TaxSlayer is an online tax preparation software that allows you to file state and federal tax returns anytime and anywhere. For $22.95, TaxSlayer Classic covers all tax situations including investment income, rental properties, and self-employed businesses, but only has limited support options. State returns are $39.95 each. Active duty military members can get TaxSlayer Classic for free, but must still pay $39.95 for each state. TaxSlayer Classic includes free phone and email support, guaranteed maximum refund, and a mobile app. Higher priced plans add live chat support, access to a tax professional, and audit support.

Pros

- Free filing for simple federal tax returns

- Less expensive than most other tax programs

- Includes a mobile app

- Access to live support from tax professionals (Premium and Self-Employed users)

Cons

- Free version doesn't include the Earned Income Credit (EIC)

- Cannot import Schedule C income and expenses

- Doesn’t support business returns (1065, 1120, and 1120S)

- Offers fewer features than competitors

- Active duty members of the military: TaxSlayer offers their Classic plan for free to active due military members. The Classic plan can handle any tax situation, but offers only limited support. Military member still must pay $39.95 or each state return.

- Self-employed individuals, contractors, and 1099 contractors who need advice from tax professionals: Premium and Self-Employed users have unlimited access to a team of tax professionals―enrolled agents (EAs) and tax preparers―who specialize in self-employed tax issues. TaxSlayer was featured in our best business tax software guide as an inexpensive tax solution for freelancers with advice from tax professionals.

- Taxpayers who want to save money on Schedule C filing: At $22.95, TaxSlayer offers an inexpensive fee for filing Schedule C, but this doesn’t include deduction assistance, advice from a tax professional or audit support

- Taxpayers that don’t need assistance: Most tax software charges more for returns that include rental properties or self-employed income. TaxSlayer is different and includes all tax situations in their base program and then charges more if you want additional support. If you don’t think you’ll need support, TaxSlayer Classic is a great value.

- Taxpayers who need to file multiple returns: TaxSlayer requires you to pay for each return separately, which can be expensive if you need to file multiple returns. Instead, we recommend the desktop software of H&R Block, which lets you prepare as many returns as you like and e-file five of them at no additional cost.

- Freelancers who want free individual tax software: We selected FreeTaxUSA as the best free tax software for freelancers because it allows self-employed business owners to file their Schedule C for free, plus a state tax return at a low cost.

- Businesses organized as C corporations (C-corps), S corporations (S corps), or partnerships: Unfortunately, TaxSlayer has no products that let you file forms 1120, 1120S, and 1065. We recommend you check out TaxAct, which offers various tax filing options for partnerships, C-corps, and S-corps.

See our article on the best small business tax software for other options. In the guide, we looked at several solutions and narrowed our recommendations down based on the price of preparing the typical bundle of returns required by most business owners.

TaxSlayer Deciding Factors

Intended Users | Contractors and self-employed individuals who need advice from tax professionals |

Small Business Tax Returns Supported | Schedule C only |

Communication | Phone and email Live chat (Premium and Self-Employed only) |

Federal Online Preparation & Filing | $0 to $22.95 |

State Online Preparation & Filing | $0 to $39.95 |

Free Trial of TaxSlayer | Start for free - pay when you file |

Access to a Tax Pro | Upgrade to Premium for $20 |

Mobile App | ✓ |

100% Accuracy Guarantee | ✓ |

Cryptocurrency Support | ✕ |

Free Plan Available | ✓ |

Tax Calculator | ✓ |

TaxSlayer Alternatives

Best for: Businesses that want desktop software to file multiple federal and state returns for one price | Best for: Freelancers looking for a free individual tax software | Best for: Businesses organized as C-corps, S-corps, and partnerships |

Business return desktop software for $99 | Free federal filing and $14.99 for state returns | Starting at $139.99 for federal filing and $54.99 for state returns |

Read our H&R Block review | Read our FreeTaxUSA review | Read our TaxAct review |

TaxSlayer Pricing

TaxSlayer offers a free version that lets you file simple returns at no cost and three paid packages that range from $22.95 to $52.95 for federal filing, plus $39.95 for state returns. All paid plans include forms for all tax situations. The plans vary in terms of the extras included, such as W-2 import, IRS audit assistance, live chat, guidance with 1099 income, and access to a tax pro with self-employed expertise.

