SBA Form 413 is commonly referred to as an “SBA Personal Financial Statement” and is a document representing a borrower’s financial position.

Ultimate Guide to SBA Form 413: What It Is & How to Fill Out

This article is part of a larger series on Business Financing.

Essentially, Form 413 outlines your financial status across various accounts, income, assets, liabilities, etc. It provides the participating lender with information regarding your overall creditworthiness. It’s one element of the lending decisioning process that can play a major role in your approval status since it can be used to evaluate whether or not you’re able to repay the loan in the event of default.

To simplify the process of completing the SBA Form 413, have your personal and company financial information organized and available. We’ll walk you through each step, from choosing a loan type to signing the form. Consider having your financial expert or accountant assist in the completion to help ensure accuracy.

To download the form, you can visit the SBA’s Form 413 page.

Who Needs to Fill Out SBA Form 413?

Generally, anyone applying for an SBA loan will be subject to filling out Form 413—it’s required as part of the application for SBA loan programs, such as SBA 7(a) loans, SBA 504 loans, or SBA Disaster Loans. The application process also requires each of the following contributors to submit their own personal financial statement:

- The proprietor of the business

- General partners

- Each owner or limited partner with 20% or more equity interest in the business

- Any person or entity providing a guarantee on the loan

If the type of SBA loan you apply for requires you to provide SBA Form 413 and you file a joint tax return, your spouse’s information should also be included. This doesn’t mean your spouse will be a guarantor on the loan, but including your spouse’s financial information informs the SBA and your lender that you have joint assets and liabilities. Your combined assets and liabilities must be reported unless a legal document (i.e., a prenuptial agreement) specifically separates certain assets.

How to Fill Out SBA Form 413

Filling out Form 413 can be a relatively quick process if you prepare accordingly and keep track of your finances and applicable documents. Reference the steps below, where we will walk you through the process of filling out each section on the form and provide detailed information on what’s required.

Step 1: Prepare the Required Financial Documents

Preparing SBA Form 413 will be much easier if you gather the necessary financial documents ahead of time. With these prepared, you can streamline the process of completing the form, which you may be able to finish in as little as a few minutes.

The financial information you will need includes:

- Checking and savings account statements

- IRA, 401(k), and other retirement account statements

- Life insurance documents showing current cash surrender value

- Stocks, bonds, and other investment documents showing current value

- Pay stub showing current annual salary

- Statements for disability income, pensions, real estate income, or other sources of income

- Mortgage statements, auto loan statements, credit card statements, and statements for other types of loans showing your account number, payment amount, and current balance

You’ll want to keep these on hand while you fill out the various sections of the form. In the next steps, we will walk you through each section for detailed instructions on how to complete the required fields.

Step 2: Choose the Loan Type or Program

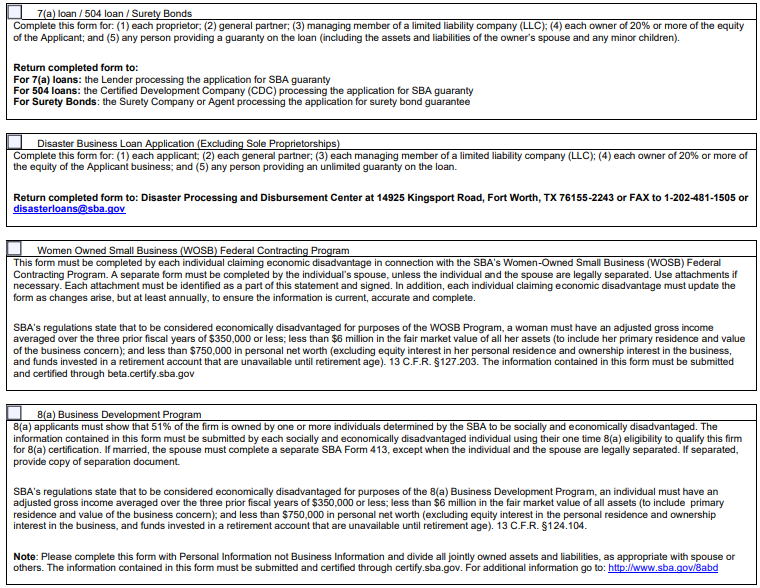

Located on the first page, the first section requires you to choose the applicable loan type or program. You should check all the boxes that apply to your loan:

- Check the first box if it is an SBA 7(a) or 504 loan or a surety bond.

- Check the second box if it is a disaster business loan application.

- Check the third box if it is a Women Owned Small Business (WOSB) Federal Contracting Program.

- Check the fourth box if it is an 8(a) Business Development Program.

