ProConnect Tax Online, a personal favorite for cloud-based professional tax preparation software, is particularly useful for firms using QuickBooks Online Accountant. It provides powerful features, such as missing data review and document management, and is priced on a pay-per-return basis with no annual fee. It also has a K-1 package and a tax planner with the ability to project multiple case scenarios.

Pros

- Ability to manage tax returns from your QuickBooks Online Accountant dashboard

- Cloud-based system allows users to work remotely

- QuickBooks Online ProAdvisors can try the software for free and not pay until filing

- Annual user license fee of only $99 for the first 10 users

Cons

- Pricing for unlimited returns isn’t transparent

- Pay-per-return pricing is expensive for high-volume preparers

- Can’t handle more complex tax returns, like consolidated returns

Pricing for 2024 Returns |

|

Supported Bookkeeping Software | QuickBooks Online |

Free Trial | ✓ |

Money-back Guarantee | Within 30 days of the product release date |

Standout Features |

|

Customer Support | Telephone and digital assistant |

Average User Reviews | Has an intuitive platform, is easy to use, has gotten increasingly better every year, and offers useful client communication tools that streamline the tax filing process; however, customer support is lacking, plus year-over-year price increase is oppressive. |

- Firms using QuickBooks Online Accountant: You can advise your bookkeeping clients with the power of QuickBooks Online Accountant, then bring information into ProConnect Tax Online seamlessly with a cloud-based workflow that resides in one place. For this reason, we selected it as one of the best professional tax software programs for QuickBooks Online ProAdvisors.

- Firms with remote tax preparers: ProConnect Tax Online is cloud-based and uses a unified portal that allows you to create and share documents with your remote tax preparer.

- Firms wanting access to extensive support features: ProConnect Tax Online offers a variety of support and training resources to ensure that you’re never at a loss for assistance. Beginning with the Easy Start onboarding program, you’ll be set up for success. The training and education provided are top-notch, and you can even access expert support and in-product help.

ProConnect Tax Online Alternatives & Comparison

ProConnect Tax Online Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Easy to set up and use | Pay-per-return pricing can be expensive for high-volume filers |

| Integration with QuickBooks Online | Doesn’t support Forms 5500 and 706 |

| Strong customer support including 24/7 support during tax time | Quote required for unlimited returns |

In general, Reddit users think highly of ProConnect’s tax product and are fond of its strong customer support and QuickBooks Online Accountant integration. Also, ProConnect is identified as being one of the more expensive options among its competitors.

As a personal user of ProConnect, I agree that the platform is strong, but the pricing is not competitive. Despite the relatively high price point, I’ve remained a ProConnect customer because I find the interface easy to use. Based on my research, converting to cheaper software would only result in marginal savings, at best.

In addition, the tax return pricing provided on its website is for the first year only. ProConnect guarantees that it won’t increase prices by more than 7% per year, but that can still be an impactful hit to the bottom line.

Many reviewers note that they have stayed with ProConnect despite noncompetitive pricing because moving their client base to another platform would be a daunting task. Users also love the vast customer support resources, including 24/7 support during tax time.

The software has earned the following average scores on popular review sites:

- TrustRadius[1]: 8.0 out of 10 based on over 20 reviews

- Capterra[2]: 4.3 out of 5 based on about 20 reviews

- G2[3]: 4.5 out of 5 based on around 140 reviews

ProConnect Tax Online Pricing

ProConnect Tax Online users can pay per return on a sliding scale based on the total number of returns purchased, but bundles are also available.

Pay Per Return Plans

If you are filing 500 or more returns, you must contact Inuit ProConnect for custom pricing. The maximum listed pricing is for 499 returns.

- business returns (1041, 1065, 1120, 1120S, 709, and 990) is $12,634.68 (499 × $25.32)

- individual returns (1040) is $10,688.58 (499 × $21.42)

Pricing for both individual and business returns includes e-file for federal, state, multistate, and municipal returns. If you’re looking for a specific form and want to ensure it is included in the provider’s offering, you can use ProConnect’s form finder to confirm.

As shown in the cost table above, ProConnect pay-per-return can be a pricey endeavor for high-volume preparers. Other software offer better pricing bundles for unlimited returns.

For example, ProSeries, a separate tax product offered by Intuit, is only $2,312 for unlimited individual returns. In comparison, ProConnect offers 499 individual tax returns for a price of $10,689. Read our review of ProSeries Professional for more information.

