Note: This calculator is for estimation purposes only.

A rental property calculator helps real estate investors determine the value of a property. Our calculator generates the return on investment (ROI), capitalization (cap) rate, and cash flow of rental properties to help investors understand the value of a potential purchase or of a property they already own. These calculations can be complicated, but the process is much more efficient with a thorough calculator.

How the Rental Property Calculator Works

The rental property calculator, also called a rental income calculator or investment property calculator, works by taking specific data relevant to rental property expenses and revenue to automatically calculate the property’s cash flow, cap rate, and return on investment. Knowing an existing or potential rental property’s return on investment (ROI) will help you make wise real estate investment decisions and maximize your profits.

Who Should & Should Not Use a Rental Property Calculator

This rental property ROI calculator is designed for real estate investors who want to efficiently and thoroughly evaluate their rental properties. It’s ideal for long-term investors who want to have a property’s cash flow and ROI automatically generated. This rental income calculator helps evaluate the profitability of potential rental properties as well as properties that are already being rented. This calculator is also right for:

- Multifamily investors, including duplexes, triplexes, and fourplexes

- Apartment complex investors

- First-time and single-family home investors

- Landlords who will be managing the property themselves

- Investors who want to sell a property and be able to give the potential buyer all of the figures on the property, such as cash flow

- Landlords with a large portfolio of properties

- Investors looking to purchase a vacation property

However, this calculator is generally not right for house-flipping business owners who purchase a property to rehab it and sell it for a profit. For these short-term investments, rental income and monthly cash flow are irrelevant metrics. Instead, these investors focus on after-repair value (ARV) and how much ROI they can make by selling the property as quickly as possible.

Inputs for the Rental Property Calculator

To get the most accurate results from this rental investment calculator, you’ll need to gather information about the property. Ask your real estate agent or the current property owner if you are considering a purchase, or review your finances if you are evaluating your own property.

You’ll need to gather financial estimations for these categories:

Purchase Details

The purchase details in the rental ROI calculator set a baseline of how much the property is currently worth. If you are evaluating a potential purchase, consider whether the property’s value is commensurate with the income potential. On the other hand, if you’re calculating the value of a property you already own, this will help you determine whether this rental property is contributing to your financial goals.

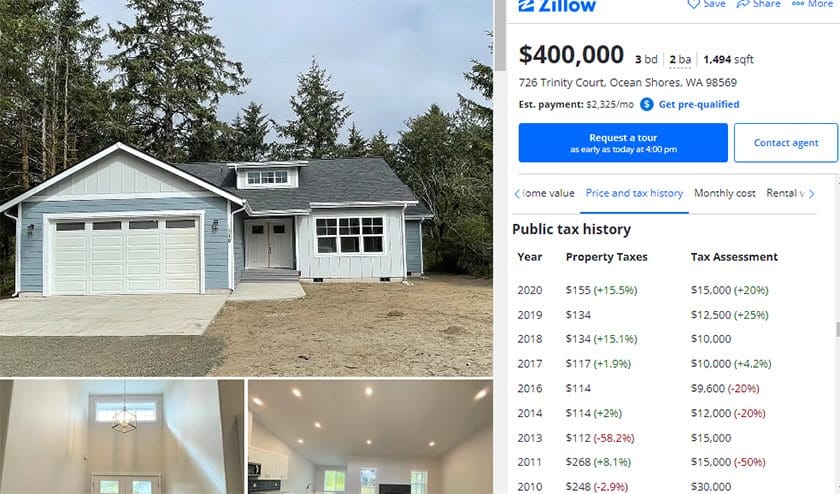

Purchase Price or Current Property Value

Your first input for the calculator will be the current property value. If you’re evaluating a potential property, you can enter the purchase price. If you already own the property, you will enter the current property value, also known as the fair market value.

To find the current value of any property, you can either hire an appraiser to evaluate the property or run a comparative market analysis (CMA). CMAs are typically run by a real estate agent, but you can also complete one yourself.

Example CMA report

Repairs & Renovations

Most properties will need varying amounts of repairs or renovations to make them suitable for renters. This can be as simple as replacing a toilet or as involved as gut-renovating an entire room or floor of your building. The estimate of these expenses must be included because it is part of your cash investment when purchasing the property. The only exception to this is when you purchase a turnkey investment property with all repairs and renovations completely finished.

