Zoho Expense is one of the cloud-based applications in the Zoho software-as-a-service (SaaS) environment. It is an expense tracking app aimed at streamlining travel and expense management for growing businesses and works seamlessly with Zoho Books, QuickBooks Online, and Xero. Though Zoho doesn’t issue cards, you can integrate your corporate card program with Zoho Expense for its direct feed integration.

The platform has a free plan for up to three users, and paid plans start at $5 per active user, per month. You can test the paid plans for free for 14 days. Those who left a Zoho Expense review had mostly positive things to say, and they mentioned that the software is affordable and has a lot of integration options.

At Fit Small Business (FSB), we are committed to delivering thorough and dependable software reviews. In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios. This approach allows us to customize our reviews and provide more relevant insights and recommendations tailored to the unique needs of your accounting firm.

Pros

- Great for existing Zoho users

- Useful for employee travel expense tracking

- Ideal for approval of expenses

- Integration with other top accounting software namely, QuickBooks, Xero, and Sage Accounting

Cons

- Standard plan has very limited features

- Steep learning curve

- First-time users may feel overwhelmed with the user interface

Zoho Expense Alternatives & Comparisons

Zoho Expense Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Affordable pricing | A bit of a learning curve |

| Excellent expense tracking | Limited free version |

| Integrations | More analytics features |

Users who left a positive Zoho Expense review commended its outstanding user interface and expense tracking features. They mentioned that the software helped them monitor expenses effectively.

On the flip side, some complained that there’s a bit of a learning curve for first-time users but said that it’ll get easier along the way. Our expert analysis shows that Zoho Expense is indeed a comprehensive expense tracker but it can certainly be overwhelming for new users:

- GetApp[1]: 4.6 out of 5 stars based on around 900 reviews

- G2.com[2]: 4.5 out of 5 stars based on about 1,000 reviews

The Zoho Expense pricing structure is affordable and ideal for small businesses. Freelancers can start with the free plan, and then upgrade to higher tiers if there’s a need for more features. Zoho Expense doesn’t have a customized plan, but we believe the Enterprise plan can handle any business since it requires a minimum of 200 users.

You can choose among four plans, but the free version is always the best to start with if you’re new to expense trackers. You can also get the 14-day free trial to discover the features of paid plans.

Free | Standard | Premium | Enterprise | |

|---|---|---|---|---|

Monthly Price | $0 | $5 per active user | $8 per active user | $12 per active user |

Minimum Users | N/A | 3 | 3 | 500 |

Maximum Users | Up to 3 | Unlimited | Unlimited | Unlimited |

Receipt Storage | 5GB | Unlimited | Unlimited | Unlimited |

Multicurrency Expenses | ✓ | ✓ | ✓ | ✓ |

Customer or Project Tracking | ✓ | ✓ | ✓ | ✓ |

Accounting Integration | ✓ | ✓ | ✓ | ✓ |

Receipt Autoscan | 20 | 20 per user | ✓ | ✓ |

Travel Requests | ✕ | ✓ | ✓ | ✓ |

Advanced Approval | ✕ | ✓ | ✓ | ✓ |

Per Diem Automation | ✕ | ✓ | ✓ | ✓ |

Advanced Customization | ✕ | ✓ | ✓ | ✓ |

ERP Integration | ✕ | ✕ | ✓ | ✓ |

Security Assertion Markup Language (SAML) SSO | ✕ | ✕ | ✕ | ✓ |

Dedicated Account Manager | ✕ | ✕ | ✕ | ✓ |

Advanced Audit Trail | ✕ | ✕ | ✕ | ✓ |

Zoho Expense Features

Zoho Expense is devoted to expense tracking, especially for travel-related expenses. It puts you at an advantage compared to other expense trackers because it works and integrates with Zoho Books, the company’s dedicated accounting software. QuickBooks Online and Xero users can integrate Zoho Expense as well.

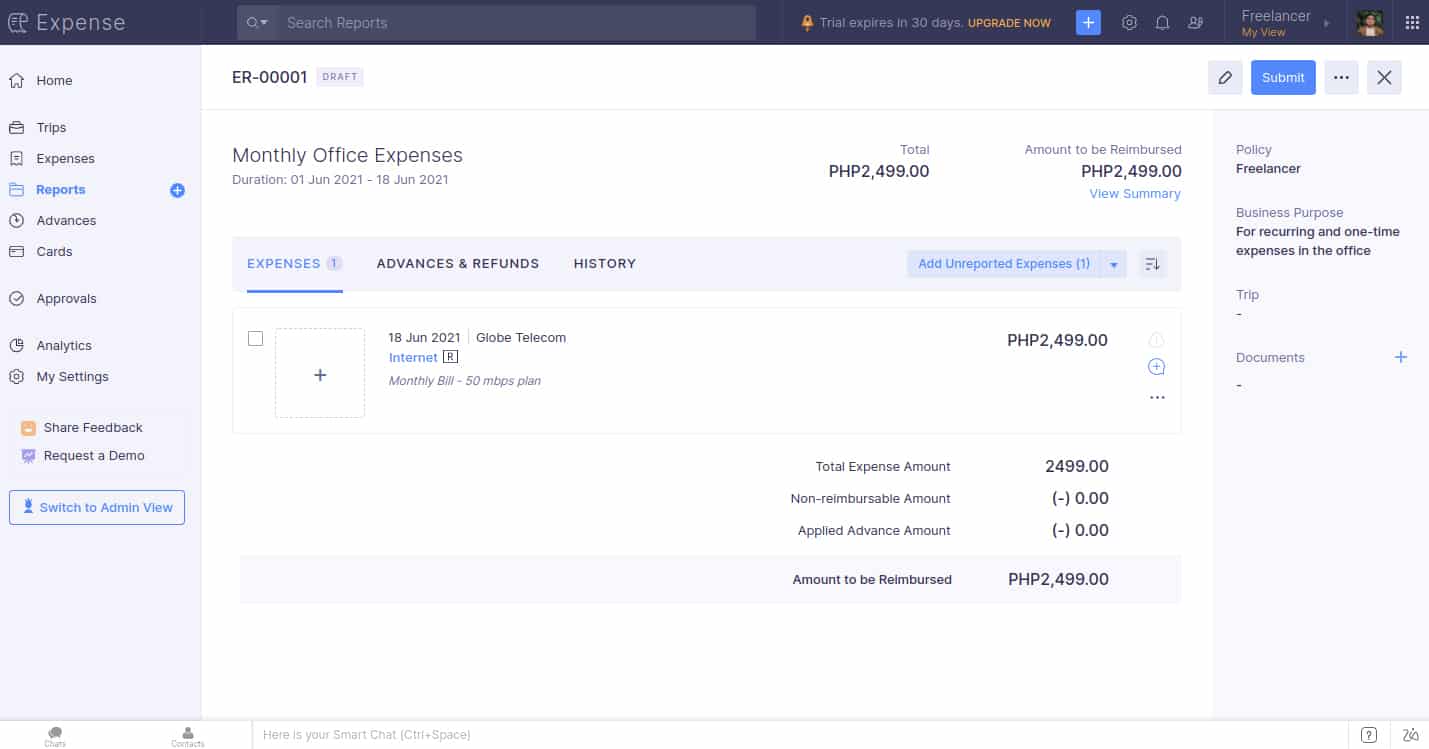

Zoho Expense didn’t disappoint in expense tracking. However, we noticed that users still need to submit expense reports before expenses are reviewed. Though this is not a major miss, it would be better if the platform would allow real-time expense approval for faster review, approval, and reimbursement. Overall, submitting reports in Zoho Expense isn’t difficult and tedious, and we still recommend this software to small businesses.