Tax Return Bundles

Bundling returns allows a user to prepay for a packaged group of returns. These bundles are designed to accommodate preparers who may need to prepare both business and individual return tax filings.

ProConnects packages start with the Essentials 50 tier for 50 returns and go up to the Enterprise option for prepayment of over 200 tax returns. Pay-per-return pricing applies to tax returns in excess of the amount indicated in the bundle.

Bundle Package | Bundle Detail | Pricing |

|---|---|---|

Essentials 50 | 50 total returns, including up to 5 business returns, 50 e-signatures, one user license | $2,799 |

Essentials 100 | 100 total returns, including up to 25 business returns, 100 e-signatures, one user license | $3,483 and up |

Plus | 200 total returns, including up to 50 business returns, 200 e-signatures, three user licenses | $6,307 and up |

Enterprise | More than 200 returns (bundled) | Contact ProConnect for pricing |

User Access Fee

In addition to the price of the tax return plan you choose, you must pay $99 per user, per year—with a maximum fee of $990 for 10 or more users. You must purchase at least one user license along with your tax return plan.

ProConnect Tax Online New Features in 2024

ProConnect Tax Online has added new features and integrations, including the ability to customize client letters and access firm performance insights.

- Intuit Tax Advisor: ProConnect is offering a new and improved tax planning service starting in 2024 that includes client-friendly reports that quantify tax savings using a combination of tax prep and advisory tools

- “Prep for Taxes” Function: In 2024, ProConnect added improvements to the integration option to preview, classify, and reconcile tax adjustments and remap QuickBooks accounts.

- Protection Plus for Business Returns: Protection Plus is an add-on service for assistance provided by ProConnect’s enrolled agents or certified public accountants. They will help defend your client against IRS notices and audits. Protection Plus also includes identity theft repair services.

- Bulk import: This feature allows multiple source documents to be imported into the tax prep software simultaneously, replacing the individual document import process.

ProConnect Tax Online Features

In addition to the new features described above, ProConnect Tax Online offers several useful features that will add to your firm’s efficiency, including built-in access to client IRS transcripts, the ability to upload and store documents, a K-1 package, and a missing data review tool that ensures accuracy.

Use ProConnect Tax Online’s tax planner to create strategies for Form 1040 and Schedule C filers by playing around with comparative tax scenarios. You can make multi-year comparisons for up to three years and build multiple case scenarios. You can also calculate tax liability and import diagnostics.

ProConnect Tax Online tax planner (Source: ProConnect Tax)

With ProConnect Tax Online, you can upload and store documents and view them as you do the return. You also have the option to download forms and customize requests for tax information based on prior year data.

ProConnect Tax Online will flag missing data fields as you’re working on a return so that you can identify any gaps or discrepancies prior to filing. This streamlines the process of identifying errors, allowing you to review more quickly.

With ProConnect Tax Online, the process of importing and distributing k-1 packages is simplified. A secure link is emailed to the parties of record, eliminating password snafus and the hassle of snail mail.

