Sage 100 Contractor is a locally installed construction management and accounting software that helps you handle projects, service operations, and accounting workflows in one place. I selected it as the best construction software for estimation because it uses easy-to-use Microsoft-based features—such as cut, copy, and paste—for creating project bids.

I find Sage 100 Contractors valuable for contractors, but it’s not as intuitive and convenient to use as cloud-based software. Also, prices are undisclosed, so you won’t be able to gauge right away if it fits your budget. See if it’s right for you in this in-depth Sage 100 Contractor review.

Pros

- Is a complete bookkeeping system—no need to integrate with a general ledger software

- Offers enhanced job costing, such as the ability to track budgeted vs actual expenses

- Lets users create customized reports from scratch

- Has easy-to-understand job income statements

- Includes ERP Enterprise Resource Planning features

Cons

- Takes time to set up and learn

- Is locally installed; requires installation and maintenance

- Lacks accounting features in the mobile app

- Requires an additional fee for inventory management

- Has time tracking—but it doesn’t track employee location

Pricing | Custom |

Number of Users | Undisclosed |

Deployment Type | Desktop; requires cloud hosting for remote data access |

Discounts | ✕ |

Free Trial | ✕ |

Internet Connection | Required for software installation |

Storage & Backups | Stored locally and must be backed up manually |

Customer Support | Phone support, online tickets, Sage Knowledgebase and Sage 100 Contractor InfoCenter, community forums, and virtual conferences |

Average User Review Ratings |

- Contractors looking for an easy estimating tool: As I mentioned earlier, Sage 100 Contractor uses Microsoft features, making it easy to create project estimates with just a few clicks. This makes it our best construction accounting software for project estimation.

- Construction companies seeking a single, comprehensive solution: Sage 100 Contractor combines project management and accounting in one platform so that you won’t have to purchase separate software for managing and tracking projects and bookkeeping.

- Small contractors looking for basic ERP features: Access to basic ERP features—such as data analysis, automation, job orders, and inventory management—allows you to collect, store, manage, and analyze data so that you can make informed decisions.

- Contractors who have outgrown QuickBooks: Sage 100 Contractor is a great QuickBooks alternative for growing contractors needing more management and automated construction accounting features. Check out our Sage 100 Contractor vs QuickBooks comparison to see how the two solutions compare.

Sage 100 Contractor Alternatives & Comparison

If you think general-purpose bookkeeping software is more suitable for your construction business, check out our guide to the best small business accounting software.

| Users Like | Users Dislike |

|---|---|

| Comes with plenty of features | Is not cloud-based |

| Offers plenty of integrations | Is not that user-friendly |

| Has responsive customer support | |

Here’s a summary of the most recent Sage 100 Contractor reviews:

- Feature-rich: One user appreciates that multiple departments in their company can use it to cover different tasks, from payroll to estimating. This also aligns with my rubric evaluation, which I’ll cover later.

- Strong integration: Some reviewers said that they like that it integrates with many business programs for various functions like document control, time tracking, and reporting. However, as desktop software, users may experience some issues in terms of real-time data syncing.

- Excellent customer support: One explained that they are happy with the support team, which always helps them resolve their issues.

- Not cloud-based: Some users wish Sage 100 Contractor was cloud-based. Currently, you need to use a cloud hosting service to use Sage 100 Contractor remotely, but I don’t find it as convenient as using a fully cloud-based alternative like QuickBooks Online.

- Not user-friendly: Many recent and older reviews mention it isn’t user-friendly. The setup is complex, and the dashboard isn’t as intuitive as cloud-based software. I recommend having an experienced bookkeeper on your team.

As of this writing, here’s how third-party sites rate Sage 100 Contractor:

I compared Sage 100 Contractor with QuickBooks Online, Buildertrend, and JOBPOWER across a similar set of criteria. The chart below sums up my findings:

Touch the graph above to interact Click on the graphs above to interact

-

Sage 100 Contractor Custom-priced

-

QuickBooks Online $99 to $235

-

Buildertrend From $499 per month

-

JOBPOWER Custom-priced

Sage 100 Contractor didn’t take the top spot in any category in my evaluation, but it still scored well overall. It performs solidly in general accounting, beating Buildertrend and JOBPOWER, though it’s not as comprehensive as QuickBooks Online. Regarding construction-specific features, it wins over QuickBooks, though it falls short compared with Buildertrend and JOBPOWER. Its biggest drawbacks are ease of use and the lack of a strong mobile app.

