PayTraQer is an integration management software that allows you to connect QuickBooks Online or Xero to your payment processors (PayPal, Stripe, or Square) and ecommerce platforms, such as Shopify and eBay. It allows you to sync your data, such as order details, product information, and transaction fees, from your payment or ecommerce account to your accounting system. PayTraQer allows you to manage all of your accounts from a single easy-to-use integration.

To help you decide if it’s a great integration for your business, our in-depth PayTraQer review covers its features, pricing, pros and cons, and more.

PayTraQer Alternatives

|  |  |

|---|---|---|

Best for: QuickBooks Online users seeking a free Shopify integration | Best for: QuickBooks Online users looking for a free WooCommerce integration | Best for: Businesses that want to build an online marketplace with other vendors |

Cost: Free | Cost: Free |

Are you looking for something else? If your business primarily needs basic accounting features like invoicing and expense tracking, check our list of the best small business accounting software.

PayTraQer Pricing

PayTraQer offers a 15-day free trial for a single user with the following features:

- 10 transactions

- Business insights

- Email support

- Historical data syncing for one month

- One sync rule

If you decide to purchase the software, PayTraQer offers five paid subscription options, which are outlined in the table below:

Launch | Rise | Scale | Large | Dynamic | |

|---|---|---|---|---|---|

Monthly Cost (Billed Monthly) | $9 | $19 | $29 | $49 | $99 |

Annual Cost (Billed Annually) | $90 | $190 | $290 | $490 | $990 |

Maximum Transactions | 100 | 500 | 1,000 | 5,000 | |

Number of Users | 1 | 1 | 5 | 5 | 10 |

Historical Transfer Allowed | 12 months | 12 months | Limitless | Limitless | Limitless |

Number of Allowed Sync Rules To Customize Data Transfer | 1 | 2 | 5 | 10 | 20 |

Customer Support | Email | Email and chat | Email, chat, and call | Email, chat, call, and a dedicated point of contact (PoC) | Email, chat, call, and a dedicated PoC |

Business Insights | ✓ | ✓ | ✓ | ✓ | ✓ |

Automation | ✕ | ✓ | ✓ | ✓ | ✓ |

White Glove Onboarding (Assisted by a Dedicated PoC) | ✕ | ✕ | ✕ | ✓ | ✓ |

PayTraQer Features

PayTraQer allows you to connect an unlimited number of payment processors (PayPal, Stripe, and Square). If your business uses multiple payment gateways to offer customers different payment options or you sell products or services through various online sales channels, you may need to connect multiple payment accounts to PayTraQer.

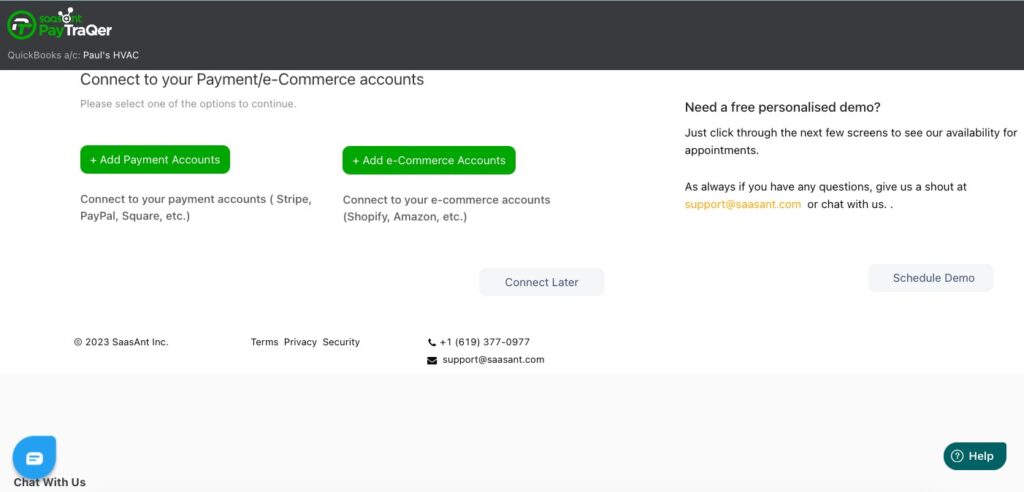

When you log in to your PayTraQer account for the first time, you will be prompted to connect your payment account to the system. However, you can choose to connect later if you wish to explore PayTraQer’s interface and features first before you integrate your financial data.