Pricing & Features | Simply Free | Classic | Premium | Self-Employed |

|---|---|---|---|---|

Pricing (Federal Tax) | $0 | $22.95 | $42.95 | $52.95 |

Additional Fee for State Filing ($/State) | One state for free | $39.95 | $39.95 | $39.95 |

Free Phone & Email Support | ✓ | ✓ | ✓ | ✓ |

W-2 & Unemployment Income | ✓ | ✓ | ✓ | ✓ |

Student Loan Interest & Education Expenses | ✓ | ✓ | ✓ | ✓ |

Earned Income Credit (EIC) | N/A | ✓ | ✓ | ✓ |

W-2 Import & PDF Upload | N/A | ✓ | ✓ | ✓ |

Schedule C | N/A | ✓ | ✓ | ✓ |

Schedule C Deduction Assistance | N/A | N/A | N/A | ✓ |

Includes all Income, Deductions & Credits | N/A | ✓ | ✓ | ✓ |

IRS Audit Assistance for Three Years | N/A | N/A | ✓ | ✓ |

Live Chat | N/A | N/A | ✓ | ✓ |

Access to a Tax Pro | N/A | N/A | ✓ | ✓ (self-employed expertise) |

Guidance With 1099 Income | N/A | N/A | N/A | ✓ |

The free plan, best for simple tax filing, includes one free state tax return. It lets you file a 1040 and a state return for free, but only if your taxable income is less than $100,000, you don’t claim dependents, and you don’t have rental income, investments, or a business. It supports W-2 income, student loan interest, and education expenses and also includes free phone and email support. Unlike many of their competitors, TaxSlayer’s free plan doesn’t cover returns claiming an Earned Income Credit (EIC).

Suitable for all tax situations, the Classic tier includes all features in Free—plus all forms, credits, income, and deduction types, and W-2 import and PDF upload. This is a great option for freelancers, landlords, and those wanting to itemize their deductions. It includes the Earned Income Tax Credit and Child Tax Credit as well as no form or schedule restrictions for income. The federal part of this package is free for all active military.

As the name suggests, this is best for self-employed individuals and independent 1099 contractors. All features in the other packages are available, plus guidance with 1099 income, quarterly estimated tax payment reminders, personalized tax guidance, access to a tax pro with self-employed expertise, year-round tax and income tips, and a deduction maximizer for Schedule C.

TaxSlayer Features

TaxSlayer offers helpful features, a searchable online knowledge base, and extended guidance and support to help you prepare and file federal and state tax returns. Here’s a glimpse of what’s available depending on the package you choose.

With the exception of the Simply Free plan, TaxSlayer guarantees that you’ll receive the maximum refund that you’re entitled to—or it’ll refund your purchase. To qualify, you must show that the larger refund or smaller tax due cannot be attributed to data that was entered incorrectly and provided to TaxSlayer for tax preparation.

All tax calculations are guaranteed to be 100% accurate, or TaxSlayer will refund any federal or state penalties and interests charged to you. If it’s determined that you entered information incorrectly, the guarantee doesn’t apply.

TaxSlayer lets you choose how you receive your refund, with three options. If you elect for direct deposit, your refund will be transferred to up to three different accounts. You can also opt for a printed check, which generally will arrive five days after the IRS issues your refund. The last option is to have the funds deposited to a TaxSlayer Visa Debit Card, which allows you to receive your refund through direct deposit even if you don’t have a bank account.