Sage 100 Contractor took a hit in my pricing evaluation because it doesn’t disclose its prices. In the last update, I mentioned that it was reportedly $115 per month, per user; however, I can no longer verify that Sage 100 Contractor pricing information, so I recommend contacting the provider to request a quote.

Sage 100 Contractor Notable New Features for 2024

- Better purchase order (PO) management: The new version of Sage 100 Contractor has a Quick Close Purchase Order tool that allows you to easily close partially received purchase orders. There’s also a new “Received” label, which you can use to mark POs that have been received but not yet invoiced.

- Improved sales order processing: There is a new option to automatically turn on the Print Forms Check Box for sales orders that are partially shipped. This means you don’t have to manually print pick sheets every time you process a sales order.

- Enhanced data entry utilities: Sage has improved its delete and change utilities for A/P, A/R, and inventory forms. You can now access and enter information while data entry is in progress or when the main entity is in use. For instance, if I am creating a new vendor and need to update an existing customer’s information, I can do so without having to exit or finalize the vendor entry.

Inventory management requires an additional fee, which cost Sage 100 Contractor points in my assessment. However, it offers an array of features and modules to help you manage and track your books and projects. As a result, you won’t have to use multiple programs to address the different needs of your construction business.

Here are some of its top general accounting features.

You can connect your bank and credit card accounts so that your transactions automatically flow into the software. If needed, you can also download bank and credit card transactions to an Excel or a CSV file and then copy them manually into the software’s grid. Additionally, Sage has a dedicated module for reconciling bank and credit card accounts.

This feature is integrated with all of Sage 100 Contractor’s modules, making it easy to organize and track your job cost information. The software generates detailed cost reports, including job status, job cost journals, job cost summaries, labor totals, labor journals, and billing summaries.

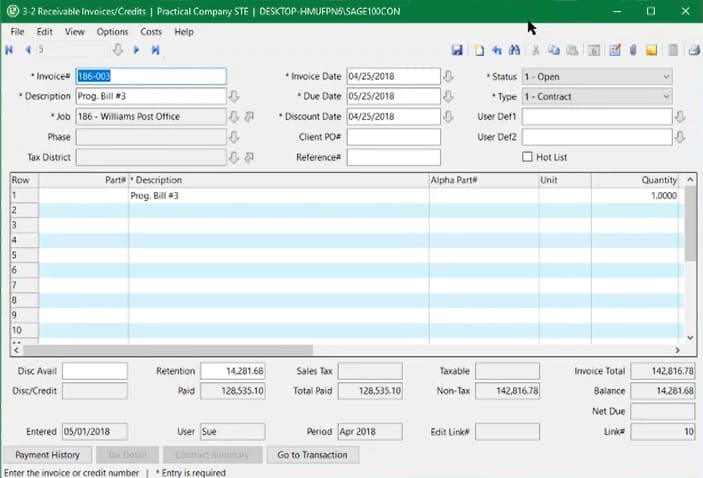

Simple invoicing is one way to create an invoice in Sage 100 Contractor. You can add items to the invoice, such as quantity, discount dates, discount rate, status, and tax status.

Simple Invoicing in Sage 100 Contractor (Source: Practical Software YouTube Channel)

For progress billings, another way would be American Institute of Architects (AIA) billing. Sage 100 Contractor can generate an AIA-compliant invoice if it’s required. Otherwise, you can print standard invoices.

The A/P module of Sage 100 Contractor shows everything about the payables. If you click the upward arrow button beside the Order Number, Sage 100 Contractor will show the PO detail pertaining to the payable entry.

Furthermore, if you want to know what costs are affected by job, go to Costs and click Job Costs or Equipment Costs. Sage 100 Contractor will show you the cost code, cost type, and amount.

Sage helps you keep an eye on your inventory, whether for a central warehouse or different locations and service trucks. It also helps you organize nonstock and serialized items for bin numbers and multiple locations and vendors. You can allocate inventory to jobs and see the inventory trail as well.

As a construction-specific software, Sage 100 Contractor offers plenty of useful features that are designed particularly for construction management. I could have awarded it a perfect mark if it could track employee location.

Below is a list of its strongest construction management features.

Sage 100 Contractor’s project management module gives you access to documents and task lists, operation status, daily field reports, and correspondence. You can also collect and approve your employees’ time and enable the entire team to share and access documents and photos online.

