Rigbooks is a cloud-based trucking management system (TMS) that helps you manage and track orders, trips, expenses, and fuel mileage, as well as send invoices and prepare International Fuel Tax Agreement (IFTA) taxes. Its main features include detailed load tracking, fleet maintenance, billing and invoicing, and document management.

Rigbooks’ Basic Entry plan starts at $19 per month. You can try it for free for 30 days with no credit card required. Our Rigbooks review covers the platform’s pricing, use cases, features, customer feedback, and more to help you decide whether it’s the right TMS for your small business.

The Fit Small Business editorial policy is rooted in our company’s core mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audiences have. This ensures that the content is rooted in knowledge and accuracy.

We also employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Pros

- Unlimited users

- Free trial includes all core features

- Detailed load tracking, like the ability to track multiple drops and pickups

- Pay drivers by the mile, load percentage, or flat rate fee

- Track miles per jurisdiction for easy IFTA reporting

Cons

- Expensive for businesses with over five trucks

- Not a full-fledged accounting software

- Limited reports; no balance sheets

- Invoicing is only in the top-tier plans

- No mobile app

Supported Business Types | Small and midsize trucking companies, especially those operating up to five trucks |

Monthly Pricing |

Companies with over 10 trucks must request special pricing. |

Free Trial | 30 days; no credit card required |

Standout Features |

|

Customer Support | Phone and email support, online tickets, and self-help guides like blogs and feature guides |

- Small trucking companies needing affordable load tracking: For as low as $19 per month, Rigbooks enables you to track cost per mile, profit per mile, and average miles to help you understand which loads are the most profitable. Because of this, Rigbooks earned a spot in our roundup of the best trucking accounting software.

- Truckers seeking an easy-to-use TMS: Rigbooks has the simplest and easiest-to-use interface among the trucking accounting software we’ve reviewed, making it an ideal choice for truckers without much bookkeeping experience.

- Trucking companies wanting easy IFTA calculation: Rigbooks imports mileage entries and the latest fuel tax rates automatically for all jurisdictions for easy IFTA reporting.

- Equipment maintenance managers: Those in charge of preventive maintenance can accurately keep track of equipment records, such as maintenance dates, work performed, odometer records, and trailer and receipt attachments.

Rigbooks Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| User-friendly and affordable | Requires special pricing for fleets with more than 10 trucks |

| Excellent customer support | Invoicing is only available with Independent O/O or Small Fleet plans |

| Easy to add details and expenses incurred with each trip | Lacks many useful general accounting features, like the ability to print checks |

As of this writing, the platform has an excellent five-star rating, but it’s from just five user reviews on Capterra[1] and Software Connect[2]. One user who left a recent Rigbooks review notes that the tool makes it easy to record trips and order details; however, they also said that they were a bit frustrated as they couldn’t find the cancellation page and were continuously charged monthly. Other reviewers commented on the software’s ease of use and strong customer support features.

Fit Small Business Case Study

We compared Rigbooks with Tailwind TMS and QuickBooks Online using our internal case study and compiled the results in the chart below.

Rigbooks Vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Rigbooks From $19 per month Secondary Series (More faded, in the background, than the primary series)

-

Tailwind TMS From $117 per month

-

QuickBooks Online From $30 per month

While Rigbooks is the most affordable solution, it’s not as comprehensive as the other two software programs. If general accounting features matter to you, you should consider QuickBooks Online. Rigbooks is easy to use, but QuickBooks stands out due to the availability of an assisted bookkeeping service in the form of QuickBooks Live and easy access to a huge network of QuickBooks ProAdvisors.

Rigbooks is available in four packages with prices that range from $19 to $149 monthly. All plans include the TMS’s core features, such as expense tracking, mileage tracking, and IFTA reporting. In our evaluation of the best trucking accounting software, Rigbooks tied with Zoho Books as the least expensive option. This is why Rigbooks earned a perfect score in this category.

If you need additional functionality like customer invoicing, you’ll need to upgrade to the Independent Owner Operator (O/O) plan, while users needing driver record management should subscribe to Small Fleet. You can try Rigbooks for free for 30 days to decide if it’s a good fit.

