the pandemic changed shopping habits. One of the most impacted areas across the world was contactless payments, which saw massive adoption starting in 2020. But was this impact lasting? Did contactless payments have staying power beyond quarantine and pandemic fears? As you will see in this section—yes, they did.

1. Global contactless payment transactions are expected to exceed $10 trillion by 2027

According to a forecast by Juniper Research, total contactless payment transactions are expected to grow to more than $10 trillion by 2027, with a whopping 221% increase in contactless payments projected between 2022 and 2026. The study cites the growth of contactless-enabled point-of-sale (POS) systems as a major factor in the widespread adoption of contactless payments.

2. By 2026, 81% of all cards will be contactless

A forecast by RBR Global suggests that more than 80% of consumer credit cards will feature contactless payment technology by 2026. But that will only be a growth of about 119% from current use, compared to the 221% rise in overall contactless payments projected for the same timeframe. The bigger growth in contactless adoption is expected to come from payment-enabled wearable devices.

3. 94% of all smartphones globally are NFC-enabled

The number of payment-enabled smartphones is expected to grow to 99% by 2027. While this shift toward NFC payments will likely lead to more retailers accepting mobile wallet payments, it will also lead to an adjustment in the chargeback procedure.

In addition to filing chargeback complaints with a credit card provider, consumers can also file a fraud complaint with the mobile wallet—and those can be harder for retailers to win. In a survey by Ravelin, only 5% of retailers claim to have won a dispute with Google Pay or Apple Pay (versus 49% who reported success refuting chargeback disputes with major card brands).

4. Contactless payments account for 50% of transactions globally

Contactless payments now account for one in every two in-person transactions globally, up from a one-in-three ratio seen in years past.

5. Per-person contactless spending is expected to double by 2026

A 2022 Insider Intelligence report projects that per-user contactless spending will reach $7,827 in 2026. This is about double the spend in 2022 ($4,177), and more than triple the 2019 figure ($2,101). Businesses that don’t offer contactless options could be leaving money on the table.

6. 59% of small businesses are already cashless or plan to shift to using only digital payments in the next two years

In a 2022 survey of small businesses, Visa found that 59% of small businesses already use or plan to exclusively use digital payments by 2024.

But, be careful about going completely cashless. While there is currently no federal law requiring private businesses to accept cash, some states have laws prohibiting a fully cashless operation. So check your local laws first and pay attention to the news. While the Payment Choice Act died in Congress in 2022, it was popular enough that some of its stipulations—like requiring private businesses to accept cash—could make their way into other bills.

7. 73% of small businesses believe that new forms of digital payments are fundamental to their growth

A 2022 study from Visa found that 73% of small businesses believe that accepting forms of digital payments is important for the growth of their business—and they would be right. When Visa asked consumers about top factors (outside of price) influencing their store purchasing choice, 36% answered “accept digital payments.”

8. Restaurants are adopting contactless payment options rapidly

In 2022, 76% of restaurants reported adding mobile pay, 66% added tap to pay, 44% added QR codes, and 4% didn’t add any contactless payment options. This is compared to much lower adoption rates in 2021, as you can see in the graphic below.

Restaurants are adopting contactless payment options rapidly. (Source: TouchBistro)

Contactless Payment Trends: Mobile Wallets vs QR Codes vs Tap to Pay

Broadly, contactless payments can be divided into three categories: mobile or digital wallets (i.e., credit or debit cards from your bank or other non-financial institutions that are stored on your mobile device), QR codes, or tap-to-pay cards. In this section, we will look at how these individual categories are performing.

Mobile/Digital Wallets

Take a look at how mobile/digital wallets are performing and what you can expect from them in the future.

9. The US is the world’s leading market for mobile payments by volume

The US saw 4.4 billion mobile payments in 2022 and this volume is expected to rise to 8.3 billion transactions by 2027. This is a monumental 88.6% increase over five years.

10. Digital payments are seeing a compound annual growth rate of 15.5%

Between 2022 and 2023, the global digital payments market will grow from $96.19 billion to $111.11 billion. This represents a 15.5% compound annual growth rate (CAGR) that is set to continue through 2027 when digital payments are anticipated to hit $197.87 billion.

11. Digital wallets are projected to account for 52.5% of the global ecommerce transaction value in 2025

In 2021, digital wallets comprised 48.6% of global ecommerce transaction value or just over $2.6 trillion. This is a huge share that is projected to rise in the coming years, accounting for 52.5% of ecom transaction value by 2025. Experts from World Pay attribute this growth to digital wallets’ superior checkout flows, availability in areas that lack strong banking infrastructure, increasing integration into ecommerce, and consolidation into regional and global super apps.

12. Digital wallets will account for a third of the US’s ecommerce transaction value by 2025

While slower than in other areas of the world, digital wallets continue to rise in popularity among Americans, accounting for 29.2% of the US’s total ecommerce transaction value in 2021. The momentum of digital wallets does not appear to be slowing either. Digital wallet payments are set to account for nearly one-third of regional ecom spend by 2025.

