FreeTaxUSA, an online tax preparation software, lets you file E-file federal returns for free and state returns for $14.99. Its features include tax return backup, accuracy guarantee, a refund maximizer, and self-help and email support. You can upgrade to Deluxe for $7.99 and get unlimited amended returns and priority support. FreeTaxUSA distinguishes itself from its competitors because the free plan includes complex returns like Schedule C for self-employed businesses and Schedule E for rental properties.

Pros

- Supports all major individual tax forms for free without the need to upgrade

- Unlimited amended returns are free with the Deluxe Edition

- Includes tax return backup if you need to print old returns

- Import previous returns from other tax software

Cons

- Doesn’t support partnership or corporate tax return preparation

- Support is limited for free customers

- No support if you have foreign earned income, are a nonresident alien, or live outside the United States

- Weak importing capabilities—not able to import W-2s or 1099s

Features

- Employees with high income seeking to prepare their own taxes: Taxpayers can prepare their federal income tax return for free regardless of their income level or source of income.

- Self-employed business owners who need free federal filing and low-cost state tax filing: FreeTaxUSA gives you access to all major tax forms and more than 350 deductions and credits without extra cost. Federal tax filing is free and add only $14.99 to file your state tax returns.

- Individuals who want to file prior-year tax returns: FreeTaxUSA lets you file prior-year federal returns for free and state returns for $17.99 each.

- Filers who need a mobile app: One of the trade-offs to its free service is that it doesn’t offer a mobile app to prepare your taxes. In this case, you may need a more robust tax preparation software like TurboTax.

- Corporations and limited liability companies (LLCs) filing Forms 1120, 1120S, or 1065: While FreeTaxUSA supports most forms that an individual will need, it doesn’t support any forms for small businesses, other than sole proprietors, which file on the owner’s individual tax return. If you own a corporation or LLC, we recommend TaxAct.

- Expats seeking tax services: H&R Block offers both do-it-yourself (DIY) and assisted tax services to United States citizens and green card holders who are required to file their US expat taxes every year. Its online tax software is designed to identify tax benefits specifically for expats.

Are you looking for something different? Read our guide to the best small business tax software. We looked at a variety of solutions and narrowed our recommendations down based on the price of preparing the typical bundle of returns required by most business owners.

FreeTaxUSA Deciding Factors

Intended Users | Self-employed business owners seeking free federal filing and low-cost state filing |

Small Business Tax Returns Supported | Schedule C only |

Communication | Email and live chat |

Federal Return Pricing | Free |

State Return Pricing | $14.99 |

Mobile App | ✕ |

Maximum Refund Guarantee | ✓ |

Cryptocurrency Support | ✕ |

Free Plan | ✓ |

Tax Calculator | ✕ |

FreeTaxUSA Alternatives

Best for: Filers who want a mobile app. | Best for: Business owners seeking a cloud-based program to prepare corporate and partnership returns | Best for: Expats seeking tax services |

Self-employed returns from $188 for federal and state | Business returns from $214.90 for federal and state | Expat tax services starting at $99 |

Read our TurboTax review | Read our TaxAct review | Read our H&R Block review |

FreeTaxUSA Pricing

FreeTaxUSA lets you file federal returns for free and add state tax returns for $14.99. Upgrade to Deluxe Edition for $7.99, and you’ll get access to advanced features like amended returns, priority support, and live chat.

Service | Pricing |

|---|---|

Federal Tax Return | $0 |

Tax Extension | $0 |

State Tax Return | $14.99 |

Deluxe Edition Upgrade | $7.99 |

Pro Support | $39.99 |

Printed Tax Return Mailed | $7.97 |

Professionally Bound Tax Return Mailed | $15.99 |

Audit Defense | $19.99 |

Prior Year Returns | $0 Federal $17.99 State |

Unlimited Amended Returns | $15.98 Current Year $17.97 Prior Years |

FreeTaxUSA Features

Whether you’re a self-employed individual or have rental income, FreeTaxUSA supports the most common tax forms that you need to file your individual and state tax returns. Check out its top features below to help you determine if the solution is for you.

For $7.99, Deluxe provides live chat with a tax specialist as well as unlimited amended returns for the year being filed.

For $39.99 you can upgrade to Pro Support to be able to ask questions to a tax professional. However, the tax pro won’t be able to prepare or review your entire return. Pro Support also gives you access to customer service by telephone.

