Explore what documents to keep in an employee personnel file—and which to keep out. Watch our instructional video and download checklists to stay compliant.

Personnel File: Documents to Include (+ Free Checklists)

This article is part of a larger series on How to Do Payroll.

A personnel file is a paper or electronic folder kept for each employee—new, existing, and past—that contains HR and payroll documents. The documents within an employee personnel file should cover the entire employment lifecycle, from offer letters and W-4 forms to performance reviews and termination paperwork. It should also include basic employee documents and compensation information in compliance with federal and state labor laws.

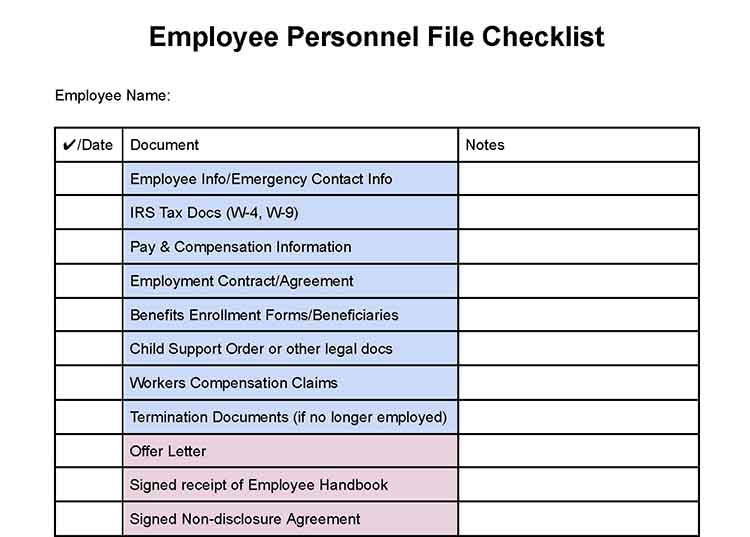

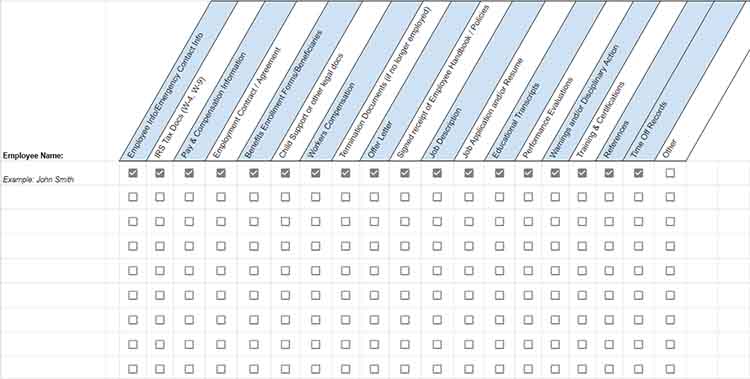

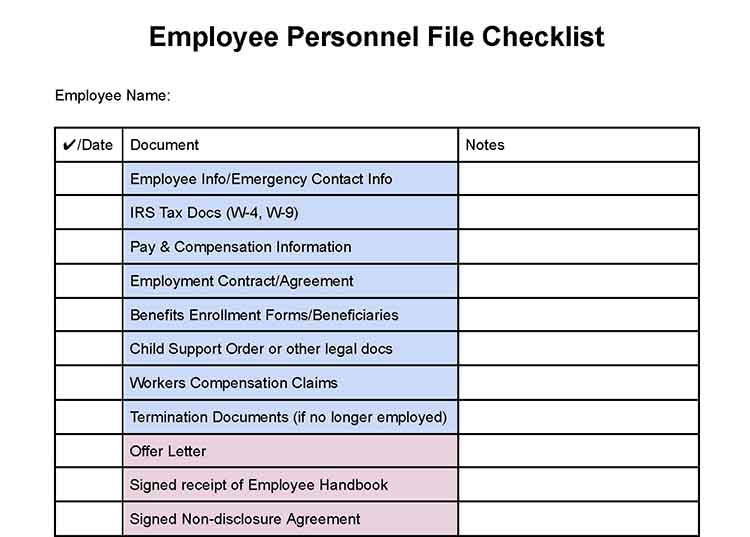

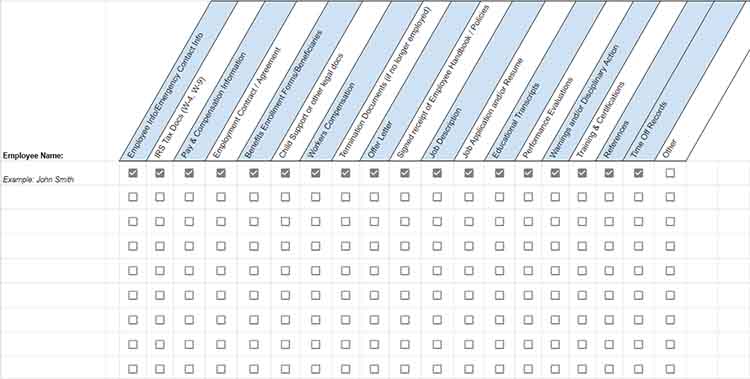

Download our free checklists to help you keep track of what employee personnel file records to store; these can be edited to add documents specific to your company. Then, continue reading for more specific information on what to include and not include in a secure personnel file.

Thank you for downloading!

Need help keeping track of your personnel files?

Let Rippling do all the work for you. They can collect and store all personnel file paperwork in one safe place.

