QuickBooks Online Accountant is a cloud-based accounting practice management software designed for accounting professionals managing clients who use QuickBooks Online. The platform provides direct access to clients’ books, which is essential for managing client transactions, reviewing books, and making adjustments. In addition to accountant-only tools, it includes QuickBooks Online Advanced, which you can use for your own firm.

With an average user rating of 4.5 out of 5 on a top review site, QuickBooks Online Accountant is commended for its ease of use and setup. On the downside, we found some notable weaknesses, such as the lack of a mobile app for managing your client’s books.

QuickBooks Online Accountant is free; and when you enroll, you’re eligible to take part in the QuickBooks Online ProAdvisor program. See if it’s worth signing up after reading our detailed QuickBooks Online Accountant review.

At Fit Small Business (FSB), we are committed to delivering thorough and dependable software reviews. In adherence to the FSB editorial policy, we seize every opportunity to try the accounting practice software we review firsthand, allowing us to test how the features work in real-world scenarios. This approach allows us to customize our reviews and provide more relevant insights and recommendations tailored to the unique needs of your accounting firm.

Pros

- Includes a portal to your client's QuickBooks Online accounts with remote, real-time access to files

- Comes with a free subscription to QuickBooks Online Advanced to use for your firm's books

- Includes free access to the QuickBooks Online ProAdvisor program

- Offers free, self-paced certification training and examinations

- Lets you list your profile for free in the Find-a-ProAdvisor Directory

Cons

- Is incompatible with QuickBooks Desktop

- Has no mobile app for managing clients

- Doesn't let you calculate realization percentage when employee time is written off of a job or project

- Lacks document management and customer relationship management (CRM) features

- Has no due date list

Visit QuickBooks Online Accountant

Is QuickBooks Online Accountant Right for You?

Is QuickBooks Online Accountant for You?

QuickBooks Online Accountant Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Easy to set up and use | Unresponsive customer support |

| Ideal for startup ventures | Unintuitive receipt capture feature |

| Free access to the QuickBooks ProAdvisor program | |

Satisfied users commented that the platform is easy to set up and use, which aligns with our key findings (discussed in our ease of use section below). One user who left a positive QuickBooks Online Accountant review explained that it has a simple interface and that it is feasible for startup ventures.

Another reviewer shared that free access to the QuickBooks ProAdvisor program is a great help, especially for managing their own books and their clients’. We agree with this, and we want to highlight that the certification training and certifications are self-paced, so you can take them at your most convenient time.

On the flip side, one user complained that the customer support was a bit unresponsive. This, however, isn’t a general reflection of QuickBooks’ customer support, as it still depends on the quality of customer service you receive from the agent assigned to you. Moreover, another reviewer wishes that the receipt capture was easier to use.

As of this writing, QuickBooks Online Accountant earns the following ratings on top review sites:

- Capterra[1]: 4.5 out of 5 based on around 25 reviews

- G2.com[2]: 4.4 out of 5 based on about 80 reviews

QuickBooks Online Accountant vs Competitors

We compared QuickBooks Online Accountant with its top competitors, and here’s the result:

QuickBooks Online Accountant vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

QuickBooks Online Accountant Free

-

QuickBooks Accountant Desktop $799 annually per ProAdvisor

-

Xero Practice Manager $149 per month

-

TaxWorkFlow $1,500 per year

QuickBooks Online Accountant wins in almost all categories, which isn’t surprising given that it has many advantages over its competitors. For instance, it’s free for accounting professionals, and it offers enhanced bookkeeping features through QuickBooks Online Advanced.

TaxWorkFlow is slightly better than QuickBooks Online Accountant in customer support due to its direct phone support option, in contrast to QuickBooks Online Accountant’s callback. More details will be provided in our customer support section below.

Accounting professionals seeking information about the QuickBooks Online Accountant pricing structure will be glad to know that the platform is available for free. A subscription includes a portal to your clients’ books and QuickBooks Online Advanced, which you can use for your firm’s books. Since you have free access to the QuickBooks Online ProAdvisor program, you can serve your clients regardless of the QuickBooks Online product they use.

