QuickBooks Online offers four standard plans—Simple Start, Essentials, Plus, and Advanced—with prices ranging from $30 to $200 per month. They vary in the number of users and features included and are built for different purposes.

Meanwhile, QuickBooks Solopreneur, a new and improved version of QuickBooks Self-Employed, is designed for one-person businesses and is available for $20 monthly. However, existing Self-Employed users can still renew their subscriptions. For new customers, consider QuickBooks Solopreneur.

Learn which version is right for you in this detailed QuickBooks Online comparison guide:

- QuickBooks Solopreneur: Best for one-person businesses

- QuickBooks Online Simple Start: Best for small service businesses with employees

- QuickBooks Online Essentials: Best for small businesses that need to assign hours worked to customers

- QuickBooks Online Plus: Best for retailers, wholesalers, contractors, and other small businesses that require inventory tracking

- QuickBooks Online Advanced: Best for small and medium-sized businesses (SMBs) seeking access for up to 25 users

We are committed to providing you with an unbiased, thorough, and comprehensive evaluation to help you find the right accounting software for your business. We meticulously and objectively assess each software based on a fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study.

To delve deeper into our best small business accounting software, we tested and used each platform to evaluate how the features perform against our metrics. This hands-on approach helps us strengthen our accounting software expertise and deliver on the Fit Small Business mission of providing the best answers to your small business questions.

QuickBooks Online Plans Comparison: Pricing & Features

The QuickBooks Online comparison chart below highlights some of the key features of the five versions. We include in-depth, side-by-side comparisons of each plan against its next-level tier in the sections that follow.

Solopreneur | Simple Start | Essentials | Plus | Advanced | |

|---|---|---|---|---|---|

Monthly Pricing | $20 | $30 | $60 | $90 | $200 |

Users Included | 1 | 1 | 3 | 5 | 25 |

Provides Double-entry Accounting | ✕ | ✓ | ✓ | ✓ | ✓ |

Send invoices | ✓ | ✓ | ✓ | ✓ | ✓ |

Connect Bank Accounts | ✓ | ✓ | ✓ | ✓ | ✓ |

Manage Expenses | ✓ | ✓ | ✓ | ✓ | ✓ |

Create & Send Estimates | ✓ | ✓ | ✓ | ✓ | ✓ |

Track Mileage | ✓ | ✓ | ✓ | ✓ | ✓ |

Print Balance Sheets | ✕ | ✓ | ✓ | ✓ | ✓ |

Print Checks | ✕ | ✓ | ✓ | ✓ | ✓ |

Manage Bills | ✕ | ✕ | ✓ | ✓ | ✓ |

Maker Contractor Payments | ✕ | ✕ | ✓ | ✓ | ✓ |

Track Time & Add to Invoices | ✕ | ✕ | ✓ | ✓ | ✓ |

Track Inventory & Cost of Goods Sold (COGS) | ✕ | ✕ | ✕ | ✓ | ✓ |

Track Activity by Project, Class & Location | ✕ | ✕ | ✕ | ✓ | ✓ |

Advanced Reporting | ✕ | ✕ | ✕ | ✕ | ✓ |

Fixed Asset Accounting | ✕ | ✕ | ✕ | ✕ | ✓ |

Dedicated Customer Service Representative | ✕ | ✕ | ✕ | ✕ | ✓ |

When To Use Each

Solopreneur

- Solopreneurs who need to separate business and personal expenses: QuickBooks Solopreneur automatically classifies business and personal expenses for tax purposes. It helps you accurately report deductible business expenses and avoid commingling of funds.

- Project-based freelancers and consultants: You can use QuickBooks Solopreneur to invoice clients and record expenses related to client projects.

- Freelancers who have outgrown QuickBooks Self-Employed: If you need improved features like the ability to create and send estimates and record and track expenses, then it may be time to switch to QuickBooks Solopreneur.

- Solopreneurs who often travel for work: You can use QuickBooks Solopreneur’s built-in mileage tracker to log your mileage for business-related trips and use the data for tax reimbursement purposes.

Simple Start

- Small businesses with recurring payment arrangements: Simple Start offers additional features beyond those offered in QuickBooks Solopreneur, including the ability to set up recurring and subscription payments. This makes it ideal for those who have ongoing monthly payments like rents, utilities, and monthly subscriptions.

- Small businesses with employees: Through its QuickBooks Payroll integration, Simple Start helps you with payroll-related tasks, like processing paychecks and calculating payroll taxes.