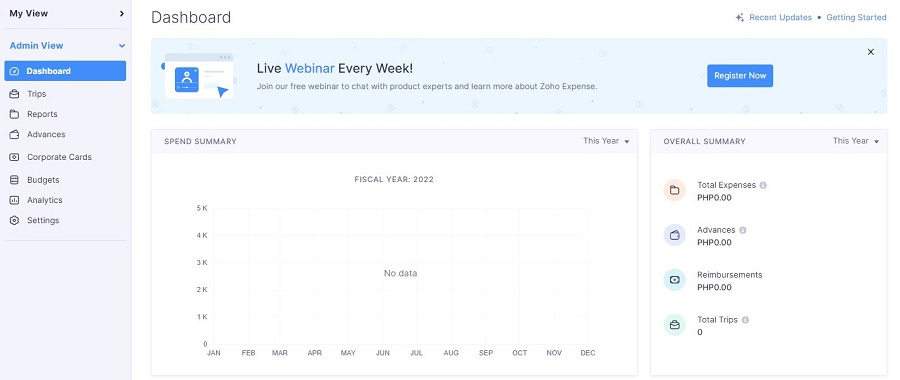

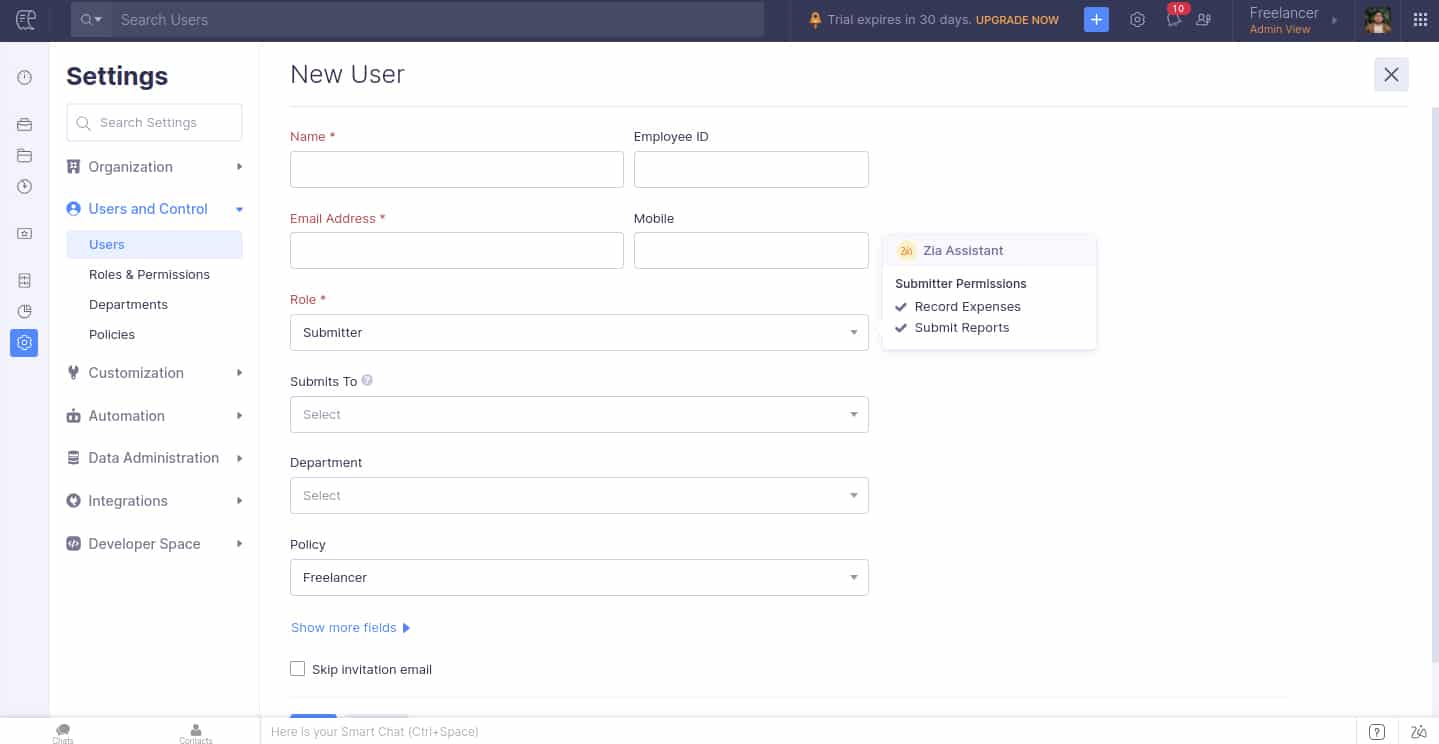

The dashboard is available in the Admin view. Companies can delegate certain employees with the Admin role so that they can oversee everything in the expense reporting and reimbursement process. Only users with the Admin role can add Submitters, Approvers, or other Admins.

On the dashboard, you can see an overview of everything that’s happening, from pending trips to top violators. Overall, it provides managers with useful information about the business.

