Hurdlr is a popular expense and mileage tracking app tailored for freelancers and small business owners. It provides tax tracking to assist with reporting correct taxable income, including allowable expenses on tax returns. Its free plan offers unlimited manual mileage tracking, the ability to add income and expenses, and a tax calculations summary. Its free user-friendly mobile app provides convenient access to your financial data and you can use it to capture receipts.

Paid plans start at $10 per month and come with additional features, such as automatic mileage, income and expense tracking, double-entry accounting, advanced reporting, and invoicing, and information for your annual tax filing. Hurdlr scored an average of 4.5 on third-party review sites, and its biggest criticism is its lack of telephone support and an option to select between actual expense over standard rates for mileage deductions.

Our editorial policy is rooted in the Fit Small Business mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions readers have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Hurdlr Alternatives & Comparison

Fit Small Business Case Study

We compared Hurdlr with TripLog and MileIQ. TripLog is our best overall mileage tracker app while MileIQ is our recommended mileage tracker for simple tracking.

Touch the graph above to interact Click on the graphs above to interact

-

TripLog $5.99 per user, per month

-

MileIQ $10 per user, per month

-

Hurdlr $5.99 per user, per month

Pricing isn’t Hurdlr’s strongest suit because TripLog and MileIQ have more affordable pricing plans. At prices that range from $8.34 to $16.67 per user, per month, when billed annually, Hurdlr offers similar features with TripLog and MileIQ. However, the possible justification for a higher price are the features available with its most expensive plan that neither TripLog nor MileIQ offer, such as invoicing and accounting capabilities.

TripLog takes the win for mileage tracking features with a perfect score, but Hurdlr isn’t far behind with a 4.7, earning it second place in this comparison. Our evaluation reveals that Hurdlr received perfect marks in related app features, which include a tax deduction finder and reimbursement system. However, both TripLog and MileIQ scored much higher than Hurdlr in ease of use due to Hurdlr’s lack of phone and live chat support.

Hurdlr Pricing

Hurdlr offers a choice of one free and two paid plans, and prices are per user. The main difference is that while the free plan allows you to track mileage, it is only manually, whereas the paid plans let you track mileage automatically.

The paid plans will also track expenses automatically through machine learning. If you’re looking for advanced features such as invoicing capabilities, accounting features, and advanced reporting, they are only available with Pro, the most expensive plan.

Free | Premium | Pro | |

|---|---|---|---|

Monthly Price per User If Billed Monthly | $0 | $10 | N/A |

Monthly Price Per User If Billed Annually | $0 | $8.34 | $16.67 |

Track Income and Expenses Manually | ✓ | ✓ | ✓ |

Summary of Tax Calculations | ✓ | ✓ | ✓ |

Track Mileage | ✓ | ✓ | ✓ |

Export Standard Financial Reports | ✓ | ✓ | ✓ |

Track Mileage Automatically | ✕ | ✓ | ✓ |

Track Expense Automatically Through Machine Learning (ML) | ✕ | ✓ | ✓ |

Track Income Automatically | ✕ | ✓ | ✓ |

Detail Tax Computations in Real-time | ✕ | ✓ | ✓ |

Tag Speed | ✕ | ✓ | ✓ |

Set Up Work Hours | ✕ | ✓ | ✓ |

Create Custom Rules | ✕ | ✓ | ✓ |

Annual Tax filing, Including Federal & 1 State Filing | ✕ | ✕ | ✓ |

✕ | ✕ | ✓ | |

Add Your Accountant | ✕ | ✕ | ✓ |

✕ | ✕ | ✓ | |

✕ | ✕ | ✓ | |

Advanced Transaction Search | ✕ | ✕ | ✓ |

Hurdlr Features

Hurdlr features free and unlimited manual and semiautomatic mileage tracking in its Free plan. However, it offers more useful features for Premium and Pro. Here are Hurdlr’s most notable features.

Through the mobile application, you can track your mileage manually, semiautomatically, or automatically. Hurdlr’s free option is limited to manual tracking, while the paid plans have access to all three:

