Lacerte Tax is Intuit’s premier tax solution. It can be used for complicated tax returns, such as oil and gas company filings. It can also import balances from QuickBooks Accountant Desktop and integrate with Intuit Practice Management.

While pay-per-return pricing is available, you must contact a sales representative for other pricing information. A free version that excludes printing or e-filing is available, and it would be useful for familiarizing yourself with the software’s capabilities. Most users rate the platform highly, especially as it relates to preparing complicated tax returns.

Pros

- It has an option for cloud-hosting

- It can prepare complex returns

- Intuit Tax Advisor add-on reviews tax return data and formulates recommendations for tax strategy

- It has a free trial (printing and e-filing limitations)

Cons

- It has no upfront pricing—save for a pay-per-return plan

- Users report frequent and mandatory updates can cause intermittent disruptions in business operations

- It has a steep learning curve for inexperienced professionals

- It can be expensive for budget-conscious firms

Pricing for 2024 Returns | The only price given upfront is for the pay-per-return plan, Lacerte REP. All other packages require you to contact Lacerte for pricing.

|

Supported Bookkeeping Software | QuickBooks Accountant Desktop |

Free Trial | Free version with no e-filing or printing |

Money-back Guarantee | Within 30 days of the product release date |

Standout Features |

|

Sample Tax Forms Supported | 1040, 1065, 1120, 1120S, 1041, 706, 709, 5500, and 990 |

Customer Support | Telephone, email, and live chat |

Average User Reviews | Has above-average ratings for its comprehensive platform and coverage of obscure tax rules; that exhaustive access comes at a cost, however, and users note that the biggest downside of Lacerte Tax is the high software cost. |

- Your firm files complex returns: We rank Lacerte high in our guide for the best professional tax software, especially for filing complicated returns for subsidiaries and oil and gas returns.

- You’re a QuickBooks Accountant Desktop user: Lacerte integrates with QuickBooks Accountant Desktop, making it a good solution for firms that use the software so that they can manage everything in one place.

- Your firm wants access to tax analysis and planning tools: Lacerte’s Intuit Tax Advisor add-on uses client data from the return to pinpoint opportunities for future tax savings.

Lacerte Tax Alternatives & Comparison

Lacerte Tax Software Reviews

| Users Like | Users Dislike |

|---|---|

| That it’s good for complicated returns with special tax rules | That input fields are not set up in the same format as the forms |

| That preparers can watch forms change while adjusting input | That there’s a steep learning curve for inexperienced professionals |

| That they can jump to relevant input lines from output forms | That it’s an expensive platform |

While I agree that Lacerte is generally better than its competitors when it comes to complicated filings, it can still be glitchy and may occasionally miss nuances for intricate forms. However, in most respects, Lacerte is incredibly powerful and built for experienced tax pros.

As one reviewer said, it “expects you to know what you’re doing.” I agree with that assessment but don’t see it as a weakness. Serious tax pros may use the program differently than a part-time preparer working evenings on a few individual returns. Lacerte gives the serious pros what they want.

Here are Lacerte Tax’s ratings on third-party review sites:

What Reddit Users Are Saying

Overall, Reddit users seem to really enjoy their experience with Lacerte Tax, but they agree that the pricing is steep—in some cases, prohibitively. One reviewer noted that their quote included a guarantee that prices would increase by no more than 7% per year. While it’s great that price increases are capped, Lacerte’s base pricing is already more expensive than competitors.

A 2024 Reddit user noted that they were given a Lacerte quote of $35,000 for unlimited returns of all types. While the pricing may be oppressive, many reviewers have expressed dissatisfaction when they moved to other vendors with low introductory pricing but higher prices year over year. Users have also confirmed that transitioning to a new software vendor is seldom a seamless experience.

Lacerte Tax Software Cost

The provider offers three plans: Lacerte 200 Federal 1040, Lacerte Unlimited, and Lacerte REP (pay-per-return pricing). The Lacerte Tax software cost for the first two plans is only available via sales representative.

Pay-per-return Pricing

Lacerte’s REP plan provides pay-per-return pricing for individual and business returns but requires an annual license fee of $860.

