The main differences between TaxAct vs TaxSlayer are pricing and use case. I really like TaxAct’s user interface (UI) and customer support options, but TaxSlayer offers simple filings at a more affordable price point. Both, however, promise ease of use, accuracy, and efficiency in helping users maximize their tax refunds and minimize their tax liabilities.

- TaxAct is a good fit for small businesses seeking an online filing solution.

- TaxSlayer is ideal for self-employed individuals needing tax advice.

TaxAct vs TaxSlayer at-a-glance comparison

| ||

|---|---|---|

Best for | Small businesses wanting to file both their personal and business taxes online | Self-employed individuals seeking advice from tax professionals |

Pricing |

|

|

Schedule C business income & loss | ✓ | ✓ |

S-corp & partnership returns | ✓ | ✕ |

Data import | ✓ | ✕ |

Deduction finder | ✓ | ✕ |

Audit guidance and/or defense | ✓ | ✓ |

Tax pro assistance for self-employed returns | ✓ | ✓ |

Tax pro assistance for partnership/corporate returns | ✕ | ✕ |

Average rating on third-party review sites | 1.3 | 4.2 |

Use cases and pros & cons

Pricing: TaxSlayer wins

TaxSlayer is far less expensive than TaxAct — including for individuals with very simple tax returns that qualify for the free plan. TaxSlayer’s free plan includes a state return, while TaxAct charges $39.99 for the simple state return. TaxSlayer is also much more affordable than TaxAct for taxpayers wanting to consult with a tax professional. It even provides consultation with a tax pro with self-employment expertise as part of TaxSlayer’s Self-Employed plan.

However, alongside a cloud version, TaxAct provides a desktop program option, something TaxSlayer lacks. TaxAct’s desktop rates are much more affordable than its main competitor for desktop software, which is TurboTax. My favorite offering from TaxAct is its online software to prepare Form 1120 or 1120S. TaxAct is the only provider I’ve found that offers a cloud-based program to prepare these business returns.

Live assistance: TaxAct wins

TaxAct | TaxSlayer | |

|---|---|---|

Communication method | Phone, email, and live chat | Phone, email, and live chat |

Qualifications of professionals | CPA, EAs, or tax specialists | CPA, EAs, or tax specialists |

Tax pro assistance for self-employed returns | $159.98 Federal $39.99 per State | $52.95 Federal $39.95 per State |

Tax pro assistance for business returns | ✕ | ✕ |

Both TaxAct and TaxSlayer offer tax pro assistance via phone, email, and live chat. They also both have tax professionals who are CPAs, EAs, and tax specialists. However, user reviews point to a better experience with TaxAct.

TaxSlayer’s assisted plan is about a third the cost of TaxAct’s plan, meaning budget-conscious preparers may find TaxSlayer sufficient. But if you’re preparing a return where you think you may need live assistance, it might be worth the extra dollars to splurge on TaxAct’s more consistently positive user experience.

Helpful tools: TaxAct wins

TaxAct | TaxSlayer | |

|---|---|---|

Accuracy guarantee | ✓ | ✓ |

Audit support | ✓ | ✓ |

Tax calculator | ✓ | ✓ |

Free plan available | ✓ | ✓ |

Deduction maximizer | ✓ | ✕ |

Maximum refund guarantee | ✓ | ✕ |

Data import | ✓ | ✕ |

Cryptocurrency support | ✕ | ✕ |

When it comes to comparing TaxSlayer vs TaxAct for helpful tools, there is one major difference: TaxSlayer’s Simply Free plan offers free filing for both federal and state tax returns for individuals with taxable income less than $100,000, no dependents, filing Single or Married Jointly. TaxAct, in contrast, offers free filing for basic federal tax returns and $39.95 for state returns if your adjusted gross income is less than $73,000.

However, TaxAct has a more comprehensive toolset than TaxSlayer, with the addition of a deduction maximizer, a maximum refund guarantee, and the ability to import data. Those added benefits give TaxAct the edge over TaxSlayer as it relates to helpful tools.

Mobile app: TaxAct wins

TaxAct Express App | TaxSlayer App | |

|---|---|---|

Availability | iOS and Android | iOS and Android |

Talk live with tax specialist | ✓ | ✓ |

E-file return | ✓ | ✓ |

Scan & upload W-2 | ✓ | ✓ |

IRS refund tracking | ✓ | ✓ |

View, print & save return as PDF | ✓ | ✕ |

TaxAct again comes out on top in the mobile app category. TaxAct and TaxSlayer’s mobile apps offer similar features, with a focus on preparing and e-filing your return. You can also track your IRS refund, scan and upload your W-2, and communicate with a tax specialist. However, since TaxSlayer doesn’t allow you to view, print, or save your returns as a PDF file, it comes up short when compared to TaxAct.