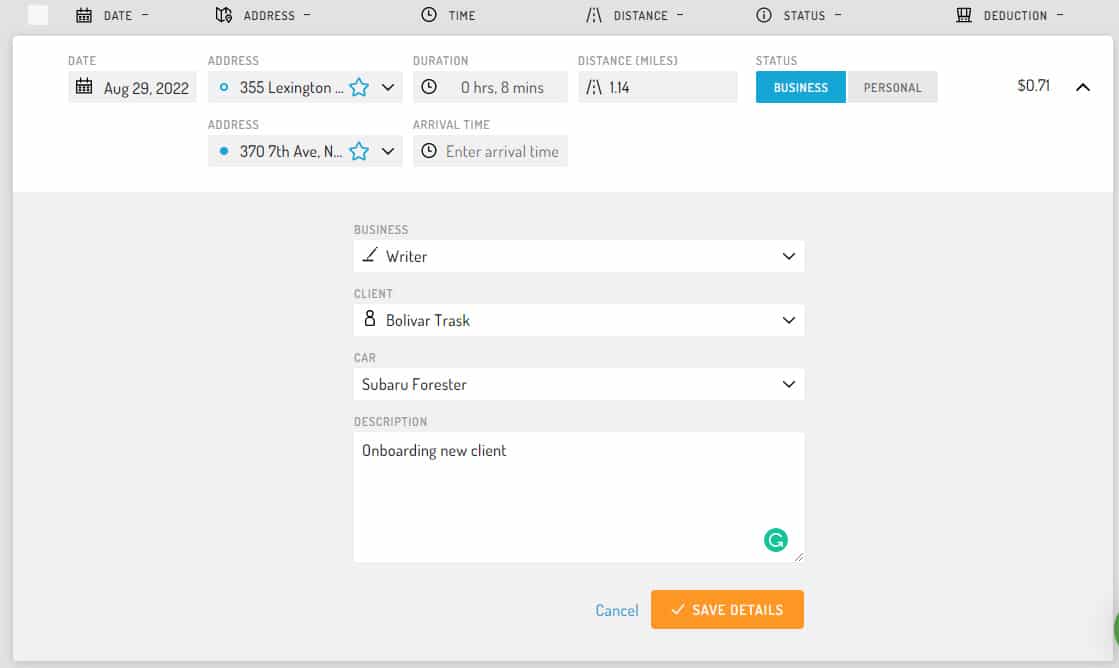

- Manual tracking: Enter mileage driven and start/stop locations in the app manually.

- Semiautomatic tracking: Push a button in the app to start and stop business mileage tracking manually using your phone’s GPS. Trips will be tagged as business and can’t be changed to personal.

- Automatic tracking: The app runs in the background and records trips automatically using your phone’s GPS based on when your vehicle starts and stops moving. All trips will be recorded and then you tag them as business or personal. This isn’t available in the free plan.

The Free plan allows manual and semiautomatic tracking. For purely manual tracking, you need to enter all drive details, including the mileage driven and the start/stop locations. The semiautomatic tracking feature allows you to use GPS for location tracking.

Recording mileage manually on Hurdlr

In semiautomatic tracking, you can use your phone’s GPS services to track your mileage by starting and stopping the trip in the app. Meaning, you don’t have to input your miles traveled manually. If you use semiautomatic tracking, Hurdlr will tag the trip as business and it cannot be reclassified as personal.

For Premium and Pro plans, automatic tracking is included. With it, Hurdlr will start and stop detection automatically. You can also classify these trips as business or personal.

