Merritt Bookkeeping provides professional remote bookkeeping services to small businesses located anywhere in the US. It’s best for those looking for affordable bookkeeping services without any tax or consulting services.

It keeps its price very low by focusing only on bookkeeping essentials: recording transactions, reconciling accounting, and providing financial information. With its flat-rate pricing of $250 per month, users love Merritt Bookkeeping, with an average rating of 4.98 out of 5 from the approximately 100 customer reviews we found.

The Fit Small Business editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Pros

- 100% money-back guarantee if you’re unsatisfied with its services

- Budget-friendly flat-rate pricing with no setup charges and transaction limits

- Catch-up bookkeeping available at a discounted price

- Very high user reviews

- No software learning curve—clients use a client portal that links to summary reports

Cons

- Only basic bookkeeping services are offered—excluded payroll, tax, and consulting

- Only method of communicating with your bookkeeper is email

- No invoicing or bill pay services

- No accrual-based accounting

- No customization beyond the chart of accounts and some financial reports

Pricing | $250 per month |

Free Trial | ✕ |

100% Money-back Guarantee | 90 days |

Assigned a Personal Bookkeeper? | ✕ |

Bookkeeper Communications | Email |

Monthly Account Reconciliations & Financial Statements | ✓ |

Detailed Monthly Financial Reporting | ✓ |

Back-office Services, e.g., Customer Invoicing and Bill Pay | ✕ |

Full-service Payroll Available | ✕ |

Tax & Consulting Services Available | ✕ |

- Small businesses wanting to track income and expenses for their tax returns: If you don’t plan on using your financial statements for anything other than preparing a tax return, then Merritt’s very basic, affordable service is ideal for you. You can also use Merritt to process 1099 forms for your contractors.

- Small businesses or freelancers using QuickBooks: If you currently use QuickBooks Online but are tired of the bookkeeping headache, you can transfer your QuickBooks Online account to Merritt and let it take over.

- Businesses on a budget: Merritt is affordable, so it’s a great choice if you’re looking to save money. Its services are available at one flat rate, regardless of your monthly expenses or transactions.

- Businesses behind on their books: Merritt has catch-up bookkeeping for an additional fee. The catch-up fee is offered at a discounted price compared to the monthly service.

Merritt Bookkeeping Alternatives & Comparison

Merritt Bookkeeping Reviews from Users

| Users Like | Users Dislike |

|---|---|

| Monthly reports are detailed and insightful | No invoicing or bill pay |

| Catch-up bookkeeping available | Communication is limited to email |

| 100% money-back guarantee | No tax services |

Customers have left outstanding Merritt Bookkeeping reviews. While its offerings are limited and communication is only by email, customers love the provider. There’s something to be said for doing one thing and doing it well. Users appreciated its flat-rate pricing and praised the provider for its transparency and budget-friendliness. They also found its team to be attentive, responsive, and helpful.

Here are the Merritt Bookkeeping review scores on third-party sites:

- Yelp[1]: 4.9 out of 5 based on about 40 reviews

- Google[2]: 5 out of 5 based on around 90 reviews

- G2.com[3]: 4 out of 5 based on about 5 reviews

Merritt Bookkeeping Pricing

Merritt is the clear price leader in online bookkeeping. Unlike other online bookkeeping services with variable rates, Merritt charges a flat rate of $250 per month. The price is the same regardless of business size, transactions, accounts, monthly expenses, and the number of employees.

Merritt also has the following add-on services:

- Catch-up bookkeeping: If you’re behind, Merritt will help you catch up for $200 per month or $100 per month if there are less than 10 transactions to be entered.

- Form 1099s: Merritt will prepare and file 1099’s for payments made to your contractors for $75 plus $10 per form.

Merritt Bookkeeping: Bookkeeping Features & Services

Personal Bookkeeper

Merritt Bookkeeping provides a personal account representative to each customer, so you’ll have a single point of contact with the company. While they aren’t technically your bookkeeper, they’ll oversee the preparation of your books to ensure things run smoothly.

When you sign up, a Merritt employee will assist you with setting up your bank and merchant accounts. The bookkeepers will manage your financial data using QuickBooks, which will automatically import read-only versions of your bank statements using LedgerSync, a free, secure, third-party application. It will:

- categorize your transactions based on the chart of account;

- reconcile your QuickBooks file with the bank statements; then

- send you PDF reports of your financial data every month

If you don’t already have a QuickBooks file A QuickBooks file is a copy of all your QuickBooks data that Merritt will manage. , Merritt will create one for you. You can still manage your QuickBooks account—and Merritt will update its QuickBooks file. You can also ask for a copy of the file from Merritt. The easy-to-access client portal lets you review reports and see how your transactions are categorized. If there are any errors, you can correct them yourself.

After setup, contact with your bookkeeper will be minimal. Each month, once Merritt updates the bookkeeping, it’ll email you a link to your Dashboard. The Dashboard includes transaction details and links to your financial reports and the support center. It’s up to you to review the transaction detail sheet. If you see anything that needs to be fixed, type the change in the sheet, and it’ll be updated.

The reason Merritt scored a little low in this category is that the only method of contact with your account representative is via email, which will be answered within one business day. You can’t arrange a meeting with your bookkeeper, although you’re allowed an unlimited number of emails. While this setup doesn’t sound ideal, it seems to work well for users, based on its outstanding customer reviews.

Bookkeeping Services

Merritt Bookkeeping is in our roundup of the best online bookkeeping services as it offers the best value for basic bookkeeping services. It keeps its price low by focusing only on the most basic bookkeeping tasks, which are—in our opinion—the most important tasks.

It’ll classify your transactions into the proper accounts, reconcile your bank accounts monthly, and provide monthly financial statements. It also offers catch-up work if you’re behind in your bookkeeping.

The provider took a hit in this category because it doesn’t offer more advanced services like invoicing your customers, paying your bills, and running your payroll. However, if you don’t need these services, it is a great option with its low price and excellent customer reviews.

