ProSeries Tax is a tax preparation software from Intuit that is designed for professional tax preparers that can process almost any individual and business tax return. With all of the features that you would expect from a professional tax software, such as e-file management and K-1 data transfers, it even offers different pricing options based on your needs. It also comes equipped with useful tools for managing your firm and helping your clients with tax planning for the future.

ProSeries Tax pricing starts at $624 per year plus $57 per federal return and $49 for each state return for their Pay-Per-Return package. It received strong user reviews, with raves about its ease of use and useful features. One of its biggest drawbacks is that most plans charge an additional fee for multi-user access.

At Fit Small Business, we’re dedicated to giving you top-notch responses to your questions. Our content is crafted with the aim of offering valuable and dependable information. Using our team’s expertise and extensive research, we tackle your specific inquiries to ensure accuracy.

Our editorial process includes working with expert writers who produce well-researched and organized articles, providing detailed insights and recommendations. Fit Small Business adheres to rigorous standards to determine the “best” answers, taking into account factors such as accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that our content is reliable, easy to understand, and unbiased.

ProSeries Tax Alternatives & Comparison

ProSeries Tax Software Pricing

ProSeries Tax separates their plans into Professional and Basic, where Basic plans only cover Form 1040 returns. Here is a summary of the plans available from ProSeries:

- Basic plans: Basic plans are for individual Form 1040 preparation only and you cannot add business returns. These plans come with a limited number of states supported, cannot be hosted by ProSeries, and include only one user. We recommend Basic plans for sole proprietors who prepare only individual returns from their local area.

Basic 20 | Basic 50 | Basic Unlimited | |

|---|---|---|---|

Annual Price | $993 | $1,442 | $2,182 |

Number of Federal 1040s Included | 20 | 50 | Unlimited |

Number of State Individual Returns Included | 20 | 50 | Unlimited |

States Supported | 1 | 2 | 4 |

- Professional plans: Professional plans allow for a mixture of individual and business returns. For an additional fee, ProSeries will host your program on their servers so you can have cloud access. Another advantage of Professional over Basic plans is you can add multiple users for an additional fee.

Pay-Per-Return | Choice 200 | 1040 Complete | Power Tax Library | |

|---|---|---|---|---|

Annual Price | $624 | Custom | $3,011 | Custom |

Federal & State Returns Included | None | 200 of any type | Unlimited 1040s | Unlimited of any type |

State Returns Included | None | 200 of any type | Unlimited individual | Unlimited of any type |

Cost of Additional Returns | Federal individual: $57 State individual: $49 Federal business: $82 State business: $52 | Federal business: $82 State business: $52 | n/a | |

ProSeries Tax Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Helpful tools like a client analyzer and presentation tool | Filing multi-state returns can be challenging |

| Easy to set up and navigate | Difficult to justify cost unless using for multiple returns |

| Able to import financial data from QuickBooks | Not able to handle more complex returns |

Users who left ProSeries tax software reviews said that they like the accessibility of client resources, such as the client analyzer and client presentation tool. The platform received high marks for ease of use and an intuitive dashboard that’s easy to navigate. However, one of the complaints is that if you’re not using it for multiple returns, it’s difficult to justify its cost. Some reviewers also mentioned that dealing with multi-state returns was a challenge.

ProSeries Professional earned the following average scores on popular review sites:

- Capterra[1]: 4 out of 5 based on about 152 reviews

- G2.com[2]: 4.2 out of 5 based on around 85 reviews

ProSeries Tax Features

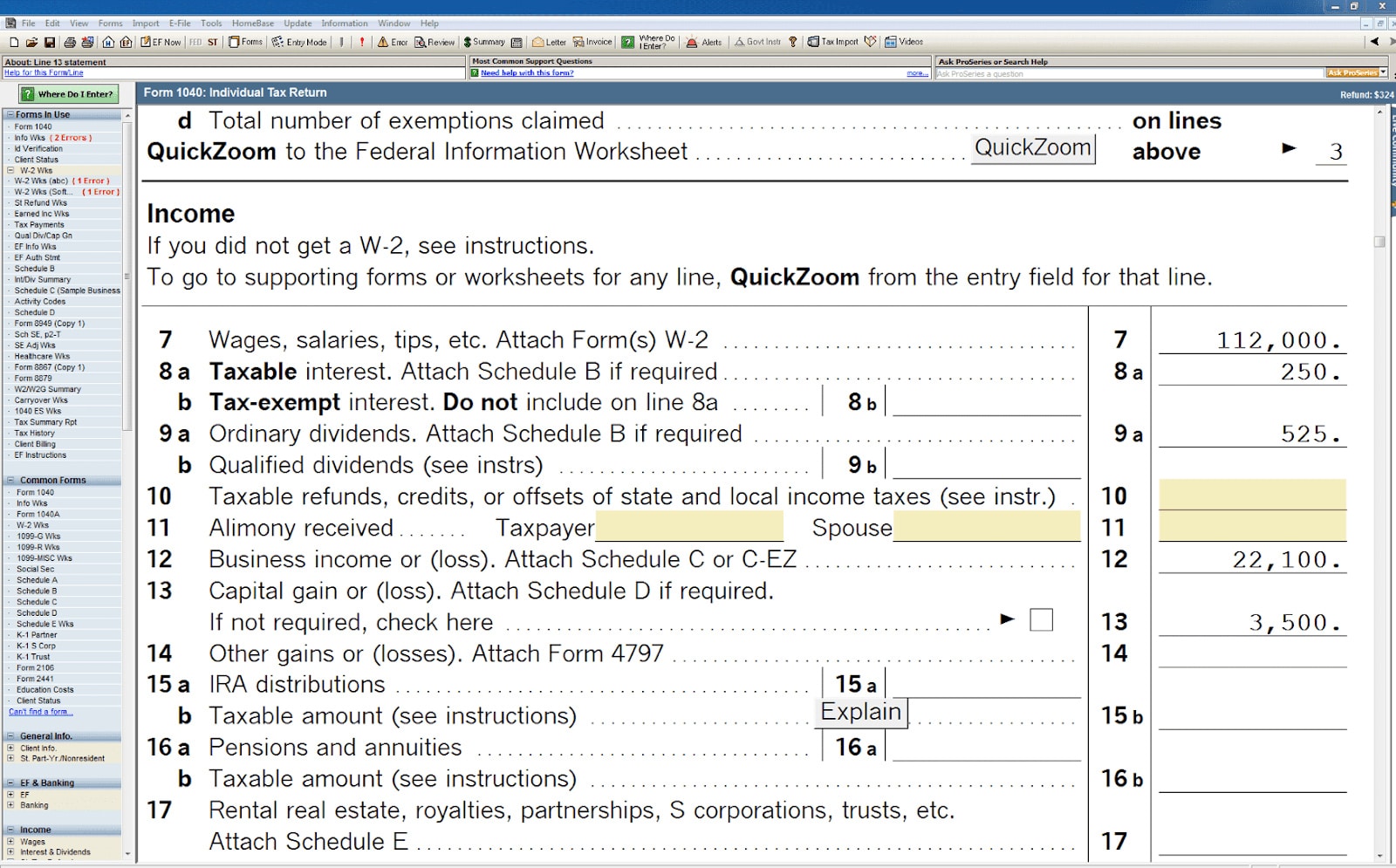

ProSeries Tax offers many useful features that will streamline your workflow, including communication tools like a client analyzer and the ability to manage all of your digital signatures in one place. It also gives you access to client resource and tax planning suggestions that are tailored for each of your clients. ProSeries Professional plans integrate with Fixed Asset Manager to import assets and SmartVault to manage documents. Its quick entry feature helps you enter data quicker and flag missing data.