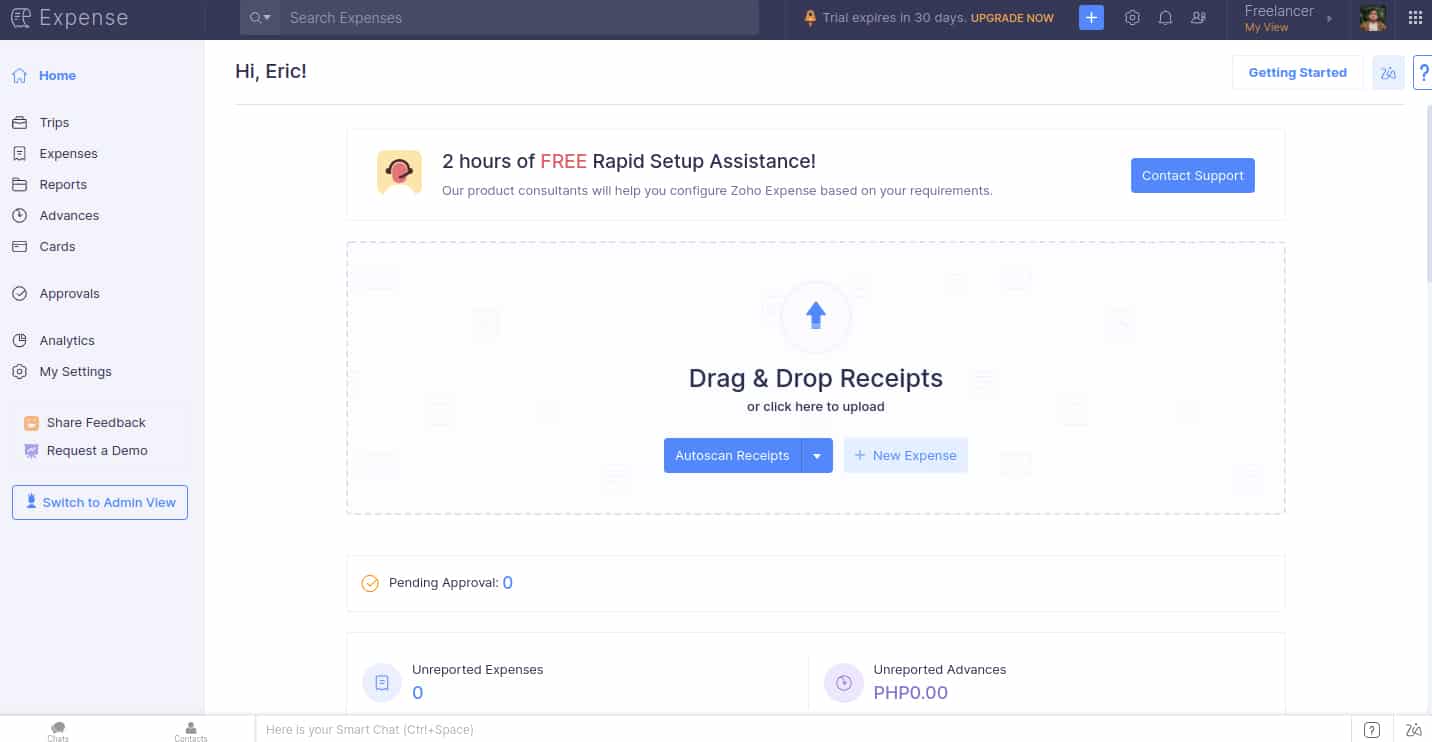

The home screen welcomes users with a Drag & Drop Receipts feature. You can autoscan receipts, upload them from your computer or the cloud, or enter them manually. This screen will appear only to employees with a Submitter role. Being one of the best receipt scanner apps available today, Zoho Expense makes documentation easier and faster.

Zoho Expense home screen for submitters

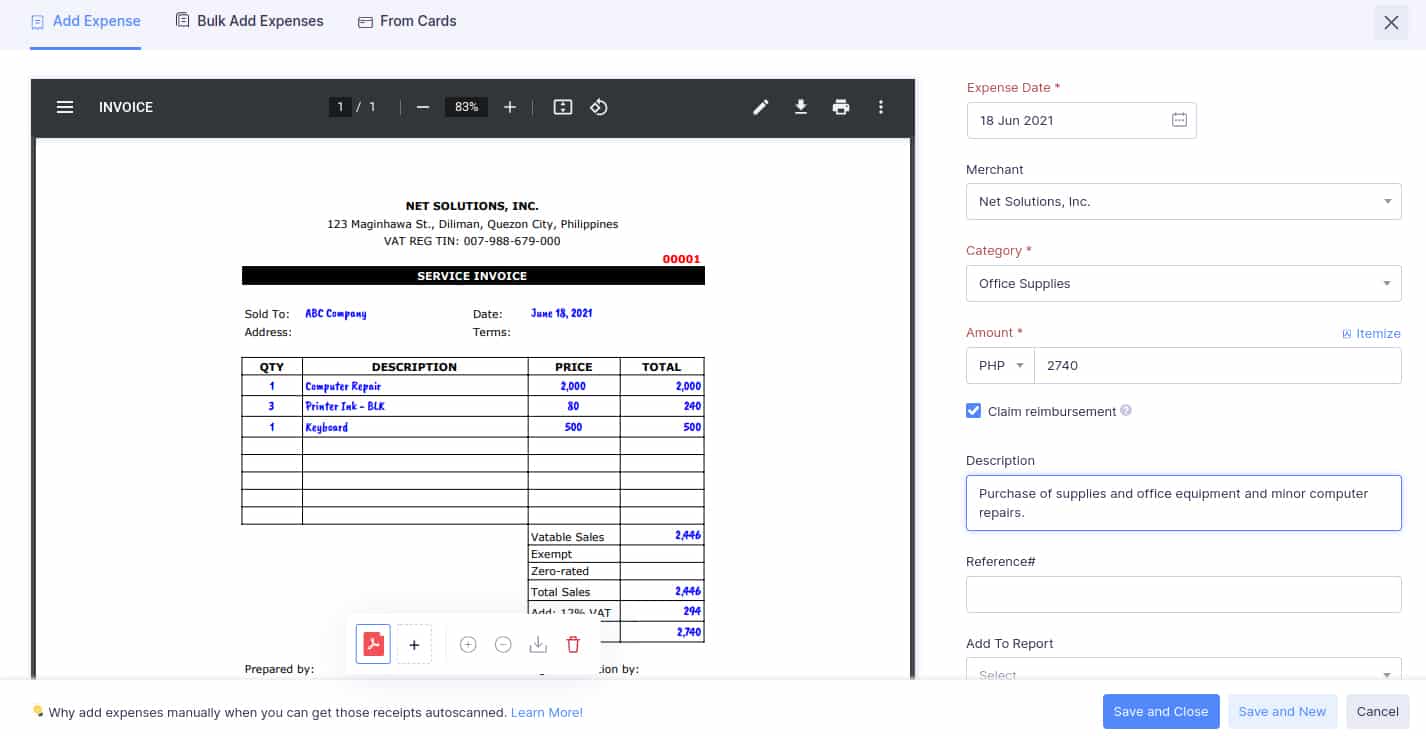

When manually entering expenses, you can click New Expense, and a pop-up window will appear. You can attach receipts here as well. When enumerating expenses, you can either choose a single-expense mode or an itemized-expense mode. After filling up the fields, you can either click Save and Close or Save and New.