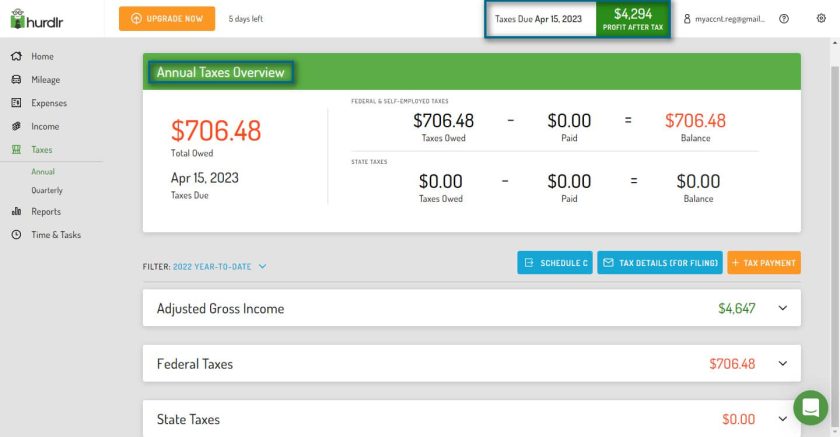

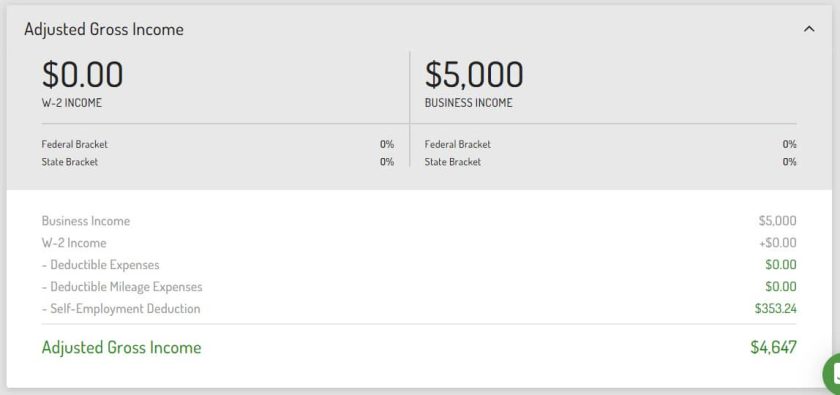

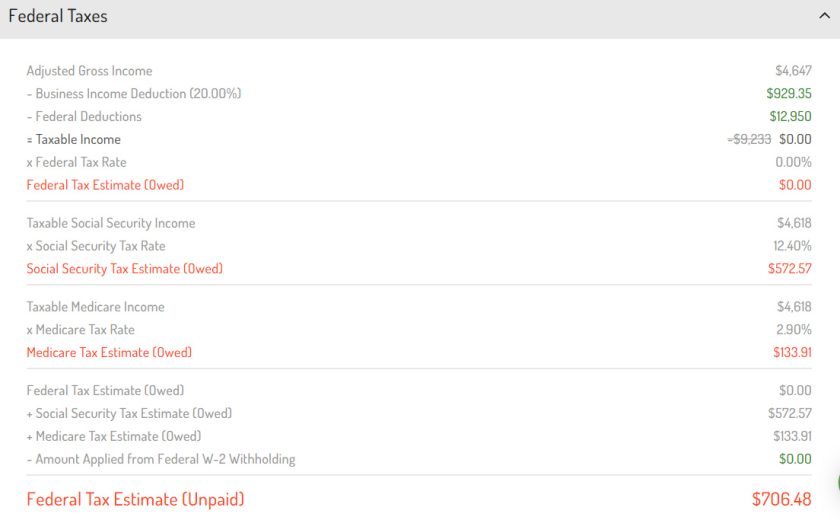

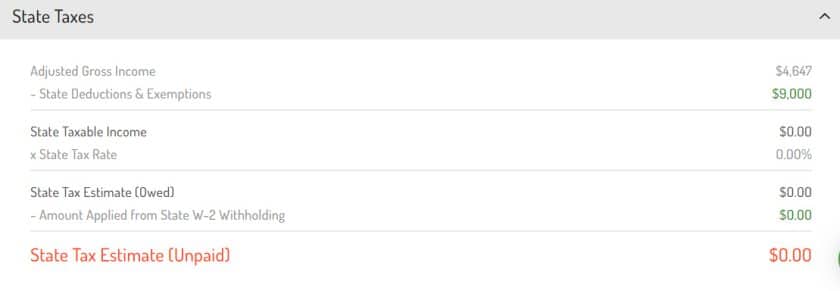

One of Hurdlr’s greatest features is its tax tracking and estimation. Hurdlr computes your tax obligations automatically based on IRS standard mileage rates. However, tax calculations are mere estimates.

Self-employed individuals should comply with IRS requirements like making estimated quarterly tax payments. For Hurdlr to estimate your tax, you must provide basic tax information so that the software can determine the most likely amount of tax payable based on your income.

Under the Pro plan, you can invite your accountant to see your tax information on Hurdlr. If you’re filing for yourself, Hurdlr’s reports can help you fill out Form 1040, Schedule C. Another perk of the Pro plan is its advanced tax reporting capabilities. You can also include a home office deduction under the Pro plan to arrive at your taxable net income.

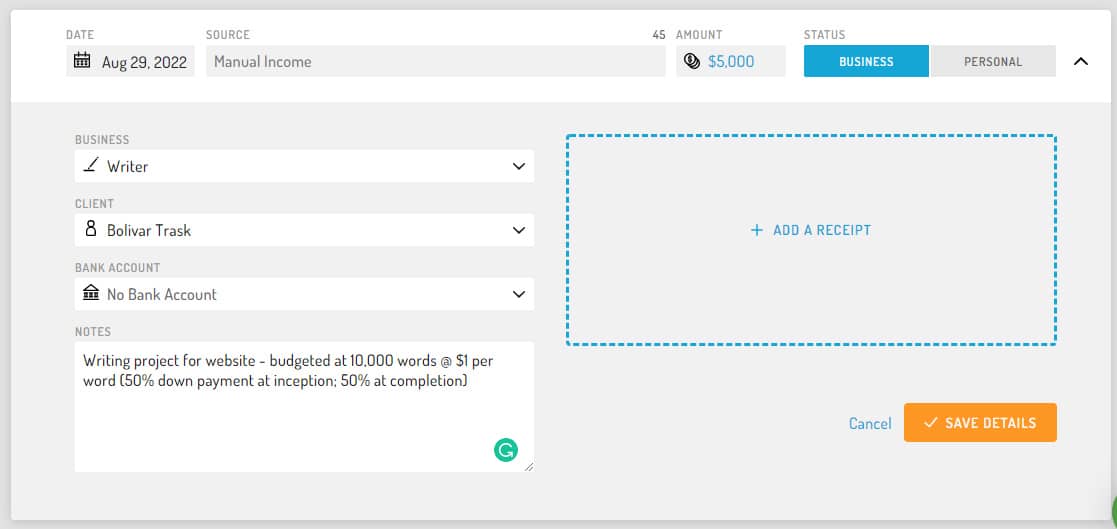

Income and expense tracking also come easy with Hurdlr. In the Free plan, you can record income and expenses manually. For paid plans, you’ll enjoy automatic tracking and recording once you receive the income or pay an expense. You can record income and expenses manually as well if you don’t have a bank connection.