Setting up your payment and ecommerce account in PayTraQer

If you sell products online through an ecommerce platform like Shopify, WooCommerce, or BigCommerce, you can connect your account to PayTraQer. This allows you to sync your ecommerce sales data, including orders, sales transactions, and customer information to QuickBooks Online or Xero.

When a new order in your ecommerce store is detected, PayTraQer extracts relevant order details, including customer information, order items, pricing, and shipping information, and syncs them with QuickBooks Online or Xero. Additionally, payments associated with the order are also pushed to your accounting system.

Once you connect your payment account to PayTraQer, you must integrate it with QuickBooks Online or Xero so that your PayPal, Stripe, and Square transactions automatically flow into your accounting system.

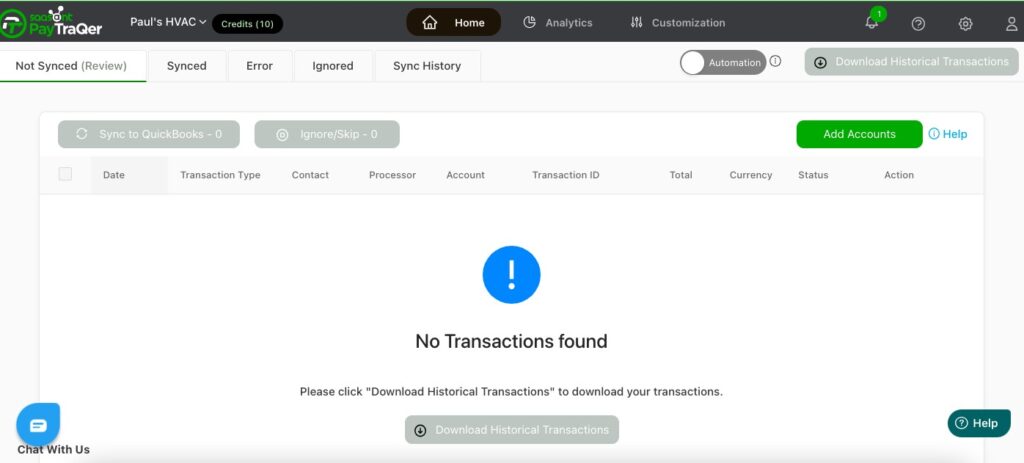

The accounting integration allows you to sync important data automatically, such as invoices, payments, deposits, and refunds, to QuickBooks Online or Xero. The transaction dashboard displays your previous transactions automatically in the last 30 days. If you wish to bring older transactions to QuickBooks, you can do so by clicking the Download Historical Transactions button and then syncing the downloaded transactions with your accounting system.

There are two ways you can sync your PayPal, Stripe, and Square transactions with QuickBooks or Xero. You can either:

- Turn on the Sync Automatically feature on the Sync Setting page and PayTraQer will auto-sync ongoing transactions. As soon as the transactions enter the payment system, the data will be synced with QuickBooks within 30 minutes; or

- Sync data manually from the transaction dashboard.

Note that the process of syncing data from PayPal, Stripe, and Square to QuickBooks Online or Xero may not be exactly the same. For QuickBooks Online users, PayTraQer provides separate guides on:

- How to sync PayPal transactions with QuickBooks

- How to sync Stripe transactions with QuickBooks

- How to sync Square transactions with QuickBooks

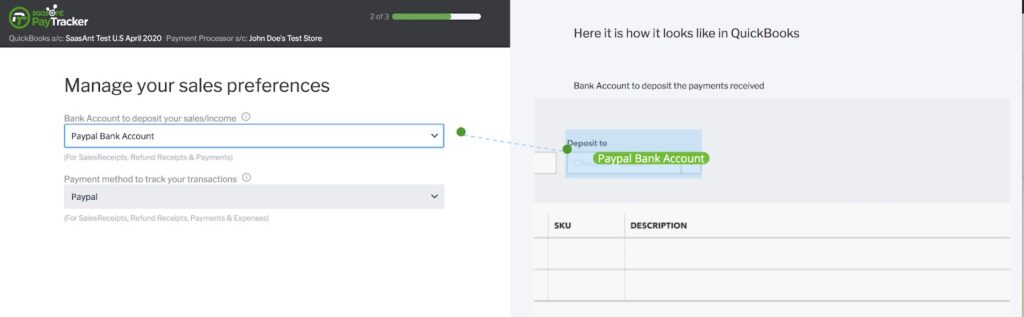

To help PayTraQer bring data accurately to QuickBooks or Xero, you can customize your sync settings. What we like about PayTraQer is that it’s easy to map the fields with those in QuickBooks Online or Xero. During setup, PayTraQer shows a screen showing the setting options in PayTraQer and a sample preview of the QuickBooks Online or Xero screen when the settings are applied.

Mapping PayTraQer fields with those in QuickBooks Online

Also, you can create sync rules and apply them to certain transactions by creating conditions and actions. For instance, you can set up PayTraQer to automatically transfer payouts to a certain bank account if the amount is greater than a certain value.

If you want to automate other aspects of your business aside from payment processing through QuickBooks Online, check out our roundup of the best QuickBooks Online integrations for small businesses.

You can manage your pending and synced transactions downloaded from your PayPal, Square, or Stripe account in the PayTraQer transaction dashboard. The dashboard provides five tabs to categorize and track your transactions:

- Not Synced shows the transactions that are successfully downloaded from your payment processors.

- Synced displays the list of transactions that are successfully synced to your accounting system.

- Error contains the list of transactions that failed to sync with your accounting system. This could result from an incorrect account, credit issue, currency, etc.

- Ignored shows the transactions that you have opted to ignore. This could happen when you have already recorded the transactions in QuickBooks Online and don’t want to process them in PayTraQer to avoid duplicate entries.

- Sync History allows you to track when transactions were synchronized along with any related details.

Transaction dashboard in PayTraQer (Source: PayTraQer)

This feature allows you to receive money in multiple currencies in PayPal, Stripe, or Square. PayTraQer will provide a list of currencies, such as United States dollars (USD), euros (EUR), Canadian dollars (CAD), and Australian dollars (AUD), and you select those that need to be tracked within the system.

Note that this feature can only be accessed when you turn on the multicurrency feature in QuickBooks Online. Once turned on in QuickBooks, you will be unable to turn it off.

When this feature is toggled on, PayTraQer analyzes the data it receives, such as invoices, payments, and sales receipts, to identify potential duplicates. The system compares the details of each new transaction with the existing entries in your QuickBooks Online to see if a similar transaction already exists. PayTraQer will then alert you to review and confirm if it’s indeed a duplicate.