- Businesses that pay vendors or employees through checks: Solopreneur allows you to enter and print checks for paying bills and employee salaries.

Essentials

Essentials is ideal for businesses with employees and those who pay through checks, but it’s more suitable than Simple Start for:

- Small businesses with up to three users: Essentials allows you to add up to three users without any additional fees.

- Businesses that need to track unpaid bills: Unlike Simple Start and Solopreneur, Essentials allows you to manage and pay bills from vendors and suppliers. You can also track outstanding bills, so you can stay on top of your accounts payable (A/P).

- Service-based businesses billing clients by the hour: Essentials allows you to track billable hours by customer and project. You can enter and record the hours worked by employees on projects directly from within the platform.

- Those who do business with other countries: The plan supports multiple currencies, making it suitable for those doing business outside the United States.

Plus

Plus has everything in Essentials, but it’s preferable for:

- Companies with up to five users: QuickBooks Online’s most popular plan, Plus, includes access for up to five users, which we believe is enough for most small businesses.

- Businesses with inventory: Plus allows you to track inventory and COGS, making it an essential tool for product-based businesses.

- Companies seeking project management tools: Plus also has project management tools, such as the ability to create and track projects, allocate costs to projects, and track costs, payroll, and expenses associated with each project.

- Businesses with multiple departments and locations: The class and location tracking in QuickBooks Online Plus is useful for businesses with multiple segments or departments or those operating in multiple locations. For instance, heating, ventilation, and air conditioning (HVAC) businesses can use classes to track income and expenses associated with each of their services, such as repair, installation, and maintenance.

Advanced

It offers all the features and capabilities of the Plus plan, but we recommend it particularly for:

- SMBs with up to 25 users: Advanced supports up to 25 users, as opposed to five in Plus.

- Businesses that need to track fixed assets: With Advanced, you can now record and track fixed assets, automatically calculate their depreciation, set up depreciation schedules, and generate fixed asset reports.

- Businesses with multiple entities: Advanced now allows you to consolidate financial information from multiple company files into a single report.

- Companies requiring estimated vs actual project cost tracking: You can generate actual vs project cost reports, helping you better understand the profitability of each project you handle.

- Businesses with complex accounting workflows: If you have complex financial operations and you want your team to fully leverage the features of QuickBooks Online, Advanced gives you access to free training worth $3,000.

QuickBooks Online Plans Comparison Quiz

QuickBooks Online is our overall best small business accounting software. To help narrow down the best plan for your business, answer a few short questions below. This will offer you a customized recommendation based on the responses you give. Afterward, continue reading our article for a more detailed comparison of the five QuickBooks Online plans.

Fit Small Business Case Study

Our internal case study compares the four standard QuickBooks Online plans for small businesses across major accounting categories and functions to help you decide which one fits your needs. We excluded QuickBooks Solopreneur because it’s not a double-entry accounting system.

QuickBooks Online Comparison Interactive Chart

Touch the graph above to interact Click on the graphs above to interact

-

Simple Start $30 per month

-

Essentials $60 per month

-

Plus $90 per month

-

Advanced $200 per month

QuickBooks Solopreneur vs QuickBooks Simple Start

Solopreneur | Simple Start | |

|---|---|---|

Monthly Pricing | $20 | $30 |

Users Included | 1 | 1 |

Create & Send Invoices | ✓ | ✓ |

Accept Partial Customer Payments | ✓ | ✓ |

Create & Send Estimates | ✓ | ✓ |

Track Mileage | ✓ | ✓ |

Record & Track Bills and Expenses | Expenses Only | ✓ |

Set Up Recurring Payments | ✕ | ✓ |

Get Paid With No Fees | ✕ | ✓ |

Manage Cash Flow | ✕ | ✓ |

Run Balance Sheets & Financial Statements | ✕ | ✓ |

Make Contractor Payments | ✕ | ✓ |

Capture & Attach Receipts to Transactions | ✕ | ✓ |

QuickBooks Solopreneur works very well for one-person businesses, especially those with a limited client base and minimal expenses and income streams. The program provides features, such as invoicing, expense tracking, and mileage tracking that can help users effectively manage business finances. Additionally, QuickBooks Solopreneur provides tax filing capabilities for those who report their income on Schedule C (Form 1040), making it ideal for solo proprietors and single-member limited liability companies (LLCs).

Simple Start is a good starting point for most small businesses, especially those that don’t need to enter bills, track billable hours, and manage projects and inventory. It includes payroll processing, which allows you to calculate and track payroll taxes, and it lets you track assets and liabilities and use automated sales tax on invoices. Additionally, it enables you to record and track payments made to 1099 contractors.