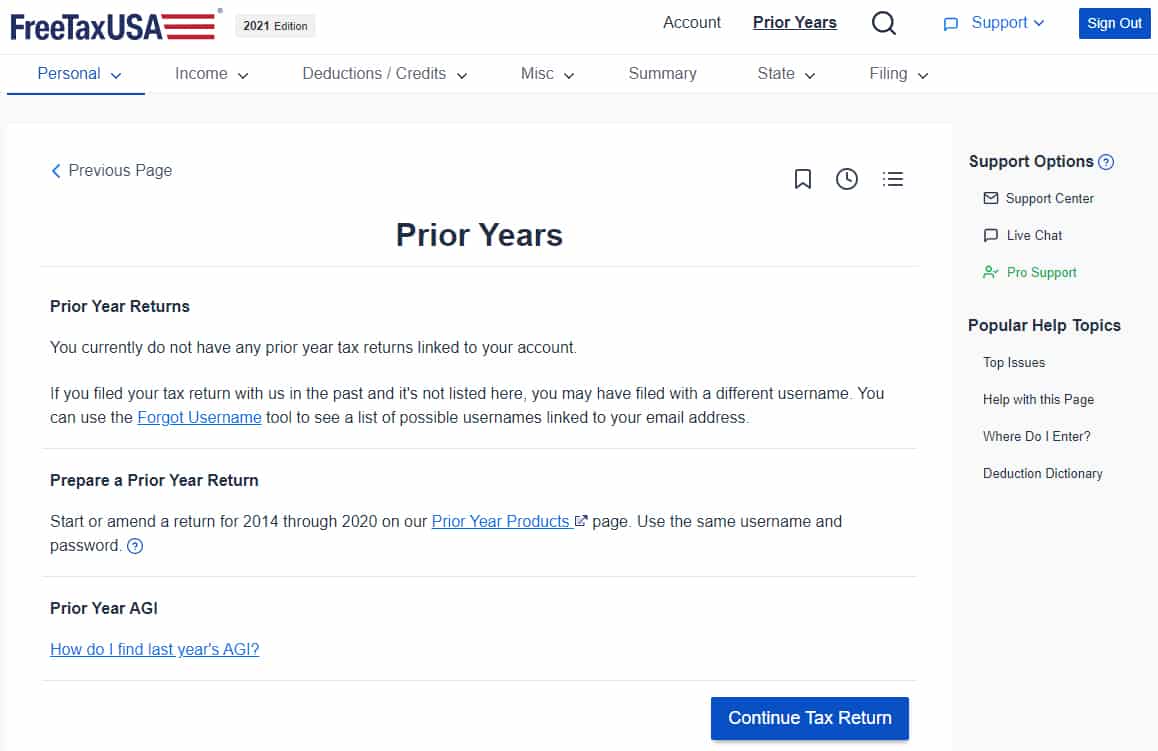

FreeTaxUSA lets you access, print, and file past-due tax returns from 2016 to 2022. If you filed prior-year returns with another tax preparation program, you can upload a PDF of your return to save time in preparing your current tax return. Prior-year federal returns are free, and prior-year state returns are $17.99.

Filing prior-year returns with FreeTaxUSA (Source: FreeTaxUSA)

You can opt to have your tax refund deposited electronically into your account via direct deposit, loaded onto a prepaid debit card, or have a paper check mailed to you.

If you’re a Free user, you can prepare and file an amended return to correct a return that has already been filed with the IRS for a fee of $15.98. Unlimited amended returns are already included for any year you purchased Deluxe.

Available for $19.99, this gives you access to a specialist who’ll help you get through an IRS notice or the audit process.

As with other tax preparation services, FreeTaxUSA offers a guarantee on its tax calculations. Should an error occur, it’ll be responsible for paying any penalties and interest to the IRS. If it’s determined that you entered information incorrectly, the guarantee doesn’t apply.

FreeTaxUSA offers you an option to pay your fee with your tax refund, provided you’re eligible. To qualify, your refund should be greater than your total fee, plus the processing fee of $24.99. You can also pay the fee with your credit or debit card for no additional fee.

Even though your return is filed electronically, you may want to have a printed copy for your records. FreeTaxUSA offers two options: a printed tax return mailed to you for $7.97 or a professionally bound copy of your federal and state income tax returns for $15.99. It’s also possible to download a PDF and print it yourself for free.

If you need more time to file your return, you can extend your filing deadline by filing Form 4868 for free. This will add six months to your filing deadline and allow you enough time in case your W-2 or other forms need to be replaced.

FreeTaxUSA will store your finished tax returns in your account for up to seven years, and it’ll carry the prior year’s information automatically to your current year’s taxes if you use the software two years in a row. Your information is kept secure with data encryption, and the website requires multifactor authentication (MFA) to verify your identity.