Basic Entry | Leased O/O | Independent O/O | Small Fleet | |

|---|---|---|---|---|

Monthly Pricing | $19 | $29 | $49 | $149 |

Trucks Included | 1 | 1 | 5 | |

Cost per Additional Trucks | $19 | $24 | $29 | $29 |

Expense Management | ✓ | ✓ | ✓ | ✓ |

Profit & Loss Reporting | ✓ | ✓ | ✓ | ✓ |

Trip Tracking | ✓ | ✓ | ✓ | ✓ |

Fuel & Mileage Tracking | ✓ | ✓ | ✓ | ✓ |

Maintenance Recording | ✓ | ✓ | ✓ | ✓ |

IFTA Tracking & Calculation | ✓ | ✓ | ✓ | ✓ |

Detailed Load Recording | ✕ | ✓ | ✓ | ✓ |

Customer Database | ✕ | ✓ | ✓ | ✓ |

Invoicing | ✕ | ✕ | ✓ | ✓ |

Driver Record Management | ✕ | ✕ | ✕ | ✓ |

Since Rigbooks isn’t a full-fledged accounting software, it lacks some essential accounting features and reports, such as bank reconciliation, check printing, and balance sheets, which is why it scored so low in this category. It also doesn’t allow you to record credits from vendors or credit memos for customers, track payments to independent contractors, generate recurring invoices, or generate financial reports. However, if you only need a basic trucking invoicing and expense tracking solution, Rigbooks can still be a good option.

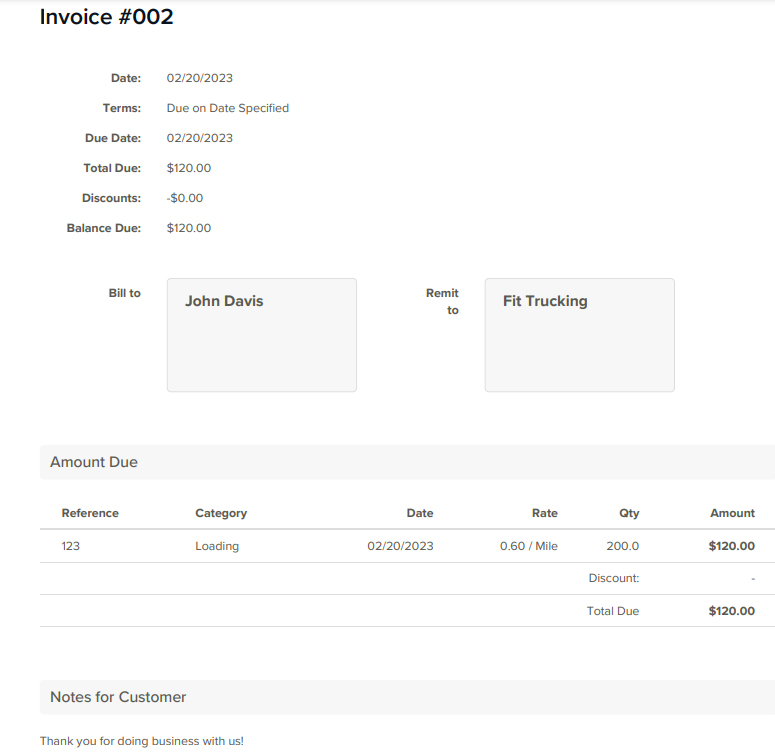

Rigbooks allows you to create and email invoices with a bill of lading (BOL) to your customers and print them if needed. You can create a new invoice from scratch or create one from an existing trip record, which is more convenient and time-saving.

Invoicing in Rigbooks is pretty intuitive, but it’s not enough to offer customization to users. For instance, you can’t upload your company logo, change the invoice color scheme, and set up recurring invoices.