If you want a dedicated expert to handle your ongoing bookkeeping work, you can sign up for QuickBooks Live Bookkeeping, available in Simple Start and higher plans. Read our detailed review of QuickBooks Live Bookkeeping to learn more about this assisted bookkeeping add-on.

QuickBooks Simple Start vs QuickBooks Essentials

Simple Start | Essentials | |

|---|---|---|

Monthly Pricing | $30 | $60 |

Users Included | 1 | 3 |

Schedule & Pay Vendor Bills | ✕ | ✓ |

Record Billable Time and Add to Invoices | ✕ | ✓ |

Supports Multiple Currencies | ✕ | ✓ |

Control What Users Can Access | ✕ | ✓ |

Number of Built-in Reports Available | 20-plus | 40-plus |

Advantages of QuickBooks Online Essentials

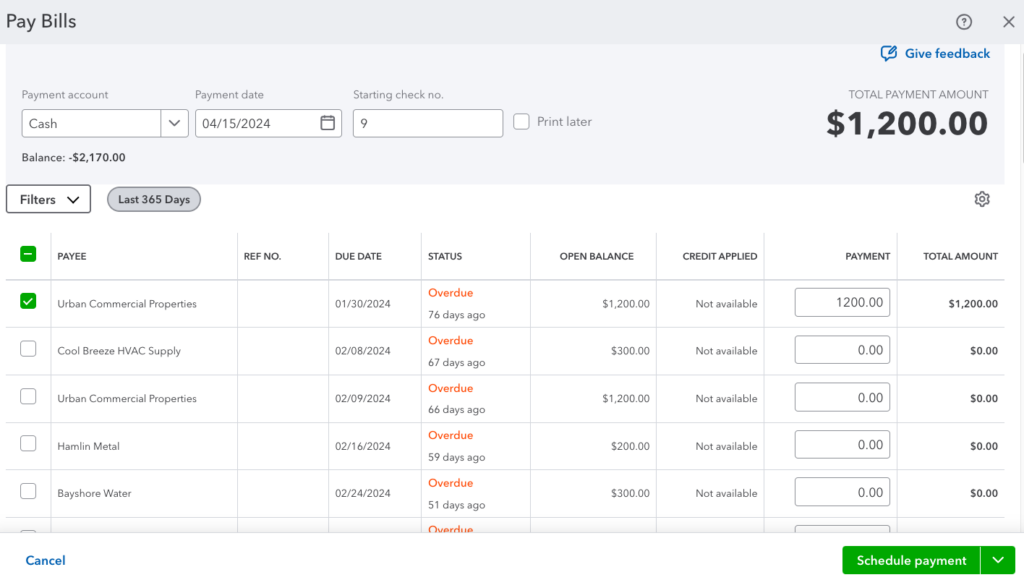

The biggest difference between Simple Start and Essentials is that Simple Start doesn’t allow you to pay and manage bills. This is inconvenient since even solopreneurs or freelancers have bills that need to be paid. However, if you only need to record expenses as you pay them, then Simple Start might be enough.

With Essentials, you can track your unpaid bills easily and pay them directly within QuickBooks. You just need to select the bills you want to pay from the Pay Bills window, place a checkmark next to the bills, and then select Save or Save and Print.

Pay Bills screen in QuickBooks Online Essentials

With QuickBooks Essentials, you can track billable time by job and assign it to a specific customer—something you can’t achieve with Simple Start. Once you’ve recorded your billable time, you can add it to your invoice and then send it to your client. This feature is ideal for service-based businesses that charge work by the hour, such as lawyers and independent contractors.

Simple Start runs basic reports, including cash flow statements, profit and loss (P&L) statements, and balance sheets. Some of the other 20-plus built-in standard reports available include P&L by month and customer, quarterly P&L summaries, and general ledger.

Meanwhile, Essentials gives you access to more than 40 reports, including those you can generate in Simple Start. Its additional reports include accounts payable (A/P) and A/R aging, transaction lists by customer, expenses by vendor, uninvoiced charges, unpaid bills, and expenses by supplier summaries. You can drill down to a list of your outstanding invoices instead of only the total outstanding.