Thank you for downloading!

Need help keeping track of your personnel files?

Let Rippling do all the work for you. They can collect and store all personnel file paperwork in one safe place.

For help setting up a hiring process, follow our guide to hiring new employees.

What Should You Keep in a Personnel File?

As repositories of important information related to individual employees, employee personnel files should include legal documents, company documents, and employee documents.

Companies can use an employee management platform like Rippling to safeguard personnel files and other employee documents. With it, all people operations are done in one place—from onboarding to offboarding, including document management. You can manage and automate employee data and operations easily to ensure compliance. Plus, when you sign up for Rippling, your first month will be free.

What Should Not Be Kept in Personnel Files?

There are also documents that you should not include in the employee’s personnel folder, primarily because of confidentiality. These include the following:

- Pre-employment records, except for the application

- Monthly attendance records

- Anything related to worker eligibility, such as I-9 forms, copies of driver’s licenses, and Social Security cards. Consider putting these forms and related documents that verify an employee’s right to work in the US into a separate folder.

- Equal Employment Opportunity (EEO) records. We suggest that you keep this documentation separate from the employee’s personnel folder; managers should not have access to view this data for the risk of discriminating against an employee in a protected class.

- Private documents—like those protected by the Health Insurance Portability and Accountability Act (HIPAA), also referred to as health information privacy.

- Any other medical information; if you have staff who have given you doctor’s notes or other documentation such as for medical leave, for example, keep these documents separate.

- Private employee data—such as bank account details, Social Security numbers, or immigration documents—are best stored separately from the personnel folder.

How to Set Up Employee Personnel Files

Business owners don’t always realize the importance of setting up personnel files until they’re audited or served with a lawsuit. If you are operating in hindsight and nervous about getting everything set up for employees that already exist, don’t stress. Use the two checklists we’ve provided above, along with the steps for you to get your employee file folders set up and in order.

You should complete the following for organizing and storing personnel records to ensure compliance and security:

First, you need to take an inventory of what you already have for each employee. Ideally, create a personnel file for each employee on the date of hire. However, if you forget to do so, you can find documents—like employee resumes, performance reviews, and tax forms—in your email or online storage. Make sure you also have I-9s for each employee as well, but they should be kept in a separate file.

Use an employee personnel file checklist to make sure everything is in order. Each person might require their own list.

Thank you for downloading!

Need help keeping track of your personnel files?

Let Rippling do all the work for you. They can collect and store all personnel file paperwork in one safe place.

If there are documents on your list that you cannot find in your files, you can request these documents from your employees. Give each employee their checklist to show what they need to submit to update their personnel file. Set a due date for all employee documents to be in and complete. Be sure to review each employee’s list with them present so that if anything was not submitted, you can address it right away.

Follow up with each employee you requested additional documents from before the deadline so that everyone has time to submit the missing documents. Then, store your documents online, on your computer network, or in a locked file cabinet.

You will want to store your personnel documents in a file folder marked specifically for each employee by name. We recommend that you keep employee personnel files in a locked cabinet to safeguard confidential employee information from unauthorized personnel. Access to employee files should be limited to an authorized individual or department whose permission is needed to view the files, such as HR.

Documents can also be stored online with an encrypted service. Rippling provides secure online document storage, including copies of employee contracts, policies, and a copy of your employee handbook.

With Rippling, you can store employee personnel files directly in the system under each employee.

Schedule a periodic review of each employee’s personnel file as part of your HR compliance. This can be done when you conduct their annual evaluation. Ensure that the files are accurate, up-to-date, and complete. If not, you can ask the employee to provide you with the updated files or information. Your business should verify that files are in order before any audits, such as payroll or labor.

Use a personnel file audit checklist to help keep track.

Thank you for downloading!

Need help keeping track of your personnel files?

Let Rippling do all the work for you. They can collect and store all personnel file paperwork in one safe place.

Please note, personnel files can be viewed during a government audit or subpoenaed in the event of a wrongful termination lawsuit. Maintaining accurate, up-to-date files will help you avoid liability.

Follow our onboarding guide to learn how some of the personnel file documents will be used upon hire.

Federal & State Laws About Personnel Files

Being compliant with federal and state law is an important aspect of being an employer because you’re required to maintain employee data and personnel files. Here are the best practices, as well as what is required, at the federal and state levels.

Personnel File Frequently Asked Questions (FAQs)

Some states require an employer to let their employees view their files. In these states, the employee may just want to see what personal information the company has on file and/or any disciplinary action notices. Former employees may also request their personnel files to see what information may be passed to their new employers, or if they intend to bring a lawsuit against their former employer.

If you no longer want to have a filing cabinet full of papers, you can easily convert your employee personnel files to electronic storage, such as through Microsoft Excel or Google Sheets. Or, you can use a free HR software solution where you can create custom fields for employee profiles and store employee records.

According to the US Equal Employment Opportunity Commission (EEOC), employers must keep personnel files of former employees who were involuntarily terminated for a minimum of one year after termination. Additional law states that payroll records must be kept for a minimum of three years after termination.

The best way is to dispose of paper files by shredding them. For electronic files, you can transfer them to an external hard drive and then wipe the files from your computer.

Bottom Line

Maintaining personnel files is an important part of being an employer and protecting yourself from liability. It’s a great way to organize employee data and provides support for human resource decisions. You can choose to manage the employee personnel files electronically or use a paper-based system; either way, it’s important to include basic employee reports and adhere to the appropriate federal and state laws.