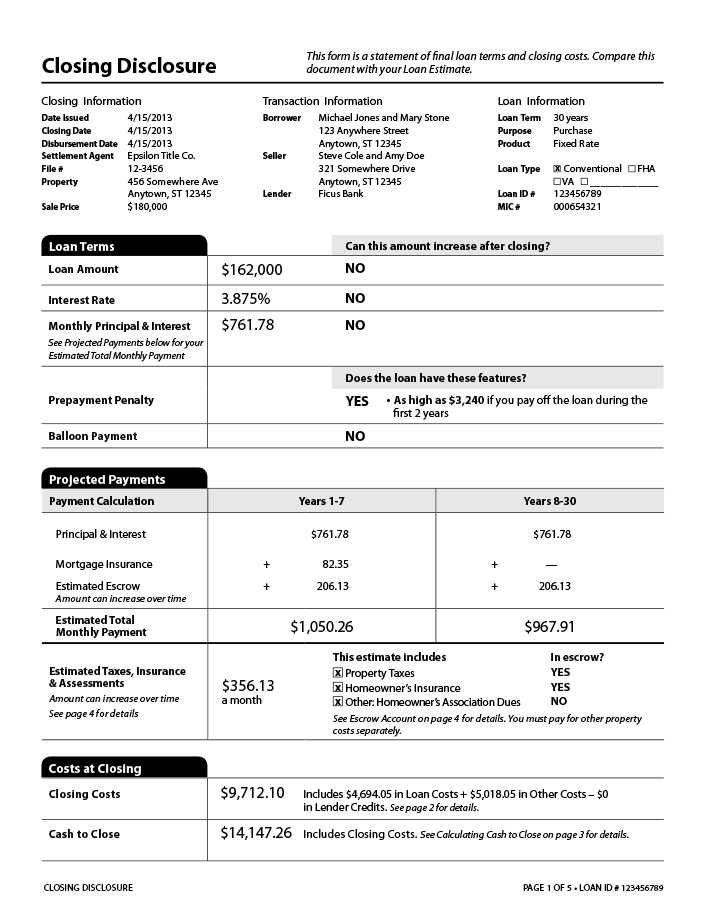

Closing Costs

Closing costs are part of every real estate transaction, whether you’re buying a primary home or your first rental property. These expenses are an important part of the rental loan calculator in addition to the purchase price and your down payment and include fees for the lender, notary, title insurance, title search, attorney, and transfer taxes. Generally, closing costs are between 2% and 5% of the purchase price, so if you’re purchasing a property for $250,000, expect closing costs to be between $5,000 and $12,500.

If you already purchased the property, review your settlement statement or closing disclosure that mortgage professionals are required to provide to buyers as part of the Real Estate Settlement Procedures Act (RESPA). This will give you a breakdown of the closing costs you paid to purchase the property. Otherwise, estimate the amount for your closing costs by figuring 2% to 5% of the purchase price. It’s best to err on the side of caution by estimating a higher amount for your closing costs.

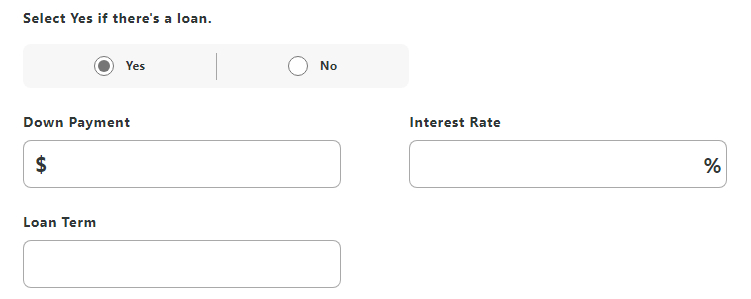

Loan Details (if Applicable)

If you are not planning to pay for the property with cash, you’ll need to determine which type of investment property financing is best for you. While there are many different types, they all have the same general requirements to include in the rental property investment calculator.

Our calculator uses the following variables to calculate your monthly mortgage payment:

- Down payment: This is the cash paid upfront by a buyer when purchasing a property. A typical down payment for an investment property is about 20% of the purchase price, but can also be higher or lower depending on the type of loan.

- Interest rate: This is the interest you’ve agreed to pay on your loan over the loan term. In 2023, interest rates have averaged between 6% and 7%, but fluctuate frequently.