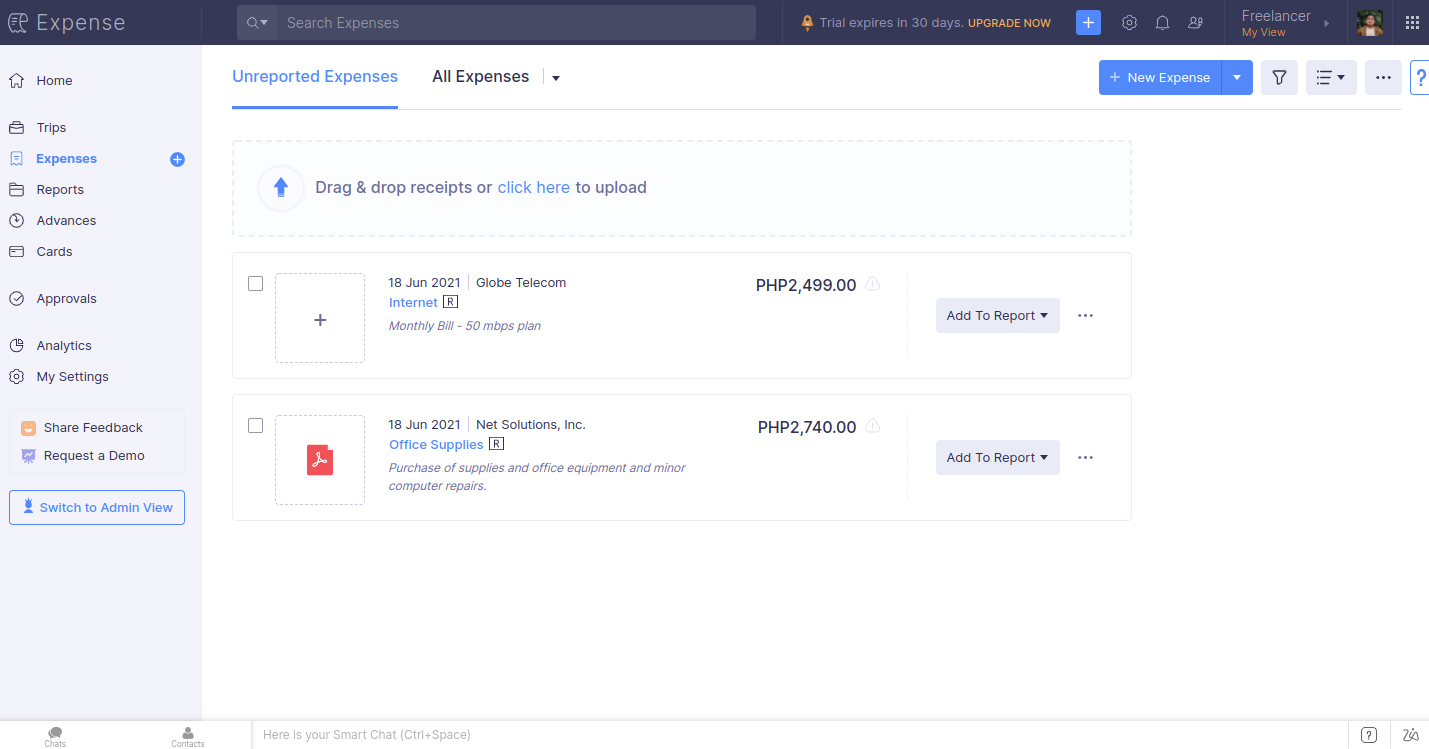

Expense tab showing all unreported expenses

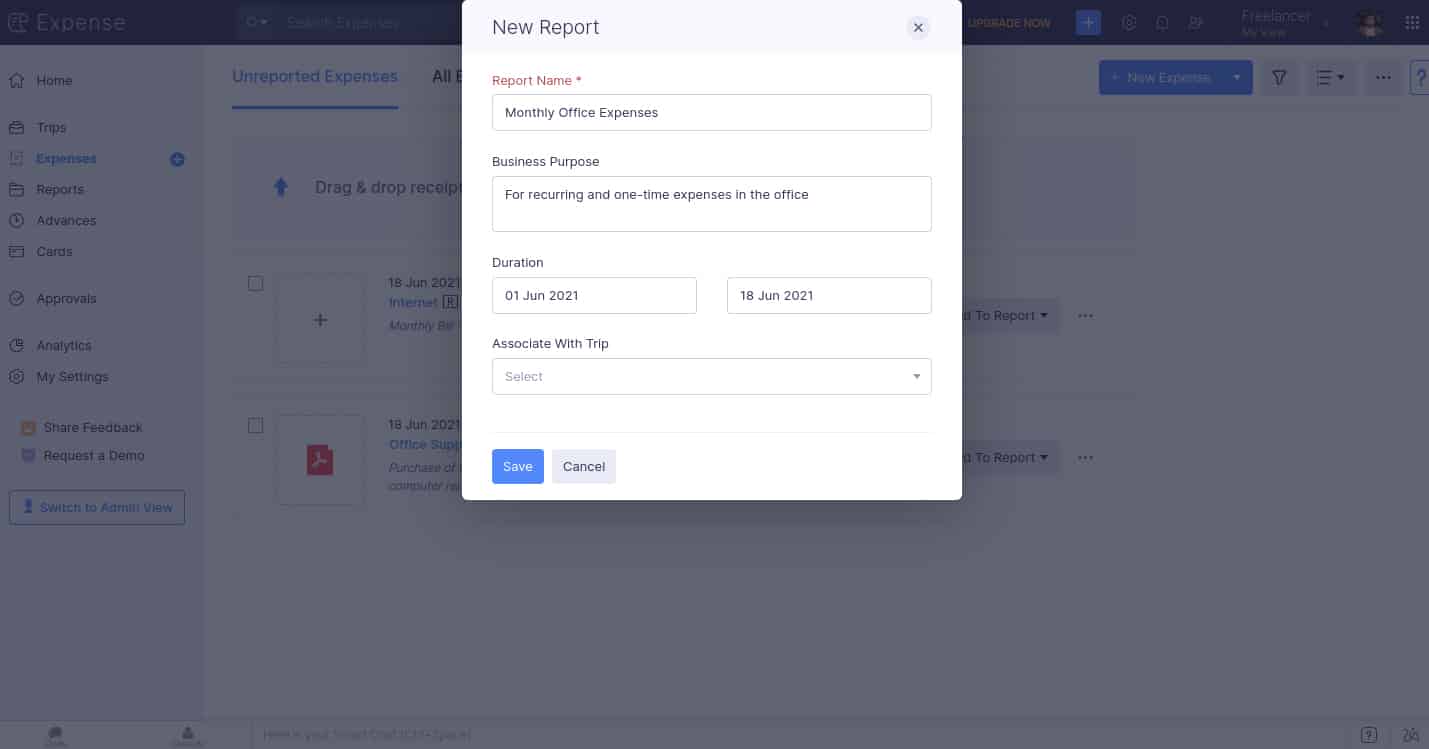

When you visit the Expense tab, you’ll see all your expenses categorized as Unreported. To report expenses, click Add to Report, and a pop-up window will appear. If you want to add it to existing reports, click the report’s name from the dropbox.

Adding expenses with uploaded invoice

If you want to see all your expenses, click All Expenses to view all unreported and reported expenses.

