Wave is inexpensive cloud-based accounting software that allows you to manage your bookkeeping, invoicing, and payment processes in one place. It allows you to create and send unlimited bills and invoices, manage invoices on the go with Wave’s mobile app, accept online payments, and generate financial reports among others.

The best things about Wave are that it is easy to set up and that it has a free plan with all the features that many businesses need. A downside is that it lacks advanced accounting features, like project management and inventory accounting. If you’re interested in the program after reading my detailed Wave review, you may sign up for the free plan (Starter) or upgrade to the paid version (Pro) for $16 monthly.

Pros

- Free plan for businesses with basic accounting needs and a single user

- Paid version for only $16 monthly for unlimited users

- Straightforward to set up and use

- Easy to manage unpaid bills—even in the free version

- Good basic accounting reports

- Live chat and email support in paid tier

Cons

- Doesn’t allow you to connect your bank accounts with the free subscription

- Add only one user in the free plan

- Not a good fit for large businesses or businesses with inventory

- Can’t set up separate income and expenses by classes or locations

- Can’t reconcile bank statements when timing differences exist

- Unprofessional-looking reports

Pricing |

|

Free Trial |

|

Payment Processing |

|

Payroll | Deeply integrates with Wave Payroll (read our review of Wave Payroll for more information)

|

Assisted Bookkeeping | Wave Advisors (starts at $149 monthly) will classify transactions, reconcile accounts, and provide monthly financial statements. |

Standout Features | |

Scalability |

|

- Small service businesses: Wave plan is a great free option for small service businesses to invoice customers, track unpaid bills, and compile their income and expenses for a tax return. You can also print a balance sheet, which is important for LLCs, partnerships, and corporations. It’s our top-recommended free accounting software.

- Business with lots of in-person purchases: Wave’s affordable receipt scanning option allows users to take a picture of receipts, categorize the expenses, and upload them to Wave—all on the mobile app.

- Businesses with lots of small credit card sales: Pro subscribers don’t have to pay a per-transaction fee on credit card sales, making it profitable to accept even the smallest credit card charge.

- Small businesses with employees: Wave Payroll is an affordable integration to pay your employees and all have the accounting entries automated.

Wave’s Featured Industry Uses on Fit Small Business

- Best accounting software for freelancers: Best free accounting software

- Best startup accounting software: Best free for startups during their organizational stage

- Best restaurant accounting software: Best free software for food trucks and carts

- Best farm accounting software: Best free for part-time and hobby farmers

- Best real estate accounting software: Best free for property managers

- Best church accounting software: Best free for very small churches

- Best nonprofit accounting software: Best free for volunteer treasurers of very small nonprofits

- Best ecommerce accounting software: Best for Zapier for ecommerce integrations

- Best multicompany accounting software: Best free for up to 15 companies

- Best Mac accounting software: Best free cloud-based Mac accounting software

- Best QuickBooks alternatives: Best free QuickBooks alternative

- Best cloud accounting software: Best free or low-cost software for service-based companies

- Best business expense tracker apps: Best free simple expense tracking and accounting

Wave Alternatives & Comparison

Learn how Wave compares with other accounting software in our head-to-head comparisons:

| PROS | CONS |

|---|---|

| Easy to set up | Invoices are not customizable |

| Great basic accounting features | No live support in the free plan |

| Includes payroll | Reports are poorly structured and lack customization |

Below, I summarized the reviews I gathered from users and shared my expert opinions:

- Ease of setup: Some reviewers mentioned that Wave has a nice and user-friendly interface and layout, making it easy to set up even for those with no accounting experience. I also find Wave extremely easy to set up and use, even the new paid version.

- Great basic accounting features: Many users are satisfied with the basic accounting features offered in the free tier, including invoicing and income and expense tracking. However, it’s a bit of a letdown that Wave no longer lets you connect bank accounts in the free plan.

- Payroll is included: One reviewer likes that Wave includes built-in payroll. I agree that it’s a great integration but want to note that it’s excluded from the price. While it’s very affordable, you will need to pay extra.

