Dext Prepare (formerly Receipt Bank) is a business management software that features receipt scanning, expense reporting, and bookkeeping and analytic tools. It integrates with popular accounting software like Xero, QuickBooks, and Sage Accounting.

Small businesses can use the platform to streamline expense reporting and reimbursement through approval flows and receipt processing features. Dext Prepare’s pricing starts at $30 per month, and a 14-day free trial is available. Our comprehensive Dext Prepare review aims to help you decide if the tool fits your business needs.

At Fit Small Business, our editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Pros

- Line item extractions from documents

- Clean user interface

- Many ways to add documents

- Classify documents as to cost, sales, or bank

Cons

- Expensive compared to similar software

- Limited line item and bank statement extractions

- Not a full accounting platform

- No direct customer support phone line

Supported Business Types | Businesses with a small workforce |

|---|---|

Pricing |

For more than 10 users, the price goes up by $5.50 per user. |

Free Trial | 14 days |

Accounting Software Integration |

|

Standout Features |

|

Customer Support | Support ticket and help center |

- Accountants and bookkeepers: Dext Prepare has Partner Accounts especially built for accountants and bookkeepers. These accounts allow you to create multiple accounts for your clients and manage them in a single space. Clients can also submit invoices, receipts, and other financial documents straight to their accounts, making Dext Prepare one of our best receipt scanner apps.

- Business owners: For solopreneurs and manager-owners, Dext Prepare can save hours of clerical work. You can snap receipts and upload them to the platform and save hours of data entry with line item extractions.

- Users of major accounting software: Dext Prepare is a tool dedicated to accountants and bookkeepers. It aims to make accounting work easy because the platform can integrate with Xero, Sage, and QuickBooks, all of which are on our list of the best small business accounting software.

Dext Prepare Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Intuitive interface and simple mobile app | Issues with errors in line item extractions |

| Efficient data entry with automatic data extraction | No expense approval workflows |

| Integrates well with popular accounting software like QuickBooks and Xero | Difficulty contacting customer support |

Dext Prepare users said that they find the software helpful in collecting and compiling receipts and in accounting for receipts and reimbursements before syncing data to their accounting software. However, they also found issues related to errors in line item extractions, slow optical character recognition (OCR), and poor customer support.

Here are the Dext Prepare review scores on third-party sites:

- GetApp[1]: 4.2 out of 5 based on almost 150 reviews

- G2.com[2]: 4.6 out of 5 based on nearly 250 reviews

- Trustpilot[3]: 4.0 out of 5 stars based on about 1,300 reviews

Dext Prepare offers three plans with monthly prices that start at $30, and you can save up to 20% if you choose the annual billing option. Although the provider offers a free trial and discounted pricing, Dext Prepare pricing took a hit in our evaluation because the prices of each plan are on the more expensive side.

The Enterprise tier is for those needing ≥11 seats, with 500 being the maximum. Our pricing comparison table below includes Enterprise’s floor and ceiling details.