- Loan term: This is the length of time that you will be paying off your loan, which can vary greatly. Most commonly, buyers will get a 15- or 30-year loan, but some investment property loans can have short periods of around 18 months.

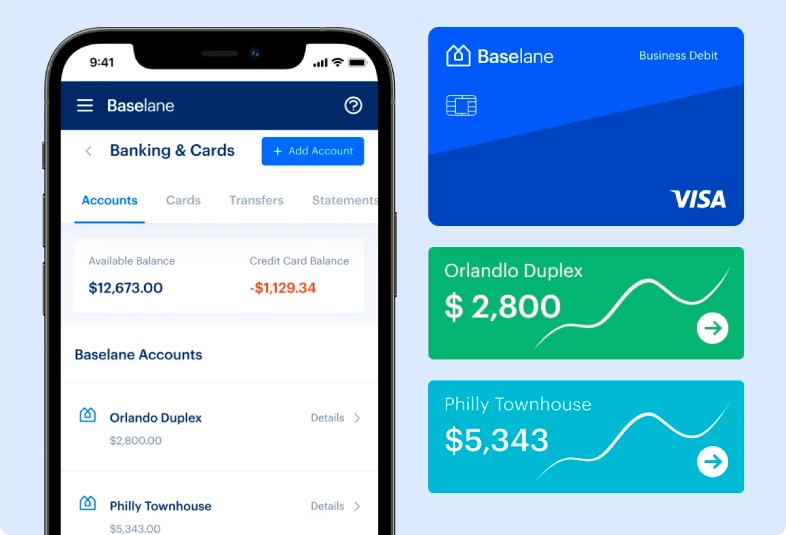

Baselane banking mobile app (Source: Baselane)

Gathering all the necessary financial information for a potential rental property or a property you already own can be tedious and complex. However, if you use a tool like Baselane, you can easily track all of your income and expenses and automatically generate financial reports. Baselane also automates rent collection, so you can depend on your tenants’ payments without having to chase them down. Learn more about how Baselane can help you manage rental finances.

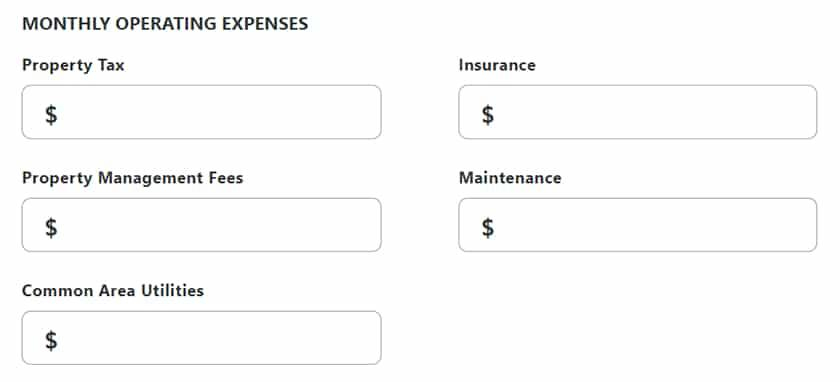

Monthly Operating Expenses

The next part of the real estate investment calculator is monthly operating expenses, which are the necessary expenses for your property. These numbers are unaffected by the type of financing you use. These are important factors when calculating a property’s cap rate, ROI, or cash-on-cash returns.

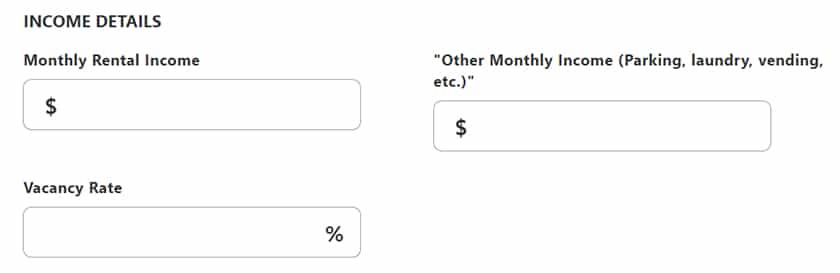

Property Tax

This is the tax on the value of the property set by a local governing authority. To calculate rental income tax, you can call your local tax collector’s office, ask a real estate agent, or look at public records for your property taxes. A property tax estimate is also usually provided on property listings. They’re generally listed yearly, so just divide by 12 to get the monthly taxes.