- Invoices are not that customizable: One user wishes that they could customize the invoices—but they’re pretty much limited. Wave allows you to upload your company logo and choose the theme color, and I believe you can still make decent invoices out of this. Invoices in the paid tier have more customization features than the free plan.

- Limited customer support in the free plan: Some dislike that Wave has no customer support options in the free plan—unless users enroll in a paid service. I’m happy that Wave includes free live chat and email support in its new paid version. Overall, users on Software Advice awarded Wave 4 out of 5 stars for customer support—which I think is pretty good considering the limited support channels available.

- Reports are poorly structured and lack customization: Some users don’t think the reports were very good—and I completely agree. They’re functional in that you can get the numbers you need to prepare your tax return or fill out a loan application. However, they are very unprofessional-looking and, honestly, I’d be a bit embarrassed to give them to a vendor or bank. They don’t allow for any customization other than you can specify the period covered. Worst of all, the balance sheet excludes beginning and ending numbers—which is a pretty sure sign it wasn’t designed by an accountant.

Here are the average Wave review scores from third-party sites:

- Software Advice: 4.4 out of 5 based on over 1,600 reviews

- G2: 4.3 out of 5 based on around 300 reviews

Fit Small Business Case Study

The Fit Small Business accounting team developed an internal case study to evaluate accounting software across 15 different categories based on a common set of facts and functions. The graph below shows how Wave scores across each category compared with two of its competitors, QuickBooks Online Plus and Zoho Books. I provide a detailed explanation of the scores in the Features section below.

Wave vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Wave From $0, $16 as tested

-

QuickBooks Online From $35 per month; $99 as tested

-

Zoho Books From $0; $50 as tested

As seen in the chart above, Wave beats QuickBooks Online and Zoho Books in pricing and ease of use. However, Wave’s two competitors have notable advantages in terms of features, like banking, A/P and A/R management, inventory, and project accounting.

Wave offers a free plan and a paid subscription that costs $16 per month. I docked a few points because there is no introductory discount for new users of the paid tier—but with a full monthly price of only $16, I don’t see this as a big problem.

The free (Starter) and paid (Pro) plans offer basic features, such as invoicing, income and expense tracking, and payment processing. Pro has additional inclusions, as outlined below.

Pricing & Features | Starter | Pro |

|---|---|---|

Monthly Pricing ($/Month) | $0 | $16 |

Annual Pricing ($/Year) | $0 | $170 |

Credit Card Processing | From 2.9% plus 60 cents per transaction | From 2.9% plus $0 per transaction |

Maximum Number of Users | 1 | Unlimited |

Wave Receipts (Unlimited Receipt Scanning) | $8 per month or $72 per year | ✓ |

Access Live Chat & Email Support | Requires any paid add-on | ✓ |

Issue Unlimited Invoices | ✓ | ✓ |

Track Bills | ✓ | ✓ |

Print Financial Statements | ✓ | ✓ |

Upload Bank Statement Transactions | ✓ | ✓ |

Connect Bank & Credit Card Accounts | ✕ | ✓ |

Automated overdue invoice reminders | ✕ | ✓ |

Recurring invoices and credit card charges | ✕ | ✓ |

Attach files to customer invoices | ✕ | ✓ |

Track 1099 Payments for Independent Contractors | ✕ | ✓ |

Add-ons available:

- Wave Payroll: Fixed monthly cost of $40 for tax service states or $20 for self-service states; there’s also an additional $6 per month, per active employee or independent contractor (read our Wave Payroll review for more information)

- Wave Advisor: Starting at $149 per month for bookkeeping support ,including classifying transactions, reconciling accounts, and providing financial statements

- Accounting and payroll coaching: One-time fee of $379 for two hours of live coaching and 30-day email access to your coach

