Plastiq is a cutting-edge financial solution that offers a sophisticated platform designed to streamline payment processes. This allows businesses to leverage credit cards for transactions that were once cash or check only. In this comprehensive Plastiq review, we evaluate Plastiq’s pricing, features, and functionality to determine how the program can optimize a company’s payment strategies and enhance its fiscal efficiency.

Plastiq Alternatives

Monthly Pricing | Number of Users | Free Trial | Mobile App | Approval Workflows | International Payments | Account Permissions | |

|---|---|---|---|---|---|---|---|

| $0 to $119 | 3 to Unlimited | ✓ | iOS and Android | ✓ | ✓ | ✓ |

| $45 to $79 per user | Unlimited | ✕ | iOS and Android | ✓ | ✓ | ✓ |

| $0 | Unlimited | ✕ | iOS | ✓ | ✓ | ✕ |

| $0 | Unlimited | ✕ | iOS and Android | ✓ | ✓ | ✓ |

$0 | Unlimited | ✕ | iOS and Android | ✕ | ✓ | ✓ | |

$30 to $200 | 1 to 25 | ✓ | iOS and Android | ✕ | ✓ | ✓ | |

| Custom quote | Unlimited | ✕ | iOS and Android | ✓ | ✓ | ✓ |

Are you seeking general-purpose accounting software? Check out our roundup of the best accounting software for small businesses.

Plastiq Pricing

Plastiq offers two separate pricing plans—one for accepting money and the other for receiving it. So if you want to do both, you’ll need to subscribe to two plans. There are free plans available for each. The following tables break down the pricing and features for PlastiqPay and PlastiqAccept.

Plastiq Features

Plastiq offers many useful features, including the ability to set payment approvals with user permissions, its integrations with accounting software like QuickBooks Online and Xero, its powerful mobile app, and access to short-term financing. You can also generate international payments with next-day wire transfers and send payment requests to your customers.

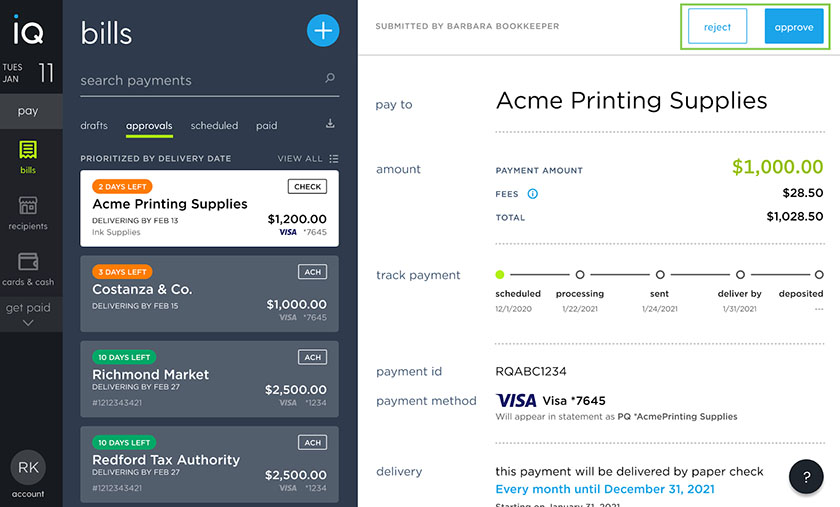

Plastiq lets you administer the bill payment approval process by creating rules and permissions to stay compliant. When you enable the payment approval setting, all payments submitted by members of your team above a specified amount threshold will require approval before they’re sent out. You can also assign other team members the ability to approve and reject payments so that they can help monitor your company’s outgoing payments.

Approving bills in Plastiq

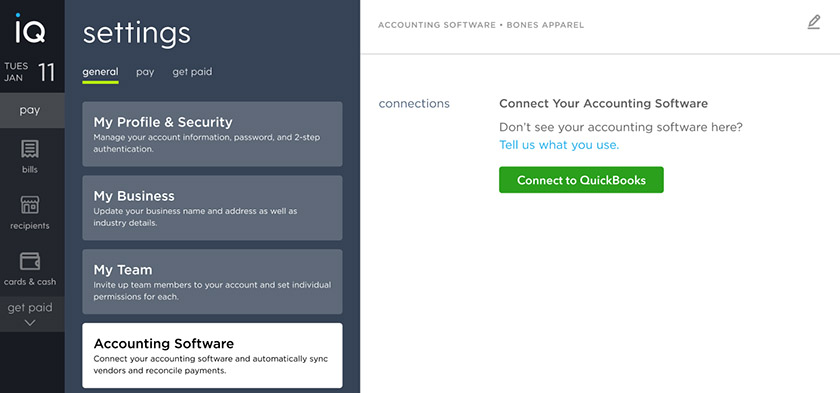

You can integrate your accounting software with Plastiq to automatically import bills and vendors. Plastiq allows for automatic two-way syncing of your transactions with its fee classified as a separate expense item. Depending on your plan, Plastiq integrates with QuickBooks Online, Xero, NetSuite, and Sage Intacct.