Recording income manually

Once you connect your bank cards (debit and credit) and other payment channels like PayPal, every charge and credit to your accounts will be sent to Hurdlr. In the app, you can classify this income or expense as either Business or Personal. A swipe to the right tags it as Business and to the left tags it as if Personal.

Moreover, you set rules on Hurdlr to tag income or expense payments automatically as Business or Personal. In this way, you won’t spend much time tagging income and expenses.

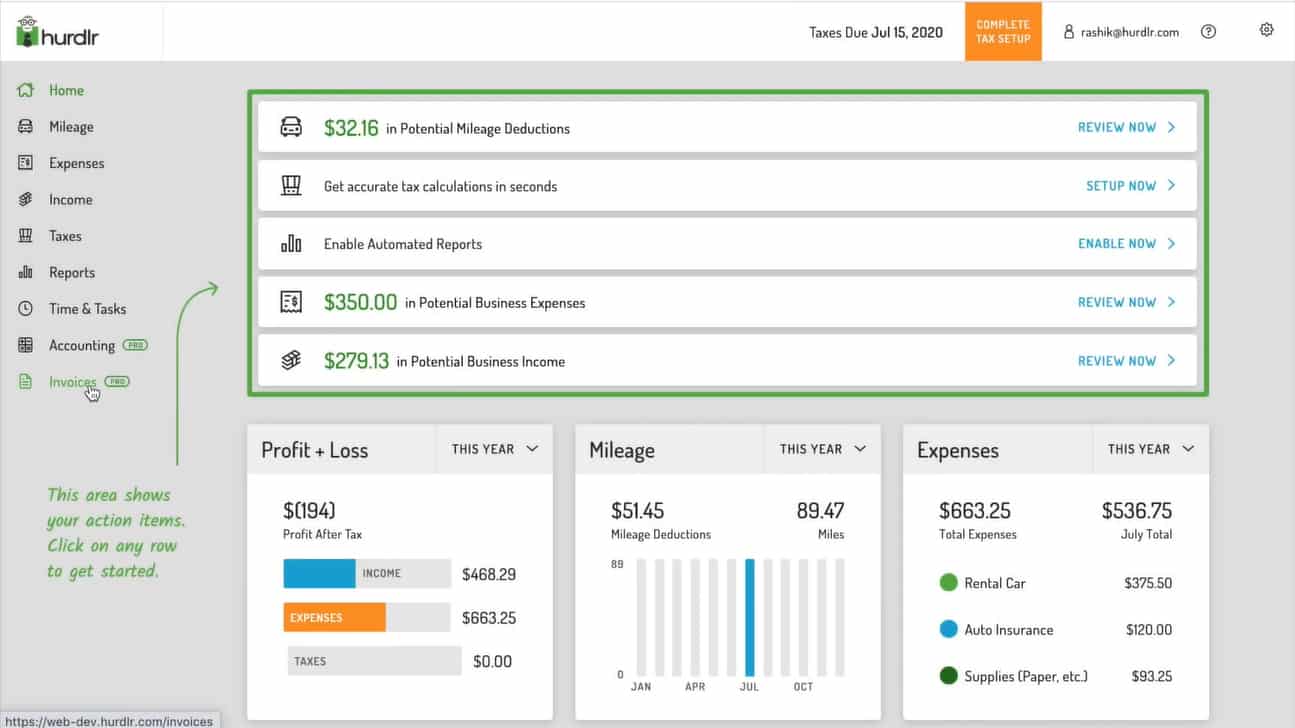

With the Pro plan of Hurdlr, you can enjoy invoicing features that complement mileage and expense tracking.

Invoices Dashboard on Hurdlr (Source: Hurdlr Tutorial Videos)