Wave Accounting Features

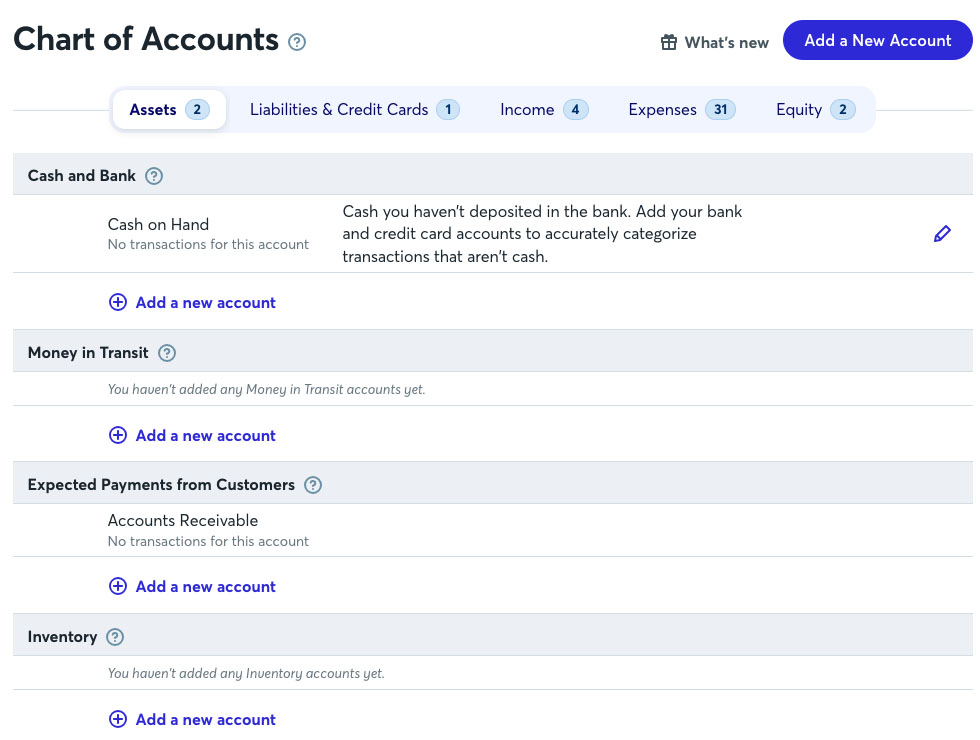

Wave earned high marks for general features, and it could have aced the criterion if users could use account numbers in the chart of accounts. For freelancers and solopreneurs account numbers probably aren’t necessary, but for companies with a bigger chart of accounts, account numbers can help organize the accounts and make data input much faster.

By default, Wave sets up your chart of accounts based on common accounts and categories, but you can add other accounts if you need to. To add an account, go to the Chart of Accounts page under the Accounting menu, and choose from the tabs at the top of the page for the account or category you wish to add.

Adding a new account in Wave

With the paid version, you can connect your bank account to Wave and upload bank statements to synchronize your transactions. However, Wave’s reconciliation feature is not as functional as those in other software like QuickBooks Online—which is partly why Wave took a hit in this category.

The primary problem is that the reconciliation doesn’t allow for entries in the books that have not yet cleared the bank, like outstanding checks. This presents a challenge if you write many paper checks as you will be unable to reconcile your account until all outstanding checks have cleared the bank.

Additionally, the free Starter plan does not allow you to connect a live feed to your bank or credit card accounts. However, you can upload your bank statements from comma-separated values (CSV) or Excel files and perform bank reconciliations.

Wave attempts to match manually inputted transactions to transactions imported from your bank and does a pretty good job. However, if it fails, it doesn’t allow you to manually match the imported transaction to the manually inputted transaction. You’ll need to watch for this carefully and then delete the imported transaction to avoid duplication. It’s not ideal, but Wave does clearly indicate imported transactions that have to be dealt with.