Plastiq’s QuickBooks Online integration

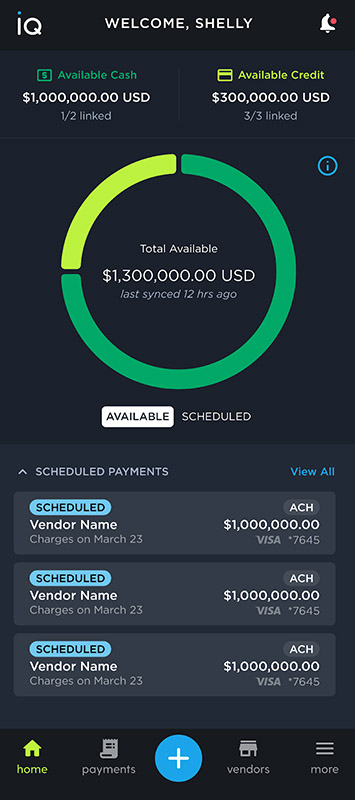

Plastiq’s mobile app is available for both iOS and Android users, and it gives you a simple and secure way to make and track payments when you’re on the go. Your home screen is your account’s dashboard, and it provides key insights to help you run your company’s A/R and A/P operations.

At a glance, you can gauge your cash flow, know the status of upcoming scheduled payments, and view a quick summary of their details. You can also make payments, approve/reject payments as needed, and add or manage vendors.

Plastiq’s mobile dashboard

Plastiq allows you to pay overseas suppliers in over 45 countries with a next-day wire transfer. You can pay by credit card or from your bank account, and save money with competitive exchange rates. You have the option of paying your vendors in US dollars or more than 20 currencies, and you can settle in whatever the local currency may be.

International payments are charged the standard Plastiq fee of 2.9% and $39 in bank and handling fees. There is also a 1% cross-border fee and an additional foreign exchange assessed on international payments that have been converted to another currency. This exchange is calculated using the currency exchange rates at the time of submission.

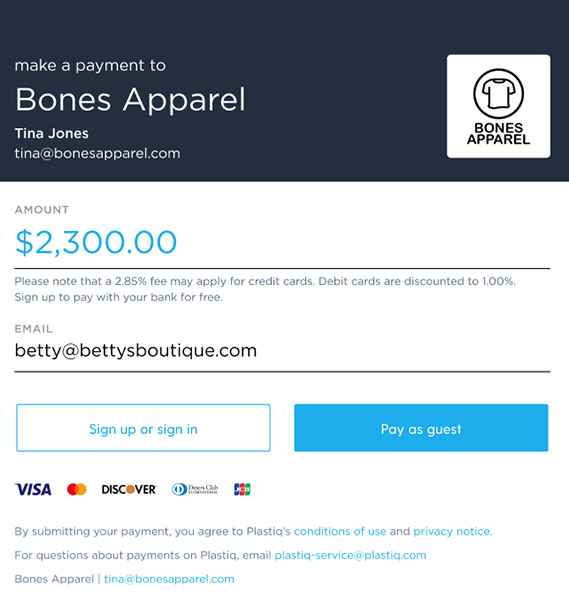

Plastiq allows you to facilitate payment from your customers with PlastiqAccept. There are two ways you can receive payments: by sending a payment request and inviting customers to submit a specific amount with a custom payment link, or by using a Plastiq Payment page.

This allows customers to add your business to their Plastiq account so that they can submit and schedule payments with your verified ACH funding details. They can also use the Guest Checkout option to send an immediate, one-off payment without having to sign up with Plastiq.