ProAdvisor Preferred Pricing Program

The ProAdvisor Preferred Pricing program provides accountants and their clients’ exclusive discounts on QuickBooks Online, QuickBooks Time, and QuickBooks Payroll. It’s applicable only for new client subscriptions that are initiated from the “Add client” tab within QuickBooks Online Accountant. There are three billing methods you can choose from when setting up a new QuickBooks Online client account:

- ProAdvisor discount: You can pay for your client’s QuickBooks Online subscription and get a 30% discount for their entire subscription duration. You or your firm will be charged monthly with the option to cancel anytime. You can pay the discounted price to QuickBooks and then charge your clients the full price if you want. If your client leaves, you can move the subscription to them and they’ll have to pay full price.

- Direct discount: With direct discount, your clients are billed directly instead of you paying on their behalf. The discount rates are the same as with the ProAdvisor Discount, but only last for 12 months instead of the entire life of the subscription. After 12 months, your client is billed the then-current regular price.

- Revenue share: Just like Direct Discount, your clients are billed directly in the revenue share billing option. When you sign up a new client with QuickBooks Online or Payroll, they will receive a 50% discount for three months, just like if they had purchased the subscription themselves on the QuickBooks website. QuickBooks will then pay you 30% of the subscription fees paid by your client for the first 12 months.

Our article on the QuickBooks ProAdvisor Preferred Pricing Program explains the three billing options in detail, the different products available for discounts, how to enroll a client in the program, and more.

QuickBooks Online Accountant New Features for 2023

- Bulk transaction processing in Books Review: This allows you to process hundreds of transactions in one go, helping you save time and deliver more efficient results for clients.

- Enhanced client request management: You can now view and fetch transaction-level information provided by your clients instantly, no matter whether they are in their QuickBooks account.

- Improved document management: Accountants can now capture and store items, such as document types, folders, and contextual notes, which provides a more organized way to manage essential data, such as tax documents, checks, and expense receipts.

- Custom roles: Select from popular role types, such as admin, payroll manager, and sales manager.

QuickBooks Online Accountant offers plenty of features to help accountants better manage their clients’ books, including client management, project management, and books review. It would have earned a perfect score if it had a dedicated document management feature, which we believe is useful for firms that manage a large volume of client files.

Meanwhile, here are some of the standout QuickBooks Online Accountant features:

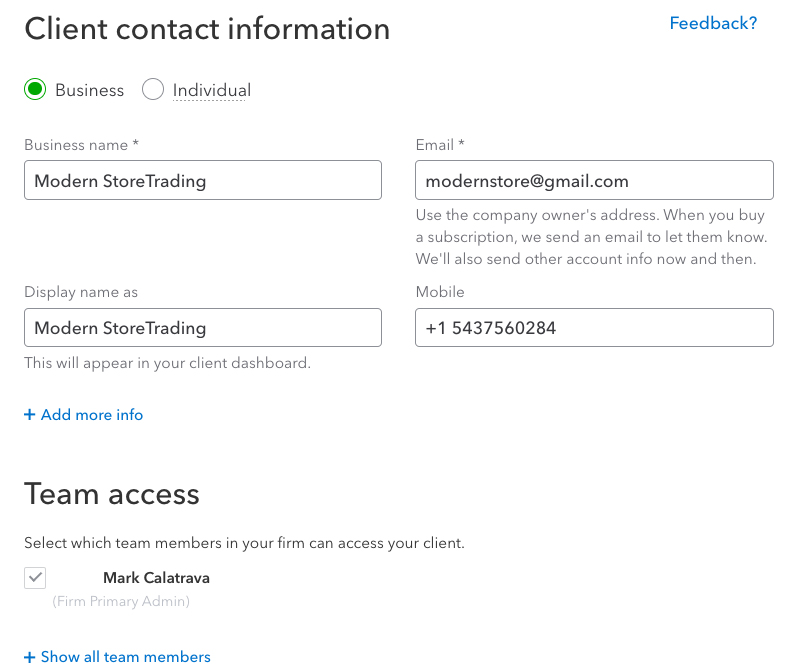

There are two ways you can add a new client in QuickBooks Online Accountant—depending on whether they already have a QuickBooks Online account.