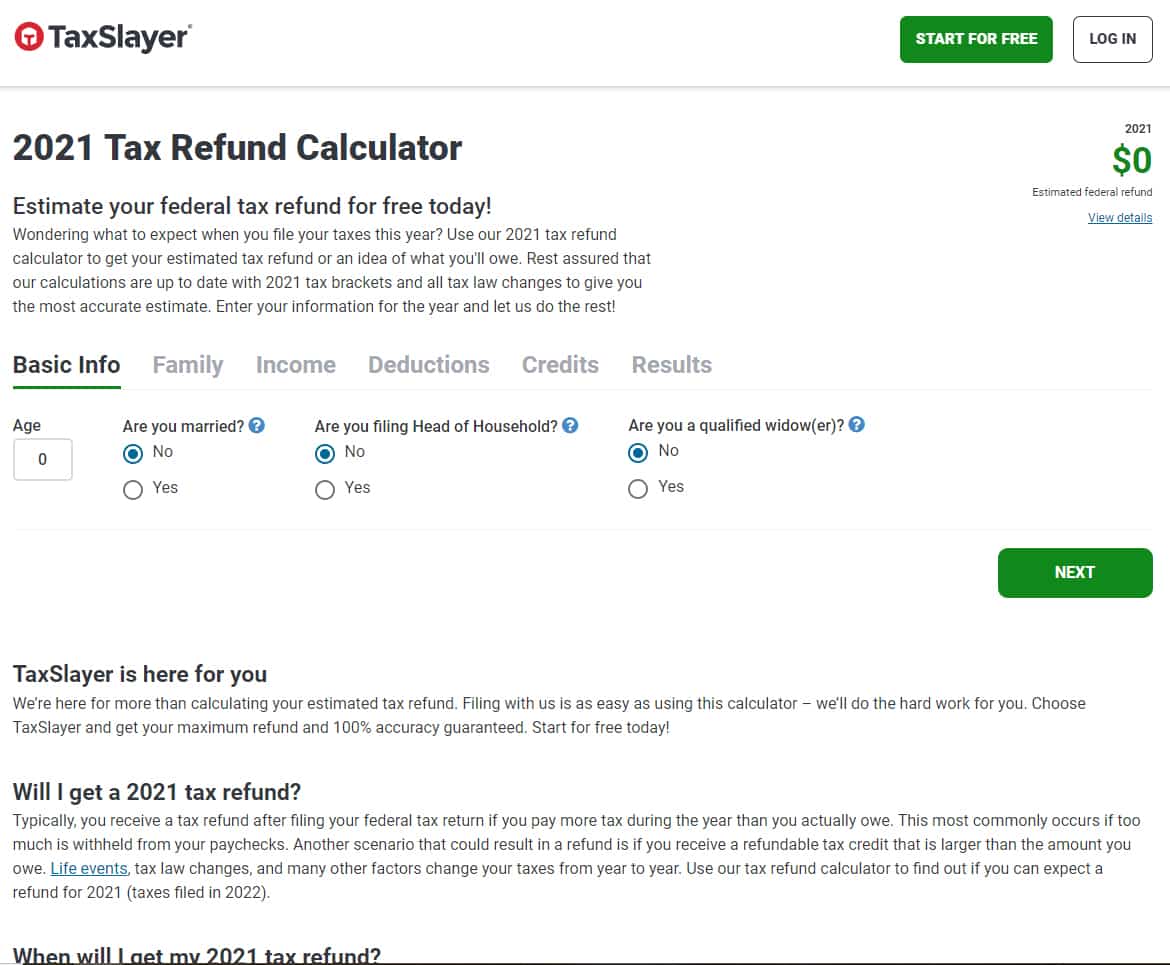

TaxSlayer’s refund calculator lets you estimate your refund using your paycheck or W-2 to plan for the next season. All you need to do is provide some basic information to determine your filing status and claim any dependents. The calculator also gives you an idea of your potential taxable income and finds the best credits and deductions you can claim.

TaxSlayer Tax Refund Calculator (Source: TaxSlayer)

Using TaxSlayer’s File and Go option, your tax filing fees will be deducted from your refund. This is a simple and convenient choice if you wish to avoid using credit cards to pay your fees.

Available in the Premium and Self-Employed plans, this gives you access to TaxSlayer’s staff of IRS-certified experts and EAs who are qualified to help you get through a possible IRS audit. This service is applicable for three full years after the IRS accepts your file.

If your returns are stored as PDF documents, you can import them to TaxSlayer from other online tax preparation programs. You can import forms, such as 1040, 1040A, and 1040EZ.

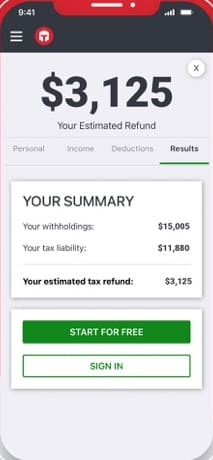

Download the TaxSlayer mobile app on Google Play and App Store and file your taxes online right from your mobile device. You can instantly see the status of your return and receive updates with personalized notifications. A refund calculator is also available.

