CCH Axcess Tax is a cloud-based professional tax preparation software ideal for small and midsized accounting firms. It’s one module of the CCH Axcess firm management software, which is great for those looking for more than a tax preparation solution. CCH Axcess Tax integrates with CCH IntelliConnect, a leading tax research service, to provide in-program links to relevant tax authority and analysis. However, for all of its useful features, the pricing isn’t transparent—you must speak with a sales representative for pricing information. While there are not many user reviews available, the ones that are there rate the software poorly―mostly due to the lack of transparency in pricing, packages, and hidden add-ons.

Why You Can Trust Fit Small Business

At Fit Small Business, we are dedicated to providing high-quality answers to our readers’ questions. Our commitment to delivering valuable and reliable information is the foundation of all our content. We leverage our team’s expertise and meticulous research to address your specific questions while always ensuring our content is based on knowledge and accuracy.

Our editorial process is enforced by inviting expert writers to create well-researched and organized articles that provide in-depth insights and recommendations. Fit Small Business adheres to strict standards to determine the “best” answers, taking into account factors, such as accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that our content is trustworthy, easy to understand, and unbiased.

Is CCH Axcess Tax not what you’re looking for? See our review of the best professional tax software.

CCH Axcess Tax Alternatives & Comparison

CCH Axcess Tax Pricing

In addition to packages for larger firms, CCH Axcess Tax provides small firm packages for new customers with one to four employees, up to nine employees, and up to 19 employees. While CCH indicates these small firm packages come with a discounted price, they don’t provide any actual pricing information. You must contact a sales representative for details.

CCH Axcess Tax Reviews from Users

| Users Like | Users Dislike |

|---|---|

| Easy to access via the cloud | Lack of transparency with pricing |

| User-friendly and intuitive navigation | Website doesn’t give much information about available packages |

| Integrations streamline workflow | Hidden add-ons that cost additional money |

CCH Axcess Tax reviews show that users like the fact that it’s cloud-based and easily accessible. They also said it’s user-friendly and easy to navigate and appreciated the integrations for practice management and workflow.

While there were only 15 reviews, CCH scored very poorly. We think the primary reason for the poor scores were user complaints about the lack of transparency in pricing, packages, and add-ons. We completely agree that CCH should offer transparency in their packages and pricing but, unfortunately, the lack of transparency seems to be consistent across their competitors as well.

User reviews are limited, but CCH Axcess Tax earned the following average score on this popular review site:

- TrustRadius[1]: 5.3 out of 10 based on around 15 reviews

CCH Axcess Tax New Features

- Improved K-1 export: K-1 export files can be automatically created each time a return is calculated. The preparer of the return the K-1 is being imported to will be notified that updated K-1 information is available.

- K-1 partner footnotes: Create custom footnotes for partner K-1s and determine which partners should receive the footnote. Amounts can also be included with footnotes and allocated based on several options.

- Ask the community: A new feature has been added allowing customers to ask questions of each other to harness the power of the community.

CCH Axcess Tax Features

CCH Axcess Tax has many useful features, such as tax research tools and the ability to create tax organizers for your clients. For these and other reasons, we selected it as the best cloud-based software to manage the whole firm in our evaluation of the top professional tax software. One of its biggest drawbacks is the lack of built-in integrations with QuickBooks and other accounting software. However, CCH Axcess has an open integrations platform that can be used to integrate with almost any software, but it takes some special knowledge to implement.

Cryptocurrency Solutions

Enhance your end-to-end digital tax workflow process by addressing your clients’ cryptocurrency reporting needs. CCH Axcess Tax integrates with both CoinTracker and Ledgible, streamlining the process.

CCH Axcess Portal

With this, you and your clients have access to a secure web-based portal, which allows you to view documents and files. You’ll be able to exchange, store, and organize files, such as a QuickBooks backup file, in one central location.

Tax Organizers

You can create tax organizers for your clients, which can be printed and sent or emailed. They can also be uploaded to the client portal, allowing clients to access them at their convenience. Clients can upload requested documents to the CCH Axcess Portal.

Integrations

Axcess Tax has built-in integrations with CCH’s seven Axcess modules, which are:

- Axcess Document: A cloud-based document management system, which allows you to store electronic copies of tax returns and file backups.

- Axcess Workstream: Use this integration for tracking projects, with the ability to link to them and update project status.

- Axcess Portal: You can send and receive client source documents, supported information, and completed tax returns securely with CCH Axcess Portal.

- Axcess Practice: Time tracking is enabled with the ability to access clocks and enter time from within CCH Axcess Tax.

- Axcess Client Collaboration: With this unified collaboration hub, you and your clients have access to a secure portal and an enhanced ability to move your clients’ work through the established workflow.