Sample invoice in Rigbooks

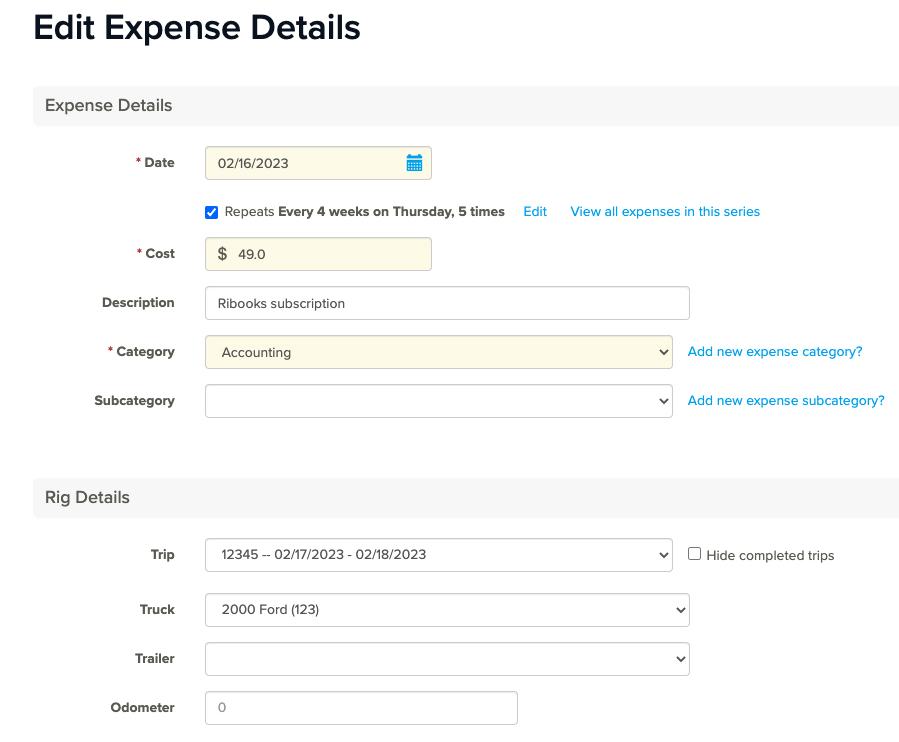

Your team members can manually log their expenses and upload receipts, and Rigbooks will automatically read the receipt and convert it into a logged expense. You can:

- Organize expenses by category—like accounting, driver pay, fuel, loading, maintenance, personal vehicles, and supplies

- Set up recurring expenses if you have ongoing regular spending, such as software, insurance, and rent and mortgage payments

The platform tracks both fixed and variable tracking costs.

- Fixed costs are expenses that are incurred whether you’re driving or not. Examples of fixed costs include equipment loan payments, permit costs, and accountant costs.

- Variable costs—like fuel, maintenance, and tire repairs—change, depending on how many miles you drive.

You can track expense totals on a weekly, monthly, quarterly, or yearly basis.

To record a new expense, click on the Add Expense button on the upper right-hand part of the Expense screen, or select the + button next to the Expenses menu on the left navigation menu. Expense details, like cost, description, and category, are needed to complete the Add New Expense form.

Adding a new expense in Rigbooks

However, Rigbooks doesn’t track the checking or credit card account used when recording an expense. This means that you will be unable to compare your bank or credit card statement to your expense records easily to verify you’ve captured all expenses.

While this makes for an easy-to-use system, it provides room for errors when receipts are lost. We recommend a double-entry accounting system like QuickBooks Online to avoid omitting expenses unintentionally (read our guide to QuickBooks Online plans to learn more).