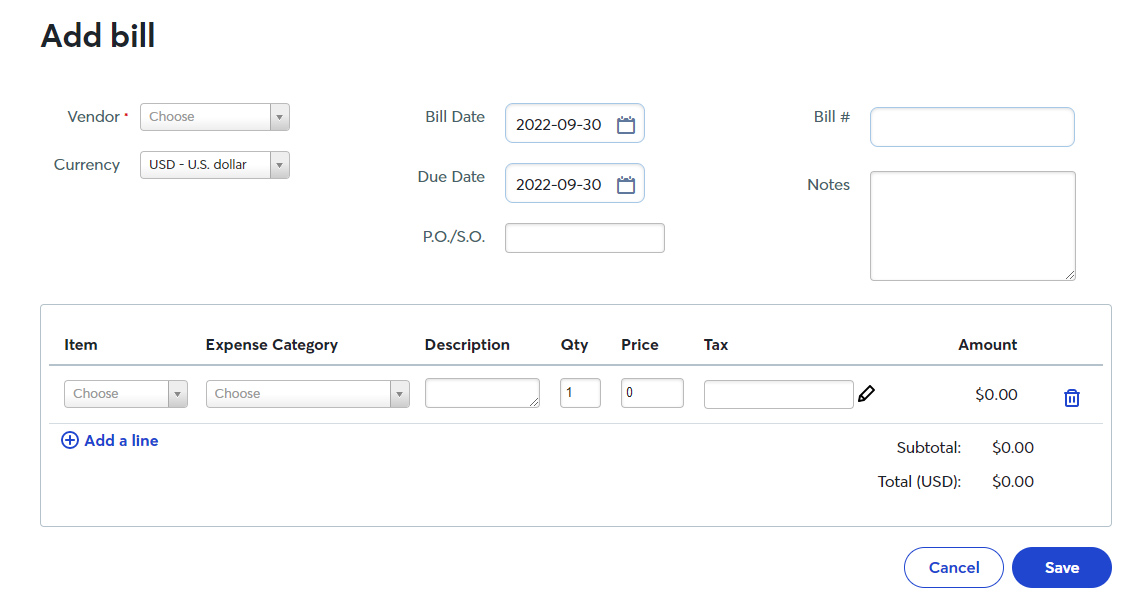

Wave is one of our best A/P software because of its ability to record unpaid bills even in the free Starter plan. However, I docked a few points because I found some weaknesses, such as the inability to input vendor credits, create purchase orders, track transactions by vendor, and attach receipts to unpaid bills.

Nevertheless, I am impressed with how easy it is to manage unpaid bills in Wave. Your A/P transactions can be conveniently managed from the Purchases menu, which consists of all the features you need to record your purchases: Bills, Vendors, and Products and Services.

Depending on your subscription, you can snap a photo of your expense receipt and upload it to Wave through the mobile app. All users can attach a receipt to transactions in the desktop interface, although you can’t attach them to unpaid bills.

To record a bill in Wave, click on the Create a Bill button, and then the Add bill screen will appear:

Creating bills on Wave

Unfortunately, you can’t create a recurring transaction directly from the bill, which is something you can do in other software like QuickBooks. You also can’t create recurring expenses and create and send purchase orders.

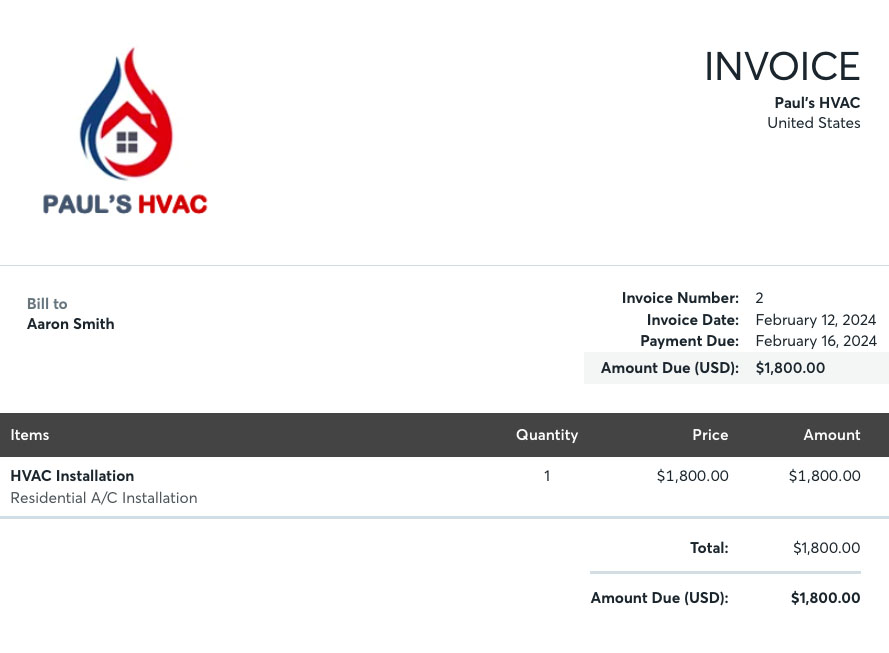

The program did well in A/R management, and it could have scored higher if there were more options to personalize invoices. The Starter tier allows you to upload your company logo, but you can’t choose from invoice templates and change the invoice color. You can create decent invoices in the Pro plan, but they aren’t as customizable as those in other software like QuickBooks Online.