1. Clients With a QuickBooks Account

If your client already has an account, then ask them to send you an invitation link to become their accountant. Then, you need to sign in with your user ID and password and then select the right firm (if you have multiple firms). If you have clients who are currently paying for their own QuickBooks Online subscription, you can transfer their QuickBooks Online subscription to your billing plan. To do this, follow QuickBooks’ guide on how to transfer clients to your wholesale discount plan in QuickBooks Online. Meanwhile, if your client wishes to manage their own billing, then you can still give them Direct Discount.

2. Clients Who Are New to QuickBooks

If your client has no QuickBooks account and doesn’t intend to sign up for QuickBooks, you can still add them to your QuickBooks Online Accountant account. To do this, select the Clients menu from the left navigation bar, click Add Client, and then provide the required client information. Make sure to select No subscription under the Products section. Click Save to add your new client.

Setting up a new client in QuickBooks Online Accountant

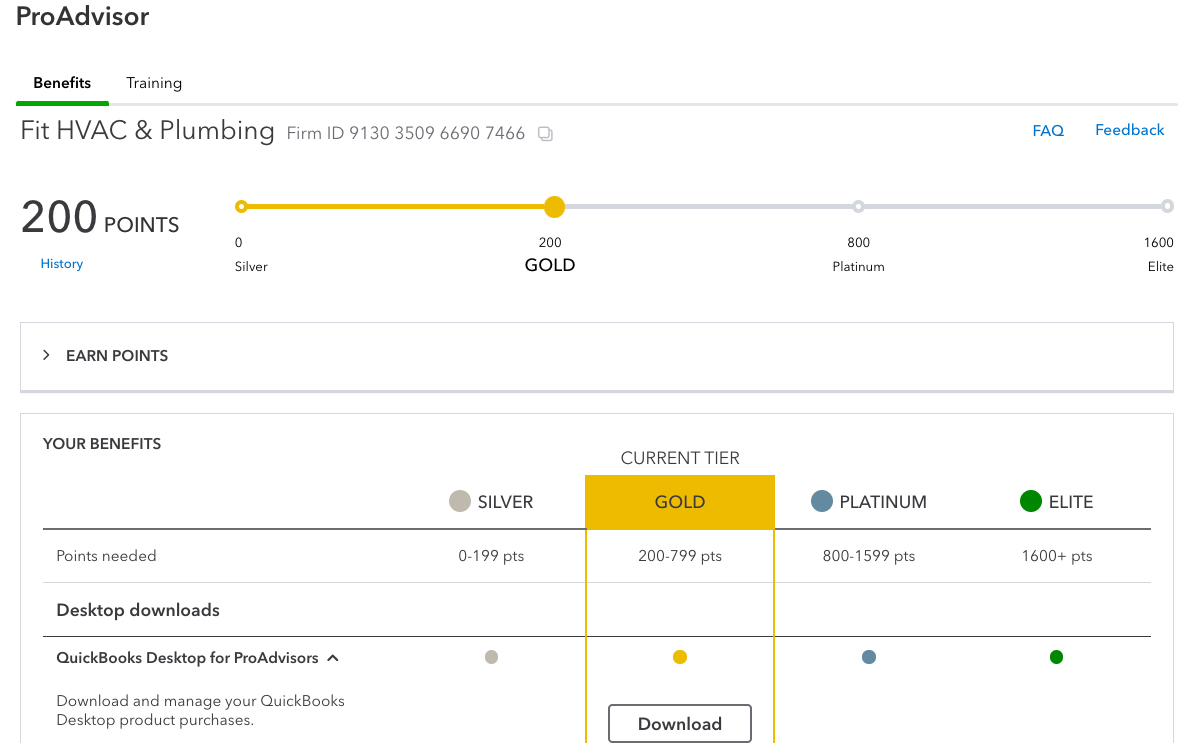

The QuickBooks ProAdvisor program offers benefits and resources that get better as your firm grows. You’ll earn ProAdvisor points and rewards, such as free training, and software discounts for performing certain actions, like training in QuickBooks Online, adding clients, and completing QuickBooks training and certification.