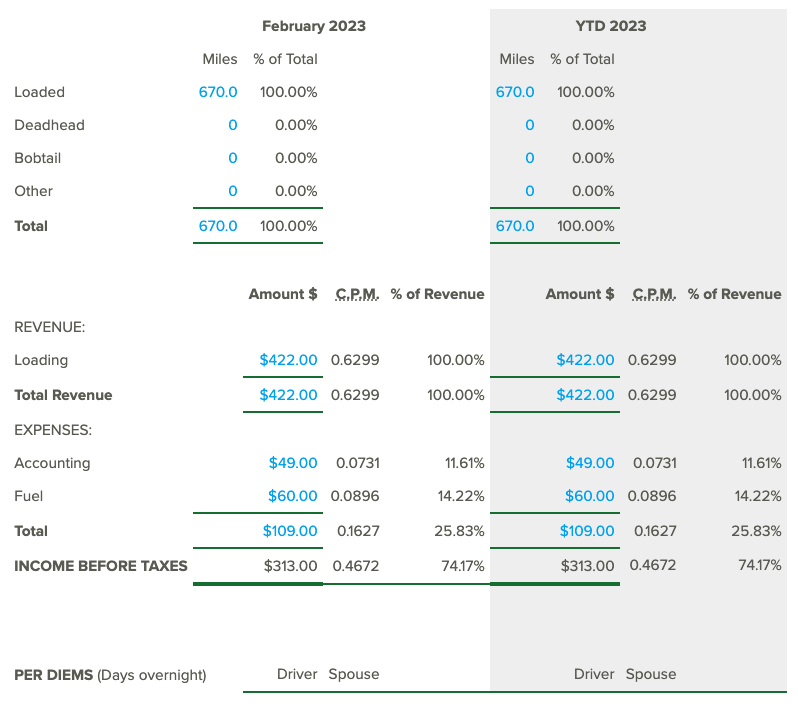

Rigbooks allows you to generate P&L reports for a certain period. If you operate multiple trucks, then you can create a customized P&L report that lets you see how much you’ve earned and spent using each truck. P&L reports in Rigbooks show important details, such as total loaded miles and deadhead and bobtail reports, if applicable.

Sample profit and loss report in Rigbooks

Rigbooks isn’t as feature-packed as more expensive software like TruckingOffice. However, it offers all of the trucking management tools we wanted to see, such as order and dispatch management, equipment maintenance, fuel and mileage tracking, and IFTA tracking and reporting, so we awarded it a perfect mark in this category.

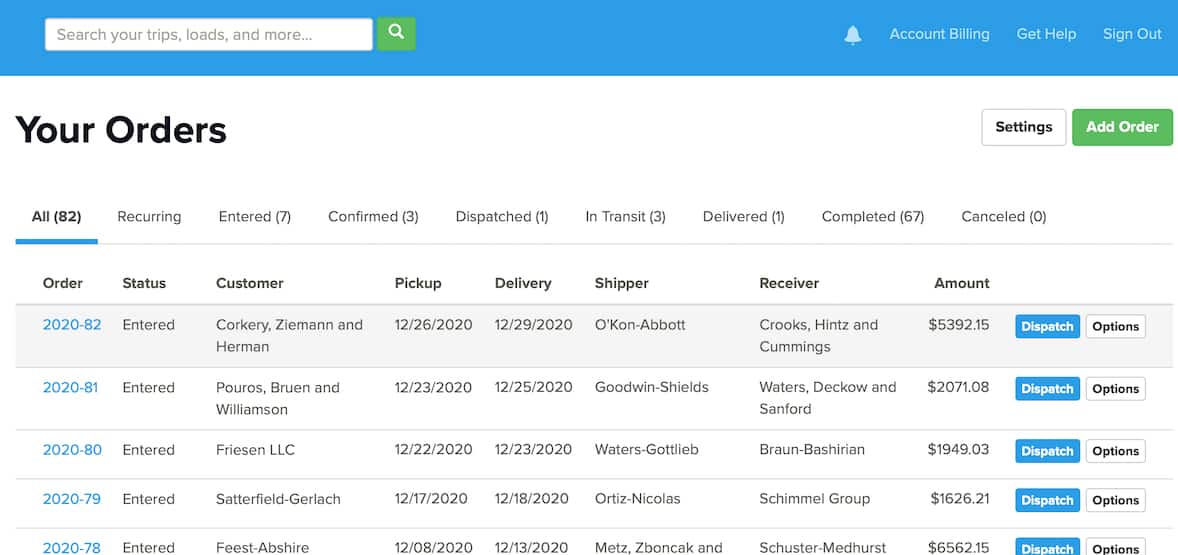

The order management module helps you track all your loads and the progress of each shipment. You can monitor loads based on status, and each status has a separate tab for easy tracking. Orders in Rigbooks are tracked based on the following statuses:

- Entered: Loads waiting for confirmation on rates

- Confirmed: Loads confirmed and ready to dispatch

- Dispatched: Loads dispatched but not yet in transit

- In-Transit: Loads being delivered to the recipient

- Delivered: Loads successfully delivered to the receiver but not yet invoiced

- Completed: Loads invoiced

- Canceled: Loads canceled by the shipper or receiver

Tracking Loads in Rigbooks (Source: Rigbooks)

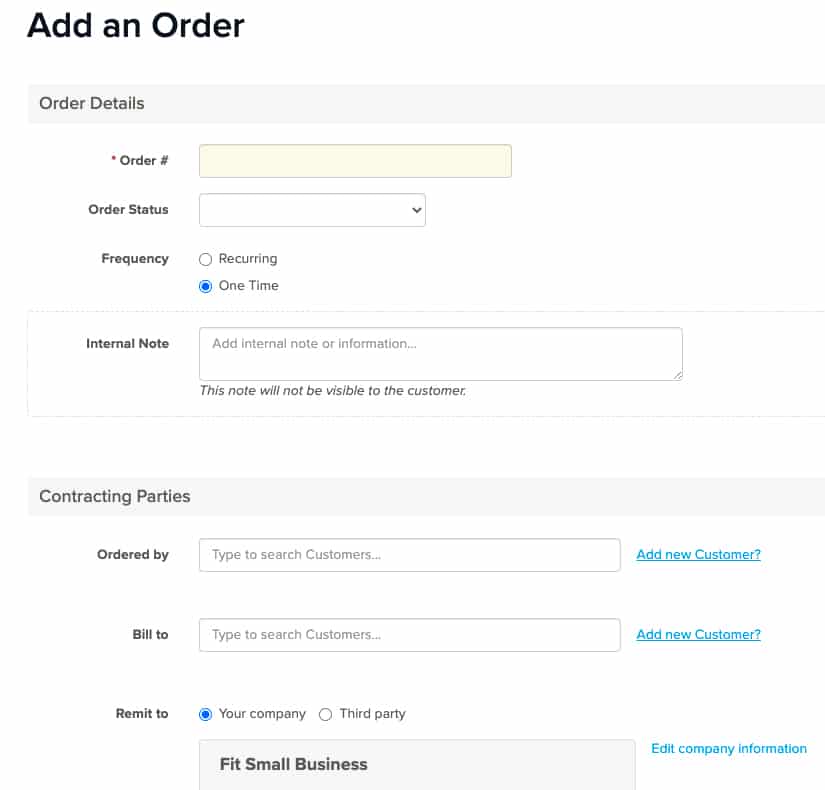

To add a new order in Rigbooks, click the Add Order button on the Orders screen or tap the + button next to Orders in the left navigation menu. The Add an Order screen will appear, asking for details such as order number, order status, frequency, and contracting parties.