Merritt Bookkeeping: Other Features & Services

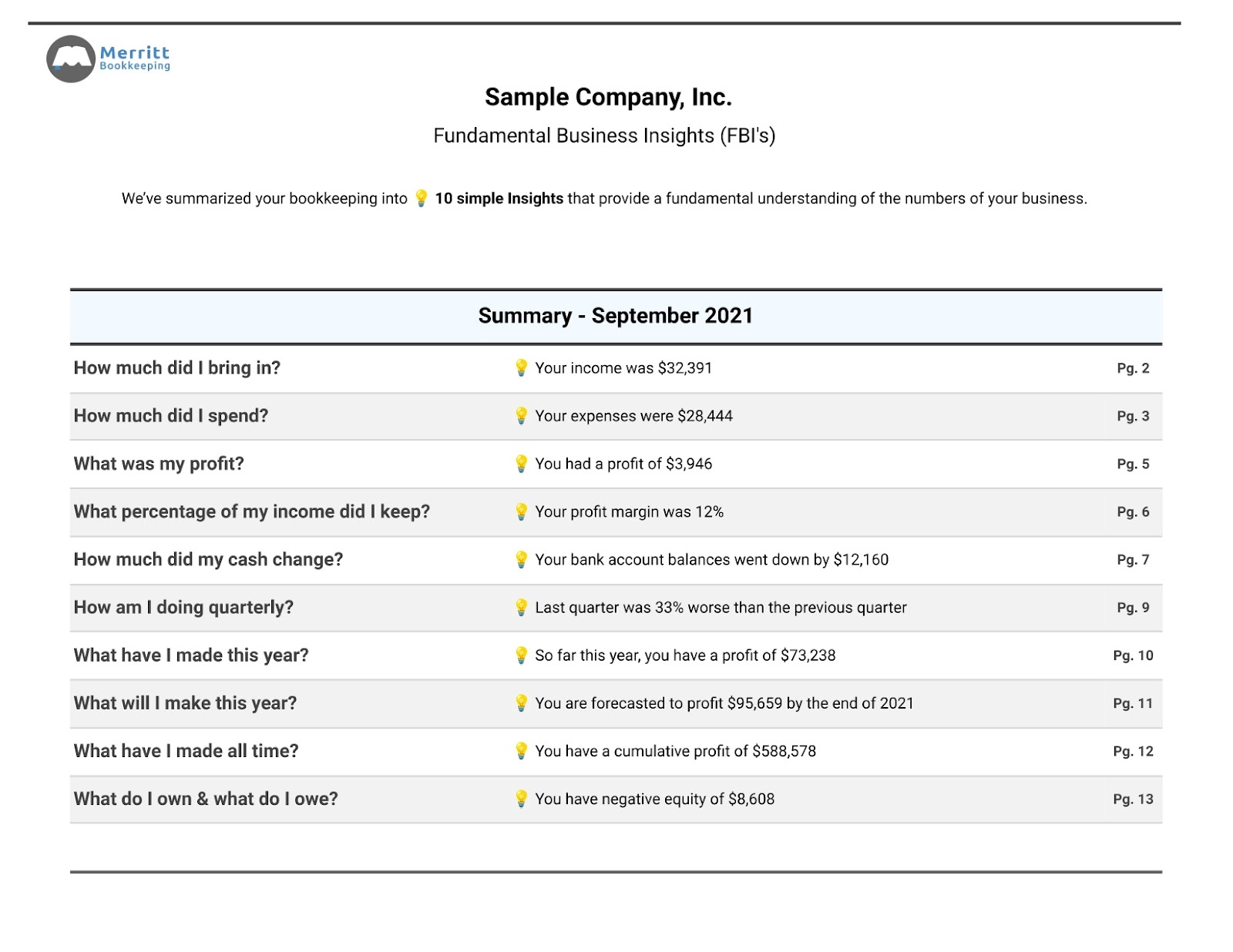

Each month, Merritt Bookkeeping will send you a cloud-based spreadsheet that details all of your transactions so that you can verify that they have been categorized correctly. You’ll also receive the following reports:

- Balance sheet

- Income statement, showing yearly comparison during the last three years

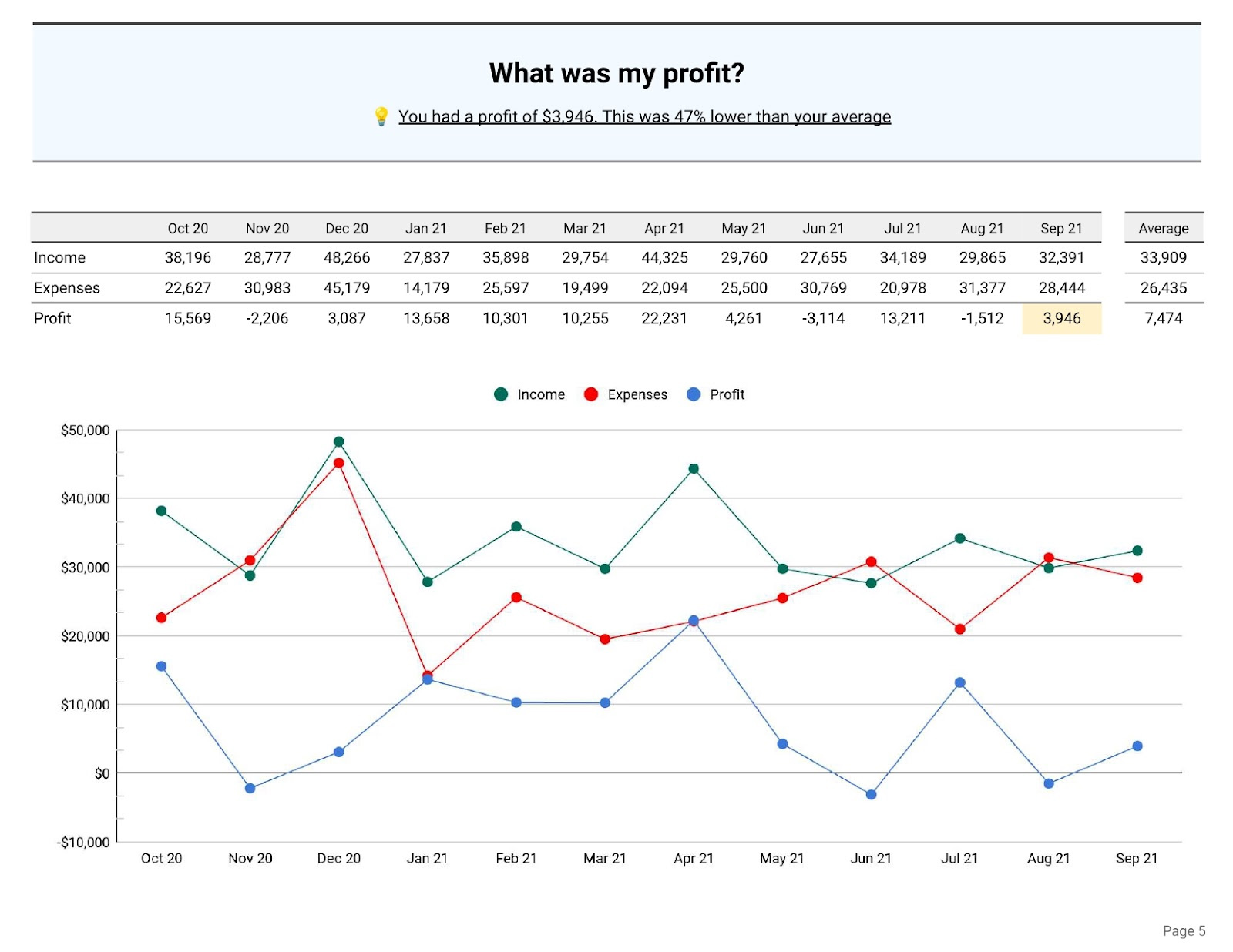

- Profit and loss (P&L) statement, showing monthly comparison during the last 12 months

- Graphical representation of income and expenses during the last 12 months

Given the low price of its service, we were pleasantly surprised by the quality of the reports provided monthly.