However, note that earning ProAdvisor points is not a specific requirement or necessity for using the platform or accessing its features. It’s simply designed to reward ProAdvisors for their ongoing education, expertise, and engagement with the QuickBooks platform. To check your ProAdvisor points, select ProAdvisor in the left navigation menu and then click Benefits.

ProAdvisor Points in QuickBooks Online Accountant

Once you complete the training, pass the exam, and become a QuickBooks ProAdvisor, you’re eligible to list your profile for free in the Find-a-ProAdvisor Directory. Essentially, the faster your firm grows and earns points, the faster you’ll elevate your status and gain access to rewards.

When you sign up for QuickBooks Online Accountant, you’ll gain access to QuickBooks Online Advanced. This version has features such as Batch Transactions, which gives you the ability to define and automate specific tasks and workflows. It also assists with organization, integrating seamlessly with Google Sheets. The Performance Center also allows accountants to track business performance and gain valuable insights with customizable, presentation-ready reports.

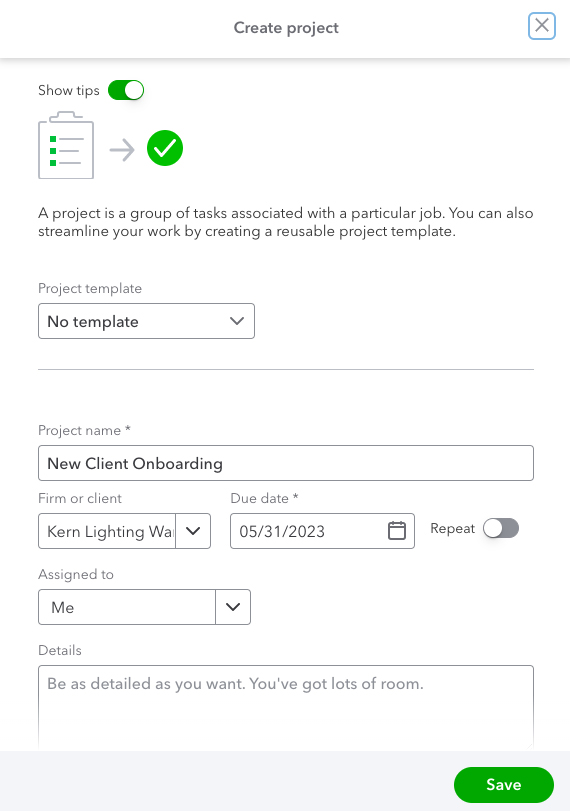

Project management can be accessed through the Work menu. This feature lets you create projects or tasks and assign them to your team members. One of the most useful features is the ability to create recurring projects, which makes sense as accounting professionals often manage projects that are repeated regularly. You can specify how often the project will be repeated and the end date.

Creating a new project in QuickBooks Online Accountant

The “Books Review” feature is an expanded version of “Month-End Review,” and it’s designed to help QuickBooks Online accountant users streamline their workflows for initial transaction review, reconciliation, and final review. The Books Review includes two new review phases:

- Setup phase: This allows you to find and fix errors made during setup, including errors on the existing balance sheet, profit and loss (P&L) reports, and opening balances and chart of account issues, like bank accounts that haven’t been linked to bank feeds, missing system accounts, and incorrectly classified account types.

- Wrap-up phase: This helps you add finishing touches to your work. With this new tool, it’s easier for you to prepare a customized report of your client’s monthly financial data and business performance, helping you provide them with better information for more strategic business decisions. The feature also enables you to email the report to your client and close the books for the accounting period.

