FarmBooks, by Sanders Software Consulting, is a locally installed farm accounting application that helps farmers and ranchers simplify various agricultural business workflows, such as invoicing, payroll, and inventory. Its features include accounts receivable (A/R) and accounts payable (A/P) management, inventory management, and a check writer.

The biggest downside to using FarmBooks is that it uses a complex transaction classification system, so it may be unideal for farmers with no bookkeeping experience. However, FarmBooks is the most affordable farm accounting program we’ve evaluated, with a cost of $495 for a single farm, plus a $95 annual maintenance fee after one year. So, if you manage a single farm operation, you might be interested in trying it. We haven’t found a FarmBooks review as of this writing, so we recommend asking around in farming communities for insights.

We evaluate every farm accounting software we review using a specialized rubric that covers criteria essential for agricultural accounting. This approach allows us to create accurate and well-researched reviews and provide customized recommendations based on the unique accounting needs of farmers. By using this methodology, we are able to commit to the Fit Small Business Editorial Policy—which is to provide the best answers to people’s questions.

Pros

- Most affordable farm-specific accounting software we’ve reviewed

- Includes farm-specific inventory management features

- Lets you create enterprise codes to track both farm and personal expenses

- Includes built-in payroll at no additional cost

- Has a batch-entry feature to process a large number of transactions

Cons

- Requires an additional fee for additional farms

- Difficult to share books with a bookkeeper or tax pro

- Can’t send recurring invoices

- Lacks a mobile accounting app

- Has a unique ATIGD transaction classification structure that may be difficult to master

FarmBooks Alternatives & Comparison

FarmBooks Reviews From Users

As of this writing, we haven’t found a FarmBooks review from users online. We recommend contacting the provider directly or reaching out to those who have used the software to learn about their experiences.

FarmBooks vs Competitors

We compared FarmBooks to our recommended alternatives based on a unique scoring system.

FarmBooks vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

FarmBooks $495 per farm

-

QuickBooks Online From $30 per month

-

The Farmer’s Office Custom-priced

-

Wave Free

As a specialized farm software, it’s no surprise that FarmBooks beats QuickBooks Online and Wave in the farm-specific features category. Also, it outshines The Farmer’s Office due to its ability to track personal income and expenses—which isn’t possible in the said competitor. Moreover, FarmBooks pricing criterion also excelled; it comes with a one-time fee of $495 plus $95 per year—the most affordable farm-specific program on our list. Wave came out on top because it’s a free accounting software.

Additionally, FarmBooks performs well in accounting features but trails behind QuickBooks because it can’t send recurring invoices and it’s difficult to provide access to your accountant.

The program didn’t do well in ease of use because it uses a unique coding structure for tracking activities, making it unideal for farmers with no bookkeeping experience. An easier-to-use alternative is QuickBooks Online or Wave.

As mentioned earlier, FarmBooks is the most inexpensive farm-specific program we reviewed, costing $495 for a single farm installation, plus an annual maintenance fee of $95 for program updates and support after one year. Despite the annual fee after the first year, we still consider the pricing structure as affordable given the benefits and features it offers.

If you have more than one farm, you should contact the provider for customized FarmBooks pricing. The program would have earned a perfect score if it offered monthly subscription plans, which we believe provide greater flexibility for small-scale farmers.

If you need to back up your farm data, you can purchase FarmBooks database backup via offsite secure file transfer protocol (FTP) for as little as $5 per month or request a customized quote to back up your entire server.

FarmBooks offers essential accounting features, such as A/P and A/R management and bank reconciliation. However, we found that there are some useful features missing, such as the ability to create recurring invoices and generate A/P and A/R aging reports. Also, it’s difficult to share a copy of your files with your accountant.

Here are some of the salient FarmBooks accounting features.

Transactions in FarmBooks are classified using three types of codes:

- The ATIGD is a five-digit code that provides a general classification of your farm’s earnings, expenditures, losses, wage, wage withholdings, and A/R.

- External codes may be used with ATIGD for more detailed transactions, such as family living, miscellaneous, or loans.

- The optional enterprise codes can track crop or livestock production or other nonfarm business.

The coding system will take time to learn, but it’s intended to allow you to track all of your activity in meaningful ways without having to understand the journal entries that bookkeepers generally rely upon.

