A credit check for employment is a type of pre-employment background screening that specifically looks at a candidate’s financial and credit history. Most companies don’t run credit checks on every new hire, typically reserving that for candidates applying for a position that deals with money. If and when you do run a pre-employment credit check, you must follow certain standards such as giving the candidate the right to dispute negative results.

Much like a background check, you’re looking for information that would disqualify a candidate for employment. While it may not be the best way to determine responsibility and capability, running a credit check can shed light on whether a candidate could be a risk to your organization.

How to Run a Pre-employment Credit Check

No federal law requires employers to run credit checks. If you choose to run one, there are FCRA standards that you need to follow, such as allowing the candidate to view the report and verify its accuracy, receive notification of adverse action, dispute the report, and have it corrected, etc. However, some cities and states forbid using pre-employment credit checks or restrict how and when companies can use them.

You can use a credit check company to run a pre-employment credit check. Covering it in a background check policy is also a good idea. This will ensure your HR staff (or whoever is managing the process) follows the proper steps and helps minimize risks for your business.

The general process is as follows:

Step 1: Obtain an Authorization Form

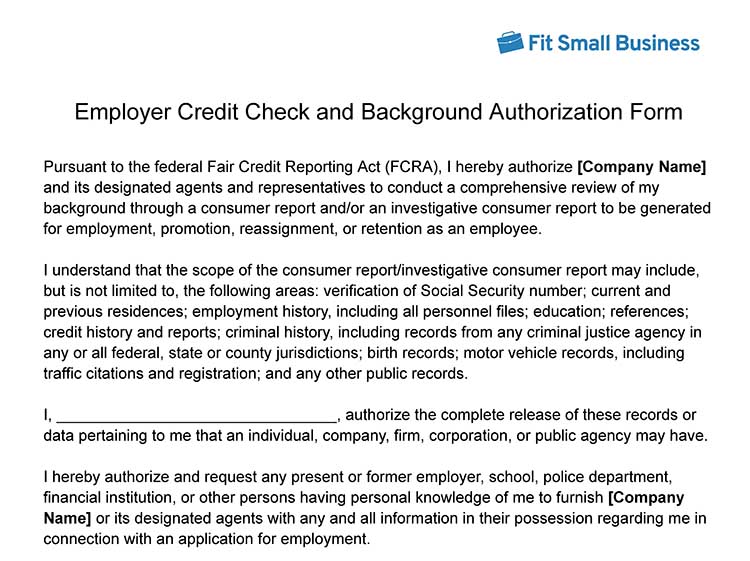

To run a credit check on a candidate, you must obtain permission from that individual. Have the candidate sign a Fair Credit Reporting Act (FCRA) credit check authorization form. We have provided a customizable template for your use.

Thank you for downloading!

Need help with credit checks? Consider using GoodHire for all your credit check and background check needs.

It is recommended that you keep a copy of the authorization form either in your candidate file or employee personnel file. This will safeguard your company against any potential lawsuits.

Step 2: Run the Pre-employment Credit Check

Your pre-employment credit check should be run by a reputable credit check company. The company will check the candidate’s credit-to-debt ratio, as well as any delinquencies, outstanding balances, and bankruptcies that may be on their record.

The following may be able to provide you with employment credit checks and verifications.

A credit check can take anywhere from 24 hours to a few weeks to complete. Once the credit check company has completed the check, you will receive the results and can decide on hiring the employee.

If you’re already working with a background check company, it’s a good idea to inquire whether it can add a financial background screen for a small charge. This saves you time and money and gives you all the background check information in one place.

Step 3: Review Results

You won’t get a copy of the candidate’s full credit report, but instead receive a modified and scaled-down version. The results show you the candidate’s payment history, the amount they owe, and their available credit. You’ll also see a limited history.

Negative information on a credit check can include many types of financial details. Whether the details rise to the level of concern where you should deny employment is a different matter and one unique to your company.

Here’s what you may see on the credit check:

- Frequent late payments

- Revolving credit

- Low credit availability

- Excessive bad debt (credit cards beyond 60 days past due)

- Bankruptcies

- Tax liens

- Civil judgments

- Foreclosures

What you won’t see are the candidate’s credit score, account numbers, birth year, and marital status. This will shield your company from liability if you choose not to hire them. Additionally, no information older than seven years will appear on the credit check results unless the candidate has a bankruptcy, which will appear for up to 10 years after they filed.

Compliance Note: According to the FCRA, you cannot deny someone employment solely because they filed for bankruptcy.

Step 4: Take Action

If the results meet your satisfaction, you can extend a formal offer to the candidate. If the results do not meet your satisfaction, provide an adverse action notice to the candidate stating there were negative results on the credit check. Be sure to include a copy of the results and the FCRA summary of rights.

You should then wait at least a week to hear back from the candidate. If there is no response, or you find the explanation to be insufficient, you can reject the candidate and provide them a final notice of adverse action—make sure to include the name of the credit check agency, contact information, and additional FCRA rights.

If you have already provided the candidate with a job offer letter, you can rescind the offer based on the credit check results.

Be careful when using credit check results to deny employment. The Equal Employment Opportunity Commission (EEOC) prohibits employers from discriminating against potential employees when using credit check results to make employment decisions.

Additionally, the House has passed legislation that would prohibit employers from using credit reports for employment decisions, except when required by law or for a national security clearance. The bill also prohibits employers from asking questions about applicants’ financial past during job interviews or including questions about credit history on job applications.

Review our guide to employment laws to make sure you stay compliant.

Common Positions Requiring a Credit Check

Companies running credit checks across the board are usually banks or other financial institutions. This presents an added cost to hiring, but these companies have also determined that uncovering potentially risky hires is worth that cost.

Apart from bank employees, the positions you might want to run a credit check on include:

- Bookkeeper

- Accountant

- Retail clerk

- Retail store manager

- Payroll clerk

- Financial analyst

- Any other position where a worker may use cash or have access to financial information

Besides using a credit check for jobs that touch money, companies may also run a credit check for positions that:

- Deal with sensitive and classified information

- Require handling large money transactions

- Are managerial roles or higher

- Have access to trade secrets

Hiring Candidates With Negative Credit Check Results

If a candidate has several negative marks on their credit check results, that may be enough for you to reconsider their employment—but it ultimately depends on several factors, such as the position you’re hiring for or the specific information in the report. For instance, if the negative marks are older, and the candidate has shown great credit history recently, then maybe they’ve changed and improved their habits.

If you’re hiring a chief financial officer, for example, and they recently filed bankruptcy and have several past due accounts in their credit history, that might warrant removing the candidate from consideration. This type of position will not only have access to your company’s detailed financial records but also client records and employee records. The high-level nature of this position requires a great deal of trust and confidence. If the individual is unable to manage their finances, they may have difficulty providing your company with sound advice.

Meanwhile, if a credit check returns the same results, but this time the position is for a financial assistant, then it may not be as bad. The individual may still have access to confidential information, but their position is not as high-level, so you may be able to better restrict their access, protecting client and company security.

Tip: Remember that you must ensure fairness when hiring employees. While you can distinguish between high-level financial positions and more administrative roles dealing with money, you cannot discriminate against anyone based on their race and gender. You also cannot reject a candidate for a bankruptcy filing alone.

Bottom Line

Running a pre-employment credit check on potential new hires can add time and expense to your hiring process. However, for positions requiring trust and confidentiality of financial information, it may be worth it to protect your company, other employees, and clients.