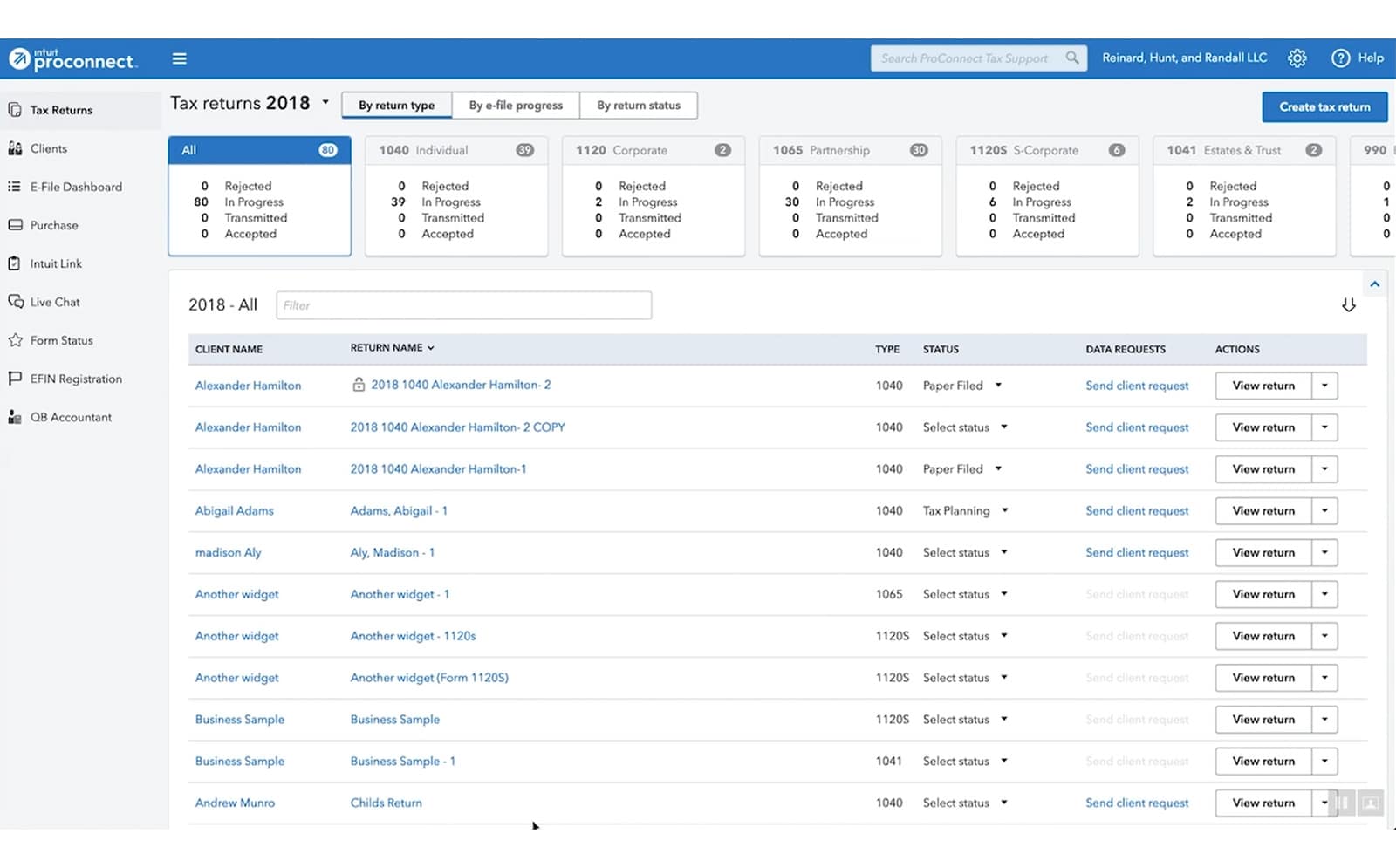

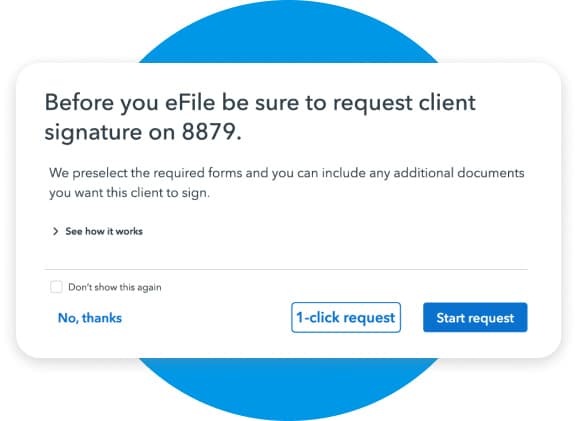

ProConnect Tax Online allows you to view the e-file status of all of your clients with a dashboard that allows you to sort, filter, and check for rejections. You can also offer e-signature, which lets your clients review and sign forms from anywhere, on any device.