Adding an order in Rigbooks

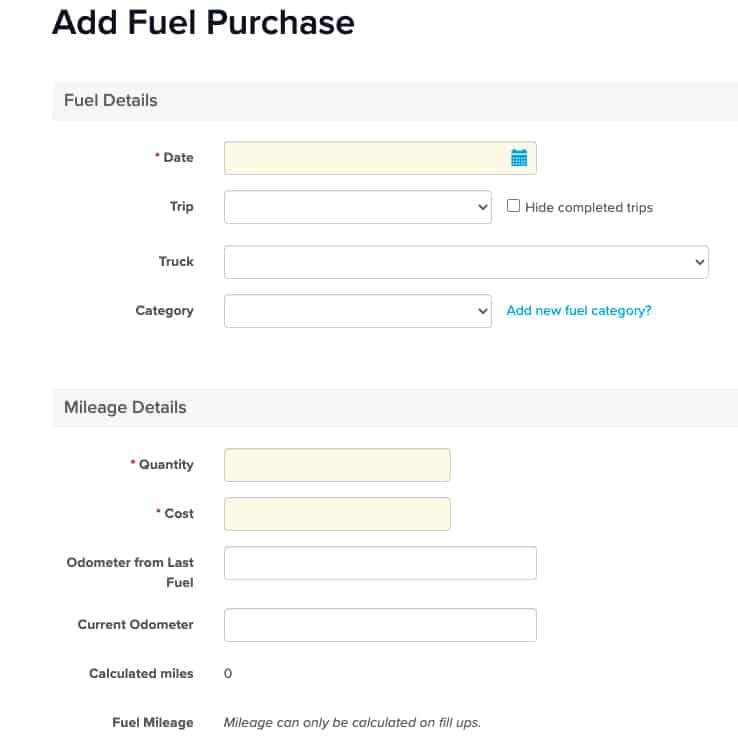

Fuel purchases often account for a large portion of a trucking business’ total expenses, making it extremely important to track. With Rigbooks, you can record the details of your fuel purchases for each truck to help you track oil and gasoline costs. It also helps you keep detailed records of truck mileage to simplify tax reimbursement.

The Fuel Purchase form can be accessed from the Add Fuel Purchase button on the Your Fuel Purchases screen or the + button next to the Fuel menu on the left navigation bar. To complete the Add Fuel Purchase form, you need to provide fuel and mileage information.

Add Fuel Purchase in Rigbooks

The document management module provides an easy way to store, organize, and manage drivers’ paperwork and expense receipts. This feature allows you to attach BOL documents to your loads, and then generate an invoice in a few seconds. Rigbooks’ document management system is compatible with most mobile scanning applications, like Adobe Scan and Microsoft Office Lens.

This helps you stay on top of your preventive maintenance (PM) needs. Rigbooks provides an easy way to record and organize your maintenance procedures and monitor maintenance records by category, such as oil change, service motor, and tire and wheels. Maintenance reports can be generated on a weekly, monthly, quarterly, or yearly basis.

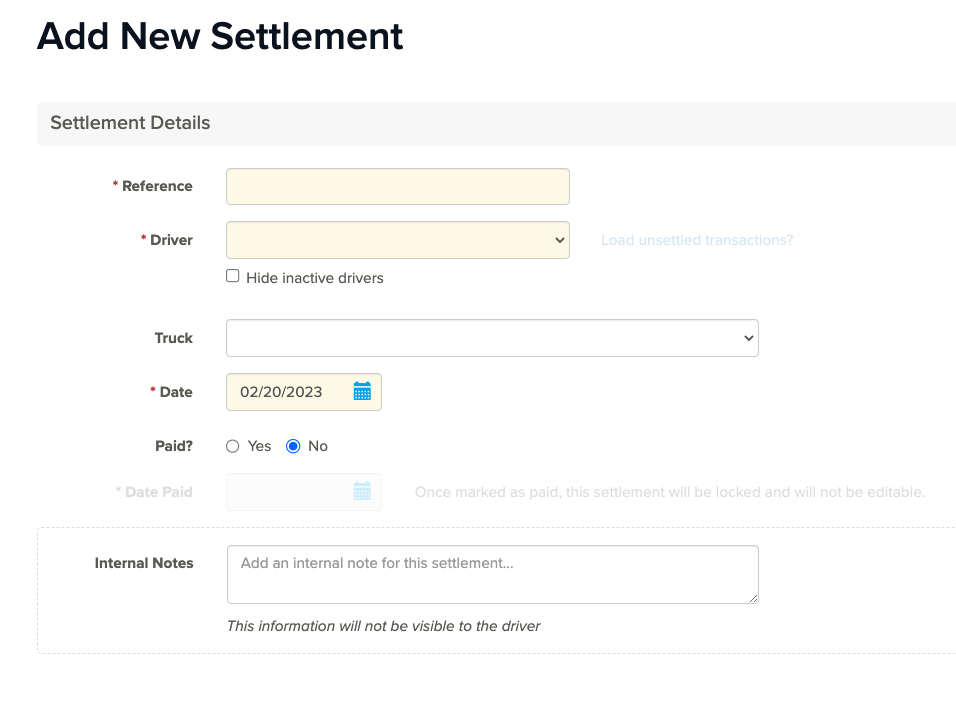

Rigbooks lets you pay your drivers and agents by mile, load percent, or flat rate per trip. You can add and track the pay for all the trips associated with a settlement.

