Digital broker Obie specializes in landlord insurance, rental property insurance, and coverage for real estate investors. Obie’s quote process is simple and quick. You can get a quote and purchase a policy online easily in minutes. Its insurance is offered in all 50 states and Washington, D.C., distinguishing it from many other providers that are currently withdrawing from certain markets. Our Obie insurance review dives into the coverages available, the quoting process, and the advantages of using Obie.

Pros

- Simple, fast, and affordable option for landlord insurance online

- Landlord insurance available in all 50 states and Washington, D.C.

- Get a quote and purchase a policy in minutes

Cons

- Cannot reach customer service during the weekend

- Can initiate claims with Obie, but it does not handle claims directly

- No dedicated app to manage your policy

Standout Features

- Obie has a large appetite for nearly every type of property, including homes, multiplexes, apartment buildings, and condo units.

- It has separate insurance specifically for real estate investors with no cap on owned properties.

- Through its quoting and binding system and its direct-to-consumer approach, Obie makes it possible for real estate investors and landlords to save up to 25% on insurance.

- Short-term insurance, landlord insurance, and insurance for large commercial insurance properties are all available.

- Rental property insurance can be purchased for property in California and Florida.

Financial Stability: Obie works with several different carriers to underwrite the policies it sells. All of them have AM Best ratings of A- or higher.

Obie Insurance Alternatives

|  | |

|---|---|---|

Best for businesses looking for more than rental insurance | Best for a single point-of-contact for claims and customer service | Best for small businesses with poor claims history |

AM Best rating: A- (Excellent) | AM Best rating: A+ (Superior) | AM Best rating: A- to A+ (Excellent to Superior) |

Obie Business Insurance Options

As a specialized insurer, Obie offers business insurance options that are more limited than you will find with other providers. However, that doesn’t mean Obie’s coverage isn’t sufficient—it is designed to meet a very specific business need.

You won’t find commercial auto or workers’ compensation from Obie because landlords typically don’t need these coverages. However, for coverage a typical landlord or real estate investor needs, Obie has a comprehensive insurance package.

Landlord insurance, or rental property insurance, is a type of commercial property coverage that combines several features: property, liability, and loss of income. This is the primary insurance Obie offers:

- Property coverage takes care of the dwelling or structure of the building.

- Liability helps protect you if someone is injured on the premises.

- Loss of income coverage provides a revenue source if your business cannot operate because of a loss.

Dwelling coverage refers to a type of commercial property insurance primarily for domestic buildings like homes. These policies can come in different forms and will sometimes be listed as DP1, DP2, or DP3 (“DP” is short for “dwelling policy,” and the numbers 1, 2, and 3 denote different levels of coverage).

These historic insurance policies are from an era when the primary loss covered was fire, although additional perils like wind have since been added. On its website, Obie breaks down each type of dwelling policy, how it works, and what it covers.

Dwelling policies are only for the primary structure (living residence). However, detached structures, such as garages, need other structures coverage. Fortunately, Obie offers this in its suite of coverage.

Medical payments coverage is a helpful type of liability policy. It is a no-fault insurance that assists with the medical costs associated with someone’s injury. “No-fault” means that it doesn’t matter whether you are at fault; the coverage is there either way.

Obie recognizes that not every type of property rented out is a residential rental situation, and so it offers business personal property (BPP) coverage. BPP is a type of commercial property policy that refers to the tangible, movable objects your business owns. So, if you own an apartment building, this coverage would protect any equipment or on-site tools or equipment your business owns.

If you’re renting out a property for a short period, such as a beach house or second home, then you’ll want short-term rental insurance. The coverage is pretty similar to rental property, although the insurer needs to be aware of the property’s intended usage so that it is properly covered. Having a standard homeowner’s policy on a vacation rental usually will not be adequate coverage.

Carriers anticipate buildings being occupied. Often, the term on a homeowner policy is “owner-occupied.” Many policies have an exclusion of coverage if the home is vacant for a certain period. Obie offers a vacant home insurance endorsement you can purchase, which is useful if you currently do not have any tenants or if you are flipping a home.

Obie Properties Covered

Obie specializes in just one industry: rental property. Of course, this property can take various forms. Maybe the coverage is for a homeowner renting their home out on a short-term basis or for someone who has been slowly accumulating property and now owns hundreds of rental units across multiple states.

When it comes to the type of property, this isn’t an issue for Obie. However, it doesn’t appear to insure mobile homes. Some of the properties that Obie will cover are:

- Single-family home

- Duplex, triplex, quadplex, or multi-unit

- Apartment building

- Condos

Regardless of the type of business you own or the type of building you want to insure, Obie can also help. It will insure nearly anyone in the rental property space. Homeowners, property managers, and real estate investors can all purchase insurance to fit the needs of their business.

In this industry, it is important to consider the following:

- Types of business: What type of rental property insurance do you need?

- Types of rentals: What is the frequency of the rental tenants?

- Number of properties: How many properties need to be insured?

- Types of building: What type of building do you need to insure?

Obie Cost & Quote Process

As with other providers, Obie’s cost will vary depending on the property you are trying to insure, its amenities, the level of coverage you select, your claims history, geographic location, and other factors. What’s remarkable is just how quickly Obie can generate a quote.

Getting insurance from Obie is very easy and can be completed in minutes. To generate a quote, all you usually need to do is enter information on the property, along with your contact information. If a quote is generated, you’ll then have the chance to customize it and purchase insurance online.

In the event that Obie doesn’t issue a quote, the company will send you a follow-up email with more questions about your property.

How to Get an Obie Business Insurance Quote Online

To get a quote with Obie, you will need to enter your contact information, including a valid email address.