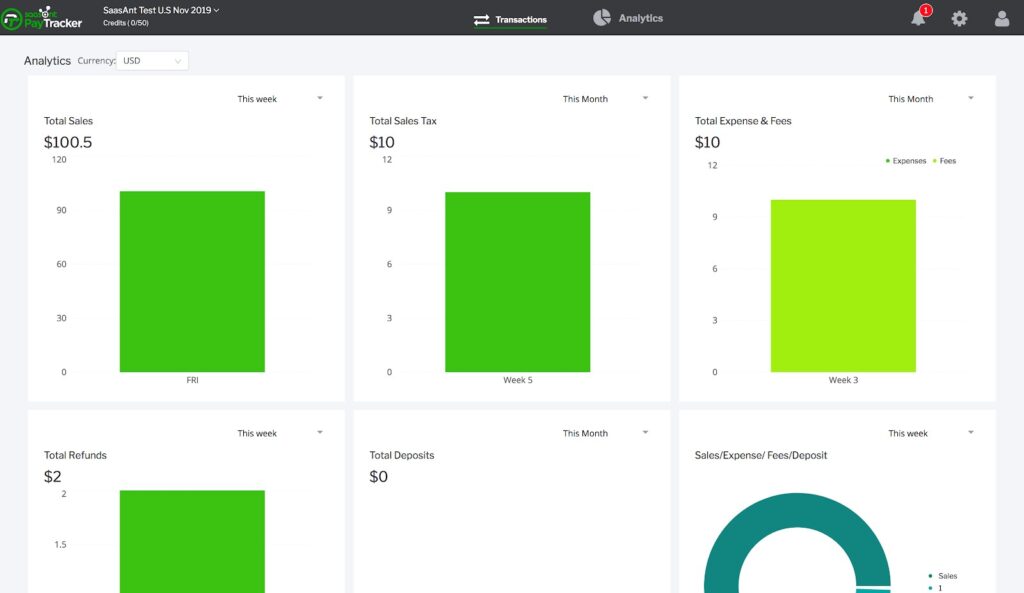

The analytics dashboard in PayTraQer provides a comprehensive view of your financial data across all your payment accounts (PayPal, Stripe, and Square). You can view various reports, including total sales, total sales tax, total expenses and fees, total refunds, and total payouts or deposits.

Analytics dashboard in PayTraQer (Source: PayTraQer)

Additionally, the analytics dashboard provides currency-wise reports, helping you identify which regions or markets are generating revenue and which may need more attention. This data is extremely useful for businesses that operate globally.

PayTraQer Ease of Use & Customer Service

PayTraQer has a simple and user-friendly interface that is easy to navigate, even for new users. When you sign in to your account for the first time, an onboarding wizard will guide you through the initial setup process and provide you with information about the key features and functions of the software.

We like the transaction dashboard because it provides organized views of all your pending and synced transactions. This means you don’t have to navigate through various menus or sections of the software to find specific transactions.

If you require help or have questions that need immediate answers, you can contact PayTraQer’s support team through the in-app live chat feature or by phone and email. You can also explore some help articles within the app for useful information about the different features and aspects of PayTraQer.

PayTraQer Reviews From Users

PayTraQer has high ratings on popular review websites, though there are few reviews as of this writing. One user who left a positive PayTraQer review commented that the platform is simple and easy to understand. Many reviewers shared that PayTraQer’s customer support team is responsive, especially in helping with syncing setup. On the flip side, one user complained that the app becomes glitchy sometimes and that transactions don’t go through.

As of this writing, here’s how PayTraQer is rated on several review sites:

- Software Advice[1]: 5.0 out of 5 based on about 10 reviews

- G2[2]: 4.7 out of 5 based on around 5 reviews

How We Evaluated PayTraQer

We evaluated PayTraQer using a set of criteria that are essential to QuickBooks ecommerce integration:

- Ease of setup: We highly recommend QuickBooks Online’s direct integrations because they can be set up with just a few clicks from inside QuickBooks.

- Two-way data syncing: Data must sync in real-time in both directions between your payment processor or ecommerce store and your accounting system.

- Task automation: Look for an integration that can automate repetitive tasks, such as payment matching. This means that as payments are received in your payment system, the integration automatically matches them to the corresponding invoices in QuickBooks Online.

- Multicurrency support: We determined whether PayTraQer can handle multicurrency transactions, which is helpful for businesses that operate globally.

- Customer support: We tested how PayTraQer responds to users’ inquiries and issues and what support options are available.

- User reviews: We checked out review websites to see what users have to say about PayTraQer.

PayTraQer Frequently Asked Questions (FAQs)

PayTraQer is an integration management solution that connects QuickBooks Online or Xero to your ecommerce platform and PayPal, Stripe, or Square payment accounts.

Yes, PayTraQer allows you to connect an unlimited number of payment accounts—making it ideal for businesses using multiple payment gateways.

You can bring various types of data to QuickBooks or Xero. These include customer and vendor information, sales transactions, payment information, fees and expenses, refunds and returns, sales tax data, and deposits.

Bottom Line

PayTraQer provides a centralized solution to connect your payment accounts and ecommerce stores to QuickBooks Online or Xero—instead of having to use separate integration platforms. This makes it easy for you to manage your eCommerce sales and payment data, such as product information, expense records, and tax details and helps you avoid the additional costs associated with managing multiple accounts.