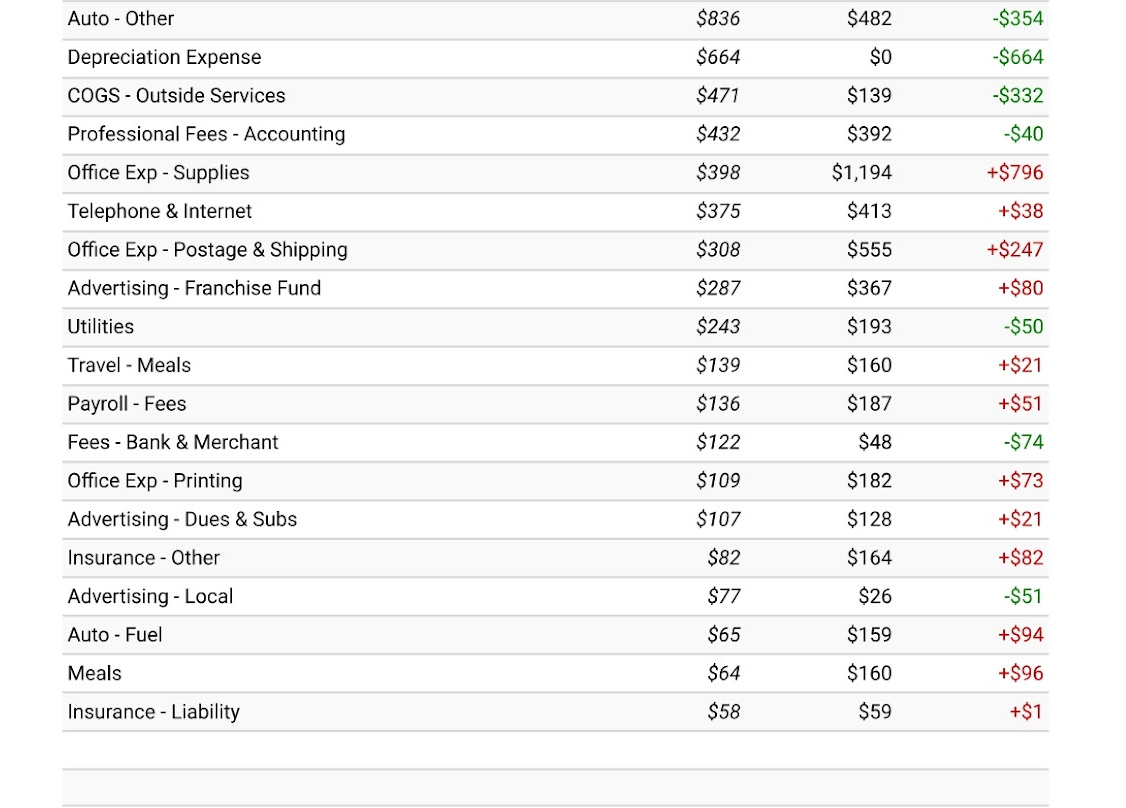

Merritt Bookkeeping makes the following reports available every month:

- Overall report summary that looks at income and expenses, cash flow projections, and key performance indicators (KPIs)