The settlements in Rigbooks let you enter:

- Additional expenses that should be paid by the driver

- Reimbursements owed to the driver

- Additional driver pay, which is commonly used for adjustments that aren’t connected to a trip

To access the Add New Settlement form in Rigbooks, click on the Settlement menu on the left navigation bar, and then click on the Add Settlement button on the Settlement screen.

Adding a new settlement in Rigbooks

Just like other trucking software, Rigbooks is compatible with IFTA. It helps you stay compliant with the IFTA by tracking mileage per jurisdiction. It makes reporting easy by providing detailed information on mileage and fuel purchases per jurisdiction.

The IFTA reporting feature in Rigbooks shows the total miles traveled in all jurisdictions, total fuel consumed in all jurisdictions, and average miles per gallon. IFTA reports can be downloaded as a PDF or Excel file.

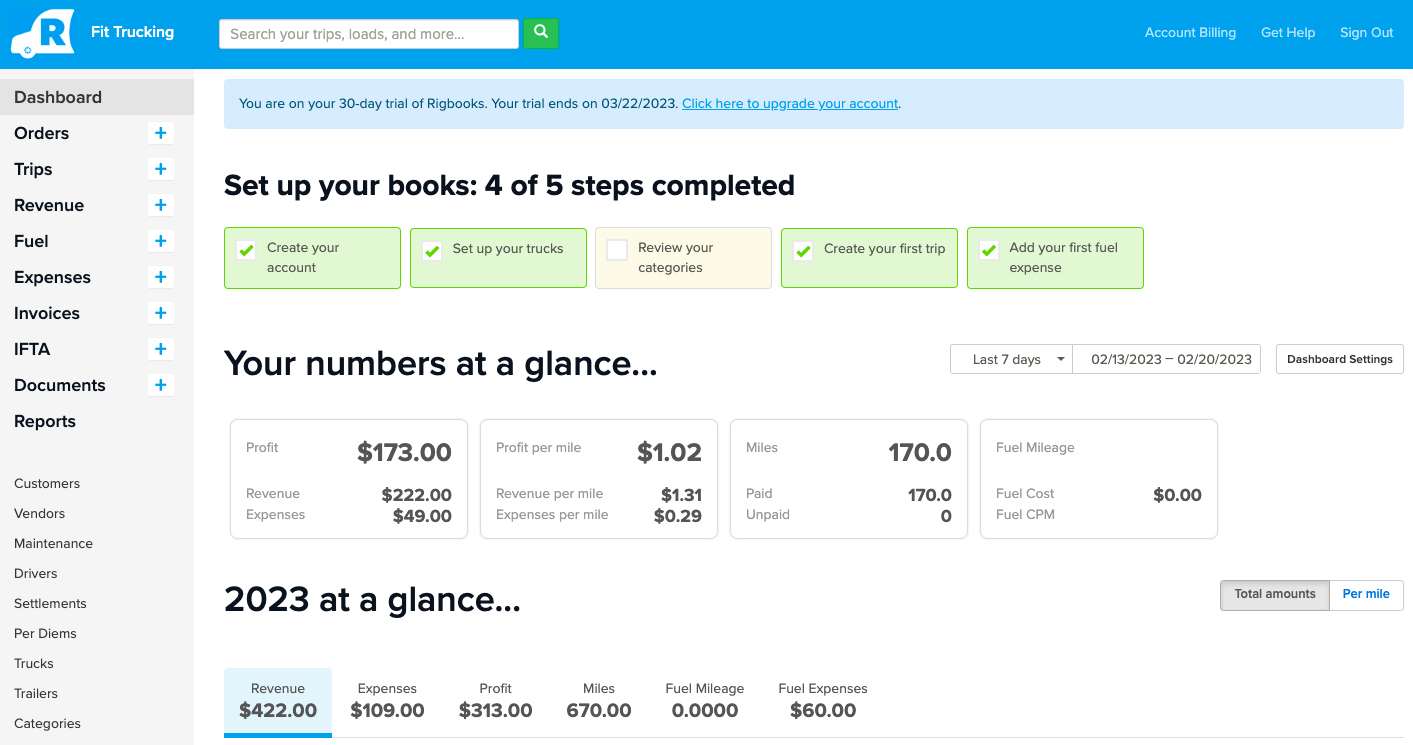

Rigbooks can be ideal for nonaccounting users. It has a very simple and neat interface that’s extremely easy to navigate. The dashboard provides quick links to all the features you may need and shortcuts for instantly adding new transactions like trips, trucks, revenues, expenses, and fuel purchases. It received slight deductions for its dashboard, which could be a bit more customizable, and its ease of setup could be a bit more user-friendly. Overall, however, we found it to be a good choice for novices.

There’s a function checklist at the top that lets you see your progress. The left-hand navigation menu is well organized, and the + buttons next to each menu make it easy to initiate a transaction. Also, the dashboard displays at-a-glance reports of your revenue and expenses and operational reports that allow you to see the financial status of your company instantly.

Rigbooks dashboard

One of the things we like best about the provider is the vast Rigbooks Trucking Resource Center, which you can access on the main menu bar of the website’s homepage easily. It includes useful tips and information about the trucking business. For instance, it has some informative blogs about how to start a trucking business, the best places to buy fuel, and how to track miles for IFTA reporting.

Rigbooks could have gained a higher score in our evaluation if it had live chat support and an assisted bookkeeping service similar to QuickBooks Online, as assisted bookkeeping options are useful for trucking companies needing help with accounting and tax.