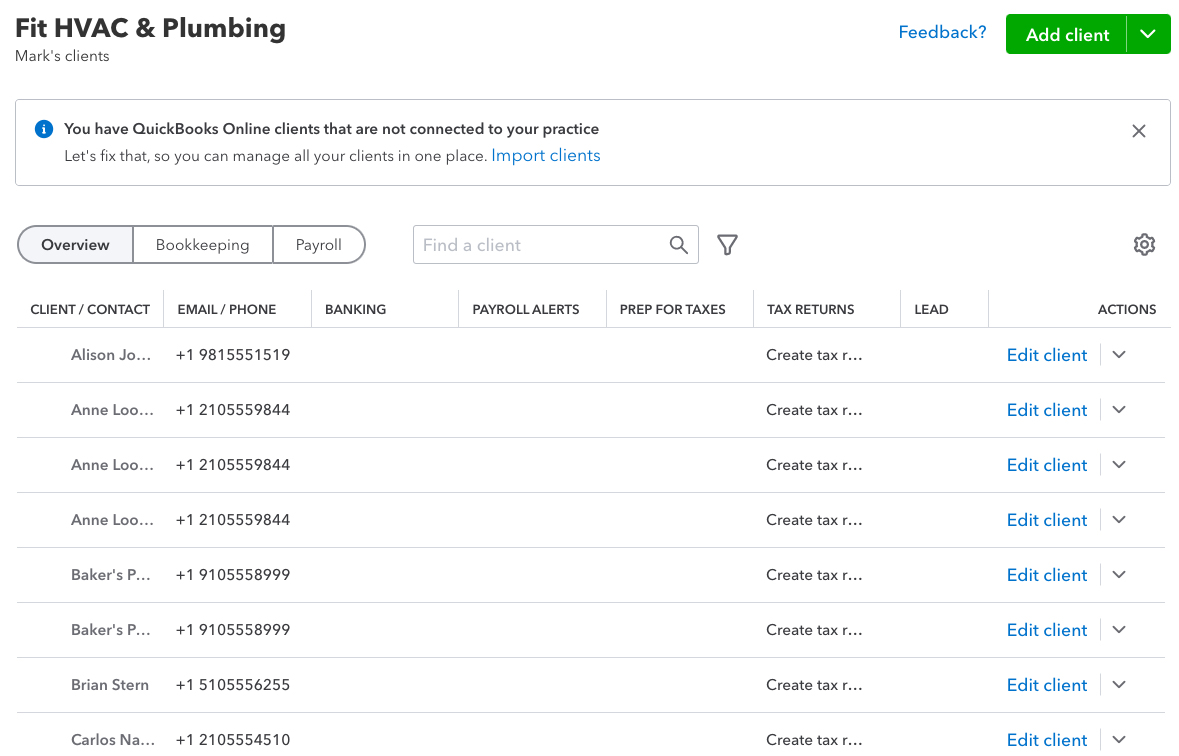

In the “Your Practice” section, you’ll have access to built-in tools for workflow tracking, document sharing, and team assignments. This enables you to streamline your communications by sharing client documents and keeping them organized in a password-protected environment.

You can also view your firm’s upcoming deadlines and urgent tasks and filter by clients, assigned team members, or type of task. Additionally, you can manage employee permissions by allowing access to specific information. The client menu lets you add new clients, edit existing clients’ details, or make a client inactive.