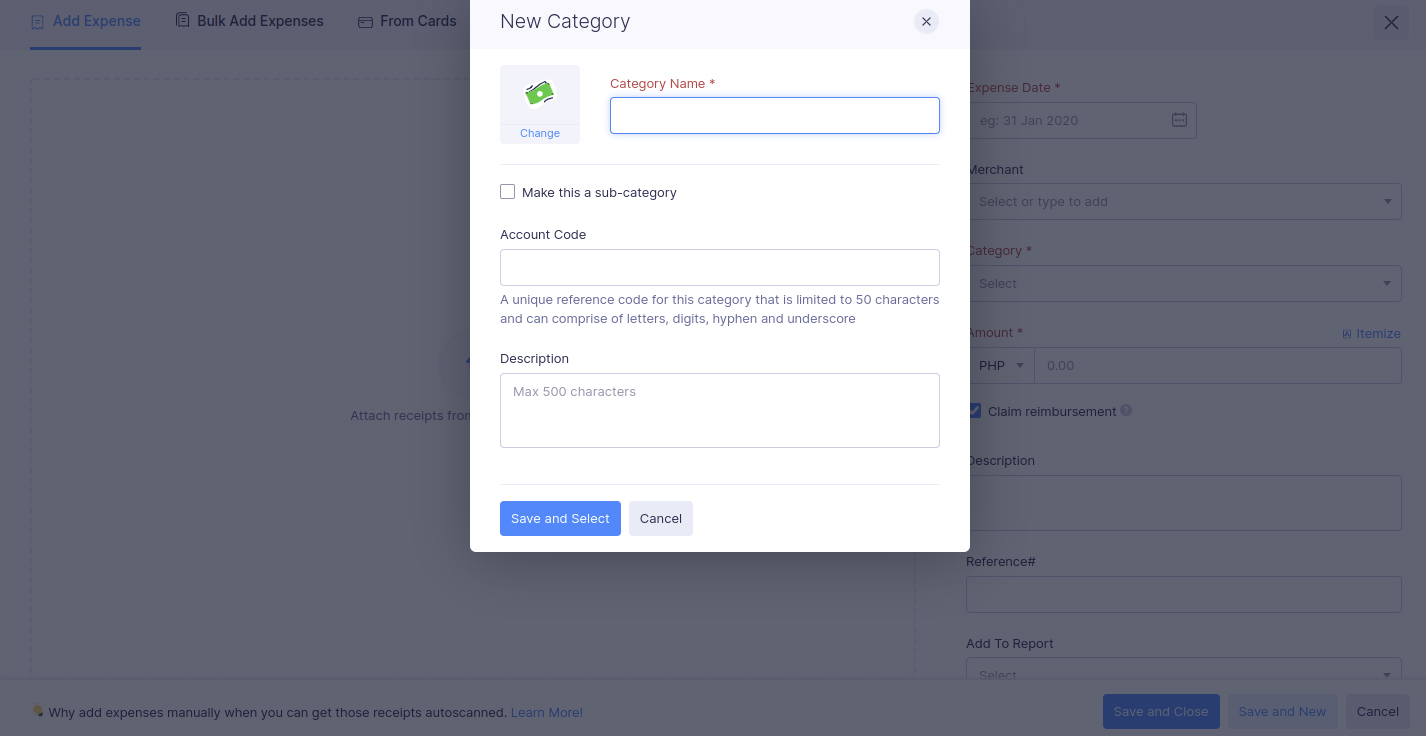

If you want to add a new type of expense, you can create a new category by clicking the + button in the category dropbox. You can set the category name and make it a subcategory of an existing category. You can also add an account code and a description.

Adding New Categories while entering a new record

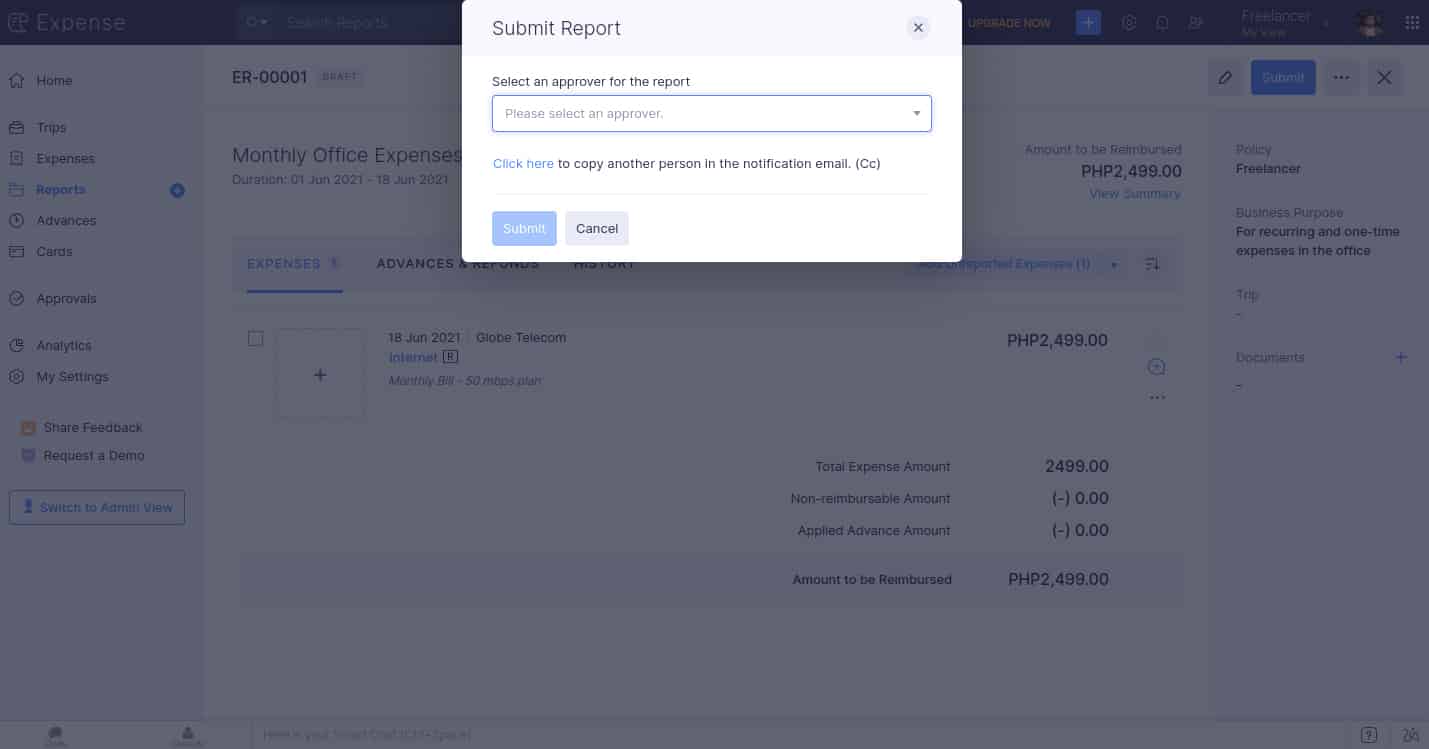

After creating a report, all reports will be categorized as Unsubmitted. By clicking the Submit button, a pop-up window will appear, prompting you to enter the approver’s name. Once submitted for approval, the approver will see the report on their end.