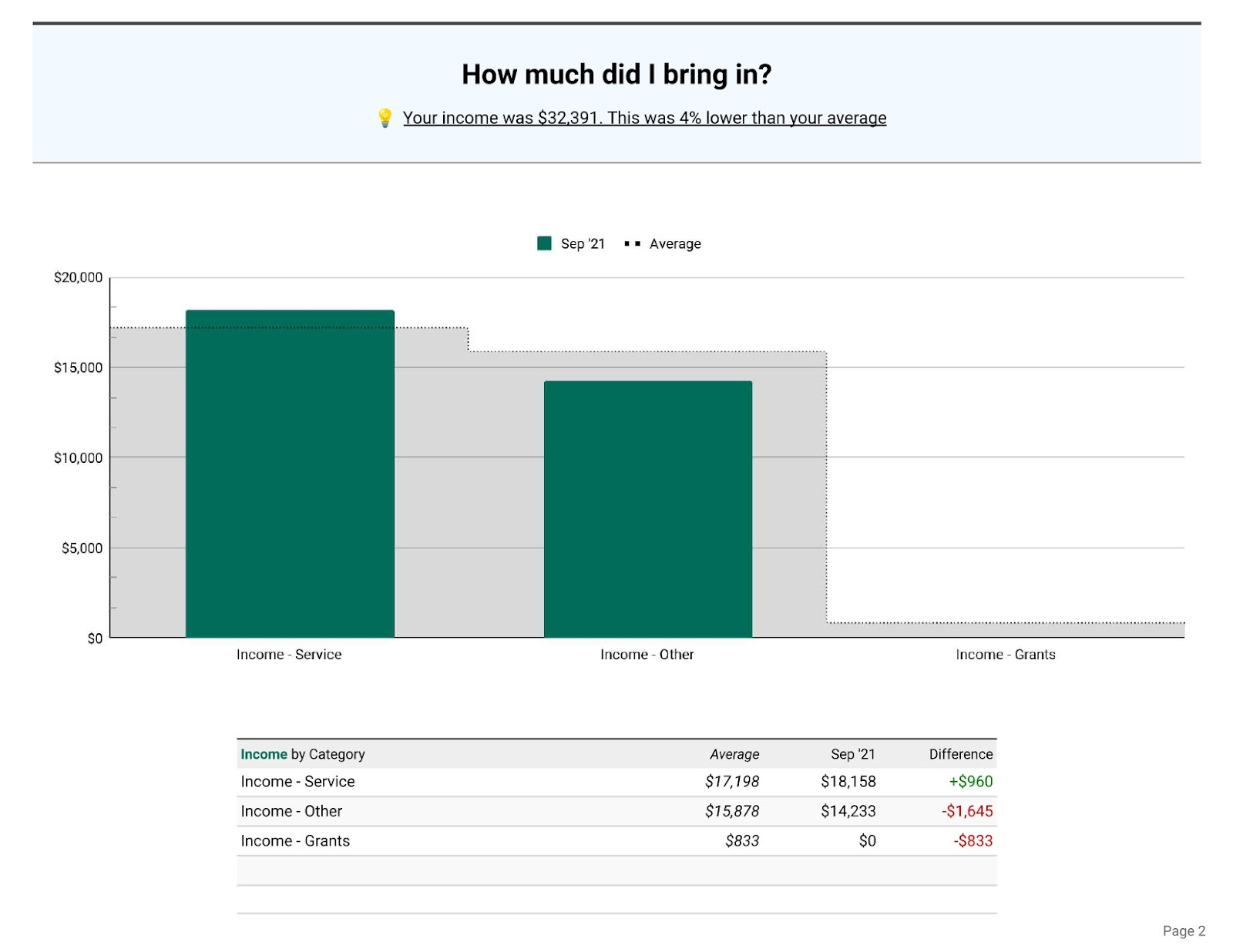

- Monthly income by type

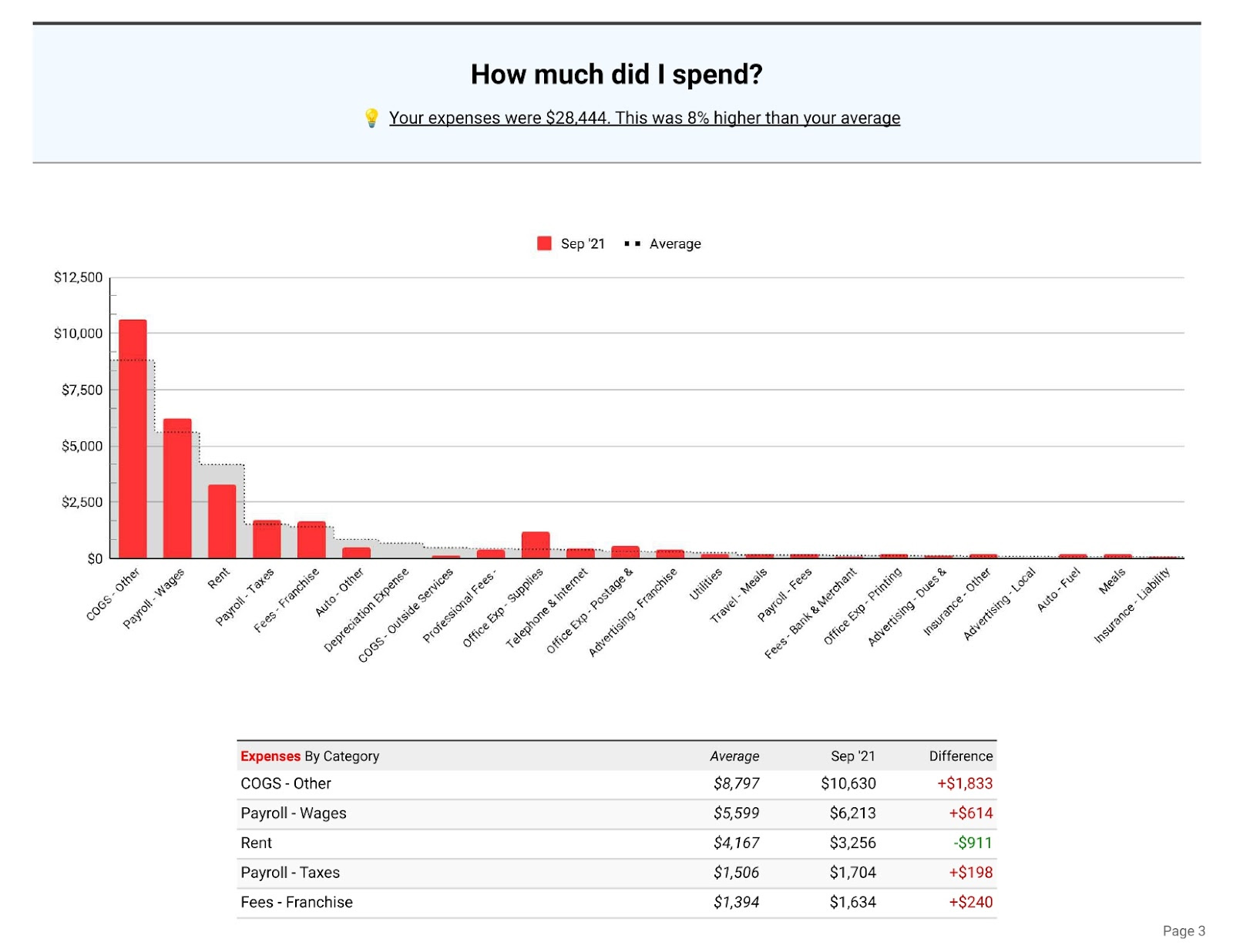

- Monthly spending by category

- Monthly income, expense, and profit

