QuickBooks Accountant Desktop, an on-premise accounting software, provides bookkeepers and accountants with special tools for serving their clients who use QuickBooks Desktop Pro or Premier. This version of QuickBooks Desktop for accounting firms has many unique features not present in the Pro and Premier editions, such as the ability to review and adjust client data and toggle between all the industry-specific versions of QuickBooks Desktop.

QuickBooks Desktop Accountant comes with the purchase of a QuickBooks Desktop ProAdvisor membership, with annual prices that start at $799 per ProAdvisor. See if it’s a good fit for your accounting firm in this detailed QuickBooks Accountant Desktop review.

The ProAdvisor Premier Software Bundle — which includes QuickBooks Desktop Accountant — will increase to $999 per year on October 1, 2024.

At Fit Small Business (FSB), we are committed to delivering thorough and dependable software reviews. In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios. This approach allows us to customize our reviews and provide more relevant insights and recommendations tailored to the unique needs of your accounting firm.

Pros

- Accountant Copy import allows easy file sharing from clients

- Accountant Toolbox helps find client errors and make year-end adjustments

- Open client files from the previous year’s edition of QuickBooks Pro or Premier

- Ability to toggle between all QuickBooks desktop editions

- Includes QuickBooks Desktop ProAdvisor membership

Cons

- More difficult to access client books than in QuickBooks Online Accountant

- Only one user at a time allowed to access the company file

- Cannot access the program remotely without third-party hosting

- No real-time update of client financial data

Visit QuickBooks Accountant Desktop

Is QuickBooks Accountant Desktop Right for You?

Is QuickBooks Accountant Desktop for You?

QuickBooks Accountant Desktop Alternatives & Comparison

QuickBooks Accountant Desktop Reviews From Users

As of this writing, we haven’t found any QuickBooks Accountant Desktop reviews. It’s best to conduct additional research and reach out to actual users who have experience with the software.

QuickBooks Accountant Desktop vs Competitors

We compared QuickBooks Accountant Desktop with our recommended alternatives, and here’s the result:

QuickBooks Accountant Desktop vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Accountant Desktop $799 annually per ProAdvisor

-

QuickBooks Online Accountant Free

-

Xero Practice Manager $149 per month

-

Jetpack Workflow From $56 per user monthly

As seen in the chart, QuickBooks Accountant Desktop is as equally powerful as QuickBooks Online in terms of accounting practice management and bookkeeping. This similarity isn’t a surprise given that they both belong to the QuickBooks family and are designed to offer the same core feature set.

QuickBooks Accountant Desktop lost in pricing, as it doesn’t have a scalable monthly plan. Jetpack Workflow is more affordable with a starting price of $56 monthly, while QuickBooks Online Accountant, the winner for pricing, is completely free. Additionally, it didn’t do well in ease of use as it’s a locally installed software, which requires initial installation, setup, and maintenance.

QuickBooks Accountant Desktop could have earned a higher score if it had monthly subscription options, which are more scalable for small firms. The program is available with the purchase of a QuickBooks Desktop ProAdvisor membership, and there are currently two membership levels available:

- ProAdvisor Premier Software Bundle: $799 per year, per ProAdvisor

- ProAdvisor Enterprise Software Bundle: $1,299 per year, per ProAdvisor

Both include QuickBooks Accountant Desktop and other features but The ProAdvisor Enterprise Software Bundle has more inclusions, such as QuickBooks Desktop Enterprise Accountant, QuickBooks Mac Desktop 2023, and QuickBooks POS Desktop. You’ll need the Enterprise bundle if you have clients that use QuickBooks Desktop Enterprise.

