Buying a mobile home or buying a trailer home is a great real estate investment for those who want a more cost-effective alternative to buying a traditional home. Depending on its size, condition, and features, it can cost from $10,000 to more than $100,000. Note that mobile homes have specific mortgage and land regulations that owners must follow. We’ve compiled a list of eight steps, from understanding what a mobile home is to choosing a location and securing financing to help you learn how to buy a mobile home.

1. What a Mobile Home Is (vs Manufacture & Modular Homes)

A mobile home, sometimes called a trailer home, is built in a factory, permanently attached to a chassis, and then transported to where the living space will be. The buyer owns the mobile home structure and can place it on owned or leased land. Traditional or stick-built homes are typically single-family residences with a poured foundation and may have a basement. Instead of being assembled somewhere and delivered, these are constructed on-site.

Example of modern mobile home

Furthermore, there are three typical sizes for mobile homes: single-wide, which ranges in size from 500 to 1,100 square feet (SF); double-wide, which runs in size from 1,200 to 2,000 SF; and triple-wide, which is larger than 2,000 SF.

When referring to these types of homes, the terms mobile, manufactured, and modular are frequently used interchangeably. Even though these homes are related, they have some significant differences.

The most notable distinctions between these types of homes are the regulations and the date they’re built. The Department of Housing and Urban Development (HUD) regulates manufactured and mobile homes, while modular homes are regulated by state, local, or regional building codes where the home resides. Also, the date they’re built determines the type of mortgage you can get. A mobile home built before the cutoff date is typically ineligible for a real estate mortgage; instead, a chattel mortgage would be used.

Click the link to jump to our section on financing to get more information on chattel mortgages and other financing options.

2. Understand the Costs of Buying a Mobile Home

A mobile home can cost anywhere from $10,000 to more than $100,000, depending on its size, design, condition, location, customization, and features. New trailer homes or those with extra features may be more expensive, from $40,000 to $250,000. In contrast, used trailer homes are less expensive, from $10,000 to $50,000.

Buying a mobile home incurs some other expenses that you must consider as part of the costs of buying a trailer home, like the following:

- Land or plot purchase: In addition to buying the property, you may also need to buy or lease the land the home will sit on. Its costs depend on the state you live in.

- Foundation: This can go from $8,000 to more than $20,000, depending on the size of your mobile home and the kind of foundation you get, like a finished basement, concrete pit, or pier and beam foundation.

- Delivery and installation: You must decide whether to utilize a transport-only or a full-service move service. Transport-only moves range from $700 to $3,500. In contrast, a full-service move may cost between $3,000 and $14,000.

- Utility hookups: Add up what you’ll pay for internet and cable service and hook up water, sewage, and other utilities. This can go for around $300 to more than $1,000.

- Taxes and insurance: The price of the house and any related taxes and levies must be paid. You must also account for insurance, which is often more expensive for mobile homes than conventional homes.

3. Decide if Buying a Mobile Home Is for You

Once you understand the structure and costs of the mobile home, purchasers need to weigh the pros and cons of purchasing one. For instance, mobile homes are more affordable than traditional homes. However, its value depreciates quicker than traditional homes.

If you’re thinking of buying a trailer home, here are some of its benefits and downsides that you must consider.

| PROS | CONS |

|---|---|

| More affordable than traditional homes | You can’t get or apply for conventional mortgage loans |

| It can easily be built and has no weather delays during construction | There are upfront costs, such as buying or leasing the land where the mobile home will be located |

| You can easily tailor the mobile home based on your wants and needs | Mobile homes depreciate quicker than traditional homes |

| There are various finance options available, like chattel and government-backed loans | Mobile homes are smaller than traditional homes |

Mobile homes can be used as a primary or secondary home. It provides a similar lifestyle quality as a traditional home and is suitable for multiple residents. Plus, you can add new modules to your home anytime as needed to expand it, which means your house can grow with you. But, if you want your mobile home to be your investment, renting it out will also be an excellent choice.

4. Choose a Location for Your Mobile Home

When you’re ready to move forward with a mobile home purchase, the first thing you’ll need to decide is the place where the mobile home will sit. Multiple options are available, including an established mobile home park or putting it on a piece of private land you own or lease.