QuickBooks Essentials vs QuickBooks Plus

Essentials | Plus | |

|---|---|---|

Monthly Pricing | $60 | $90 |

Users Included | 3 | 5 |

Assign Billable Expenses to Customers | ✕ | ✓ |

Class and Location Tracking | ✕ | ✓ |

Profit and Loss by Project | ✕ | ✓ |

Inventory Management | ✕ | ✓ |

Prepare Budgets | ✕ | ✓ |

QuickBooks Plus is a substantial upgrade compared to Essentials. The main differences between the two QuickBooks plans are the ability to create billable expenses and assign them to customers, track inventory costs, and calculate P&L by project. Other helpful features in Plus are budgets, classes, customer types, locations, and unlimited report-only users.

Retailers and wholesalers should choose Plus so that they can track the quantity on hand and the cost of inventory. Contractors should also select Plus to track the profitability of individual projects. Other businesses should consider whether tracking P&L by class and location is worth the extra $30 per month.

Advantages of QuickBooks Online Plus

Plus includes inventory accounting that allows you to monitor stock items and quantity—a necessity if you’re selling products. It also lets you update inventory costs and quantities, separate taxable from nontaxable items, and set up alerts if you’re running out of stock. Most importantly, Plus will separate the cost of your ending inventory from COGS using first-in, first-out (FIFO). You’ll need to make this tedious calculation in a spreadsheet if you choose a lower-tier plan.

With Plus, you can make POs, track them, and send them to vendors. POs are essential because they help you specify what products and services you need from your vendor or supplier and by when you need them. When creating POs in Plus, you can input specific items you want to purchase. When your POs are fulfilled, you can convert them to a bill easily.

Plus allows you to assign classes and locations to your transactions, so you can see how your business performs across divisions, locations, rep areas, or any units that are relevant to your business. If you run businesses in multiple locations and you want to see which one is most profitable, an upgrade to Plus from Essentials is worth the price.

With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. However, the problem with Plus or any of the other versions is that you can’t compare cost estimates to actual costs by project.

Other features of Plus not present in Essentials include the ability to:

- Create and manage budgets

- Generate 60-plus reports, including unbilled charges, unbilled time, and budget overview and budget vs outturn

QuickBooks Plus vs QuickBooks Advanced

Plus | Advanced | |

|---|---|---|

Monthly Pricing | $90 | $200 |

Users Included | 5 | 25 |

Maximum Classes & Locations | 40 | Unlimited |

Maximum Chart of Accounts | 250 | Unlimited |

Batch Invoices, Bills, Checks & Expenses | ✕ | ✓ |

Customize Access by Roles | ✕ | ✓ |

Dedicated Success Manager | ✕ | ✓ |

Training for Staff | ✕ | ✓ |

Advanced Reporting | ✕ | ✓ |

✕ | ✓ | |

✕ | ✓ | |

✕ | ✓ |

Most small businesses will find Plus the perfect fit, but there are many reasons you may want to upgrade to Advanced, especially now that several new features have been added to the program. Advanced now offers fixed asset accounting, estimated vs actual cost reporting, and multi-company report consolidation. These can be useful for companies with more complex business structures and accounting workflows.

It supports up to 25 users, as compared to five in Plus. Advanced also removes the limitations on the number of classes, locations, and charts of accounts, making it ideal for businesses with a growing staff. It also has a batch invoicing and expense management feature, which is ideal for those who manage a large volume of invoices and expenses daily.

Advantages of QuickBooks Online Advanced

Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time. This can be useful if you have many customers who need to be invoiced for the same products or services. You just need to create a single invoice template and then apply it to all the customers who require the same invoice.

Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually. This is especially useful if you have many expenses to record, such as business travel expenses, office supplies, and equipment purchases. You can upload expense receipts in bulk, categorize them according to the appropriate expense account, and then submit them for approval.

QuickBooks Advanced provides greater flexibility in customizing reports than the other QuickBooks Online plans. Users can tailor their reports by filtering and grouping data and creating custom fields and dashboards. Additionally, Advanced lets you generate multi-company reports and schedule emailed reports to be sent to specified email addresses.

A notable new feature is Spreadsheet Sync, which helps you generate consolidated reports across multiple entities easily. It is an advanced feature that lets you import and export data between QuickBooks and Microsoft Excel. You can easily generate custom reports in a single spreadsheet, create complex calculations, and use Excel’s built-in tools to work on your data. Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced.

Advanced users receive better customer support through its Priority Circle membership. As a Priority Circle member, you get access to a dedicated customer success manager who can assist you with any questions or issues you have with your software. You will get priority support through chat and phone, with shorter wait times than non-Priority Circle members.