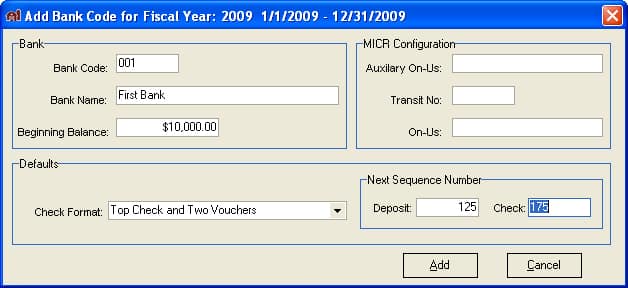

You can set up and manage as many bank accounts as needed in FarmBooks. To set up a bank account, click on the Setup menu and select Bank Accounts. Click the Add button on the Bank Accounts window, enter your bank information, and click Add:

Adding a new bank account in FarmBooks (Source: Sanders Software Consulting)

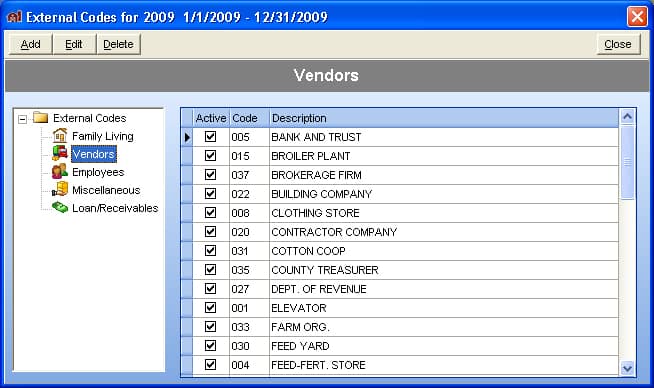

The A/P module in FarmBooks allows you to create a new vendor and manage your list of vendors. What we like about the A/P feature is that you can track your unpaid bills as well as track payments to 1099 contractors. However, FarmBooks has a few downsides, such as the inability to enter vendor credits to record refunds to the vendor and attach receipts to expenses.

Below is a sample vendor list in FarmBooks:

Sample vendor list in FarmBooks (Source: Sanders Software Consulting)

With FarmBooks, you can generate invoices, estimates, and billings, which can be sent directly to your customers. It can also post payments and deposits automatically and monitor customer balances. You can generate various invoice forms and statements and email them to your customers, and you can also track sales tax collections.

The biggest limitation of FarmBooks’ A/R feature is that there’s no option to create recurring invoices. If you have a customer who orders the same product or service on a regular basis, you may benefit from recurring invoices, which are offered by other programs such as QuickBooks Online and The Farmer’s Office.

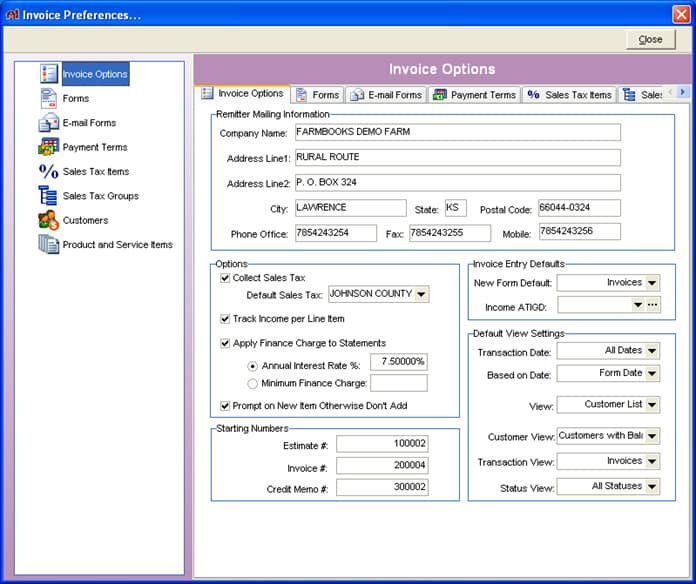

When it’s your first time using the invoicing feature in FarmBooks, you need to specify a few invoice preferences before you can create invoices:

- Invoice options: This tab lets you enter your business remitter mailing details, as well as set up a few important options, such as whether you collect sales taxes or you apply finance charges to statements. You’ll also specify how you want your income to be tracked.

- Forms: This section allows you to personalize your forms by including your business logo and adding images and text messages. You can customize various forms, including invoices, estimates, and credit memos.

- Email forms: Make your email more personalized by adding customized email messages.

- Payment terms: Indicate due dates and any discount given within a certain period.

- Sales tax items: Set up important tax items like tax rate, description, and payment vendor.

- Sales tax groups: This feature is for users who need to pay tax amounts to several tax authorities―city, local, and state.

- Customers: Set up customer addresses, email contact information, and payment terms.