After viewing the report, the approver may reject the report and enter the reason for rejection in the pop-up textbox window. Once rejected, the report will be categorized as Rejected. The accountable person may re-submit the report after addressing the reason for rejection.

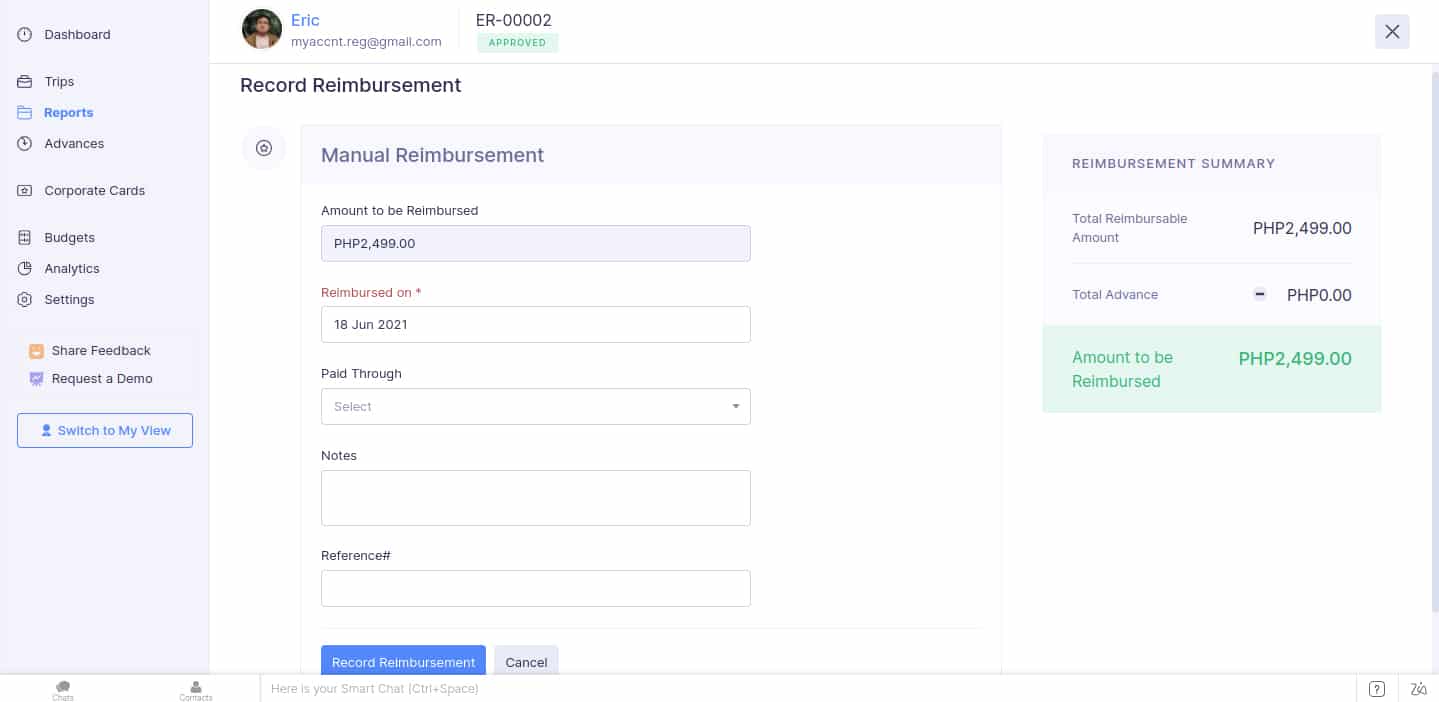

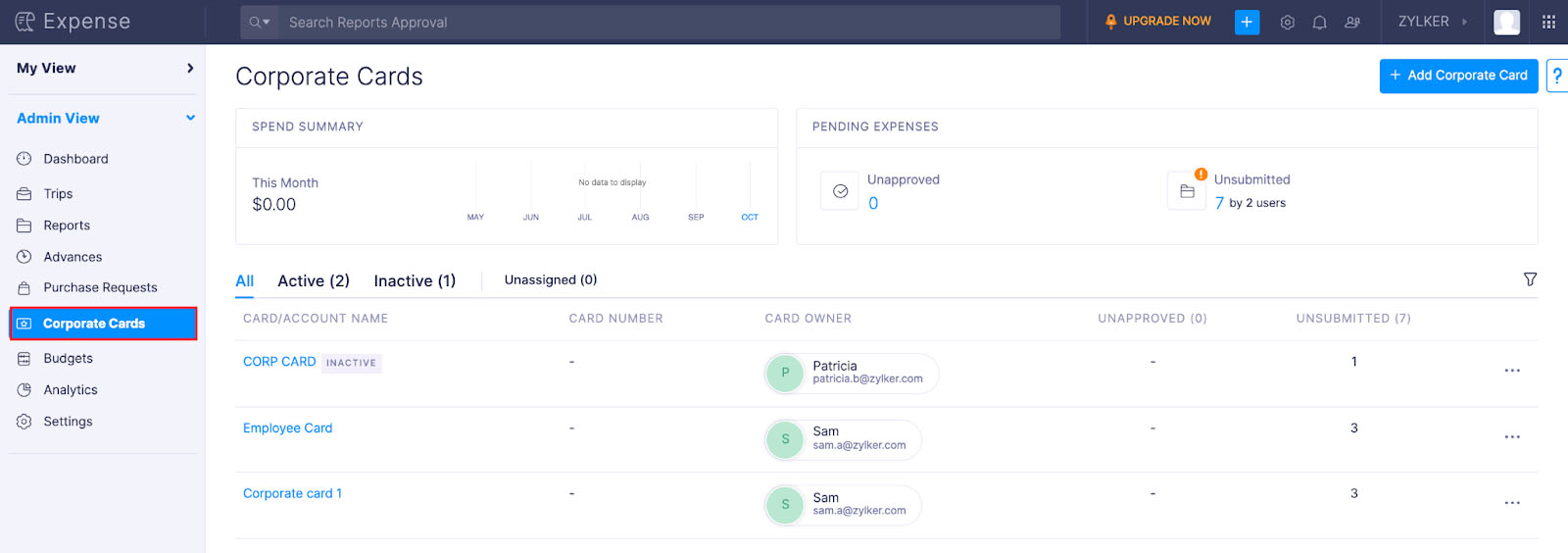

If the user doesn’t have a corporate card, the reimbursement will have to be made manually. Otherwise, all expenses charged to the corporate card will feed into Zoho Expense’s approval and reimbursements automatically.