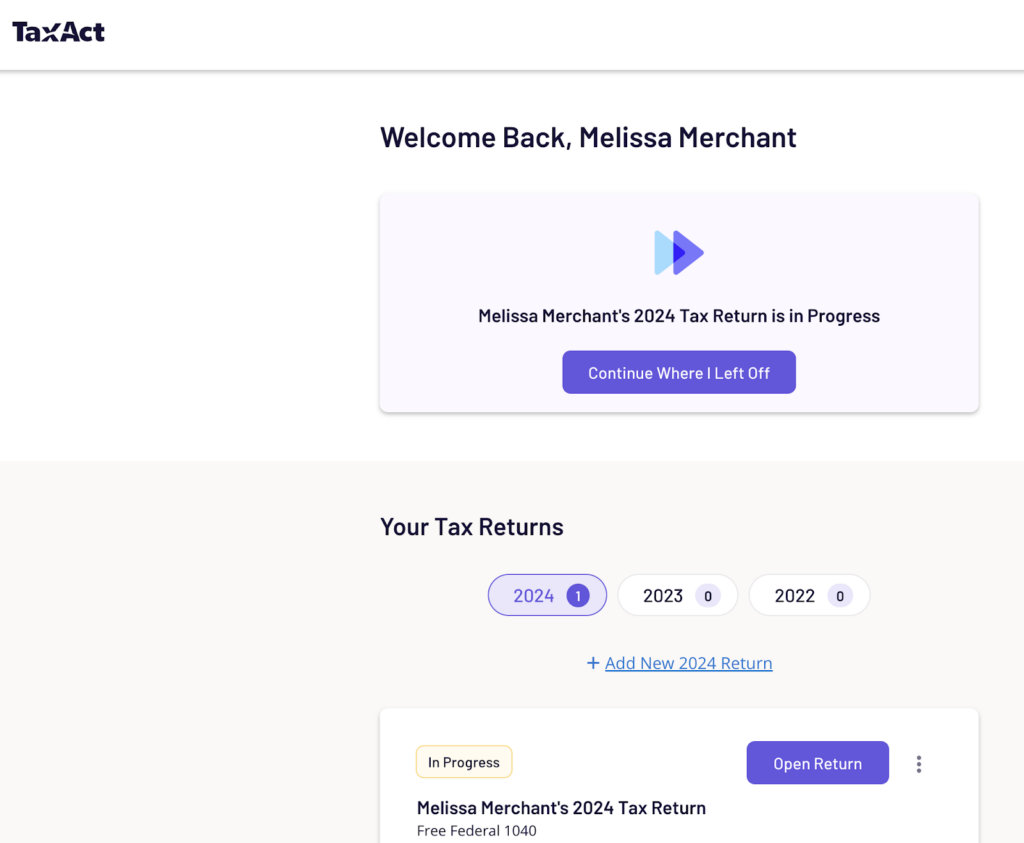

Ease of use: TaxAct wins

TaxAct offers an intuitive and clean user interface. This is especially helpful for novice users, as it makes it easy for filers to enter their information. Another useful feature is a quick summary of each section that allows you to review for potential errors. You can also easily import your tax forms, such as W-2s and 1099s.

TaxAct Dashboard (Source: TaxAct)