See the image below for details on each section of page one.

Page 1 of SBA Form 413, choosing a loan type or program

Step 3: Fill Out Your Personal and Business Information

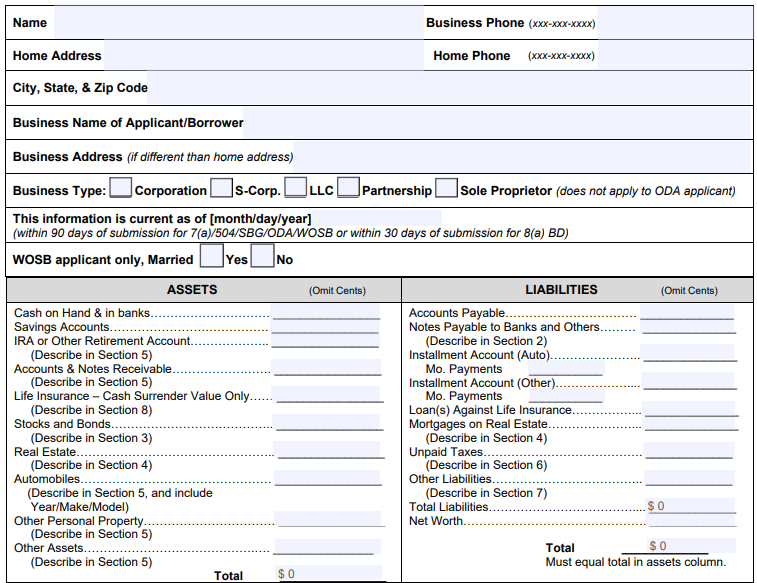

The top portion of page two requires your name, address, phone numbers, and business name. This is followed by a summary section for your assets and liabilities, which should be filled out last. These sections summarize information contained in other sections throughout the form. Complete sections one through eight first, then use the information from those sections to total your assets and liabilities.

Page 2 of SBA Form 413 includes personal and business information, assets, and liabilities fields

Step 4: Complete Section 1; List Sources of Income & Contingent Liabilities

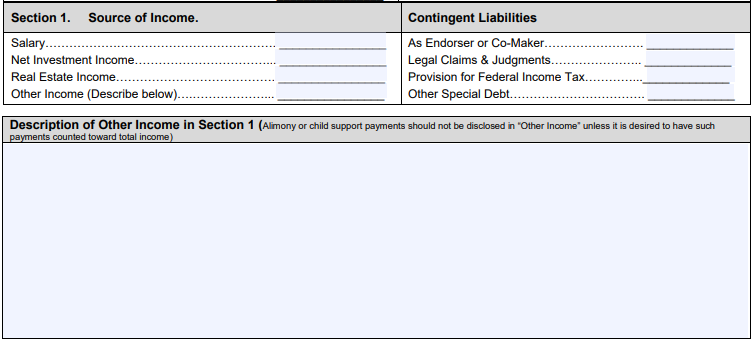

In this section, you’ll list your income sources and contingent liabilities.

- Potential income sources include income you expect to receive on a regular and recurring basis.

- Contingent liabilities are debts that become your responsibility in certain events. For example, if you’re a cosigner on a loan, you become responsible if the other person doesn’t pay. Here, you’re summarizing the contingent liabilities you will list in the Other Liabilities section (Section 7).

Sources of Income

Instructions for providing this information and definitions of terms used on this form are:

- Salary: Include all wage income for you (and your spouse, if applicable.) Only include the amount reported on your W-2 or 1099 tax forms. If your company is a partnership or an LLC, do not include income you take out of the company through distributions, withdrawals, or guaranteed payments in this section.

- Net investment income: This section includes any income from interest earned on savings accounts, dividends and interest earned on stocks and bonds, and recurring capital gains or losses on the sale of investments.

- Real estate income: This is your annual net operating income (NOI) from your owned properties after expenses, inclusive of rental income or sale of a property.

- Other income: This can include pension, social security, distributions, dividends, or guaranteed payments you receive on a regular or recurring basis. Describe this income in detail in the box provided beneath Section 1.

Contingent Liabilities

Instructions for providing this information and definitions of terms used on this form are:

- As endorser or co-maker: List the total potential outstanding debt on any loans you’ve co-signed or guaranteed.

- Legal claims and judgments: List any potential debts associated with legal judgments and claims.

- Provision for federal income tax: List any money you are setting aside to pay expected federal income taxes.

- Other special debt: This is another catch-all for any other potential debts not already listed in the above categories.