- Product and service items: Set up items for the products or services you sell to your customers, including unit prices, weight per unit, and quantity codes:

Setting up invoice options in FarmBooks (Source: Sanders Software Consulting)

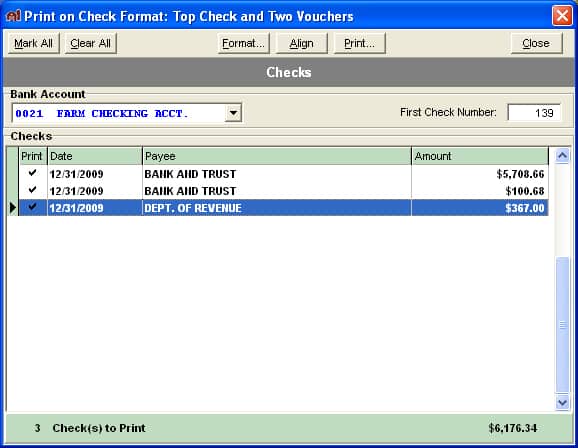

FarmBooks allows you to record and print checks directly while completing the payee/vendor, date, check number, and bank account information automatically. The checks are then registered in the farm’s accounts automatically to help monitor payments to vendors and other expenses.

To print a check in FarmBooks, click on File and select the Print Checks drop-down. Choose from the list of checks, click beside the check icon in the check item, and click the printer button:

Selecting checks to print in FarmBooks (Source: Sanders Software Consulting)

Your FarmBooks account includes “Payroll Defaults,” which contains a master list of earnings, deductions, and benefits that you can assign to your employees. You can adjust this list based on your needs, and you can pull in these items quickly when setting up employee records. You’ll need to keep your tax tables up to date, but FarmBooks will help. You can download the latest tax table for the current year from the FarmBooks website.

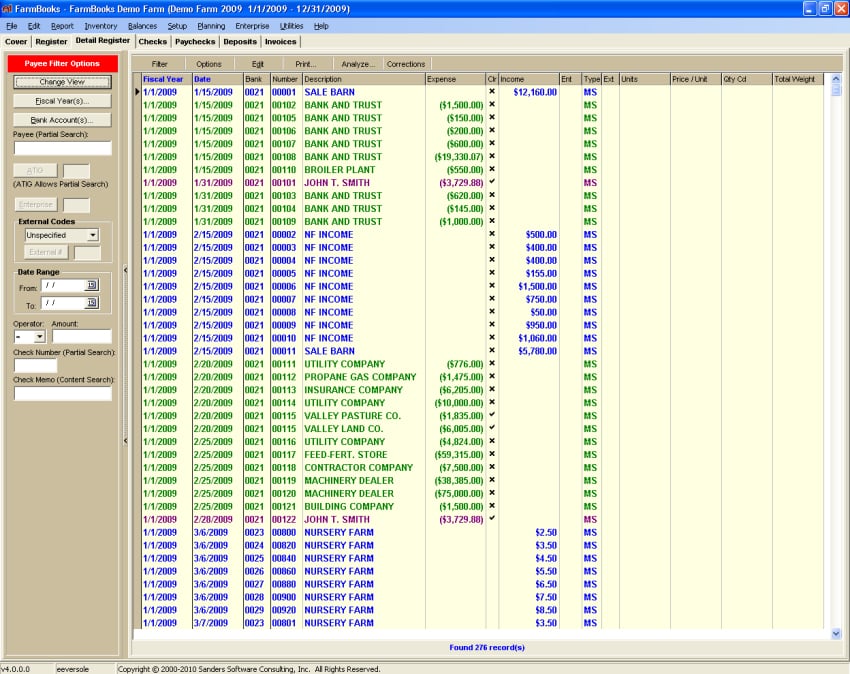

The FarmBooks Accounts Register is similar to the typical paper check register with color-coded transactions. Checks, deposits, and paychecks are green, blue, and burgundy, respectively. The accounts register tab gives you a quick list of all of your farm’s income and expenses:

The Details Register tab displays the same information as the Accounts Register Tab, but you can toggle between the payee and the detail. This means that you can filter down or search for a specific transaction by description, amount, external code, date, check number, and check memo as well as account, transaction, item, and general (ATIG) code:

Details Register in FarmBooks (Source: Sanders Software Consulting)

FarmBooks generates an extensive list of reports for farm and nonfarm transactions. These reports help determine how well your farm is doing, which can help you evaluate business plans or expansion. Some reports you can run in FarmBooks include the following:

- Income statement: Shows total farm income and expenses, including net operating income:

- Transaction journals: All transactions for income, expense, wage withholdings, losses, loans, and A/Rs

- Financial analysis: Farm and nonfarm income and expenses

- Nonfarm income statement: Summary of nonfarm income, itemized expenses, family living expenses, and net nonfarm income

- Monthly cash flow report: Sources and uses of cash by income and expense

- Check register: Listing of all checks, deposits, and transfers

- Balance Sheet: Detailed information on assets and liabilities:

- Income statement/profit and loss (P&L) statement: Farm business receipts, expenses, and depreciation

- Net taxable income statement: Farm and nonfarm taxable income as well as net income

- Schedule F: Farm income and expenses that need to be reported on Schedule F of your individual income tax return

- Sources and uses statement: Sources and uses of cash to compute the net change in cash and ending bank balances.