Public tax history on Zillow (Source: Zillow)

Insurance

Part of the rent calculator for landlords must specifically include rental property insurance to protect themselves against liabilities caused by tenants or other unforeseen circumstances like crime or weather damage. These policies typically cost about 25% more than homeowner’s insurance policies, with an average annual premium of $1,478. However, this depends on the location, age, size, and type of policy you’re looking for.

Depending on the type of property you own or are considering purchasing, visit our articles on Rental Property Insurance for Landlords: Costs & Coverage or Vacation Rental Insurance: Coverage, Cost & How It Works to find out more about your insurance options.

Property Management

Managing a rental property is a complex job, so your expenses will vary based on the property management strategy you use. For example, 45% of landlords manage their own properties to minimize expenses, but you may choose to use property management software to reduce expenses and workload.

Responsibilities of a property manager

If you work directly with a property management company, you can factor in around 8% to 15% of the monthly collected rent, which is the average cost for services.

Maintenance

Every property requires maintenance, and there will be both scheduled maintenance costs and unplanned costs. For example, you should plan for continual costs like lawn care, pest control services, common area cleaning, and changing detectors’ batteries. In addition, you must also be prepared for emergency maintenance repairs like clogged toilets or roof leaks as you use the rental cash flow calculator.

There are two general rules of thumb to estimate your maintenance costs:

- 1% rule: Maintenance costs about 1% of the property value per year

- 50% rule: Maintenance and repairs are equal to 50% of your total operating costs

Common Area Utilities

Utilities are a predictable expense for every property, although tenants are usually responsible for some of them, like electricity, gas, water, and internet. However, landlords should know the cost of any utilities that you are responsible for, like electricity in the hallways of an apartment building or trash collection. These costs will vary depending on the size and type of the building as well as the location of the property.

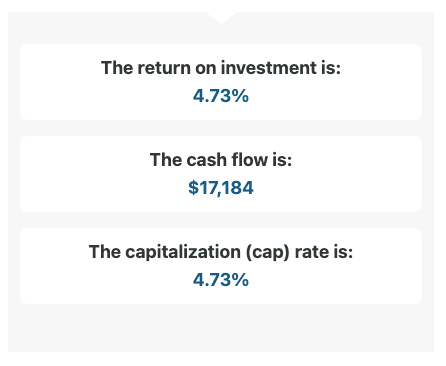

Income Details

The final section of the rental income calculator inputs includes details about the income the property generates, affecting the cash flow and ROI. For the most accurate results, have your vacancy rate, operating expenses, and monthly rental income in front of you so you can easily input the correct numbers.

Monthly Rental Income

On the real estate cash flow calculator, the monthly income is the gross rental income the property is expected to bring in before expenses. It should include the total income from each unit in the building. If you don’t have current tenants or a current rental rate set, try using the 1% rule: simply multiply the property value by 1%. For example, a $300,000 property using the 1% rule would be $3,000 in rent.

Other Monthly Income

Many landlords who use this real estate cash flow calculator for single-family homes won’t have any additional income to add. However, other assets in rental properties can include parking, laundry, vending machines, or gym memberships. These might not seem like big money-makers, but it’s important to track all income. For example, if you charge $2.50 per load of laundry with 20 tenants doing two loads per month, you’ll be able to earn an extra $100 per month, which is $1,200 per year.

Vacancy Rate

A vacancy rate is the number of vacant units divided by the total available units. It’s an important metric for an accurate result from any cash flow calculator for rental properties with two or more units, like multifamily investment properties or apartment complexes. The goal for every investor is to have a 0% vacancy rate, but you’ll have to build your occupancy with a new property with no tenants. The formula looks like this:

Vacancy Rate Formula = # of Vacant Units x 100 / Total # of Units

Outputs for the Rental Property Calculator

After you’ve filled out the required information, our rental property calculator will automatically generate the property’s ROI, cash flow, and capitalization rate (cap rate). These metrics will help you determine whether or not a property is a good investment. To understand each metric and the formulas associated with them, continue reading.

What if the calculations are lower than expected?

If the ROI, cash flow, and cap rate results from the rental calculator are lower than average, it might be a sign to move on to another property. On the other hand, it could simply mean that the property, as it is now, is not capitalizing on certain financial aspects. In this case, you may be able to increase profits by making changes.

For instance, if comparable properties in the same location are charging $2,500 per month in rent and the current owner only charges $1,500, these output variables might be lower than they should be. Under your new management, you can raise the rent to increase your cash flow and return on investment.

