The first step in becoming a QuickBooks Online ProAdvisor is to sign up for a free QuickBooks Online Accountant subscription. This will give you access to all training materials to help you prepare for and pass the QuickBooks ProAdvisor certification exam.

We’ll walk you through the step-by-step process of how to become a QuickBooks ProAdvisor and the benefits of becoming one. We’ll also share some valuable tips for passing the exam.

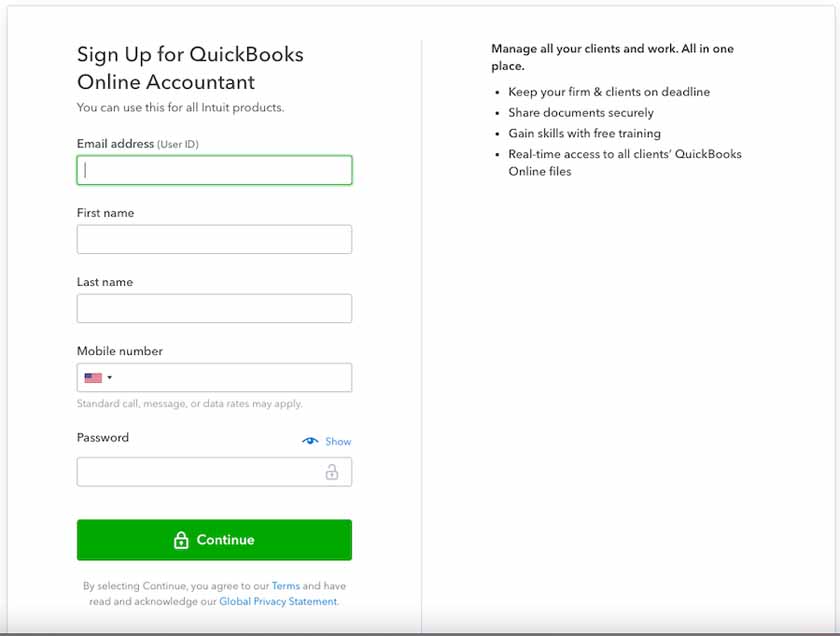

Step 1: Sign Up for QuickBooks Online Accountant

On the QuickBooks ProAdvisor Program website, there’s a button you can click to sign up for QuickBooks Online Accountant. It’s free to sign up and create your profile, and no credit card and other sensitive information is required.

Creating your QuickBooks ProAdvisor account via QuickBooks Online Accountant

Upon enrollment, you’ll receive a free QuickBooks Online Accountant subscription that can be used for your own firm’s bookkeeping and to access your client’s QuickBooks Online accounts.

Becoming a certified QuickBooks ProAdvisor doesn’t make you a certified bookkeeper—it indicates that you’re knowledgeable in QuickBooks products. Check out our guide on how to become a certified bookkeeper if you’re interested in becoming one.

