Unlike hourly and salaried employees, truckers may have pay rates based on miles driven or truckloads carried. The best payroll for trucking companies can support these unique scenarios and fulfill trucking-specific requirements while simplifying salary calculations, driver payment processing, and International Fuel Tax Agreement (IFTA) reporting.

To find the top trucking payroll software, we looked at 18 options—from general payroll solutions to transportation management systems (TMS) that include payroll. We narrowed it down to our four best.

- QuickBooks Payroll: Best overall trucking payroll software and for those needing fast direct deposits

- Gusto: Best for small trucking businesses looking for an HR payroll solution with robust benefits options

- ADP Run: Best for growing trucking companies needing strong human resources (HR) tools

- TruckLogics: Best full TMS with driver settlement tools to pay contractors

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Best Trucking Payroll Software Compared

All the trucking payroll software on our list can handle driver payments, direct deposits, and manual check payouts. Below are some of the standout features.

Starter Monthly Pricing | Contractor Plan* ($/Month) | Pay by Mile, Work Hour, or Percentage | Built-in IFTA Reporting Tools | |

|---|---|---|---|---|

$6 per employee plus $45 base fee | $15 monthly for 20 contractors; plus $2 for each additional worker | Limited | ✕ | |

$6 per employee plus $40 base fee | $6 per contractor plus $35 base fee monthly | Limited | ✕ | |

$2.50 per employee, per weekly pay run plus $49 base fee** | ✕ | Limited | ✕ | |

| $9.95*** | ✕ | ✓ | ✓ |

*Contractor plan is for businesses without W-2 employees

**Based on a quote we received

***Pricing is for the “Owner Operator” plan (covers one to two trucks); the provider also offers discounted rates if you sign up for an annual plan (but you pay the annual fee upfront)

Quiz: Determine the Best Trucking Payroll Software for You

QuickBooks Payroll: Best Overall & for Those Needing Fast Direct Deposits

Pros

- Supports multiple pay items; you can also create your own pay types (eg., pay by per diem, etc)

- Next-day direct deposits included even in starter tier (same-day option available in higher plans)

- User-friendly with an intuitive interface

- Seamless integration with QuickBooks accounting

- Low-cost contractor payments plan

Cons

- Limited trucking-specific features; lacks IFTA tracking

- Requires QuickBooks to integrate payroll and bookkeeping, including third-party TMSes and other software

- Doesn’t handle local payroll tax payments and filings unless you upgrade to its higher tiers

- Health insurance doesn’t cover all states (unavailable in HI, VT, and DC)

QuickBooks Payroll offers full-service payroll—meaning, it will handle all of your payroll and tax calculations. It will even remit payroll tax payments, file tax forms, and prepare year-end W-2s/1099s for you. When used with QuickBooks accounting software, it can integrate with TMSes, making it one of the best payroll options for trucking companies. With it, you can run unlimited payrolls and pay employees via next- and same-day direct deposits.

It doesn’t charge for setup, plus it works with SimplyInsured for employee health benefits and Mineral for expert HR support. This is in contrast to TruckLogics, which doesn’t offer benefits plans and lacks HR features.

QuickBooks offers multiple products that help you take control of your business’s financial health by making it easier to manage your income and expenses. Learn more about it in our full What Is QuickBooks guide.

It earned 4.36 out of 5 in our evaluation, with high marks in nearly all criteria. It scored the lowest in trucking-specific tools because QuickBooks Payroll doesn’t have a direct way to pay by miles—you have to manually calculate and input the applicable rates when you run payroll. However, with QuickBooks Online, you can set up vendor profiles for employees, so you can track and reimburse mileage per driver or import the information from your TMS.

In terms of user feedback, many left positive comments on third-party review sites like G2 and Capterra. They commended QuickBooks Payroll’s ease of use and efficient pay processing tools.

