Hurdlr is a cloud-based expense and mileage-tracking mobile app designed for freelancers and small business owners. It provides tax tracking to assist with reporting correct taxable income, including allowable expenses, on tax returns.

The free plan includes unlimited manual mileage tracking, income and expense tracking, and a tax calculations summary. Paid tiers start at $9.99 monthly and come with additional features, such as automatic mileage, income and expense tracking, advanced reporting, invoicing, and information for your annual tax filing. Learn if the solution is worth considering in my detailed Hurdlr review.

Pros

- Includes tax calculation feature under the free plan

- Includes one free Federal and state income tax filing in Pro plan

- Includes income, expense, and mileage tracking

- Provides basic accounting features

- Offers a helpful support site called Hurdlr University

Cons

- Doesn’t offer the option to choose between actual expense or standard rates for mileage deductions

- Classifies trips as “business” with semi-automatic tracking; can’t be tracked as “personal”

- Lacks telephone support

- Has no route planning features

- Self-employed individuals needing mileage, expense, and income tracking: Hurdlr combines mileage, income, expense, and tax tracking into one app. It’s one of our best mileage tracker apps, specifically for self-employed individuals.

- Individuals looking for tax tracking and reporting: Hurdlr’s tax tracking, estimating, and reporting features can help individuals efficiently budget their money for tax obligations. With its Tax Engine, you can project estimated tax payments and set aside how much cash you need to pay.

- Companies requiring a simple accounting system and mileage tracking: If your business does not maintain inventories or have many bills to organize, Hurdlr Pro’s accounting and invoicing features can help keep your transactions organized. Also, Hurdlr’s accounting features are basic and suitable if you don’t have complex transactions.

Hurdlr Alternatives & Comparison

There are no recent Hurdlr reviews online, but older feedback highlights that the app is appreciated for its user-friendly interface, automatic mileage tracking, and real-time tax estimates. Some also like that the app tracks their mileage without draining their battery, while others mentioned that its customer support team is responsive.

However, a review from early 2024 mentioned that the app has many missing features, including the ability to sort new trips based on date. The reviewer added that they submitted feature suggestions two years ago, but nothing changed. I recommend reaching out to current users to get a clearer picture of how Hurdlr works now.

As of this writing, here’s how Hurdlr is rated on third-party sites:

- Google Play[1]: 4.4 out of 5 from over 8,000 reviews

- App Store[2]: 4.7 out of 5 from over 19,000 reviews

Fit Small Business Case Study

I compared Hurdlr with MileIQ, TripLog, and QuickBooks Online across several categories, including mileage tracking, related app features, and ease of use. The chart below sums up my findings.

Hurdlr vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

Hurdlr Free, $9.99 per month, or $100 per year per user

-

MileIQ $0 to $10 per month

-

TripLog $0 to $15 per month

-

QuickBooks Online $35 to $235 per month

Pricing isn’t Hurdlr’s strongest suit because TripLog and MileIQ have more affordable pricing plans. However, it stands out in related app features due to the availability of additional tools like accounting, invoicing, a tax deduction finder, and a reimbursement system. All four platforms are tied for ease of use, but they aren’t scored identically in my evaluation. Each has its own strengths and weaknesses that affect the overall score.

In my evaluation, Hurdlr took a hit for pricing because most essential features are found in the highest plan, Pro.

Hurdlr’s website doesn’t provide any pricing information, but you can find the prices for the Premium plan on the App Store and Google Play. The information for the Pro tier is available only after signing in to the Hurdlr App. Here’s what I found:

Hurdlr offers a free version and two paid options.

- Premium costs $9.99 monthly or $100 per year.

- Pro is $200 a year, available only as an annual subscription.

The main difference is that while the free option allows you to track mileage, it is only manually. Meanwhile, the paid plans let you track mileage automatically and monitor expenses automatically through machine learning. If you’re looking for advanced features such as invoicing capabilities, accounting functions, and advanced reporting, they are only available with Pro, the most expensive plan.

Hurdlr would have aced my assessment of this category if it had a route planning feature. However, it provides many of the features I wanted to see, including:

Through the mobile app, you can track your mileage manually, semiautomatically, or automatically. Hurdlr’s free option is limited to manual tracking, while the paid plans have access to all three:

- Manual tracking: Enter mileage driven and start/stop locations in the app manually.

- Semiautomatic tracking: Push a button in the app to start and stop business mileage tracking manually using your phone’s GPS. Trips will be tagged as business and can’t be changed to personal.