1040 Federal + 1 State | $96 per return |

1040 Additional States | $73 per return |

Business/Exempt/Trust/Estate (Federal + 1 State) | $125 per return |

Business/Trust/Estate—Additional States | $81 per return |

Gift Tax/Employee Benefit—Federal | $83 per return |

Consolidated Corps | $124 per return |

Tax Scan and Import | $14 per return |

Lacerte Tax Features

Lacerte Tax has multiple time-saving tools for simplifying the tax prep process. These tools include the missing client data tool, a trial balance utility, and a user-friendly e-organizer.

Missing Client Data Tool

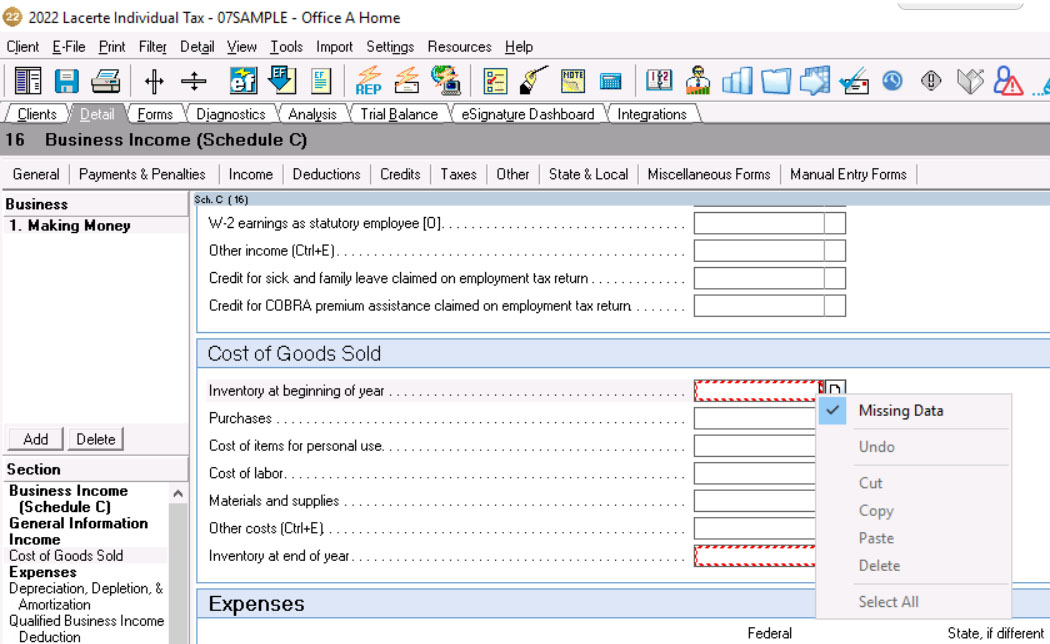

This built-in tool allows you to flag missing information throughout a return and then prepare a report of all missing information to send to your client. For example, I can flag beginning and ending inventory on a Schedule C as missing by simply right-clicking on the input field and selecting “Missing Data.” The missing field will have a checkered border until the flag is cleared or a value is input.