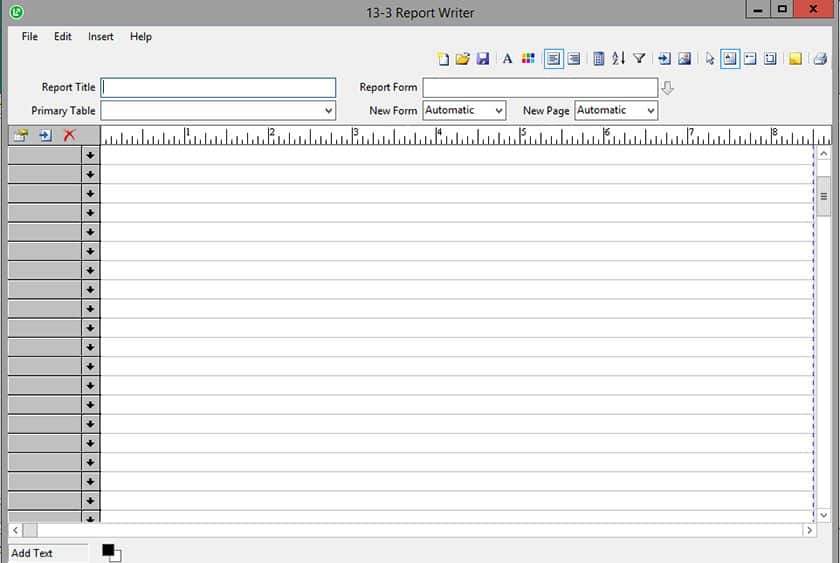

The Report Writer Wizard provides the tools you need to design customized reports in any fields that are tracked in the system. You can modify some of the existing reports available in the system or create entirely new reports based on your needs.

To access the Report Writer Wizard, go to Review & Reporting (drop-down 13) under the My Menu tab and then click on Report Writer.

Sage 100 Contractor’s Report Writer wizard (Source: Sage 100 Contractor)

This add-on allows you to maximize your productive hours using in-depth analytics on equipment, such as cost, maintenance, and revenue records. It provides the data you need to allocate equipment costs directly to jobs, service your equipment at the right cycles, and optimize equipment return on investment (ROI).