Client management tool in QuickBooks Online Accountant

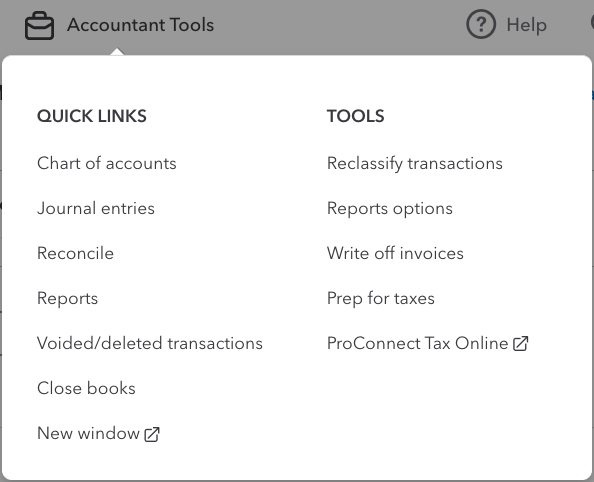

With these accountant-only tools, you can streamline your work and access customizable reports, so you can advise clients quickly. The accountant toolbox includes quick links to your chart of accounts, journal entries, and reports, as well as tools for performing several functions like reconciliation and reclassifying transactions.

Accountant Toolbox in QuickBooks Online Accountant

- Chart of Accounts: Review the list of your client’s chart of accounts to make sure it’s still relevant to their business.

- Journal entries: Create an accounting journal entry easily to track money spent and received by your client.

- Reconcile: Match your client’s transactions on QuickBooks to their bank and credit card statements to make sure their books are accurate.

- Report: Build and view different types of reports. You can pick from standard reports, like balance sheets, P&L statements, and cash flow reports, or you can create a customized report based on your client’s business needs. The Performance Center gives a visual chart of your financial data, which is easier to comprehend than plain numbers:

Performance Center in QuickBooks Online Accountant

- Void/Deleted Transactions: Quickly run a report of voided or deleted checks. You can select your desired date range and track which user made the transaction.

- Close Books: Reconcile your client’s books to the prior year’s tax return. If everything is accurate and complete, you can close the books to prevent unwanted changes.

- New Window: Open a new window within the same browser session. This feature is useful when you need to work simultaneously on different areas or tasks within QuickBooks Online Accountant.

- Reclassify Transactions: Reclassify income, expenses, cost of goods, and balance sheet accounts to make sure that no transactions are incorrectly paired up with classes or accounts.

- Reports options: Specify the period for which you want to generate the reconciliation report.

- Write off Invoices: Record uncollectible invoices as bad debt by using the Write Off Invoice tool. This feature helps you keep your net income and accounts receivable up to date.

- Prep for Taxes: Review and adjust your client’s accounts to prepare for the tax season. After you review their accounts, you can export the pre-filled form to ProConnect Tax Online to help you file your client’s tax returns easily.

While there isn’t a mobile app designated for managing clients or their books within QuickBooks Online Accountant, you can access your own books through the QuickBooks Online mobile app, just like any other user. The app has most of the same features as the software itself, such as entering transactions, recording expenses, invoicing customers, and sending reports.

This tool reduces time spent on manual data entry by exporting your clients’ QuickBooks Online data directly into their tax returns prepared with Intuit ProConnect and correcting entries to simplify end-of-year duties. This includes adjusting entries and mapping account balances to specific tax lines.

The Trial Balance tool is particularly useful during the preparation of financial statements. It serves as a preliminary step before generating reports like balance sheets and income statements. Additionally, it allows you to easily identify any unbalanced accounts, missing entries, or misclassified transactions, helping you catch and correct errors before finalizing financial statements.

If your client wants you to handle their payroll, you can add QuickBooks Payroll to your account. You can choose from three plans (Core, Premium, and Elite), starting at $45 per month plus $5 per employee. All plans include full-service payroll, including unlimited payroll processing, tax payments and filings for federal and state taxes, and employee benefits management. If you upgrade to Premium or Elite, you’ll get access to HR tools, such as onboarding checklists and performance tools.

Starting February 2023, you must use QuickBooks Online Accountant to add payroll to your service. With the previous version, your client could add it through their QuickBooks Online account.

If you drive for work, you can use QuickBooks Online Accountant to record your deductible mileage. With the free QuickBooks mobile app, you can automatically track your business mileage without manually recording your odometer readings. Alternatively, you can manually enter your mileage each time you drive.