- Credit analysis: Detailed information on loans and A/R, highlights the financial strengths and weaknesses of your farm

- Flow of funds: Budget versus actual values and the percentage of budget used

In addition to its accounting functionality, FarmBooks offers farm management features that help farmers and ranch managers streamline their daily farm-related tasks and responsibilities. FarmBooks earned a perfect score as it provides all of the features we wish to see, such as the ability to monitor farm and personal expenses, management inventory, and track fixed assets.

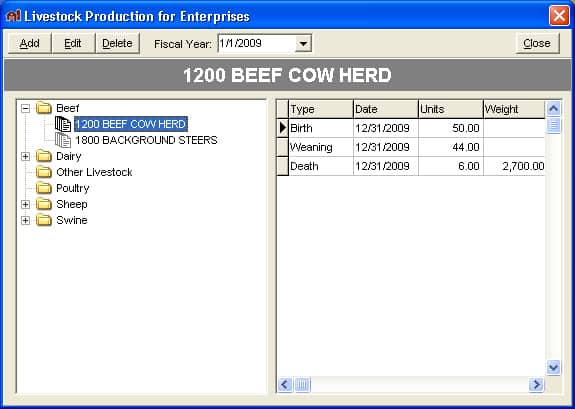

FarmBooks helps you track all your inventory items for easy organization. It includes two units of measurement, real-time inventory for crops, and key dates and weight measures for livestock. With FarmBooks, you can also track births, weanings, and deaths.

FarmBooks inventory module for livestock production (Source: Sanders Software Consulting)

Enterprise codes are used to track both farm-related and personal expenses. With this feature, you also take advantage of FarmBooks’ allocation feature. For instance, when you purchase a 40,000-pound fertilizer, you don’t know where it is allocated to, so you record the cash expense without an enterprise code.

By using enterprise codes, you’ll be able to record and track the actual usage of the fertilizer to a specific crop species or crop field. This helps you determine which among your fields or crops are the most profitable.

FarmBooks has a fixed asset manager that allows you to track the cost and value of your agricultural assets. It helps you set up depreciation, and it calculates the annual depreciation value of your equipment automatically, which can be used for tax planning. If you plan to purchase equipment with a loan, you can create amortization schedules to help you better plan your cash flow requirements.

In addition to being a desktop-based software that’s typically more difficult to learn than a cloud-based program, FarmBooks uses a unique coding structure to categorize and track your activities properly. As a result, it has a steep learning curve, especially for farmers with no bookkeeping experience.

To support new users, FarmBooks offers a comprehensive user guide as well as plenty of online resources, such as user manuals, FAQs, and live training sessions. You can also contact FarmBooks support through email or over the phone or submit a support ticket online.

While FarmBooks comes loaded with general accounting and farm management features, we believe that it’s not a complete package. For instance, there’s no mobile app that would allow you to work on the go. Also, it’s not that popular among accounting professionals, which implies that you might have difficulty finding a bookkeeper who is an expert in FarmBooks.

How We Evaluated FarmBooks

Using an internal rubric, we evaluated and rated the FarmBooks and our other best farm accounting software based on several categories, including pricing, ease of use, and user reviews. Each category has its assigned weights based on how essential they are to our evaluation process.

Below is a detailed breakdown of our scoring rubric:

20% of Overall Score

Each application is evaluated based on its upfront cost and the number of users included. Software providers that don’t disclose pricing information received the lowest scores.

25% of Overall Score

General accounting features like bill tracking, invoicing, and bank account reconciliation are essential to farm operations.

25% of Overall Score

The main farm features we like to see include the ability to track personal income and expenses, track and manage fixed assets, create cost centers or enterprises, and manage farm inventory.

20% of Overall Score

Most farmers have no bookkeeping experience, so the best farm accounting software should be easy to use and provide reliable customer service for first-time users.

10% of Overall Score

Our experts conducted a subjective evaluation of each software program across several factors, such as ease of use, features, and popularity.

Frequently Asked Questions (FAQs)

It costs $495 per single farm installation, and after one year, you’ll pay a maintenance fee of $95 for product updates and support.

Yes, farmers with no background in bookkeeping may use FarmBooks. However, we recommend that you hire an experienced bookkeeper to help you get the full benefits of the software.

If you don’t find FarmBooks suitable for your needs, you should consider QuickBooks Desktop or explore our recommendations for the best farm accounting software.

Bottom Line

Whether you’re a small-scale farm business owner managing a single farm or a self-employed rancher, FarmBooks is a low-cost solution for you. It gives you access to many great farm-specific features for around $500 plus $95 per year. FarmBooks works best if you’re keeping your books on a single computer and don’t need remote access.