Mobile Home Park

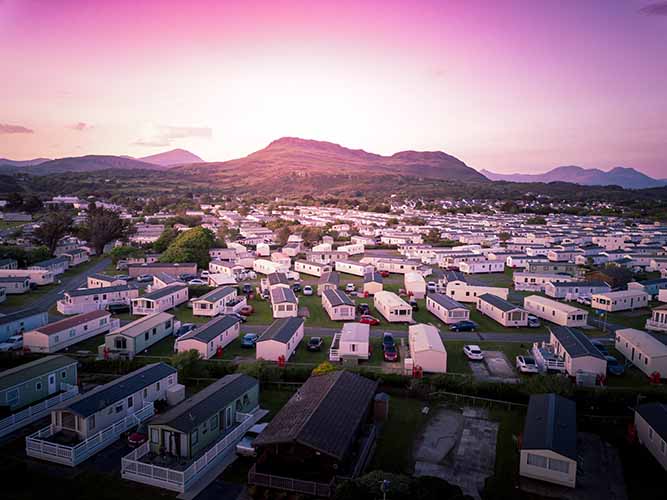

Choosing mobile home parks is a great solution since they are already equipped for all mobile home needs. It is separated into lots, each designed to hold a dwelling. These lots often come with a road, a permanent foundation, a yard space, and all necessary utility hookups. Land within a mobile home park can either be leased or owned.

Example mobile home park

Additional considerations:

- What is included in the park, e.g., communal amenities and security?

- Is there a homeowner’s association (HOA), and if so, how much does it cost and what does it provide?

- Is the lot large enough to accommodate your desired mobile home?

- Does the land have to be leased or purchased?

Buying Private Land

For many growing families, laying down roots on land you own outright is part of that American Dream. Having your mobile home settled on your private land will give you more privacy and allow you to do anything you like without interference from association guidelines. But you need to have the money available if you want to buy land. You can consult the local zoning ordinances to verify that your desired location allows and permits mobile homes.

Example of private land property

Additional considerations:

- What are the annual taxes for the land?

- What is the local community like?

- Is it close to conveniences, like groceries, fire departments, etc.?

- Is there an internet connection, power, water, and sewer available?

5. Search for a New or a Used Mobile Home

After you decide where your mobile will be located, it’s time to search for a new or used mobile home to purchase. To get a new mobile home, search for a local manufacturer or retailer or look for mobile home builders close to where you are purchasing the property, like Champion Home Builders and Clayton Homes. Work with your chosen manufacturer or retailer to customize your mobile home unless you buy a standard model or an existing manufactured home.

If you decide to buy a used mobile home, be sure to check its foundation, walls, windows, and ceiling condition thoroughly before making an offer. Aside from these, remember to examine the insulation, floor damage, plumbing facility, gaps in doors and windows, wiring, and other miscellaneous repairs.

Moreover, mobile homes come with many different floor plans; pick a plan that suits your lifestyle. Also, you must consider the following factors when choosing a mobile home:

- How many bedrooms do you need?

- How many people will be living in the house?

- How is the floor plan divided?

- Is the floor plan have enough space for you and your family?

Example of mobile home listing on Zillow (Source: Zillow)

Consider conducting an online search on real estate listing sites like Zillow and Foreclosure.com. Zillow has the most significant manufactured and mobile home listings, from used to new trailer homes. Zillow also has search filters, such as pricing, number of beds and bathrooms, and home type, for a faster home search process. It obtains listing information from both the MLS (multiple listing service) and non-MLS sources.

6. Secure Financing for Buying a Mobile Home

Even if the average cost of a mobile home is less than a traditional home, financing may still be necessary, especially for those with a tight budget. Here are five financing options you can apply:

Conventional mortgages are not offered or guaranteed by any government agencies. However, they can be obtained through government-sponsored enterprises, Freddie Mac or Fannie Mae. Fannie Mae and Freddie Mac are not direct lenders, so you’ll still have to go through a bank or lender to obtain them. But these programs allow the bank or lender to mitigate risk by underwriting loans to specific standards, making them saleable to Fannie Mae and/or Freddie Mac.

For loan programs, Fannie Mae offers the HomeReady Mortgage, which targets low- to middle-income homeowners and enables them to put down as little as 3%. However, candidates must earn no more than 80% of the area’s median annual income and have a debt-to-income ratio of not greater than 50%.

In contrast, Freddie Mac provides the Home Possible Mortgage, which typically calls for a 3% down payment as a minimum. For this specific loan program, eligible candidates cannot make more money than the average salary in their area. While a 3% to 5% down payment may be all that is required, if you paid less than 20% down, Private Mortgage Insurance (PMI) will likely be an additional expense.

There are three main government-backed mortgage programs to finance the costs of purchasing a mobile home. First is the Federal Housing Administration (FHA). Its terms range from 25 to 30 years, depending on which option you choose between Title I and II.