Input Fields Flagged as Missing in Lacerte Tax

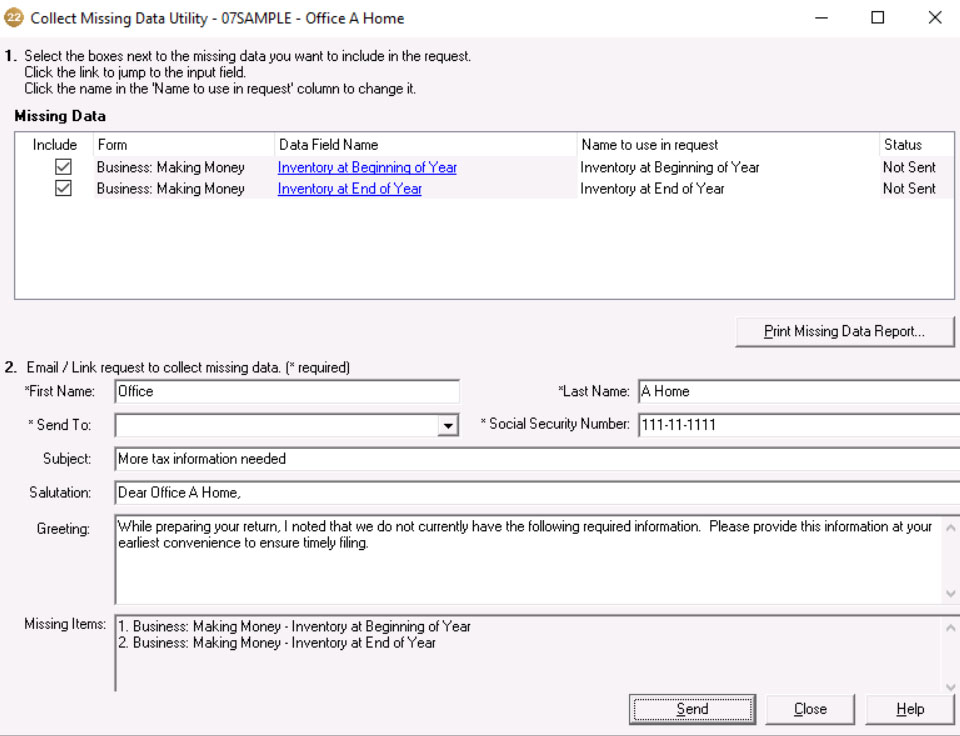

Once all the missing fields have been flagged within the return, you can email a missing data report to your client. The Missing Data Utility keeps track of missing items you’ve already sent your client, so you can send additional emails without duplicating the missing content.

Missing Data Utility in Lacerte Tax

E-organizer

This paperless option assists with the organization and collection of information. You can send clients forms, questionnaires, and emails, providing them access to a customized, password-protected executable file. This file includes detailed information on using the organizer and frequently asked questions.

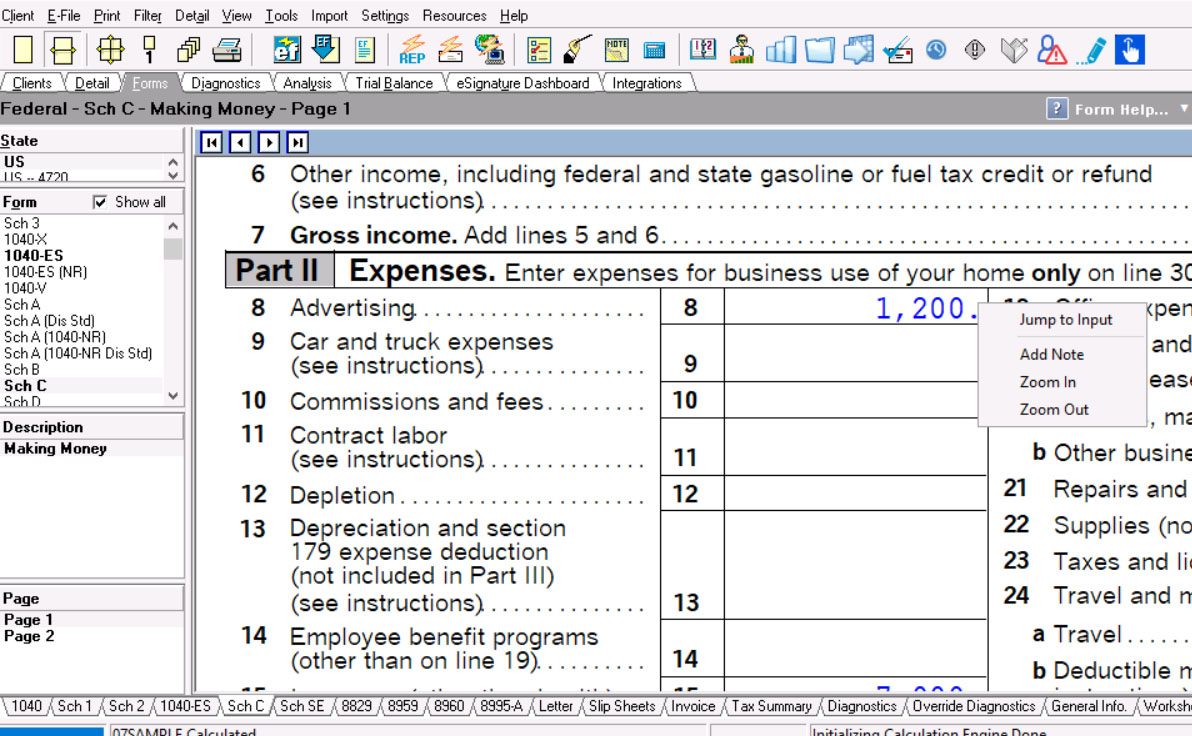

Forms View

You can easily view the final forms before printing or filing. After selecting the “Forms” tab, the left menu bar lists the forms added to the return. You can select any form to view it and then right-click on most lines to drill down to the input form where this line item originated.