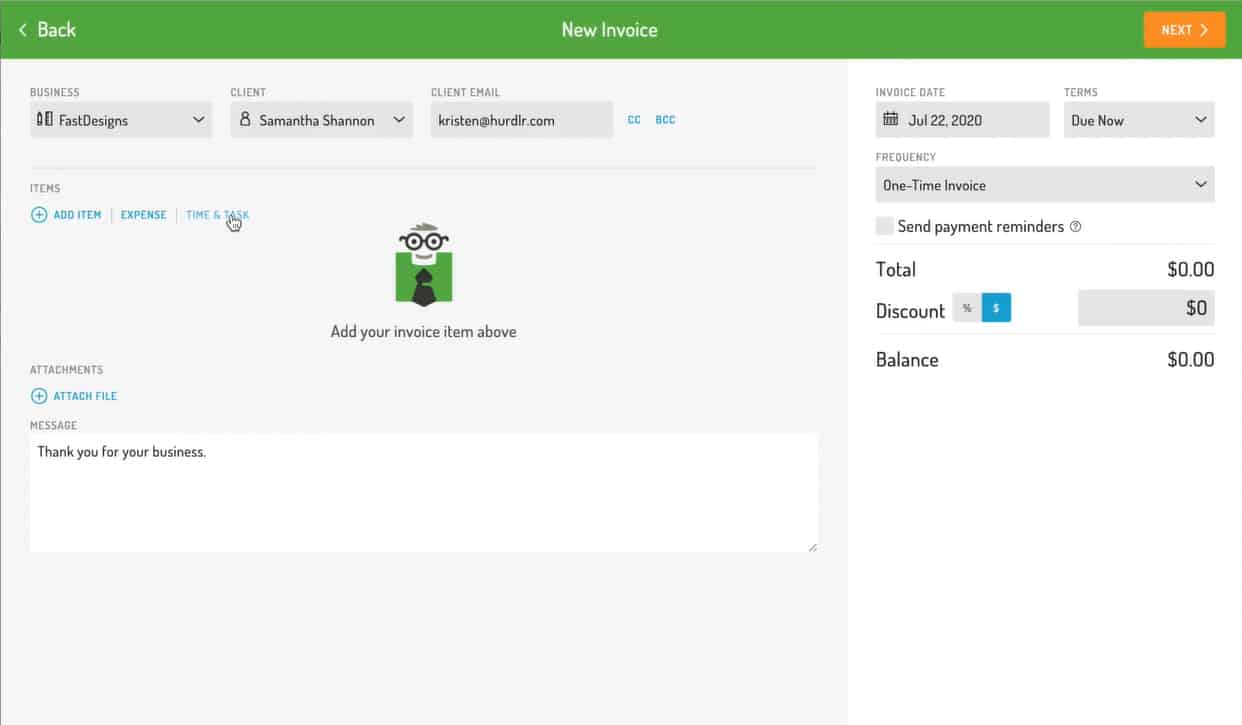

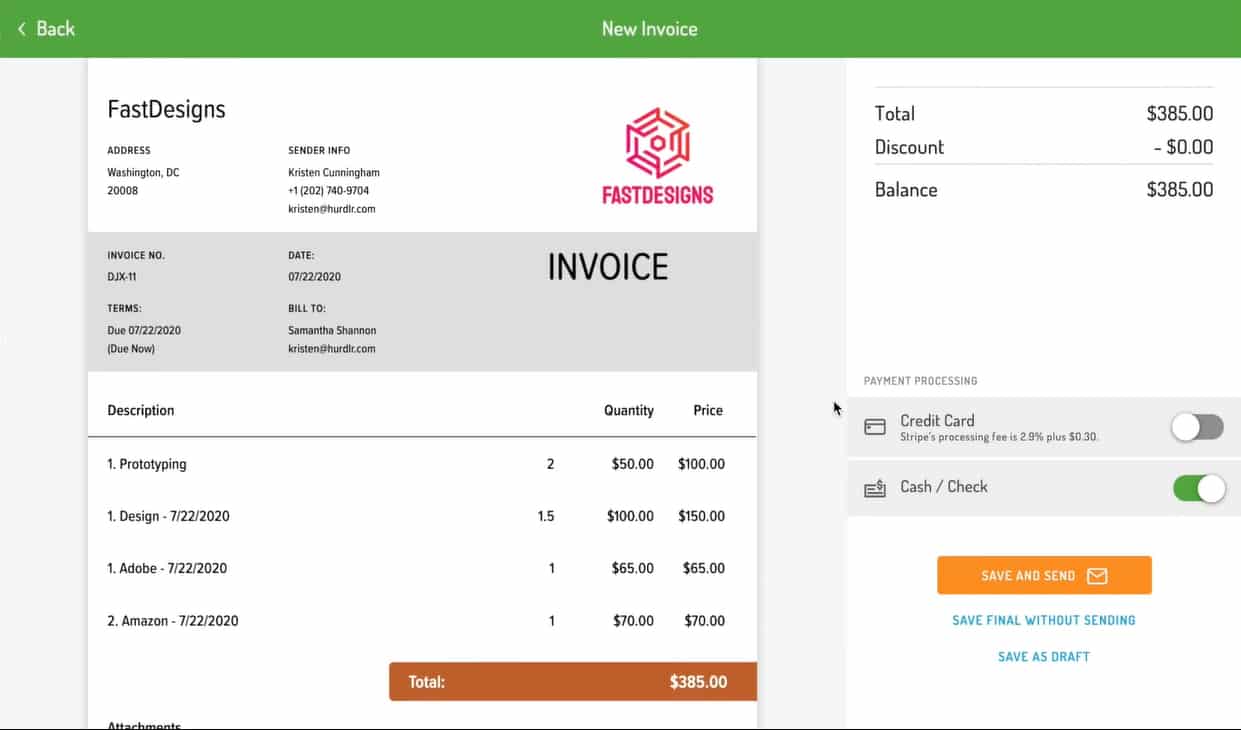

On Hurdlr, you can generate invoices to send to your client. You can even personalize your invoice by including your logo and brand color. Once you’re done filling in the invoice form, Hurdlr will generate your actual invoice that can be exported or sent via email.