Tracking mileage in QuickBooks Online Accountant

I awarded QuickBooks Online Accountant perfect marks because it comes with free access to QuickBooks Online Advanced that you can use for your own firm. QuickBooks Online Advanced offers all of the core features discussed in our QuickBooks Online review, plus some enhanced features like advanced reporting, batch invoicing, and access to a dedicated customer service representative.

For more information about how QuickBooks Online Advanced differs from the other QuickBooks Online plans, read our QuickBooks Online plans comparison.

We believe QuickBooks Online Accountant is the easiest to use among the accounting practice software we reviewed. The slight dip in its score is due to some advanced functionality that may be overwhelming for new users, including fixed asset accounting—which is a new feature of QuickBooks Online Accountant.

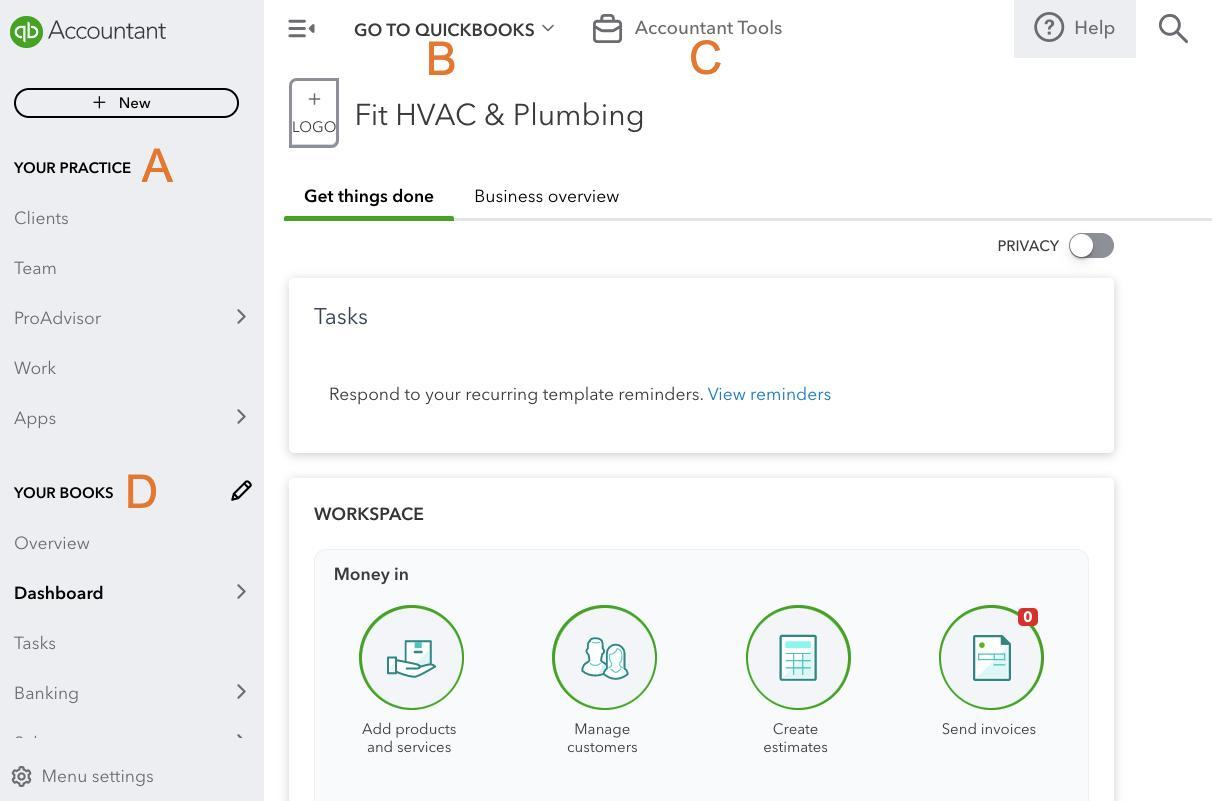

Other than that, we believe the platform is easy to use and that it only takes a short period to familiarize yourself with the features. When you log in to your account, you’ll be greeted by an intuitive dashboard that allows you to access both your books and your clients’ books in one central area. Your dashboard includes important sections:

QuickBooks Online Accountant’s dashboard

A. Your Practice: Here, you can find links to view your list of client companies, see the team section where your team members and their access rights are listed, and the ProAdvisor section, which has great tips for ProAdvisors to develop their business. You can also access the Workspace, where you can create projects and tasks, and there’s a link to the Apps space, with additional apps that can help your practice and support clients.