Business Plus | Premium | Enterprise | ||

|---|---|---|---|---|

Cost per Month (Monthly Billing) | $30 | $57.50 | $63 | $562.50 |

Cost per Month (Annually Billing) | $24 | $46.50 | $51 | $450 |

Number of Users | 5 | 10 | 11 | 500 |

Number of Documents Per Month | 250 | 500 | 550 | 50,000 |

Sheets of Bank Statement Extraction | 10 | 35 | 40 | 500 |

Documents With Line Item Extraction | 5 | 30 | 35 | 500 |

Extract Information From Documents | ✓ | ✓ | ✓ | |

Collect Bills & Invoices Automatically | ✓ | ✓ | ✓ | |

Connect With Major Accounting Software | ✓ | ✓ | ✓ | |

Export Data Into PDF or CSV Files | ✓ | ✓ | ✓ | |

Publish Bills & Invoices to Accounting Software | ✓ | ✓ | ✓ | |

Supplier & Customer Rules | ✓ | ✓ | ✓ | |

Connect With Secondary Software | ✓ | ✓ | ✓ | |

Check for Missing Items | ✓ | ✓ | ✓ | |

Track Unpaid Invoices | ✓ | ✓ | ✓ | |

Purchase Order (PO) Matching | ✕ | ✓ | ✓ | |

Line Item Extraction From Receipts | ✕ | ✓ | ✓ | |

Prioritize Urgent Items | ✕ | ✓ | ✓ | |

Create Automated Expense Reports | ✕ | ✓ | ✓ | |

Dext Prepare offers basic features that can help businesses and accountants manage their books conveniently. Except for being able to scan receipts via TWAIN-compliant scanners, Dext Prepare offers all other capabilities that were in our scoring rubric—including scanning receipts via mobile, uploading receipts manually, auto-forwarding receipts from inbox, attaching receipts from cloud drives, and scanning documents other than receipts. It also integrates with popular accounting software and allows you to create tags and categories for documents.

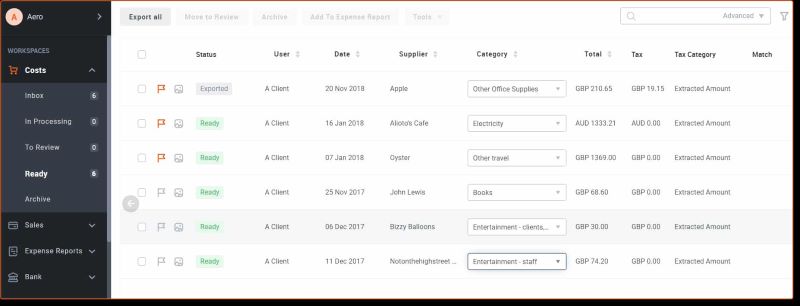

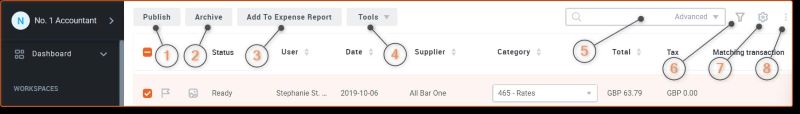

Dext Prepare’s workspace is easily understandable and isn’t intimidating for first-time users. Its tabular-style format is neat and doesn’t look cramped, making it easy to read. You can also reorder the items by user, date, supplier, category, and total.

Dext Prepare Workspace (Source: Dext Prepare Support)

The platform’s toolbar includes buttons for easy access and use.

Dext Prepare Toolbar (Source: Dext Prepare Support)

- Publish: All checked items will be published to the accounting software integrated with Dext Prepare.

- Archive: All published, downloaded, or processed items will be transferred to the Archive page, where they’ll be stored permanently.

- Add To Expense Report: Selected items can be included in an expense report that Dext Prepare can generate.

- Tools: Click to access other tools like bulk edit, export, convert to sale, clear publishing data, flag, unflag, and delete.

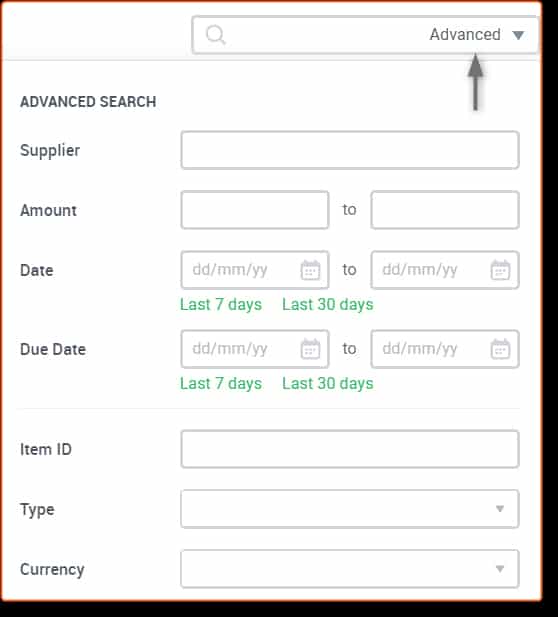

- Search Bar: Search for items in your system through Advanced Search where you can look specifically for particular items based on certain categories.