Are you looking for accounting software? Check out our picks for the best small business accounting software, which includes QuickBooks Online.

FreeTaxUSA Customer Service & Ease of Use

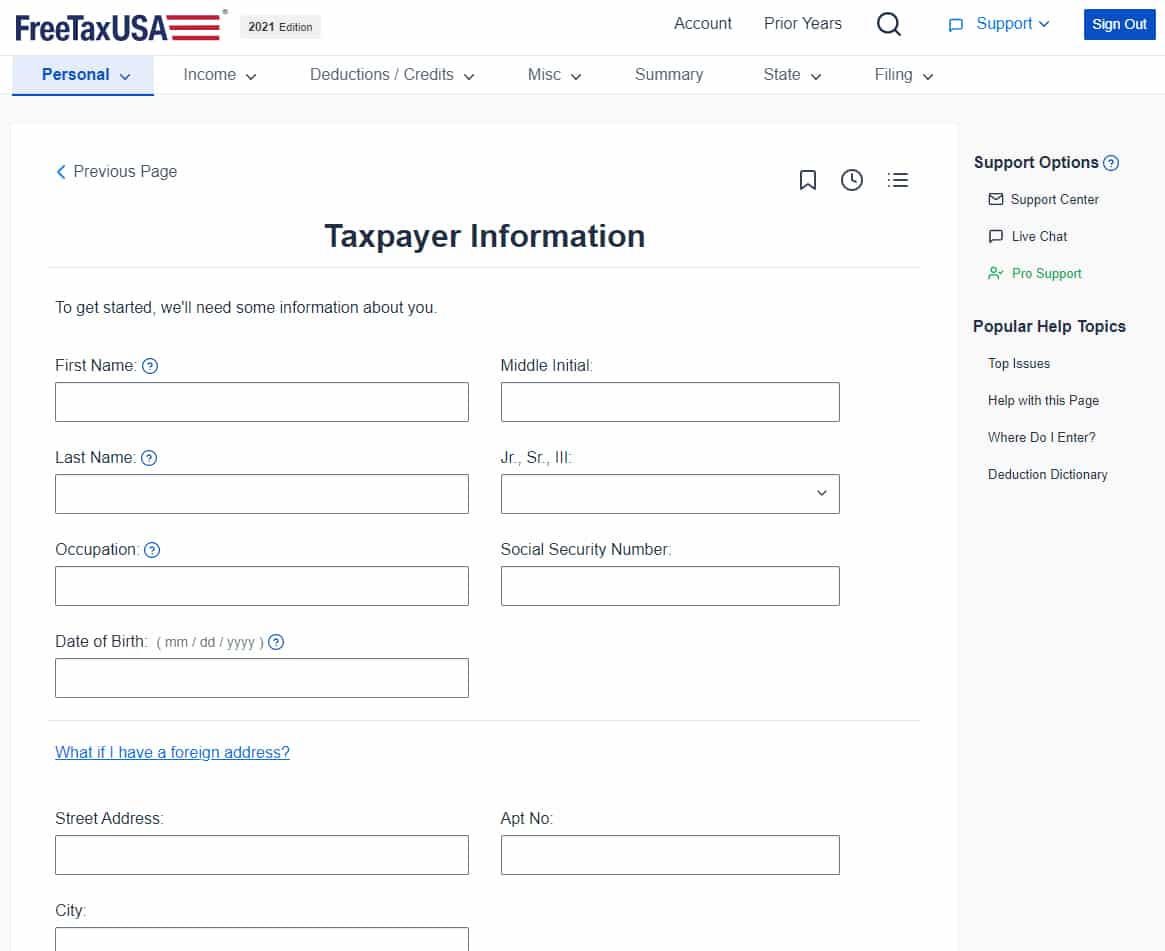

FreeTaxUSA’s interface is clean and easy to navigate, with no downloads or special plug-ins or add-ons required. Upon logging in, you’ll be redirected to a page where you can set up your account information easily. It also includes user-friendly navigation tabs that let you jump to particular information, income, miscellaneous topics, deductions and credits, and a tax filing page.

After you answer a few questions, you’ll complete the relevant tax forms to determine whether you qualify for certain credits or deductions. FreeTaxUSA includes helpful explainers of tax concepts for clarifications and will calculate the estimated tax refund or amount due manually.