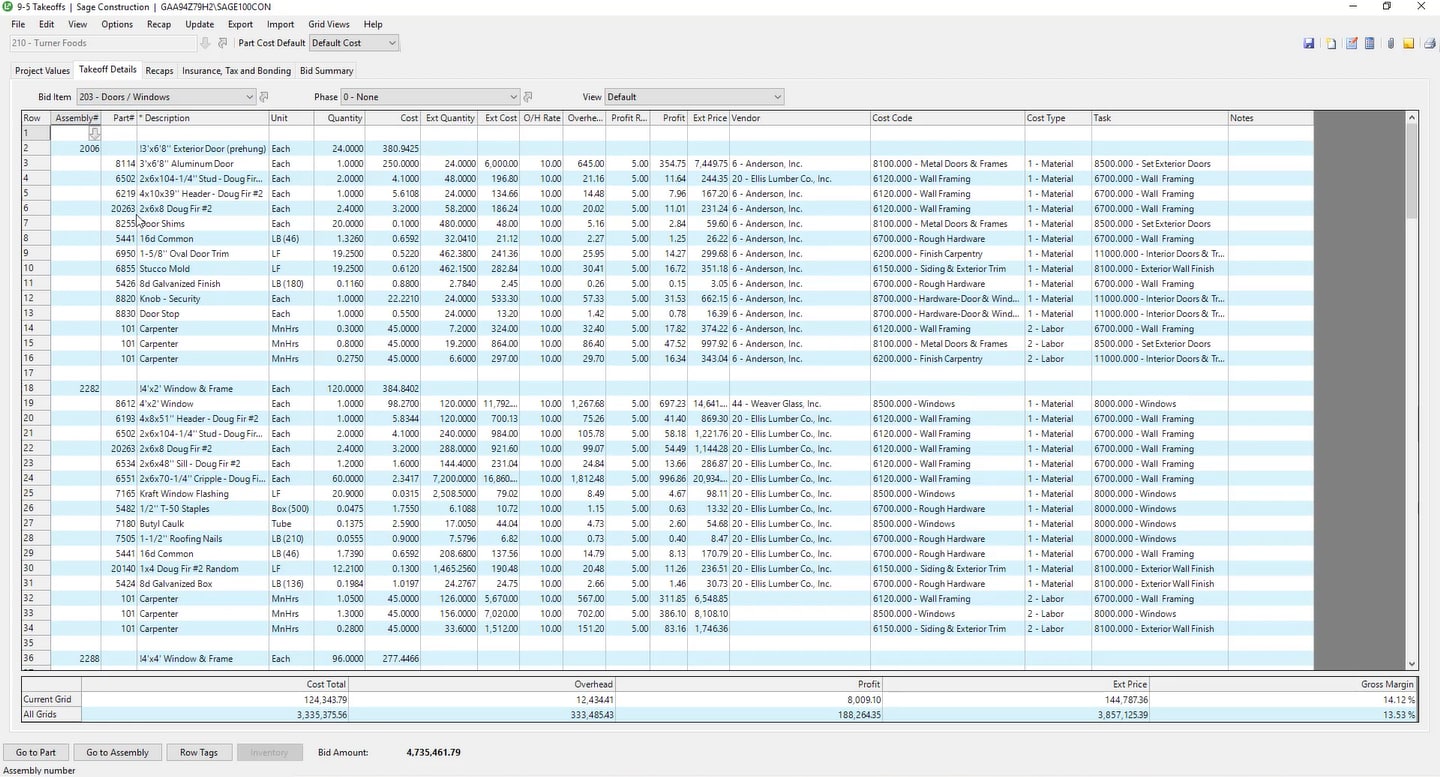

Sage 100 Contractor makes it easy to manage your budget and complete bids. You can export budgets, estimates, subcontracts, and POs—saving you more time and reducing the chance of data entry errors. You may also include budgeted hours in your estimates and copy a budget directly from Excel.

Creating and Viewing Estimates (Source: Sage 100 Contractor)

The Job Estimates module allows you to see all details about the job. You can see the part number, description of the part, unit of measurement (such as by piece, box, or direct labor hours), and the quantity needed. Sage 100 Contractor will compute the cost automatically and apply overhead rates and profit rates. If you’re going to outsource some materials or labor, you can add the vendor and expense account. Furthermore, you can classify the cost as material and labor.

Sage 100 Contractor can also filter data by selecting the vendor that offers the lowest cost for the material or labor needed. This feature can help you minimize the cost and increase the overall profit of the project. Once you’ve selected the vendors, you can generate a budget.

Sage 100 Contractor generates subcontractor and supplier notices automatically that alert them when work should be done. It also creates call sheets with schedules, phone numbers, dates, and work descriptions, and it sends project documents to your customers and subcontractors automatically at your set dates and times.