Sample Invoice from Wave

Once an invoice is created, you can email it directly to your customer in the paid version. The free plan doesn’t let you do that, but it provides you with a link to your invoice so that you can include it in your own email. Another benefit of the paid Pro tier is that you can attach documents to your customer’s invoice. With a subscription to Wave Payments, you can include a payment link in your customer’s invoice.

Other tasks you can perform in Wave’s A/R system include:

- Set up recurring invoices

- Create a product or service item to auto-fill invoices

- View outstanding invoices without generating a report

- Track sales tax collected and remitted by jurisdiction

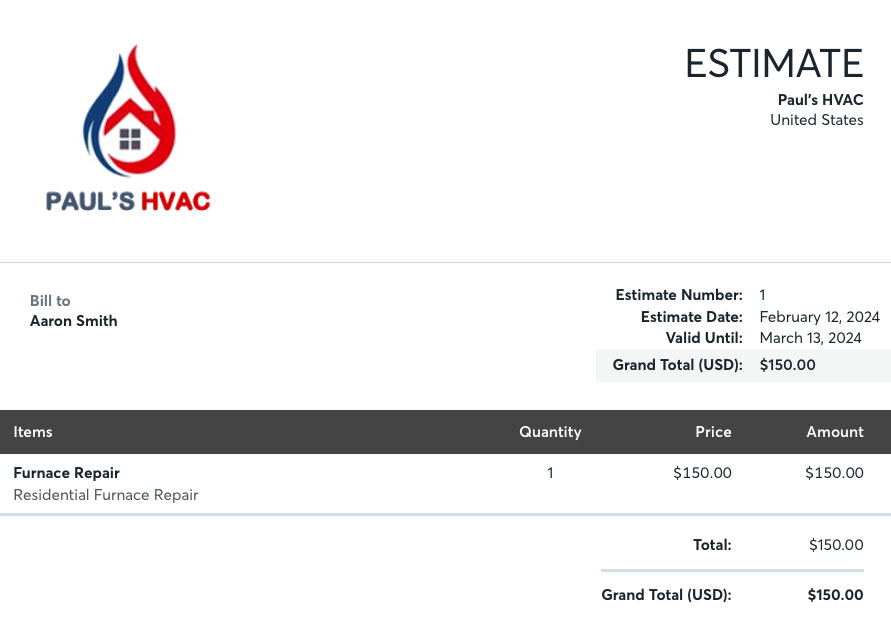

Wave doesn’t have a feature to accumulate costs by project, so it’s not great for project-based businesses. However, you can create customized estimates for project bids, but then there is no way to automatically compare actual costs to the estimate. These are why I couldn’t award Wave more points in this criterion.

Sample estimate in Wave

Wave allows you to add sales taxes to invoices, estimates, and income transactions. Whenever you enter a transaction with a sales tax, it records the amount automatically in the sales tax liability account. But while you can track your sales tax in Wave, there’s no way to file your returns, which explains its score in this category.

Another good tax feature is the ability to track payments and generate 1099’s for your independent contractors. This feature requires either the Pro plan or a subscription to Wave Payroll.

The sales and income tax features are evaluated across the other categories, so it has no separate video.

Wave’s inventory management feature is very basic, which is why it lost points in my evaluation. So, if you’re a product-based business, you should consider alternatives like QuickBooks Online or Xero. You can add a product or service, but not the quantity purchased or sold. This means that Wave can’t calculate your COGS, which is important if you deal with inventory.

I examined Wave’s inventory management feature across the other categories, mostly in A/R and A/P, so there is no separate video for inventory.