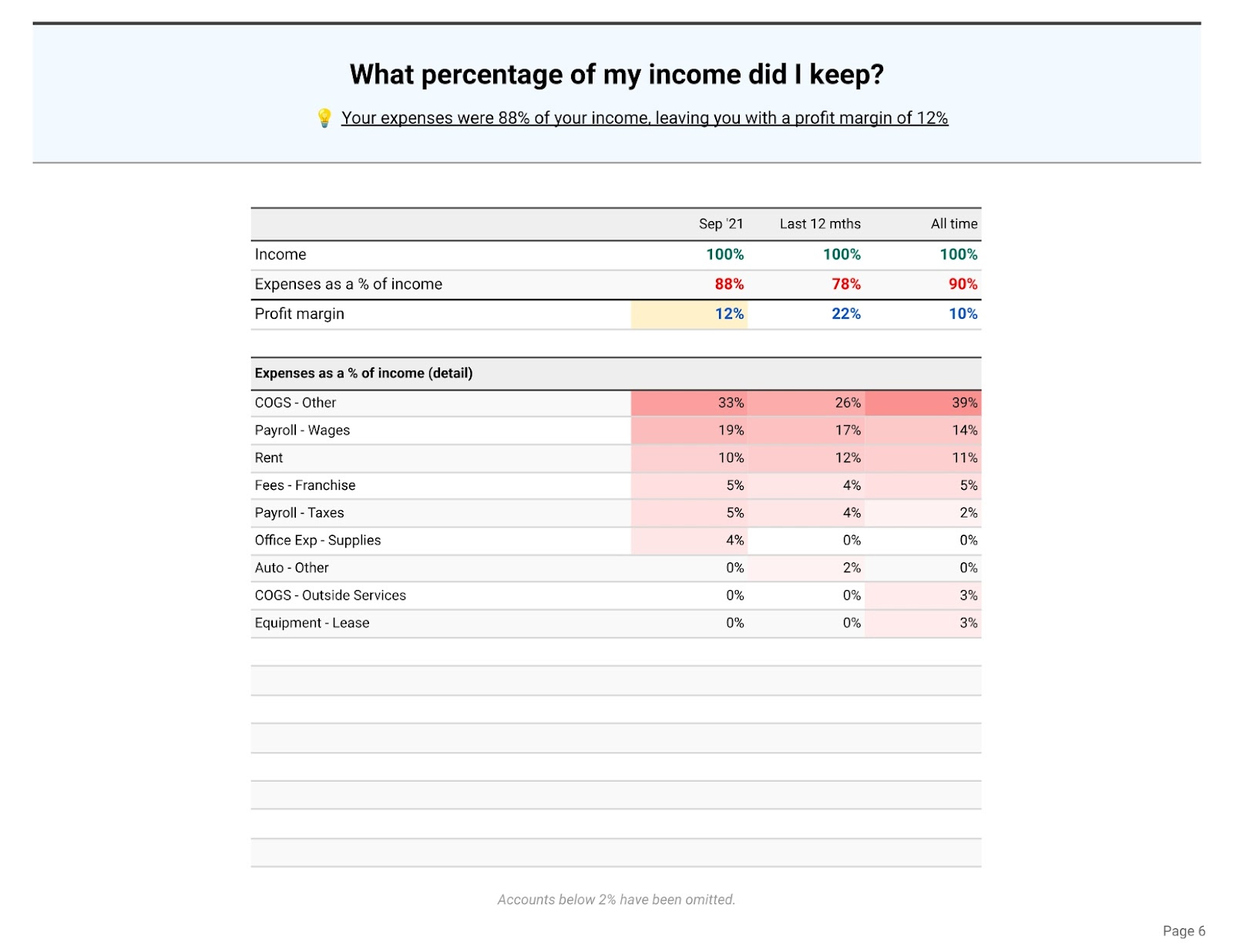

- Profit margin and expenses as a percentage of income

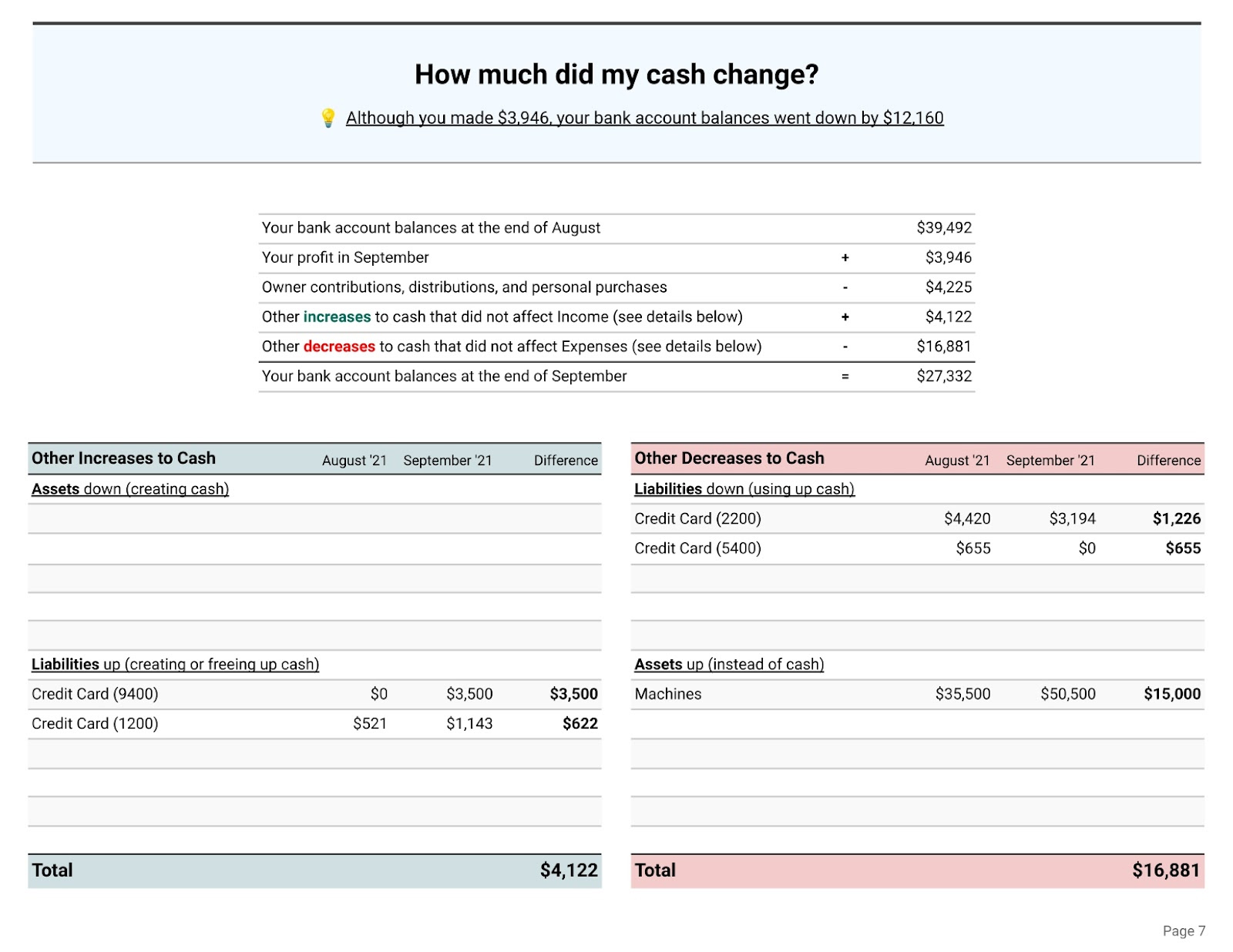

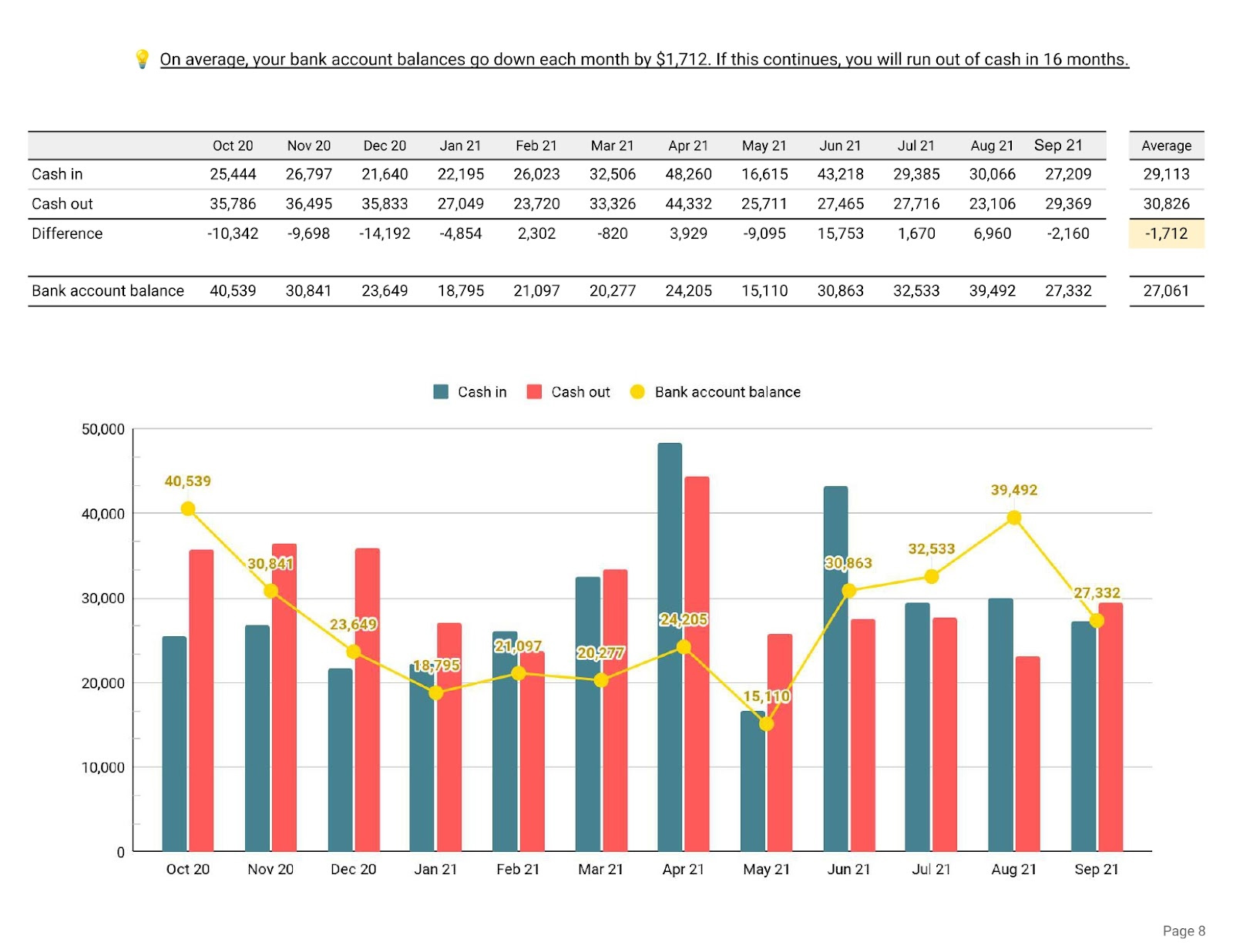