Step 2: Prepare for the QuickBooks Online ProAdvisor Certification Exam

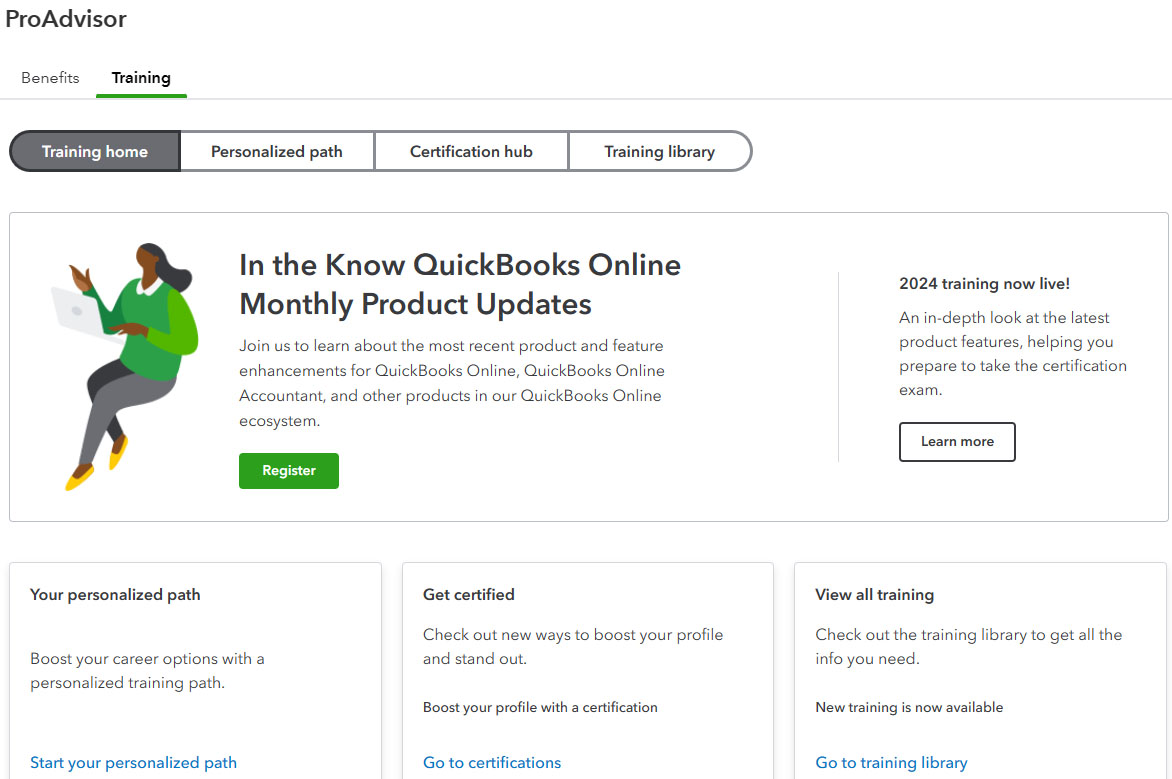

Once you’ve created your account with QuickBooks Online Accountant, you’ll gain access to all of the study guides, webinars (live and recorded), and exams for free. To begin the training, go to the ProAdvisor link found in the left menu bar of your QuickBooks Online Accountant screen and click on the Training tab to access the brand-new training portal.

QuickBooks Online ProAdvisor’s brand-new training portal

The Personalized path is where you can personalize your training journey based on your goals, product knowledge, and more. Answer a few questions, and QuickBooks will suggest a customized learning path for you.

The Certification hub helps you increase your chances of passing the exam by helping you understand what it means to be a QuickBooks ProAdvisor and whether it’s right for you. You’ll see which topics are likely to be covered in the exam and get to try some sample questions. This is also where you take the exam and track your certification history.

