ProSeries Tax, a versatile tax preparation software from Intuit, is designed for professional tax preparers. With strong user reviews, ProSeries is known to be a solid choice for professional tax preparation. It provides features such as e-file management, K-1 data transfers, and an assortment of firm management tools.

ProSeries Tax software pricing for the pay-per-return package starts at a flat fee of $661 a year, plus a separate fee of $87 per business return and $61 for individual returns. Basic plans (for 1040 only) run from $1,052 for 20 returns to $2,312 for unlimited returns. Those with high 1040 volume may choose a professional plan, like 1040 Complete, which starts at $3,191 for unlimited returns.

Pros

- Integrated billing clock

- Diverse package options

- Intuitive interface

- Desktop or online hosted options

- Integration with QuickBooks and TXF files

Cons

- Ambiguous pricing for some plans

- Add-on fees for multi-user access

- Multiple state filings subject to pay-per-return pricing

- Basic plans include only 1, 2, or 4 states

- Difficulty with complex filings

Pricing for 2024 Returns |

|

Supported Bookkeeping Software | QuickBooks |

Free Trial | No listed expiration date; no e-file or printing capability without paid upgrade |

Money-back Guarantee | 30 days |

Standout Features |

|

Customer Support | Telephone and in-product help |

Average User Reviews | High marks for ease of use, intuitive interface, and useful client communication tools that streamline the tax filing process; customer support is lacking, per some reviewers |

- Firms seeking a desktop software compatible with QuickBooks: The forms-based interface simplifies the process of importing account balances from QuickBooks Desktop.

- Firms needing client tools: Helpful client checklists provide access to strategic tax planning tools. You can project income, expenses, and calculate estimated tax payments.

- Firms wanting assistance with input guidance and forms: ProSeries automatically transfers data from partnership K-1 forms to individual returns. The Intuit link portal allows clients to upload and categorize their personal documents.

Those features are some of the many reasons why we selected ProSeries Professional as the overall best professional tax software.

ProSeries Tax Alternatives & Comparison

ProSeries Tax Software Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Helpful tools like a client analyzer and presentation tool | Filing multi-state returns can be challenging |

| Easy to set up and navigate | Additional fee for multi-user access |

| Import financial data from QuickBooks | Can’t handle more complex returns |

Users who left a ProSeries Tax Software review said that the tool offers comprehensive tax products for those with a preference for desktop software. The quick entry sheets are noted as being particularly useful in expediting the tax prep process. I like the “where do I enter” feature, which can help users quickly locate the proper place to input information.

The platform earned the following average scores on popular review sites:

ProSeries Tax Software Pricing

ProSeries Tax offers a Professional and Basic option. Only Form 1040 returns are included in the Basic plan. A brief rundown of the plans is shown below:

Basic Plans

These include a single user license and are for individual Form 1040 preparation only—making them best for sole proprietors preparing tax returns for individuals in local jurisdictions. There are fewer federal and state forms available for individual returns than in the Professional plan, and no business returns are included.

Basic 20 | Basic 50 | Basic Unlimited | |

|---|---|---|---|

Annual Price | $1,052 | $1,528 | $2,312 |

Number of Federal 1040s Included | 20 | 50 | Unlimited |

Number of State Individual Returns Included | 20 | 50 | Unlimited |

States Supported | 1 | 2 | 4 |

Professional Plans

These are a more comprehensive tax preparation option than the Basic plans—meaning they’re optimal for firms with business clients or multiple preparers, especially since multiple users and cloud hosting can be added for an additional fee. These plans allow for a mixture of individual and business returns and include client organizers, client checklists, and business to 1040 K-1 transfers.

Pay-Per-Return | Choice 200 | 1040 Complete | Power Tax Library | |

|---|---|---|---|---|

Annual Price | $661 | Custom | $3,191 | Custom |

Federal & State Returns Included | None | 200 of any type | Unlimited 1040s | Unlimited of any type |

State Returns Included | None | 200 of any type | Unlimited individual | Unlimited of any type |

Cost of Additional Returns |

| Federal business: $87 State business: $55 | N/A | |

ProSeries Tax Features

ProSeries Tax offers many useful features—such as communication tools like the client analyzer and consolidation of digital signature management—that will streamline your workflow. It also gives you access to client resource and tax planning suggestions that can be individually tailored for each client. Plans even integrate with ProSeries Fixed Asset Manager to import assets and SmartVault to manage documents.