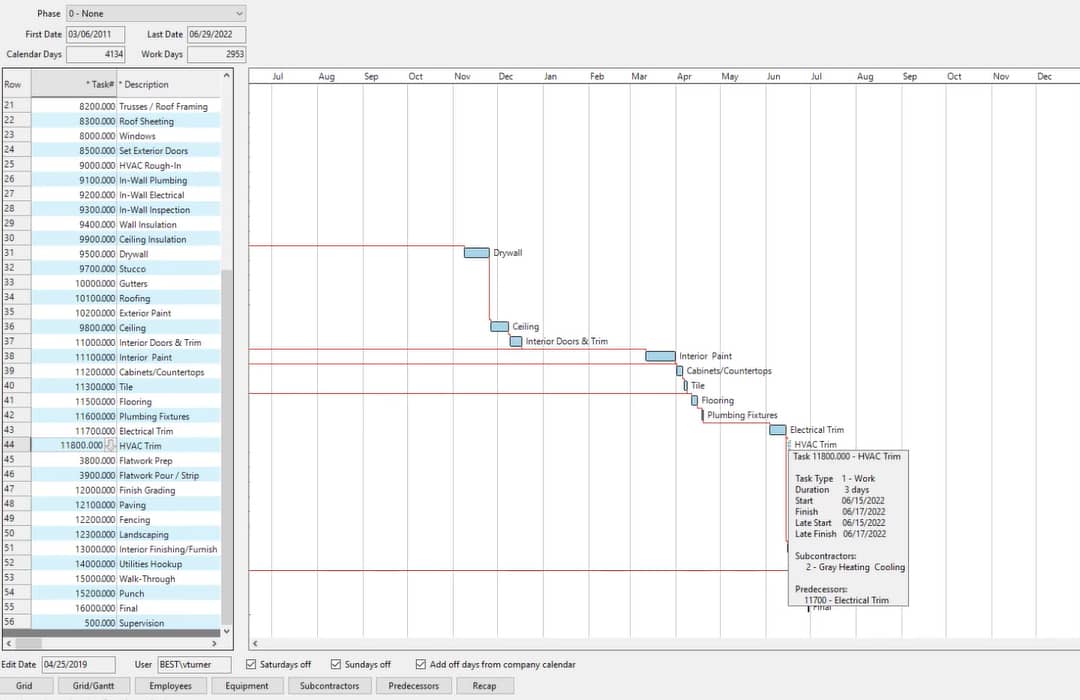

Scheduling Work Based on the Budget (Source: Sage 100 Contractor)

After you create a budget, Sage 100 Contractor will create a Gantt chart automatically based on the items in the budget. Task details are also brought forward from the budget, alongside the standard time per task.

Since Sage 100 Contractor creates the Gantt chart based on standard time, you can adjust the bars if a certain task needs to be extended due to unforeseen delays or downtime. Sage 100 Contractor can also show critical path and float time, which can be useful in project evaluation and review.

This is a companion app for Sage 100 Contractor. It helps employees in the field receive updates from the back office and vice versa, and users can also view change orders and incidents. Back office personnel can use the app to send dispatch orders to employees in the field, while employees can see dispatch orders under Assignments.

However, even though the app can relay information to and from the back office, it lacks communication channels where employees can directly message each other.

Sage 100 Contractor generates various construction-related reports that allow you to track how profitable your business is. Examples of construction reports available include job cost summary reports, job cost detail reports, work-in-progress (WIP) reports, and subcontractor payment reports.

Sage 100 Contractor has a mobile app called Sage 100 Contractor Time, which your employees can use to submit their time entries from their mobile devices. It could have earned a higher rating in my evaluation if it had accounting features, such as the ability to create and send invoices and accept payments.

You can download the Sage 100 Contractor Time app on Google Play and the App Store.

Sage 100 Contractor isn’t software that you can use out of the box. It’ll take time to set it up since you’ll need to input a lot of accounting and construction data.

Using the platform can be difficult for those without experience in construction accounting, as Sage 100 Contractor is best if you have an in-house certified public accountant (CPA) with experience in financial accounting and reporting, as well as taxation for construction companies.