Example of a payment request in Plastiq

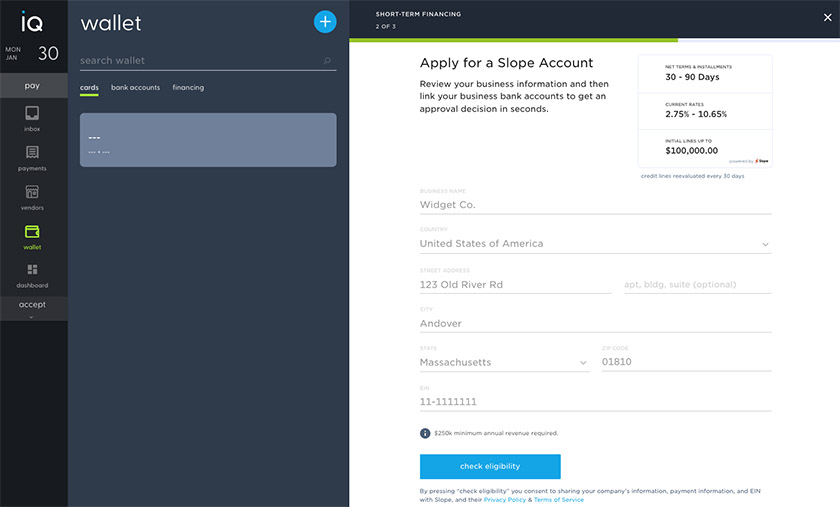

Plastiq lets you access funds when you need them, so you can work with a more flexible cash flow, aligning your payments closer to when you get paid. Its short-term financing payment method provides instant funds whenever you submit a new payment. You can receive extended payment terms of up to 90 days on the spot and apply for credit instantly, without a trip to the bank.

The provider also offers eligibility decisions instantly for lines up to $100,000, and qualified businesses can receive up to $750,000 with additional review. It also allows for flexible repayment options—either payment with one lump sum or installments. Rates range from 2.75% to 10.65% on single and installment payments and 30-, 60-, or 90-day repayment options. Credit approval and underwriting are provided by Slope.

Applying for short-term financing with Plastiq

Plastiq Customer Service & Ease of Use

Plastiq’s customer support is limited to support via email and live chat, and an online help center with articles about using the software. On its support page, it states that all support requests submitted as an email are replied to within a business day.

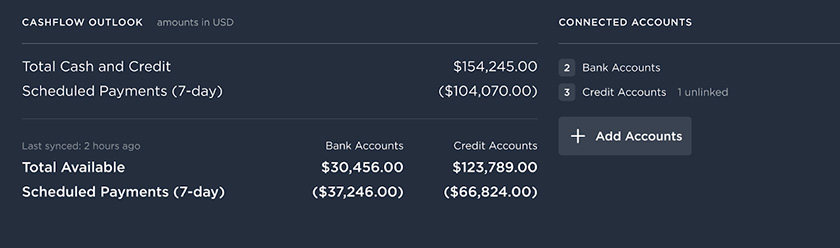

The platform is easy to use, and the dashboard is fairly intuitive, bringing you insight into funding and payment timelines that extend payment terms and maximize cash. You can access your dashboard by clicking the Dashboard icon on the navigation bar. It is separated into three sections: Cashflow Outlook, Accounts, and Tasks:

- Cashflow Outlook: This section gives you a succinct overview of your cash flow position, and you can add bank and credit card accounts here.

- Accounts: This shows every payment method you’ve added to your account.

- Tasks: Your dashboard tracks your business payables and summarizes them in the section labeled My Tasks.

Cashflow Outlook section of Plastiq’s dashboard

Plastiq Reviews From Users

Those who left a Plastiq review praised the ability to use credit cards to pay vendors who do not accept them or charge a higher percentage than what is charged by Plastiq. They also appreciate its ease of use and the fact that you can pay international vendors. The biggest complaint about the solution is the lack of phone support.

- Capterra[1]: 4.7 out of 5 stars based on approximately 25 reviews

- Trustpilot[2]: 3.2 out of 5 stars based on approximately 950 reviews

- G2[3]: 4.3 out of 5 stars based on approximately 5 reviews

Frequently Asked Questions (FAQs)

Plastiq is a payment service that allows businesses to pay bills and make payments using credit cards, even in situations where credit cards are not traditionally accepted.

Plastiq accepts Visa, Mastercard, and Discover, but it doesn’t accept American Express.

Plastiq offers PlastiqPay, a free plan for up to three users, but it also offers two paid plans. PlastiqPay Pro, priced at $59 per month, includes unlimited users and additional features like integration with QuickBooks Online and Xero, invoice data capture, and payment approval workflows. Meanwhile, PlastiqPay Enterprise is $119 per month and has everything in Pro, plus account management support and NetSuite and Sage Intacct sync.

Plastiq payments are approved instantly, and funding can take one to three business days.

Bottom Line

Plastiq has emerged as a valuable tool for businesses seeking to simplify their payment processes. Its user-friendly interface and wide range of supported payment methods make it a versatile solution for bill payment and expense management. While it does charge a fee for payments, the convenience and flexibility it offers can outweigh the cost. Plastiq remains a solid platform to streamline financial transactions and enhance financial efficiency.