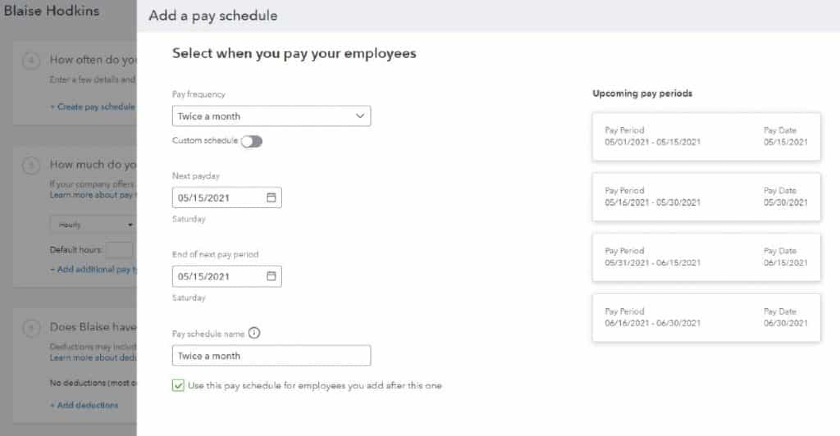

When adding employees into QuickBooks Payroll, the system helps you set up how often they are paid and what their deductions are.

(Source: QuickBooks)

You can choose from three QuickBooks Payroll plans:

- Payroll Core: $45 + $6 per employee monthly

- Includes full-service payroll, next-day direct deposit, federal and state tax filings and payments, and access to 401(k) plans and benefits

- Payroll Premium: $80 + $8 per employee monthly

- Core + same-day direct deposit; federal, state, and local tax payments and filings; workers’ compensation administration; and HR support center

- Payroll Elite: $125 + $10 per employee monthly

- Premium + multiple state tax filing, project tracking, personal HR adviser, tax penalty protection up to $25,000 per year, and expert setup

QuickBooks also has a special plan for businesses that only hire contract workers.

- Contractor payments: $15 monthly for 20 workers; plus $2 for each additional contractor

- Includes next-day direct deposits, unlimited pay runs and 1099 e-filings, and a free online account where contractors can complete W-9s and provide bank deposit information

- Ease of use: QuickBooks Payroll has an intuitive interface with tools that are easy to learn and use. You can even set up and do payroll in just a few clicks. In case you require assistance, it offers customer support (through phone and 24/7 live chat), how-to guides, video tutorials, and a community forum with other QuickBooks users. However, the how-to section is cluttered and hard to search compared to the others on our list.

- Fast employee payments: Aside from comprehensive pay processing tools, you get fast direct deposits—quicker than any of the providers on our list with its same-day option.

- Efficient HR tools: Online onboarding, time and PTO tracking, and employee benefits are just some of the HR features that come with QuickBooks Payroll. The coverage of its health insurance plans is also wider than Gusto—it covers nearly all states except Hawaii, Vermont, and the District of Columbia, while Gusto’s is unavailable in 13 states (Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming). However, it lacks non-standard benefits options, like Gusto’s college savings plan and ADP Run’s retail and restaurant discounts for employees.

- Integration with TMS: You can connect to TMS solutions like Tailwind and Kuebix—provided you have QuickBooks. ADP Run and TruckLogics offer similar integration options, whereas Gusto doesn’t integrate with a TMS.

- Robust reporting: Aside from payroll-related documents, you can generate and customize reports that show time sheet activity and labor costs by driver and fleet.

Gusto: Best for Small Trucking Businesses Needing an HR Payroll Solution With Robust Benefits Options

Pros

- Reasonably priced plans with full-service payroll in all tiers

- Unlimited pay runs and custom pay items

- Multiple payment options, including a payroll card

- Has with hiring, job posting, and performance review tools

Cons

- Lacks integration with TMSes

- Has limited trucking-specific features

- Health insurance is available only in 37 states

- Multi-state pay processing and time tracking tools are only available in higher tiers

Gusto ranks No. 1 on our lists of the best online payroll software and leading payroll solutions. It is also one of our recommended payroll services for trucking companies because it can manage pay processes for both driver and non-driver staff at reasonable rates. For a monthly fee of $40 plus $6 per person, it can calculate employee and contractor pay, handle off-cycle payruns for fuel bonuses, and file federal, state, and local taxes for you.