Section 1 of SBA Form 413 – Sources of Income and Contingent Liabilities fields

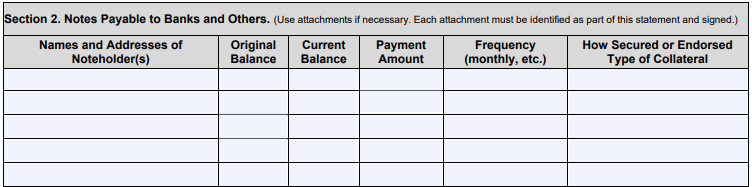

Step 5: Complete Section 2; Include Notes Payable to Banks and Others

This section details all your debts, such as credit cards and outstanding loans. We recommend reviewing your statements and personal and business credit reports to ensure accuracy.

You can use as many supplemental pages as needed if you don’t have enough space to list all your loans. If you do so, ensure they all include the “as of” date on your SBA personal financial statement, reference Section 2, include the name of the business applicant, and are signed by the applicable individuals.

Instructions for providing this information and definitions of terms used in this section are:

- Name and address of noteholders: Enter the names and addresses of the banks that hold your debt. If you have multiple loans or credit cards from the same bank, list the last four numbers of the account numbers so that they can be matched with a credit report.

- Original balance: List the total amount borrowed when the account was first established. For credit cards, put $0.

- Current balance: List the amount that you currently owe. Put $0 for credit cards if you pay your balance in full each month.

- Payment amount: Enter the minimum payment that you have to pay with each statement. For credit cards, you can write “varies.”

- Frequency: Indicate how often payments are made. This is typically monthly.

- How secured or endorsed/Type of collateral: Describe the object or property used as collateral (e.g., make and model of the automobile securing the loan). If collateral was not required, write “unsecured” in the text box. Most credit cards are unsecured.

Section 2 of SBA Form 413 – Notes Payable to Banks and Others

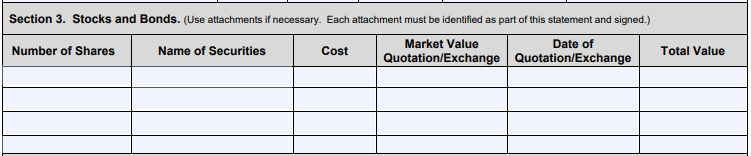

Step 6: Complete Section 3; Mention Your Stocks and Bonds

In this section, you’ll list the marketable securities you own. This does not include retirement savings, as that will be reported in another section of the form. If needed, you can attach supplemental pages with more entries.

Instructions for providing this information and definitions of terms used in this section are:

- Number of shares: List the total number of shares you own.

- Name of securities: Enter the name of the stock or bond.

- Cost: List the initial cost of your purchase.

- Market value quotation/Exchange: Enter the value of the security on the “as of” date you selected.

- Date of quotation/Exchange: Report the date of the value you reported (the same as the “as of” date).

- Total value: Multiply the market value of each security by the number of shares you own, and list this amount.

Section 3 of SBA Form 413 – Stock and Bonds

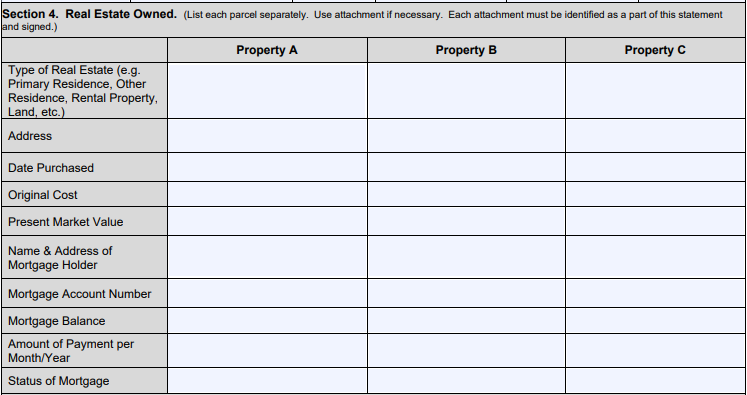

Step 7: Complete Section 4; Include Real Estate Owned

This section is where you’ll provide a detailed description of all the real estate you own in your personal name, and you should list any property reported on your personal tax return. Property A is your primary residence, if you own it. If you own more than three properties, attach supplemental sheets or a “schedule of real estate” that identifies the same information as required on the SBA personal financial statement form.

Instructions for providing this information and definitions of terms used in this section of the form are:

- Type of property: List the type of property, such as “primary residence,” “undeveloped lot,” or “investment property.”

- Address: List the physical address of the property.

- Date of purchase: Use the date on your mortgage bill of sale.

- Original cost: List the purchase price.