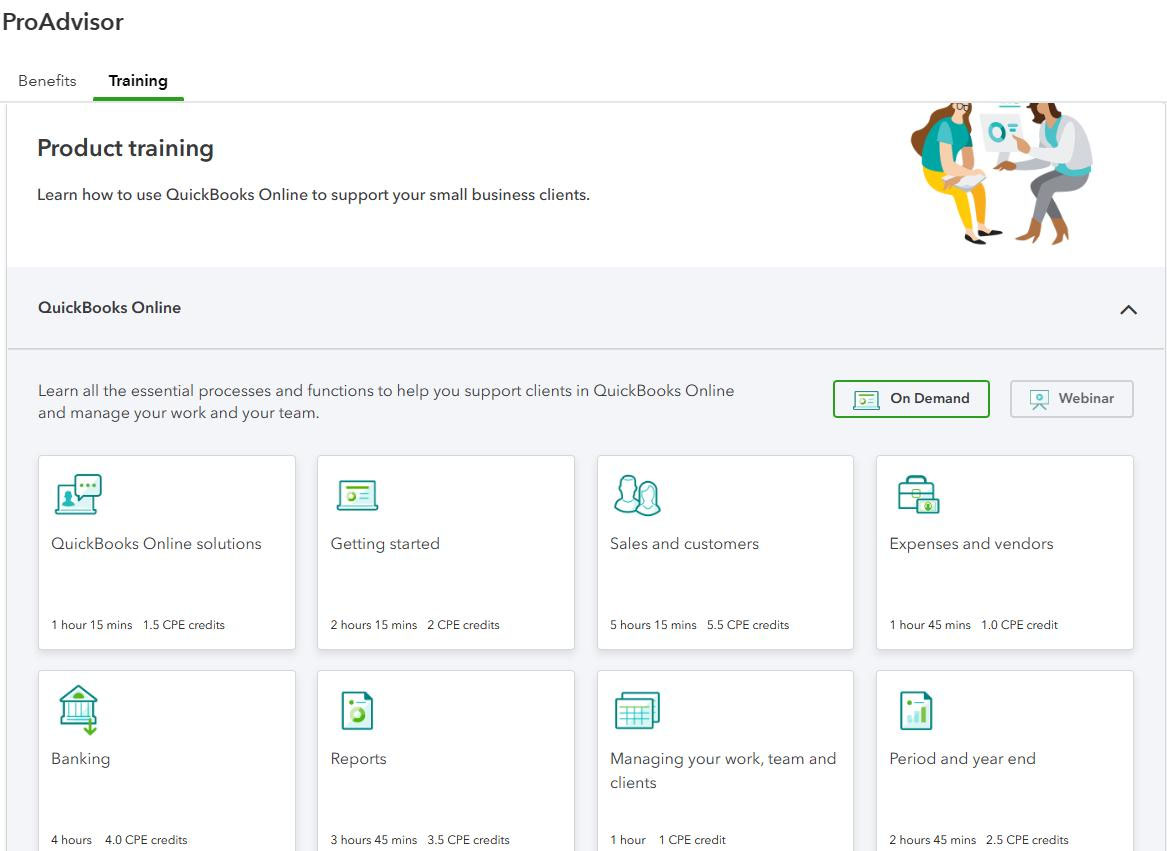

The Training library is where you can access all self-paced product training sources, which are grouped by topic. You’ll also see scheduled webinars and be able to download continuing professional education (CPE) certificates. This is also where you can access the 10 QuickBooks Online certification training modules:

- QuickBooks Online solutions: Understand your clients’ needs to best advise them on the best QuickBooks Online subscription solution, learn how to set up a QuickBooks Online account, and learn how to discuss billing features with clients.

- Getting started: Learn how to navigate QuickBooks Online’s features, set up bank feeds, create and customize the chart of accounts, manage the products and services list, and more.

- Sales and customers: Add customers, create sales receipts, create online invoices, and enter payments received.

- Expenses and vendors: Learn about the Expense and Vendor workflows and the Expenses center, how to enter expenses, and how to enter and pay bills.

- Banking: Learn about how to use bank feeds and best practice bank feed workflows.

- Reports: Review the Chart of Accounts and Products and Services list, which are the building blocks for creating basic reports.

- Managing your work, team, and clients: Learn about the practice management features in QuickBooks Online Accountant and how to set up projects and track them for QuickBooks and non-QuickBooks clients.

- Period and year-end: Learn how to prepare a client’s books for the year-end close.

- Using the enhanced features of the Advanced subscription: Discover how you can use the QuickBooks Online Advanced features to support larger clients.

- Converting and migrating clients into QuickBooks Online: Learn how to import your clients to QuickBooks Online from QuickBooks Desktop or any third-party accounting software to QuickBooks.

QuickBooks Online certification training modules

While preparing, you can also earn CPE credits, which apply to maintaining your certified public accountant’s (CPA’s) license. You don’t have to complete all the modules in one session. The system saves where you end a session, which enables you to pick up where you left off later.

It’ll be helpful if you have a basic understanding of general accounting principles and knowledge of the QuickBooks Online Accountant system. However, if you already possess this knowledge, you can proceed directly to the test and receive your certification.