- Monthly cash flow

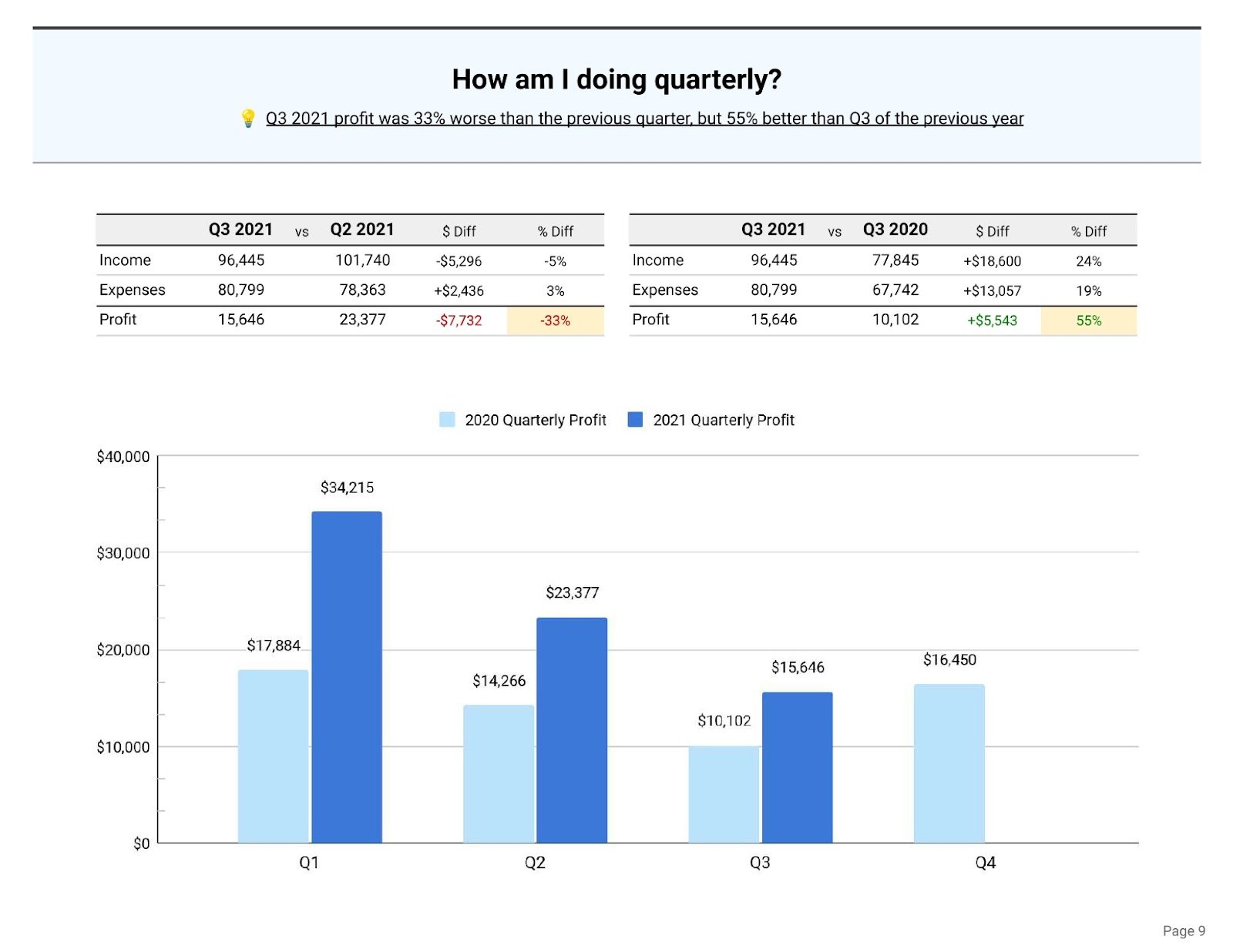

- Quarterly income, expense, and profit

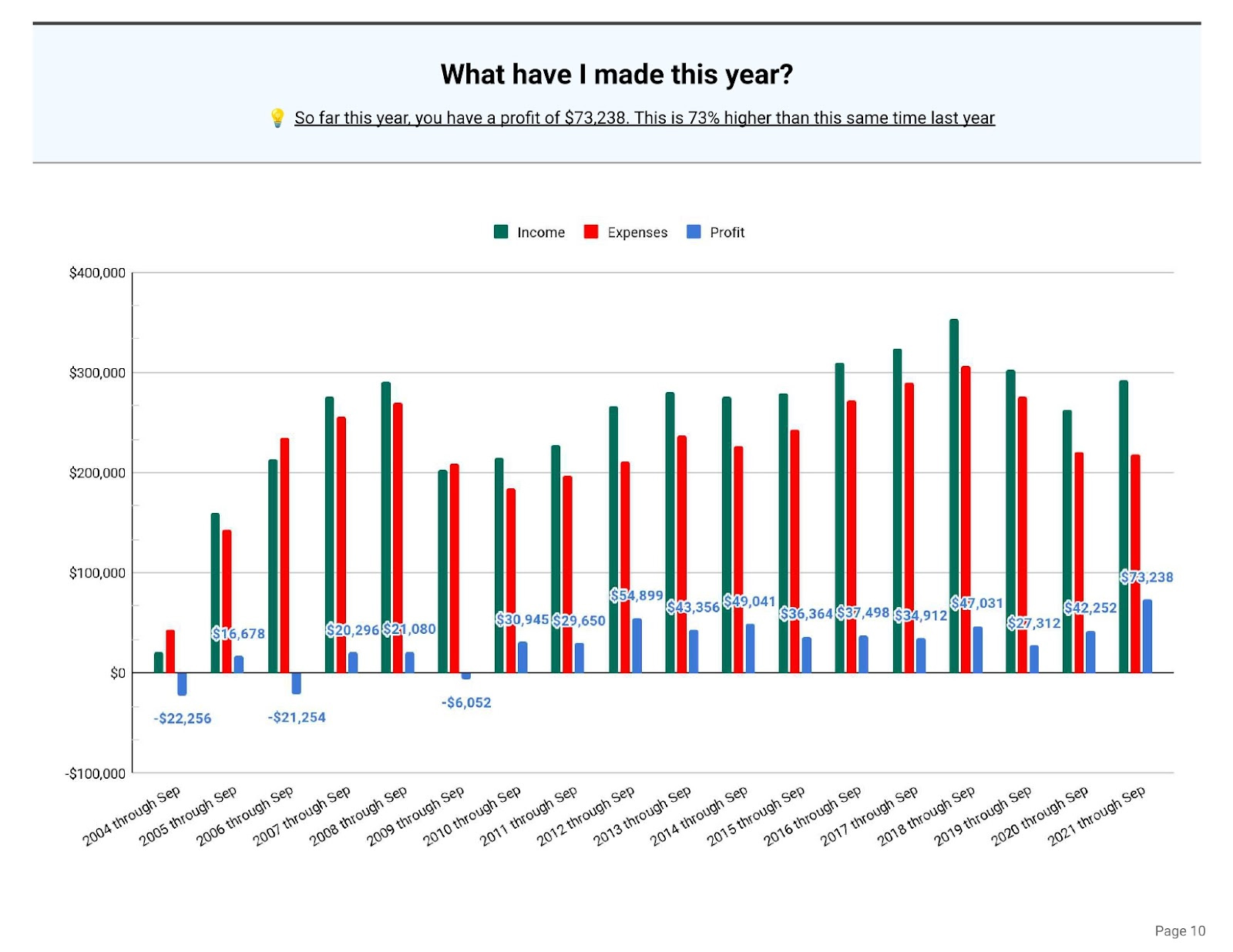