In the program, I can right-click on advertising expenses on Schedule C. If I select “Jump to Input” on the popup menu, I’ll be taken to the business income and expense input screen where the advertising amount was input.

Jumping to the Input Screen from Schedule C

Jumping directly from the tax forms to the related input fields is extraordinarily useful when reviewing returns. This feature is not always available in alternatives to Lacerte Tax.

Trial Balance Utility

The trial balance utility is useful for developing a chart of accounts, modifying journal entries, reviewing trial balance reports, and more. It can import data from QuickBooks, Excel, and EasyACCT. You can also set up a chart of accounts directly in Lacerte Tax or copy a chart of accounts from a similar company.

- Comprehensive form library: Lacerte Tax gives you access to over 5,700 forms—including multistate, K-1s, and 5500 benefit plan returns—enabling you to service various clients and businesses.

- Tax analysis and planning tools: Users can access sophisticated tax analysis and planning tools as part of the trial balance utility.

- Tax Analyzer helps professionals manage client liabilities and financial health, flagging amounts most likely to trigger an IRS audit.

- Tax Planner provides customized plans for each client’s future liability based on current and future state and federal tax rates.

Lacerte Tax Customer Support

Lacerte Tax’s technical support is included with the purchase and is offered in the following ways:

- Toll-free phone support from Monday to Friday, 6 a.m. to 5 p.m. Pacific time

- Email support

- Website support

- In-program help

- Help Me option with screen-specific topics

Various training courses and how-to video tutorials can also get you up to speed quickly. There’s also a searchable knowledge base and community user forum.

Lacerte Tax Dashboard Navigation & Ease of Use

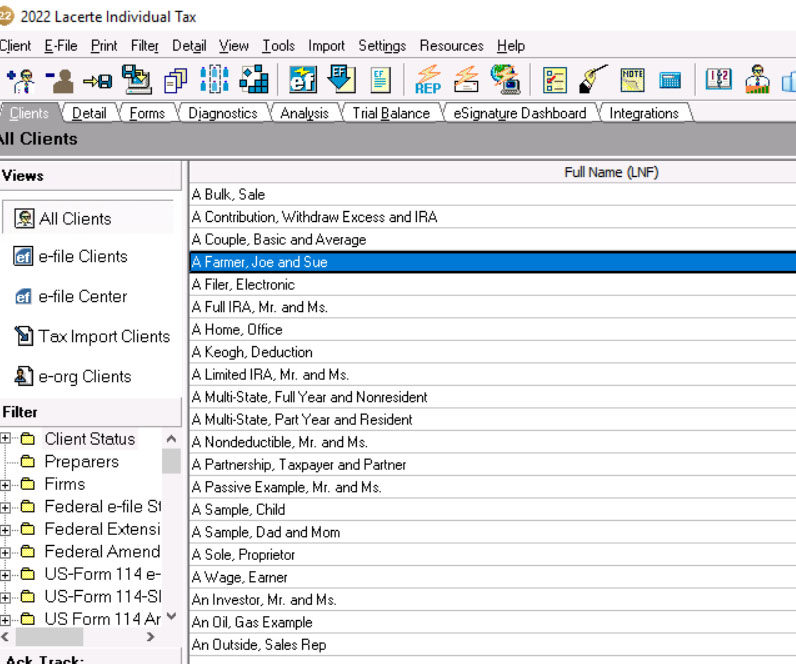

Lacerte has so many features that, at first blush, its dashboard is a little hard to read, but it gets easier to navigate after multiple uses. Everything is sorted in separate menus, including your client list. You can select the client you want to work on from the “Clients” tab.