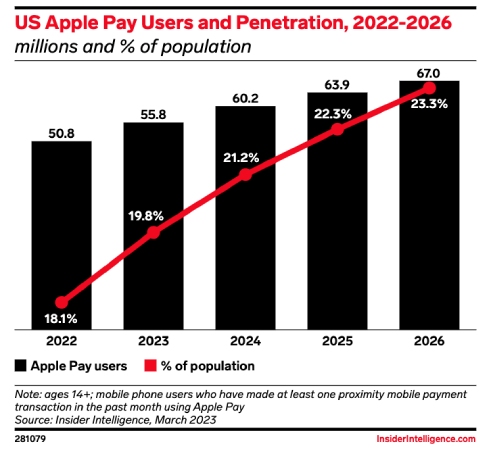

13. 55.8 million Americans used Apple Pay in 2023

Apple Pay was used by over 55 million Americans in 2023, a nearly 10% growth in usage over 2022. While you might think things would be starting to slow, Apple Pay’s proliferation does not look like it is going to stop. From 2023 to 2026, the number of people who use Apple Pay is projected to grow to 67 million users, or 23.3% of the US population.

Apple Pay is only going to become increasingly popular in the years to come. (Source: Insider Intelligence)

14. Mobile wallets accounted for over 28.6% of global POS transactions in 2021

Mobile wallets’ share of global POS transactions jumped over 21% YoY between 2020 and 2021. In 2021, mobile wallets accounted for just under 30% of the total global POS transaction value, or over $13.3 trillion.

15. US mobile wallet use increased by 7% from 2021 to 2022

A recent survey from Marqeta found that the number of US consumers who reported using a mobile wallet in the past 12 months increased from 64% in late 2020 to 71% in 2022. Not only that, 2022’s 11% increase came in the wake of a 64% increase in adoption from 2019 to 2020.

QR Codes & Tap to Pay

Take a look at how QR code payments are performing and what you can expect from them in the future.

16. Global QR code payments are expected to reach nearly $5 trillion by 2028

According to a forecast by Juniper Research, global QR code payments are expected to reach $4.8 trillion by 2028, up from $2.9 trillion in 2023. Researchers expect this 59% increase to be driven by promoting QR code payment use in developing countries.

17. QR codes will account for 40% of all digital wallet transactions by 2025

According to Juniper Research, QR code payments will account for 40% of all digital wallet transactions globally in 2025. While this is a massive share, it does represent a decrease from the 47% we saw in 2020.

As QR code technology is cost-effective and easy to adopt, it was a great solution when the pandemic first started. However, the decline in QR code use indicates that they probably don’t have staying power as additional contactless payment options become more widely available.

18. 0% of Americans want to pay via QR code when dining in

While consumers are less averse to using QR codes in traditional retail stores, for restaurants, they don’t want it. According to Touch Bistro’s Top Dining Trends of 2023, 0% of Americans want to pay via a QR code when dining in at restaurants.

19. One in three in-person transactions in the US use tap-to-pay, up 10% YoY

Globally, 74% of all in-person transactions outside the US are done via tap-to-pay. In the US, we’re at 34%, up 7x from three years ago and more than 10 percentage points from 2021.

Consumer Perspective on Contactless Payments

With an eye on the current contactless payments landscape, the next thing we will look at is how consumers are feeling about contactless payments, including their adoption habits and preferences.

20. 89% of Americans are now using some form of digital payments

According to McKinsey’s 2022 Global Payments Report, nearly nine in every 10 Americans has and is using some form of digital payments. Not only that, 62% are using two or more forms of digital payment, up from 51% in 2021.

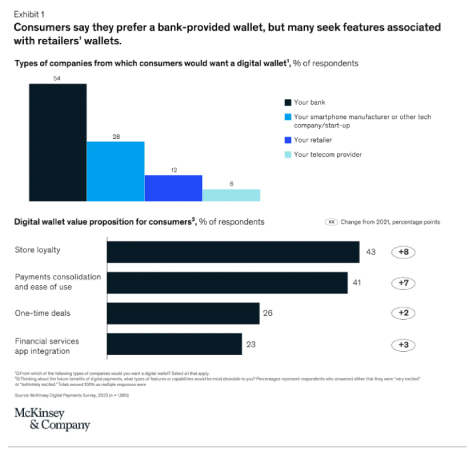

21. American consumers prefer bank-provided digital wallets

While other regions in the world prefer non-bank-issued digital cards, in the US, the majority of consumers (54%) prefer digital wallets that are bank-provided.

American consumers prefer bank-issued digital wallets over those issued by a smartphone company, retailers, or telecom providers. (Source: McKinsey)

22. 41% of consumers would not shop at a store that didn’t offer contactless payments

The 2022 Visa Back To Business study found that businesses exclusively offering payment methods that require contact with a cashier or shared machine like a card reader deters 41% of consumers.