It also offers essential HR tools like onboarding and new hire reporting and a variety of benefits options, from retirement and college savings plans to workers’ compensation and commuter benefits. If you need financial management tools, the provider offers a Gusto Wallet app that you can download for free. However, its health insurance coverage isn’t as wide as that of ADP Run, which covers all 50 states—Gusto’s is available only in 38 states (plus D.C.) as of this writing. TruckLogics doesn’t have this feature.

Since Our Last Update:

Gusto is no longer offering the Cashout program, which enabled employees to access a portion of their earned salaries between paydays.

Scoring 4.19 out of 5 in our evaluation, Gusto received perfect marks in pricing, reporting, and user popularity. Many users find its interface intuitive and its support team helpful. It also scored well in several of our other criteria, given its ease of use, efficient HR features, and solid payroll tools. It would have gotten a higher overall rating if not for the limited coverage of its health benefits and lack of TMS features, like IFTA information tracking.

With Gusto, you can input additional employee earnings like per-diem for meals, bonuses, and commission payouts.

(Source: Gusto)

With Gusto, you can choose from three plans and a contractor-only payroll package.

- Simple: $40 + $6 per employee monthly

- Includes full-service payroll, tax filings, payroll tax filings, single state pay processing, two- and four-day direct deposits, employee benefits, new hire reporting, offer letter templates, onboarding, and basic support

- Plus: $80 + $12 per employee monthly

- Simple + next-day direct deposits, time and paid time off (PTO) tracking, applicant tracking, job postings, project tracking, and full support with extended support hours

- Premium: Custom-priced

- Plus + performance reviews, surveys, full-service payroll migration, access to HR experts, direct line to priority phone and email support, and a dedicated account manager

- Contractor-only plan: $35 + $6 per contractor monthly*

- Full-service payroll, four-day direct deposits, and state new hire reporting

*New clients signing up for Gusto’s contractor-only plan will get discounted pricing of only $6 per contractor monthly (no base fee) for the first six months. After this period, you will be charged the regular monthly fee of $35 plus $6 per contractor. Note that this promotion can change at any time. Check the Gusto website for the latest promos on offer.

Gusto also offers add-on solutions and services. Here are some of the options:

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

- Health insurance broker integration: $6 per eligible employee monthly; free with the Premium plan

- 529 college savings: $6 per participant monthly (with an $18 monthly minimum)

- Commuter benefits: $4 per participant monthly (with a $20 monthly minimum)

- Health savings account (HSA): $2.50 per participant monthly

- Flexible spending account (FSA): $4 per participant monthly (with a $20 monthly minimum)

*NOTE: Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

- User-friendly platform: Gusto’s intuitive platform makes navigating through all its features easy for users. Its online tools are simple to learn, unlike ADP Run, which has a moderately steep learning curve. If you have questions about its functionalities, Gusto has how-to guides, an online help center, and phone, email, and chat support.

- Robust payroll tools: You get full-service payroll with unlimited and automatic pay runs. Plus, you can add custom earning types, such as payment by miles—something most payroll companies don’t do. You’ll need an integration like Timeero to track miles, however. In addition to payroll tax payments and filings, Gusto automatically generates and sends electronic copies of W-2s/1099s to employees for free. This is unlike ADP Run, which charges an additional fee for that service.

- Multiple payment options: You can pay employees through manual checks, pay cards, and direct deposits with two- and four-day options (next-day if you get its higher tiers). However, if you need faster direct deposits, consider QuickBooks Payroll since it offers next- and same-day options. If you prefer check payments, ADP Run has check signing and stuffing services—features the three other providers on our list don’t offer.

- Efficient HR tools and support: You are granted access to onboarding, time tracking, hiring, performance reviews, and self-service tools, including compliance alerts and support from HR experts. Gusto also provides standard and non-standard benefits options like medical, dental, vision, retirement, commuter benefits, workers’ compensation, HSA, FSA, and 529 college savings. However, its health benefits are unavailable in 13 states: Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming.