If Obie does generate a quote for your property—and in my experience, it does the majority of the time—then it will look something like this:

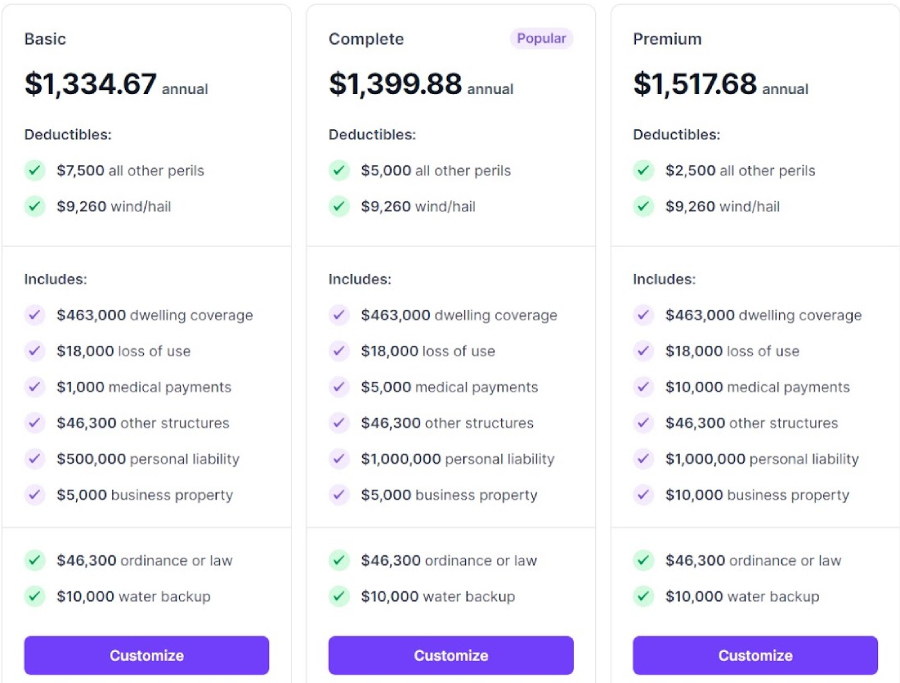

Obie quote with coverage options (Source: Obie)

As you can see, Obie offers three tiers of coverage with its quotes. Each tier contains the same coverages with different limits that, in turn, can impact the overall cost of the policy. Once you select a tier to customize it, you will then proceed to the next screen.

Here, customization includes selecting the policy start date and choosing the coverage amount for loss of use, medical payment coverage limits, and premise liability limits. After making those decisions, you need to ensure all involved parties, such as a mortgagee, are listed. You can then purchase the policy.

Obie Customer Service

Today, being a broker means offering many services similar to what providers offer. Obie is no different in that respect. Its additional offerings create value in partnering with it for insurance.

Once you start the quote process with Obie, you will have access to a dashboard where you can manage your policy and initiate a claim.

One unique service Obie provides is a risk map. Using this service, you can type in the address of your property and receive a custom risk report on the area. You can see if the property is in a flood zone, how high the risk is for wildfire, earthquakes, and wind damage, and the property’s proximity to local fire stations. The service also provides replacement costs in the area.

If you need to contact Obie, you can call or email. Its hours are Monday through Thursday from 9 a.m. to midnight Eastern time, and Friday from 9 a.m. to 11 p.m. ET.

Obie Private Client

If you are a real estate investor looking to get coverage for your portfolio of properties, consider Obie’s Private Client service for investors with multiple properties. The website says it will insure businesses that own property, from “100 to 10,000” units. The details are rather limited, but you can fill out a contact request form to learn more.

Obie Partner Insurance Carriers

As a broker, Obie partners with several carriers to provide coverage for the policies it sells, including Accelerant Specialty Insurance Company and American National Lloyds Insurance Company:

- Accelerant Specialty’s AM Best rating is A- (Excellent).

- American National Lloyds Insurance Company carries a rating of A (Excellent) from AM Best.

Obie Insurance Reviews

Complaints With the Department of Insurance

The nonprofit National Association of Insurance Commissioners (NAIC) is the closest equivalent to a federal government agency for insurance. Because Obie is a broker, there is no way to track complaints submitted to the NAIC at the local state department level.

However, you can look into complaints submitted for Obie’s partner carriers, with whom you would work directly when filing a claim. Fortunately, the results are quite good. Accelerant’s complaints are far lower than the national average. American National Lloyds Insurance Company has zero complaints registered in the 2023 data, which is the most recent data available.

Third-party Reviews

On Google[1], Obie currently has 4.9 out of 5 stars from approximately 500 reviews. The reviews highlight Obie’s great customer service, the ease of getting insurance, and customers’ gratitude for Obie’s availability in states like California and Florida.

Beyond that, not many third-party reviews can be found online for Obie—but it is still a relatively new company in this space.

Frequently Asked Questions (FAQs)

Yes, Obie is a legitimate insurance company. A newer company, it was founded in 2017 with a specific emphasis on landlord insurance.

As a landlord insurance provider, Obie offers landlord insurance and additional coverages associated with rental property businesses.

Obie’s hours of operation are on weekdays only: from 9:00 a.m. to midnight ET, Monday through Thursday, and from 9:00 a.m. to 11:00 p.m. ET on Friday. Its phone number is 773-820-7132. You can also reach Obie via email at support@obieinsurance.com.

Bottom Line

Getting into the rental property business is a great opportunity to grow your revenue stream. However, it also increases your risk exposure. The liability risk aside, one small spark can lead to a devastating financial loss for your business. That’s why insurance is so important: it doesn’t prevent a loss but rather helps you when you need it.

Obie is a great landlord insurance provider. It has a very fast and simple quote system that allows you to purchase rental property online in minutes—a unique offering within the industry. Its policies are affordable and its dashboard makes it easy to manage your policy or start a claim.