- Automatic tracking: Let the app run in the background, recording trips automatically using your phone’s GPS based on when your vehicle starts and stops moving. All trips will be recorded, then you tag them as business or personal.

Hurdlr uses GPS to automatically record trips, allowing you to track mileage for tax deductions or reimbursements accurately. You can also enter trips by hand if needed. Once logged, you can easily categorize trips as Business or Personal with a simple swipe—right for Business and left for Personal.

Also, you can set rules to tag income or expense payments automatically as Business or Personal. In this way, you won’t spend much time tagging income and expenses.

In the free plan, you can record income and expenses manually. For paid subscribers, you’ll enjoy automatic tracking and recording once you receive the income or pay an expense. You can record income and expenses manually as well if you don’t have a bank connection.

Once you connect your bank cards (debit and credit) and other payment channels like PayPal, every charge and credit to your accounts will be sent to Hurdlr.

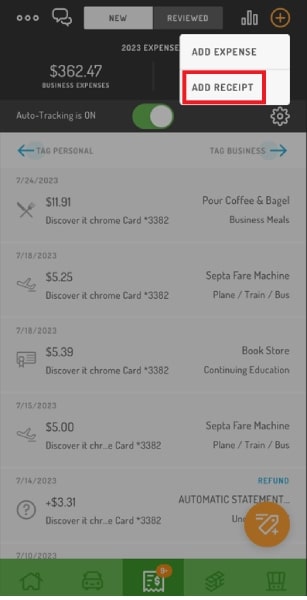

You can create and store digital copies of your receipts for business-related expenses, like travel and meals. Additionally, you can link the captured receipts to specific expense categories, making it easier for you to categorize them for tax deductions.

You can upload expense receipts via the desktop software or by clicking the Add receipt button in the mobile app, which is an easier approach.

Capturing expense receipts through Hurdlr’s mobile app

One of Hurdlr’s greatest features is its tax tracking and estimation. Hurdlr computes your tax obligations automatically based on IRS standard mileage rates. However, tax calculations are mere estimates.

Self-employed individuals should comply with IRS requirements, like making estimated quarterly tax payments. For Hurdlr to estimate your tax, you must provide basic tax information so that the software can determine the most likely amount of tax payable based on your income.

Under the Pro tier, you can invite your accountant to see your tax information on Hurdlr. If you’re filing for yourself, Hurdlr’s reports can help you fill out Form 1040, Schedule C. Another perk of the Pro plan is its advanced tax reporting capabilities. You can even include a home office deduction to arrive at your taxable net income.

Hurdlr nailed my evaluation of this criterion because it provides several additional tools that enhance its functionality without requiring third-party integrations. For instance, unlike other mileage tracking software that require integration with bookkeeping software like QuickBooks Online, Hurdlr has built-in accounting features.

Hurdlr Pro offers basic accounting features like a chart of accounts, journal entries, and financial reporting. If you’re familiar with double-entry bookkeeping, Hurdlr’s simple accounting system will be easy to use.

It has a chart of accounts that shows the account name, account number, and running balance. To see the transactions in every account, you can access the general ledger. It’ll show you the debits and credits in each account and its running balance.

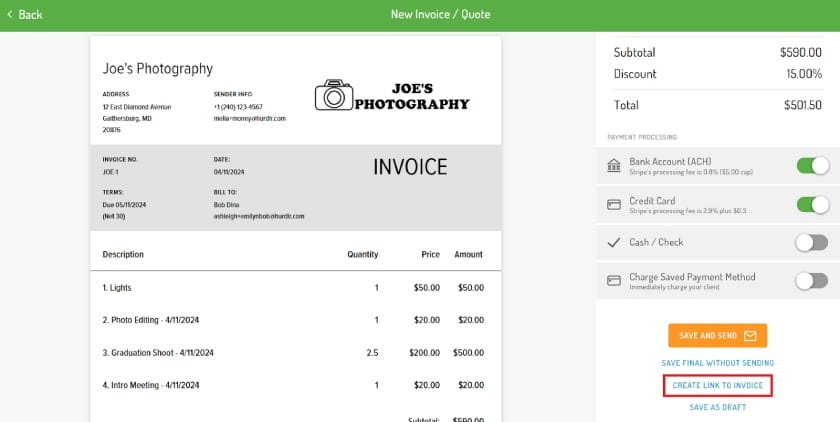

You can create, customize, and send invoices directly from within Hurdlr. However, I don’t find the invoicing feature intuitive, as it requires the use of custom scripts to customize invoices, such as uploading a company logo and changing the invoice template. On the bright side, I like that you can create an invoice link where your clients can view and pay their invoices directly.