If you’re stuck with something, Rigbooks provides a toll-free hotline, but it is unclear what its business support hours are. You can also send an email with your query and wait for an answer from one of its agents. We sent an email, and it took about seven hours to get a response, but we’re uncertain whether that is an average response time.

How We Evaluated the Best Trucking Accounting Software

We used the following scoring rubric in evaluating the best trucking accounting software.

15% of Overall Score

We ranked each truck accounting software based on its affordability, considering the number of users included in each plan and the costs to add an extra seat.

30% of Overall Score

Regardless of the industry, specialized accounting software should include general bookkeeping features like A/P, A/R, and bank account reconciliation.

30% of Overall Score

The best trucking accounting software should be able to manage and track dispatches, orders, fuel and mileage, driver settlements, and IFTA reporting.

10% of Overall Score

Most trucking business owners likely don’t have accounting experience, so the best bookkeeping software for truckers should be easy to understand and use.

10% of Overall Score

We checked the availability of different customer support options, including phone support, email, and live chat.

5% of Overall Score

We used average user review ratings from several websites like G2.com and Software Advice.

Frequently Asked Questions (FAQs)

No, but it’s among the most affordable trucking accounting software on the market. If you’re hesitant to buy the software, you can sign up for a 30-day free trial with no credit card required.

No, it doesn’t. If you want an accounting and trucking-management solution combined, consider Q7 or integrate QuickBooks Online with TruckingOffice.

QuickBooks Online is designed for any business needing advanced accounting features, like bank reconciliation, inventory management, and payroll. Meanwhile, Rigbooks is custom-tailored for trucking companies, and it has unique features, like the ability to enter trips and loads and track fuel purchases.

No, Rigbooks doesn’t currently offer a mobile app.

No, Rigbooks isn’t a general accounting software like QuickBooks. It focuses on the specific needs of trucking businesses and doesn’t offer features like balance sheets.

Bottom Line

Whether you’re an owner-operator or a small trucking fleet owner with no more than five trucks, Rigbooks can be an affordable choice. It has the tools you need to dispatch and track your loads, track fuel and other expenses, bill customers, and stay compliant with the IFTA. It is very easy to use and has simple yet powerful cost-per-mile reporting that helps trucking companies understand the profitability of every load they dispatch.

User review references:

[1]Capterra

[2]Software Connect