- Smart reporting: You can run and customize a wide range of reports, from payroll registers to bank transaction summaries and workforce costs. Gusto also lets you create custom payroll journals, employee lists, and employment status reports.

ADP Run: Best for Growing Trucking Companies That Want Strong HR Tools

Pros

- Multiple payroll plans to choose from

- Feature-rich HR suite that offers hiring, payroll, time tracking, benefits, and talent management tools

- Integrates with TMSes

- Built-in compliance tools that flag potential errors

Cons

- Pricing isn’t transparent

- Time tracking, health insurance, retirement, and workers’ compensation are paid add-ons

- W-2/1099 form delivery and filing are available for an additional fee

- Lacks IFTA tracking

ADP Run is a versatile payroll program that can meet the needs of small to large businesses in a variety of industries, including trucking. It has multiple payroll packages with a wide range of payroll and HR features to support trucking companies as they grow. It even offers professional employer organization (PEO) services if you need expert assistance in handling HR administrative tasks without expanding your in-house HR team.

With an overall score of 3.67 out of 5 in our evaluation, it earned high ratings in nearly all of our criteria. Compared to Gusto, ADP Run offers a wider range of payroll tools for truckers as it supports nondriver staff designations and integrates with trucking software. It also has background checks, which is useful when hiring drivers. However, nontransparent pricing, additional fees for year-end tax reporting, and the lack of IFTA tracking features prevented ADP Run from ranking higher on our list.

In terms of user reviews, many reviewers said ADP Run is generally easy to use with efficient payroll tools that help save them time. Meanwhile, some users complained about pricing, adding that many of the features they need are paid add-ons or require a plan upgrade.

ADP Run lets you manage payroll on the web or mobile.

(Source: ADP Run)

With ADP, you have to call its sales team to discuss your requirements and request pricing details. In the quote we received, a 25-employee business under its starter Essentials plan will be charged $2.50 per employee, per weekly pay run, plus a $49 base monthly fee.

For more information about ADP Run’s plan options, including some of the features included in each plan, see the list below.

- Essential: Custom-priced

- Includes full-service payroll, tax filings and year-end tax reports, new hire reporting, background checks, and onboarding tools

- Enhanced: Custom-priced

- Essential + check signing and stuffing services, state unemployment insurance (SUI) management, and ZipRecruiter job postings

- Complete: Custom-priced

- Enhanced + access to HR forms, salary benchmarks, an employee handbook wizard, and a dedicated HR support team

- HR Pro: Custom-priced

- Complete + applicant tracking, online training programs, employee handbook creation assistance, and HR advisory services

- Feature-rich platform: Compared to TruckLogics, Gusto, and QuickBooks Payroll, ADP Run has the most extensive HR solution suite, enabling you to efficiently handle the entire employee lifecycle. Aside from payroll, it offers recruitment, time and attendance, benefits, learning and development, and performance management tools. It even provides HR outsourcing and PEO services. Of course, these extras come at an increased price.

- Efficient HR solutions: While several of the products on our list have basic onboarding tools, ADP Run offers complete employee onboarding tools, including background checks. There’s even a mobile app for payroll administrators to run payroll—TruckLogics may have an app, but it lacks payroll tools. Plus, if you need expert support, ADP Run has a team of HR professionals that can assist you with compliance and HR issues—provided you subscribe to its higher tiers.

- Trucker-friendly payroll tools: ADP Run can handle nondriver staff designations and integrates with TMSes, such as Tenstreet and allGeo. Aside from hours worked, it supports pay calculations by other means like miles driven—a pay processing functionality that most trucking companies need. Gusto and QuickBooks Payroll can’t do this automatically.

- Multiple payment options with secure paychecks: In addition to direct deposits, you can pay employees through paychecks and a Wisely Direct debit card. If you subscribe to ADP Run’s premium payroll packages, you are granted access to paychecks with advanced fraud protection features, including check signing and stuffing services—a feature that none of the other providers in this guide offers.