- Axcess iQ: This integration uses predictive intelligence to gather clients to grow tax advisory services, with the ability to create additional engagements and revenue opportunities within your existing client base.

- Axcess Financial Prep: This is a cloud-based trial balance solution, which enables you to instantly produce accurate balances for preparing business tax returns.

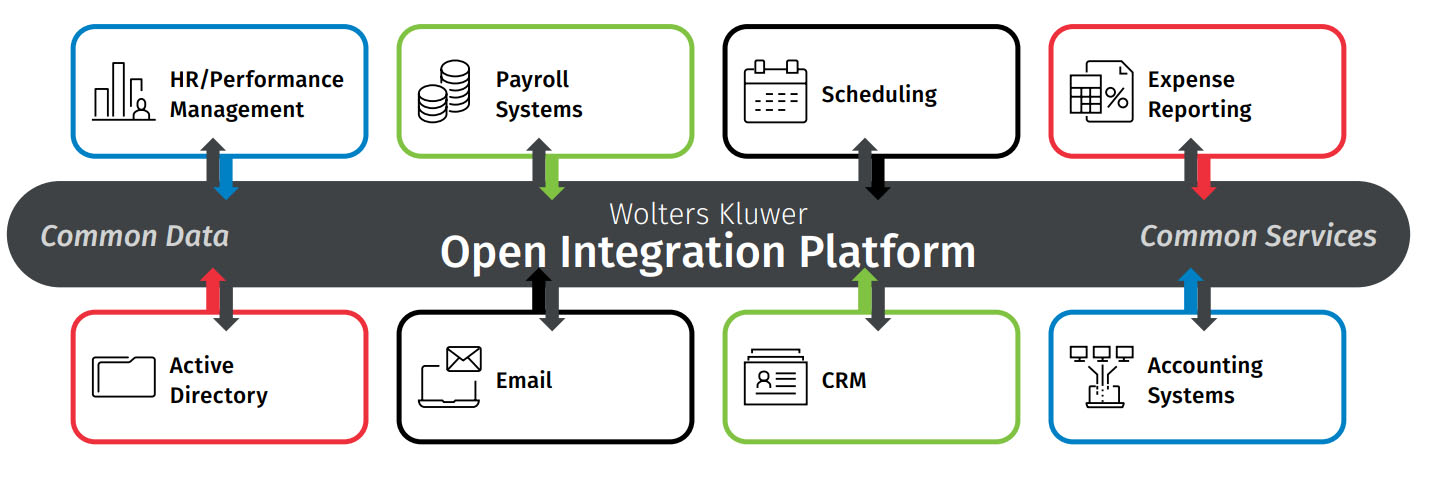

Open Integrations Platform

Using application programming interfaces (APIs), Axcess customers can integrate their tax preparation with a wide array of other software to create a custom, comprehensive workflow. Of course, you’ll need some knowledge of APIs to make this work.

Open Integration Platform (Source: Wolters Kluwer)

E-filing Capability

CCH Axcess Tax offers complete e-filing for all supported forms, and users can check their status easily, viewing alerts and rejections. Digital tax workflow is also available, which automates the entire tax preparation process.

Tax Research Tools

The platform comes with a real-time link to CCH AnswerConnect and CCH IntelliConnect, powerful resources for comprehensive tax research. You’ll have access to explanations of tax law and how to apply it in real-world situations, as well as the ability to research topics and find answers to compliance questions without leaving the tax preparation process.

Robust Diagnostics

Helpful alerts notify you of incomplete returns or tasks, changes that need to be reviewed, and conflicts that need to be resolved. You can also speed up your on-screen reviews with features such as tick marks and preparer notes.

Client Communication Options

Create professional correspondence that you build from templates and edit in Microsoft Word. Then, save them to libraries and reuse the content in any return. You’ll have complete control of your client correspondence.