B. Go to QuickBooks: This is where you’ll find links that take you to your clients’ QuickBooks Online accounts. Select the client you want to view, and you’ll immediately access their QuickBooks Online company dashboard. The Client Switcher stays at the top of the screen, allowing you to switch quickly to another client’s books.

C. Accountant Tools: This drop-down menu is only available to you as an accountant user. Selecting this takes you to a list of accountant-only tools, including Prep for Taxes, Reclassify Transactions, and Write-Off Invoices.

D. Your Books: This area is where your firm’s own versions of QuickBooks Online Advanced and Payroll Elite are accessed. You can manage expenses and sales dashboards, calculate taxes, view financial reports, and track mileage here.

QuickBooks Online Accountant could have earned a better rating if it provided direct phone support without the need for a callback or waiting in a queue. Currently, you have to send a request first, and an agent will call you back when they are available to assist you.

Nevertheless, QuickBooks Online Accountant still provides a variety of support methods, including callback phone support, live chat, a searchable knowledge base, video tutorials, webinars, and quick-start guides. You can also ask a question in the community forum, and other users may be able to help troubleshoot issues.

How We Evaluated QuickBooks Online Accountant

We evaluated and scored QuickBooks Online Accountant using the internal scoring rubric below.

15% of Overall Score

We checked not only the initial purchase or subscription fee but also any ongoing costs, such as updates, support, and training.

35% of Overall Score

The core features we wanted to see, directly related to managing your accounting practice, carry the highest weight. This includes features like direct access to your client’s books, client management, time tracking and billing, and task and workflow management.

20% of Overall Score

A good accounting practice management software should also offer fundamental bookkeeping features to support your firm. Some of the essential bookkeeping features we look for include general ledger (GL), A/P, and A/R management.

10% of Overall Score

We recommend an accounting practice management software that your team can quickly learn and use.

10% of Overall Score

Ideally, accounting practice software providers should offer various ways for users to seek support, including phone and email support, self-help guides, and training opportunities.

10% of Overall Score

We checked out online reviews to see if users have positive experiences with the software.

Frequently Asked Questions (FAQs)

QuickBooks Online Accountant lets you access your client’s books and provides tools that help you prepare a trial balance, reclassify transactions, write off invoices, close books, and more.

QuickBooks Online is a cloud-based accounting software designed to be used by business owners, whereas QuickBooks Online Accountant is a cloud-based portal that lets professional bookkeepers access the QuickBooks Online accounts of their clients. QuickBooks Online Accountant also includes access to QuickBooks Online Advanced for the professional bookkeeper to use for their own books.

Yes, you can benefit from plenty of training courses, including free online recorded sessions and in-person and virtual events.

QuickBooks Online Accountant is free for accounting professionals.

Yes, and you can do so by clicking the Add Clients menu on the Clients screen. However, note that your client will need to invite you as an accountant user to their QuickBooks Online company. During the import process, QuickBooks Online will display a list of companies where you are an accountant user.

Bottom Line

QuickBooks Online Accountant is more than a portal for your clients’ information. It includes a free subscription to QuickBooks Online Advanced to use for your firm, free access to the QuickBooks Online ProAdvisor program, free training and other educational materials, and a listing on the QuickBooks Certified ProAdvisor website. It’ll also help you improve your business by providing key trends based on client data, performance indicators, and financial ratios.

Visit QuickBooks Online Accountant