ProConnect Tax Online e-filing feature (Source: ProConnect Tax)

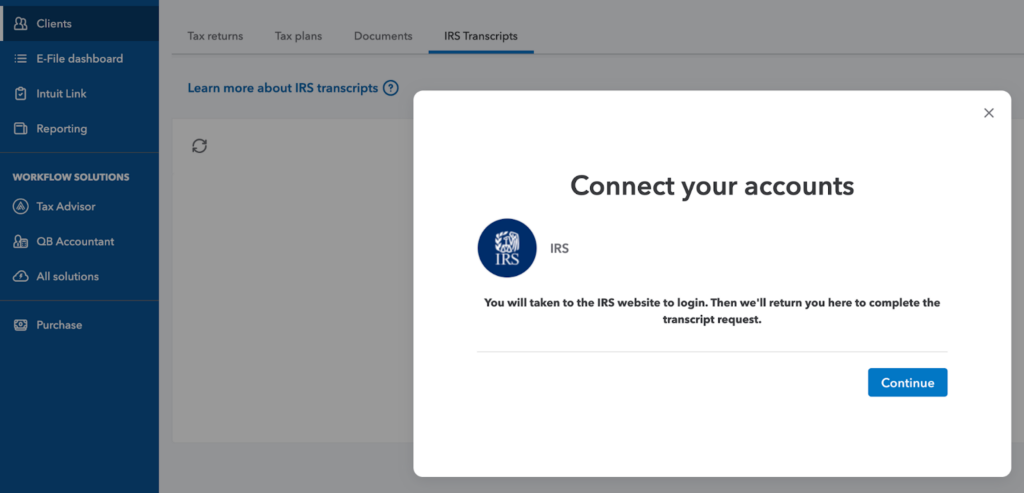

ProConnect allows you to connect your account to the IRS website in order to view client transcripts. This feature allows you to consolidate client information and address issues without many of the standard hassle involved in resolution of IRS controversy.

ProConnect Tax Online IRS transcript feature (Source: ProConnect Tax)

ProConnect Tax Online Ease of Use & Customer Support

ProConnect Tax Online’s integration with QuickBooks Online Accountant makes it easy to access all of your data in one place. Equipped with an intuitive client portal, ProConnect Tax Online allows you to manage your accounting and tax clients from one dashboard.

When you make changes to client information in QuickBooks Online Accountant, those changes will be reflected automatically in ProConnect Tax Online. You can also take your client’s balance sheet and profit and loss statement and apply them to your year-end tax work with the “Prep for Taxes” feature.

ProConnect Tax Online has a variety of support resources that are available from the moment you sign up. The Easy Start onboarding program provides:

- Personalized customer support

- Automated data conversion

- A success guide to help ensure that you’re completely set up

By accessing the training portal in your software, you can earn free continuing professional education (CPE)/continuing education (CE) credits, join webinars, and participate in virtual conferences to learn from industry experts.

You can reach ProConnect Tax by phone Monday through Friday from the hours of 6 a.m. to 5 p.m. Pacific Time. You’ll also have access to free 24/7 product support from ProConnect Tax Online’s agents during tax season. An online peer community and a searchable help widget are also available.

How I Evaluated ProConnect Tax Software

I evaluated ProConnect tax software using relevant benchmarks for small business tax preparers. These benchmarks factor in software cost, ease of data import, document management, software support, and general ease of product use.

Based on the needs of small business tax preparers, these features were evaluated as follows:

- Software cost: I first identified the cost for different service tiers and provided that information for bundled services and individual purchases. I also considered flat fees and the inclusion of customer support.

- Data import: I researched the complexity of data automation features, including QuickBooks and Excel imports, and auto-flow capability for source document data.

- Document management: I reviewed the feature to determine if there were any unique functions to assist tax preparers with administrative tasks.

- Software support: I assessed the amount of technical support available, including representative availability and user confidence in the resolution of issues that arise.

- Ease of use: As the final part of my assessment, I analyzed the efficiency of user flow between forms, data entry, and input review.

Frequently Asked Questions (FAQs)

Yes, ProConnect Tax Online requires all return preparers to be authorized by the IRS as an electronic return originator (ERO) and have a current electronic filing identification number (EFIN).

ProSeries is a desktop software product for tax prep of individual and small business tax returns. ProConnect can also be used for tax prep of individual and small business tax returns, but it is completely cloud-based and deeply integrated with QuickBooks Online Accountant.

ProConnect Tax includes forms 1041, 1065, 1120, 1120s, 990, 709, and 1040.

Bottom Line

ProConnect Tax Online is a great companion software for firms specializing in providing client services with QuickBooks Online. It integrates seamlessly with QuickBooks Online Accountant and can be managed from a single dashboard within the software. While it’s an ideal solution for firms that prepare a limited number of returns, it can get pricey if you anticipate filing a large quantity of them because of its pay-per-return pricing basis.

User review references:

[1]TrustRadius

[2]Capterra

[3]G2