Wave scores fair in this category because it provides all the basic financial reports you’ll need to file your tax return. Specifically, you can generate the following:

- profit and loss (P&L) statement,

- cash flow statement,

- A/P aging,

- A/R aging,

- general ledger,

- trial balance,

- transaction list by customer, and

- expense by vendor.

While the reports are accurate, they’re not very professional looking—especially the balance sheet that doesn’t provide a beginning and an ending balance. The reports also lack any customization options.

As seen in my rubric score, the Wave app is pretty limited, especially for the Starter subscribers. The most useful features are the ability to send invoices and estimates and collect payments. Users can also add customers and items to their products and services list.

Pro subscribers, as well as Starter subscribers with a Receipts add-on, can scan receipts and classify income and expense transactions directly within the app. There are some basic overview charts to see the financial status of your company, but no complete reports.

If having a good mobile app is important to you, I highly recommend Zoho Books—which aced our mobile app category.

Wave took a hit in integrations because you can’t connect it to time tracking and electronic bill pay processors. For comparison, QuickBooks actually has an electronic bill pay and time tracking built into all its plans except Simple Start.

While not built in, Xero has an integration with BILL (formerly Bill.com) and some useful tools like Google Sheets and BlueCamroo, but all other integrations must be made through Zapier. If you have a Zapier subscription, you can integrate a lot of other apps—but it will be more difficult than having a deep integration, such as those offered in other accounting software.

On the positive side, Wave does integrate with its own payroll and payment processing services, which are crucial functions for most businesses. For more information, check out our Wave Payroll review and Wave Payments review.

Wave Accounting scored poorly in this criterion because of the amount of manual data entry that is required to set up a company file for existing businesses. When I set up my sample company for the case study, I had to manually input the chart of accounts, service items, and beginning account balances. Even worse, the only way I found to enter beginning account balances was with a large journal entry. None of these really matter if you’re setting up a brand new company—but it can take considerable time for established companies.

I did find a few bright spots in setting up my company, though. Wave lets you import a CSV file of customers and vendors. It also has a new company wizard to walk you through the setup process and that prompts you for the basic information needed.