QuickBooks Accountant Desktop New Feature for 2023

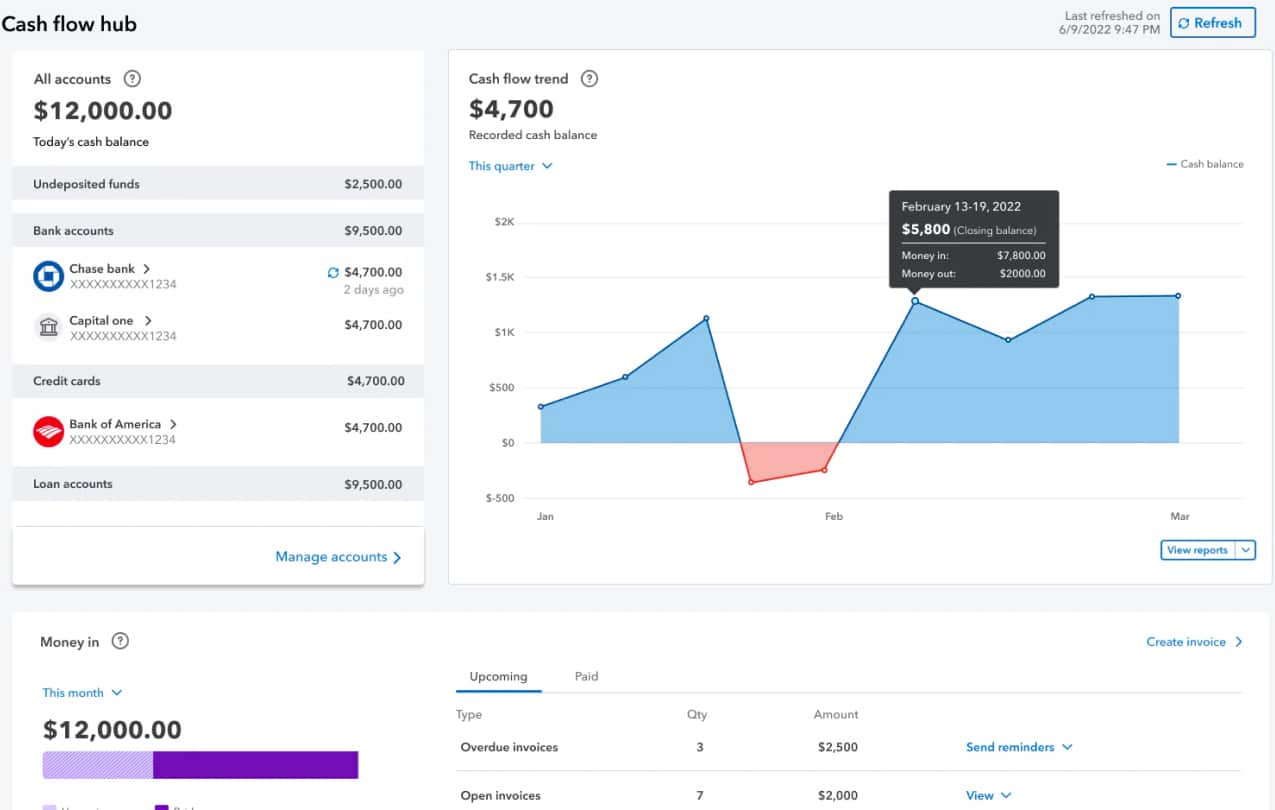

- Cash Flow Hub: This provides a single screen where you can track all incoming and outgoing cash flow. You can monitor paid and incoming invoices, payments, sales receipts, and credit memos easily as well as upcoming and paid vendor bills. The Cash Flow Hub is customizable, so you can display specific information, such as cash balances and cash flow trends.

Cash Flow Hub in QuickBooks Accountant Desktop (Source: QuickBooks)

QuickBooks Accountant Desktop offers plenty of time-saving tools that can help accountants better manage their clients’ books. The only drawback we encountered is the lack of a dedicated document management system, which could have been useful for firms that manage a large volume of files.

However, there are still plenty of QuickBooks Accountant Desktop features that you can use to manage your client’s books.