FreeTaxUSA account information page (Source: FreeTaxUSA)

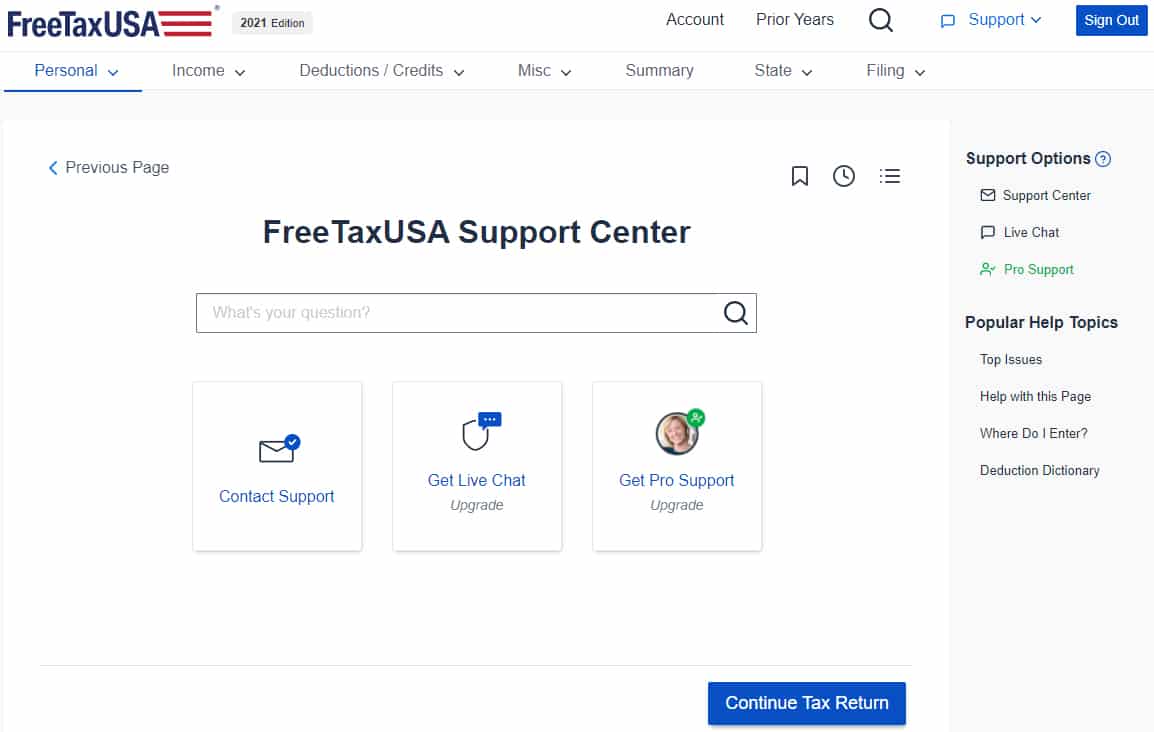

You can seek help via email or search for support topics on its Customer Support page and question and answer database. In addition, Deluxe subscribers get access to support via Live Chat and Pro Support subscribers receive phone support.

FreeTaxUSA Support Center (Source: FreeTaxUSA)

FreeTaxUSA User Reviews

Overall, users appreciate FreeTaxUSA’s affordable price options for both federal and state returns and the fact that the provider offers suggested deductions for standard and itemized deductions. Reviewers also praised the tax return storage and supported forms. Its biggest drawback is the inability to contact customer support via telephone with the free plan. While we agree telephone support is always nice, we don’t think $39.99 for the Pro Support package that includes both telephone support and access to a tax pro is unreasonable.

Other users disliked that FreeTaxUSA doesn’t offer audit protection. Audit protection has now been added to their services for $19.99. .

FreeTaxUSA earned the following average scores on popular review sites:

- Best Company: 4.2 out of 5 based on about 87 reviews

- Trustpilot: 3.0 out of 5 based on around 48 reviews

Frequently Asked Questions (FAQs)

How much does FreeTaxUSA charge to file federal and state tax returns?

There’s no charge to file federal returns, but it costs $14.99 per state tax return.

Can I track my refund on FreeTaxUSA?

Yes, you can track your refund by logging into your account to check the status of your e-filed return.

How do I talk to someone at FreeTaxUSA?

All customer support is provided through email or direct messaging within the software for free users. Pro Plan subscribers also have phone and live chat support.

Bottom Line

FreeTaxUSA is an extremely affordable solution for individuals and sole proprietors wanting to file their own taxes. Its free service may come with some trade-offs, such as the lack of advanced support and personalized advice from an expert, but it offers nearly everything that you expect from DIY tax software. If you love the idea of saving money on filing your income tax returns, you should try FreeTaxUSA today.