Creating an Invoice on Hurdlr Pro (Source: Hurdlr Tutorial Videos)

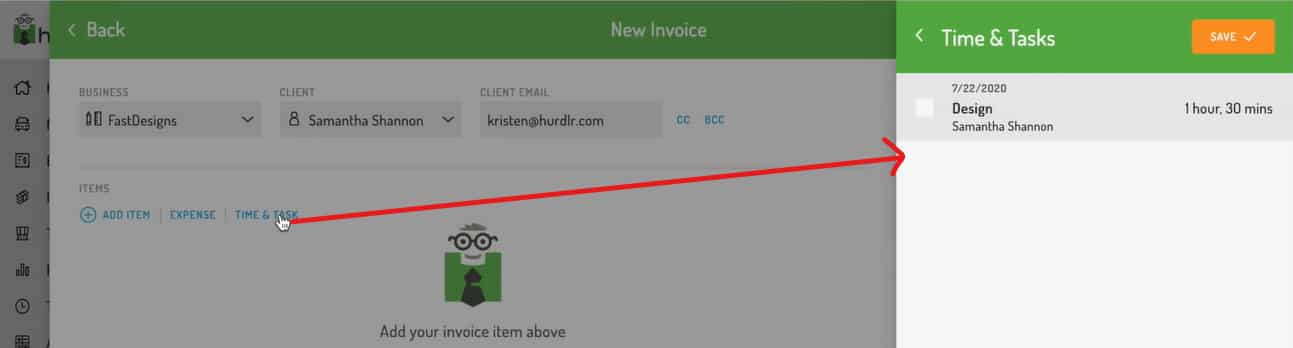

If your invoice is based on billable hours, Hurdlr’s Time and Task feature—included in the Pro plan—can assist you in billing your client. You can track your time automatically or enter it manually.

You can start and stop a timer in the background and then assign the time to a client. Hurdlr will record hours spent, which can be used in invoicing clients. Otherwise, you can enter work hours manually.

Adding Hours Worked in an Invoice (Source: Hurdlr Tutorial Videos)

Aside from hours worked, you can add expenses you’ve incurred on behalf of the client. To include them in the invoice, you must first record these expenses in the expense tracker and then add them as an item on the invoice form. Once you’re done adding your time and expenses, you can generate an invoice with your logo. You can export the invoice immediately or save it to be sent at a later time.

Finalizing an Invoice on Hurdlr (Source: Hurdlr Tutorial Videos)

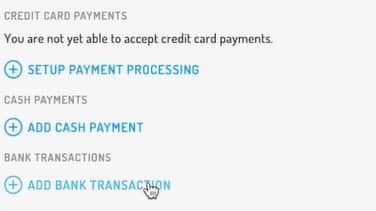

After submitting invoices to clients, all open invoices will be listed in the Invoices dashboard. If clients submit a payment to your bank accounts connected to Hurdlr, you can reconcile open invoices easily by choosing a payment channel.

Adding Invoice Payments on Hurdlr

(Source: Hurdlr Tutorial Videos)

By clicking Add Cash Payment or Add Bank Transaction, Hurdlr will show you a list of transactions. Then, you can choose the transaction that matches the invoice, and Hurdlr will mark the invoice as fully paid.