Create an invoice link in Hurdlr

Hurdlr’s tax deduction finder helps you identify potential deductions to maximize your tax savings. It scans expenses and categorizes them based on the IRS guidelines so that deductible expenses like travel costs and business mileage are properly recorded.

You will also receive real-time updates on your estimated tax obligations and potential deductions. Plus, you can generate tax reports that you can share directly with your accountant.

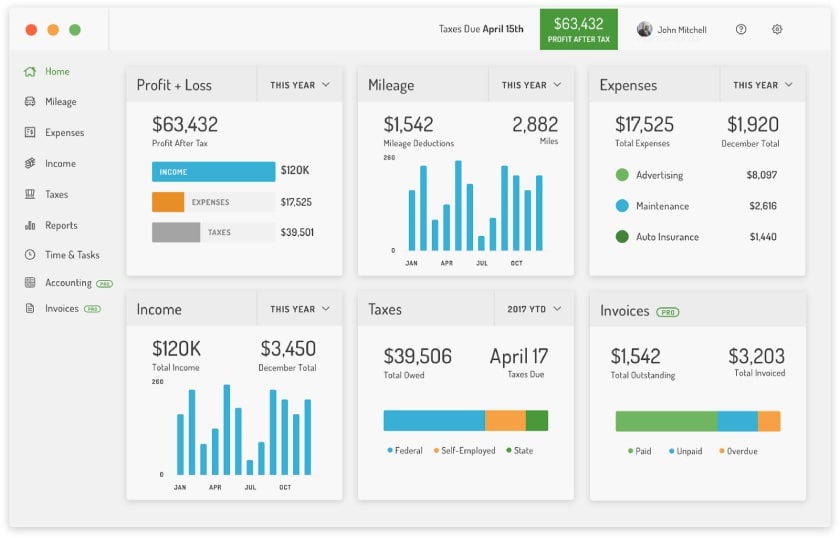

I find Hurdlr user-friendly overall, but its weak customer support—which I consider a key aspect of ease of use—cost it points in my assessment. I appreciate its minimalistic dashboard, making it easy to access essential features like mileage and expense tracking.

The dashboard also displays important insights, including profit and loss summaries, mileage deductions, and yearly total expenses—all presented in visually appealing and colorful graphs and charts.

Hurdlr’s dashboard

I hope Hurdlr considers improving its customer support by adding phone assistance in addition to live chat, email, and self-help guides.

This is my subjective evaluation of Hurdlr based on various criteria like customer support, ease of use, reporting capabilities, and overall popularity. I deducted a few points to allow room for potential improvement. For example, adding a route planning feature could enhance Hurdlr’s mileage tracking capabilities and make the tool even more user-friendly.

How I Evaluated Hurdlr

I rated and evaluated Hurdlr and other leading mileage tracking software using an internal scoring rubric with six major categories:

20% of Overall Score

In evaluating pricing, I considered the affordability of the software based on price, number of users, and any limitations on transactions or customers.

30% of Overall Score

This section focuses on key mileage tracking features, such as the ability to track mileage, connect to a bank or credit card to account to track expenses, categorize trips as personal or business, and generate tax-compliant reports automatically. The software should include multiple tracking options and route planning and be able to accommodate multiple vehicles. You should also be able to snap photos of receipts and secure data through the cloud. Additional useful features include a clock-in/clock-out timesheet and accounting software integrations.

20% of Overall Score

For this section, I evaluated the software’s customer support options, including whether unlimited customer support and support via live chat and telephone are available. I also looked at whether the software is cloud-based and its subjective ease of use.

10% of Overall Score

I checked user review websites to read first-hand reviews from actual users. This user review score helped me give more credit to software products that deliver a consistent service to customers.

10% of Overall Score

I assigned an expert score that is based on the following categories: features, accessibility, ease of use, reports, and popularity of the software.

Frequently Asked Questions (FAQs)

It automatically uses GPS tracking to log mileage when you’re driving. You can then categorize each trip as Personal or Business with a single swipe.

Hurdlr is suitable for freelancers, independent contractors, and small business owners, especially those needing automatic mileage tracking with additional useful features like a tax deduction finder.

Bottom Line

On top of its mileage tracking capabilities, I like Hurdlr’s tax reporting features because they help self-employed individuals manage their tax payments and claim tax deductions when recording a business expense. Users can also track income and expenses and manage receipts. Overall, Hurdlr is a worthy investment if the app’s features fit your needs as a small business or freelancer.

[1]Google Play

[2]App Store