The second choice is for veterans, who can look into a mortgage loan through the U.S. Department of Veteran Affairs.

If a buyer’s mobile home is regarded as real property, the site is categorized as rural, and if the home is less than a year old, they may also consider the U.S. Department of Agriculture Rural Development.

The word “chattel” refers to moveable property, which is appropriate given that this particular investment property loan type is accessible for mobile homes only. It covers mobile home pricing as determined by the buyer and is more akin to a personal loan than a mortgage. Due to the shorter repayment terms of 15 to 20 years, this results in greater installments than those for traditional residences and is more affordable than a personal loan, and its loan carries a higher interest rate.

To learn more about chattel mortgages, take a look at What Is A Chattel Mortgage? courtesy of Rocket Mortgage.

Personal loans are an excellent option if you only want to finance the mobile home, not the land. Since mobile homes are less expensive than traditional homes, you might still be able to get a loan big enough to pay for mobile home costs, even though overnight personal loans typically have smaller loan capacities and higher interest rates.

Consider dealing directly with sellers or manufacturers who provide financing solutions rather than banks. When purchasing from a private vendor, you can negotiate an installment contract based on their offered plans. Ensure the property’s title is free of any judgments or liens before making an offer on the house.

7. Sign Up for Home Insurance or Warranty

Choose a manufacturer or retailer that provides warranties for appliances, like air conditioners, washers and dryers, and stoves. An annual warranty in the event of poor workmanship or dire circumstances may cover you in case these appliances stop working.

To minimize potential issues or delays, you must also get insurance for the house and satisfy any other occupancy and maintenance requirements before moving in. Mobile home insurance policy generally covers the following standard protections:

- Dwelling: If your mobile home is damaged, the dwelling coverage helps to repair the physical structure damage.

- Contents: If lost or destroyed in a covered incident, your personal property, such as furniture, appliances, and gadgets, is covered up to a predetermined limit. Policies will cover the cash value of items minus the deductible and policy limits.

- Liability: Personal liability insurance can protect you up to your policy’s limits if a non-household member is injured or has property damaged while on your premises.

- Loss of use: Loss of use coverage, referred to as “additional living expenses,” can cover lodging and food expenditures if a covered loss prevents you from residing in your home.

8. Prepare the Home Site for Delivery & Installation

If you’ve purchased a used mobile home, you can move in your belongings and enjoy your new home. However, if you are buying a new mobile home, your manufacturer or retailer will work closely with you to ensure that the home site is ready for the installation of your home. Hire a contractor to prepare the lot to install the mobile home, and depending on the property’s slope, excavation may be required.

Plus, you should apply and secure all the necessary permits to install your home, like a building permit and a special permit to connect to city utility lines (this only is required in some municipalities). Additionally, you need to contact the utility companies in the area where you will install the house and set up an appointment for the utilities to be connected after it has been delivered. Remember to use registered contractors to connect your utilities to the city supply lines.

Example of mobile home foundation

Additional land use permits may also be needed if you plan to use your land for business or agricultural purposes. In addition, preparing the foundation for your mobile home, arranging the delivery date, addressing any issues affecting the home’s installation, and preparing utility hookups must all be completed.

Bottom Line

Purchasing a mobile home may be lucrative and perilous. Remember that an investment real estate property that creates a return on investment can pay off for many years. Be diligent and deliberate at every stage of the process. The next time you consider purchasing a mobile home as an investment, utilize the aforementioned professional advice as your guide on how to buy a mobile home correctly and wisely.

Frequently Asked Questions (FAQs)

Mobile home living has its perks as well as drawbacks. For example, one of its pros is it can be customized based on your preferences, like adding space or a bedroom. However, mobile homes are often smaller than traditional homes and hinder you from applying for conventional mortgage loans. To ensure you choose the suitable park or community, consider some of the following factors:

- How much does the homeowner’s association (HOA) charge cost?

- Are there shared spaces in the park that you can use?

- Is there a gated security system at the mobile home park?

- Do you have enough space and privacy for your needs?

- Can leased land eventually become owned?

The construction of mobile homes adheres to strict standards and rules to ensure that the foundation will last for at least 35 years. A mobile home can last longer if maintained well; its typical usable life is from 30 to 55 years.

For most types of loans, including those backed by the government and those secured by personal property, a credit score of 580 to 620 is needed. In most circumstances, a credit score of 580 is required for prefabricated home loans; however, you may still be eligible for financing through a special program even with a lower score, albeit you might have to put down a bigger deposit.