Search Bar with Advanced Search (Source: Dext Prepare Support)

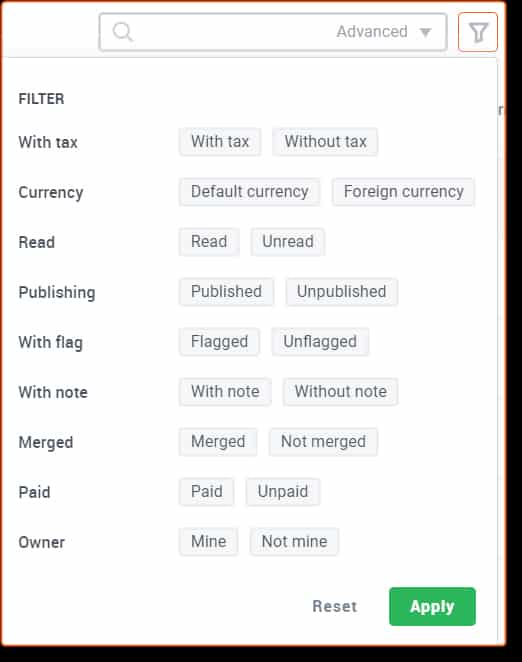

- Filters: It can help you see specific items that match the categories. You can check several categories to narrow your search down.

Advanced Filters (Source: Dext Prepare Support)

- Table Settings: You can edit your workspace through the table settings. You can add or remove columns based on the following categories:

- User

- Supplier

- Total

- Date

- Category

- Tax

- Invoice number

- Base total

- Payment

- Project

- Type

- Note/Message

- Due Date

- Description

- Customer

- Project

- Item ID

- Vertical Menu Button: You can see additional features here, such as the Outstanding Paperwork function, which is available in Dext Streamline and Optimize Partner accounts. These accounts are specific for accountants and bookkeepers, and you can get them through the Dext Partner program.

Small businesses that aren’t engaged in accounting and bookkeeping services shouldn’t get them.

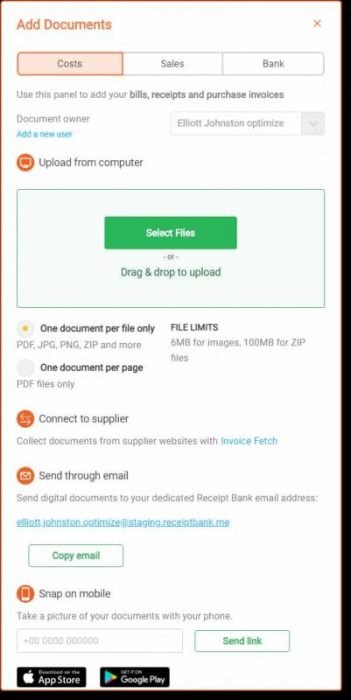

There are several ways to add documents on Dext Prepare:

- Upload from computer: Upload directly from your computer or use the drag-and-drop feature for ease of use

- Collect directly from suppliers: By establishing a Fetch Connection in the Connections tab, Fetch will collect documents automatically from authorized suppliers and post them on Dext Prepare within 48 hours

- Send through email: Send documents using your Dext Prepare email

- Use Dropbox: By establishing a Dropbox Connection in the Connections tab, Dext Prepare will have a dedicated folder on your Dropbox account; upload any file and it’ll upload it to your Dext Prepare account automatically

- Use PayPal: By establishing a PayPal Connection in the Connections tab, Dext Prepare will check your PayPal account for payments and automatic payments automatically at 24-hour intervals