- Year-to-date income, expense, and profit compared to prior years

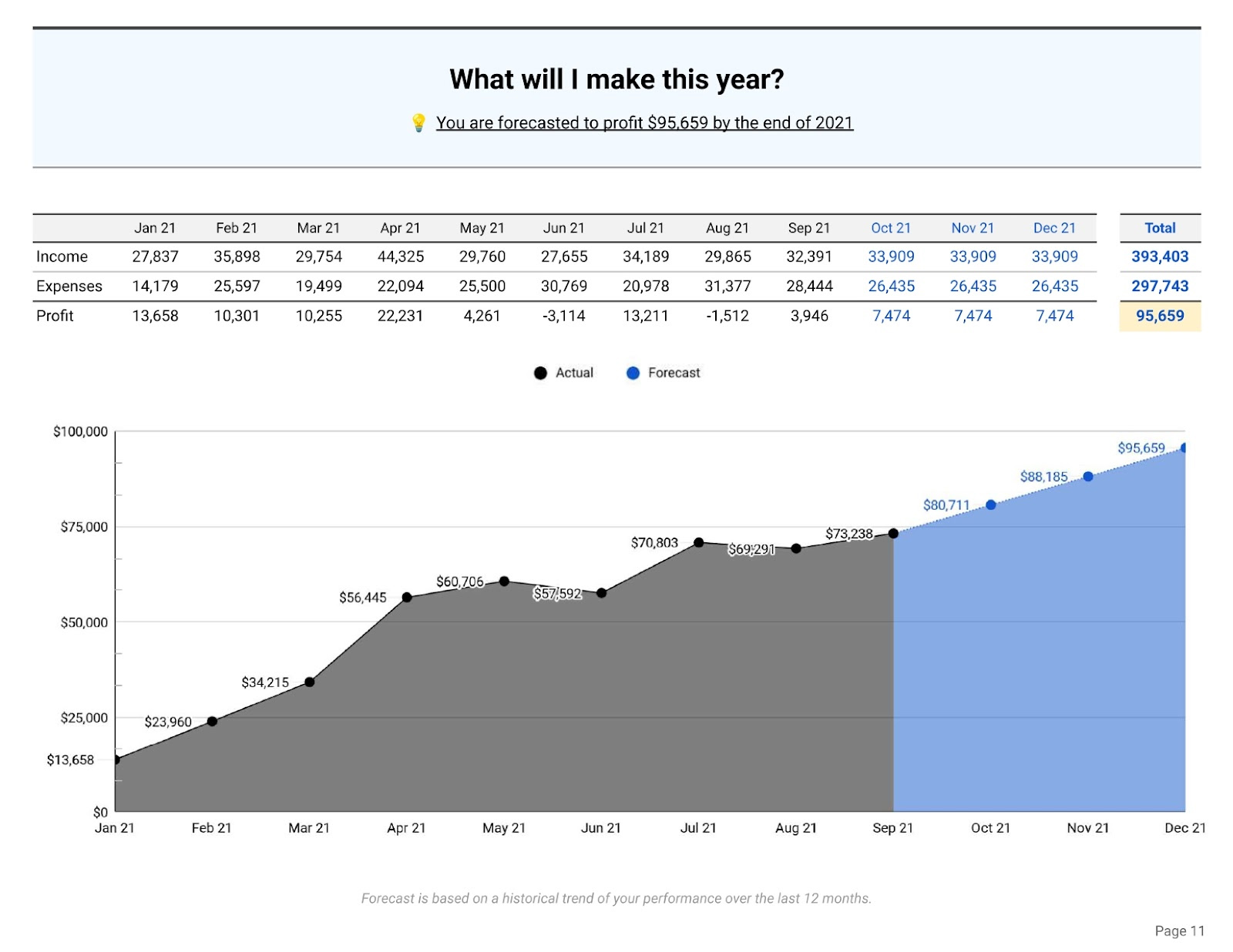

- Year-to-date income, expense, and profit along with forecast for the remainder of the year