- Robust reporting: You can view, run, customize, and print a wide range of payroll and HR reports.

TruckLogics: Best Full TMS With Driver Settlement Tools to Pay Contractors

Pros

- Easy to learn and use

- Includes IFTA tracking

- Inexpensive for very small trucking companies/indie drivers

- Driver settlement solution supports expense and allowance payments

Cons

- Driver settlement tool doesn’t include payroll tax filings

- You have to integrate with third-party software (like PayWow) for time tracking and payroll for non-driver employees

- Lacks employee benefits options and benefits administration tools

TruckLogics is a comprehensive TMS that includes everything from truck dispatch and IFTA tracking to maintenance scheduling and driver management. It also has business intelligence tools and online document management—plus, it can handle driver settlements and manage your accounts. It doesn’t have payroll tax filing capabilities and HR features like the other providers on our list. And if you want payroll for your nondriver staff, you have to integrate with third-party software solutions like PayWow, which can handle payments for contractors and hourly and salaried employees.

PayWow is designed by the same company that made TruckLogics, so the two integrate seamlessly. However, you need a paid PayWow subscription to access its platform. Plus, PayWow’s complete payroll plan is available only in North and South Carolina as of this writing.

With 3.5 out of 5 on our evaluation, TruckLogics earned high marks (3 and up) in most of our criteria, with perfect scores in pricing and trucking-specific features. It lost points due to its lack of employee benefits options and HR solutions (like online onboarding) and the low number of average user reviews on third-party sites like G2 and Capterra. However, users still find TruckLogics easy to learn and use. They also appreciate its breadth of trucking management tools and good customer support.

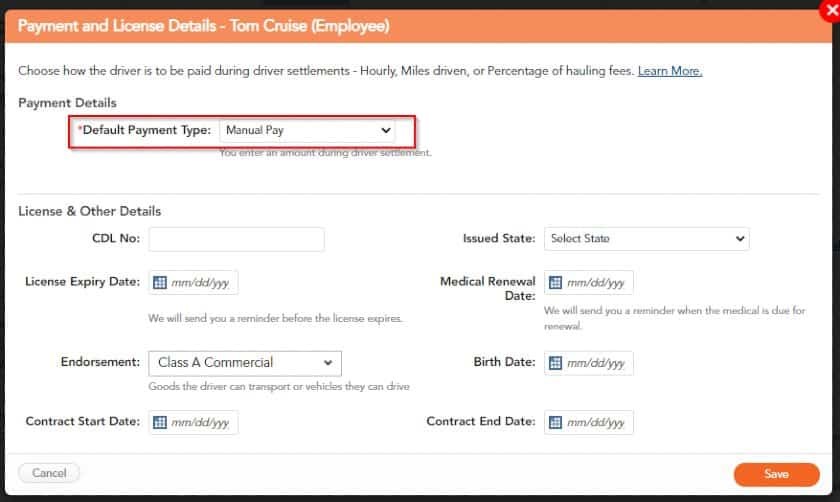

TruckLogics, by itself, can handle paying drivers. (Source: TruckLogics)

TruckLogics’ pricing plans are based on the number of trucks you have. Each plan comes with three sub-packages: Pro, Preferred, and Premium. The provider also offers special plans for trucking lease operators and brokers. While you can opt to pay on a month-to-month basis, you get discounted rates if you sign up for an annual billed plan (but the fees are paid upfront, in a lump sum).

- Owner Operator (one to two trucks): $9.95 to $29.95 per month (or $8.95–$26.95 per month, if billed yearly)

- Small Fleet (three to seven trucks): $29.95 to $69.95 per month (or $26.95–$62.95 per month, if billed yearly)

- Mid-size Fleet (eight to 14 trucks): $49.95 to $89.95 per month (or $44.95–$80.95 per month, if billed yearly)

- Large Fleet (15 and more trucks): $79.95 to $119.95 per month (or $71.95–$107.95 per month, if billed yearly)

- Leased Operator: $7.95 per month (or $7.15 per month, if billed yearly)

- Broker: $39.95 per month (or $35.15 per month, if billed yearly)

The basic sub-packages include truck dispatch, load, contact, document, and staff management tools. Higher tiers come with extensive IFTA reporting features. TruckLogics also charges extra for quarterly IFTA reports. It costs $24.95 per report for business owners and $19.95 per report for service providers.