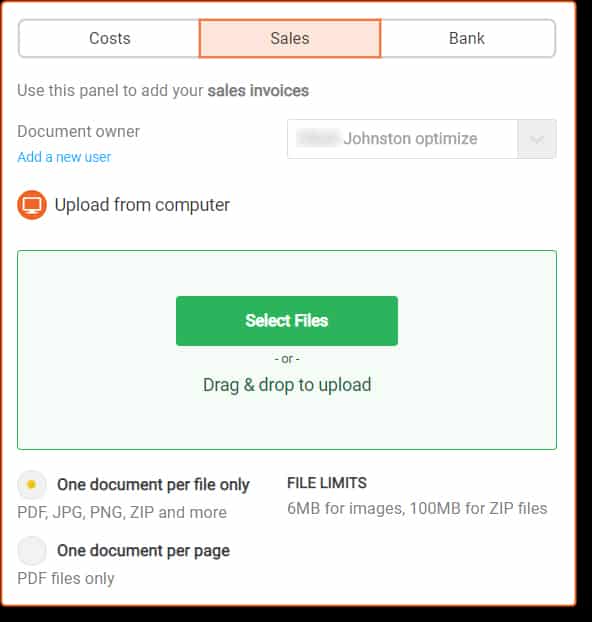

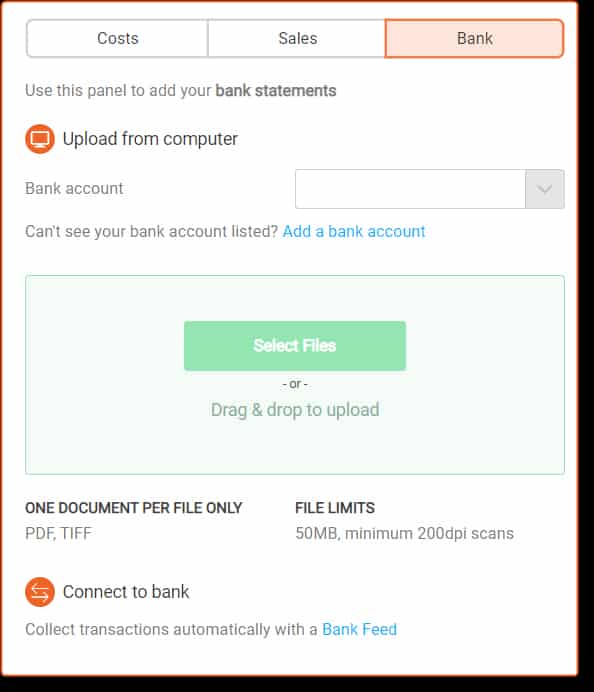

When adding documents, you can classify them immediately into three major categories: Costs, Sales, and Bank:

- Use the Costs panel to add bills, receipts, and purchase invoices.

- Use the Sales panel for sales invoices.

- The Bank panel is where all of your bank statements go.

In our evaluation, Dext Prepare received an above-average score for its advanced features, which is mainly because it doesn’t provide assisted receipt scanning. Its expense tracking features are limited as well, so it also took a hit for that. However, it does allow you to organize and scan documents into folders and view trends and insights. You can also share files and collaborate with colleagues.

Dext Prepare can generate expense reports automatically with the Effortless Expense Reports feature. With it, you can choose weekly, bimonthly, or monthly as the period of reporting. Employees can also get the feature on their accounts, and you will need to indicate which ones do. Dext Prepare recommends that only employees submitting expense items should use this feature.

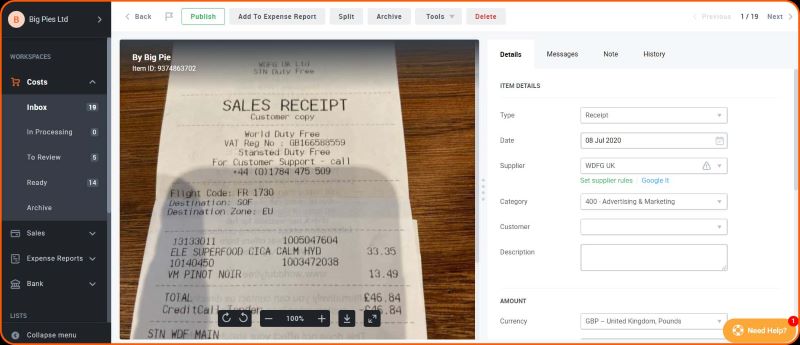

Once you’ve uploaded documents to the software, its automatic extraction will gather all the necessary information. It can extract the following information:

- Original document image

- Type of document, including receipt, sales invoice, and credit note

- Document date

- Supplier

- Currency

- Total amount paid or due

- Tax amount

- Invoice number

- Payment method

Uploaded Document on Dext Prepare (Source: Dext Prepare Support)

Dext Prepare’s customer support seems to be a bit of a mixed bag. There isn’t a way to receive support via telephone, so users are restricted to messaging within the Dext Prepare mobile or web apps or sending an email. Because of this, users have reported challenges connecting with customer support, with response times varying depending on the chosen method. The lack of phone support also affected its score.

Ultimately, whether Dext Prepare’s customer support meets your needs will depend on your priorities. If you require prompt and readily available assistance, you might want to investigate further before making a decision.

Dext Prepare is a very user-friendly software, with several features that make it easy to learn and use. The web and mobile apps are known for their intuitive designs—they are clutter-free and well-organized, making it easier for you to find the features you need. It is for this reason that it scored high for subjective ease of use in receipt scanning, mobile app functionality, and document management system. It took a minor hit for the fact that it has an integrated, not built-in, accounting system.

The platform provides a straightforward user experience, with minimal setup time and the ability to use the software effectively without extensive training. It even offers clear and easy-to-understand expense categories, making it simple to organize your financial data.

Also, the tool integrates with popular accounting software programs like QuickBooks and Xero, and while these programs might have steeper learning curves, Dext Prepare itself is designed for ease of use. It is a strong option if you’re managing receipts and bills, but it’s a good idea to explore a free trial to get a firsthand feel for its user-friendliness before committing.

How We Evaluated Receipt Scanner Apps

In evaluating the best receipt scanner apps, we created a rubric that highlights seven main areas.

10% of Overall Score

The cost of the receipt scanner app matters greatly for small businesses on a budget. In our pricing evaluation, we considered different pricing levels that vary with the number of users. We also gave points to providers that give free trials, monthly plan options, and annual billing discounts.

35% of Overall Score

Basic receipt scanning features are must-have features. The provider must at least have the majority of these features to be usable as a receipt scanner. In this criterion, we gave more weight to OCR and methods of receipt scanning. The provider that can give multiple receipt scanning methods received more points.

15% of Overall Score

20% of Overall Score

We check user review websites to gauge actual user feedback and incorporate these ratings in our evaluation.

10% of Overall Score

10% of Overall Score

In this criteria, we want providers to have many support channels available for users just in case they need assistance. Support channels like phone, email, and chat are the primary channels we’d like to see. Alternatively, we also considered the knowledge base as a source of self-help information.

Frequently Asked Questions (FAQs)

Dext Prepare is a cloud-based accounting software that automates data extraction from receipts, invoices, and bank statements. It uses OCR technology to capture key financial data and integrates with popular accounting software like QuickBooks and Xero.

Dext Prepare can save time and money by automating data entry, reducing errors, improving efficiency, and providing better insights into finances.

Yes, Dext Prepare supports over 11,500 banks and institutions, allowing you to easily upload your bank statements for automatic transaction logging.

Dext Prepare offers some basic document management features like centralized storage, categorization by vendor or date, and data extraction for searchability. However, it lacks advanced features like extensive tagging and version control, found in dedicated document management systems.

Bottom Line

Dext Prepare shows promising features that can compete with its direct competitors. It’s best suited for small businesses since it provides a convenient way for them and their accountants to upload invoices and receipts. With Dext Prepare expanding into different software solutions in the near future, we’re excited to see how it will interconnect products.