TaxAct is an online tax preparation software that supports all the major tax forms and schedules (both federal and state). Its features include W-2 import, a deduction maximizer, a maximum refund guarantee, and a mobile app.

It offers a free plan that allows you to file a simple federal for free plus $39.99 for the state return. If you have investments, rental properties, or foreign bank accounts, you can file a federal return for $34.99, and self-employed individuals can file a federal return for $64.99. You can also file small business returns online – like S-corps and partnerships – starting at $139.99

Pros

- Online filing of business returns including Form 1040 (Schedule C), 1120, 1120S, and 1065

- Offers Live Tax Advice for $59.99

- Less expensive than TurboTax

- Includes accuracy and maximum refund guarantees

Cons

- Price includes only one return

- State returns are $44.99, which is slightly higher than competitors

- Limited audit support

- No special cryptocurrency support

- Free plan does not include a free state

Are you looking for something different? Read our article on the best small business tax software. We looked at a variety of solutions and narrowed our recommendations down based on the price of preparing the typical bundle of returns required by most business owners.

TaxAct Deciding Factors

Intended Users | Small business owners wanting to file a personal return and business return online |

Communication | Phone, email, and chat |

Personal Federal Return Pricing | $0 to $64.99 plus state return fees |

Personal State Return Pricing | $39.95 to $44.95 |

Business Federal Return | $139.99 to $159.99 |

Business State Return | $54.99 |

Live Tax Advice | $59.99 |

Free Trial of TaxAct | Start for free |

Mobile App | ✓ |

Maximum Refund Guarantee | ✓ |

Cryptocurrency Support | ✕ |

Tax Calculator | ✓ |

TaxAct Alternatives

|  |  |

|---|---|---|

Best for: Filers who need inexpensive tax software for corporate and partnership returns | Best for: Taxpayers looking for robust tax audit support | Best for: Freelancers who want free software to file an individual return with Schedule C |

Business returns from: $99 including one state | Self-employed returns from: $129 for federal and $59 for state | Individual returns from: Free federal return plus $14.99 for state |

Read our H&R Block review | Read our TurboTax review | Read our FreeTaxUSA review |

New Features for 2024

Staring in 2024, TaxAct no longer bundles Xpert Assist with all of their plans. Instead, they have significantly reduced the price of each plan and allow users decide if they want Xpert Assist for an additional $59.99. Xpert Assist allows you to speak with a live tax expert over the phone and even request a quick review of your return before filing. This is a great change for users that don’t need to speak with a tax expert.

TaxAct Pricing

TaxAct offers a free version that allows you to file a Form 1040 for free, plus a state return for $39.99. Prices for its paid online packages start at $24.99 for a federal return for most homeowners and $64.99 for a self-employed federal return.

Free | Deluxe | Premier | Self Employed | Business Returns | |

|---|---|---|---|---|---|

Federal Return (DIY) | $0 | $24.99 | $34.99 | $64.99 | $139.99 Partnerships $159.99 S and C-corps |

State Return | $39.99 | $44.99 | $44.99 | $44.99 | $54.99 |

W-2 Income | ✓ | ✓ | ✓ | ✓ | N/A |

Itemized Deductions | N/A | ✓ | ✓ | ✓ | N/A |

Royalty & Schedule K-1 Income | N/A | N/A | ✓ | ✓ | N/A |

Schedule C | N/A | N/A | N/A | ✓ | N/A |

Deduction Maximizer | N/A | N/A | N/A | ✓ | N/A |

This plan lets you file federal returns for free, but you can’t file schedules 1 to 3. It’s suitable for taxpayers with wages, dependents, college expenses, and retirement income. The package handles W-2 income, child tax credits, dependents, current students, and earned income credits, and it includes prior-year import, free account, and technical support.

Considered TaxAct’s most popular tier, Deluxe is best for homeowners with deductions, credits, and adjustments. It includes everything in Free, plus itemized deductions, child and dependent care, mortgage interest, real estate taxes, student loan interest, health savings accounts (HSA), and adoption credits.