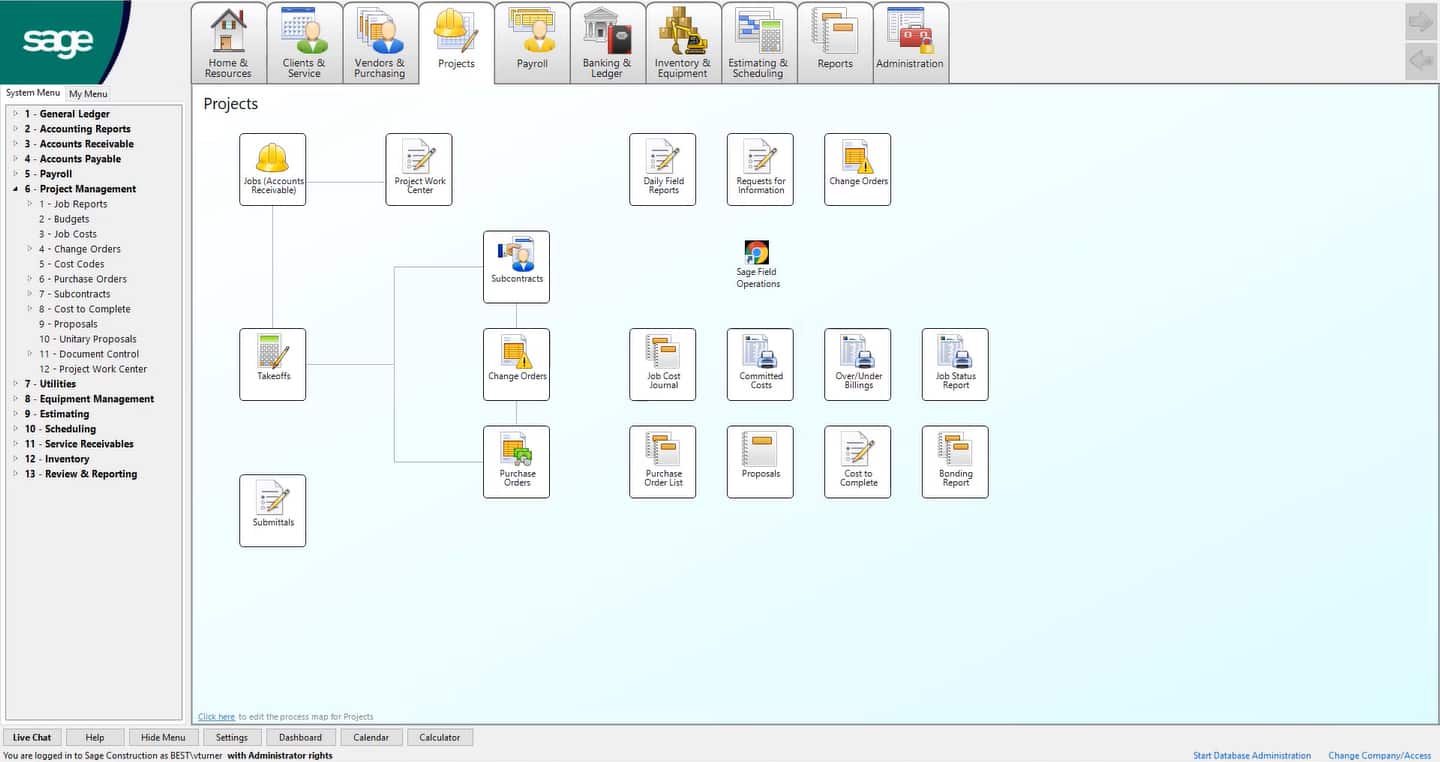

The dashboard features a workflow-based navigation menu, which feels less intuitive than cloud-based software. Those are why the platform took a hit in my assessment.

Here’s a look at the dashboard:

Sage 100 Contractor’s dashboard (Source: Sage 100 Contractor)

I would have awarded Sage 100 Contractor a higher score if users could access support via live chat. However, many valuable resources still help you ease into the system. From anywhere within it, you can access a library of easy-to-find topics to learn more about particular features.

If you want to check out other resources, you can explore the Sage Knowledgebase or visit the Sage 100 Contractor InfoCenter. You can also contact Sage over the phone or submit your request for customer support online, 24 hours a day, through the customer log-on portal.

How I Evaluated Sage 100 Contractor

I used the internal scoring rubric below to evaluate Sage 100 Contractor.

10% of Overall Score

Pricing is only 10% of the score because it’s more important to focus on getting contractor accounting software that has the features that fit your business needs than fixating on price.

20% of Overall Score

The best construction accounting software must have essential bookkeeping features, such as A/P and A/R management, income and expense tracking, and financial reporting.

35% of Overall Score

Contractor features include specialized tools, such as the ability to manage and track equipment, share project documents with clients, track employee location, and general construction reports.

10% of Overall Score

Ease of use is an important factor, particularly if the owner or other nonaccountant will be keeping the books. I allocated extra credits to cloud-based construction accounting software, as I believe it is generally easier to use than locally installed programs.

10% of Overall Score

I checked whether the provider offers essential customer support options, like phone, live chat, email support, and self-help guides, such as blogs, videos, and user communities.

10% of Overall Score

Most construction companies have crews working on the field, so it is important to have a mobile app that allows them to record their activity anywhere from their smartphone.

5% of Overall Score

I used software ratings from several review websites—but note that these ratings may change quickly depending on user reviews.

Frequently Asked Questions (FAQs)

Yes, Sage 100 Contractor is a locally installed software, but you can access it in the cloud through a cloud hosting service.

Sage 100 Contractor doesn’t publish its prices on its website. You must contact sales for a quote.

No, Sage 100 Contractor doesn’t offer a mobile app that can handle accounting tasks, such as job costing or billing customers. However, it does offer a mobile app called Sage 100 Contractor Time, and it lets your employees submit time entries from their mobile devices.

Bottom Line

Sage 100 Contractor is a midrange construction accounting and management program. It offers the best of both worlds, with a mix of useful accounting features and project management tools. However, using it can be a challenge to users without bookkeeping knowledge. It has many niche features, such as AIA billing, that only CPAs with construction accounting experience can understand.

[1]Software Advice

[2]G2