23. 87% of consumers prefer using contactless payment options when shopping in-store

In 2020, contactless payment use in the US increased by 150% year-over-year. With this widespread adoption came a shift in consumer preferences, and now, 87% of consumers prefer using contactless payment options for in-store purchases.

24. 78% of Americans say they expect to be able to use their mobile wallet anywhere they want

A study from Marqeta found that 78% of Americans expect to be able to use their mobile wallet for purchases anywhere they want, with 56% saying they felt confident enough in this to leave their wallet at home and just take their phones.

25. 41% of consumers are already cashless or plan to shift to only digital payments by 2024

According to the Visa Back to Business Global Study, 41% of consumers are looking to ditch cash and shift to digital wallets by 2024. While this is a huge percentage of the market, be careful if you plan to shift your business to digital wallets only as 23% of consumers say they will never use digital wallets exclusively.

26. Americans don’t want to see exclusively contactless payment options in restaurants

We saw earlier that no Americans want to pay with QR codes when dining in at a restaurant. This aversion to contactless payments at restaurants does not stop there though—only 3% of American diners want to pay for their food with mobile payments when dining in versus 4% when ordering food online. In other words, traditional credit cards and cash are king for restaurant payments.

27. Convenience and speed are the top reasons that consumers prefer contactless

In a 2021 report from Amex, consumers were asked why they prefer contactless payments. Of the respondents, 73% cited convenience as the top reason, and 54% cited the speed of money transfer.

What Contactless Payment Stats Mean for Small Businesses

What do these contactless payment statistics mean for your small business? Our small business experts offer this advice:

- Get equipped for biometrics: Customer comfort with biometric security measures will make contactless payments more fraud-resistant. Fraud resistance is great for small businesses because it means fewer chargebacks. If your payment processor supports biometric payments, you should add this technology as soon as you are able.

- Adopt a contactless card reader: Most modern credit card terminals are equipped with tools that allow you to accept contactless payments. Check to be sure that your card reader can process tap-to-pay and mobile payment options, and if it can’t consider one of our top-recommended card readers to get started.

- Create a chargeback plan: As we learned above, it can be difficult for merchants to win chargeback disputes with Apple and Google Pay. Get ahead of this and create plans for documenting your transactions and having the necessary information ready to win chargeback disputes.

- Take care with cost-effective QR codes: As one of the most cost-effective and dynamic contactless tools, QR codes remain an efficient and inexpensive way to offer contactless options in your store. But keep your QR codes branded and secure; it would be very easy for fraudsters to place competing QR codes in your shop to skim customer payments.

- Contactless is chip 2.0: When chip payments became popular in the 2010s, the liability for fraud prevention shifted to merchants, and small businesses that were late to adopt the technology lost a lot of chargeback disputes. As contactless technology becomes more secure, card processors are likely to shift liability again. Staying on top of contactless technology will protect your future profits.

The EMV liability shift from 2015 has a lot of lessons for small business owners considering contactless payments in 2024. When EMV (chip-card) payments became standard in the USA, in-person credit card fraud plummeted. So fraudulent payments moved to less secure online—or card-not-present (CNP)—payments. Fraudulent CNP charges more than doubled when EMV-compliant in-person transactions became more secure.

As more security measures—like biometric scans—are added to contactless payments, businesses that operate with less secure payment methods are likely to see more fraud and more chargebacks. There may also be another liability shift in the future, as payments become even more secure.

It is more important now than ever for small, independent businesses to stay on top of payment trends. To avoid increasing your liability for chargebacks and payment fraud, communicate with your merchant services provider and your point-of-sale (POS) partner to ensure you always have the latest, most secure payment options in your store.

Frequently Asked Questions (FAQs)

Click through the questions below to get answers to some of your most frequently asked contactless payment questions.

Contactless payments are transactions made without a credit card making direct contact with a card reader and instead transmitting payment information via near-field communication (NFC) technologies.

The most popular contactless payment methods are mobile wallets and tap-to-pay. QR codes were once very popular, but are falling from favor among consumers and business investments.

Most small businesses offer contactless payments in order to capture as many shoppers as possible.

No, offering contactless payments often requires no investment. If you have a modern card reader (which can start as low as $50), it already has the near-field technology that allows you to process contactless payments with no need to spend additional money. Not only that, there are lots of free QR code generators that you can use to offer QR code payments.

Bottom Line

Contactless payments statistics show that this payment type grew in popularity during the COVID-19 pandemic and subsequent calls for greater convenience and cleanliness, but this technology continues to expand. From QR codes to NFC-enabled cards and payment-enabled mobile devices, contactless payments continue to evolve and expand their reach.

With these contactless payment statistics, you get a better understanding of the payments landscape. If you think you’re ready to invest in contactless yourself, learn more about contactless payments and how they work in our article on everything you need to know about contactless payments.