QuickBooks Online Advanced now offers a fixed asset accounting feature that allows you to enter and track fixed assets, such as vehicles, buildings, and equipment. Based on the depreciation method you choose, Advanced automatically calculates the depreciation for the fixed asset and creates a depreciation schedule.

This allows you to compare the estimated costs and revenues of your projects against the actual numbers incurred throughout the completion of the project. This helps you identify potential problems and make adjustments once you determine that your projects are not profitable.

How We Evaluated QuickBooks Online Plans

Our QuickBooks Online comparison is based on our internal case study, explained below.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

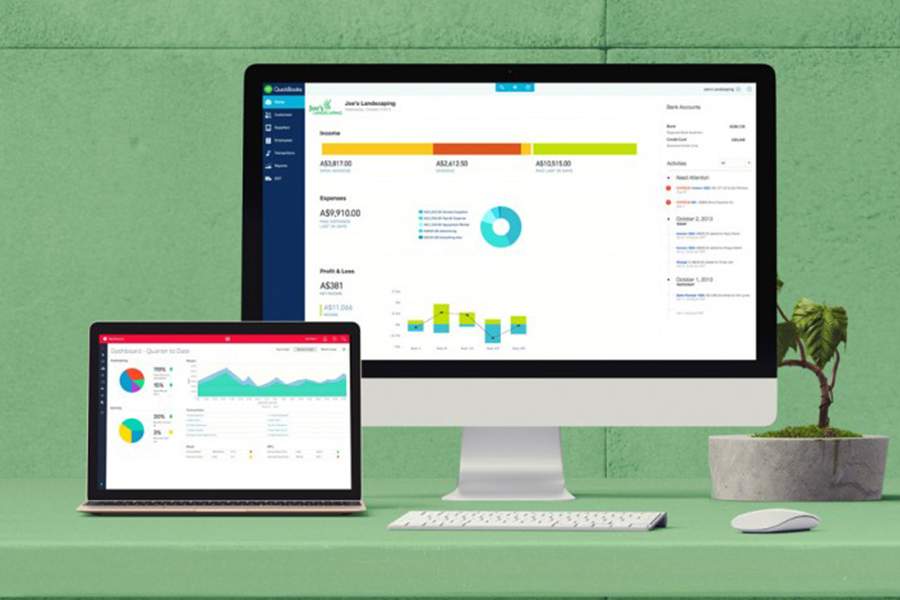

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

The right QuickBooks Online plan depends on the size of your business and the features you need. For example, QuickBooks Solopreneur is best for freelancers or solopreneurs, while Simple Start is ideal for small businesses wanting to track assets and liabilities. Essentials is preferable if you need to track unpaid bills, while Plus is great if you require inventory and project management. If you scale to 25 users, then upgrade to Advanced.

Yes, you can. However, note that there’s no direct data migration option available from QuickBooks Solopreneur to any higher version of QuickBooks Online. This means you must first cancel your Solopreneur subscription and then sign up for the QuickBooks Online version you wish to upgrade to.

QuickBooks Online is better than QuickBooks Desktop if you prefer a cloud-based accounting software to a locally installed one. QuickBooks Online’s biggest advantage is its ability to be accessed from anywhere with an internet-enabled device. Learn about all the differences in our comparison of QuickBooks Online vs Desktop.

QuickBooks Online isn’t a one-size-fits-all solution. Some instances where you need to find an alternative include when you

- Want free accounting software: If you’re looking for a free invoicing and accounting solution, then check out our article on the best free accounting software.

- Need parts inventory management: While QuickBooks Online has strong inventory management features, it can’t track parts and inventory assemblies. If you’re a manufacturing company that needs this feature, QuickBooks Desktop Pro is a good alternative.

- Prefer desktop-based software: Some businesses might prefer desktop-based accounting programs for several reasons, including limited internet connectivity. If you’re among them, then QuickBooks Desktop might be preferable to QuickBooks Online.

If you think QuickBooks isn’t for you, check out our top alternatives to QuickBooks to find a solution that fits your needs.

Bottom Line

The best QuickBooks Online plan for you depends on the size of your business and your particular needs. If you deal with inventory or large projects heavily, Plus is the best option. However, self-employed individuals and solo business owners should consider Solopreneur—unless they have an employee, which will require an upgrade to Simple Start.

If your business is service-based without any inventory, then Essentials should provide everything you need while saving you $30 per month compared to Plus. If you’re scaling from five to 25 users and need advanced features like fixed asset accounting, then go with Advanced.