- Present market value: Use the current appraised value of the property if you were to sell the property today. You can obtain an estimate by calling a broker or using an online valuation platform; visit Zillow.

- Name and address of mortgage holder: Enter the name and address of the lender that holds the mortgage on the property.

- Mortgage account number: The number of the loan with the financial institution.

- Mortgage balance: The remaining principal balance left to be paid on the mortgage.

- Amount of payment per month/year: Enter your monthly/yearly mortgage payment.

- Status of mortgage: Indicate the current repayment status of your mortgage (e.g., current, foreclosure, paid in full).

Section 4 of SBA Form 413 – Real Estate Owned

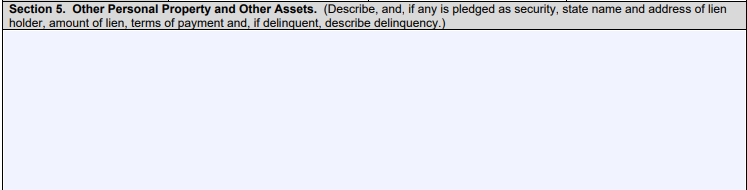

Step 8: Complete Section 5; List Any Other Personal Property and Other Assets

In this section, you’ll report personal property of significant value. This includes property such as jewelry, IRAs or other retirement accounts, cars, and recreational vehicles. For cars, include the make, model, and year along with a quick estimate of current value from a tool such as Kelley Blue Book.

Section 5 of SBA Form 413 – Other Personal Property and Other Assets

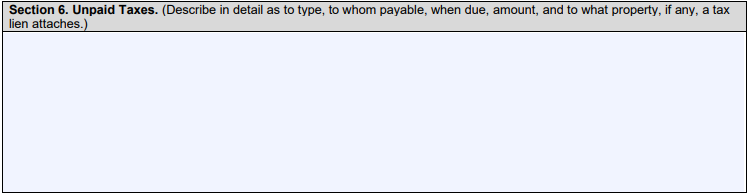

Step 9: Complete Section 6; Describe Any Unpaid Taxes

This section is available for you to provide a detailed description of any federal, state, or local taxes you owe. You should also state whether the unpaid taxes are current or delinquent. For taxes you owe to a foreign government, report them in the Other Liabilities section of the form.

The SBA requires you to be current on all federal, state, and local taxes before it will approve a loan. The only exception is if you have delinquent federal income taxes with an IRS-approved payment plan. The SBA also doesn’t allow you to use loan proceeds to pay for past due taxes such as income, payroll, real estate property, or sales.

Section 6 of SBA Form 413 – Unpaid Taxes

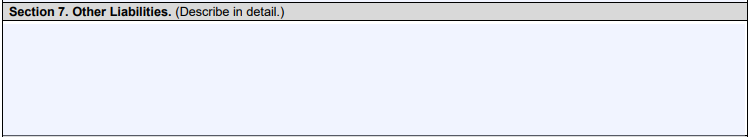

Step 10: Complete Section 7; Include Any Other Liabilities

Here, you can report any liabilities uncategorized or undisclosed in the previous sections of the form. Some examples of the types of liabilities that can be found here are:

- Co-signed or guaranteed obligations: If you are obligated on another person’s debt as a co-signer or guarantor, you should list those potential liabilities in this section. You will ultimately report this as a contingent liability.

- Debts to foreign governments: Any debts owed to foreign governments, typically taxes, are disclosed here even though they are a tax obligation.

- Debts that come from private agreements: If you made a significant financial agreement to pay someone, with or without documentation, then you should list it here.

- Outstanding lawsuits: If you’re currently being sued, but a judgment hasn’t been entered, then you should list your potential liability in this section.

Section 7 of SBA Form 413 – Other Liabilities

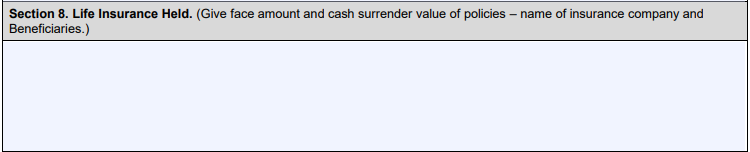

Step 11: Complete Section 8; List Life Insurance Held

You need to list all life insurance you (or your spouse, if applicable) currently holds in this section of the form. List all your policies—including term, whole life, and variable life insurance.

Indicate the face value (death benefit) of your policy that would be provided to your beneficiaries upon your death and the cash surrender value of whole life insurance policies. Also, list the full names of all policy beneficiaries and the name of the insurance company that carries your insurance policies.