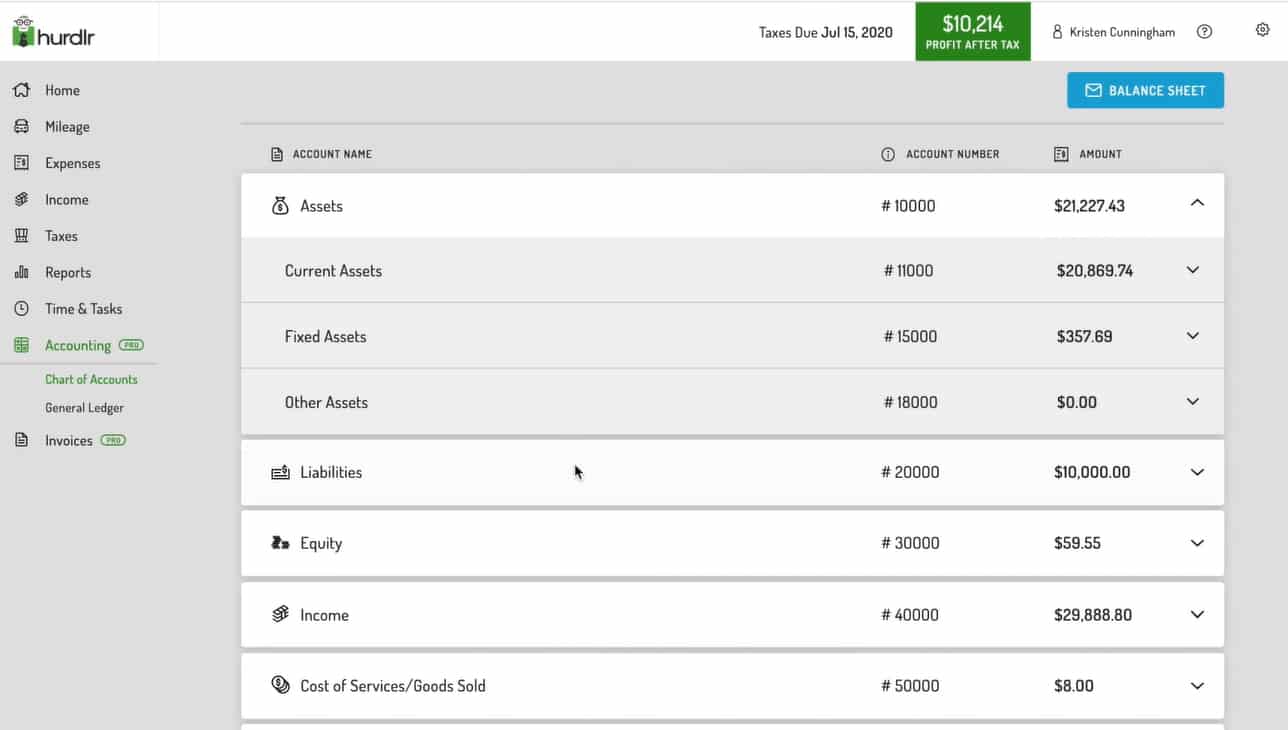

Hurdlr Pro offers basic accounting features like a chart of accounts, journal entries, and financial reporting. If you’re familiar with double-entry bookkeeping, Hurdlr’s simple accounting system will be easy to use.

Chart of Accounts

Your chart of accounts will show the account name, account number, and running balance. If you click each financial statement element, such as Assets, it’ll show you the breakdown of accounts within that element. If you click further, you’ll see specific accounts like Cash and Cash Equivalents or Accounts Receivable.

Chart of Accounts on Hurdlr Pro (Source: Hurdlr Tutorial Videos)

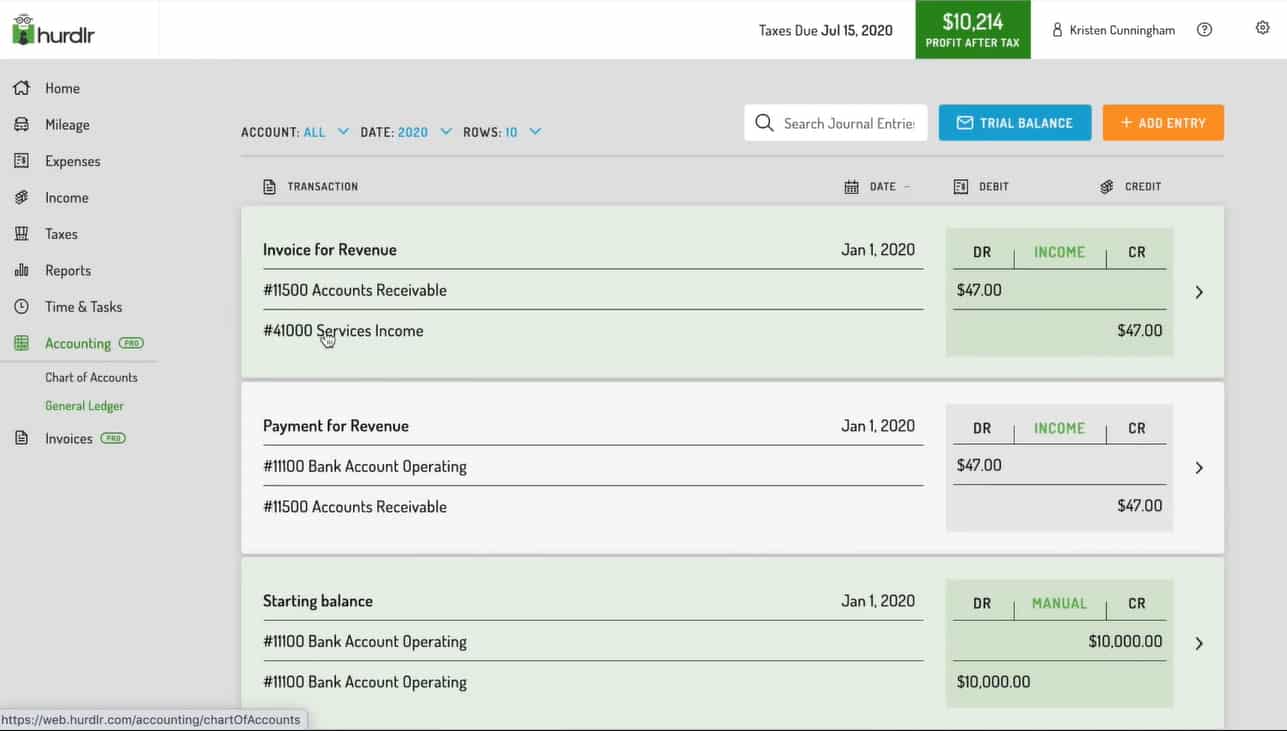

General Ledger

To see the transactions in every account, you can access the general ledger. It’ll show you the debits and credits in each account and its running balance. In this section, you can also add a journal entry by clicking Add Entry in the top right corner of the screen.