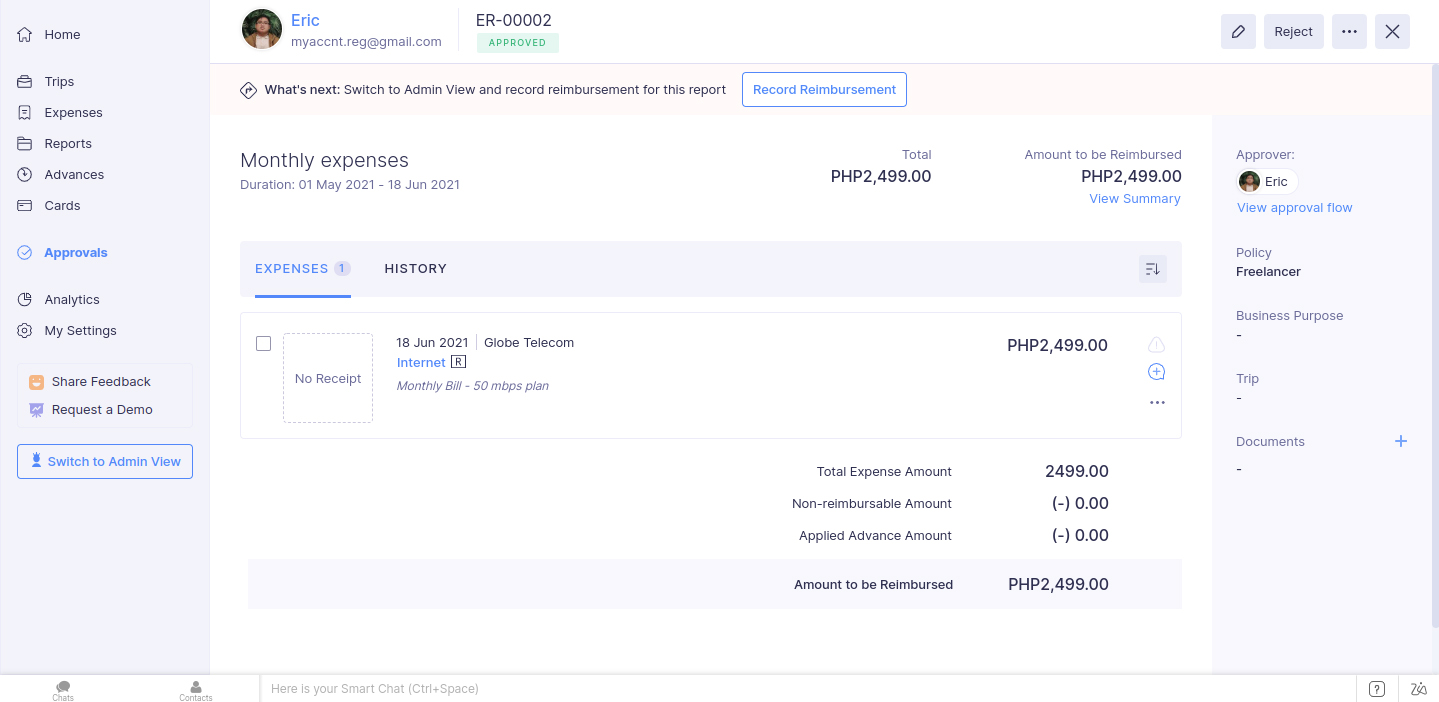

Once the report is good to go, it can now be reimbursed by clicking Record Reimbursement. After clicking, the report’s status will be marked Reimbursed.

Reimbursement Screen

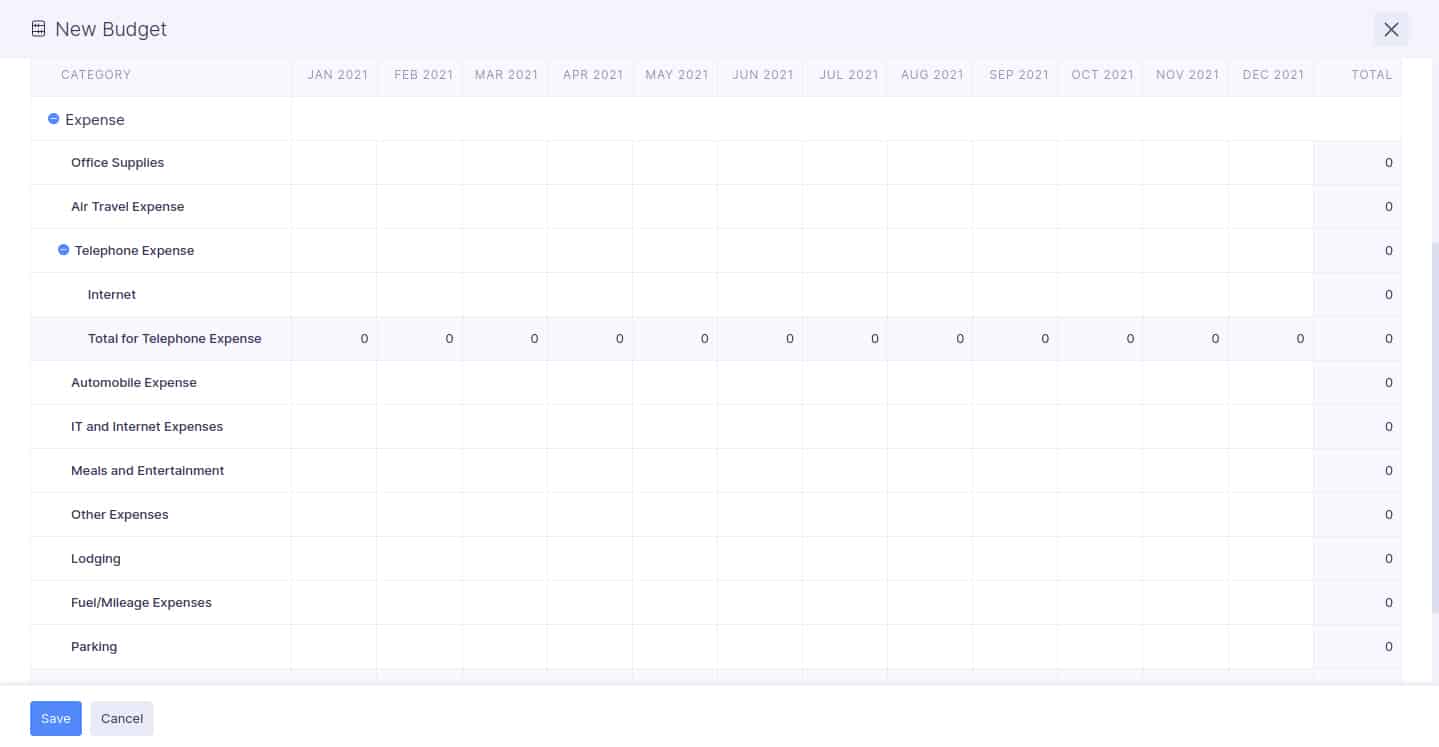

Zoho Expense also lets you create budgets for your expenses. Click the Budgets tab in the admin view of the dashboard, and it’ll show you how to create a new budget.