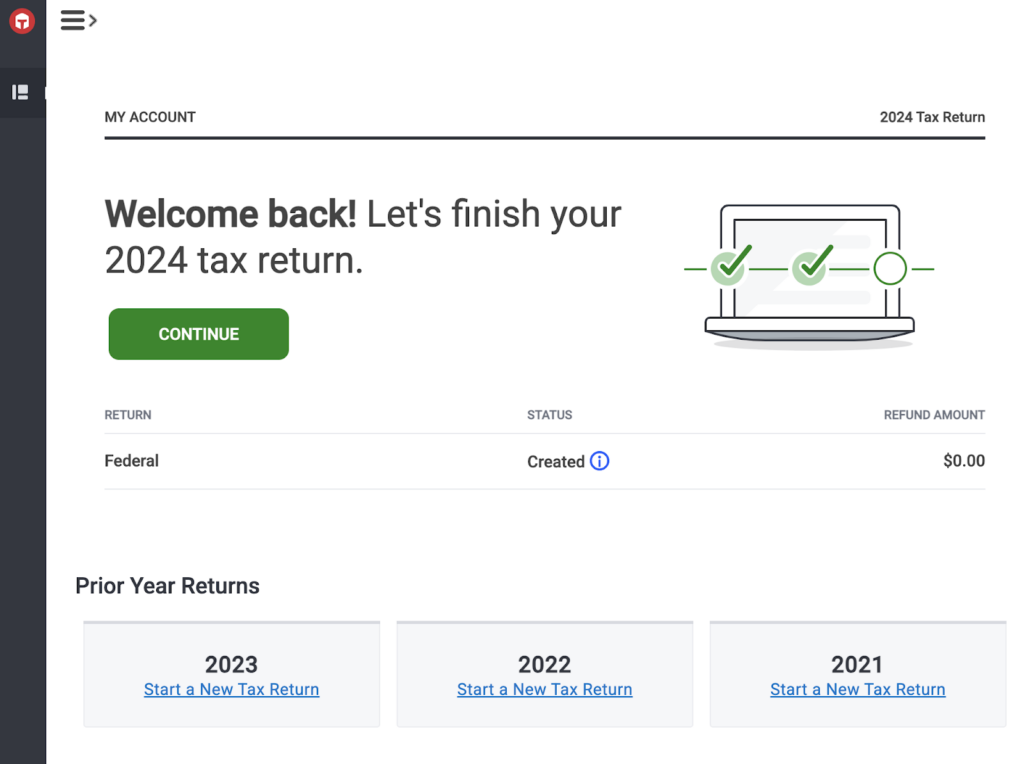

Meanwhile, TaxSlayer’s UI is easy to navigate, and its left navigation bar provides easy access to different sections of the site. To get started, you need to set up a free account, then you’ll be able to view your dashboard and start filing your tax return. Included are an interview process and useful tools like a tax refund calculator. TaxSlayer’s design is similar to TaxAct, with an interview process that also lets you skip from section to section.

TaxSlayer Dashboard (Source: TaxSlayer.com)

Customer service: TaxAct wins

TaxAct | TaxSlayer | |

|---|---|---|

Support channels | Phone, email, and live chat | Phone, email, and live chat |

Expert help offered | ✓ | ✓ |

Additional services | Deduction maximizer, audit support, and tax calculator | Zero out-of-pocket fees, Ask a Tax Pro, and tax refund calculator |

TaxAct excels in the support realm, as it offers account and technical support through phone, email, and chat for all of its products. It also has an online knowledge base that provides answers to questions and can be used to troubleshoot issues. Xpert Help is available for an additional fee, and it provides unlimited screen-sharing access with a tax expert and help on demand. In some states, you can also set up a call with one of TaxAct’s tax professionals.

Meanwhile, TaxSlayer offers multiple support options, including free phone and email support for all plans. Its online knowledge base is also helpful, as it provides answers and advice for various tax questions. If you purchase the Premium or Self-Employed version, you’ll have access to live help from tax professionals.While TaxSlayer offers very adequate customer support options, TaxAct surpasses the competition in this category.

User reviews: TaxSlayer wins

TaxAct | TaxSlayer | |

|---|---|---|

Users like |

|

|

Users dislike |

|

|

Average rating on third-party sites | 1.3 out of 5

| 4.2 out of 5

|

I examined user reviews from the providers’ websites and two third-party user review sites. Both TaxAct and TaxSlayer reported high user reviews on their own websites, but third-party websites reported much lower ratings. DIY tax software regularly scores very poorly on third-party review sites, however, and I attribute that at least in part to the stress and frustration users feel when trying to file their taxes.

On TaxAct’s website, users praised the user interface for ease and efficiency of navigation. Most negative feedback on the third-party websites seem to do with the particulars of their returns, like calculations or which forms were included.

Meanwhile, on the TaxSlayer website, users shared that they appreciate that the software is less expensive than most other tax programs. Negative reviews on the third-party sites largely deal with being charged more than expected and confusion with the user interface

How I evaluated TaxSlayer vs TaxAct

I compared TaxSlayer and TaxAct based on these criteria:

- Features: I considered product characteristics such as ease of data import, navigation, refund tracking tools, and in-product support.

- Pricing: I verified the availability of free trials and confirmed pricing for varying tax prep packages.

- Technical support: Being able to access help when needed is a primary concern for users, so I assessed the ease of access to product experts via phone, email, or chat options.

- Ease of use: Particularly with DIY software, it’s important that software be easy to navigate. I reviewed how easy it is to move around the product from inception to completion of the tax return.

Frequently asked questions (FAQs)

Yes, TaxSlayer offers a free mobile app for both iOS and Android users.

No, neither TaxAct nor TaxSlayer offer full-service filing. I recommend TurboTax if you’re interested in this service.

Only TaxAct can prepare and file business returns as TaxSlayer doesn’t support Forms 1120, 1120S, and 1065.

Yes, both providers offer free preparation and filing for a basic tax return. However, while TaxAct charges an additional $39.95 fee to file a state tax return, TaxSlayer includes one state at no cost in the free tier.

TaxAct is ideal for corporate return filings and individuals needing a more intuitive interface. TaxSlayer is better for taxpayers wishing to file simple returns at a budget-friendly price point.

TaxAct is a trustworthy method of filing business and personal tax returns.

Bottom Line

TaxAct is more expensive but allows for filing of more complex returns. It also offers expert help at an additional cost through its Xpert Assist feature. Meanwhile, TaxSlayer has a clean user interface and extends free IRS audit support to its Premium and Self-Employed subscribers. TaxSlayer, however, only allows for personal tax returns, whereas TaxAct allows you to file both personal and business taxes online.