TaxSlayer mobile app (Source: TaxSlayer)

TaxSlayer Customer Service & Ease of Use

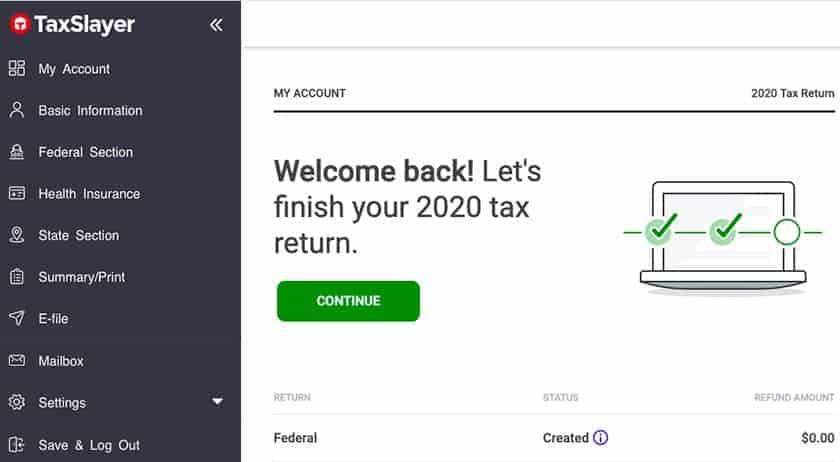

TaxSlayer has a clean user interface and a website layout that’s easy to navigate. To get started, you need to set up a free account where you’ll be asked to provide your email address and create a password. When you log in, you’ll be greeted by the My Account page with a menu laid out in a sidebar with different sections: My Account, Basic Information, Federal Section, Health Insurance, State Section, Summary/Print, E-file, Mailbox, and Settings.

TaxSlayer’s My Account page (Source: TaxSlayer)

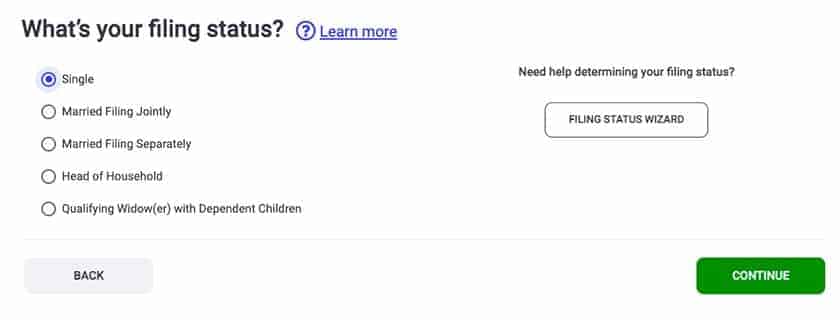

It includes an interview process, but you can skip around some sets of questions as you go.

TaxSlayer interview question (Source: TaxSlayer)

If you get lost, TaxSlayer offers multiple support options, including free phone and email support for all filers, regardless of your plan. It also has an online knowledge base with answers to many common tax questions. If you need access to live help from tax professionals, you’ll need to purchase the Premium or Self-Employed version.

TaxSlayer User Reviews

TaxSlayer received good reviews on TrustPilot, but only marginal reviews on Consumer Affairs. TaxSlayer users appreciate the free filing option and excellent customer service. Reviewers also praised its ease of use—both the quickness and accuracy of preparing returns. Its biggest drawback is the fact that its free features are limited. We agree the Free plan is more limited than with its competitors, specifically the inability to use the Free plan if you claim the Earned Income Credit. Other users experienced issues with the time involved to process refunds and payments.

User complaints in prior years included the inability to import capital gain transactions. TaxSlayer listened and now offers the ability to import security transactions via a CSV file.

TaxSlayer earned the following average scores on popular review sites:

- Consumer Affairs: 2.9 out of 5 based on about 206 reviews

- Trustpilot: 4.3 out of 5 based on over 24,000 reviews

Frequently Asked Questions (FAQs)

Is TaxSlayer able to import W-2 forms?

Yes, the TaxSlayer Classic option can import W-2s and includes other features like easy preparation, e-filing, and printing of your return.

Does TaxSlayer offer refund anticipation loans?

No, this feature was discontinued in 2020.

Is TaxSlayer’s Simply Free option really free?

Yes, you can file your taxes with Simply Free if your taxable income is less than $100,000, you don’t claim dependents, and you don’t have investment, rental, or business income. You can also file one state return for free.

How much are TaxSlayer’s paid plans?

TaxSlayer’s paid plans range in price from $22.95 to $52.95 plus $39.95 for each state filing.

Bottom Line

Overall, TaxSlayer is a cost-friendly choice for many tax filers, especially those that don’t need assistance. It may not have the robustness of other tax software, but its biggest strength―low price points―offers a compelling value that rivals expensive programs. We especially recommend TaxSlayer for self-employed individuals who need a budget-friendly program to file Schedule C but still want the ability to speak with a tax professional.