If you need to report rental properties or investments, this plan is for you. It contains all the features in Deluxe, plus advanced features like stock sales, sales of homes or other investments, rental property income, royalty and Schedule K-1 income, investment expenses, and foreign bank and financial accounts. Users also have access to prioritized support with screen sharing.

This package caters to freelancers and self-employed taxpayers looking to maximize their deductions. It comes with all the features in Premier, in addition to freelance income, business and farm income, personalized business deductions, depreciation calculations, and year-round planning resources.

TaxAct Features

We selected TaxAct as the overall best small business tax software because it’s ideal for business owners needing to file both a 1040 and a separate business return. It offers multiple paid plans for taxpayers in a variety of situations and useful tools like a tax estimator and tax planner. Below is a list of some of its top features.

TaxAct uses a question-and-answer format that provides you with a step-by-step guide to help you complete your returns in a way that maximizes your deductions. This tool helps self-employed individuals uncover common deductions specific to their work. Sales representatives, for instance, can uncover additional tax advantages on business travel and meals, credit card processing fees, supplies, and more.

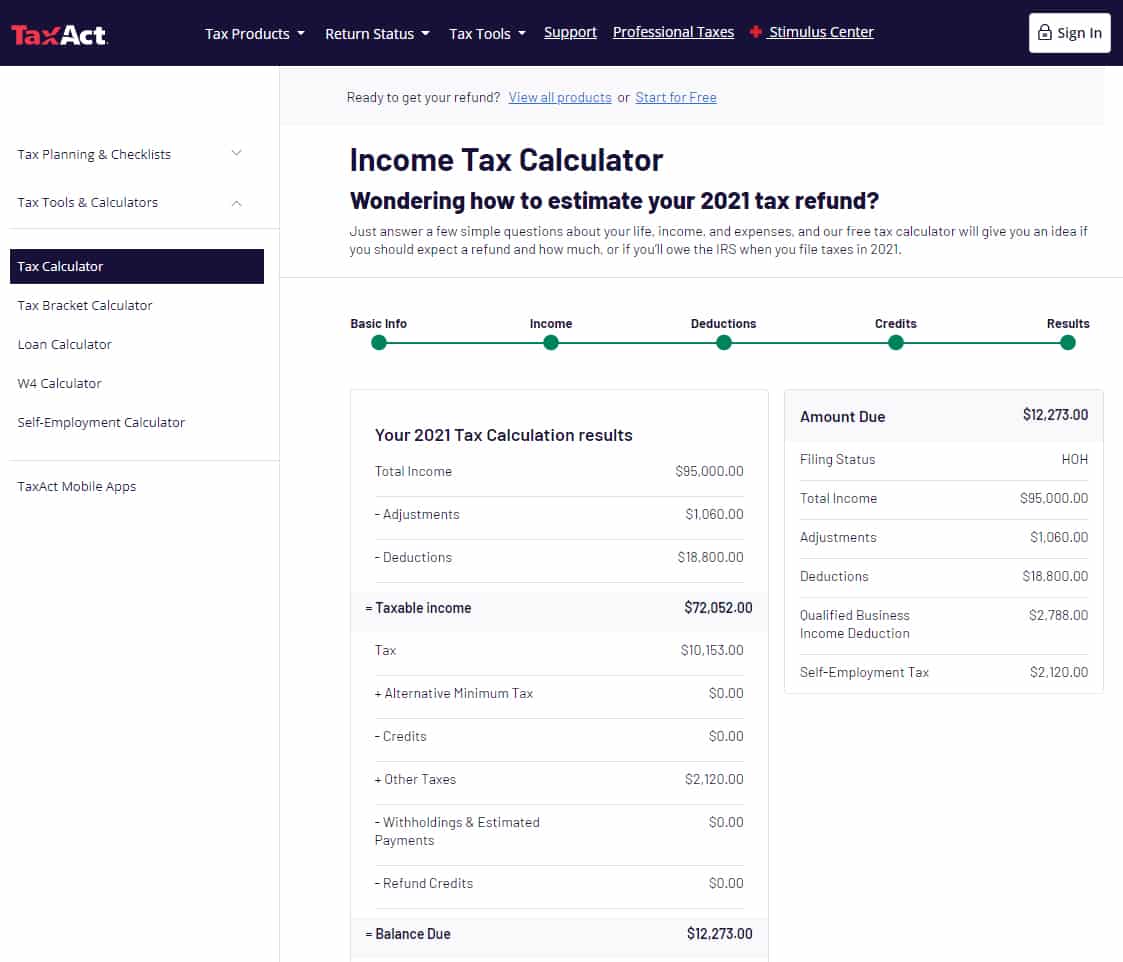

TaxAct says that its program is 100% accurate, so taxpayers can get the maximum refund. If you receive a reduced refund or increased tax liability or pay a penalty or interest because of a TaxAct error, your charges will be covered by TaxAct. The company will refund your full software costs. pay any difference in your higher tax liability or lower refund and cover any legal or audit-related costs of up to $100,000.

The TaxAct Express app is available for both iOS and Android and allows you to e-file your federal and state tax returns on your tablet or smartphone. Its top features include free federal extension filing, W-2 capture, IRS refund tracking, and enhanced support with live chat.

It supports all online products: Free, Deluxe, Premier, and Self Employed. You can switch seamlessly from the app to the desktop and pick up right where you left off. It even lets you view, print, or save your federal return as a PDF. Security is also a priority, as you can use touch ID or face ID support and a two-factor authentication (2FA) security feature.

TaxAct Express Mobile App (Source: TaxAct)

This lets you create what-if scenarios for future years in your current return. You can estimate your income and expenses for the next few years and then project changes to the information to estimate your tax liability for the current or following years.

TaxAct Income Tax Calculator (Source: TaxAct)

TaxAct offers various tax tools that can help in different situations. The Forms Assistant gives you access to all available tax forms, while the Topics Assistant provides answers to various tax questions.