Client Return List in Lacerte

I would expect access to client-specific data input to be intuitive, typically accessed by double-clicking on the client’s name. That is not the case for Lacerte. Data input is accessed by selecting the “Detail” tab after selecting your client in the “Client” tab.

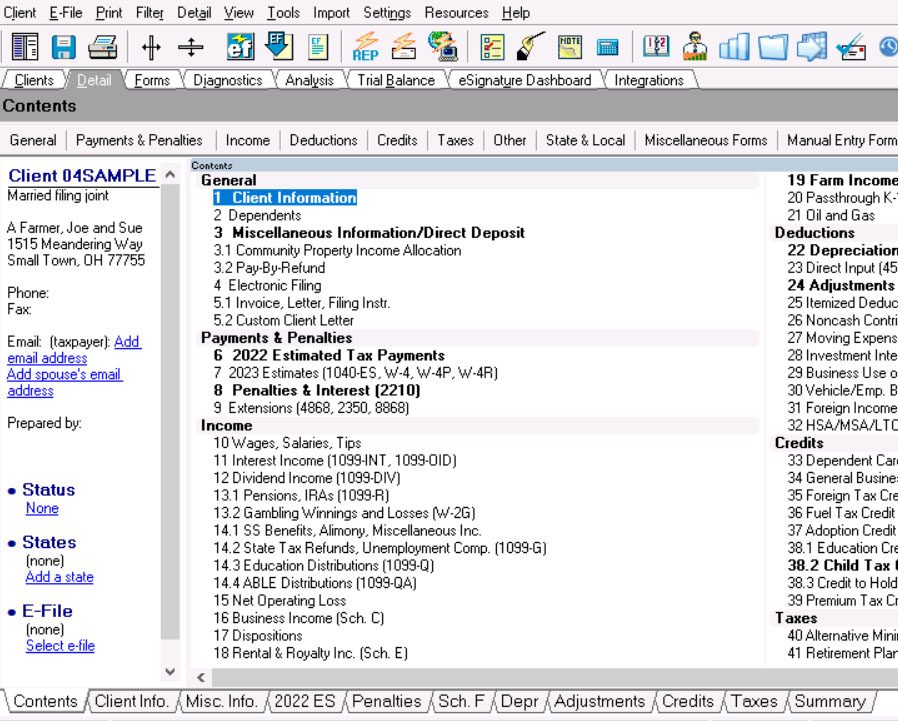

Return input detail in Lacerte

Meanwhile, the “Contents” tab lists all the available input forms for the type of tax return being prepared. Scroll to the right to browse all of the available forms. You can also use the navigation tabs on the lower part of the screen to access input for specific input areas. This direct access is another of Lacerte’s great features, but the layout takes some getting used to.

How I Evaluated Lacerte Tax

I evaluated Lacerte Tax software using relevant benchmarks for small business tax preparers. These benchmarks factor in software costs, ease of data import, document management, software support, and general ease of product use.

- Software costs: I first identified the cost for different service tiers and provided that information for bundled services and individual purchases. I also considered flat fees and the inclusion of customer support.

- Data import: I researched the complexity of data automation features, including QuickBooks and Excel imports and autoflow capability for source document data.

- Document management: I reviewed the software features to determine if any were unique in assisting tax preparers with administrative tasks.

- Software support: I also assessed the technical support available, including representative availability and user confidence in the resolution.

- Ease of use: As the final part of my evaluation, I analyzed the efficiency of user flow between forms, data entry, and input review.

Frequently Asked Questions (FAQs)

Tax software for the previous calendar year is available in November of each year.

Data conversion to Lacerte is supported for ATX, Crosslink, Drake, ProSeries, ProSystem Fx, TaxAct, TaxSlayer, TaxWise, TurboTax, and UltraTax CX. Note that not all forms are supported for Lacerte conversion.

Some questions are more easily answered when the support team can see the issue. Intuit SmartLook allows you to screen-share during your support call to expedite resolutions.

Bottom Line

Lacerte Tax is a superior option for tax preparation software. Its range of useful tools includes an expansive form library, a paperless option for organizing and collecting tax information, and various tax analysis and planning tools. The platform also includes time-saving features, such as a QuickBooks Desktop integration.

[1]TrustRadius

[2]G2.com