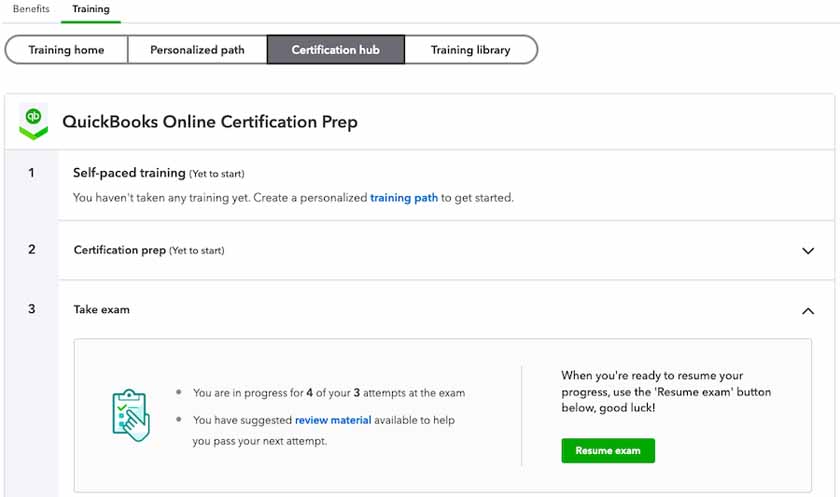

Step 3: Take the QuickBooks Certification Exam

If you’re ready to take the exam, go to the Certification hub and then click the Take exam button. If you’ve already started the exam and resume later, you should see a green Resume exam button, as shown below.

Click on Take exam (or Resume exam) to take or resume the examination

There’s no cost to take the exam, which has a total of 80 questions broken down into five sections. It should take approximately three and a half hours to complete all five sections. You can review your answers for a particular section before confirming the submission.

To pass, you need to complete the exam successfully with a score of 80% or higher. You can take the exam up to three times if you don’t pass on your initial attempt. If you fail the first three attempts, you’ll be locked out for 60 days. When the period is up, you can retake the exam.

Step 4: Receive Your Certification

When you pass the QuickBooks Online ProAdvisor exam, you’ll receive a digital copy of your certification and badge in your email inbox. You can download your certificate and badge directly from QuickBooks Online Accountant.