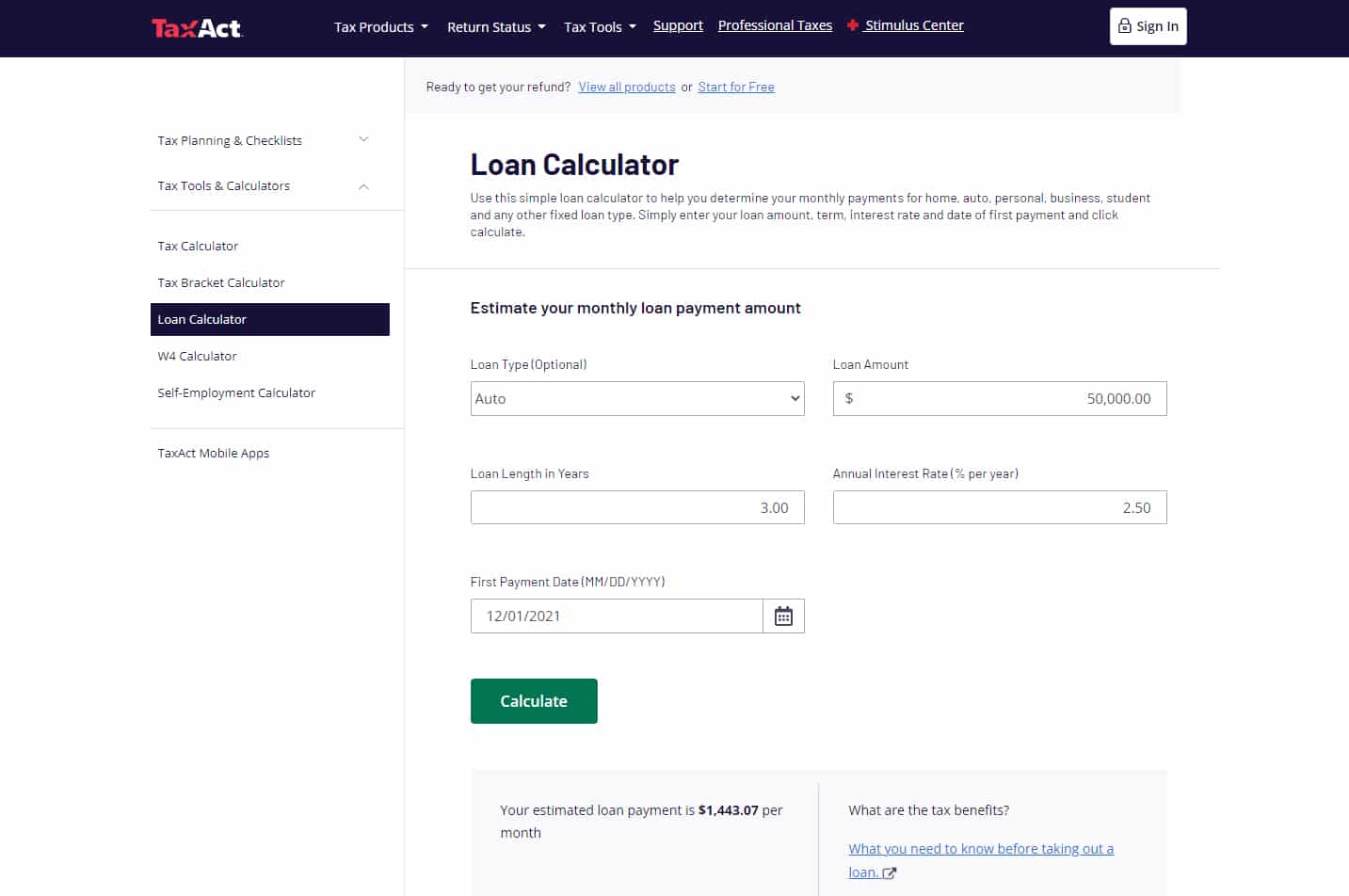

When recording a donation, you can use the Donation Assistant to find the deduction value of donated clothes, household items, and other objects quickly. Meanwhile, the Loan Calculator helps you determine your monthly payments for home, auto, personal, student, and any other fixed loan type.

TaxAct Loan Calculator (Source: TaxAct)