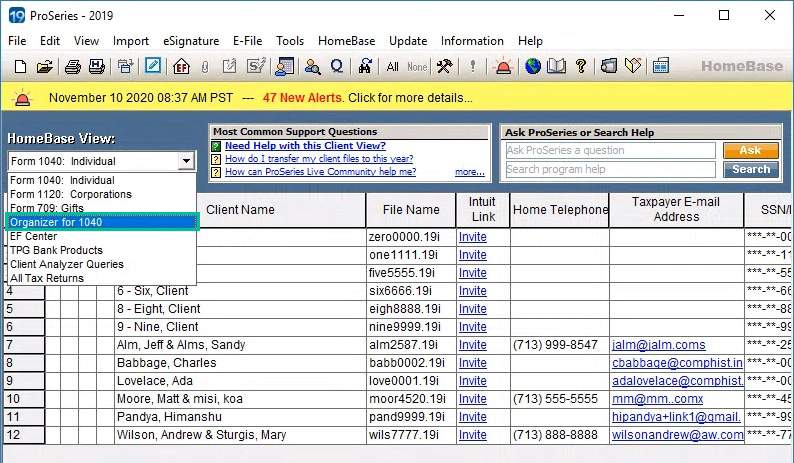

ProSeries Tax offers a client analyzer that allows you to get a better understanding of your client base. It breaks down groups of clients by return type, and the analysis can be printed or exported to a spreadsheet. The client presentation tool shows a client their bottom line, income and deductions, and comparisons to prior years with easy-to-understand visuals.

Manage all of your digital signatures from within ProSeries Tax so that your clients can sign when and how they want. You’ll also be able to view, track status, and manage your clients’ e-filed returns. Missing client data is also tracked, and entries must be completed before the return is submitted.

ProSeries Tax offers a variety of resources for your clients, including the ability to create checklists for the items clients need for each year’s tax return. Client-specific billing and editable invoice options are available as well, including flat rates, hourly fees, and charges per form.

You can generate a list of up to 73 custom tax planning suggestions to assist with lowering your clients’ future taxes. The tax planner estimates income, expenses, withholdings, and tax payments for future tax years, and you can use it to create custom tax plans for clients, from pro forma estimates to projections.

For an additional fee, ProSeries Tax integrates with ProSeries Fixed Asset Manager to import assets into various activities such as Schedule C and Schedule E. SmartVault also integrates seamlessly with ProSeries, providing a secure and reliable document management system with an integrated client portal. Clients in ProSeries can be imported to SmartVault.

Importing ProSeries tax organizer into SmartVault (Source: SmartVault)

Data can be entered quickly with less scrolling on many forms, such as Schedule D and Schedule K-1. I use Ctrl-M to toggle between quick entry mode and form entry mode easily. You can also flag missing data as you work on a client’s return and send them an email, requesting the information you flagged.

ProSeries Tax Ease of Use & Customer Support

ProSeries is very user-friendly, with helpful features for catching errors and data omissions. These features reduce the rate of form rejections. With over 3,700 forms to choose from, the data input provides an easy-to-read display for simple client presentations. Users have access to on-screen help if needed, which works by a software representative visually observing the issue and recommending a solution.

ProSeries provides free US-based tech support (available via a toll-free number with extended hours during peak season), in-product help, and a searchable knowledge base. Regular hours of operation are Monday through Friday, 6 a.m. to 5 p.m. Pacific Time. Sales representatives are available Monday through Friday, 6 a.m. to 3 p.m. Pacific Time.

In addition to telephone support, free online training options are available to simplify enrollment and get the most value from your software. New users can take advantage of Intuit Easy Start onboarding to get up and running quickly.

How I Evaluated ProSeries Professional Tax Software

I evaluated ProSeries Tax by weighing it against a variety of relevant benchmarks for small business tax preparers. These benchmarks took into account software cost, ease of data import, document management, software support, and general ease of product use.

Based on the needs of small business tax preparers, these features were evaluated as follows:

- Software cost: I first identified the cost for different tiers of service and provided that information for bundled services and individual purchases. I also considered flat fees and the inclusion of customer support.

- Data import: I researched the complexity of data automation features, including QuickBooks and Excel imports as well as auto-flow capability for source document data.

- Document management: I determined if there were any unique features to assist tax preparers with administrative tasks.

- Software support: I also assessed the amount of technical support available, including representative availability and user confidence in the resolution of issues that arise.

- Ease of use: As the final part of my evaluation process, I analyzed the efficiency of user flow between forms, data entry, and input review.

Frequently Asked Questions (FAQs)

Supported forms include 1040, 1120, 1120S, 1065, 1041, 990, 706, 709, and more. ProSeries does not currently support Form 5500 returns.

One ProSeries license is required at each physical location where clients are served. If multiple preparers use ProSeries within a location, then a network license will be required. It’s currently available for a fee of $1,348 and includes toll-free tech support and a network installation user guide.

Yes, ProSeries allows you to e-file all of your clients’ tax returns—provided you’re approved by the IRS as an electronic return originator (ERO). If you’re trying to e-file your do-it-yourself (DIY) return, check out our list of the best small business tax software.

Yes. You cannot e-file or print with the ProSeries free trial.

Bottom Line

ProSeries Tax provides several tools for small and midsize tax firms. It offers a variety of packages and access to helpful resources, including tax planning suggestions. It’s a good fit for accounting firms looking for desktop software with a forms-based interface that can import data from QuickBooks Desktop. As an affordable and easy to use option, it’s also well-suited for accounting firms that process a variety of different returns.