Step 5: Complete Your ProAdvisor Profile

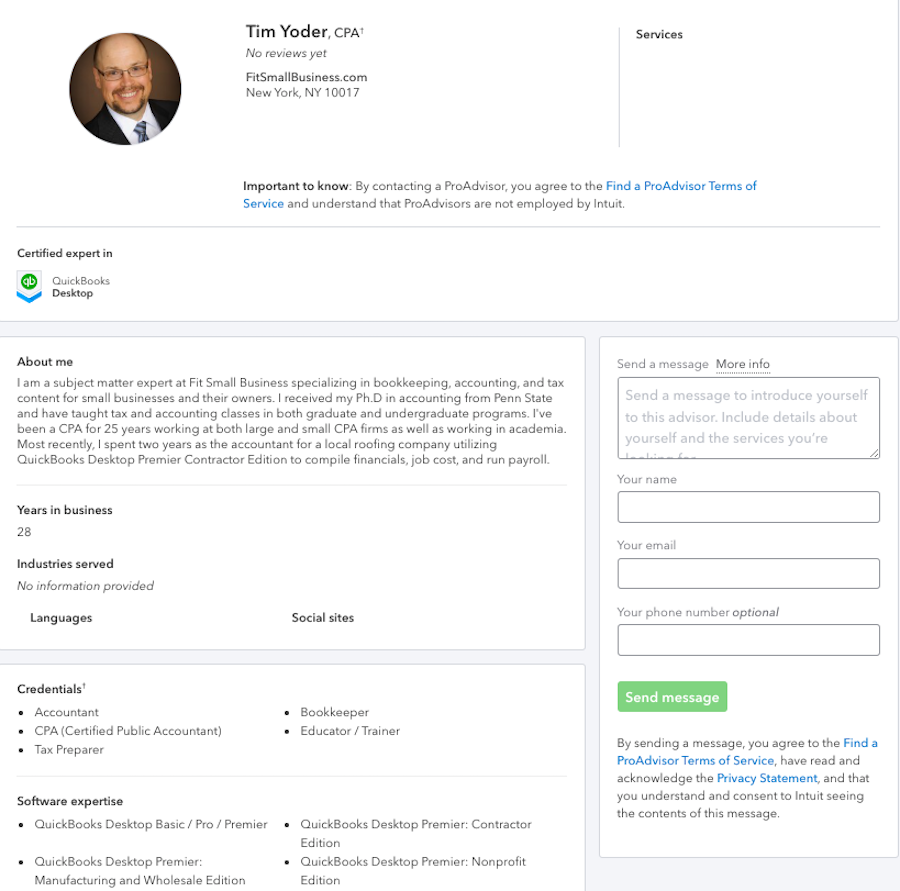

Be sure to complete your profile as soon as possible. It includes the certification badges you have earned, an “About me” section, the number of years in business, the services you offer, any industries that you have experience in, and your social media links.

Below is a screenshot of a QuickBooks Advisor profile (view the actual profile of Tim Yoder, CPA).

Sample QuickBooks ProAdvisor profile page

QuickBooks ProAdvisor Recertification. Your QuickBooks Online certification is valid until June 30 of the following year. We recommend that you take the updated exam each year to stay current. Members who are certified on the latest version of QuickBooks Online are listed in the top section of the QuickBooks Find a ProAdvisor website.

Earning CPE Credit for QuickBooks Online

CPAs can earn CPE credit for learning QuickBooks Online. The number of credits they can earn depends on the specific program they choose, and these include free simulation-based training and interactive lessons via webinar, virtual conference, or an in-person event.

CPE credits range from 1 to 2 for each program. You can earn up to 14.5 credits with the new self-paced training courses for QuickBooks Online ProAdvisor and Advanced QuickBooks Online ProAdvisor.

However, it is important to note that not all states allow CPE credits for QuickBooks ProAdvisor training, and each individual state board of accountancy has final authority on the acceptance of individual training for CPE credit. Therefore, you must check with them to determine how many CPE credits, if any, are available to earn.

Benefits of Becoming a QuickBooks ProAdvisor

There are many benefits that come with being a Certified QuickBooks ProAdvisor.

- Gain valuable knowledge of the most popular small business accounting software

- Get discounts on Intuit products and services and dedicated telephone and chat support

- Get added to the Find a ProAdvisor online directory listing—this allows you to connect with potential clients, build your client list, and earn their trust

- Can display your ProAdvisor certification badge on your website, emails, and business cards

- Boost your credibility and increase your profile ranking

- Distinguish yourself as a true expert with QuickBooks software

- Access unlimited United States-based phone support from QuickBooks experts

- Receive free or discounted products and supplies

- Unlock the QuickBooks Online Advanced Certification exam, which helps improve your visibility on the directory, giving you more opportunities to connect to new clients

- Advance in rankings (your ProAdvisor Profile climbs in the ranking as you earn more points), and as you do, you can grow your business and take advantage of more features of this program, discounts, product support, and training opportunities

Frequently Asked Questions (FAQs)

A QuickBooks ProAdvisor is a certified professional who can advise and assist clients with QuickBooks products, particularly QuickBooks Online. Earning this designation shows expertise and can help you attract clients who need help with their accounting software.

If you’re wondering how to become certified in QuickBooks, the process involves signing up for QuickBooks Online Accountant, taking and passing the QuickBooks Online ProAdvisor Certification Exam, and completing your ProAdvisor profile.

The time frame depends on your existing knowledge and how much time you can dedicate to studying. Intuit offers a variety of resources, including self-paced courses and live webinars, to help you learn at your own pace.

Yes, it will, and recertification frequency depends on the type of certification you hold. QuickBooks Online ProAdvisors need to recertify by June 30 each year to maintain their certifications.

Bottom Line

Earning your QuickBooks Advisor designation is a strategic move for any accountant or bookkeeper looking to expand their skill set and attract new clients. By following the steps outlined in this article, you can gain valuable knowledge of QuickBooks Online, demonstrate your expertise to potential clients, and unlock a range of exclusive benefits within the ProAdvisor program. To get started, we recommend that you sign up for a free account with QuickBooks Online Accountant. For additional assistance, be sure to check out our free QuickBooks tutorials.