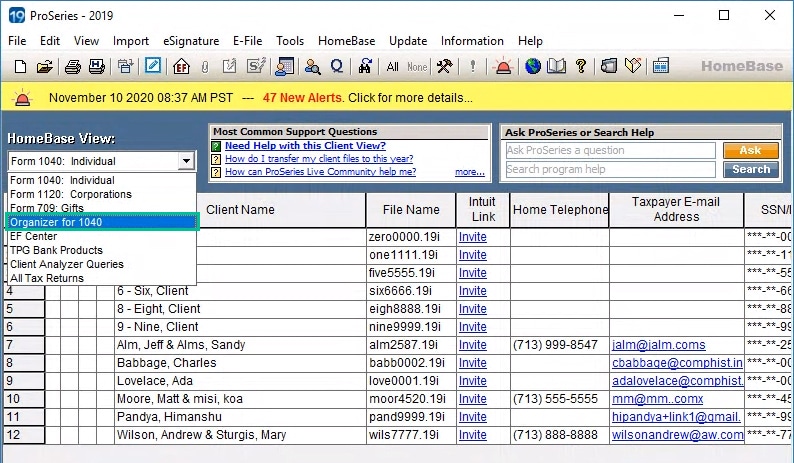

ProSeries Professional offers a client analyzer that allows you to get a better understanding of your client base. It breaks down groups of clients by return type, which you can also print or export to a spreadsheet. The client presentation tool shows a client their bottom line, income and deductions, and comparisons to prior years with easy-to-understand visuals.

Manage all of your digital signatures from within ProSeries Professional so that your clients can sign when and how they want. You’ll also be able to view, track the status of, and manage your clients’ e-filed returns. Missing client data is also filed and tracked, and data must be entered before the return is sent.

ProSeries Professional offers a variety of resources for your clients, including the ability to create checklists for the items clients need for each year’s tax return. Client-specific billing and editable invoice options are available as well, including flat rates, hourly fees, and charges per form.

You can generate a list of up to 73 tax planning suggestions that’s tailored to each client and will assist them with lowering future taxes. The tax planner estimates income, expenses, withholdings, and tax payments for future tax years, and you can use it to create custom tax plans for clients, from pro forma estimates to projections.

For an additional fee, ProSeries Professional integrates with ProSeries Fixed Asset Manager to import assets into various activities such as Schedule C and Schedule E. SmartVault also integrates seamlessly with ProSeries, providing a secure and reliable document management system with an integrated client portal. Clients in ProSeries can be imported to SmartVault.

Importing ProSeries tax organizer into SmartVault (Source: SmartVault)

You can enter data quickly with less scrolling on many forms, such as Schedule D and Schedule K-1. Type Ctrl-M and toggle between quick entry mode and form entry mode easily. You can also flag missing data as you work on a client’s return and send them an email, requesting the information you flagged.

ProSeries quick entry sheets (Source: Intuit ProSeries)

ProSeries Professional Ease of Use & Customer Support

ProSeries is very user-friendly, and some of its features are designed to catch errors and data omissions. This reduces the rate of form rejections and optimizes each return to improve client relationships. With over 3,700 forms to choose from, the data input provides an easy-to-read display that’s easy to present to clients. Users have access to on-screen help if needed, and your issue will be solved by someone who visually observes what is occurring with the software.

ProSeries provides you with free U.S.-based tech support (available via toll-free phone with extended hours during peak season), in-product help, and a searchable knowledge base. Regular hours of operation are Monday through Friday, 6 a.m. to 5 p.m. Pacific Time.

The provider also offers various free training options that make it simple to switch and get the most value from your software. New users can take advantage of Intuit Easy Start onboarding to get up and running quickly.

Frequently Asked Questions (FAQs)

Some of the forms, schedules, and worksheets supported include 1040, 1120, 1120S, 1065, 1041, 990, 706, and 709. ProSeries doesn’t support Form 5500 returns.

One ProSeries license is required at each physical location where clients are served. If multiple preparers use ProSeries within a location, then a network license will be required. It’s currently available for a fee of $1,212 and includes toll-free tech support and a network installation user guide.

ProSeries allows you to e-file all of your clients’ tax returns—provided you’re approved by the IRS as an electronic return originator (ERO). If you’re trying to e-file your do-it-yourself (DIY) return, check out our list of the best small business tax software.

Bottom Line

ProSeries Professional provides several tools that will suit the needs of small and mid-sized tax firms. With the exception of Form 5500 returns, the software offers a variety of packages and access to helpful resources, including tax planning suggestions. It’s a good fit for accounting firms looking for desktop software with a forms-based interface that can import account balances from QuickBooks Desktop. Both affordable and easy to use, it’s also well-suited for accounting firms that process a variety of different returns.