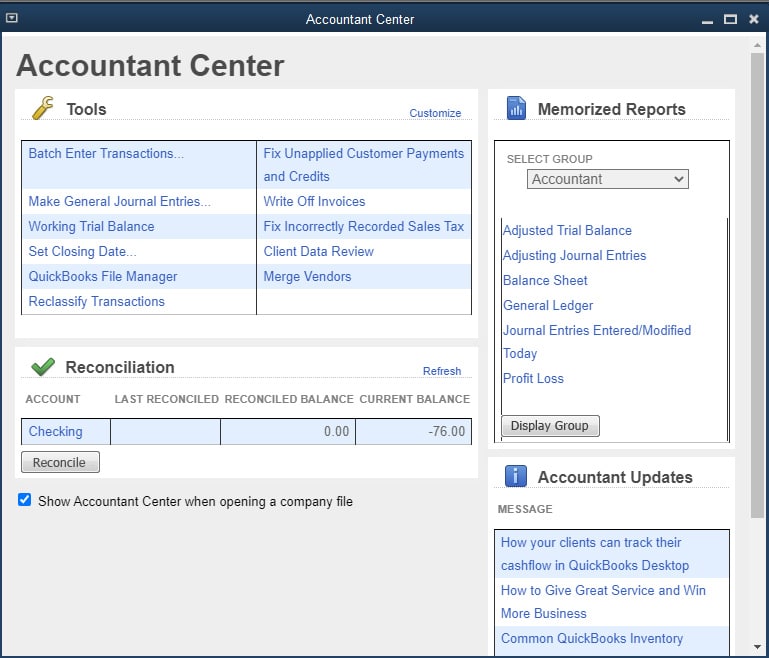

As the name itself suggests, the Accountant Toolbox provides extra features and tools exclusively for accountants and bookkeepers to help you review and adjust your client’s books:

- Access the Accountant Center: Your Accountant Center gives quick access to many of the features in your toolbox, such as the ability to batch-enter transactions, write off invoices, and merge vendors.

Accountant Center in QuickBooks Accountant Desktop

- Troubleshoot prior account balances: Users can compare the prior-year balances in a client’s QuickBooks file to what they should be, based on the actual prior-year numbers that you input. The system will then prepare a proposed adjusting entry that you can accept.

- Bulk-reclassify transactions: Instead of making a journal entry when a client repeatedly makes a classification error, you can specify criteria to locate the suspect transactions. You can then select the individual transactions to reclassify and perform the bulk reclassification with one click.

- Bulk write-off invoices: You can specify criteria to generate a list of invoices to review. After reviewing, perform a bulk write-off by indicating the appropriate invoices and clicking one button.

- Fix incorrectly recorded sales and payroll taxes: You can find and correct instances where your client recorded tax payments incorrectly.

- Merge vendors: If clients create duplicate vendor accounts accidentally, you can merge all of their transactions into a single vendor.

- Batch enter transactions: You can input numerous transactions quickly using a spreadsheet-like interface. This is much quicker than entering checks or other transactions through the regular screens.

Clients create an Accountant’s Copy to share their QuickBooks data. They specify a dividing date, usually the end of the most recent period. Only the client can work on transactions after the dividing date, and only the accountant can work on transactions prior to the dividing date. You can import their Accountant’s Copy, make the necessary changes, and then export your changes. When the client imports your changes, the dividing date they set will be unlocked.