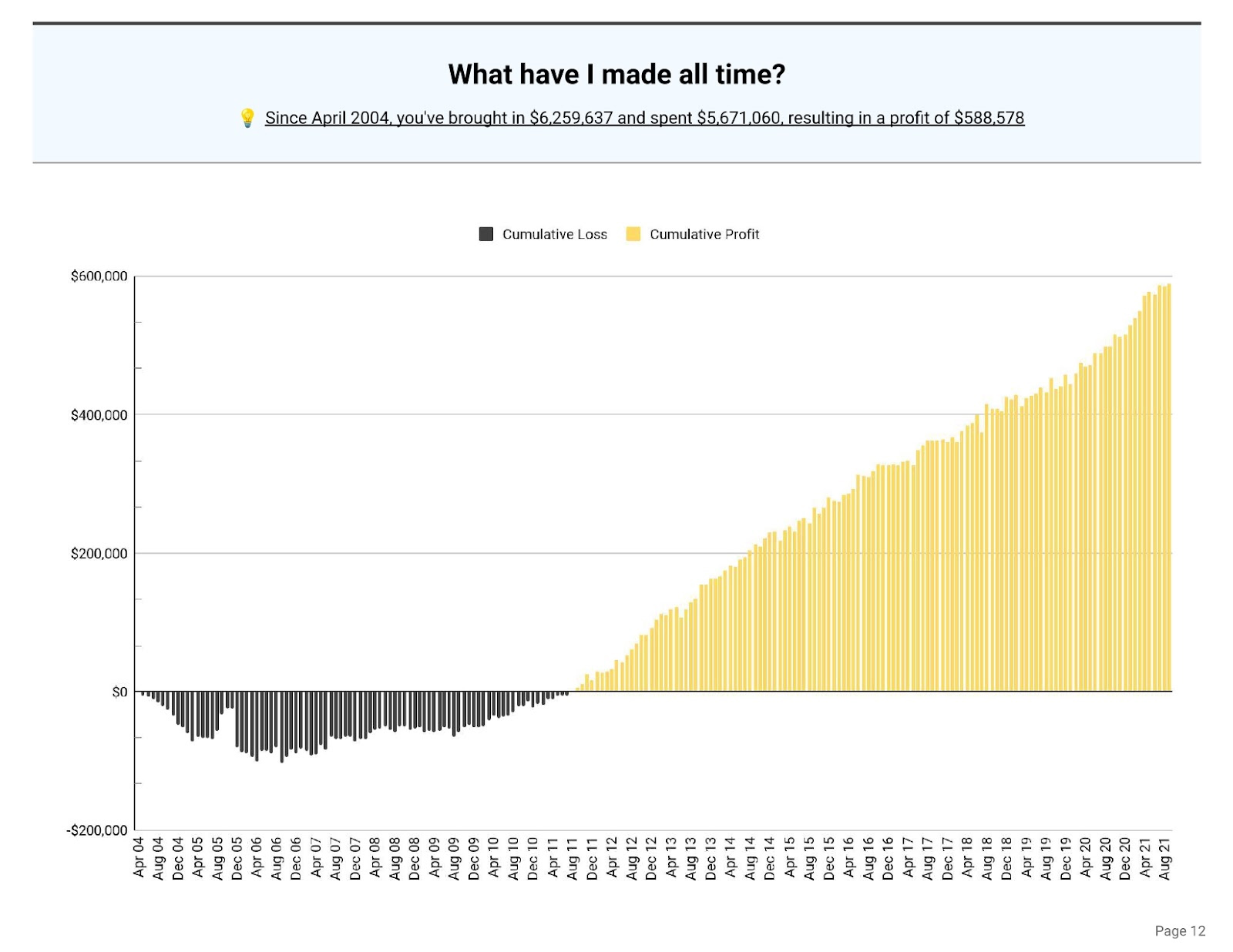

- Cumulative income by year

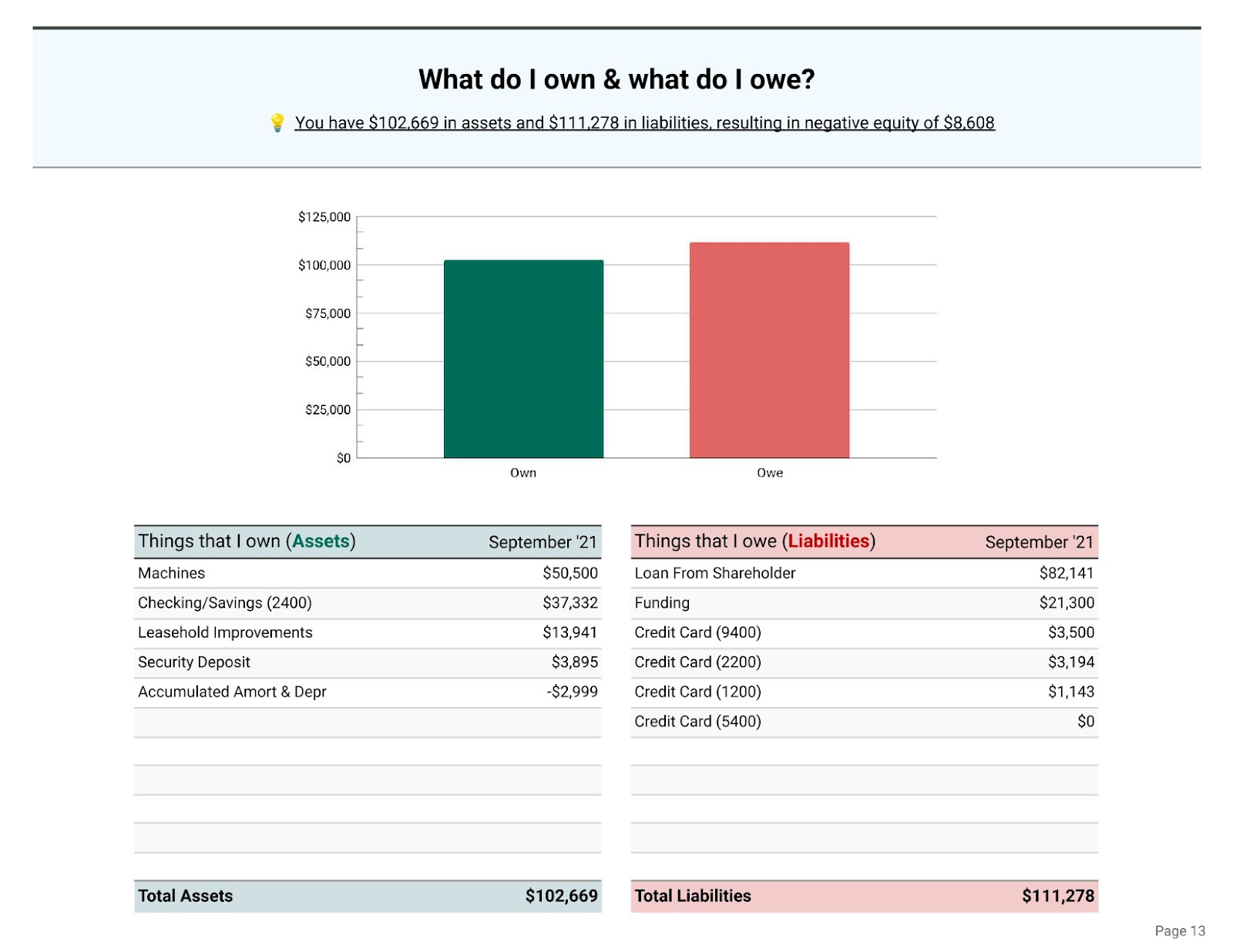

- Assets and liabilities as of current month

Once you connect your bank and credit card accounts, your bookkeeper can download your account statements directly into a QuickBooks file that they set up for you. If you’re already using QuickBooks, you can provide them with your file. This makes it easier to organize and manage information.

Merritt provides a simplified issuance and electronic filing of 1099s to your contractors. This service costs extra, as detailed in our pricing section.

Merritt Bookkeeping will import read-only versions of your bank and credit card statements and reconcile your accounts monthly.

Merritt Bookkeeping doesn’t provide any tax and consulting services but can refer to companies that it trusts will provide you with great service.

How We Evaluated Merritt Bookkeeping

We evaluated Merritt Bookkeeping on price, personal bookkeeper accessibility, bookkeeping services, and user reviews.

20% of Overall Score

While a lower price is typically better, we like to see that the price paid is appropriate for the services being received.

30% of Overall Score

We mainly look to see that there is a personal bookkeeper or someone that is the customer’s primary contact at the customer. We also like customers to be able to talk directly with their bookkeeper either on the phone or virtually.

30% of Overall Score

The most important bookkeeping services are reconciling bank accounts and preparing financial statements. However, we also like bookkeeping companies to offer back-office services like preparing invoices, paying bills, and running payroll.

20% of Overall Score

We calculate an average user reviews across major websites dedicated to collecting reviews.

Frequently Asked Questions (FAQs)

Merritt Bookkeeping charges a flat rate of $250 per month, with no restriction on the number of monthly transactions or the frequency of service.

Yes, Merritt Bookkeeping will assist with filing 1099 forms for your contractors for an additional fee of $75 for report preparation and $8 per form.

No, but you can test out Merritt Bookkeeping for 90 days with no risk. If you’re unsatisfied within that period, you’ll receive a full refund.

Merritt Bookkeeping primarily uses QuickBooks.

Yes, Merritt offers catch-up bookkeeping at a fee of $140 for each month you’re behind. The rate goes down to $70 per month for months that are almost complete.

Bottom Line

Merritt Bookkeeping, an online bookkeeping service for cash-based businesses, uses QuickBooks as its bookkeeping platform. It offers a basic package that includes automated monthly downloads of bank statements and monthly financial reports. This service is ideal for businesses with basic bookkeeping needs, as it doesn’t assist with taxes, payroll, and invoicing. The affordable flat-rate pricing also makes it a great option for freelancers on a budget or the self-employed.