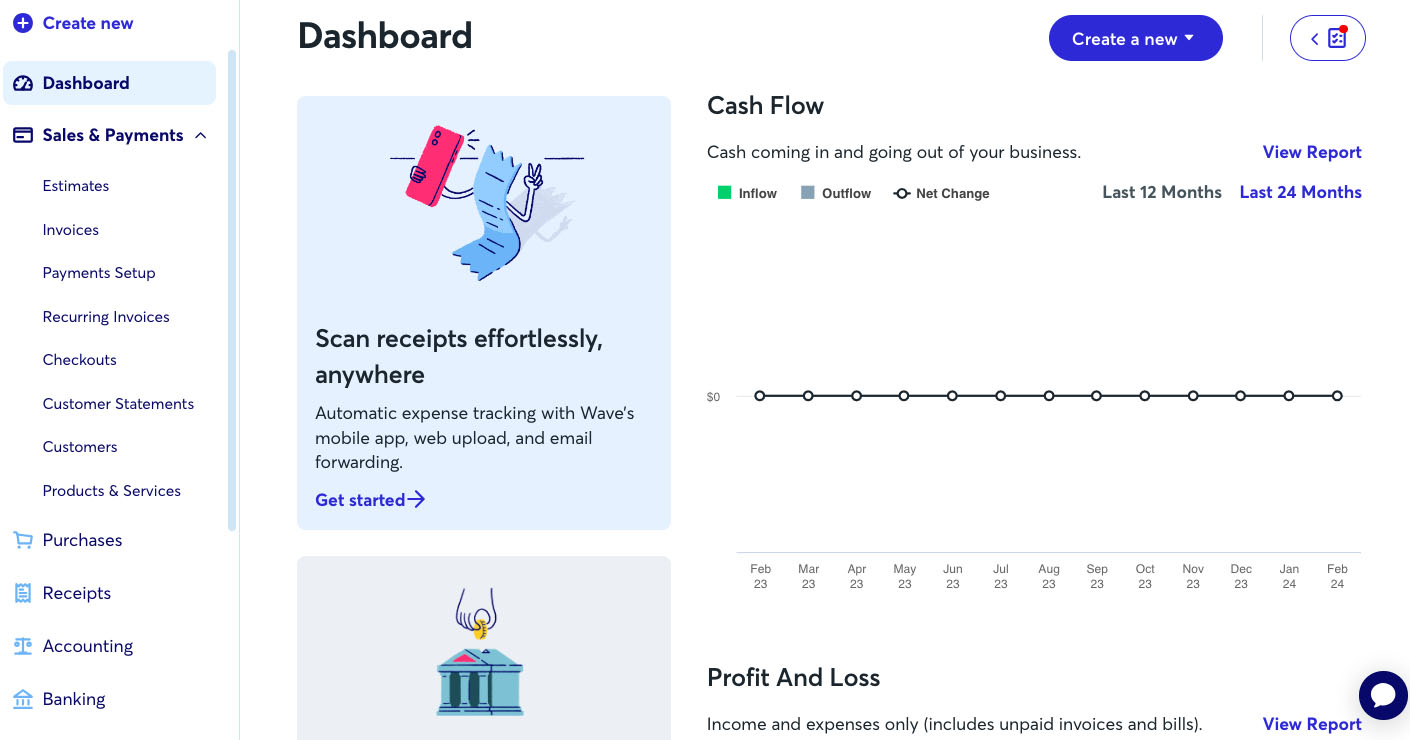

Wave is easy to use and has a low learning curve, whether you’re in the free or paid version. The interface is clean and not overwhelming, and you can easily find your way around. The dashboard includes shortcut buttons so that you can easily create new transactions, like bills, estimates, and invoices. Even if you don’t have accounting experience, you can familiarize yourself with the features of Wave in less than a week.

Wave’s dashboard

Wave has limited customer service in the Starter plan. Your only support is through an automated chatbot or self-help resources. If you need access to email and live chat support, you must purchase any add-on—like Payroll or Payments—or upgrade to the paid Pro tier.

You can access personalized support through the Wave Advisor program where you can get coaching and year-round advice from a Wave expert starting at $149 per month. While that is very reasonable for the services delivered, it’s only a starting price—and Wave doesn’t publish any additional pricing information.

Wave Accounting Assisted Bookkeeping Options

The Wave Advisor program is an in-house bookkeeping, accounting, and tax service from Wave. The advisors are trained employees of Wave who will assist you with your bookkeeping needs.

The program has two options:

- Bookkeeping support: This package starts at $149 per month. Bookkeeping pros from Wave manage your bank fees, classify transactions, reconcile your accounts, and produce monthly financial statements. Basically, they’ll do everything you need except invoice your customers.

- Accounting and payroll coaching: This is available with a one-time payment of $379, unlike bookkeeping support, which is a month-to-month contract. This program is ideal for business owners or freelancers wanting to learn Wave so that they can do their own bookkeeping. Your payment provides you two hours of one-on-one training and 30 days of follow up support via email.

How I Evaluated Wave Accounting

I was able to evaluate Wave using our scoring rubric. The criteria is as follows:

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

Yes—and Wave Accounting still has the best free accounting software that we’ve found. It also has a paid version that you’ll need if you want to connect your bank account, have multiple users, scan receipts, plus a few other nice features.

Yes. Wave uses 256-bit transport layer security (TLS) encryption for data security, and all accounting data are stored in servers monitored 24/7. Your credit card numbers are also not stored in Wave.

Yes, Wave offers payment processing through Wave Payments. You only need to pay for the processing fees: 2.9% plus 60 cents per transaction for Visa, Mastercard, and Discover; and 3.4% plus 60 cents for American Express. When you upgrade to Pro, the 60 cents per transaction fee is waived. To learn more about its features, check out our review of Wave Payments.

Yes, Wave includes a sales tax tracking feature. You can set up multiple sales tax rates, apply them to invoices, and generate reports to help with tax compliance.

Bottom Line

Despite several limitations, Wave still has plenty to offer small businesses. It offers essential functionality that will help you pay bills, invoice customers, and track your expenses—even in the free Starter plan. You’ll need to upgrade to the Pro plan for $16 a month if you want live customer support.