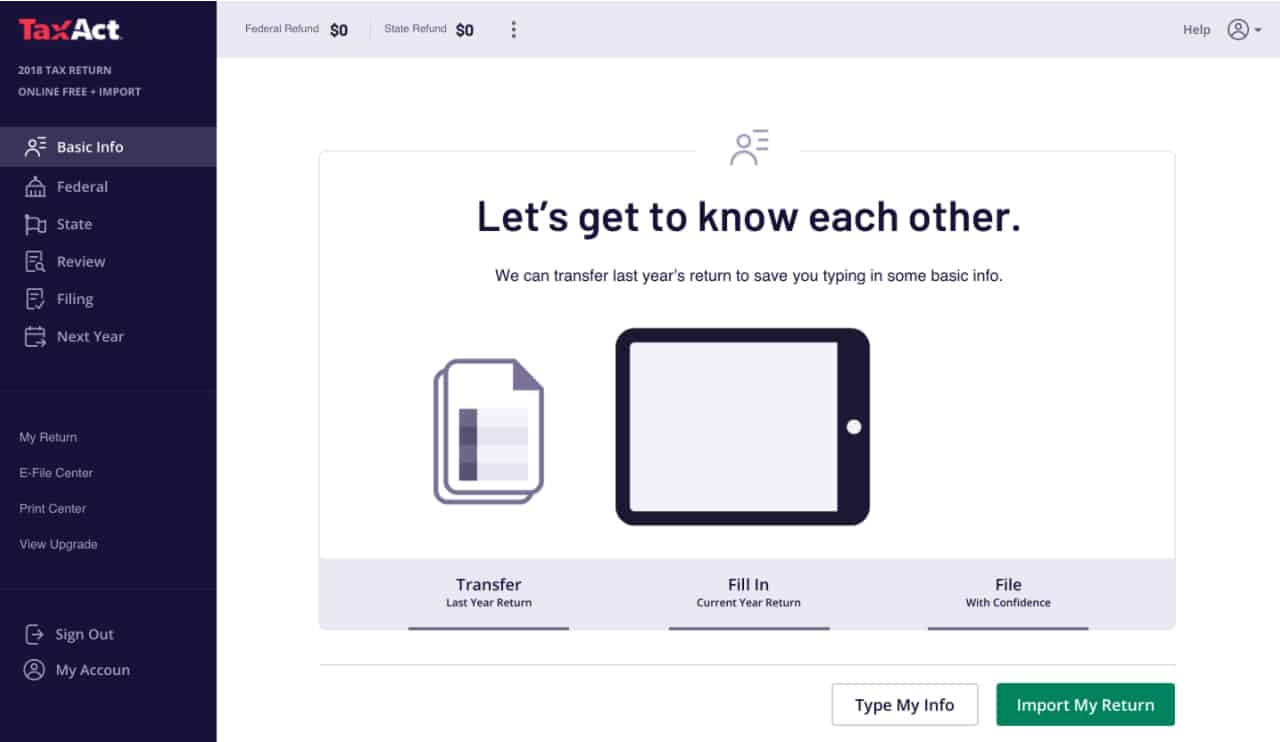

Regardless of your previous tax program, TaxAct lets you import the previous year’s tax return, including those coming from TurboTax or H&R Block. However, it can only be imported as a PDF, and you can only bring over your 1040—not including all the supporting forms and schedules. You can also import W-2s or take a photo and upload them via the mobile app, and with paid versions, you can upload 1099-B information from your broker if it’s in a spreadsheet (a CSV file).

TaxAct Customer Service & Ease of Use

As with other tax filing programs, TaxAct features user-friendly navigation and an intuitive interview process, which is helpful for new users. It offers guided and unguided navigation that makes it extremely easy for filers to enter their information. The navigation bar also provides easy access to all other sections, and another nice feature is a quick summary of each section that allows you to catch data-entry errors.

TaxAct allows easy import of tax forms, such as 1099s, W-2s, and 1099-NECs. It also offers account and technical support through email, chat, and phone in all its products, as well as a huge knowledge base that provides answers to frequently asked questions.

Perhaps the most useful addition to TaxAct’s support offering is Xpert Help, which provides unlimited screen-sharing access to a tax expert. Help is available on-demand, and in some states, you can schedule a call with one of TaxAct’s CPAs, enrolled agents, or other tax specialists.

TaxAct Dashboard (Source: TaxAct)

TaxAct User Reviews

TaxAct users appreciate the ease of use in filing tax returns and the variety of helpful tools such as the tax calculator. Reviewers also praised the accuracy and maximum refund guarantees.

TaxAct’s biggest drawbacks are its limited audit support and that its price includes only one tax return. Other users found that the fees for filing state returns are higher than its competitors.

TaxAct earned the following average scores on popular review sites:

- Consumer Affairs: 3.4 out of 5 based on about 839 reviews

- Influenster: 4.36 out of 5 based on around 3,244 reviews

Frequently Asked Questions (FAQs)

Is TaxAct e-filing really free?

Yes, e-filing is included in all TaxAct packages for no additional charge, including its Free package for simple returns.

Can I use TaxAct for previous years?

Yes, but you can’t e-file previous year returns. You can print your completed tax return and mail it to the IRS.

Does TaxAct have a mobile app?

Yes, TaxAct has a mobile app that is available for both iOS and Android.

Bottom Line

TaxAct is a terrific choice for freelancers, sole proprietors, or small business owners looking for an online filing platform with a competitive price point that offers everything you need to get the job done. It’s less expensive than much of the competition and has a variety of features and guarantees that help you simplify and save on your tax filing without the full cost of hiring an accountant.