Budget screen

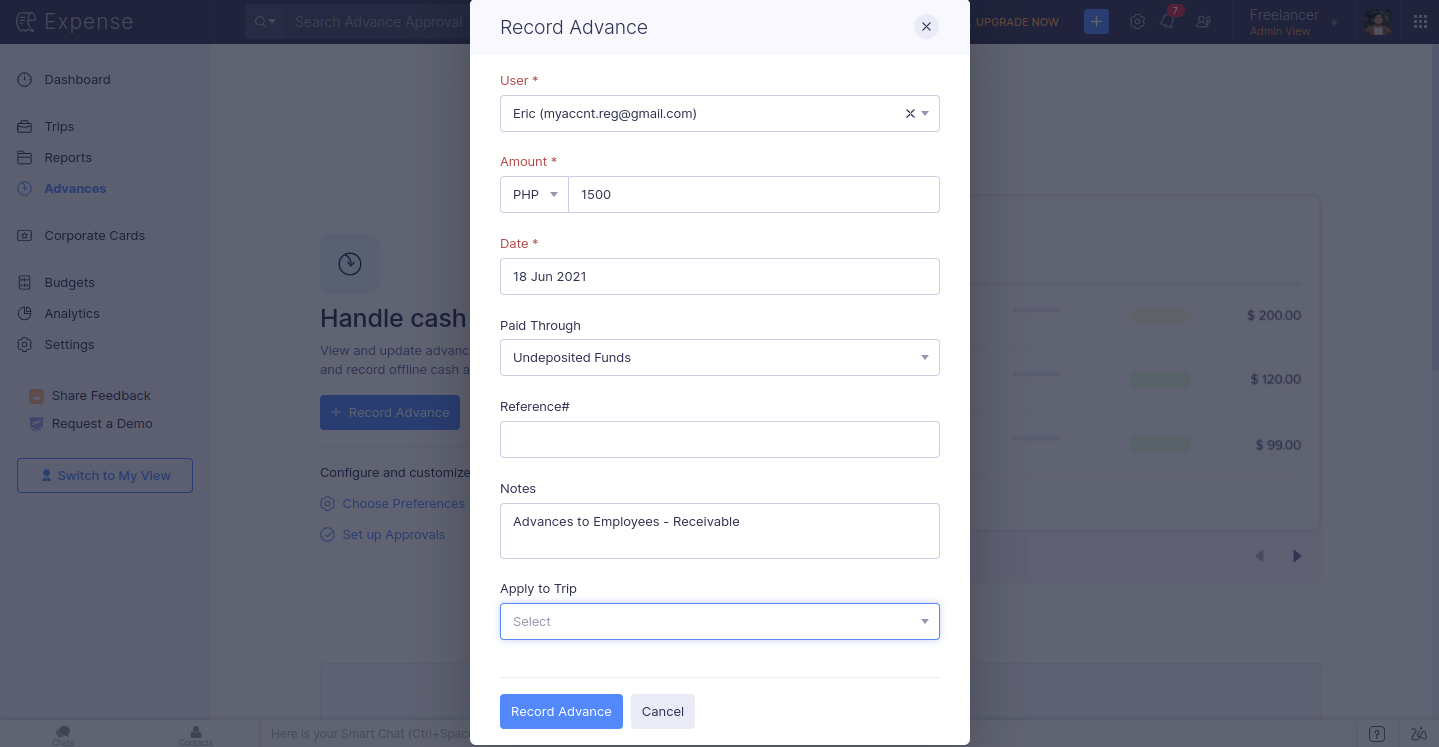

Apart from expenses, you can insert advances from employees. Advances use the same process as Expenses. After adding an Advance entry, it’ll appear in the Advances tab. You can then click Submit. If the user has existing unreported expenses, Zoho will ask to include unreported expenses automatically in a new report.

Once submitted and approved, the advance will offset the expense when the expense is incurred and submitted. After submitting, the report will be marked as Reimbursed.

Recording Advances made to employees

Zoho Expense has a mobile app that can be downloaded from App Store or Google Play. The app contains the same features as the web version. Through the app, submitters can use mileage tracking to monitor travel expenses and submit payments and reports for faster reporting of expenses.

Zoho Expense includes secure sockets layer (SSL) encryption and multifactor authentication (MFA) to prevent unauthorized access. Additionally, you can set up permission access to control what employees within your organization can see and do. If your company is already using other Zoho apps, Zoho has an SSO feature. You only need to sign in to your Zoho account, and you will be logged in to all Zoho apps you’re subscribed to automatically.

Zoho Expense does great in connecting your third-party corporate card programs to the system. You can manage, review, and approve card transactions easily.

We like that the platform provides flexibility to the users, especially those with existing corporate card programs. It would be a big plus if Zoho Expense could also issue prepaid cards as an added function; however, we don’t see this as a major miss. We’d prefer if Zoho Expense could work with card providers and offer real-time card feeds rather than simple direct feeds.

Corporate Cards

Zoho is one of the providers that offer excellent customer support. It features a detailed knowledge base that discusses all the features and capabilities of the software. Zoho Expense users can also access different support channels such as phone, email, live chat, and chatbot. These are why it scored well in our ease of use criterion.

Its integration with accounting and ERP software like QuickBooks, Zoho Books, Xero, Oracle, SAP, and Sage makes the platform a flexible pick. Also, Zoho’s integration with productivity software like Google Workspace, Microsoft 365, and Slack adds more ways for Zoho Expense to send alerts and gather receipts much faster.

How We Evaluated Zoho Expense

As part of our best business expense tracker apps buyer’s guide, we evaluated Zoho Expense’s features and capabilities based on the following criteria:

15% of Overall Score

Pricing is an important part of your decision. In evaluating this criterion, we considered factors, such as a free trial, monthly and annual billing options, scalability, plan customizability, and price comparison with competitors.

40% of Overall Score

Since we’re evaluating expense trackers, we placed significant weight on expense tracking features. We evaluated this criterion based on the major expense workflow steps: recording, review, approval, and reimbursement.

25% of Overall Score

We include card programs in our rubric since we believe that expense tracking should be tied to the business’ card program. Here, we considered whether the provider can issue cards or enroll in third-party corporate programs.

20% of Overall Score

The ease of use score revolves around customer support channels, integrations, user reviews, and our expert rating. The software must make it easy for users to access support in case of problems. Moreover, it must have adequate integrations with other software so that it would be easier to insert it into existing business processes. We looked at user reviews from third-party websites for the user review scores. We weighed the comments and made sure that we remained objective in our evaluation.

Frequently Asked Questions (FAQs)

Zoho Expense is focused on tracking, approving, and reimbursing employee expenses while Zoho Books is bookkeeping software that tracks assets, liabilities, revenue, and expenses to produce financial reports like an income statement or a balance sheet. Both are both apps within the Zoho environment.

Aside from the 5 GB receipt storage and maximum limit of three users, features like travel requests, approval flows, and budgeting are unavailable in the free plan. The free plan is suitable for mom-and-pop shops, freelancers, solopreneurs, and startups.

Bottom Line

Zoho Expense is a great auxiliary app to supplement your dedicated accounting software. It helps speed up expense recording, approval, and reimbursement processing. Moreover, users of Zoho apps only need one account to integrate with Zoho Expense easily. Overall, it is an excellent app for tracking and managing expenses.