CCH Axcess Tax Ease of Use & Customer Support

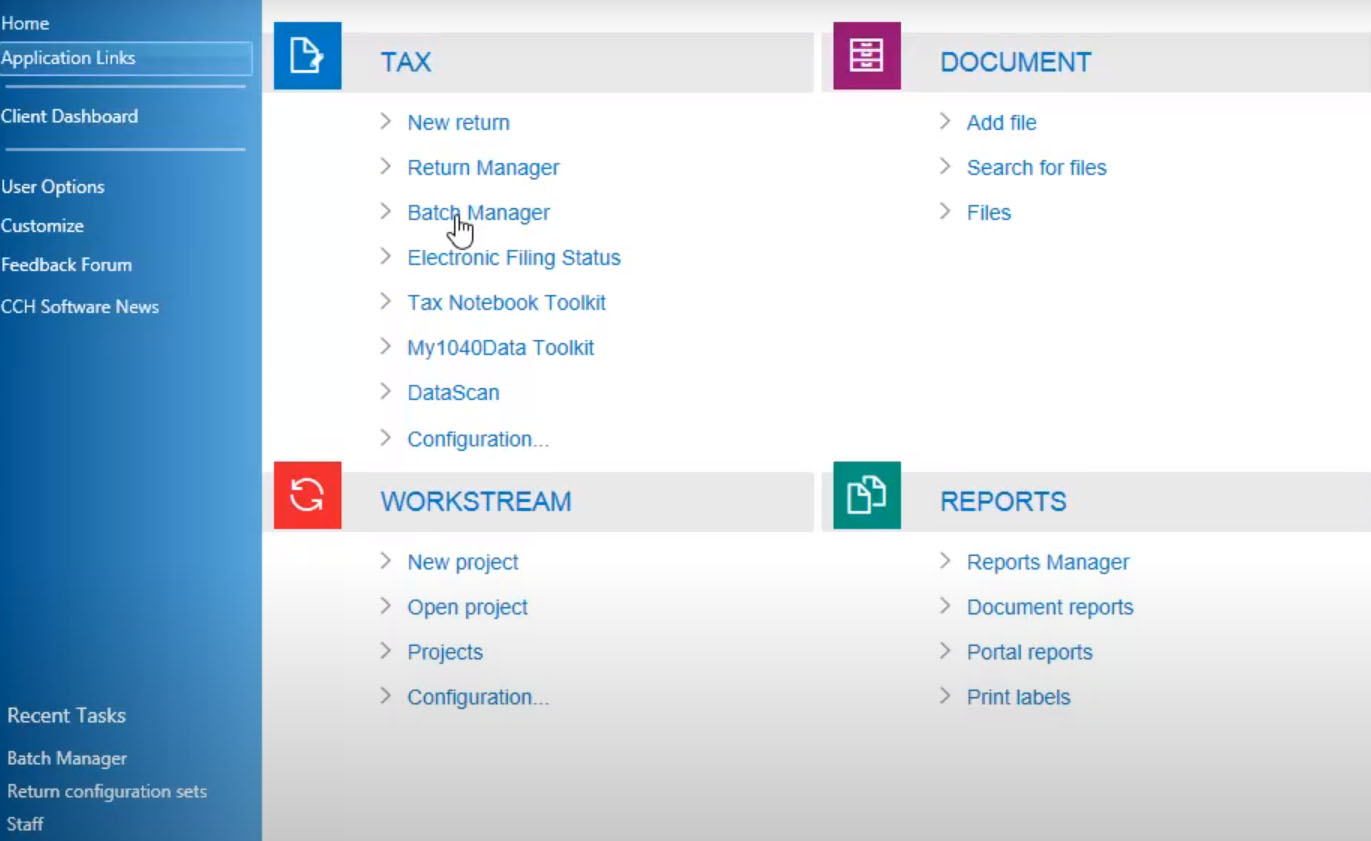

CCH Axcess Tax has the same familiar user-friendly interface as Microsoft Office, making it easy to navigate. The dashboard gives you quick access to all related projects, tasks, and client documents. Helpful tool tips provide useful information about each particular icon’s function, and you can customize the Quick Access Toolbar with your most-used tools. The enhanced Return Manager allows you to customize information based on what you need to see, and quick filters allow you to arrange tax returns in the desired order.

CCH Axcess Tax Dashboard

All registered users have access to support via telephone, email, and live chat. Additional help and support options include product guides, user videos, a searchable knowledge base, and a community user forum. You can also download product enhancements or updates from the website.

Frequently Asked Questions (FAQs)

CCH Axcess Tax is used by small and midsized accounting firms, corporate tax offices, and institutions, such as colleges and universities. The software is scalable and integrates with CCH’s workflow and practice management solutions.

CCH Axcess Tax assists accounting firms with preparing tax returns through features, such as a tax research service, robust diagnostics that simplify the identification of errors, and integrations with other CCH solutions that streamline your workflow.

CCH Axcess Tax’s pricing information is unavailable on its website, so you must contact a sales representative for details.

Bottom Line

CCH Axcess Tax has many strong features, including its integration with other CCH Axcess modules for cloud-based management for your entire firm. You can link to the CCH IntelliConnect tax research service without leaving the tax preparation program. Access to strong customer support is also a plus. However, CCH Axcess Tax lacks transparent pricing and is unable to import data from QuickBooks files.

1 TrustRadius