Return on Investment (ROI)

ROI measures the profitability of an investment in a percentage. It measures how well a rental property is performing and can be a great way to decide which property to purchase or how much you should offer on a potential property. To calculate the ROI of a property, take your annual return and divide that by your total cash investment. Our rental property investment calculator does this automatically, but the ROI formula looks like this:

ROI (without loan) = [(Monthly Rental Income + Other Monthly Income) – Vacancy Rate] x 12 months – (Monthly Operating Expenses x 12 months)

_______________________________________

Purchase Details

If you have a loan or are planning on taking out a loan to finance the purchase, you will have to include that as part of your calculations:

ROI (with loan) = [(Monthly Rental Income + Other Monthly Income) – Vacancy Rate] x 12 months – (Monthly Operating Expenses x 12 months) – (Monthly Loan Amount x 12 months)

______________________________________

(Repairs/Renovation + Closing Costs + Down Payment)

According to the S&P 500, the average ROI for investment properties in 2023 is 8.6%. The average ROI for residential properties is 10.6%, while commercial properties average 9.5%.

Cash Flow

Simply put, cash flow is the money flowing in (rental income) and flowing out (expenses) of your investment property. It is categorized as cash flow positive (if it’s generating a profit) or cash flow negative (not generating a profit). To calculate your monthly cash flow, the calculator starts with your rental income and subtracts your operating expenses and mortgage payments. Here is the formula used in the rental property cash flow calculator:

Cash Flow (without a loan) = [(Monthly Rental Income + Other Monthly Income) – Vacancy Rate] x 12 months – (Monthly Operating Expenses x 12 months)

The cash flow output will change if you take out a loan to pay for your property. The loan payment is considered money flowing out and will decrease your cash flow. Consider putting more money toward the down payment to increase your cash flow. The formula is as follows:

Cash Flow (with a loan) = [(Monthly Rental Income + Other Monthly Income) – Vacancy Rate] x 12 months – [(Monthly Operating Expenses x 12 months) – (Month Loan Payment x 12 months)

Capitalization Rate (Cap Rate)

Cap rate is a metric used specifically on rental properties to evaluate their rate of return, meaning how much the owner can gain or lose if they purchase the property. In general, the higher the cap rate, the more profitable the investment. However, high cap rates are also associated with more risky investments, since they usually indicate properties with lower value. To calculate the cap rate, take the net operating income divided by the property value. The formula looks like this:

Cap rate = Rental income + Additional income – Vacancy Losses

________________________________

Property Value

Unlike the ROI and cash flow outputs, the cap rate does include mortgage debt, so only one formula is needed regardless of whether an investor decides to take a loan on the property or not. Average cap rates vary by location and property type, but a good cap rate ranges from 4% to 10% or higher. Calculating the cap rate is especially important when comparing multiple investment properties.

For more information on how a cap rate works and what is considered a good cap rate, check out our in-depth guide: Capitalization Rate: Calculator, Formula & What It Is

All of the output metrics from our rental calculator are necessary to evaluate a current or potential investment property. To compare multiple properties and understand the potential profitability of different investments, you’ll also want to calculate the gross rent multiplier (GRM).

Frequently Asked Questions (FAQs)

The 2% rule is a guideline for rental property owners and investors. It suggests that a property’s monthly rental income should be at least 2% of the property’s total acquisition cost. This rule of thumb is the same as the 1% rule, just with a different estimation. These rules can help you make simple, fast calculations at the moment, but make sure that you evaluate potential investment properties in more detail before making a large purchase.

There are many ways to calculate a rental property’s potential profits, but the most important metrics are ROI, cash flow, and cap rate. By using our free rental property calculator, you can generate all three of these metrics and most accurately determine whether or not a specific property can be a strong, income-producing investment.

There isn’t a specific dollar amount of profit that you can or should expect from buying a rental property, since there are so many factors that affect the income and expenses of each property. However, most investors aim for a positive cash flow, where rental income exceeds the expenses. In addition, the current average ROI for residential rental properties is 10.6%.

Bottom Line

A rental property calculator is an extremely useful tool for investors to calculate the ROI, cap rate, and cash flow of a current property or potential property purchase. Knowing these calculations will help investors and landlords clearly and accurately decide on the profitability of potential investments and increase their revenue.