Section 8 of SBA Form 413 – Life Insurance Held

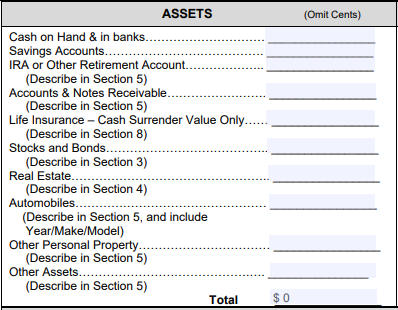

Step 12: Summarize Your Assets

On the second page of the form, the Assets section not only summarizes the information you provided earlier as you filled out the form but also includes your cash on hand and savings account balances.

You’ll need to list the following assets:

- Cash on hand and in banks

- Savings accounts

- IRA or other retirement accounts

- Accounts and notes receivables

- Life insurance—Cash surrender value only

- Stocks and bonds

- Real estate

- Automobiles

- Other personal property

- Other assets

When completing this section, ensure you round up to the nearest dollar. Once you’ve included all of the line items, add up all of your assets to get your total.

Assets summary section of SBA Form 413

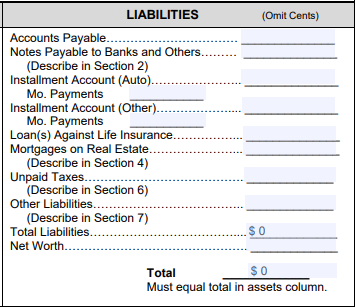

Step 13: Summarize Your Liabilities

The Liabilities section summarizes the information you provided in the prior steps and includes your accounts payable. With accounts payable, report the total amount of products and services purchased on credit or on a regular payment basis, excluding those using credit cards or personal lines of credit.

When completing this section, ensure you round up to the nearest dollar. You’ll need to list the following liabilities:

- Accounts payable

- Notes payable to banks and others

- Installment account (auto), both monthly payments and total owed

- Installment account (other), both monthly payments and total owed

- Loans against life insurance (total amount)

- Mortgages on real estate

- Unpaid taxes

- Other liabilities

Then, follow the instructions for the last three items to complete this section:

- Total liabilities: Provide the sum of all your liabilities included in the prior line items above.

- Net worth: While net worth isn’t a liability, it is reported in this section. You can arrive at your net worth by calculating your total assets reported in the Assets section of the form, minus your total liabilities reported on the prior line.

- Total liabilities and net worth: Add your total liabilities with your net worth. Ensure this matches the number you reported for total assets in the Assets section of the form.

Liabilities summary section of SBA Form 413

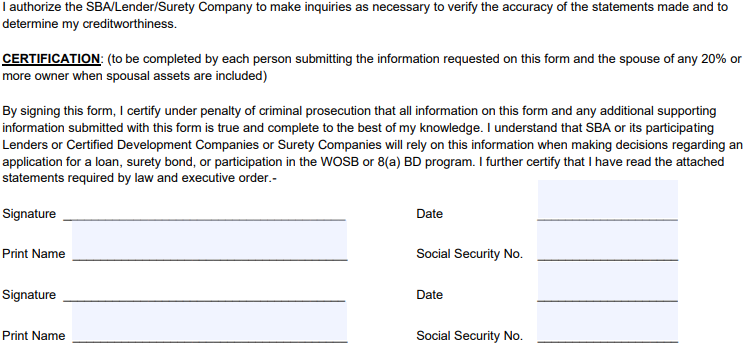

Step 14: Sign the Form

Once you complete the summary of assets and liabilities and each person listed on the SBA personal financial statement has completed and signed the certification on page 3, you’re done preparing SBA Form 413. You’ll provide this form to your lender with your SBA loan application and other supporting documents.

Signature section of SBA Form 413

Our Related Resources:

Frequently Asked Questions (FAQs)

SBA Form 413 is a personal financial statement that is filled out when applying for an SBA 7(a), SBA 504, or SBA Disaster loan.

Gather all of your financial documents and fill out each section. Save the assets and liabilities for last as you will be able to use your other sections to help fill out those sections at the end. Have your company’s financial expert help fill these forms out. Your SBA loan provider can also give you guidance on any SBA forms that need to be completed.

The SBA Form 413 will be used to determine your creditworthiness as a borrower and can impact your lending decision for an SBA loan program. It’s an important factor that will be taken into account as part of the application process.

Bottom Line

SBA Form 413 is a commonly required document when preparing an application for an SBA loan program. When filling out the SBA personal financial statement, be sure to answer the relevant fields regarding your financials and ensure they are complete and accurate so that the lender can make its approval decision with confidence.