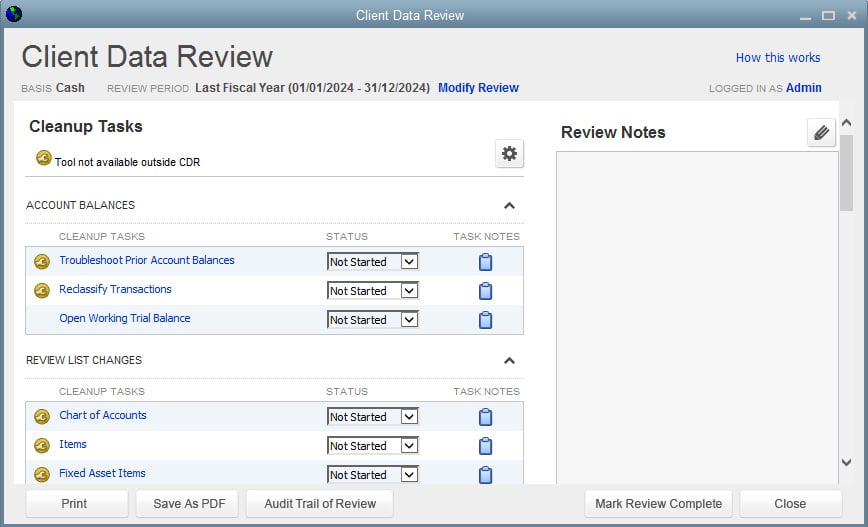

This provides specialized tools to detect and correct common data entry errors, such as incorrectly recorded sales tax payments invoices written off in bulk instead of individually. It also lets you reclassify multiple transactions in one go, troubleshoot inventory problems, and detect changes made to your lists in QuickBooks.

Client Data Review tool in QuickBooks Accountant Desktop

QuickBooks Desktop Accountant lets you toggle between all the industry-specific editions of Premier: General Business, Retail, Professional, Contractor, Nonprofit, and Manufacturing and Wholesale.

To switch to another edition, select File from the top menu bar, click Toggle to Another Edition, and then select the edition you want to switch to as demonstrated in the GIF below.

Toggle between industry-specific editions of Pro and Premier

- Categorize transactions with improved bank feeds: Categorize bank transactions automatically with more detail by using enhanced rules, batch editing, and improved matching.

- Send statements automatically: Automate regularly sent statement emails tailored to different customer needs.

- Customize payment receipts: Customize payment receipt formatting, including logos, for a professional and consistent look across your customer communications.

- Create customer groups: Create rule-based customer groups based on fields like customer type, status, location, and balance so that you can manage and communicate with customers easily.

- Access QuickBooks Desktop Manager: Use one management tool to find and install all of your QuickBooks products.

- Access QuickBooks Tool Hub: Fix common problems and errors with a hub containing easy-to-use troubleshooting tools.

QuickBooks Accountant Desktop offers the core bookkeeping features available in QuickBooks Desktop Premier, so you can use it to manage your firm’s books without an integration. This makes it unique from other specialized accounting practice tools, such as OfficeTools Workspace and Jetpack Workflow.

We discuss QuickBooks Premier’s features in detail in our QuickBooks Premier review, but to give you a sense of what you can get from QuickBooks Accountant Desktop, here are some of its notable bookkeeping features.

QuickBooks Accountant Desktop allows you to enter and pay bills directly from within the platform. It also keeps track of all outstanding bills and shows you what you owe. To help you stay organized, QuickBooks Accountant Desktop enables you to categorize expenses, such as rent, utilities, and supplies. You can also set up partial payments, schedule recurring transactions, and create A/P reports so that you can better track and manage your payables.

With QuickBooks Accountant Desktop, you can create invoices, send them to clients, and track payment receipts. It also lets you track customer balances, payment due dates, and outstanding receivables, helping you better manage your cash flow and follow up on overdue payments. You can also generate A/R reports to gain insights into your customers’ payment behavior and aging receivables.

You can connect your bank and credit card accounts to QuickBooks Accountant Desktop so that you can automatically download your transactions and categorize them for easy tracking. The program provides the tools you need to reconcile accounts and identify errors or missing transactions.

QuickBooks Accountant Desktop allows you to run various standard reports, such as profit and loss statements, balance sheets, cash flow statements, and more. You can also create customized reports to meet your specific business needs.

QuickBooks Accountant Desktop while generally user-friendly, requires setup and maintenance due to its desktop nature. You need to install and set up the software and manage updates manually.