- Comprehensive mobile app: TruckLogics’ mobile app works for employers and drivers and has no limit on users. The toolset depends on the plan you purchase but can include dispatch, filing Form 2290s, logging trips, fuel purchases, per diem, storing receipts, and more. ADP Run also offers a mobile app but the functionalities are more HR- and payroll-related.

- Complete set of TMS tools: TruckLogics is the only trucking payroll software we reviewed that has a complete set of trucking management tools. Its features include dispatch scheduling and assignment, miles calculations, bills of lading, and invoicing. You can also monitor truck maintenance schedules, driver preferences, and IFTA information. TruckLogics even offers several reporting options, from year-end taxes to equipment maintenance and insurance tracking. Plus, it provides an online portal for drivers.

- Pay drivers and staff: If all you want is to reimburse drivers, TruckLogics can handle that with a simple process. It lets you pay drivers by miles driven, a flat hourly rate, and a percentage of hauling fees. You can also add reimbursements and deductions (like fuel and parking fees) that are not part of the truck dispatch. However, integrating its platform with PayWow provides you with more flexibility to manage driver and dispatch settlements, reimbursements, and deductions. You can pay hourly and salaried employees and use the included time tracker for capturing your workers’ actual hours worked. Plus, PayWow deposits and files state and federal taxes for you.

If you need help selecting from our list of top payroll for trucking companies, follow our step-by-step guide on choosing payroll services.

How We Chose the Best Payroll Software for Trucking Companies

In our evaluation of the best trucking payroll software, we compared a mix of trucking software with payroll functionalities and payroll software that would allow payment by miles or loads. We chose solutions that offered the best combination of payroll processing and trucking-specific features, giving priority to the latter.

Trucking-specific systems (like TMSes) usually scored high for trucking-related features but low for essential HR and payroll functionalities. Similarly, payroll software providers offer solid pay processing and HR solutions but limited trucking features. You’ll need to decide your priorities when selecting.

To see our full evaluation criteria for the best payroll software for trucking companies, click through the tabs in the box below:

20% of Overall Score

15% of Overall Score

We gave points for plans costing less than $100 monthly for five employees. We also favored companies with transparent pricing, no set-up fees, and unlimited pay runs.

15% of Overall Score

Software that can calculate taxes and offer two-day direct deposits and other payroll tools, such as automatic pay runs and year-end tax report preparation and delivery, are rated favorably.

15% of Overall Score

Our experts considered affordability and how well the features meet the needs of small trucking businesses for HR and payroll.

10% of Overall Score

We looked for HR tools like new hire reporting, online onboarding, compensation management, training, performance management, and self-service portals.

10% of Overall Score

Aside from having access to standard payroll reports, we looked at whether you can customize them.

10% of Overall Score

We looked for features that make the software easy to learn and use, such as having an intuitive and modern-looking interface. We also checked the integration options available, file export capabilities, and the type of customer support offered.

5% of Overall Score

Bottom Line

Trucking companies have many moving parts to keep track of—and we’re not just talking about the trucks themselves. With the best trucking payroll software, especially one that is part of a TMS or can integrate with one, your office staff can keep your drivers paid on time and accurately.

Although it’s not TMS software, we chose QuickBooks Payroll as the best payroll software for trucking companies. It has a solid set of payroll and HR features, and comes with direct deposit options that allow you to pay either the next or same day. It connects seamlessly with QuickBooks for accounting and can even integrate with TMSes. It even has a low-cost option for paying contractors.

Sign up for QuickBooks Payroll plan today and enjoy either a 30-day free trial or 50% off its base fee for the first three months.