When an employee receives a court-ordered document calling them for jury duty, you, as the employer, must provide them with time off to attend to it. This is where having a jury duty policy will come in handy—it will outline who is eligible, whether it is paid, and what process to follow.

Although federal law does not require employers to pay employees while on jury duty, some state regulations do require it. To ensure you are fully compliant with both federal and state laws read through your relevant local laws and download our free template for guidance.

Thank you for downloading!

If you want to ensure your business stays compliant while keeping your employees’ best interests in mind, consider Bambee. Bambee is an outsourced HR company built for small businesses. From policy creation to full HR audits, payroll, and employee training, Bambee’s team of dedicated advisors is here to help. The best part is plans start at just $99/month.

Elements of a Jury Duty Policy

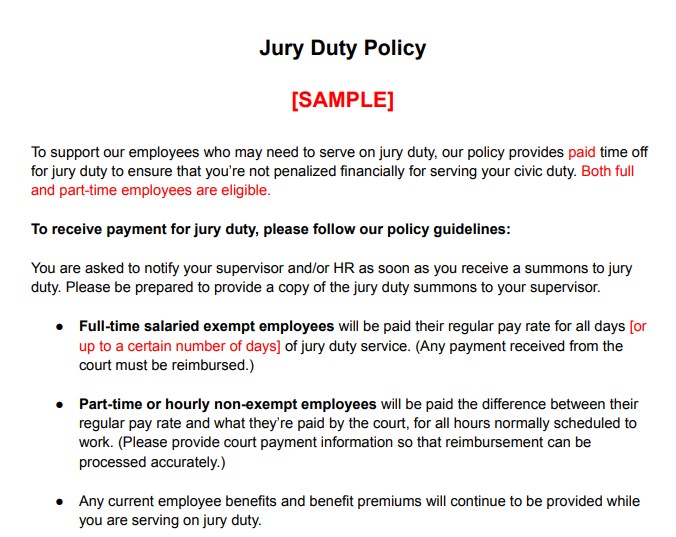

When adding a jury duty policy to your employee handbook, indicate if you will pay your employees while they serve on jury duty—and be aware of any state laws that require you to do so to maintain compliance. If there are no specific state laws in your area, consider the following:

We recommend using an all-in-one HR management software like Bambee to help track time off requests for jury duty, store your policies, and properly handle onboarding for employees.

Federal Jury Duty Requirements

US federal law is clear about what you must do as an employer when your employee is summoned for jury duty. As an employer:

- You must excuse the employee from work to attend jury duty

- You may be required to pay an exempt employee their regular salary while on jury duty

- You may not be required to pay a non-exempt employee for work hours missed

- You may ask the employee to notify you in advance

- You may ask the employee to postpone jury duty based on a business need

- You may request an employee to “return to work” if dismissed/excused before the end of the business day if they’re not selected for jury duty

If you are unsure if your employee is exempt or nonexempt, check out our comparison guide.

In addition to federal jury duty requirements that instruct an employer to provide unpaid time off, employers are not responsible for paying employees any compensation for absence due to jury duty—unless there is a company policy, contract, collective bargaining agreement, or state law that applies.

Jury Duty Leave Laws by State

Several states have guidelines in place outside of the federal requirements regarding jury duty leave and whether or not you must provide paid time off for jury duty to your employees for this leave. Click on any state below to learn jury duty leave laws by state.

Jury Duty Laws by State

Potential Reasons to Be Excused From Jury Duty

Not all individuals called to jury duty will serve. Many will be dismissed by the courts for any number of reasons. Others may have a legitimate reason they cannot attend; whether it be a personal or business reason.

Personal Excuse

Your employee may have a personal reason why he or she cannot attend jury duty. In this case, you may only need to pay the employee for one day, as they potentially will not return.

Some common personal reasons to be excused from jury duty (only at the discretion of the courts) include:

- Medical reasons

- Undue hardship

- Military involvement

- Student status

- Dependent care

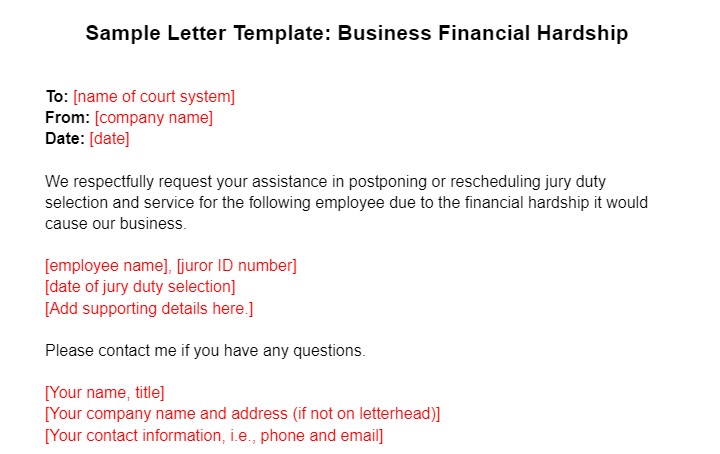

Business Excuse

You can write a letter to the courts in an attempt to excuse your employee from jury duty if it will cause severe hardship to your business. If you choose to do this, you must explain in the letter how the employee serving on a jury will impact your business and provide documentation. Courts still have the final decision on this, and your letter does not guarantee that your employee will be released from jury duty.

Some possible examples for your employee to be excused from jury duty include:

- Valid business reason: The employee is your only “licensed agent” on staff

- Valid business scheduling conflict: The employee is scheduled for a business event or trip that cannot be postponed

- Financial hardship: Your business risks losing income if the employee is out

- Seasonal business: Your business is seasonal and/or you do not have enough employees

We’ve provided two sample letters to help you request a judge postpone or reschedule jury duty for your employee based on business needs.

Thank you for downloading!

If you want to ensure your business stays compliant while keeping your employees’ best interests in mind, consider Bambee. Bambee is an outsourced HR company built for small businesses. From policy creation to full HR audits, payroll, and employee training, Bambee’s team of dedicated advisors is here to help. The best part is plans start at just $99/month.

Caution! Do not risk fines or jail time for your employee or business by misrepresenting your needs to help an employee get out of jury duty.

Jury Duty Policy Frequently Asked Questions (FAQs)

Should employees be required to return jury duty payments?

Anyone who serves on jury duty will receive a small stipend per day for their service (anywhere from $10-$50 depending on the type of service). Some employers allow employees to keep this payment along with their regular salary, whereas others may require employees to reimburse the company for the total amount provided by the courts. If you do plan to require your employees to reimburse any money received by the courts, make sure this is clearly stated in your policy.

Am I required to provide time off for my employee to attend jury duty?

Yes. Federal law mandates that you must allow at a minimum unpaid time off for your employees to attend jury duty. Some states require that you provide paid time off. Click on your state in our interactive map to see if you must provide paid or unpaid time off.

What type of employee is exempt from jury duty?

The majority of employees at a small business will not be exempt from jury duty. However, people in the following full-time professions are exempt from federal jury duty: active duty military, fire and police professionals (does not include volunteer), and public officers (federal, state, or local governments).

Bottom Line

Adding a jury duty leave policy to your employee handbook is a best practice in employee management. This clearly communicates to your employees what is expected of them and whether or not they will receive compensation from the business. Be sure to determine which states require employers to pay employees for jury duty and follow through with paying employees where it is required.

Certified HR specialists at Bambee can create a jury policy fully compliant with all federal, state, and local laws. You get a certified HR manager who will work with you to craft, implement, and securely store the HR policies your business needs.