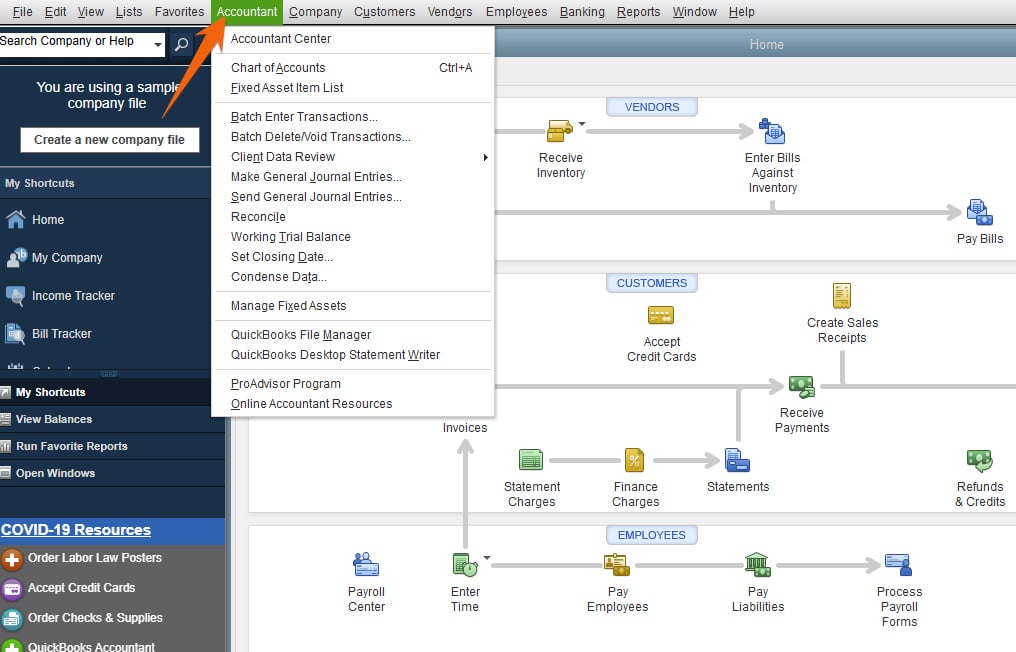

The program essentially has the same user interface as the other QuickBooks Desktop products, except for the addition of the Accountant menu. The menu lets you access the special tools you need, such as the Accountant Center and the Client Review tool.

Accountant Menu in QuickBooks Accountant Desktop

The platform also has some helpful features that make it easy to transfer and access your clients’ QuickBooks company files. For instance, you can open client files from the preceding two years without updating the file. This enables your client to still access the file with their older version of QuickBooks.

QuickBooks Accountant Desktop includes telephone support, but you have to send a request and wait for a call from a representative—resulting in a significant blow to its score. You can also talk to an agent through live chat during business hours or explore some of its self-help resources and troubleshooting guides online.

How We Evaluated QuickBooks Accountant Desktop

We evaluated QuickBooks Accountant Desktop using the internal scoring rubric below.

15% of Overall Score

We checked not only the initial purchase or subscription fee but also any ongoing costs, such as updates, support, and training.

35% of Overall Score

The core features we wanted to see, directly related to managing your accounting practice, carry the highest weight. This includes features like direct access to your client’s books, client management, time tracking and billing, and task and workflow management.

20% of Overall Score

A good accounting practice management software should also offer fundamental bookkeeping features to support your firm. Some of the essential bookkeeping features we look for include general ledger (GL), A/P, and A/R management.

10% of Overall Score

We recommend an accounting practice management software that your team can quickly learn and use.

10% of Overall Score

Ideally, accounting practice software providers should offer various ways for users to seek support, including phone and email support, self-help guides, and training opportunities.

10% of Overall Score

We checked out online reviews to see if users have positive experiences with the software.

Frequently Asked Questions (FAQs)

QuickBooks Accountant Desktop has the same accounting features as QuickBooks Premier. In addition, it has special tools to allow accounting professionals to import, adjust, and export their clients’ QuickBooks Pro and Premier company files.

No, it’s a desktop-based software that needs to be installed on a local computer.

Yes, but you’ll need QuickBooks Accountant Desktop. It has an option under the File menu to convert an Accountant’s Copy (.QBA) to a regular QuickBooks company file (.QBW).

Bottom Line

If you have clients who use Pro or Premier versions of QuickBooks Desktop, then you need QuickBooks Accountant Desktop. It includes comprehensive tools to import your client’s data file, review the file for errors, and make adjustments. The latest version includes a Cash Flow Hub that can help you better track your or your client’s outgoing and incoming cash flow.