General Ledger on Hurdlr Pro (Source: Hurdlr Tutorial Videos)

With the Pro plan, you have additional options to consider in recording a disbursement. You can associate disbursements with specific general ledger accounts based on the nature of the disbursement. If you click Expense Type, Hurdlr will ask you to choose how you want to account for the disbursement:

- Expense: Account for the disbursement as a normal expense line item on the income statement under operations like salaries and wages

- COGS: Account for the disbursement as part of the cost of goods sold (COGS) for direct costs of manufacturing goods or performing services like direct materials

- Asset: Account for the disbursement as an acquisition of an asset like furniture and equipment

- Equity: Account for the disbursement as a reduction to equity accounts like drawings

- Other Expense: Residual type in case the expense can’t be attributed to any of the following above

After including its type, you can categorize the expense further. The category drop-down menu will vary depending on the expense type you choose. If you choose Expense, it’ll show all expense accounts in your ledger. If you choose Asset, you’ll see all asset accounts instead.

Choosing an Expense Type when recording a disbursement

(Source: Hurdlr Tutorial Videos)

Hurdlr Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Automatic mileage tracking that simplifies IRS reporting requirements | Lack of telephone support |

| Quarterly tax calculations streamline payment process | Must upgrade to paid versions to enable automatic tracking for mileage, income, and expenses |

| Easy to set up and use, with an intuitive interface | Not suitable for businesses with complex financial structures or accounting needs |

While many users who left a Hurdlr review praised the app’s ease of use, they also were pleased with the useful features, especially with the Pro plan. However, reviewers were also disappointed that automatic tracking wasn’t available with the free plan.

Based on Hurdlr reviews from popular review sites, the platform received the following scores:

- Google Play[1]: 4.5 out of 5 stars based on about 8,400 reviews

- App Store[2]: 4.7 out of 5 stars based on almost 18,000 reviews

- G2.com[3]: 4.3 out of 5 stars based on around 20 reviews

- Capterra[4]: 4.4 out of 5 stars based on about 10 reviews

How We Evaluated Hurdlr

We rated and evaluated Hurdlr and other leading mileage tracking software using an internal scoring rubric with six major categories:

20% of Overall Score

In evaluating pricing, we considered the affordability of the software based on price, number of users, and any limitations on transactions or customers.

30% of Overall Score

This section focuses on key mileage tracking features, such as the ability to track mileage, connect to a bank or credit card to account to track expenses, categorize trips as personal or business, and generate tax-compliant reports automatically. The software should include multiple tracking options and route planning and be able to accommodate multiple vehicles. You should also be able to snap photos of receipts and secure data through the cloud. Additional useful features include a clock-in/clock-out timesheet and accounting software integrations.

20% of Overall Score

For this section, we evaluated the software’s customer support options, including whether unlimited customer support, and support via live chat and telephone are available. We also looked at whether the software is cloud-based and its subjective ease of use.

10% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

10% of Overall Score

We assigned an expert score that is based on the following categories: features, accessibility, ease of use, reports, and popularity of the software.

Frequently Asked Questions (FAQs)

If your job involves driving your personal vehicle for business purposes, then you probably need a mileage tracker. However, driving to and from work is commuting and doesn’t count as a business purpose. Also, employees cannot deduct employee business expenses, so mileage is only deductible if you’re a freelancer or self-employed.

The best mileage tracker apps use GPS tracking to accurately track miles, can run in the background, and can detect the beginning and ending of a trip automatically, without any input from the user. Of course, a good mileage tracking app should also include manual tracking features so that you can add trips where the app wasn’t running or you didn’t have your device.

The IRS doesn’t allow mileage to and from work as a deductible expense. The IRS considers this as “commuting”—and it cannot be claimed as mileage deductions.

Provided you are a freelancer or self-employed and not an employee, you can deduct expenses for the following travel from

- A regular work location to a temporary work location

- Your home to a temporary work location—only if you have a regular work location at another location

- A regular or temporary work location to a second job

Bottom Line

Along with its mileage tracking capabilities, we like Hurdlr’s tax reporting features because it helps self-employed individuals manage their tax payments and claim tax deductions when recording a business expense. Users can also track income and expenses and manage receipts. Overall, Hurdlr is a worthy investment if the app’s features fit your needs as a small business or freelancer.

[1]Google Play

[2]App Store

[3]G2.com

[4]Capterra